ニュージーランドの民間医療保険市場は、医療費の高騰、人口の高齢化、公的医療保険の適用範囲の狭さといった要因を背景に、着実な成長を遂げています。医療保険は、キャッシュレス入院や払い戻しオプションなど、様々な特徴とメリットを提供しています。複数の補償タイプが用意されているため、加入者は自身のニーズや希望に合ったプランを選択できます。包括的なヘルスケアソリューションと医療費に対する経済的保障への需要の高まりを受け、ニュージーランドの民間医療保険市場は今後も成長を続けると予想されます。

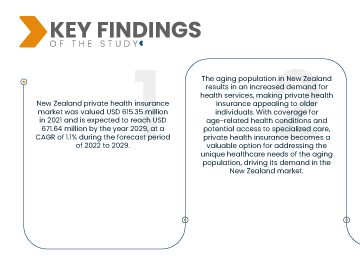

データブリッジ市場調査の分析によると、ニュージーランドの民間医療保険市場は2021年に6億1,535万米ドルと評価され、2022年から2029年の予測期間中に1.1%のCAGRで成長し、2029年には6億7,164万米ドルに達すると予想されています。ニュージーランドでは医療費や医療サービス費が高騰しているため、個人が予期せぬ医療費に対する経済的保護を求めて民間医療保険を求めるようになり、市場における民間医療保険の需要が高まっています。

研究の主な結果

ニュージーランドの公的医療保険の適用範囲が限られていることが、市場の成長率を押し上げると予想される。

ニュージーランドでは公的医療保険の適用範囲が限られており、特定の医療処置の待ち時間や制限が生じる可能性があるため、人々は民間医療保険を求める傾向があります。民間医療保険を選択することにより、医療サービスや専門治療への迅速なアクセスが可能になり、タイムリーで包括的な医療を受けることができます。医療オプションの拡充と待ち時間の短縮を求める声は、ニュージーランド市場における民間医療保険の需要を牽引し、その成長と普及を牽引する大きな要因となっています。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2022年から2029年

|

基準年

|

2021

|

歴史的な年

|

2020年(2014~2019年にカスタマイズ可能)

|

定量単位

|

売上高(百万米ドル)、販売数量(個数)、価格(米ドル)

|

対象セグメント

|

タイプ(重大疾病保険、個人健康保険、家族健康保険、特定疾病保険など)、健康保険プランのカテゴリー/メタルレベル(ブロンズ、シルバー、ゴールド、プラチナなど)、プロバイダータイプ(健康維持機構(HMOS)、優先プロバイダー組織(PPOS)、独占プロバイダー組織(EPOS)、ポイントオブサービス(POS)プラン、高額控除対象健康保険(HDHPS)など)、年齢層(若年成人(19~44歳)、中年成人(45~64歳)、高齢成人(65歳以上))、流通チャネル(直接保険会社、保険アグリゲーターなど)

|

対象国

|

ニュージーランド

|

対象となる市場プレーヤー

|

シグナ(米国)、AIAグループ・リミテッド(香港)、HCF(オーストラリア)、アリアンツ(ドイツ)、サンコープ・グループ(オーストラリア)、HSBCグループ(香港)、東京海上(日本)、ユニメッド(ニュージーランド)、サザンクロス、アキュロ・ヘルス・インシュアランス(ニュージーランド)、パートナーズ・ライフ(ニュージーランド)

|

レポートで取り上げられているデータポイント

|

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、患者の疫学、パイプライン分析、価格分析、規制の枠組みも含まれています。

|

セグメント分析:

民間健康保険市場は、タイプ、健康保険プランのカテゴリー/メタルレベル、プロバイダータイプ、年齢層、流通チャネルに基づいてセグメント化されています。

- タイプに基づいて、民間健康保険市場は、重大疾病保険、個人健康保険、家族健康保険、疾病特定保険、その他に分類されます。

- 健康保険プランのカテゴリー/メタルレベルに基づいて、民間健康保険市場はブロンズ、シルバー、ゴールド、プラチナ、その他に分類されます。

- プロバイダーの種類に基づいて、民間健康保険市場は、健康維持機構 (HMOS)、優先プロバイダー組織 (PPOS)、独占プロバイダー組織 (EPOS)、ポイントオブサービス (POS) プラン、高額控除額健康保険プラン (HDHPS) などに分類されます。

- 年齢層に基づいて、民間健康保険市場は、若年成人(19〜44歳)、中年成人(45〜64歳)、高齢成人(65歳以上)に分類されます。

- 流通チャネルに基づいて、民間健康保険市場は、直接保険会社、保険アグリゲーター、その他に分類されます。

主要プレーヤー

データブリッジマーケットリサーチは、ニュージーランドの民間医療保険市場における主要なプレーヤーとして、シグナ(米国)、AIAグループリミテッド(香港)、HCF(オーストラリア)、アリアンツ(ドイツ)、サンコープグループ(オーストラリア)、HSBCグループ(香港)、東京海上(日本)、ユニメッド(ニュージーランド)の企業を認識しています。

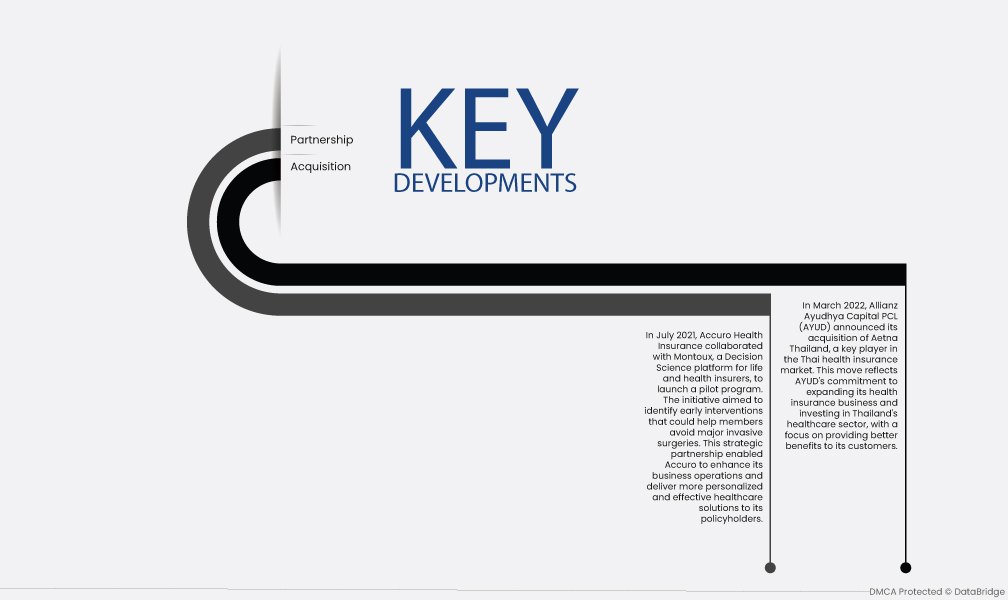

市場動向

- 2022年3月、アリアンツ・アユダヤ・キャピタルPCL(AYUD)は、タイの医療保険市場の主要プレーヤーであるアエトナ・タイランドの買収を発表しました。この買収は、顧客により良いベネフィットを提供することに重点を置き、医療保険事業の拡大とタイのヘルスケアセクターへの投資に対するAYUDのコミットメントを反映しています。

- 2021年7月、Accuro Health Insuranceは、生命保険・医療保険会社向けの意思決定科学プラットフォームであるMontouxと提携し、パイロットプログラムを開始しました。この取り組みは、加入者が大規模な侵襲性手術を回避できるよう、早期介入を特定することを目的としていました。この戦略的パートナーシップにより、Accuroは事業運営を強化し、保険加入者によりパーソナライズされた効果的なヘルスケアソリューションを提供できるようになりました。

ニュージーランドの民間医療保険市場レポートの詳細については、こちらをクリックしてください – https://www.databridgemarketresearch.com/reports/new-zealand-private-health-insurance-market