Global Sugar Based Excipients Market

Taille du marché en milliards USD

TCAC :

%

USD

7.36 Billion

USD

12.12 Billion

2024

2032

USD

7.36 Billion

USD

12.12 Billion

2024

2032

| 2025 –2032 | |

| USD 7.36 Billion | |

| USD 12.12 Billion | |

|

|

|

|

Global Sugar Based Excipients Market Segmentation, By Product (Actual Sugar, Sugar Alcohol and Artificial Sweeteners), Type (Powders, Compression Sugars, Crystals and Syrups), Application (Fillers, Diluents, Tonicity Agents and Flavoring Agents), Formulation (Oral, Topical, Parenteral) - Industry Trends and Forecast to 2032

Sugar Based Excipients Market Size

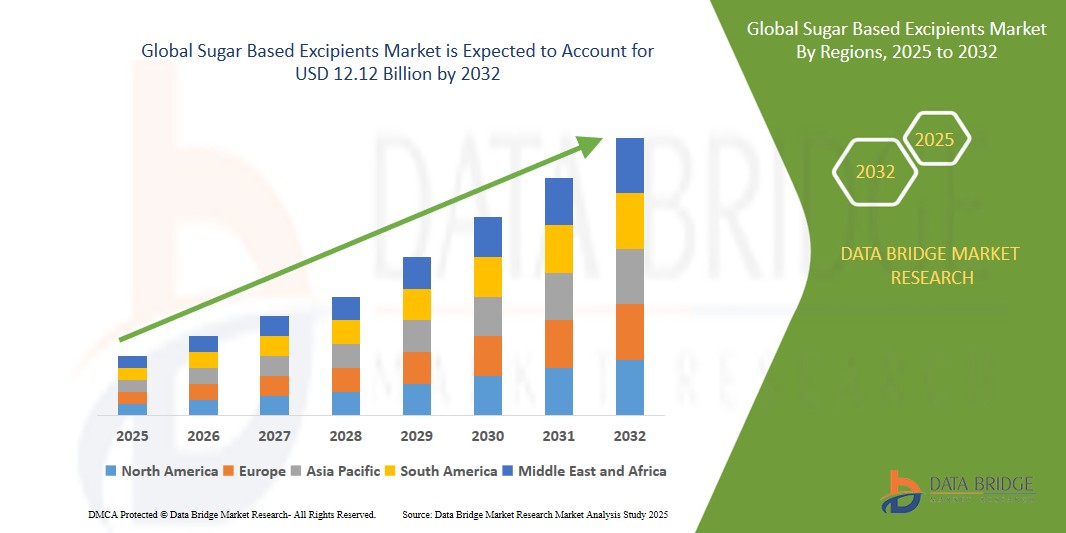

- The global Sugar Based Excipients market was valued atUSD 7.36 billion in 2024 and is expected to reachUSD 12.12 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at aCAGR of 6.4%, primarily driven by the increasing demand for orally disintegrating tablets (ODTs)

- This growth is driven by sugar-based excipients, such as mannitol and sorbitol, are effective in masking the bitter taste of APIs, enhancing the palatability of ODTs and making them more acceptable to patients.

Sugar Based Excipients Market Analysis

- The growing preference for oral solid dosage forms, such as tablets and capsules, is driving the demand for sugar-based excipients.

- These excipients enhance drug stability, bioavailability, and patient compliance through improved taste masking and ease of swallowing.

- The pharmaceutical industry is increasingly adopting co-processed excipients to improve the functionality of drug formulations.

- These excipients offer enhanced properties like better flowability, compressibility, and solubility, leading to more efficient and patient-friendly drug delivery systems.

Report Scope and Sugar Based Excipients Market Segmentation

|

Attributes |

Sugar Based Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sugar Based Excipients Market Trends

“The Rising Adoption of Co-Processed Excipients”

- Co-processed excipients combine multiple excipients to improve flowability, compressibility, and stability, enhancing drug formulation efficiency.

- The pharmaceutical sector increasingly seeks multifunctional excipients to streamline manufacturing processes and improve product performance.

- The popularity of tablets and capsules boosts demand for co-processed excipients that facilitate better taste masking and bioavailability.

- As generic drug manufacturing expands, co-processed excipients help maintain consistent quality and efficacy across products

- For instance, Roquette launched PEARLITOL Flash, a co-processed excipient based on mannitol (a sugar alcohol) and starch for fast-dissolving tablets, improving patient compliance and product performance.

- The integration of co-processed excipients addresses multiple formulation challenges, positioning them as a key driver in the evolution of sugar-based excipients within the pharmaceutical industry.

Sugar Based Excipients Market Dynamics

Driver

“Increasing Demand for Orally Disintegrating Tablets (ODTs)”

- ODTs eliminate the need for swallowing pills, making medication intake easier for patients with swallowing difficulties, thereby improving adherence to prescribed treatments.

- The rapid dissolution of ODTs facilitates faster absorption of active pharmaceutical ingredients (APIs), leading to improved bioavailability and quicker therapeutic effects.

- Sugar-based excipients, such as mannitol and sorbitol, are effective in masking the bitter taste of APIs, enhancing the palatability of ODTs and making them more acceptable to patients.

- The use of sugar-based excipients in ODTs can reduce production costs due to their multifunctional properties, including serving as fillers, binders, and sweeteners, streamlining the formulation process.

For instance,

- A study explored the use of erythritol, a sugar alcohol, as an excipient in ODTs. The MADG method was employed to enhance tablet ability and achieve rapid disintegration while maintaining tablet hardness. This approach addressed challenges associated with erythritol's low compressibility, offering a promising strategy for ODT formulation.

- The growing preference for ODTs, driven by their patient-friendly attributes and the functional benefits of sugar-based excipients, is significantly contributing to the expansion of the sugar-based excipients market.

Opportunity

“Expansion of Sugar-Based Excipients in Pediatric and Geriatric Drug Formulations”

- The increasing global pediatric and geriatric populations necessitate medications that are palatable and easy to administer. Sugar-based excipients enhance taste and solubility, making them ideal for these age groups.

- There's a growing demand for natural, non-toxic excipients in pharmaceuticals. Sugar-based excipients, derived from natural sources, align with this trend, offering safety and efficacy.

- Innovations in drug formulations, such as orally disintegrating tablets, benefit from sugar-based excipients due to their binding properties and ability to improve drug stability.

- Emerging markets, particularly in Asia-Pacific, are witnessing a surge in pharmaceutical manufacturing, driving the demand for sugar-based excipients.

For instance,

- Mannitol, a sugar alcohol, is frequently used by Merck in formulations for elderly patients due to its sweetness, low glycemic index, and smooth mouthfeel

- The convergence of demographic shifts, consumer preferences, and pharmaceutical innovations positions sugar-based excipients as a pivotal component in developing age-appropriate drug formulations, presenting significant growth opportunities in the global market.

Restraint/Challenge

“Stringent Regulatory Compliance”

- Regulatory bodies like the FDA and EMA require detailed justification for the inclusion of excipients in pharmaceutical formulations. This includes demonstrating safety, efficacy, and necessity, which can be time-consuming and resource-intensive for manufacturers.

- The rigorous standards set by regulatory agencies have led to a shortage of FDA-approved manufacturing sites for sugar-based excipients.

- This limitation restricts production capacity and can delay the introduction of new products to the market.

- Manufacturers must adhere to strict quality control procedures to ensure product consistency and safety. These demands can increase operational costs and require significant investment in quality assurance infrastructure.

- Navigating the complex regulatory landscape is a major challenge for the sugar-based excipients market. While these regulations are essential for ensuring product safety and efficacy, they can also impede market growth and innovation.

Sugar Based Excipients Market Scope

The market is segmented on the basis of product, type, application, and formulation.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Type |

|

|

By Application |

|

|

By Formulation |

|

Sugar Based Excipients Market Regional Analysis

“Europe is the Dominant Region in the Sugar Based Excipients Market”

- Europe dominates the Sugar Based Excipients market, driven by significant demand for sugar-based excipients used in oral formulations, including pediatric and geriatric medications

- Germany holds a significant share due to contribute significantly to demand, driven by presence of major excipient producers such as Roquette Group (France), DFE Pharma (Germany), and BASF SE (Germany) enhances Europe's market position through advanced research and development capabilities

- Supportive initiatives and substantial investments in drug development and generic drug production across Europe further bolster the region's dominance in the sugar-based excipients market.

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific region is expected to witness the highest growth rate in the Sugar Based Excipients market, driven by increasing pharmaceutical manufacturing activities

- China is growing with highest CAGR in the region due to growing population, rising healthcare expenditure, and expanding pharmaceutical industries contribute to the demand for sugar-based excipients.

- In addition, regulatory reforms, technological advancements, and strategic collaborations in the pharmaceutical sector further support market growth in the Asia Pacific region

Sugar Based Excipients Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Roquette Frères (France)

- DFE Pharma (Germany)

- BASF SE (Germany)

- Ashland Inc. (U.S.)

- Archer Daniels Midland Company (U.S.)

- MEGGLE AG (Germany)

- Associated British Foods Plc (U.K.)

- Cargill, Inc. (U.S.)

- Colorcon, Inc. (U.S.)

- FMC Corporation (U.S.)

- The Lubrizol Corporation (U.S.)

- MB Sugars & Pharmaceuticals (India)

- Citron Scientific (India)

- Harshad Agencies (India)

- Emilio Castelli (Italy)

- New Zealand Pharmaceuticals Limited (New Zealand)

- IMCD Pharma (Netherlands)

- Pfanstiehl, Inc. (U.S.)

Latest Developments in Global Sugar Based Excipients Market

- In In October 2022, MB Sugars showcased its Rich Specialty Sugars for the festive season. The brand embraced the celebratory spirit, recognizing that India's Diwali festivities are traditionally centered around sweets and delicacies. Sweets also play a vital role in Indian weddings and festivals.

- In January 2022, Cargill inaugurated its first Food Innovation Center in India to cater to the growing demand for nutritious food. Located in Gurugram, Haryana, the Cargill Innovation Center was established to respond to evolving trends in the food and beverage (F&B) market.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.