IQVIA ファクトシートによると、2022 年 7 月、同社のデータ クエリ システム (DQS) は、非常に堅牢で検索可能なデータ リポジトリでマスター データ管理を使用し、スポンサーと CRO が臨床試験に適した研究者や施設を見つけ、研究計画をより適切にサポートできるようになりました。

さらに、国立科学技術統計センター(NCSES)のデータによると、2020年に米国は研究開発費として5,380億ドルを費やし、2019年の支出と比較して9.1%増加しました。

完全なレポートにアクセスするには、https://www.databridgemarketresearch.com/reports/north-america-eclinical-solutions-market

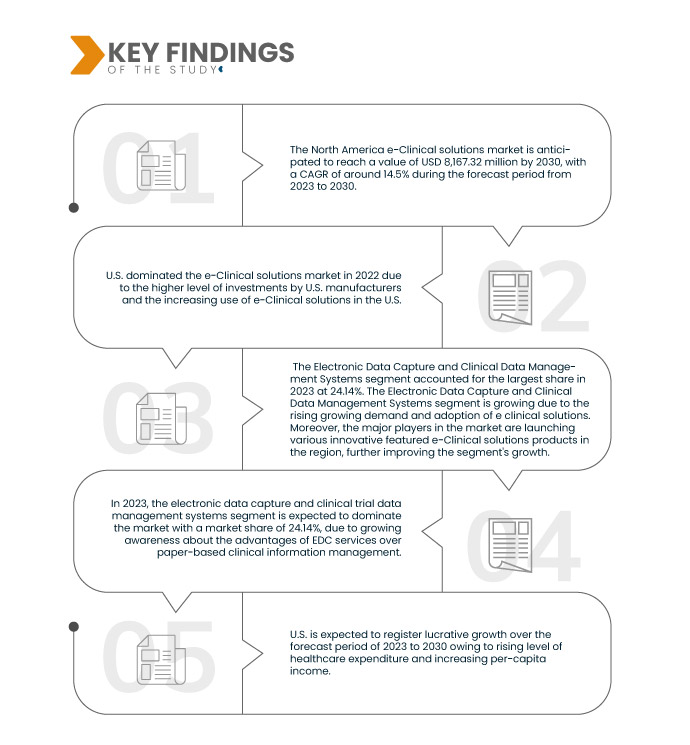

データブリッジマーケットリサーチは、 北米の電子臨床ソリューション市場 2023年から2030年の予測期間に14.5%のCAGRで成長し、2030年までに200億2,242万米ドルに達すると予想されています。電子データキャプチャおよび臨床データ管理システムは、臨床試験データを収集し、医療データを電子的に分析するためのe臨床ソリューションで広く使用されているため、市場の成長を促進すると予測されています。

研究の主な結果

臨床試験における電子臨床ソリューションの利用増加

臨床試験は、分子の安全性と有効性を評価するための医薬品開発の研究に使用される調査手順です。臨床試験は広範囲で複雑なプロセスであるため、臨床試験期間を簡素化および短縮するための革新的で自動化された電子ソリューションの需要が高まっています。研究者とメーカーは、臨床試験管理システムで評価を行うための自動化された電子的方法を開発しました。

e-Clinical ソリューションは、電子健康記録、電子同意書、統合型 e テクノロジー、電子データ キャプチャ、臨床データ管理システムで構成されています。e-Clinical ソリューションは、長期にわたる臨床研究プロセスを適切に管理するソリューションを提供することで、エンドツーエンドの臨床研究プロセスで研究者を支援します。臨床研究組織では、規制文書の管理、チーム コラボレーション、サプライ チェーンの管理、サイト パフォーマンス管理、レポート作成を支援しており、市場では e-Clinical ソリューションの需要が高まっています。

e-clinical ソリューションは、医師や研究者が臨床試験のコストと期間を削減し、データを収集するのに役立っています。

したがって、データ損失の可能性を減らし、臨床試験の数を増やすために、臨床試験における電子臨床ソリューションの使用が増加しています。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2023年から2030年

|

|

基準年

|

2022

|

|

歴史的な年

|

2021 (2015~2020年にカスタマイズ可能)

|

|

定量単位

|

収益(百万米ドル)

|

|

対象セグメント

|

製品(電子データキャプチャおよび臨床試験データ管理システム、臨床試験管理システム、臨床分析プラットフォーム、ケアコーディネーション医療記録(CCMR)、 ランダム化と治験供給管理、臨床データ統合プラットフォーム、電子臨床アウトカム評価ソリューション、安全性ソリューション、電子試験マスターファイルシステム、規制情報管理ソリューションなど)、配信モード(Webホスト(オンデマンド)ソリューション、ライセンスエンタープライズ(オンプレミス)ソリューション、クラウドベース(SAAS)ソリューション)、臨床試験フェーズ(フェーズI、フェーズII、フェーズIII、フェーズIV)、組織規模(中小規模および大規模)、ユーザーデバイス(デスクトップ、 タブレット、ハンドヘルドPDAデバイス、スマートフォンなど)、エンドユーザー(製薬会社、バイオ医薬品会社、開発業務受託機関、コンサルティングサービス会社、医療機器メーカー、病院、学術研究機関)

|

|

対象国

|

米国、カナダ、メキシコ

|

|

対象となる市場プレーヤー

|

Oracle(米国)、Signant Health(米国)、MaxisIT(米国)、Paraxel International Corporation(米国)、Dassault Systemes(フランス)、Clario(米国)、Mednet(米国)、OpenClinica, LLC(米国)、4G Clinical(米国)、Veeva Systems(米国)、Saama Technologies, LLC(米国)、Anju(米国)、Castor、Medrio, Inc.(米国)、ArisNorth America(米国)、Merative(米国)、Advarra(米国)、eClinical Solutions, LLC(米国)、Y-Prime LLC(米国)、RealTime Software Solutions LLC(米国)、Datatrak Int.(米国)、IQVIA Inc.(米国)など

|

|

レポートで取り上げられているデータポイント

|

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。

|

セグメント分析

北米の電子臨床ソリューション市場は、製品、配信モード、臨床試験の段階、組織の規模、ユーザーデバイス、エンドユーザーに基づいてセグメント化されています。

- 製品に基づいて、市場は電子データキャプチャと臨床試験データ管理システムに分類されます。 臨床試験管理システム臨床分析プラットフォーム、ケアコーディネーション医療記録 (CCMR)、ランダム化および試験供給管理、臨床データ統合プラットフォーム、電子臨床結果評価ソリューション、安全性ソリューション、電子試験マスターファイルシステム、規制情報管理ソリューションなど。

2023年には、電子データキャプチャと臨床試験データ管理システムセグメントが市場を支配すると予想されています。

2023年には、紙ベースの臨床情報管理よりもEDCサービスの利点が認識されるようになり、電子データキャプチャおよび臨床試験データ管理システムセグメントが24.14%の市場シェアで市場を支配すると予想されています。

- 配信モードに基づいて、市場は、Web ホスト型 (オンデマンド) ソリューション、ライセンスされたエンタープライズ (オンプレミス) ソリューション、およびクラウドベース (SAAS) ソリューションに分類されます。

2023年には、ウェブホスト型(オンデマンド)ソリューションセグメントが市場を席巻すると予想されています。 市場

2023 年には、e クリニカル ソリューションのアプローチの進歩と革新により、Web ホスト型 (オンデマンド) ソリューション セグメントが 42.70% の市場シェアで市場を支配すると予想されます。

- 臨床試験の段階に基づいて、市場はフェーズ I、フェーズ II、フェーズ III、フェーズ IV に分割されます。2023 年には、フェーズ III セグメントが 39.05% の市場シェアで市場を支配すると予想されます。

- 組織規模に基づいて、市場は中小規模と大規模に分割されています。2023年には、中小規模のセグメントが63.10%の市場シェアで市場を支配すると予想されています。

- ユーザーデバイスに基づいて、市場はデスクトップ、タブレット、ハンドヘルドPDAデバイスに分類されます。 スマートフォン、など。2023年には、デスクトップセグメントが50.18%の市場シェアで市場を支配すると予想されています。

- エンドユーザーに基づいて、市場は製薬およびバイオ医薬品会社、契約研究機関、コンサルティングサービス会社、医療機器メーカー、病院、学術研究機関に分類されます。2023年には、契約研究機関セグメントが41.08%の市場シェアで市場を支配すると予想されます。

主要プレーヤー

Data Bridge Market Research は、北米の e-clinical ソリューション市場における主要な e-clinical ソリューション市場プレイヤーとして、Oracle (米国)、Signant Health (米国)、MaxisIT (米国)、Paraxel International Corporation (米国)、Dassault Systemes (フランス)、Clario (米国)、Mednet (米国)、OpenClinica, LLC (米国)、4G Clinical (米国)、Veeva Systems (米国)、Saama Technologies, LLC (米国)、Anju (米国)、Castor, Medrio, Inc. (米国)、ArisNorth America (米国)、Merative (米国)、Advarra (米国)、eClinical Solutions, LLC (米国)、Y-Prime LLC (米国)、RealTime Software Solutions LLC (米国)、Datatrak Int. (米国)、IQVIA Inc. (米国) などを認識しています。

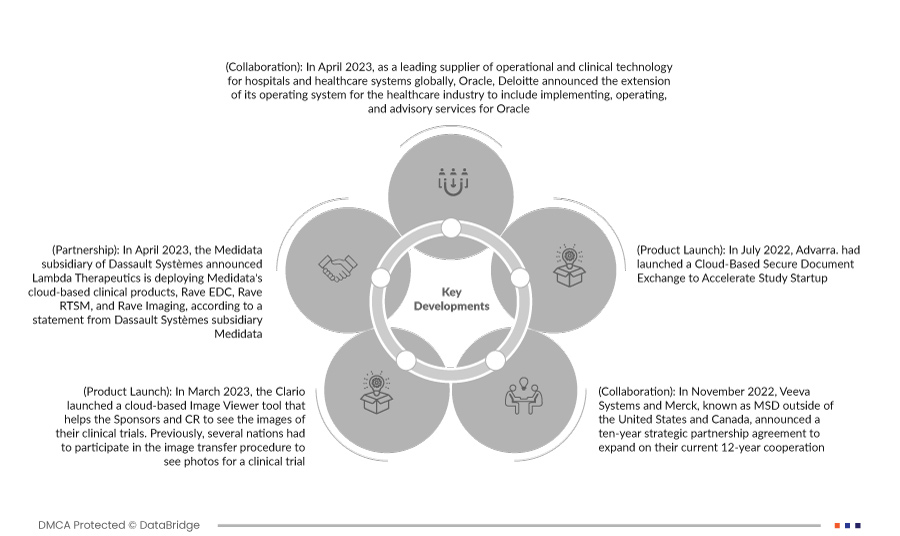

市場開拓

- 2023年4月、世界中の病院や医療システム向けの運用および臨床テクノロジーの大手サプライヤーであるオラクルとデロイトは本日、医療業界向けのオペレーティング システムを拡張し、オラクル向けの実装、運用、アドバイザリ サービスを含めることを発表しました。デロイトの拡大を続ける医療テクノロジー製品ポートフォリオである Deloitte Health-Oracle Accelerated は、病院、プロバイダー、保険会社ではなく患者主導の広大なエコシステムとプラットフォームへの業界の変革に対応するために作成されました。長年にわたる Oracle PartnerNetwork (OPN) メンバーであるデロイトは、Oracle Health と協力して、将来に備えた医療提供システムを顧客に提供しています。

- ダッソー・システムズの子会社であるメディデータは2023年4月、Lambda Therapeuticsがメディデータのクラウドベースの臨床製品であるRave EDC、Rave RTSM、およびRave Imagingを導入すると発表しました。これはダッソー・システムズの子会社であるメディデータの声明によるものです。データ管理業務を自動化および最適化し、より高品質なデータを安全に提供してより迅速な洞察を得ることで、臨床試験の生産性がさらに向上します。これにより、同社は地域全体だけでなく世界中で自社の製品を宣伝することができました。

- 2023 年 3 月、Clario はクラウドベースの画像ビューア ツールをリリースしました。このツールは、スポンサーや CRO が臨床試験の画像を確認できるように支援します。以前は、臨床試験の写真を確認するために、複数の組織が画像転送手順に参加する必要がありました。これにより、すでにリスクの高いプロセスが複雑化し、遅延やミスの可能性が高まりました。これにより、同社のサービス提供が拡大しました。

- 2022年7月、Advarraは研究の立ち上げを加速するためにクラウドベースの安全な文書交換を開始しました。これにより、同社は世界的な存在感を確立することができました。

- 2022年11月、Veeva Systemsと米国とカナダ以外ではMSDとして知られるMerckは、現在の12年間の協力関係を拡大する10年間の戦略的パートナーシップ契約を発表しました。契約条件に従い、Merckは新しい業界固有のソフトウェアとデータを開発する際にVeevaの統合クラウドベースのプラットフォームと製品を優先し、適切な場合にはVeevaのソリューションを選択します。MerckはVeevaからVeevaの製品開発と戦略的な価格設定アプローチに関する意見を受け取ります。このコラボレーションにより、Merckのデジタル戦略が加速され、Veevaの商品とサービスを分析、取得、使用し、価値を引き出す能力が向上します。

地域分析

地理的に見ると、先進的創傷ケア市場レポートの対象国は米国、カナダ、メキシコです。

Data Bridge Market Research の分析によると:

米国は、 市場 予測期間2023年~2030年。

米国は、米国メーカーによる投資レベルが高く、e-Clinical ソリューションの採用が増えているため、市場を支配すると予想されています。米国は、市場シェアと市場収益の面で市場を支配し続け、予測期間中にその優位性を高め続けるでしょう。これは、この地域での先進技術の採用の増加と新しい e-Clinical ソリューション製品の発売によるものです。さらに、医薬品の開発と発見のための臨床研究の数が増加し、この地域での EDC システムの需要を促進すると予想されます。

米国は、この地域の新興経済における医療施設の急速な発展により、予測期間中に成長すると予想されています。これに加えて、医療費の増加と一人当たりの所得の増加により、この地域の市場の成長率が加速すると予想されます。

詳細については、 北アメリカ e-clinicalソリューション市場レポートについては、ここをクリックしてください –https://www.databridgemarketresearch.com/reports/north-america-eclinical-solutions-market