Global Medical Device Sterilization Market

Taille du marché en milliards USD

TCAC :

%

USD

12.59 Billion

USD

22.76 Billion

2024

2032

USD

12.59 Billion

USD

22.76 Billion

2024

2032

| 2025 –2032 | |

| USD 12.59 Billion | |

| USD 22.76 Billion | |

|

|

|

|

Marché mondial de la stérilisation des dispositifs médicaux, par produit (instruments, réactifs et services), technologie (stérilisation thermique, stérilisation par rayonnement ionisant, stérilisation par filtration, stérilisation au gaz et chimique), utilisateur final (sociétés pharmaceutiques, hôpitaux, cliniques, laboratoires, instituts universitaires et de recherche, fabricants de dispositifs médicaux et autres), canal de distribution (appels d'offres directs, vente au détail et distributeurs tiers) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de la stérilisation des dispositifs médicaux

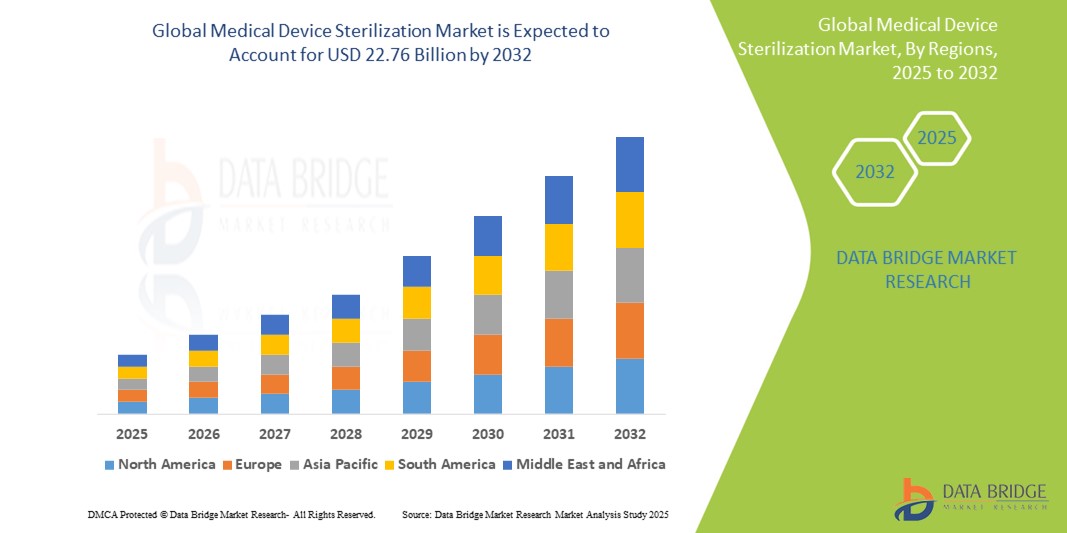

- Le marché mondial de la stérilisation des dispositifs médicaux était évalué à 12,59 milliards USD en 2024 et devrait atteindre 22,76 milliards USD d'ici 2032.

- Au cours de la période de prévision de 2025 à 2032, le marché devrait croître à un TCAC de 7,68 %, principalement en raison de la prévalence croissante des infections contractées à l'hôpital et de la demande croissante d'équipements médicaux stériles.

- Cette croissance est due à des facteurs tels que l’expansion des infrastructures de santé, l’augmentation des interventions chirurgicales et des normes réglementaires strictes en matière de contrôle des infections et de sécurité des patients.

Analyse du marché de la stérilisation des dispositifs médicaux

- La stérilisation des dispositifs médicaux est un processus essentiel qui garantit l'absence de micro-organismes viables dans les instruments médicaux, prévenant ainsi les infections et garantissant la sécurité des patients. Elle est essentielle dans les hôpitaux, les centres chirurgicaux et les laboratoires de diagnostic pour la stérilisation d'instruments tels que les instruments chirurgicaux, les cathéters et les implants.

- La demande de solutions de stérilisation est fortement stimulée par l'augmentation du nombre d'interventions chirurgicales, l'incidence croissante des infections nosocomiales et les normes réglementaires strictes en matière de sécurité des soins de santé. L'adoption de dispositifs médicaux à usage unique et d'instruments réutilisables renforce encore le besoin de méthodes de stérilisation efficaces.

- L'Amérique du Nord se distingue comme l'une des régions dominantes pour le marché de la stérilisation des dispositifs médicaux, en raison de ses systèmes de santé avancés, de sa forte application de la réglementation et de sa sensibilisation généralisée aux pratiques de contrôle des infections.

- Par exemple, les États-Unis ont connu une croissance des investissements dans les infrastructures de stérilisation dans les hôpitaux et les centres de chirurgie ambulatoire, les principaux acteurs innovant continuellement dans les technologies de stérilisation à basse température et à base de peroxyde d'hydrogène.

- À l’échelle mondiale, la stérilisation des dispositifs médicaux est considérée comme l’un des éléments fondamentaux des stratégies de contrôle des infections, aux côtés des équipements de protection individuelle et des systèmes de désinfection, jouant un rôle essentiel dans le maintien d’environnements de soins de santé stériles.

Portée du rapport et segmentation du marché de la stérilisation des dispositifs médicaux

|

Attributs |

Informations clés sur le marché de la stérilisation des dispositifs médicaux |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

Europe

Asie-Pacifique

Moyen-Orient et Afrique

Amérique du Sud

|

|

Acteurs clés du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de la stérilisation des dispositifs médicaux

« Adoption croissante des technologies de stérilisation à basse température et avancées »

- L’une des tendances marquantes du marché mondial de la stérilisation des dispositifs médicaux est l’adoption croissante de technologies de stérilisation à basse température et avancées.

- Ces méthodes, notamment le plasma gazeux de peroxyde d'hydrogène, le peroxyde d'hydrogène vaporisé (VHP) et les systèmes à base d'acide peracétique, gagnent en popularité en raison de leur compatibilité avec les instruments médicaux thermosensibles et complexes.

- Par exemple, la stérilisation à basse température permet la stérilisation efficace d’instruments délicats tels que les endoscopes, les outils chirurgicaux robotisés et les dispositifs à base de plastique qui ne peuvent pas résister aux méthodes traditionnelles à haute température telles que l’autoclavage.

- Des systèmes d'automatisation et de surveillance intelligents sont intégrés aux unités de stérilisation, permettant un suivi des données en temps réel, une sécurité renforcée et une conformité réglementaire

- Cette tendance transforme les pratiques de contrôle des infections dans les établissements de santé, favorisant une efficacité opérationnelle améliorée, une meilleure longévité des équipements et une sécurité accrue pour les patients et les prestataires de soins de santé.

Dynamique du marché de la stérilisation des dispositifs médicaux

Conducteur

« Inquiétude croissante concernant les infections nosocomiales (IN) »

- La préoccupation croissante concernant les infections nosocomiales (IAS) est l’un des principaux facteurs qui alimentent la demande de stérilisation des dispositifs médicaux dans les établissements de santé du monde entier.

- Les infections nosocomiales constituent une menace sérieuse pour la sécurité des patients, entraînant des séjours hospitaliers prolongés, des coûts médicaux supplémentaires et des taux de morbidité et de mortalité plus élevés.

- À mesure que les volumes chirurgicaux augmentent et que davantage de dispositifs médicaux réutilisables sont introduits, il existe un besoin croissant de processus de stérilisation efficaces capables d'éliminer toutes les formes de vie microbienne, y compris les bactéries, les virus et les spores.

- Les organismes de réglementation des soins de santé, tels que le CDC, la FDA et l'OMS, ont mis en œuvre des normes et des directives de stérilisation strictes pour garantir le contrôle des infections, incitant les hôpitaux et les cliniques à investir dans des technologies de stérilisation avancées.

- L'accent croissant mis sur la sécurité des patients et la prévention des infections, en particulier dans les environnements à haut risque tels que les salles d'opération et les unités de soins intensifs, continue d'accélérer l'adoption de méthodes de stérilisation traditionnelles et modernes.

Par exemple,

- En mars 2023, le CDC a signalé qu'environ 1 patient hospitalisé sur 31 aux États-Unis contracte au moins une infection associée aux soins de santé chaque jour, soulignant la nécessité de protocoles de stérilisation rigoureux.

- En 2022, l'Organisation mondiale de la santé (OMS) a souligné que 15 % des patients hospitalisés dans les pays à revenu faible ou intermédiaire souffrent d'au moins une infection nosocomiale, ce qui a donné lieu à des initiatives mondiales visant à améliorer les normes de stérilisation et d'hygiène.

- À mesure que la prise de conscience des risques et des coûts associés aux infections nosocomiales augmente, la demande de méthodes de stérilisation des dispositifs médicaux fiables, efficaces et sûres continue de croître, ce qui en fait un moteur clé du marché mondial.

Opportunité

« Progrès technologiques et automatisation des processus de stérilisation »

- L'intégration de technologies avancées et de l'automatisation dans les processus de stérilisation présente une opportunité significative d'améliorer l'efficacité, la précision et la conformité dans la stérilisation des dispositifs médicaux.

- Les systèmes de stérilisation intelligents équipés de capteurs IoT, d'un suivi du cycle piloté par l'IA et d'une surveillance basée sur le cloud peuvent garantir une qualité de stérilisation constante, réduire les erreurs humaines et fournir des informations opérationnelles en temps réel aux prestataires de soins de santé.

- Ces innovations permettent la maintenance prédictive, la validation automatique du cycle et la traçabilité, qui sont essentielles pour les audits réglementaires et l'amélioration des protocoles de contrôle des infections.

Par exemple,

- En septembre 2024, un rapport publié par MedTech Dive a mis en lumière l'utilisation croissante de l'IA et de l'apprentissage automatique dans les unités de stérilisation pour surveiller les paramètres de stérilisation et les ajuster automatiquement afin d'obtenir des résultats optimaux. Cela améliore non seulement la sécurité des patients, mais aussi l'efficacité des flux de travail dans les hôpitaux.

- En décembre 2023, selon un article du magazine HealthTech, plusieurs hôpitaux ont adopté des plateaux de stérilisation compatibles RFID et des stérilisateurs intégrés à l'IA pour suivre les instruments tout au long du cycle de stérilisation, réduisant ainsi considérablement les cas de stérilisation incorrecte et les risques d'infection associés.

- Le passage vers des solutions de stérilisation automatisées et intelligentes révolutionne les stratégies de prévention des infections, permettant aux établissements de santé d'étendre leurs opérations, de garantir la conformité et de fournir des soins plus sûrs avec une intervention manuelle réduite.

Retenue/Défi

« Coûts d'investissement et de maintenance élevés »

- Le coût élevé associé à l’achat, à l’installation et à la maintenance d’équipements de stérilisation avancés représente un défi majeur pour le marché de la stérilisation des dispositifs médicaux, en particulier dans les établissements de santé sensibles aux coûts et en développement.

- Les systèmes de stérilisation modernes, en particulier les unités à basse température et automatisées, peuvent nécessiter des investissements en capital importants, allant souvent de dizaines à des centaines de milliers de dollars, selon la capacité et la technologie.

- Ces contraintes financières limitent l’accès des petits hôpitaux, cliniques et établissements de soins ambulatoires, les obligeant à recourir à des méthodes de stérilisation de base ou à des services tiers, ce qui peut compromettre l’efficacité et le contrôle des infections.

Par exemple,

- En octobre 2023, selon un rapport de Healthcare Purchasing News, de nombreux centres de santé ruraux et plus petits d'Amérique latine et d'Asie du Sud-Est ont cité les limitations budgétaires comme un obstacle majeur à la mise à niveau vers des systèmes de stérilisation avancés, affectant leur capacité à répondre aux normes mondiales de stérilisation.

- En juin 2024, un article publié par l'Association pour l'avancement de l'instrumentation médicale (AAMI) soulignait qu'au-delà des coûts d'achat initiaux, les dépenses liées à l'étalonnage, à la validation et à la maintenance de routine du système créent une pression financière continue pour les prestataires de soins de santé.

- Par conséquent, les coûts initiaux et opérationnels élevés des solutions de stérilisation modernes peuvent ralentir la pénétration du marché, élargir l'écart dans les capacités de contrôle des infections entre les régions et remettre en cause l'adoption généralisée des meilleures pratiques de stérilisation.

Portée du marché de la stérilisation des dispositifs médicaux

Le marché est segmenté en fonction du produit, de la technologie, de l’utilisateur final et du canal de distribution.

|

Segmentation |

Sous-segmentation |

|

Par produit |

|

|

Par technologie |

|

|

Par utilisateur final |

|

|

Par canal de distribution

|

|

Analyse régionale du marché de la stérilisation des dispositifs médicaux

« L'Amérique du Nord est la région dominante sur le marché de la stérilisation des dispositifs médicaux »

- L'Amérique du Nord domine le marché de la stérilisation des dispositifs médicaux, grâce à son infrastructure de soins de santé avancée, à ses cadres réglementaires stricts et à l'adoption généralisée de technologies de stérilisation innovantes.

- Les États-Unis représentent une part importante du marché en raison du volume élevé d'interventions chirurgicales, de l'accent accru mis sur la prévention des infections et de la présence d'acteurs bien établis proposant une large gamme de solutions de stérilisation.

- Les systèmes de remboursement favorables et l’accent mis sur la qualité des soins de santé et la sécurité des patients stimulent davantage la demande de technologies de stérilisation haut de gamme dans la région.

- En outre, la région bénéficie d'investissements continus en recherche et développement et de l'adoption précoce de technologies émergentes telles que le plasma au peroxyde d'hydrogène, la stérilisation à basse température et les systèmes de suivi automatisés, améliorant ainsi l'efficacité opérationnelle et la conformité.

« L'Asie-Pacifique devrait enregistrer le taux de croissance le plus élevé »

- L'Asie-Pacifique devrait enregistrer le taux de croissance le plus élevé sur le marché de la stérilisation des dispositifs médicaux, grâce à l'augmentation des investissements dans les soins de santé, à la hausse des volumes chirurgicaux et à la sensibilisation croissante à la prévention des infections nosocomiales .

- Des pays comme la Chine, l'Inde et la Corée du Sud connaissent une croissance significative en raison de l'expansion de leurs infrastructures de santé, de la croissance de leur population de classe moyenne et de la demande croissante de services médicaux de haute qualité.

- L'Inde et la Chine, en particulier, connaissent une demande croissante de solutions de stérilisation dans les établissements de santé publics et privés, alors que les efforts visant à normaliser les protocoles de contrôle des infections prennent de l'ampleur.

- L’afflux de fabricants internationaux de dispositifs médicaux, associé aux initiatives des gouvernements locaux promouvant de meilleures normes d’hygiène et de sécurité des soins de santé, accélère encore la croissance du marché dans toute la région.

Part de marché de la stérilisation des dispositifs médicaux

Le paysage concurrentiel du marché fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence mondiale, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la domination de ses applications. Les données ci-dessus ne concernent que les activités des entreprises par rapport à leur marché.

Les principaux leaders du marché opérant sur le marché sont :

- STERIS (Irlande)

- Getinge (Suède)

- 3M (États-Unis)

- Sotera Health Company (États-Unis)

- Fortive (États-Unis)

- Cardinal Health (États-Unis)

- Metall Zug AG (Suisse)

- Stryker (États-Unis)

- Merck KGaA (Allemagne)

- Groupe MMM (Allemagne)

- ANTONIO MATACHANA, SA (Espagne)

- Tuttnauer (Pays-Bas)

- Stérilisateurs Andersen (États-Unis)

- Steelco SpA (Italie)

- Noxilizer, Inc. (États-Unis)

- DE LAMA SPA (Italie)

- Groupe Cosmed (États-Unis)

- CBMSrl Équipement médical (Italie)

- E-BEAM Services, Inc. (États-Unis)

- Shinva Medical Instrument Co., Ltd. (Chine)

Derniers développements sur le marché mondial de la stérilisation des dispositifs médicaux

- En novembre 2024, Cosmed Group Inc., une entreprise de stérilisation, s'est placée sous la protection du Chapitre 11 de la loi sur les faillites à Houston, au Texas, à la suite de poursuites alléguant des blessures, notamment des cancers, causées par l'inhalation d'oxyde d'éthylène, un gaz cancérigène utilisé pour la stérilisation. L'entreprise a fait face à au moins 300 poursuites, dont deux recours collectifs, mettant en péril la poursuite de ses activités.

- En août 2024, Mudanjiang Plasma Physics Application Technology Co., Ltd. a obtenu la certification CE pour son agent peroxyde d'hydrogène utilisé dans les stérilisateurs plasma basse température. Cette certification marque une avancée significative dans la technologie de stérilisation, offrant une alternative efficace et écologique aux méthodes traditionnelles.

- En avril 2024, Ecolab a annoncé la vente de son unité mondiale de solutions chirurgicales à Medline pour 950 millions USD, dans le but de renforcer sa concentration sur les services de santé de base.

- En mars 2024, l'Agence américaine de protection de l'environnement (EPA) a mis en œuvre de nouvelles règles visant à réduire de 90 % les émissions d'oxyde d'éthylène (EtO), abordant ainsi les risques cancérigènes associés à la stérilisation des dispositifs médicaux.

- En 2024, Sterile State LLC a dévoilé une méthode de stérilisation révolutionnaire utilisant l'oxyde nitrique, offrant une alternative écologique à la stérilisation traditionnelle à l'EtO

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Global medical device sterilization market

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- PRODUCT LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- market END USER coverage grid

- vendor share analysis

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- Global Medical Device Sterilization Market: regulations

- REGULATIONS IN THE U.S.:

- REGULATIONS IN EUROPE

- REGULATIONS IN CHINA

- REGULATIONS IN INDIA

- Relevant Acts for the Framework:

- Market Overview

- drivers

- escalation in number of Surgeries

- INCREASE IN prevalence of CHRONIC DISEASES

- INCREASE IN NUMBER OF PRODUCT APPROVALS AND LAUNCHES

- RisE IN geriatric population

- Restraints

- High cost associated with sterilization products

- product recall

- Disadvantages associated with sterilization technologies

- OPPORTUNITIES

- RisE IN healthcare expenditure

- high prevalence Hospital-acquired infections (HAI’s)

- Strategic Initiatives by Key market players

- IncreasE IN usage of sterilizers in emerging market

- CHALLENGEs

- stringent Regulatory frameworks for product approval

- lack of accessibility of medical devices and sterilizers

- IMPACT OF COVID-19 ON THE GLOBAL MEDICAL DEVICE STERILIZATION MARKET

- IMPACT ON PRICE

- IMPACT ON SUPPLY

- IMPACT ON DEMAND

- STRATEGIC DECISIONS BY MANUFACTURERS

- CONCLUSION

- Global medical device sterilization market, By product

- overview

- Instruments

- thermal sterilizers

- HIGH TEMPERATURE STERILIZERS

- LOW TEMPERATURE STERILIZERS

- ionizing radiation sterilizers

- filtration sterilizers

- chemical & gas sterilization

- Reagents

- sterilization indicators

- CHEMICAL INDICATORS

- BIOLOGICAL INDICATORS

- POUCHES

- DETERGENTS

- LUBRICANTS

- ACCESSORIES

- Services

- STEAM STERILIZATION SERVICES

- GAMMA STERILIZATION SERVICES

- ETHYLENE OXIDE STERILIZATION SERVICES

- OTHERS

- Global medical device sterilization market, By TECHNOLOGY

- overview

- thermal sterilization

- AUTOCLAVE

- DISTILLATION

- PASTEURIZATION

- RETORTING

- OTHERS

- ionizing radiation sterilization

- E-BEAM RADIATION STERILIZATION

- GAMMA RADIATION STERILIZATION

- OTHERS

- FILTRATION STERILIZATION

- chemical & Gas sterilization

- ETHYLENE OXIDE STERILIZATION

- FORMALDEHYDE RADIATION STERILIZATION

- HYDROGEN PEROXIDE GAS PLASMA

- PERACETIC ACID STERILIZATION

- CHLORINE DIOXIDE STERILIZATION

- OTHERS

- Global medical device sterilization market, By END USER

- overview

- hospitals

- clinics

- laboratories

- medical device manufacturers

- academic and research institutes

- pharmaceutical companies

- Global medical device sterilization market, By distribution channel

- overview

- direct sales

- retail sales

- third party distributors

- GLOBAL Medical Device Sterilization MARKET, by REGION

- overview

- north america

- U.S.

- Canada

- MEXICO

- Europe

- Germany

- France

- U.K.

- Belgium

- Italy

- Spain

- Russia

- Turkey

- Netherlands

- Switzerland

- Rest of Europe

- Asia-Pacific

- China

- India

- JAPAN

- South Korea

- Australia

- Singapore

- Thailand

- Malaysia

- Indonesia

- Philippines

- Rest of Asia-Pacific

- Middle East and Africa

- South Africa

- Saudi Arabia

- U.A.E.

- Egypt

- Israel

- Rest of Middle East and Africa

- South America

- Brazil

- Argentina

- Rest of South America

- Global medical device sterilization market: COMPANY landscape

- company share analysis: Global

- company share analysis: North America

- company share analysis: Europe

- company share analysis: Asia-Pacific

- swot analysis

- Company profile

- Steris

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- 3m

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Merck kgaa

- COMPANY SNAPSHOT

- ReVENUE analysis

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Getinge AB

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Cardinal Health

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ASP

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Belimed ag

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- BIObase Biodusty (Shandong), Co., Ltd.

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- dentsply sirona

- COMPANY SNAPSHot

- REVENUE ANALYSIS

- product Portfolio

- RECENT DEVELOPMENT

- matachana group

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- MELAG Medizintechnik GmbH & Co. KG

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- Midmark Corporation

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- MMM Group

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- Sartorius AG

- COMPANY SNAPSHOT

- ReVENUE analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- SciCan, Inc.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- Steelco s.p.a.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- Sterigenics U.S., LLC (a subsidiary of Sotera Health Company)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- SYSTEC GMBH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- tuttnauer

- COMPANY SNAPSHot

- product Portfolio

- RECENT DEVELOPMENT

- W&H Dentalwerk Bürmoos GmbH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTs

- questionnaire

- related reports

Liste des tableaux

TABLE 1 NUMBER OF PEOPLE WITH DIABETES (MILLION) AMONG AGES 20–79 YEARS

TABLE 2 AVERAGE COST RANGE OF SURGERIES IN INDIA (USD)

TABLE 3 Global medical device sterilization market, By product, 2019-2028 (USD million)

TABLE 4 Global INSTRUMENTS IN Medical Device Sterilization Market, By Region, 2019-2028 (USD Million)

TABLE 5 Global INSTRUMENTS IN Medical Device Sterilization Market, By PRODUCT, 2019-2028 (USD Million)

TABLE 6 Global Thermal Sterilizers in Medical Device Sterilization Market, By Product, 2019-2028 (USD Million)

TABLE 7 Global Reagents in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 8 global Reagents in Medical Device Sterilization Market, By Product, 2019-2028 (USD Million)

TABLE 9 global Sterilization Indicators in Medical Device Sterilization Market, By Product, 2019-2028 (USD Million)

TABLE 10 Global Services in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 11 global Services in Medical Device Sterilization Market, By Product, 2019-2028 (USD Million)

TABLE 12 global Medical Device Sterilization Market, By Technology, 2019-2028 (USD Million)

TABLE 13 Global Thermal Sterilization in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 14 global Thermal Sterilization in Medical Device Sterilization Market, By Technology, 2019-2028 (USD Million)

TABLE 15 Global ionizing radiation Sterilization in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 16 global Ionizing Radiation Sterilization in Medical Device Sterilization Market, By Technology, 2019-2028 (USD Million)

TABLE 17 Global Filtration Sterilization in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 18 Global Chemical & Gas Sterilization in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 19 global Chemical & Gas Sterilization in Medical Device Sterilization Market, By Technology, 2019-2028 (USD Million)

TABLE 20 global Medical Device Sterilization Market, By End User, 2019-2028 (USD Million)

TABLE 21 Global Hospitals in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 22 Global Clinics in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 23 Global Laboratories in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 24 Global Medical Device Manufactures in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 25 Global Academic and Research Institutes in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 26 Global Pharmaceutical Companies in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 27 global Medical Device Sterilization Market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 28 Global Direct sales in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 29 Global Retail Sales in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 30 Global Third Party Distributions in Medical Device Sterilization Market, By region, 2019-2028 (USD Million)

TABLE 31 GLOBAL medical device sterilization market, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 North America MEDICAL DEVICE Sterilization Market, By country, 2019-2028 (USD Million)

TABLE 33 North America medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 34 North America Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 35 North America Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 36 North America Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 37 North America Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 38 North America Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 39 North America medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 40 North America Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 41 North America Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 42 North America Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 43 North America medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 44 North America medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 45 U.S. medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 46 U.S. Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 47 U.S. Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 48 U.S. Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 49 U.S. Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 50 U.S. Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 51 U.S. medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 52 U.S. Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 53 U.S. Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 54 U.S. Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 55 U.S. medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 56 U.S. medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 57 Canada medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 58 Canada Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 59 Canada Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 60 Canada Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 61 Canada Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 62 Canada Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 63 Canada medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 64 Canada Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 65 Canada Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 66 Canada Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 67 Canada medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 68 Canada medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 69 MEXICO medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 70 MEXICO Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 71 MEXICO Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 72 MEXICO Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 73 MEXICO Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 74 MEXICO Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 75 MEXICO medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 76 MEXICO Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 77 MEXICO Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 78 MEXICO Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 79 MEXICO medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 80 MEXICO medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 81 EUROPE MEDICAL DEVICE Sterilization Market, By country, 2019-2028 (USD Million)

TABLE 82 Europe medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 83 Europe Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 84 Europe Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 85 Europe Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 86 Europe Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 87 Europe Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 88 Europe medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 89 Europe Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 90 Europe Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 91 Europe Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 92 Europe medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 93 Europe medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 94 Germany medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 95 Germany Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 96 Germany Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 97 Germany Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 98 Germany Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 99 Germany Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 100 Germany medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 101 Germany Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 102 Germany Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 103 Germany Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 104 Germany medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 105 Germany medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 106 France medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 107 France Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 108 France Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 109 France Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 110 France Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 111 France Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 112 France medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 113 France Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 114 France Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 115 France Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 116 France medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 117 France medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 118 U.K. medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 119 U.K. Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 120 U.K. Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 121 U.K. Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 122 U.K. Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 123 U.K. Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 124 U.K. medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 125 U.K. Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 126 U.K. Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 127 U.K. Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 128 U.K. medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 129 U.K. medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 130 Belgium medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 131 Belgium Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 132 Belgium Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 133 Belgium Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 134 Belgium Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 135 Belgium Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 136 Belgium medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 137 Belgium Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 138 Belgium Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 139 Belgium Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 140 Belgium medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 141 Belgium medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 142 Italy medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 143 Italy Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 144 Italy Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 145 Italy Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 146 Italy Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 147 Italy Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 148 Italy medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 149 Italy Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 150 Italy Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 151 Italy Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 152 Italy medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 153 Italy medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 154 Spain medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 155 Spain Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 156 Spain Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 157 Spain Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 158 Spain Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 159 Spain Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 160 Spain medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 161 Spain Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 162 Spain Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 163 Spain Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 164 Spain medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 165 Spain medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 166 Russia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 167 Russia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 168 Russia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 169 Russia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 170 Russia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 171 Russia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 172 Russia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 173 Russia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 174 Russia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 175 Russia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 176 Russia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 177 Russia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 178 Turkey medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 179 Turkey Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 180 Turkey Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 181 Turkey Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 182 Turkey Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 183 Turkey Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 184 Turkey medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 185 Turkey Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 186 Turkey Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 187 Turkey Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 188 Turkey medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 189 Turkey medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 190 Netherlands medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 191 Netherland Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 192 Netherlands Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 193 Netherlands Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 194 Netherlands Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 195 Netherlands Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 196 Netherlands medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 197 Netherlands Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 198 Netherlands Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 199 Netherlands Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 200 Netherlands medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 201 Netherlands medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 202 Switzerland medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 203 Switzerland Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 204 Switzerland Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 205 Switzerland Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 206 Switzerland Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 207 Switzerland Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 208 Switzerland medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 209 Switzerland Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 210 Switzerland Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 211 Switzerland Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 212 Switzerland medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 213 Switzerland medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 214 Rest of Europe medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 215 Asia-Pacific MEDICAL DEVICE Sterilization Market, By country 2019-2028 (USD Million)

TABLE 216 Asia-Pacific medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 217 Asia-Pacific Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 218 Asia-Pacific Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 219 Asia-Pacific Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 220 Asia-Pacific Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 221 Asia-Pacific Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 222 Asia-Pacific medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 223 Asia-Pacific Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 224 Asia-Pacific Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 225 Asia-Pacific Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 226 Asia-Pacific medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 227 Asia-Pacific medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 228 China medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 229 China Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 230 China Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 231 China Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 232 China Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 233 China Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 234 China medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 235 China Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 236 China Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 237 China Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 238 China medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 239 China medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 240 India medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 241 India Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 242 India Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 243 India Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 244 India Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 245 India Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 246 India medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 247 India Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 248 India Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 249 India Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 250 India medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 251 India medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 252 JAPAN medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 253 JAPAN Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 254 JAPAN Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 255 JAPAN Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 256 JAPAN Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 257 JAPAN Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 258 JAPAN medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 259 JAPAN Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 260 JAPAN Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 261 JAPAN Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 262 JAPAN medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 263 JAPAN medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 264 South Korea medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 265 South Korea Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 266 South Korea Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 267 South Korea Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 268 South Korea Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 269 South Korea Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 270 South Korea medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 271 South Korea Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 272 South Korea Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 273 South Korea Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 274 South Korea medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 275 South Korea medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 276 Australia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 277 Australia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 278 Australia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 279 Australia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 280 Australia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 281 Australia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 282 Australia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 283 Australia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 284 Australia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 285 Australia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 286 Australia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 287 Australia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 288 Singapore medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 289 Singapore Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 290 Singapore Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 291 Singapore Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 292 Singapore Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 293 Singapore Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 294 Singapore medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 295 Singapore Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 296 Singapore Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 297 Singapore Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 298 Singapore medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 299 Singapore medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 300 Thailand medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 301 Thailand Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 302 Thailand Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 303 Thailand Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 304 Thailand Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 305 Thailand Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 306 Thailand medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 307 Thailand Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 308 Thailand Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 309 Thailand Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 310 Thailand medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 311 Thailand medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 312 Malaysia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 313 Malaysia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 314 Malaysia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 315 Malaysia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 316 Malaysia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 317 Malaysia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 318 Malaysia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 319 Malaysia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 320 Malaysia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 321 Malaysia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 322 Malaysia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 323 Malaysia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 324 Indonesia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 325 Indonesia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 326 Indonesia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 327 Indonesia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 328 Indonesia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 329 Indonesia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 330 Indonesia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 331 Indonesia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 332 Indonesia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 333 Indonesia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 334 Indonesia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 335 Indonesia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 336 Philippines medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 337 Philippines Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 338 Philippines Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 339 Philippines Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 340 Philippines Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 341 Philippines Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 342 Philippines medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 343 Philippines Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 344 Philippines Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 345 Philippines Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 346 Philippines medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 347 Philippines medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 348 Rest of Asia-Pacific medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 349 MIDDLE EAST AND AFRICA MEDICAL DEVICE Sterilization Market, By country, 2019-2028 (USD Million)

TABLE 350 Middle East and Africa medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 351 Middle East and Africa Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 352 Middle East and Africa Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 353 Middle East and Africa Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 354 Middle East and Africa Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 355 Middle East and Africa Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 356 Middle East and Africa medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 357 Middle East and Africa Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 358 Middle East and Africa Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 359 Middle East and Africa Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 360 Middle East and Africa medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 361 Middle East and Africa medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 362 South Africa medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 363 South Africa Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 364 South Africa Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 365 South Africa Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 366 South Africa Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 367 South Africa Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 368 South Africa medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 369 South Africa Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 370 South Africa Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 371 South Africa Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 372 South Africa medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 373 South Africa medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 374 Saudi Arabia medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 375 Saudi Arabia Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 376 Saudi Arabia Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 377 Saudi Arabia Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 378 Saudi Arabia Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 379 Saudi Arabia Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 380 Saudi Arabia medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 381 Saudi Arabia Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 382 Saudi Arabia Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 383 Saudi Arabia Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 384 Saudi Arabia medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 385 Saudi Arabia medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 386 U.A.E. medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 387 U.A.E. Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 388 U.A.E. Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 389 U.A.E. Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 390 U.A.E. Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 391 U.A.E. Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 392 U.A.E. medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 393 U.A.E. Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 394 U.A.E. Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 395 U.A.E. Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 396 U.A.E. medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 397 U.A.E. medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 398 Egypt medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 399 Egypt Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 400 Egypt Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 401 Egypt Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 402 Egypt Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 403 Egypt Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 404 Egypt medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 405 Egypt Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 406 Egypt Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 407 Egypt Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 408 Egypt medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 409 Egypt medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 410 Israel medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 411 Israel Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 412 Israel Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 413 Israel Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 414 Israel Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 415 Israel Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 416 Israel medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 417 Israel Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 418 Israel Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 419 Israel Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 420 Israel medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 421 Israel medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 422 Rest of Middle East and Africa medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 423 SOUTH AMERICA MEDICAL DEVICE Sterilization Market, By country, 2019-2028 (USD Million)

TABLE 424 South America medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 425 South America Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 426 South America Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 427 South America Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 428 South America Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 429 South America Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 430 South America medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 431 South America Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 432 South America Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 433 South America Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 434 South America medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 435 South America medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 436 Brazil medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 437 Brazil Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 438 Brazil Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 439 Brazil Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 440 Brazil Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 441 Brazil Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 442 Brazil medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 443 Brazil Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 444 Brazil Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 445 Brazil Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 446 Brazil medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 447 Brazil medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 448 Argentina medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 449 Argentina Instruments in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 450 Argentina Thermal Sterilizers in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 451 Argentina Reagents in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 452 Argentina Sterilization Indicators in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 453 Argentina Services in medical device sterilization market, By Product, 2019-2028 (USD Million)

TABLE 454 Argentina medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 455 Argentina Thermal Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 456 Argentina Ionizing Radiation Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 457 Argentina Chemical & Gas Sterilization in medical device sterilization market, By Technology, 2019-2028 (USD Million)

TABLE 458 Argentina medical device sterilization market, By End User, 2019-2028 (USD Million)

TABLE 459 Argentina medical device sterilization market, By Distribution Channel, 2019-2028 (USD Million)

TABLE 460 Rest of South America medical device sterilization market, By Product, 2019-2028 (USD Million)

Liste des figures

FIGURE 1 Global medical device sterilization market: segmentation

FIGURE 2 Global medical device sterilization market: data triangulation

FIGURE 3 Global medical device sterilization market: DROC ANALYSIS

FIGURE 4 Global medical device sterilization market : global vs REGIONAL MARKET ANALYSIS

FIGURE 5 Global medical device sterilization market : COMPANY RESEARCH ANALYSIS

FIGURE 6 Global medical device sterilization market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Global medical device sterilization market: DBMR MARKET POSITION GRID

FIGURE 8 GLOBAL medical device sterilization MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 Global medical device sterilization market: vendor share analysis

FIGURE 10 Global medical device sterilization market: SEGMENTATION