靴底の素材の重要性は、健康と整形外科的配慮と密接に関係しています。サポート力とクッション性に優れた靴底は足のストレスを最小限に抑えるのに役立つため、靴底の素材の選択は足の健康に極めて重要な役割を果たします。慎重に選ばれた靴底の素材は、十分なサポート力とクッション性を提供し、長時間履くことによる怪我や不快感のリスクを軽減することで、整形外科的健康に貢献します。運動用靴でも普段履きの靴でも、適切な靴底の素材は足の健康を高め、足にとって快適でサポート力のある環境を促進します。

完全なレポートにアクセスするには、 https://www.databridgemarketresearch.com/reports/south-america-footwear-sole-material-market

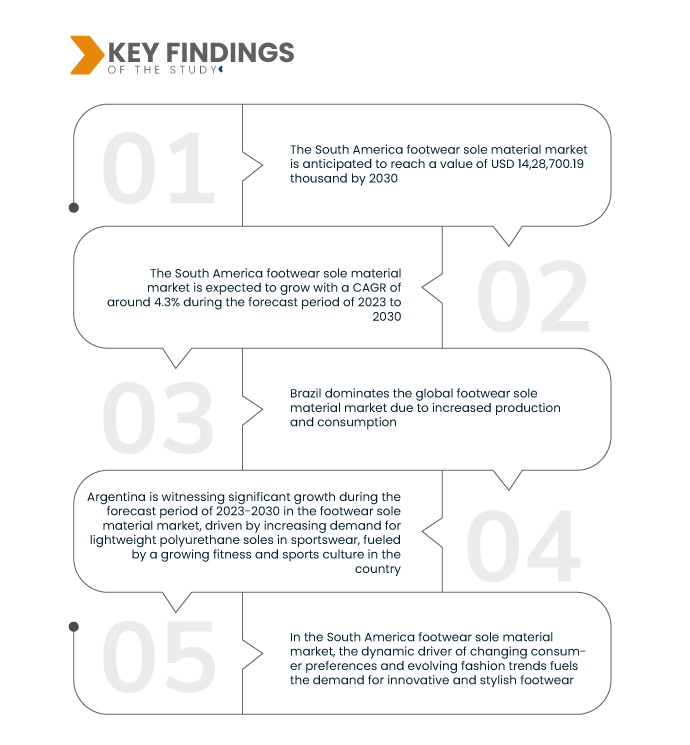

データブリッジマーケットリサーチは、 南米の靴底材料市場は、2022年には10,20,156.11千米ドルでしたが、2030年には14,28,700.19千米ドルに達し、2023年から2030年の予測期間中に4.3%のCAGRで成長すると予想されています。南米のスポーツとフィットネス文化の高まりは、履物ソール素材市場の重要な推進力です。スポーツ活動への参加の増加は、特殊な運動靴の需要を促進し、優れた快適性、サポート、およびパフォーマンスを提供する高度なソール素材の必要性を促進し、それによって市場の成長に影響を与えます。

研究の主な結果

消費者の重視の高まりによる需要の増加が市場の成長率を押し上げると予想される。

南米の靴底素材市場における主な推進力は、消費者が履物の選択において快適さと性能を重視するようになったことによる需要の高まりです。現代の消費者は、靴に優れたクッション性、衝撃吸収性、耐久性を重視します。この傾向により、これらの期待に応える高度な靴底素材の需要が高まっています。メーカーは、快適で高性能な体験を提供することを目指して、革新的な素材と技術を開発して靴底に取り入れることで対応しています。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2023年から2030年

|

|

基準年

|

2022

|

|

歴史的な年

|

2021 (2015~2020年にカスタマイズ可能)

|

|

定量単位

|

売上高は千米ドル、販売数量は個数、価格は米ドル

|

|

対象セグメント

|

靴底素材(プラスチック靴底、ゴム靴底、皮革靴底、バイオ化合物、伐採木材、その他の素材)、靴底コンポーネント(アウトソール、インナーソール、ミッドソール、ユニットソール)、製品(運動靴底素材、非運動靴底素材、その他)、流通チャネル(オンライン、オフライン、その他)、エンドユーザー(男性、女性、子供)、靴底タイプ(新品靴底、修理用靴底)、業界(農業、化学、建設、金属、食品、輸送、警備、鉱業、製薬、電子産業、その他)

|

|

対象国

|

ブラジル、アルゼンチン、その他の南米諸国は南アメリカの一部である

|

|

対象となる市場プレーヤー

|

ルーブリゾール社(米国)、万華(中国)、ハンツマン・インターナショナル社(米国)、コイム・グループ(イタリア)、ソルベイ(ベルギー)、BASF社(米国)、ダウ社(米国)、コベストロ社(ドイツ)、旭化成株式会社(日本)、エラ・ポリマーズ社(オーストラリア)、ブラスケム社(アメリカ)、イノアック社(日本)、インゴム社(イタリア)、ビブラム・コマース社(イタリア)、オールバーズ社(米国)、ミシュラン・ソールズ社(中国)、アルケマ社(フランス)、エボニック・インダストリーズ社(ドイツ)

|

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要企業などの市場シナリオに関する洞察に加えて、専門家による詳細な分析、地理的に表された企業別の生産量と生産能力、販売業者とパートナーのネットワークレイアウト、詳細かつ最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。

|

セグメント分析:

南米の履物靴底材料市場は、靴底材料、靴底部品、製品、流通チャネル、エンドユーザー、靴底タイプ、および業界に基づいて分類されています。

- 靴底材料に基づいて、南米の靴底材料市場は、プラスチック靴底、ゴム靴底、革靴底、バイオコンパウンド、伐採木材、およびその他の材料に分類されます。

- 南米の靴底材料市場は、ソールのコンポーネントに基づいて、アウトソール、インナーソール、ミッドソール、ユニットソールに分類されます。

- 製品に基づいて、南米の靴底材料市場は、運動靴底材料、非運動靴底材料、その他に分類されます。

- 流通チャネルに基づいて、南米の靴底材料市場はオンライン、オフライン、その他に分類されます。

- エンドユーザーに基づいて、南米の靴底材料市場は男性、女性、子供に分類されます。

- 靴底の種類に基づいて、南米の靴底材料市場は、新しい靴底と修理用靴底に分類されます。

- 産業別に見ると、南米の靴底材料市場は、農業、化学、建設、金属、食品、運輸、セキュリティ、鉱業、製薬、電子産業などに分かれています。

主要プレーヤー

データブリッジマーケットリサーチは、南米の靴底材市場における主要な南米の靴底材市場プレーヤーとして、ルーブリゾールコーポレーション(米国)、ワンフア(中国)、ハンツマンインターナショナルLLC(米国)、コイムグループ(イタリア)、ソルベイ(ベルギー)、BASF SE(米国)、ダウ(米国)、コベストロAG(ドイツ)、旭化成株式会社(日本)を挙げています。

市場動向

- 2021年、アヴェイロ大学、ポルト大学、ミーニョ大学は、ポルトガルの学者チームが主導する靴の安全素材プロジェクト(SM4S)で協力しました。この協力の主な目的は、コロナウイルスやその他のウイルスとの戦いを特にターゲットとした、ウイルス耐性のある靴底を開発することでした。このプロジェクトは、先進的な材料と技術を取り入れて靴の安全機能を強化し、進行中の世界的パンデミックにおける公衆衛生に貢献することを目指していました。

- 2021年、大手化学会社BASFはホッターと提携し、ホッターのカジュアルシューズの快適性と性能を向上させました。この提携では、BASF SEが開発した発泡熱可塑性ポリウレタン(E-TPU)の一種であるInfinergyをホッターのシューズデザインに取り入れました。ホッターのクッション技術とBASFのInfinergyの相乗効果により、クラシックなシューズに並外れた快適さを提供することを目指しました。このパートナーシップにより、より快適で技術的に進歩した履物の選択肢を求めるより幅広い顧客層を引き付けることが期待されました。

- 2020年、プーマは革新的な靴ひもシステムを発表し、プーマ Fi トレーナーの発売で注目を集めました。このトレーナーは、指で軽くスワイプするだけで靴ひもを締めることができる技術を採用していました。この開発は、従来の靴ひもを結ぶ方法に代わる便利で未来的なソリューションを提供し、フットウェア技術の飛躍的な進歩を表しています。プーマ Fi トレーナーは、スポーツシューズにスタイルと機能性の両方を求める消費者のニーズに応えました。

- 2020年、プーマはリサイクルプラスチックから作られた新しいフットウェアラインを立ち上げ、持続可能性に向けて大きな一歩を踏み出しました。リサイクル会社であるファーストマイルと協力し、プーマはリサイクルプラスチック素材を使用して靴を製造することで環境問題に対処することを目指しました。この環境に優しい取り組みは、持続可能で環境に配慮した製品に対する消費者の需要の高まりに応えるように設計されました。ファーストマイルとのコラボレーションは、環境への影響を減らし、より持続可能な未来に貢献するというプーマのコミットメントを示しています。

地域分析

地理的に見ると、南米の靴底材料市場レポートでカバーされている国は、南米の一部としてブラジル、アルゼンチン、およびその他の南米諸国です。

Data Bridge Market Research の分析によると:

ブラジルは、 南米の靴底素材市場 予測期間2023~2030年

ブラジルが世界の靴底素材市場で優位に立っているのは、これらの素材の生産と消費の両方が大幅に増加したためです。ブラジルの靴業界は、国内外で高まる需要に応えて、著しい成長を遂げています。消費者が快適さを重視する傾向を反映して、日常履きの靴に柔らかい靴底が好まれるようになり、市場の拡大を牽引しています。効率的で費用対効果の高い生産インフラを特徴とするブラジルの製造力は、その優位性をさらに強固なものにしています。

アルゼンチンは最も急速に成長していると推定される 国 で 南米の靴底材料市場 予測期間 2023-2030

アルゼンチンは、特にスポーツウェアにおいて、ポリウレタン素材に重点を置いた軽量ソールの需要の高まりにより、2023~20230年の予測期間中に靴底素材市場で大幅な成長を遂げると予想されています。この傾向は、快適でパフォーマンス重視の靴への消費者の好みのシフトを反映しています。国内でのスポーツ活動の急増は、フィットネスとスポーツ文化の増加を示し、市場の成長をさらに推進しています。軽量ポリウレタンソールの好みとスポーツシーンの盛んさの組み合わせにより、アルゼンチンは、スポーツが引き続き注目を集めるにつれて持続的な拡大の可能性を秘めた、靴底素材市場の軌道を形成する上で重要なプレーヤーとしての地位を確立しています。

詳細については、 南米の靴底材料市場レポートについては、ここをクリックしてください –https://www.databridgemarketresearch.com/reports/south-america-footwear-sole-material-market