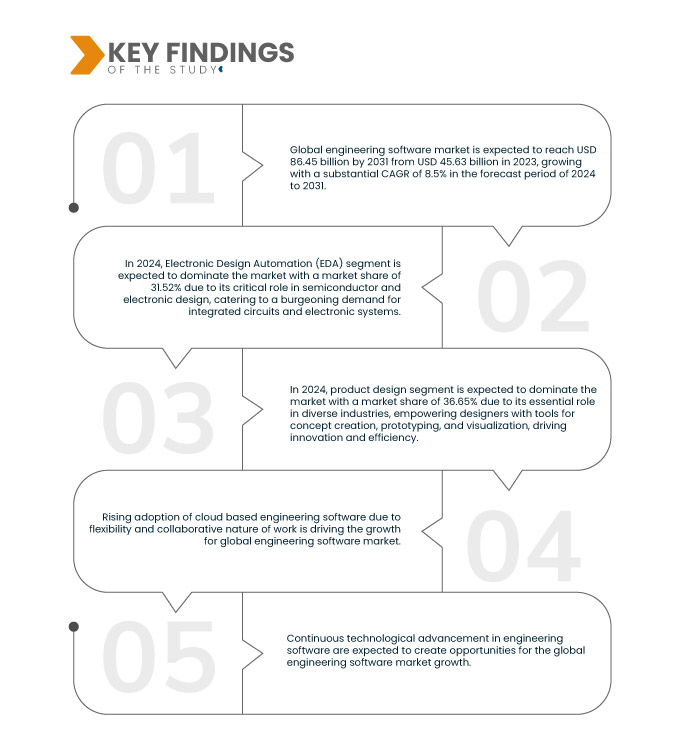

クラウドベースのソリューションは比類のない柔軟性と拡張性を提供し、エンジニアはインターネット接続があればどこからでも重要なツールやデータにアクセスできます。このモビリティにより、チームは地理的な境界を越えてシームレスに連携できるようになり、従来のコミュニケーションの障壁を打ち破り、生産性を向上させます。さらに、クラウドベースのソリューションは、アクセシビリティの向上、イノベーションの加速、ワークフローの最適化を通じて、エンジニアリングソフトウェア市場に変革をもたらしています。これにより、企業は今日の急速に変化するビジネスの世界において、競争と繁栄に必要な柔軟性を獲得できます。

完全なレポートは https://www.databridgemarketresearch.com/reports/global-software-engineering-marketからご覧いただけます。

データブリッジマーケットリサーチは、世界のエンジニアリングソフトウェア市場は、2024年から2031年の予測期間中に8.5%のCAGRで成長し、2023年の456億3,000万米ドルから2031年には864億5,000万米ドルに達すると予測しています。

研究の主な結果

インフラプロジェクトへの投資増加

世界中でインフラプロジェクトへの投資が増加していることは、エンジニアリングソフトウェア市場を大きく牽引しています。政府や民間セクターがインフラ開発に多額の資金を投入するにつれ、エンジニアリングソフトウェアソリューションの需要が高まっています。これらの投資は、交通、エネルギー、水道、都市開発など、幅広いプロジェクトに及んでいます。エンジニアリングソフトウェアは、エンジニアが複雑なインフラシステムを効果的に設計、シミュレーション、管理できるようにすることで、これらのプロジェクトにおいて重要な役割を果たしています。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016~2021年にカスタマイズ可能)

|

定量単位

|

収益(10億)

|

対象セグメント

|

ソフトウェアの種類 (電子設計自動化 (EDA)、コンピュータ支援設計 (CAD)、建築・エンジニアリング・建設 (AEC)、コンピュータ支援エンジニアリング (CAE)、コンピュータ支援製造 (CAM))、アプリケーション (製品設計、3D モデリング、自動化設計、プラント設計など)、企業規模 (大企業、中規模企業、小規模企業)、エンドユーザー (自動車、航空宇宙・防衛、石油・ガス、IT ・通信、ヘルスケアなど)

|

対象国

|

米国、カナダ、メキシコ、ドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国、中国、日本、インド、韓国、マレーシア、オーストラリア、シンガポール、タイ、フィリピン、インドネシア、その他のアジア太平洋諸国、サウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ諸国、ブラジル、アルゼンチン、その他の南米諸国

|

対象となる市場プレーヤー

|

Autodesk Inc.(米国)、Synopsys, Inc.(米国)、Dassault Systèmes(フランス)、ANSYS, Inc(米国)、Cadence Design Systems, Inc.(米国)、The MathWorks, Inc.(米国)、PTC(米国)、Siemens(ドイツ)、Bentley Systems, Incorporated(米国)、Hexagon AB(スウェーデン)、Altair Engineering Inc.(米国)、Altium Limited(米国)、HCL Technologies Limited(インド)、AVEVA Group(Schneider Electricの子会社)(英国)、BY COMSOL(米国)、BETA CAE Systems(スイス)、CNC Software, LLC(Sandvik ABの子会社)(米国)、Carlson Software(米国)、ESI Group(フランス)、ZWSOFT CO., LTD.(中国)、SimScale(ドイツ)、Computers and Structures, Inc.(米国)など

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、専門家による詳細な分析、輸入/輸出分析、価格分析、生産消費分析、乳棒分析が含まれています。

|

セグメント分析

世界のエンジニアリング ソフトウェア市場は、ソフトウェアの種類、アプリケーション、企業規模、エンド ユーザーに基づいて 4 つのセグメントに分類されています。

- ソフトウェアの種類に基づいて、世界のエンジニアリングソフトウェア市場は、電子設計自動化(EDA)、コンピュータ支援設計(CAD)、建築、エンジニアリングおよび建設(AEC)、コンピュータ支援エンジニアリング(CAE)、コンピュータ支援製造(CAM)に分類されます。

2024年には、電子設計自動化(EDA)セグメントが 世界のエンジニアリングソフトウェア市場を支配すると予想されています。

2024年には、電子設計自動化(EDA)セグメントが、半導体および電子設計における重要な役割を果たし、集積回路および電子システムに対する急増する需要に応えることで、31.52%の市場シェアで市場を支配すると予想されています。

- アプリケーションに基づいて、世界のエンジニアリング ソフトウェア市場は、製品設計、3D モデリング、自動化設計、プラント設計などに分類されます。

2024年には、製品設計セグメントが世界のエンジニアリングソフトウェア市場を支配すると予想されています。

2024年には、製品設計セグメントがさまざまな業界で重要な役割を果たし、コンセプト作成、プロトタイピング、視覚化のためのツールをデザイナーに提供し、イノベーションと効率性を推進することで、36.65%の市場シェアで市場を支配すると予想されています。

- 企業規模に基づいて、世界のエンジニアリングソフトウェア市場は、大企業、中規模企業、小規模企業に分類されます。2024年には、大企業セグメントが57.32%の市場シェアで市場を独占すると予想されています。

- エンドユーザー別に見ると、世界のエンジニアリングソフトウェア市場は、自動車、航空宇宙・防衛、石油・ガス、IT・通信、ヘルスケア、その他に分類されています。2024年には、自動車分野が市場シェア31.84%でトップになると予想されています。

主要プレーヤー

Data Bridge Market Research は、Autodesk、Inc (米国)、Synopsis、Inc. (米国)、Dassault Systèmes (フランス)、ANSYS、Inc (米国)、および Cadence Design Systems、Inc. (米国) を世界のエンジニアリング ソフトウェア市場の主要企業として分析しています。

市場動向

- 2024年5月、シノプシスはソフトウェア・インテグリティ・グループをクリアレイク・キャピタル・グループとフランシスコ・パートナーズに21億米ドルで売却します。これにより、シノプシスはシリコン・ツー・システム戦略や設計自動化といったコアビジネスに注力し、ソフトウェアエンジニアリング能力を強化することができます。

- 2024年5月、アルテアはクモ国立工科大学と提携し、機械工学、産業工学、電子工学の教育と研究を強化するために、3年間の無償ソフトウェアを提供しました。設計、シミュレーション、HPC、AIツールを含むアルテアのソフトウェアは、スキル開発と技術交流を促進し、学生と人材育成における同社の評判の両方に利益をもたらしました。

- 2024年4月、AnsysはAI搭載のバーチャルアシスタント「AnsysGPT」をリリースしました。拡張されたナレッジベースと高度なインフラストラクチャにより、24時間365日体制のカスタマーサポートを提供し、リアルタイムサポートを強化しました。AnsysGPTはAnsysのAI+製品を補完し、厳選されたナレッジと幅広いマルチフィジックスの専門知識を提供することで、応答精度と顧客体験の向上というメリットをもたらしました。

- ダッソー・システムズは2023年12月、TD SYNNEX DatechをCAD設計・製図ソフトウェア「DraftSight」の販売代理店に任命しました。プロフェッショナルグレードの2Dおよび3D製図ソリューションは、業界標準のファイル形式との互換性や、CATIAおよびSOLIDWORKSアプリケーションとの相互運用性など、設計・製図に不可欠なツールを提供します。このパートナーシップは、手頃な価格のCADソリューションに対する需要の高まりに対応し、ダッソー・システムズの市場における成長見通しを強化します。

- 2023年6月、ケイデンスはBETA CAE Systemsを買収し、マルチドメインエンジニアリングシミュレーション機能を強化し、製品ポートフォリオを拡大します。BETA CAEの専門知識を活用することで、ケイデンスはより高度なソリューションを提供し、インテリジェントシステム設計戦略を加速し、顧客にさらなる価値を提供できるようになります。

地域分析

地理に基づいて、市場は米国、カナダ、メキシコ、ドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国、中国、日本、インド、韓国、マレーシア、オーストラリア、シンガポール、タイ、フィリピン、インドネシア、その他のアジア太平洋諸国、サウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ諸国、ブラジル、アルゼンチン、その他の南米に分類されます。

データブリッジ市場調査分析によると:

北米は世界のエンジニアリングソフトウェア市場で支配的な地域です

北米は、豊富な研究資金、革新的な技術拠点、そして起業家精神とコラボレーションを育む文化によって最先端の進歩がもたらされ、世界のエンジニアリングソフトウェア市場を牽引すると予想されています。さらに、この地域は大学、テクノロジー企業、そして優秀な人材からなる強力なエコシステムを有しており、ヒューマノイドロボティクスの継続的な進歩を牽引しています。このリーダーシップは、北米が世界のロボティクスの未来を形作る上で極めて重要な役割を果たしていることを裏付けています。

アジア太平洋地域は、世界のエンジニアリングソフトウェア市場において最も急速に成長する地域になると予想されています。

アジア太平洋地域は、急速な技術進歩と業界横断的な自動化への大規模な投資により、世界のエンジニアリングソフトウェア市場において最も急速に成長する地域になると予想されています。これにより、ヒューマノイドロボットへの旺盛な需要が促進され、イノベーションが促進されます。さらに、この地域における製造業の急成長と、カスタマーサービスやヘルスケアなどの業務におけるヒューマノイドロボットの導入増加も、急速な成長軌道を推進する重要な要因となっています。

グローバルエンジニアリングソフトウェア市場レポートの詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/global-software-engineering-market