Global Remote Sensing Technology For Agriculture Market

Taille du marché en milliards USD

TCAC :

%

USD

1.81 Billion

USD

3.28 Billion

2022

2030

USD

1.81 Billion

USD

3.28 Billion

2022

2030

| 2023 –2030 | |

| USD 1.81 Billion | |

| USD 3.28 Billion | |

|

|

|

|

Global Remote Sensing Technology for Agriculture Market, By Component (Hardware, Software, and Service), Application (Yield Monitoring, Field Mapping, Crop Scouting, Weather Tracking & Forecasting, Irrigation Management, Inventory Management, Farm Labour Management, and Others) – Industry Trends and Forecast to 2030.

Remote Sensing Technology for Agriculture Market Analysis and Size

A modern farm and agriculture management approach that employs information technology to ensure that crops and soil receive exactly what they require for optimum health and productivity. Remote sensing technologies in agriculture aims to ensure profitability, sustainability, and environmental protection. The market is also benefiting from access to real-time data on crop, soil, and ambient air conditions, as well as other relevant information such as hyper-local weather forecasts, which is expected to grow the market which will raise revenues during the forecast period 2023-2030.

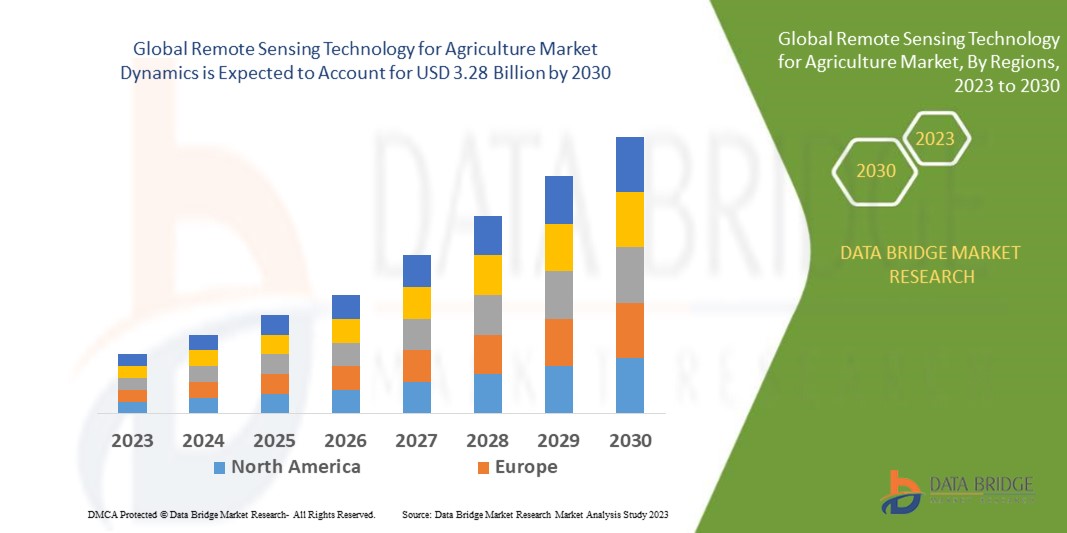

Data Bridge Market Research analyses that the global remote sensing technology for agriculture market was valued at USD 1.81 billion in 2022 and is expected to reach the value of USD 3.28 billion by 2030, at a CAGR of 7.70% during the forecast period of 2023 to 2030. “Hardware segment” is expected to dominate the market due to driving farming communities to use efficient agricultural methods. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Remote Sensing Technology for Agriculture Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Component (Hardware, Software, and Service), Application (Yield Monitoring, Field Mapping, Crop Scouting, Weather Tracking & Forecasting, Irrigation Management, Inventory Management, Farm Labour Management, and Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, Israel, Egypt, South Africa, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Yara (Norway), Koch AG & Energy Solutions LLC (U.S.), Coromandel International Limited (India), AGRICULTURE SOLUTIONS INC. (Canada), Hafia Groups (Israel), Sapec Agro S.A. (Portugal), Kugler Company (U.S.), ICL (Israel), Van Iperen International (Netherlands), U.S. AG LLC (U.S.), Levant Power Corporation (U.S.), Honeywell International, Inc. (U.S.), Green Peak Technologies (Netherlands), Fujitsu (Japan), ABB(Switzerland), Texas Instruments Inc. (U.S.), ST Microelectronics (Switzerland) |

|

Market Opportunities |

|

Market Definition

Access to real-time data on crop, soil, and ambient air conditions, as well as other relevant information such as hyper-local weather forecasts, labour costs, and equipment availability, is part of the approach. Data is used by predictive analytics software to advise farmers on crop rotation, optimal planting and harvesting times, and soil management. Sensors in the field measure the moisture content and temperature of the soil as well as the surrounding air. Images can be processed and integrated with sensor and other data to provide guidance for immediate and future decisions, such as which fields to water and when or where to plant a specific crop.

Global Remote Sensing Technology for Agriculture Market Dynamics

Drivers

- Remote Sensing Technology for Agriculture

The primary factor driving farming communities to use efficient agricultural methods is a labour shortage in agricultural practises. High-value crops such as apples, strawberries, and sweet peppers are becoming less economically viable due to rising labour costs and a decrease in the number of skilled workers. Farmers of such fruits are increasingly turning to crop sensing solutions to facilitate effective plucking without causing physical damage to the crop.

- Implementation of Smart Agricultural Practices to Meet Rising Food Demand Globally

Rapid population growth is putting pressure on the agricultural sector around the world to increase productivity in order to meet rising food demand. Farmers are increasingly implementing smart harvest technologies such as harvesting robots, automation, control systems, sensors, and imaging systems to increase profitability and output in less time and at a lower cost. The scarcity of arable land is a major factor driving demand for indoor farming activities and the increased use of remote sensing technologies to reduce labour costs.

Opportunity

- Business growth

Firms in the target industry focuses on business growth through strategies such as advanced product launches, capacity expansion, and heavy production investments in their facilities, which are expected to flourish in the near future as the global remote sensing technology for agriculture market grows. Furthermore, site-specific nutrient management with precision agriculture, increased demand for industrial crops, and investment in agricultural operations in developing countries provide profitable opportunities to market participants.

Restraint/Challenge

- Large investment

The requirement for large initial investments in the production of numerous components is impeding the growth of the remote sensing technology market. Market participants must manufacture components and encrypt data content that meet regulatory organisation standards. This limits market growth opportunities for companies.

Recent Development

- In March 2021, China planned to launch a new satellite with a LiDAR (light detection and ranging) system to monitor CO2 levels in the atmosphere. Since 2016, China has launched three satellites into orbit for CO2 monitoring and research, all equipped with passive optical remote sensing technology.

Global Remote Sensing Technology for Agriculture Market Scope

The global remote sensing technology for agriculture market is on the basis of components and application. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Components

- Hardware

- Software

- Services

Application

- Yield Monitoring

- Field Mapping

- Crop Scouting

- Weather Tracking & Forecasting

- Irrigation Management

- Inventory Management

- Farm Labour Management

- Others

Global Remote Sensing Technology for Agriculture Market Regional Analysis/Insights

The global remote sensing technology for agriculture market is analyzed and market size insights and trends are provided by country, components and application as referenced above.

The countries covered in the global remote sensing technology for agriculture market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (M.E.A.) as a part of Middle East and Africa (M.E.A.), Brazil, Argentina and Rest of South America as part of South America.

North America had the largest market share, accounting for 38.10%. This share is accounted for by the presence of significant market players such as Lockheed Martin Corporation, Esri, and General Dynamics Mission Systems, Inc., among others.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Remote Sensing Technology for Agriculture Market Share Analysis

The global remote sensing technology for agriculture market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to global remote sensing technology for agriculture market .

Some of the major players operating in the global remote sensing technology for agriculture market are:

- Yara (Norway)

- Koch AG & Energy Solutions LLC (U.S.)

- Coromandel International Limited (India)

- AGRICULTURE SOLUTIONS INC. (Canada)

- Hafia Groups (Israel)

- Sapec Agro S.A. (Portugal)

- Kugler Company (U.S.)

- ICL (Israel)

- Van Iperen International (Netherlands)

- U.S. AG LLC (U.S.)

- Levant Power Corporation (U.S.)

- Honeywell International, Inc. (U.S.)

- Green Peak Technologies (Netherlands)

- Fujitsu (Japan)

- ABB(Switzerland)

- Texas Instruments Inc. (U.S.)

- ST Microelectronics (Switzerland)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

5.8 BENEFITS OF USING REMOTE SENSING TECHNOLOGY IS AGRICULTURE

5.9 FUTURE OF REMOTE SENSING IN AGRICULTURE

6. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, BY TECHNOLOGY

6.1 OVERVIEW

6.2 ACTIVE

6.2.1 RADAR

6.2.2 SONAR

6.2.3 LASER

6.3PASSIVE

6.3.1 THERMAL INFRARED ENERGY

6.3.2 VISIBLE

6.3.3 NEAR INFRARED

7. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, BY SYSTEM TYPE

7.1 OVERVIEW

7.2 OPTICAL SENSING

7.3 MULTISPECTRAL SENSING

7.4 HYPERSPECTRAL SENSING

7.5 THERMAL SENSING

7.6 RADAR SENSING

7.7 LIDAR SENSING

7.8 UNMANNED AERIAL VEHICLES (UAVS)

7.9 OTHERS

8. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, BY PRODUCT MECHANISM

8.1 OVERVIEW

8.2 PHOTOGRAPHIC IMAGES

8.3 DIGITAL IMAGES

9. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, BY IMAGE RESOLUTION

9.1 OVERVIEW

9.2 LOW SPATIAL RESOLUTION RESOURCE (>30 METERS)

9.3 MEDIUM RESOLUTION SATELLITE (5-30 METERS)

9.4 HIGH RESOLUTION INDUSTRY (1-5 METERS)

9.5 VERY HIGH RESOLUTION INDUSTRY (< 1 METER)

10. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 YIELD MONITORING

10.3 FIELD MAPPING

10.4 CROP SCOUTING

10.5 WEATHER TRACKING & FORECASTING

10.6 IRRIGATION MANAGEMENT

10.7 INVENTORY MANAGEMENT

10.8 FARM LABOUR MANAGEMENT

10.9 OBSERVING SOIL CONDITIONS

10.10 WEEDS MANAGEMENT

10.11 OTHERS

11. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, BY GEOGRAPHY

GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

11.2 EUROPE

11.2.1 GERMANY

11.2.2 FRANCE

11.2.3 U.K.

11.2.4 ITALY

11.2.5 SPAIN

11.2.6 RUSSIA

11.2.7 TURKEY

11.2.8 BELGIUM

11.2.9 NETHERLANDS

11.2.10 NORWAY

11.2.11 FINLAND

11.2.12 SWITZERLAND

11.2.13 DENMARK

11.2.14 SWEDEN

11.2.15 POLAND

11.2.16 REST OF EUROPE

11.3 ASIA PACIFIC

11.3.1 JAPAN

11.3.2 CHINA

11.3.3 SOUTH KOREA

11.3.4 INDIA

11.3.5 AUSTRALIA

11.3.6 NEW ZEALAND

11.3.7 SINGAPORE

11.3.8 THAILAND

11.3.9 MALAYSIA

11.3.10 INDONESIA

11.3.11 PHILIPPINES

11.3.12 TAIWAN

11.3.13 VIETNAM

11.3.14 REST OF ASIA PACIFIC

11.4 SOUTH AMERICA

11.4.1 BRAZIL

11.4.2 ARGENTINA

11.4.3 REST OF SOUTH AMERICA

11.5 MIDDLE EAST AND AFRICA

11.5.1 SOUTH AFRICA

11.5.2 EGYPT

11.5.3 SAUDI ARABIA

11.5.4 U.A.E

11.5.5 OMAN

11.5.6 BAHRAIN

11.5.7 ISRAEL

11.5.8 KUWAIT

11.5.9 QATAR

11.5.10 REST OF MIDDLE EAST AND AFRICA

11.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

12. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET,COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: GLOBAL

12.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

12.3 COMPANY SHARE ANALYSIS: EUROPE

12.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12.5 MERGERS & ACQUISITIONS

12.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

12.7 EXPANSIONS

12.8 REGULATORY CHANGES

12.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

13. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, SWOT & DBMR ANALYSIS

14. GLOBAL REMOTE SENSING TECHNOLOGY FOR AGRICULTURE MARKET, COMPANY PROFILE

14.1 NORTHROP GRUMMAN.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 GEOGRAPHIC PRESENCE

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENT

14.2 KUGLER COMPANY

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 GEOGRAPHIC PRESENCE

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENT

14.3 ICL

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 GEOGRAPHIC PRESENCE

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENT

14.4 HUMMINGBIRD TECHNOLOGIES LIMITED

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 GEOGRAPHIC PRESENCE

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENT

14.5 SATYUKT ANALYTICS PRIVATE LIMITED

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 GEOGRAPHIC PRESENCE

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENT

14.6 HONEYWELL INTERNATIONAL INC

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 GEOGRAPHIC PRESENCE

14.6.4 PRODUCT PORTFOLIO

14.6.5 RECENT DEVELOPMENT

14.7 FARMERS EDGE INC

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 GEOGRAPHIC PRESENCE

14.7.4 PRODUCT PORTFOLIO

14.7.5 RECENT DEVELOPMENT

14.8 AIRBUS

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 GEOGRAPHIC PRESENCE

14.8.4 PRODUCT PORTFOLIO

14.8.5 RECENT DEVELOPMENT

14.9 LEICA GEOSYSTEMS AG (PART OF HEXAGON)

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 GEOGRAPHIC PRESENCE

14.9.4 PRODUCT PORTFOLIO

14.9.5 RECENT DEVELOPMENT

14.10 MAXAR TECHNOLOGIES

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 GEOGRAPHIC PRESENCE

14.10.4 PRODUCT PORTFOLIO

14.10.5 RECENT DEVELOPMENT

14.11 SCANEX GROUP

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 GEOGRAPHIC PRESENCE

14.11.4 PRODUCT PORTFOLIO

14.11.5 RECENT DEVELOPMENT

14.12 SATELLITE IMAGING CORPORATION

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 GEOGRAPHIC PRESENCE

14.12.4 PRODUCT PORTFOLIO

14.12.5 RECENT DEVELOPMENT

14.13 PLANET LABS PBC

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 GEOGRAPHIC PRESENCE

14.13.4 PRODUCT PORTFOLIO

14.13.5 RECENT DEVELOPMENT

14.14 SKY LAND MANAGEMENT PTY LTD

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 GEOGRAPHIC PRESENCE

14.14.4 PRODUCT PORTFOLIO

14.14.5 RECENT DEVELOPMENT

14.15 SATELLITE IMAGING CORPORATION

14.15.1 COMPANY SNAPSHOT

14.15.2 REVENUE ANALYSIS

14.15.3 GEOGRAPHIC PRESENCE

14.15.4 PRODUCT PORTFOLIO

14.15.5 RECENT DEVELOPMENTS

14.16 ESRI AGRICULTURE

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 GEOGRAPHIC PRESENCE

14.16.4 PRODUCT PORTFOLIO

14.16.5 RECENT DEVELOPMENTS

14.17 CORTEVA

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 GEOGRAPHIC PRESENCE

14.17.4 PRODUCT PORTFOLIO

14.17.5 RECENT DEVELOPMENTS

14.18 SYNGENTA

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 GEOGRAPHIC PRESENCE

14.18.4 PRODUCT PORTFOLIO

14.18.5 RECENT DEVELOPMENTS

14.19 BAYER AG

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 GEOGRAPHIC PRESENCE

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.20 CARGILL, INCORPORATED

14.20.1 COMPANY SNAPSHOT

14.20.2 REVENUE ANALYSIS

14.20.3 GEOGRAPHIC PRESENCE

14.20.4 PRODUCT PORTFOLIO

14.20.5 RECENT DEVELOPMENTS

14.21 SEMIOS

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 GEOGRAPHIC PRESENCE

14.21.4 PRODUCT PORTFOLIO

14.21.5 RECENT DEVELOPMENTS

14.22 CLIMATE LLC.

14.22.1 COMPANY SNAPSHOT

14.22.2 REVENUE ANALYSIS

14.22.3 GEOGRAPHIC PRESENCE

14.22.4 PRODUCT PORTFOLIO

14.22.5 RECENT DEVELOPMENTS

14.23 METER

14.23.1 COMPANY SNAPSHOT

14.23.2 REVENUE ANALYSIS

14.23.3 GEOGRAPHIC PRESENCE

14.23.4 PRODUCT PORTFOLIO

14.23.5 RECENT DEVELOPMENTS

14.24 SENTERA

14.24.1 COMPANY SNAPSHOT

14.24.2 REVENUE ANALYSIS

14.24.3 GEOGRAPHIC PRESENCE

14.24.4 PRODUCT PORTFOLIO

14.24.5 RECENT DEVELOPMENTS

15. CONCLUSION

16. QUESTIONNAIRE

17. RELATED REPORTS

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.