ユニバーサル シリアル バス (USB) は、コンピュータが周辺機器やその他のデバイスと通信できるようにするプラグ アンド プレイ インターフェイスです。USB 接続デバイスには、キーボードやマウス、音楽プレーヤー、フラッシュ ドライブなど、さまざまなものがあります。USB は、スマートフォンやタブレットの電源供給やバッテリーの充電など、デバイスに電力を送るために使用されます。USB では、5 ボルト DC 標準を生成する電源アダプタが必要です。アンペア数は通常、0.07A から 2.4A の範囲です。充電器は AC コンセントに差し込み、USB ケーブルは充電器に差し込みます。コンピュータの USB ポートの上限は 500 ミリアンペアですが、携帯電話やその他のデバイスに付属する USB 充電器は、1 アンペア以上の電流を処理できます。

完全なレポートにアクセスするには、https://www.databridgemarketresearch.com/reports/us-usb-charger-market

市場には、壁掛け充電器、車載充電器、ワイヤレス充電器など、さまざまな種類の USB 充電器があります。市場には USB-A、USB-B、USB-C など、さまざまな種類の USB ケーブルがあり、そのうち USB-A と USB-C は、データ転送速度と充電速度の点で大きな需要があります。

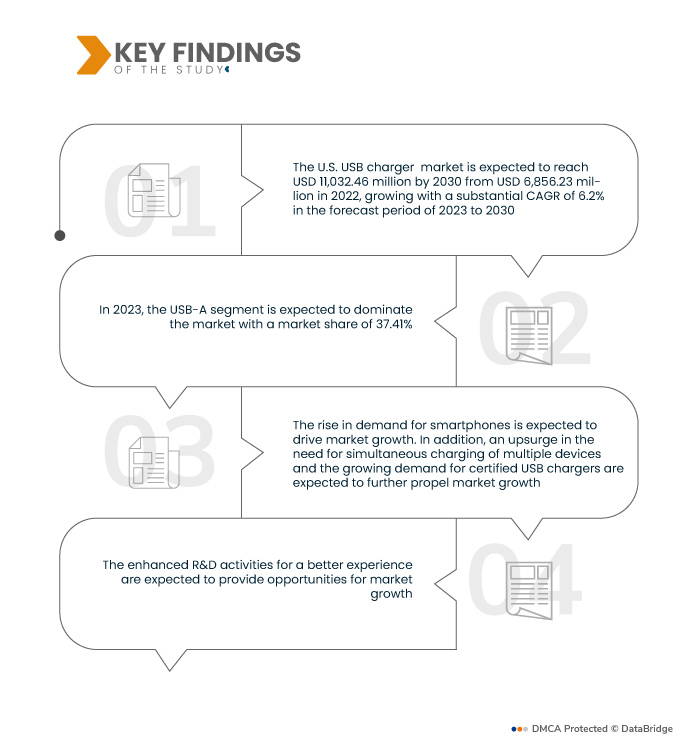

データブリッジマーケットリサーチは、 米国のUSB充電器市場 2022年の68億5,623万米ドルから2030年には110億3,246万米ドルに達すると予想されており、2023年から2030年の予測期間では6.2%という大幅なCAGRで成長すると予想されています。

研究の主な結果

認証済みUSB充電器の需要増加

人々は、偽物の充電器よりも認証製品の方が優れていることに気づき始めており、市場では認証済みの充電器を選ぶようになっています。この充電器は品質が良いだけでなく、安全性と保護機能も備えているため、人々は認証済みの充電器を選びます。これが市場での需要の増加につながります。多くの企業が、自社製品が高品質で安全に使用できることを証明するために、USB IF 認証を取得しようとしています。また、USB-IF ケーブル認証プログラムは、USB エンドユーザーに、USB 環境で動作するために必要な品質基準を満たすケーブルのリストを提供することを目的としています。さらに、多くの企業が Qi 認証を取得しようとしています。Qi 認証製品は、安全性の向上、品質の保証、リスクの軽減、相互運用性の証明、信頼性の確保のために国際規制基準に従ってテストされているためです。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2023年から2030年

|

|

基準年

|

2022

|

|

歴史的な年

|

2021 (2015~2020年にカスタマイズ可能)

|

|

定量単位

|

収益(百万米ドル)

|

|

対象セグメント

|

製品 (USB-A、USB-C、Micro-USB、Mini-USB、USB-3、USB-B)、充電器タイプ (ポータブルパワーバンク/ドッキングシステム/目覚まし時計、壁掛け充電器、車載充電器など)、ポート (シングルポートとマルチポート)、流通チャネル (オンラインとオフライン)、電力 (30W-44W、45W-59W、60W-75W など)、コネクタ (マクロコネクタ、マイクロコネクタなど)、機能 (USB 2.0、USB 3.0 など)、アプリケーション (スマートフォン、ラップトップ、デスクトップ、 タブレット、ヘッドセット/オーディオアクセサリ、 スマートウォッチ、カメラ/ビデオカメラ、ゲームコントローラ、電子書籍リーダー、スマート時計、音楽プレーヤー、玩具、プリンタ、光学ドライブおよびハードドライブ、その他

|

|

対象国

|

私たち

|

|

対象となる市場プレーヤー

|

Goal Zero(ユタ州)、J5create(米国)、MIZCO International Limited(ニュージャージー州)、myCharge(ミシガン州)、Nekteck(カリフォルニア州)、Ravpower(中国)、Spigen(カリフォルニア州)、Inc.、Native Union、Belkin(米国)、ZAGG Inc.(ユタ州)、Fantasia Trading LLC(米国)、Apple Inc.(カリフォルニア州)、Eaton(アイルランド)、SAMSUNG(韓国)、AT&T Intellectual Property(テキサス州)など

|

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、専門家による詳細な分析、輸入/輸出分析、価格分析、生産消費分析、消費者行動が含まれています。

|

セグメント分析

米国の USB 充電器市場は、製品、充電器の種類、ポート、流通チャネル、電力、コネクタ、機能、およびアプリケーションに基づいて、8 つの主要なセグメントに分類されています。

- 製品に基づいて、市場は USB-A、USB-C、Micro-USB、Mini-USB、USB-3、および USB-B に分類されます。

2023年には、USB-Aセグメントが米国のUSB充電器市場を支配すると予想されています。

2023 年には、USB-A セグメントが 37.41% の市場シェアで市場を独占すると予想されています。これは、ラップトップや充電器で最も一般的なポートだからです。また、同じフォーム ファクターで USB-2 および USB-3 規格に対応できるため、最も汎用性が高く、一般的なタイプとなっています。

- 充電器の種類に基づいて、市場はポータブルパワーバンク/ドッキングシステム/目覚まし時計、壁掛け充電器、車載充電器、その他に分類されます。

2023年には、ポータブルパワーバンク/ドッキングシステム/目覚まし時計セグメントが米国のUSB充電器市場を支配すると予想されています。

2023年には、スマートフォン、ラップトップ、タブレットなどの消費者向け電子機器の需要増加により、ポータブルパワーバンク/ドッキングシステム/目覚まし時計セグメントが45.99%の市場シェアで市場を支配すると予想されています。さらに、これらのデバイスの電力消費の増加に伴い、ポータブルパワーバンクの需要が大幅に増加しています。

- 港に基づいて、市場は単一港と複数港に分割されています。2023年には、単一港セグメントが57.82%の市場シェアで市場を支配すると予想されています。

- 流通チャネルに基づいて、市場はオフラインとオンラインに分割されています。2023年には、オンラインセグメントが64.04%の市場シェアで市場を支配すると予想されています。

- 電力に基づいて、市場は30W-44W、45W-59W、60W-75Wに分割されています。2023年には、30W-44Wセグメントが42.64%の市場シェアで市場を支配すると予想されています。

- コネクタに基づいて、市場はマクロコネクタ、マイクロコネクタ、その他に分類されます。2023年には、マクロコネクタセグメントが40.45%の市場シェアで市場を支配すると予想されます。

- 機能に基づいて、市場はUSB 2.0、USB 3.0、その他に分類されます。2023年には、USB 3.0セグメントが73.24%の市場シェアで市場を支配すると予想されています。

- アプリケーションに基づいて、市場は次のように分類されます。 スマートフォン、ノートパソコン、デスクトップ、タブレット、ヘッドセット/オーディオアクセサリ、スマートウォッチ、カメラ/ビデオカメラ、ゲームコントローラ、電子書籍リーダー、スマートクロック、音楽プレーヤー、おもちゃ、プリンター、光学ドライブとハードドライブなど。2023年には、スマートフォンセグメントが22.54%の市場シェアで市場を支配すると予想されています。

主要プレーヤー

Data Bridge Market Research は、米国の USB 充電器市場の主要企業として、Goal Zero (ユタ州)、J5create (米国)、MIZCO International Limited (ニュージャージー州)、myCharge (ミシガン州)、Nekteck (カリフォルニア州)、Ravpower (中国)、Spigen (カリフォルニア州)、Inc.、Native Union、Belkin (米国)、ZAGG Inc. (ユタ州)、Fantasia Trading LLC (米国)、Apple Inc. (カリフォルニア州)、Eaton (アイルランド)、SAMSUNG (韓国)、AT&T Intellectual Property (テキサス州) など、以下の企業を認識しています。

市場動向

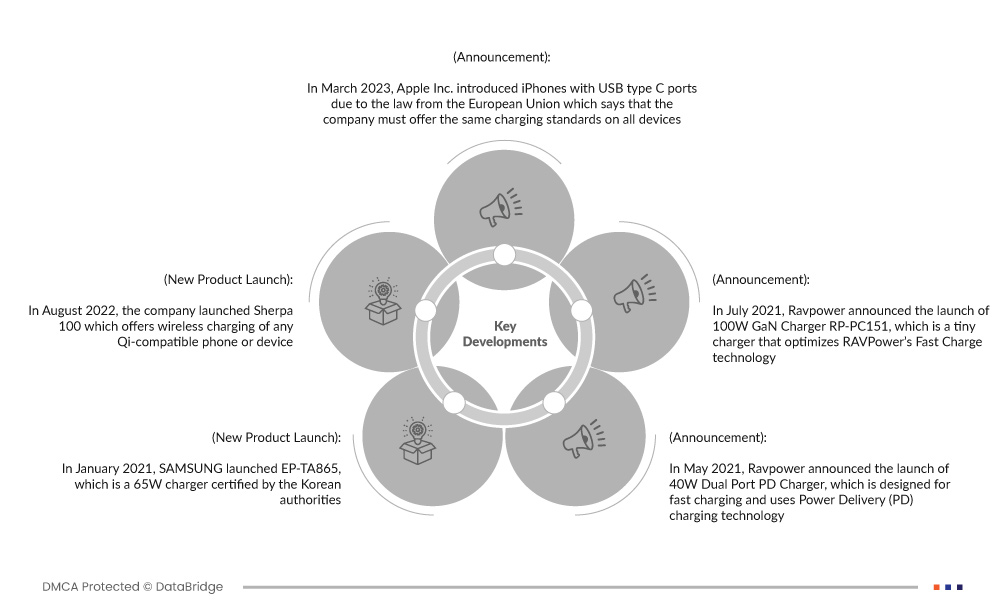

- 2023年3月、Apple社は、すべてのデバイスで同じ充電規格を提供しなければならないという欧州連合の法律により、USBタイプCポートを備えたiPhoneを導入しました。これにより、顧客はデバイスをより便利に充電できるようになります。

- 同社は2022年8月に、Qi対応のスマートフォンやデバイスをワイヤレス充電できるSherpa 100を発売した。これにより、同社の製品ポートフォリオが拡大し、収益が増加することになる。

- 2021年1月、サムスンは韓国当局の認定を受けた65W充電器EP-TA865を発売した。最大20V、3.25AのUSB Power Deliveryに対応し、プログラム可能な電源も備えている。この製品はノートパソコンで使用できるほど強力で、USB-Cポートからデバイスを充電できる。そのため、同社は顧客に急速充電充電器を提供することができた。

- 2021年5月、Ravpowerは急速充電用に設計され、Power Delivery(PD)充電技術を採用した40WデュアルポートPD充電器の発売を発表しました。RP-PC152はより高い電力を処理できるように構築されており、さまざまなデバイスをUSB接続で急速充電できます。これにより、同社は顧客に標準の充電器よりも70%速い充電器を提供しました。

2021年7月、Ravpowerは100W GaN充電器RP-PC151の発売を発表しました。これは、RAVPowerの急速充電技術を最適化した小型充電器です。この製品は高度なGaN II技術を採用し、デュアルUSB-C充電ポートを備えています。これにより、同社は電力出力を犠牲にすることなく、より小型のUSB充電器製品を発表し、顧客のニーズと要求に応えました。

スウェーデンの小麦粉市場レポートの詳細については、ここをクリックしてください。https://www.databridgemarketresearch.com/reports/us-usb-charger-market