ポリウレタン フォームは、ジイソシアネートとポリオールを反応させて得られるポリマーです。ポリウレタン フォームは一般に PU フォームまたは PUR フォームと呼ばれます。ポリウレタン フォームは、腐食の原因となる外部要因から材料を絶縁し保護します。ポリウレタン フォームの製造でイソシアネートとともに使用する試薬または触媒の種類は、PU フォームの用途によって異なります。ポリウレタン フォームには、硬質フォーム、軟質フォーム、スプレー フォームの 3 種類があります。

完全なレポートにアクセスするには https://databridgemarketresearch.com/reports/global-polyurethane-foam-market

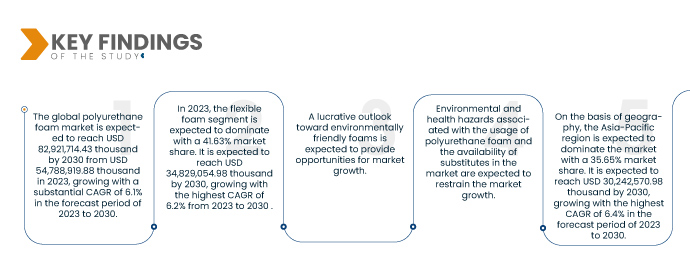

データブリッジマーケットリサーチは、 世界のポリウレタンフォーム市場 2023年から2030年にかけてCAGR 6.1%で成長し、2030年までに82,921,714.43千台に達すると予想されています。自動車および航空分野での普及拡大が市場の成長を牽引するでしょう。

研究の主な結果

自動車および航空業界での受け入れ拡大

ポリウレタンフォームは、高引張強度、軽量、耐薬品性、加工性、機械的特性を備えたポリマー材料であり、さまざまな用途に使用されています。その独特の特性により、航空宇宙産業や自動車産業では軽量で高性能な材料の需要が高まっています。自動車業界では、自動車用フォームが、自動車からカーペットの下敷きまで、乗客の安全と快適性に重要な役割を果たすため、重要な役割を果たしています。ポリウレタンフォームは、自動車業界では、トリム、シート、ヘッドレスト、防音材、エアコンフィルターに使用されています。これは、フォームが振動遮断、吸音、断熱など、幅広い特性を提供する材料であるためです。オープンセルフォームとクローズドセルフォームの両方を、現代の自動車のクッションと座席に使用できます。

現在の自動車に使用されているポリウレタンフォームは、耐久性と軽量性に優れているため、車全体の重量がさらに軽減され、燃費が向上し、環境への影響も軽減されます。

航空宇宙産業におけるポリウレタンフォームの用途は、より多様化する必要があります。ポリウレタンフォームは、客室の壁、荷物室、天井、トイレ、フライトデッキパッド、クラスとセクションの仕切りなどの構造部品に使用されています。このフォームは、航空機とその中の乗客を過度の温度変動から保護することができます。航空宇宙フォームの密度は、航空機の内外への空気の漏れを防ぎ、客室の圧力を維持するのにも役立ちます。また、航空機エンジンの高デシベルレベルから乗客を保護する防音壁としても機能します。自動車および航空部門におけるこのようなハイエンド用途のアプリケーションは、ポリウレタンフォームの市場成長を促進するでしょう。

レポートの範囲と市場セグメンテーション

|

レポート指標

|

詳細

|

|

予測期間

|

2023年から2030年まで

|

|

基準年

|

2022

|

|

歴史的な年

|

2021 (2020 - 2015 にカスタマイズ可能)

|

|

定量単位

|

収益(百万米ドル)と価格(米ドル)

|

|

対象となるセグメント

|

製品別(硬質フォーム、フレキシブルフォーム、スプレーフォーム)、カテゴリー別(オープンセル、クローズドセル)、密度組成別(低密度組成物、中密度組成物、高密度組成物)、プロセス別(スラブストックフォーム、成形フォーム) 、ラミネート、スプレー)、エンドユーザー(建築および建設、寝具および家具、自動車、履物、エレクトロニクス、包装、その他)

|

|

対象国

|

米国、カナダ、メキシコ、ブラジル、アルゼンチン、その他の南米諸国、ドイツ、フランス、英国、スペイン、イタリア、ポーランド、オランダ、ロシア、トルコ、ベルギー、スウェーデン、スイス、デンマーク、フィンランド、ノルウェー、その他のヨーロッパ諸国、中国、日本、インド、韓国、台湾、オーストラリア、タイ、シンガポール、フィリピン、マレーシア、ベトナム、ニュージーランド、インドネシア、その他のアジア太平洋諸国、南アフリカ、サウジアラビア、アラブ首長国連邦、エジプト、カタール、オマーン、クウェート、バーレーン、その他の中東およびアフリカ諸国

|

|

対象となる市場プレーヤー

|

Foamcraft, Inc.(米国)、積水化学工業株式会社(日本)、イノアックコーポレーション(日本)、Wisconsin Foam Products(米国)、Dow(米国)、Rogers Corporation(米国)、UFP Technologies, Inc.(米国)、Saint-Gobain(フランス)、BASF SE(ドイツ)、 Sunpreeth Engineers (インド)、Eurofoam Srl (イタリア)、Meenakshi Polymers Pvt. Ltd. (インド)、General Plastics Manufacturing Company, Inc.、ALSTONE INDUSTRIES PVT.株式会社ヘンケル AG & Co. KGaA (ドイツ)、Recticel NV/SA (ベルギー) など。

|

|

レポートで取り上げるデータポイント

|

Data Bridge Market Research がまとめた市場レポートには、市場価値、成長率、セグメンテーション、地理的範囲、主要プレーヤーなどの市場シナリオに関する洞察に加えて、専門家による詳細な分析、材料の取り扱いと保管、輸送と予防措置、危険の特定も含まれています。

|

セグメント分析:

世界のポリウレタンフォーム市場は、製品、カテゴリー、密度組成、プロセス、エンドユーザーに基づいて 5 つの注目すべきセグメントに分類されています。

- 製品に基づいて、市場は硬質フォーム、軟質フォーム、スプレーフォームに分類されます。

2023 年には、フレキシブルフォームセグメントが市場を支配すると予想されます。

2023年には、フレキシブルフォームセグメントが41.63%の市場シェアで優位に立つと予想されています。2030年までに34,829,054.98千米ドルに達し、2023年から2030年にかけて6.2%という最高のCAGRで成長すると予想されています。2023年には、軽量で通気性に優れているため、寝具やマットレス、シートクッションに幅広く使用されているフレキシブルフォームが、世界のポリウレタンフォーム市場を支配すると予想されています。

- カテゴリー別に見ると、市場はオープンセルとクローズドセルに分かれています。2023年には、オープンセルセグメントが70.67%の市場シェアで市場を支配すると予想されています。2030年までに59,127,599.56千米ドルに達すると予想されており、2023年から2030年にかけて6.2%という最高のCAGRで成長します。

- 密度組成に基づいて、市場は低密度組成、中密度組成、高密度組成に分類されます。 2023 年には、低密度組成セグメントが浮力、エネルギー吸収性、クッション性により 49.16% の市場シェアを獲得し、市場を支配すると予想されており、これらが予測期間中の需要の押し上げに役立ちます。 2030年までに41,490,940.16千米ドルに達すると予想されており、2023年から2030年にかけて6.4%という最高のCAGRで成長します。

- プロセスに基づいて、市場は成形フォーム、スラブストックフォーム、スプレー、ラミネートに分類されます。 2023年には、成形フォームセグメントがクッション用途により39.61%の市場シェアを獲得し市場を支配すると予想されており、これが予測期間中の需要の押し上げに貢献します。 2030年までに33,820,649.78千米ドルに達すると予想されており、2023年から2030年にかけて6.5%という最高のCAGRで成長します。

- エンドユーザーに基づいて、市場は寝具と家具、建築と建設、自動車、電子機器、包装、履物、その他に分類されます。2023年には、マットレスにポリウレタンフォームが使用されるため、寝具と家具のセグメントが32.11%の市場シェアで市場を支配すると予想されており、予測期間中の需要の増加に役立ちます。2030年までに27,150,322.04千米ドルに達し、2023年から2030年にかけて6.4%という最高のCAGRで成長すると予想されています。

主なプレーヤー

Data Bridge Market Researchは、Foamcraft, Inc.、積水化学工業株式会社、イノアックコーポレーション、Wisconsin Foam Products、Dow、Rogers Corporation、UFP Technologies, Inc.を含む世界のポリウレタンフォーム市場の主要プレーヤーとして次の企業を認識しています。 、Saint-Gobain、BASF SE、Sunpreeth Engineers、Eurofoam Srl、Meenakshi Polymers Pvt. Ltd.、General Plastics Manufacturing Company, Inc.、ALSTONE INDUSTRIES PVT. LTD.、Huntsman International LLC、Tirupati Foam Ltd.、Sheela Foam Ltd.、Henkel AG & Co. KGaA、および Recticel NV/SA など。

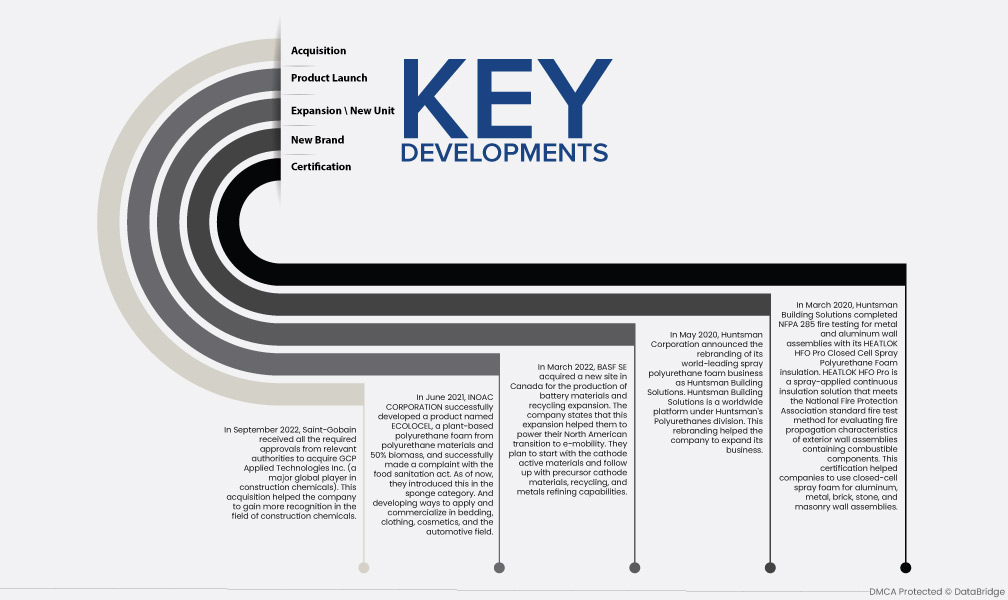

市場開拓

- 2022年9月、サンゴバンはGCP Applied Technologies Inc.(建設用化学薬品の世界的大手企業)を買収するために必要なすべての承認を関係当局から取得しました。この買収により、同社は建設用化学薬品の分野での認知度がさらに高まりました。

- 2022年3月、BASF SEは電池材料の生産とリサイクル拡大のためにカナダに新しい拠点を取得しました。同社は、この拡張により北米での e-モビリティへの移行が促進されたと述べています。彼らは、カソード活物質から始めて、前駆体カソード材料、リサイクル、金属精製機能をフォローアップする予定です。

- イノアックコーポレーションは、2021年6月にポリウレタン原料と50%バイオマスを使用した植物由来ポリウレタンフォーム「ECOLOCEL(エコロセル)」という製品の開発に成功し、食品衛生法に抵触しない製品となった。現在はスポンジカテゴリーで導入しており、寝具、衣料、化粧品、自動車分野への応用・製品化に向けて開発を進めている。

- 2020 年 3 月、Huntsman Building Solutions は、HEATLOK HFO Pro クローズドセル スプレー ポリウレタン フォーム断熱材を使用して、金属およびアルミニウムの壁アセンブリの NFPA 285 火災試験を完了しました。HEATLOK HFO Pro は、可燃性コンポーネントを含む外壁アセンブリの火災伝播特性を評価するための米国防火協会の標準火災試験方法に準拠した、スプレー塗布型連続断熱ソリューションです。この認証により、企業はアルミニウム、金属、レンガ、石、および石積みの壁アセンブリにクローズドセル スプレー フォームを使用できるようになりました。

- 2020 年 5 月、ハンツマン コーポレーションは、世界をリードするスプレー ポリウレタン フォーム事業をハンツマン ビルディング ソリューションズとしてブランド変更すると発表しました。ハンツマン ビルディング ソリューションズは、ハンツマンのポリウレタン部門に属する世界的なプラットフォームです。このブランド変更により、同社は事業を拡大することができました。

地域分析

地理的に、世界のポリウレタンフォーム市場の対象国は、米国、カナダ、メキシコ、ブラジル、アルゼンチン、南米の残りの地域、ドイツ、フランス、英国、スペイン、イタリア、ポーランド、オランダ、ロシア、トルコ、ベルギー、スウェーデンです。 、スイス、デンマーク、フィンランド、ノルウェー、ヨーロッパの残りの部分、中国、日本、インド、韓国、台湾、オーストラリア、タイ、シンガポール、フィリピン、マレーシア、ベトナム、ニュージーランド、インドネシア、アジア太平洋の残りの部分、南アフリカ、サウジアラビア、アラブ首長国連邦、エジプト、カタール、オマーン、クウェート、バーレーン、その他の中東およびアフリカの国々。

データブリッジ市場調査分析によると:

2023年には、アジア太平洋地域が世界のポリウレタンフォーム市場で36.07%のシェアを占め、市場規模は2030年には6億4,658万米ドルに達すると予測されています。アジア太平洋地域は、2023年から2030年にかけて9.6%という最高のCAGRで成長すると予想されています。2023年には、この地域での建築・建設活動の増加により、中国がアジア太平洋市場を支配すると予想されています。

世界のポリウレタンフォーム市場に関する詳細情報 レポートはこちらをクリックしてください –https://www.databridgemarketresearch.com/reports/global-polyurethane-foam-market