米国における非接触決済の進化は、重要な節目を迎えてきました。2004年には、初の非接触カードが導入され、決済利便性の新時代の礎が築かれました。2008年までには、すべての主要ネットワークが非接触技術を採用し、消費者に非接触カードを提供しました。2014年には、初のデジタルウォレットの発売により、消費者は非接触取引の柔軟性とセキュリティをさらに高めることができました。翌年には、「EMVライアビリティシフト」により、EMV対応端末が広く採用され、その多くが非接触にも対応したことで、非接触決済が主流の決済方法として確固たる地位を築きました。2020年には、COVID-19パンデミックにより、消費者と企業が安全と衛生を優先したことで非接触決済への移行が加速し、非接触取引がかつてないほど急増しました。

完全なレポートはこちら: https://www.databridgemarketresearch.com/reports/us-electronic-point-of-sale-epos-market

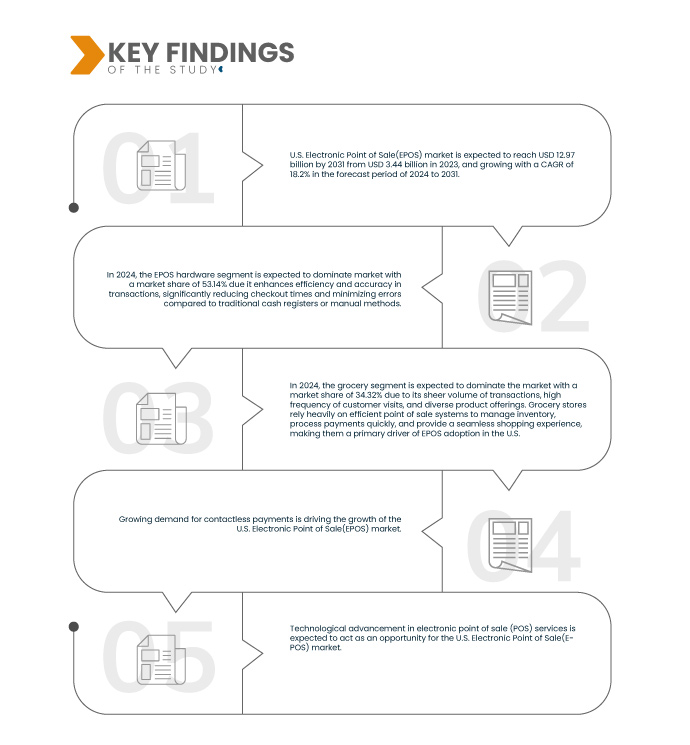

データブリッジマーケットリサーチは、米国の電子販売時点管理(EPOS)市場は、 2024年から2031年の予測期間中に18.2%のCAGRで成長し、2023年の34億4,000万米ドルから2031年には129億7,000万米ドルに達すると予測しています。

研究の主な結果

オムニチャネル小売業の台頭

オムニチャネル・リテーリングとは、実店舗、eコマースプラットフォーム、モバイルアプリ、ソーシャルメディアなど、オンラインとオフラインの販売チャネルを統合することを指します。あらゆるタッチポイントにおいて、一貫したメッセージング、価格設定、そして顧客体験を提供することに重点を置き、実店舗とデジタル小売環境の境界を曖昧にします。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016~2021年にカスタマイズ可能)

|

定量単位

|

収益(10億米ドル)

|

対象セグメント

|

提供内容(EPOSハードウェア、POSソフトウェア、EPOSサービス)、エンドユーザー(食料品、一般商品、ホスピタリティ、燃料・コンビニエンスストア、レストラン、ファッション/専門店、旅行、エンターテイメント、その他)

|

対象となる市場プレーヤー

|

NCR Voyix Corporation(米国)、Diebold Nixdorf, Incorporated(米国)、Toshiba Global Commerce Solutions(米国)、Oracle(米国)、Posiflex Technology, Inc.(台湾)、富士通(日本)、Block, Inc.(米国)、Agilysys NV LLC.(米国)、QINGDAO HISTONE INTELLIGENT COMMERCIAL SYSTEM CO. LTD.(中国)、HP Development Company, LP(米国)など

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要企業などの市場シナリオに関する洞察に加えて、専門家による詳細な分析、地理的に表された企業別の生産量と生産能力、販売業者とパートナーのネットワークレイアウト、詳細かつ最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。

|

セグメント分析

米国の電子販売時点管理 (EPOS) 市場は、提供内容とエンドユーザーに基づいて 2 つの主要なセグメントに分割されています。

- 提供に基づいて、米国の電子販売時点管理(EPOS)市場は、EPOSハードウェア、POSソフトウェア、およびEPOSサービスに分類されます。

2024年には、EPOSハードウェアセグメントが 米国の電子販売時点管理(EPOS)市場を支配すると予想されています。

2024年には、EPOSハードウェアセグメントが、従来のレジや手動の方法に比べて、取引の効率と精度を高め、チェックアウト時間を大幅に短縮し、エラーを最小限に抑えることから、53.14%の市場シェアで米国電子販売時点管理(EPOS)市場を支配すると予想されています。

- エンドユーザーに基づいて、米国の電子販売時点管理(EPOS)市場は、食料品、一般商品、ホスピタリティ、燃料およびコンビニエンスストア、レストラン、ファッション/専門店、旅行、エンターテイメント、その他に分類されます。

2024年には、食料品セグメントが米国の電子販売時点管理(EPOS)市場を支配すると予想されています。

2024年には、食料品セグメントが、その膨大な取引量、顧客来店頻度の高さ、そして多様な商品ラインナップにより、米国電子POS(EPOS)市場において34.32%の市場シェアを獲得し、市場を席巻すると予想されています。食料品店は、在庫管理、迅速な決済処理、そしてシームレスなショッピング体験の提供のために、効率的なPOSシステムに大きく依存しており、米国におけるEPOS導入の主な推進力となっています。

主要プレーヤー

Data Bridge Market Researchは、米国の電子販売時点管理(EPOS)市場で事業を展開する主要企業として、NCR Voyix Corporation(米国)、Oracle(米国)、Block, Inc.(米国)、QINGDAO HISTONE INTELLIGENT COMMERCIAL SYSTEM CO. LTD.(中国)、およびHP Development Company, LP(米国)を分析しています。

市場動向

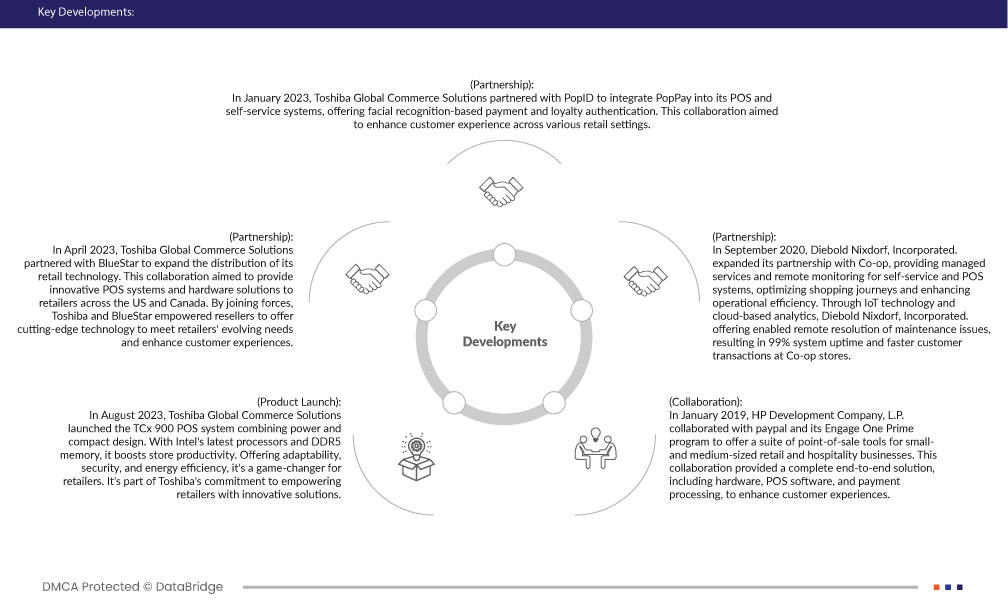

- 2023年1月、東芝グローバルコマースソリューションズはPopIDと提携し、POSおよびセルフサービスシステムにPopPayを統合しました。これにより、顔認証による決済とロイヤルティ認証が利用可能になりました。この協業は、様々な小売業における顧客体験の向上を目指しています。

- 2023年4月、東芝グローバルコマースソリューションズは、小売技術の販売拡大のため、BlueStar社と提携しました。この提携は、米国とカナダの小売業者に革新的なPOSシステムとハードウェアソリューションを提供することを目指していました。東芝とBlueStar社の協力により、販売代理店は小売業者の進化するニーズに対応し、顧客体験を向上させる最先端技術を提供できるようになりました。

- 東芝グローバルコマースソリューションズは、2023年8月、パワフルさとコンパクトさを兼ね備えたPOSシステム「TCx 900」を発売しました。インテルの最新プロセッサーとDDR5メモリを搭載し、店舗の生産性を向上させます。優れた適応性、セキュリティ、そしてエネルギー効率を備え、小売業者にとって画期的な製品です。これは、革新的なソリューションで小売業者を支援するという東芝のコミットメントの一環です。

- 2019年1月、HP Development Company, LPはPayPalとそのEngage One Primeプログラムと提携し、中小規模の小売業およびホスピタリティ事業者向けのPOSツールスイートを提供しました。この提携により、ハードウェア、POSソフトウェア、決済処理を含む包括的なエンドツーエンドのソリューションが提供され、顧客体験が向上しました。

- 2020年9月、Diebold Nixdorf, IncorporatedはCo-opとのパートナーシップを拡大し、セルフサービスシステムとPOSシステムのマネージドサービスとリモートモニタリングを提供することで、ショッピング体験の最適化と業務効率の向上を実現しました。Diebold Nixdorf, Incorporatedは、IoTテクノロジーとクラウドベースの分析を通じて、メンテナンスの問題をリモートで解決できるようになり、Co-op店舗におけるシステム稼働率99%と顧客取引の迅速化を実現しました。

Data Bridge Market Researchの分析によると:

米国の電子販売時点管理(EPOS)市場レポートの詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/us-electronic-point-of-sale-epos-market