リバースロジスティクス市場は、返品の最適化によるコスト削減、廃棄物の削減、顧客満足度の向上など、大きなメリットをもたらします。この市場の主なセグメントは、 電子商取引 セクター。電子商取引の急速な成長により、製品の返品が増加し、効率的な逆物流が重要になっています。電子小売業者は、逆物流を活用して返品プロセスを合理化し、返品関連コストを削減し、返品された商品を修理または再販します。このセクターの優位性は、効果的な製品返品管理の必要性によって推進されており、逆物流戦略の進化において重要な役割を果たしています。

完全なレポートにアクセスするには、 https://www.databridgemarketresearch.com/reports/global-reverse-logistics-market

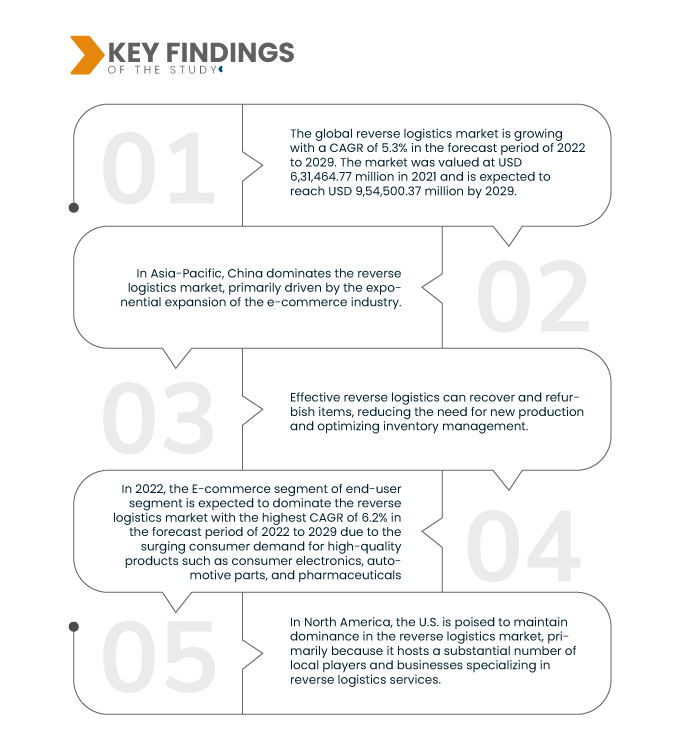

データブリッジマーケットリサーチの分析によると、 世界のリバースロジスティクス市場 2022年から2029年の予測期間において、5.3%のCAGRで成長しています。市場規模は2021年に6,31,464.77百万米ドルと評価され、2029年までに9,54,500.37百万米ドルに達すると予想されています。製品の返品、リサイクル、廃棄物管理に関する政府の規制は厳格化しています。規制を遵守し、罰金を回避するために、企業は効率的なリバースロジスティクスの実践を実施し、製品の返品を管理し、廃棄物を削減し、環境基準を満たす必要があります。

研究の主な結果

持続可能性と環境への配慮が市場の成長率を押し上げると予想される

環境問題への意識が高まるにつれ、企業は効果的なリバース ロジスティクス戦略を採用せざるを得なくなっています。これには、環境への影響を最小限に抑えるための製品の責任ある廃棄とリサイクルが含まれます。消費者はますます環境意識が高まり、企業に持続可能な慣行を求めています。堅牢なリバース ロジスティクスを実装すると、環境への影響が軽減されるだけでなく、顧客に好印象を与え、ブランドの評判も高まります。したがって、環境問題に対処する必要性が、環境に優しいリバース ロジスティクス慣行の採用の原動力となっています。

レポートの範囲と市場セグメンテーション

|

レポートメトリック

|

詳細

|

|

予測期間

|

2022年から2029年

|

|

基準年

|

2021

|

|

歴史的な年

|

2020 (2014~2019年にカスタマイズ可能)

|

|

定量単位

|

売上高(百万米ドル)、販売数量(個数)、価格(米ドル)

|

|

対象セグメント

|

返品タイプ(返品、寿命終了、再製造、改修、売れ残り商品、レンタルおよびリース、修理およびメンテナンス、配送失敗、返品回避、梱包、その他)、コンポーネント(返品ポリシーおよび手順(RPP)、再製造または改修(ROR)、廃棄物処理(WAD))、サービスタイプ(輸送、倉庫保管、交換管理、再販、返金管理承認、その他)、エンドユーザー(電子商取引、小売、自動車、 家電、医薬品、再利用可能な包装、 繊維 衣料品、高級品、その他

|

|

対象国

|

北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ諸国、アジア太平洋地域 (APAC) では中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、その他のアジア太平洋地域 (APAC)、中東およびアフリカ (MEA) の一部としてサウジアラビア、UAE、南アフリカ、エジプト、イスラエル、その他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米。

|

|

対象となる市場プレーヤー

|

CH Robinson Worldwide, Inc. (米国)、Deutsche Post DHL Group (ドイツ)、FedEx (米国)、Core Logistic Private Limited (インド)、Schenker AG (ドイツ)、Kintetsu World Express, Inc. (日本)、YUSEN LOGISTICS CO., LTD. (日本)、LogiNext Solutions Inc (米国)、NFI Industries (米国)、ReverseLogix (米国)、Indev Group of companies (インド)、Safexpress Pvt. Ltd. (インド)、Optoro, Inc. (米国)、Reverse Logistics Group (オーストリア)、DGS Translogistics India Pvt. Ltd. (インド)、ShipWizard (米国)、Woodfield Distribution, LLC (米国)、United Parcel Service of America, Inc. (米国)、XPO Logistics, Inc (米国)、IBM Corporation (米国)

|

|

レポートで取り上げられているデータポイント

|

データブリッジマーケットリサーチがまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要企業などの市場シナリオに関する洞察に加えて、専門家による詳細な分析、地理的に表された企業別の生産量と生産能力、販売業者とパートナーのネットワークレイアウト、詳細かつ最新の価格動向分析、サプライチェーンと需要の不足分析も含まれています。

|

セグメント分析:

世界のリバース物流市場は、返品タイプ、コンポーネント、サービスタイプ、エンドユーザーに基づいてセグメント化されています。

返品の種類に基づいて、世界のリバースロジスティクス市場は、返品、返品回避、再製造、改修、梱包、売れ残り商品、耐用年数終了、配送失敗、レンタルとリース、修理とメンテナンス、その他に分類されます。 2022年には、返品セグメントがリバースロジスティクス市場を支配し、2022年から2029年の予測期間で6.1%という最高のCAGRを達成すると予想されています。 この変化は、オンラインプラットフォームと電子商取引業界の人気の高まりに起因し、消費者製品の需要の増加を促進しています。

2022年には、返品タイプセグメントの返品セグメントが、2022年から2029年の予測期間中に世界のリバース物流市場を支配すると予想されます。

2022年には、返品部門がリバース物流市場を独占すると予想されており、2022年から2029年の予測期間に6.1%という最高のCAGRで成長します。この変化は、オンラインプラットフォームと電子商取引業界の人気の高まりによるもので、消費者製品の需要の増加を後押ししています。特に、オンライン製品の3分の1は返品されており、効率的な返品管理が急務となっているため、このセグメントの成長が促進されています。

- 世界のリバース ロジスティクス市場は、コンポーネントに基づいて、返品ポリシーと手順 (RPP)、再製造または改修 (ROR)、および廃棄物処理 (WAD) に分類されます。2022 年には、返品ポリシーと手順 (RPP) セクターがリバース ロジスティクス市場を支配し、2022 年から 2029 年の予測期間に 5.8% という最高の CAGR で成長すると予想されています。この傾向は、e コマース業界の急速な拡大の影響を受けており、消費者製品の需要が高まっています。

2022年には、コンポーネントセグメントの返品ポリシーと手順(RPP)セグメントが、2022年から2029年の予測期間中に世界のリバースロジスティクス市場を支配すると予想されます。

2022年には、返品ポリシーと手順(RPP)セクターがリバースロジスティクス市場を支配し、2022年から2029年の予測期間に5.8%という最高のCAGRで成長すると予想されています。この傾向は、eコマース業界の急速な拡大の影響を受けており、消費者製品の需要が高まり、その結果、商品が消費者の期待を満たさない場合の製品返品の発生が増加します。リバースロジスティクスプロバイダーは、効果的な返品ポリシーと手順を実施する上で重要な役割を果たします。

- サービスタイプに基づいて、世界のリバースロジスティクス市場は、輸送、倉庫保管、再販、交換管理、返金管理承認、その他に分類されています。2022年には、輸送セグメントが2022年から2029年の予測期間に5.9%という最高のCAGRでリバースロジスティクス市場を支配する態勢が整っています。この傾向は、eコマースセクターの急速な成長によって推進されており、最終消費者への効率的な輸送を必要とする消費者製品の需要の増加につながっています。輸送はリバースロジスティクスにおいて極めて重要な役割を果たし、製品のタイムリーで安全な配送を保証するため、業界の重要な要素となっています。

- エンドユーザーに基づいて、世界のリバースロジスティクス市場は、繊維・衣料、電子商取引、自動車、医薬品、家電、小売、高級品、再利用可能な包装、その他に分類されます。2022年には、消費者向け電子機器、自動車部品、医薬品などの高品質製品に対する消費者の需要が急増しているため、電子商取引部門が2022年から2029年の予測期間に6.2%という最高のCAGRでリバースロジスティクス市場を支配する態勢が整っています。この需要は主に、急速に拡大している電子商取引プラットフォームを通じてもたらされ、製品の品質と配送基準を維持することの重要性を強調しています。

主要プレーヤー

Data Bridge Market Researchは、世界のリバースロジスティクス市場における主要なグローバルリバースロジスティクス市場プレーヤーとして、CH Robinson Worldwide, Inc.(米国)、Deutsche Post DHL Group(ドイツ)、FedEx(米国)、Core Logistic Private Limited(インド)、Schenker AG(ドイツ)、Kintetsu World Express, Inc.(日本)、YUSEN LOGISTICS CO., LTD.(日本)、LogiNext Solutions Inc(米国)、NFI Industries(米国)、ReverseLogix(米国)を認定しています。

市場動向

- 2022 年 1 月、FedEx は Microsoft と提携して、物流機能の強化を目的としたロジスティクス サービス ソリューションを導入しました。主な目標は、物流における進化するテクノロジ トレンドとイノベーションに適応する同社の能力を強化することでした。このコラボレーションを活用することで、FedEx はテクノロジの進歩に直面しても競争力と俊敏性を維持し、現代の物流環境の高まる需要に応えながら、効率的で革新的なソリューションを顧客に提供することを目指しました。

- 2021年1月、シェンカーAGは、香港サイエンス・テクノロジー・パーク・コーポレーション(HKSTP)と10年契約を締結し、アジアの先駆的な先進製造施設の設立を支援しました。この最先端の施設には、自動化されたインテリジェントな物流ソリューションが備わっています。このパートナーシップにより、DBシェンカーは世界的な足跡を拡大できただけでなく、革新的で先進的なサプライチェーンソリューションへの取り組みを示すことで、グローバル物流のリーダーとしての地位を確立しました。

地域分析

地理的に見ると、主要な世界リバース ロジスティクス市場レポートでカバーされている国は、北米では米国、カナダ、メキシコ、ヨーロッパではドイツ、フランス、英国、オランダ、スイス、ベルギー、ロシア、イタリア、スペイン、トルコ、その他のヨーロッパ、中国、日本、インド、韓国、シンガポール、マレーシア、オーストラリア、タイ、インドネシア、フィリピン、アジア太平洋地域 (APAC) ではその他のアジア太平洋地域 (APAC)、サウジアラビア、UAE、南アフリカ、エジプト、イスラエル、中東およびアフリカ (MEA) の一部としてその他の中東およびアフリカ (MEA)、南米の一部としてブラジル、アルゼンチン、その他の南米です。

Data Bridge Market Research の分析によると:

アジア太平洋地域が 世界のリバース物流市場 予測期間2022年~2029年

アジア太平洋地域では、主に電子商取引業界の急激な拡大により、中国がリバース ロジスティクス市場を支配しています。オンライン ショッピングの急増により、効率的な製品返品およびリサイクル プロセスに対するニーズが高まっています。さらに、自動車および家電製品分野への多額の投資により、企業が製品の返品、リサイクル、再製造を効率的に管理しようと努めているため、リバース ロジスティクスの需要がさらに高まり、中国が地域市場で支配的な勢力となっています。

北米が優勢になると予想されている 世界のリバース物流市場 予測期間2022年~2029年

北米では、米国がリバース ロジスティクス市場で優位を維持する態勢が整っています。これは主に、リバース ロジスティクス サービスに特化した現地のプレーヤーや企業が多数存在するためです。業界関係者の広範なネットワークと成熟したロジスティクス インフラストラクチャにより、米国は製品の返品、リサイクル、再製造を効率的に管理するリーダーとしての地位を確立し、市場における重要な役割を強化しています。

詳細については、米国の幻覚剤市場レポート、こちらをクリック –https://www.databridgemarketresearch.com/reports/global-reverse-logistics-market