ドローン、衛星画像、先進センサーの利用増加は、精密農業に不可欠な詳細かつ正確なデータを提供することで、農業マッピングと画像撮影に革命をもたらしました。マルチスペクトルカメラやハイパースペクトルカメラを搭載したドローンは、作物の高解像度画像を撮影できるため、農家は植物の健康状態を監視し、害虫の発生を特定し、灌漑方法を最適化することができます。衛星画像は広範囲をカバーし、頻繁に更新されるため、広大な地域における作物の生育、土壌水分量、気候変動の影響を追跡することができます。モノのインターネット(IoT)技術と統合された先進センサーは、土壌条件、気象パターン、作物の状態に関するリアルタイムデータを提供し、タイムリーな意思決定を促進します。これらの技術を組み合わせることで、生産性が向上し、資源の無駄が削減されるだけでなく、持続可能な農業慣行が促進され、収穫量の向上と環境管理が確保されます。

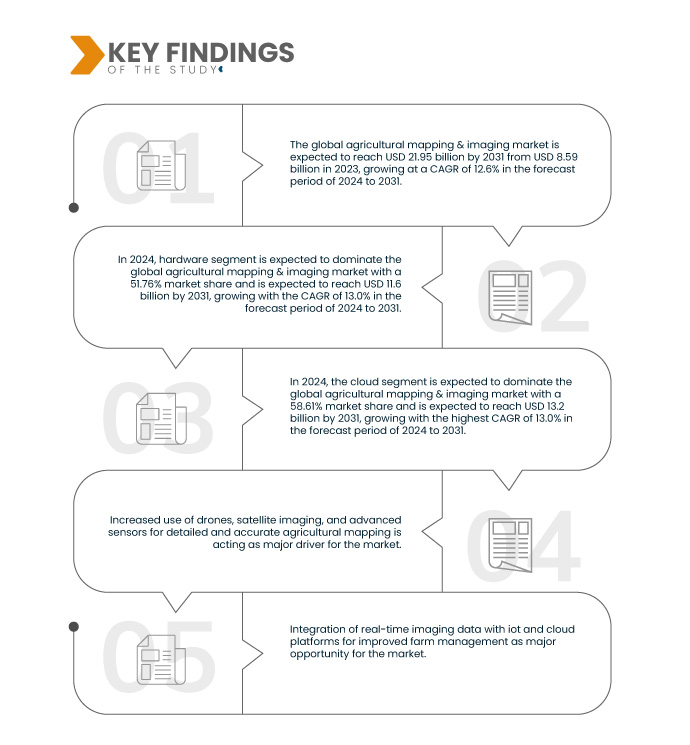

データブリッジマーケットリサーチは、農業マッピングおよびイメージング市場は、2024年の85億9,000万米ドルから2031年には219億5,000万米ドルに達し、2024年から2031年の予測期間に12.6%のCAGRで成長すると分析しています。

研究の主な結果

精密農業技術の導入拡大

農業マッピングおよび画像化技術の進歩に支えられた精密農業技術の導入拡大は、農業の実践に革命をもたらしています。精密農業は、ドローン、衛星画像、先進センサーから得られる詳細なデータを活用し、灌漑、施肥、害虫管理といった農作業を圃場の状況に合わせて調整します。精密農業の普及が進むにつれ、農業における高度なマッピングおよび画像化ソリューションの需要が高まり、農業マッピングおよび画像化分野におけるイノベーションと投資を促進することが期待されます。

レポートの範囲と市場セグメンテーション

レポートメトリック

|

詳細

|

予測期間

|

2024年から2031年

|

基準年

|

2023

|

歴史的な年

|

2022年(2016年から2021年までカスタマイズ可能)

|

定量単位

|

収益(10億米ドル)

|

対象セグメント

|

提供内容(ハードウェア、ソフトウェア、サービス)、自律性(半自律、手動、自律)、導入モード(クラウド、オンプレミス)、アプリケーション(作物の健康状態監視、フィールドマッピング、収穫量監視、気象監視と予測、水管理)、エンドユーザー(農場、アグロテクノロジー企業、研究機関、農薬会社)

|

対象国

|

米国、カナダ、メキシコ、中国、日本、インド、韓国、オーストラリアおよびニュージーランド、シンガポール、マレーシア、タイ、インドネシア、フィリピン、台湾、ベトナム、その他のアジア太平洋諸国、英国、ドイツ、フランス、イタリア、スペイン、ロシア、オランダ、スイス、スウェーデン、ベルギー、デンマーク、ポーランド、ノルウェー、トルコ、フィンランド、その他のヨーロッパ諸国、サウジアラビア、南アフリカ、UAE、イスラエル、エジプト、カタール、オマーン、クウェート、バーレーン、その他の中東およびアフリカ諸国、ブラジル、アルゼンチン、その他の南米諸国

|

対象となる市場プレーヤー

|

Yara(ノルウェー)、AGCO Corporation(米国)、Corteva(米国)、CNH Industrial NV(英国)、Trimble Inc.(米国)、Syngenta(スイス)、Bayer AG(ドイツ)、Raven Industries, Inc.(米国)、DJI(中国)、Cargill, Incorporated(米国)、ヤンマーホールディングス(日本)、ヤマハ発動機(日本)、Semios(カナダ)、Farmwise(米国)、Sentera(米国)、ESRI(米国)、METER Group(米国)、Climate LLC.(米国)、HUMMINGBIRD TECHNOLOGIES LIMITED(英国)、HIPHEN(フランス)、Satellite Imaging Corporation(米国)、AGRICOLUS(イタリア)など

|

レポートで取り上げられているデータポイント

|

データブリッジ市場調査チームがまとめた市場レポートには、市場価値、成長率、市場セグメント、地理的範囲、市場プレーヤー、市場シナリオなどの市場洞察に加えて、専門家による詳細な分析、輸入/輸出分析、価格分析、生産消費分析、乳棒分析が含まれています。

|

セグメント分析

農業マッピングおよびイメージング市場は、提供内容、自律性、展開モード、アプリケーション、およびエンドユーザーに基づいて、5 つの主要なセグメントに分割されています。

- 農業マッピングとイメージング市場は、提供内容に基づいて、ハードウェア、ソフトウェア、およびサービスに分類されます。

2024年には、ハードウェアセグメントが農業マッピングとイメージング市場を支配すると予想されています。

2024年には、ドローン、センサー、画像機器といった物理デバイスの重要性から、ハードウェアセグメントが51.76%の市場シェアを占め、市場を席巻すると予想されています。これらのハードウェアコンポーネントは、農業における高度なマッピングおよび画像化ソリューションの基盤となる正確なデータ取得の基盤となります。

- 農業マッピングとイメージング市場は、自律性に基づいて、半自律型、手動型、自律型に分類されます。

2024年には、半自律型セグメントが農業マッピングおよびイメージング市場を支配すると予想されています。

2024年には、リアルタイム画像データとIoTおよびクラウドプラットフォームの統合により、半自律セグメントが49.00%の市場シェアで農業マッピングおよび画像処理市場を支配すると予想されています。

- 農業マッピング・イメージング市場は、導入形態に基づいてクラウドとオンプレミスに区分されます。2024年には、クラウドセグメントが市場シェア58.61%で農業マッピング・イメージング市場を席巻すると予想されています。

- 用途別に見ると、農業マッピング・イメージング市場は、作物健全性モニタリング、圃場マッピング、収量モニタリング、気象モニタリング・予測、水管理、その他に分類されます。2024年には、作物健全性モニタリング分野が市場シェア31.80%で農業マッピング・イメージング市場を席巻すると予想されています。

- エンドユーザー別に見ると、農業マッピング・イメージング市場は、農場、アグロテック企業、研究機関、農薬会社、その他に分類されます。2024年には、農場セグメントが市場シェア43.87%で農業マッピング・イメージング市場を席巻すると予想されています。

主要プレーヤー

Data Bridge Market Research は、農業マッピングおよびイメージング市場で事業を展開している主要企業として、Yara (ノルウェー)、AGCO Corporation (米国)、Corteva (米国)、CNH Industrial NV (英国)、および Trimble Inc (米国) を分析しています。

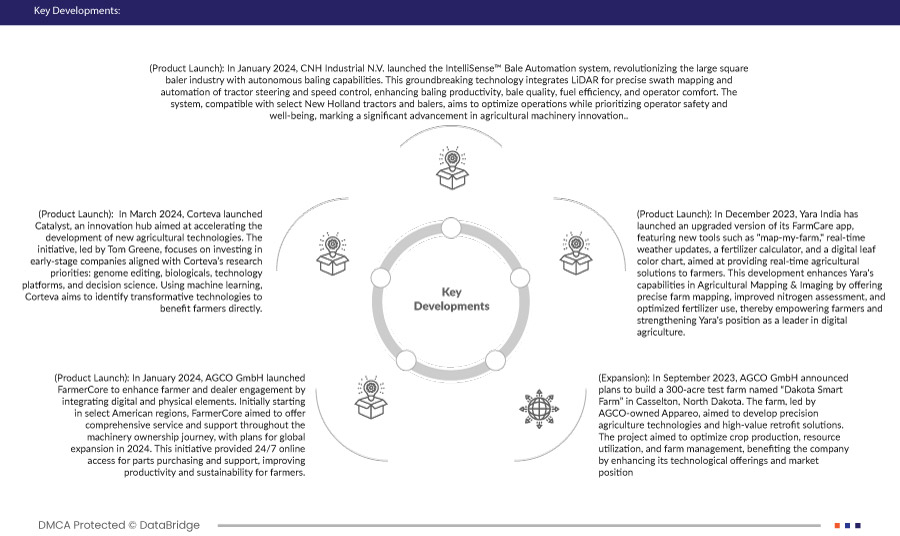

市場開発

- 2024年3月、コルテバは新たな農業技術の開発を加速させることを目的としたイノベーションハブ「カタリスト」を設立しました。トム・グリーン氏が率いるこのイニシアチブは、コルテバの研究優先事項であるゲノム編集、生物製剤、技術プラットフォーム、意思決定科学に合致する初期段階の企業への投資に重点を置いています。コルテバは機械学習を活用し、農家に直接利益をもたらす革新的な技術の特定を目指しています。

- 2024年1月、AGCO GmbHは、デジタルと物理的な要素を統合することで農家と販売店のエンゲージメントを強化するFarmerCoreを立ち上げました。FarmerCoreは、当初はアメリカの一部の地域から開始し、機械の所有期間全体にわたる包括的なサービスとサポートを提供することを目指し、2024年には世界展開を計画しています。この取り組みにより、部品の購入とサポートに24時間365日オンラインでアクセスでき、農家の生産性と持続可能性が向上しました。

- 2023年12月、Yara IndiaはFarmCareアプリのアップグレード版をリリースしました。このアプリには、「map-my-farm」、リアルタイムの天気予報、肥料計算ツール、デジタル葉色チャートなどの新しいツールが搭載され、農家にリアルタイムの農業ソリューションを提供することを目指しています。この開発により、Yaraの農業マッピングとイメージング機能が向上し、正確な農場マッピング、窒素評価の改善、肥料使用の最適化が可能になり、農家の力を高め、デジタル農業のリーダーとしてのYaraの地位を強化します。

- AGCO GmbHは2023年9月、ノースダコタ州キャッセルトンに300エーカーの試験農場「ダコタ・スマート・ファーム」を建設する計画を発表しました。AGCO傘下のAppareoが主導するこの農場は、精密農業技術と高付加価値の改良ソリューションの開発を目的としています。このプロジェクトは、作物の生産、資源の活用、そして農場管理の最適化を目指しており、技術提供と市場ポジションの強化によってAGCOに利益をもたらします。

- 2024年1月、CNHインダストリアルNVはIntelliSense™ベール自動化システムを発表し、大型スクエアベーラー業界に革命をもたらしました。この画期的な技術は、LiDARを統合し、正確なスワスマッピングとトラクターのステアリングおよび速度制御の自動化を実現することで、ベールの生産性、ベールの品質、燃費、そしてオペレーターの快適性を向上させます。ニューホランドの一部トラクターおよびベーラーと互換性のあるこのシステムは、オペレーターの安全と健康を最優先にしながら作業を最適化することを目指しており、農業機械のイノベーションにおける大きな進歩となります。

地域分析

地理的に、グローバル仮想インフラストラクチャ マネージャー市場レポートでカバーされている国は、米国、カナダ、メキシコ、中国、日本、インド、韓国、オーストラリアおよびニュージーランド、シンガポール、マレーシア、タイ、インドネシア、フィリピン、台湾、ベトナム、その他のアジア太平洋諸国、イタリア、フランス、ドイツ、スペイン、ポーランド、オランダ、ルーマニア、デンマーク、ベルギー、ギリシャ、ハンガリー、ポルトガル、アイルランド、オーストリア、チェコ、スウェーデン、ブルガリア、フィンランド、クロアチア、リトアニア、スロベニア、ラトビア、スロバキア、キプロス、エストニア、ルクセンブルク、マルタ、EU 非加盟ヨーロッパ諸国、サウジアラビア、南アフリカ、エジプト、バーレーン、オマーン、イスラエル、クウェート、カタール、UAE、その他の中東およびアフリカ諸国、ブラジル、アルゼンチン、メキシコ、その他のラテンアメリカ諸国です。

Data Bridge Market Researchの分析によると:

北米は農業マッピングとイメージング市場において優位に立ち、最も急速に成長する地域になると予想されています。

北米は、先進的な農業慣行、精密農業技術の広範な導入、IoTとクラウドコンピューティングを支える強固なインフラ、そして農業研究開発への多額の投資により、市場を牽引すると予想されています。これらの要因が相まって、高度なマッピングおよび画像化ソリューションを効果的に統合する能力が強化され、農業技術革新における導入率の向上と市場リーダーシップの確立が促進されます。

農業マッピング・画像市場において、北米では米国が先進技術の導入と精密農業への積極的な投資により優位に立っています。欧州では、イタリアが広範な農業活動と近代的な農業技術に対する政府の支援によりリードしています。アジア太平洋地域では、中国が大規模な農業活動とアグリテック・イノベーションの急速な進歩により、最前線に立っています。

世界の農業マッピングとイメージング市場レポートの詳細については、ここをクリックしてください – https://www.databridgemarketresearch.com/reports/global-agricultural-mapping-and-imaging-market