自動化が自動車産業の未来を形作り続ける中で、センサーは生産プロセスとロボット操作の精度、効率、安全性を確保する上でますます重要な役割を担っています。センサーは、組立ライン、ロボットアーム、車両安全システムなど、さまざまな自動車製造アプリケーションで活用されています。これらの技術が進化し、複雑化するにつれて、動作効率を維持し、コストのかかるエラーや故障の可能性を減らすために、センサーを清潔で機能的な状態に保つ必要があります。自律走行車、産業オートメーション、高度な監視システムへの需要が高まる中、定期的な洗浄によってセンサーの精度と性能を維持することが重要になっています。ほこり、湿気、汚染物質などの環境要因も、効率的なセンサー洗浄ソリューションの必要性を高めています。自動、非接触、セルフクリーニングセンサーなどの洗浄システムにおける技術進歩は、市場のイノベーションを牽引しています。

完全なレポートは https://www.databridgemarketresearch.com/reports/global-sensor-cleaning-system-marketからご覧いただけます。

データブリッジ市場調査は、世界のセンサークリーニングシステム市場は、2025年から2032年の予測期間に12.2%のCAGRで成長し、2024年の58億3,000万米ドルから2032年には145億3,000万米ドルに達すると予測しています。

研究の主な結果

清浄度とセンサー精度に関する規制基準の強化

環境への懸念は、世界中の産業計画や事業運営にますます影響を与えています。持続可能性が最重要課題となるにつれ、企業は効率的で生産性の高い製造プロセスを維持しながら、環境への影響を削減するというプレッシャーにますます直面しています。センサー技術に依存する分野では、環境要件を遵守しながらセンサーの動作を維持することが最優先事項となっています。その結果、性能の確保だけでなく環境への影響の低減も目的とした最新のセンサー洗浄システムが採用されるようになりました。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2025年から2032年

|

基準年

|

2024

|

歴史的な年

|

2023年(2013~2017年にカスタマイズ可能)

|

定量単位

|

収益(10億米ドル)

|

対象セグメント

|

センサータイプ(カメラクリーニングシステム、ライダークリーニングシステム、レーダークリーニングシステム)、クリーニングシステム(自動センサークリーニングシステム、手動センサークリーニングシステム、半自動センサークリーニングシステム)、エンドユーザー(自動車、航空宇宙および防衛、産業、ヘルスケアおよび医療機器、民生用電子機器、石油およびガス、その他)、販売チャネル(オリジナル機器およびアフターマーケット)

|

対象国

|

米国、カナダ、メキシコ、中国、日本、インド、韓国、オーストラリアおよびニュージーランド、シンガポール、マレーシア、タイ、インドネシア、フィリピン、台湾、ベトナム、その他のアジア太平洋諸国、英国、ドイツ、フランス、イタリア、スペイン、ロシア、オランダ、スイス、スウェーデン、ベルギー、デンマーク、ポーランド、ノルウェー、トルコ、フィンランド、その他のヨーロッパ諸国、サウジアラビア、南アフリカ、UAE、イスラエル、エジプト、カタール、オマーン、クウェート、バーレーン、その他の中東およびアフリカ諸国、ブラジル、アルゼンチン、その他の南米諸国

|

対象となる市場プレーヤー

|

SOLERO TECHNOLOGIES, LLC.(米国)、Continental AG(ドイツ)、Ficosa International SA (スペイン)、Valeo Service (Valeo SA) (フランス)、Actasys Inc. (米国)、Araymond (フランス)、Röchling SE & Co. KG (ドイツ)、Kautex (Textron GmbH & Co. KG) (ドイツ)、Process Instruments UK Ltd (英国)、Mettler Toledo (ドイツ)、Vitesco Technologies (Schaeffler AG) (米国)、Endress+Hauser Group Services AG (スイス)、Jet Clean gmbh (オーストラリア)、Rapa (ドイツ)、entegris inc. (米国) など。

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、専門家による詳細な分析、輸入/輸出分析、価格分析、生産消費分析、乳棒分析が含まれています。

|

セグメント分析

世界のセンサー洗浄システム市場は、センサーの種類、洗浄システム、エンドユーザー、販売チャネルに基づいて 5 つの主要なセグメントに分類されています。

- センサーの種類に基づいて、市場はカメラクリーニングシステム、LIDARクリーニングシステム、レーダークリーニングシステムなどに分類されます。

2025年には、カメラクリーニングシステムセグメントが市場を支配すると予想されています。

2025年には、自律走行車、ドローン、セキュリティシステムへのカメラの採用が増加し、最適なパフォーマンスを得るために頻繁なクリーニングが必要となるため、カメラクリーニングシステムセグメントが50.27%の市場シェアで市場を支配すると予想されています。

- 洗浄システムに基づいて、市場は自動センサー洗浄システム、手動センサー洗浄システム、半自動センサー洗浄システムに分類されます。

2025年には、自動センサー洗浄システムが65.83%の市場シェアで市場を支配すると予想されています。

2025年には、優れた効率性、信頼性、そして重要なアプリケーションにおけるダウンタイムの最小化により、自動センサー洗浄システムが市場シェア65.83%を占め、市場を席巻すると予想されています。このシステムは、高度な自動車および産業用センサーに不可欠な、一貫した洗浄性能を実現します。さらに、自動運転車やスマートデバイスへの導入増加も、その需要をさらに押し上げています。

- エンドユーザー別に見ると、世界のセンサー洗浄システム市場は、自動車、航空宇宙・防衛、産業、ヘルスケア・医療機器、民生用電子機器、石油・ガス、その他に分類されています。2025年には、自動車分野が69.11%の市場シェアで市場を席巻すると予想されています。

- 販売チャネルに基づいて、市場はオリジナル機器とアフターマーケットに区分されます。2025年には、オリジナル機器セグメントが34.43%の市場シェアで市場を独占すると予想されています。

主要プレーヤー

Data Bridge Market Researchは、市場で事業を展開している主要企業として、SOLERO TECHNOLOGIES, LLC.(米国)、Continental AG(ドイツ)、Ficosa International SA(スペイン)、Valeo Service (Valeo SA)(フランス)、Actasys Inc.(米国)を分析しています。

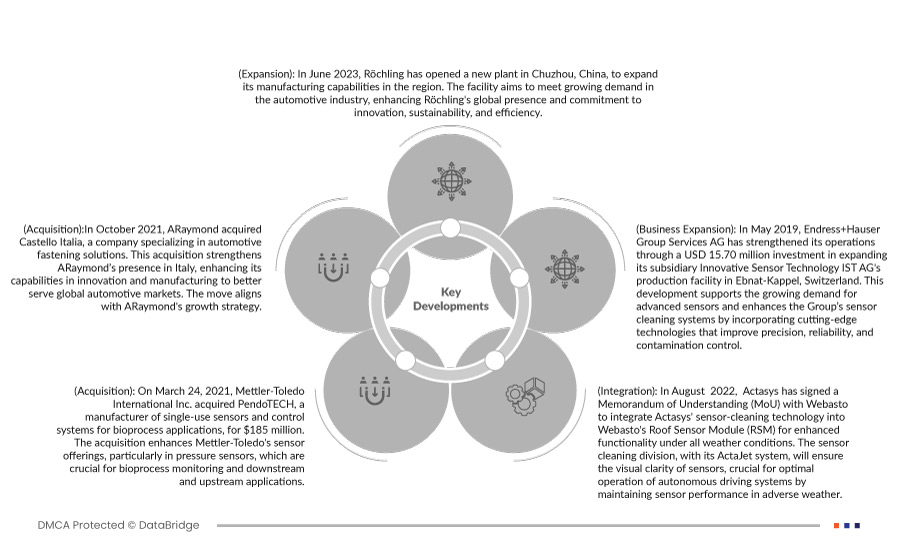

市場開発

- 大手電子材料メーカーであるインテグリスは、2024年9月にコロラドスプリングスに6億ドルを投資し、FOUPSと高度な液体フィルターを製造し、半導体サプライチェーン部品の国内回帰を支援する新施設を建設します。この拡張により、ウェーハハンドリングにおける欠陥制御が向上し、インテグリスのセンサー洗浄システムに関する専門知識が強化されます。この施設では、高度なプロセスを活用して高精度なFOUPSを製造し、半導体メーカーの生産歩留まりを向上させます。

- 2024年8月、SICKとEndress+Hauserは戦略的パートナーシップを締結しました。Endress+Hauserは、SICKのプロセス分析装置およびガス流量計の世界的な販売・サービス責任を担うとともに、それらの製造・開発のための合弁事業も開始します。このパートナーシップにより、高度な分析装置および流量計技術を組み込むことでEndress+Hauserのポートフォリオが強化され、センサ洗浄システムも強化され、汚染管理の改善と産業プロセスの効率化が実現します。

- 2021年5月、dlhBOWLESとRAPA Automotiveが開発した流体制御ユニット(FCU)が市販開始され、先進運転システムと自動運転車両向けのセンサーおよびカメラ洗浄技術を強化します。この開発により、RAPAグループはバルブ設計の専門知識を活用し、センサー洗浄システムの性能と信頼性を向上させ、先進運転技術と自動運転車両技術の機能をサポートできるようになります。

- 2024年4月、Atar Capitalの支援を受けるSolero Technologiesは、Kendrionの自動車事業の買収を発表しました。この戦略的動きにより、Soleroは電動化とサステナビリティにおける能力を強化し、欧州と米国に新たな工場を開設することでグローバル展開を拡大し、年間売上高を倍増させます。

- 2024年1月、フィコサとインディー・セミコンダクターは、安全性向上を目的としたAIベースの車載カメラソリューションの開発で提携しました。この協業により、フィコサの視覚技術とインディーのAI処理技術を組み合わせ、高度な物体検出と画像処理を実現し、外部要素の保護性能を向上させます。最初のスマートカメラソリューションは2024年に試験運用を開始し、2025年には本格生産開始を予定しています。この提携は、ADASシステムのインテリジェントセンシングを通じて、歩行者や自転車利用者などの脆弱な道路利用者の保護に重点を置いた自動車安全規制の強化に合致しています。

地域分析

地理的に、市場レポートでカバーされている国は、米国、カナダ、メキシコ、中国、日本、インド、韓国、オーストラリアおよびニュージーランド、シンガポール、マレーシア、タイ、インドネシア、フィリピン、台湾、ベトナム、その他のアジア太平洋諸国、イタリア、フランス、ドイツ、スペイン、ポーランド、オランダ、ルーマニア、デンマーク、ベルギー、ギリシャ、ハンガリー、ポルトガル、アイルランド、オーストリア、チェコ、スウェーデン、ブルガリア、フィンランド、クロアチア、リトアニア、スロベニア、ラトビア、スロバキア、キプロス、エストニア、ルクセンブルク、マルタ、非EUヨーロッパ諸国、サウジアラビア、南アフリカ、エジプト、バーレーン、オマーン、イスラエル、クウェート、カタール、UAE、その他の中東およびアフリカ諸国、ブラジル、アルゼンチン、メキシコ、その他のラテンアメリカ諸国です。

Data Bridge Market Researchの分析によると:

北米は世界のセンサー洗浄システム市場で優位を占め、最も急速に成長する地域になると予想されています。

2025年には、北米が物流、eコマース、製造業など幅広い業界における技術革新と自動化への積極的な投資により、市場を牽引すると予想されています。さらに、主要市場プレーヤーの存在と、イノベーションを支援する政府の積極的な取り組みが相まって、この地域における導入が加速しています。

グローバルセンサークリーニングシステム市場レポートの詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/global-sensor-cleaning-system-market