Marché de l'assurance maladie privée au Vietnam, par type (assurance maladies graves, assurance maladie individuelle, assurance maladie familiale, assurance maladie spécifique et autres), catégorie de régime de santé/niveaux de métal (Bronze, Argent, Or Platine et autres), type de fournisseur (organisations de maintien de la santé (HMOS), organisations de fournisseurs privilégiés (PPOS), organisations de fournisseurs exclusifs (EPOS), plans de point de service (POS), plans de santé à franchise élevée (HDHPS) et autres), groupe d'âge (jeune adulte (19-44 ans), âge moyen (45-64 ans) et âge adulte plus avancé (65 ans et plus)), canal de distribution (compagnies d'assurance directe, agrégateurs d'assurance et autres) - Tendances et prévisions du secteur jusqu'en 2029.

Analyse du marché et taille

Une police d'assurance maladie comprend plusieurs types de prestations et d'avantages. Elle offre une couverture financière aux assurés pour certains soins. Elle offre également des avantages tels que l'hospitalisation sans numéraire, la prise en charge des remboursements avant et après l'hospitalisation, ainsi que diverses options complémentaires.

L'assurance maladie propose plusieurs types de couvertures, notamment les remboursements et les déblocages de fonds. La déblocage de fonds est possible lorsque l'assuré se fait soigner dans les hôpitaux du réseau de la compagnie d'assurance. Si l'assuré se fait soigner dans des hôpitaux non membres du réseau, il prend en charge tous les frais médicaux et demande ensuite le remboursement à la compagnie d'assurance en soumettant toutes les factures. Cette assurance maladie privée offre un soutien financier à l'assuré en prenant en charge tous les frais médicaux liés à son hospitalisation.

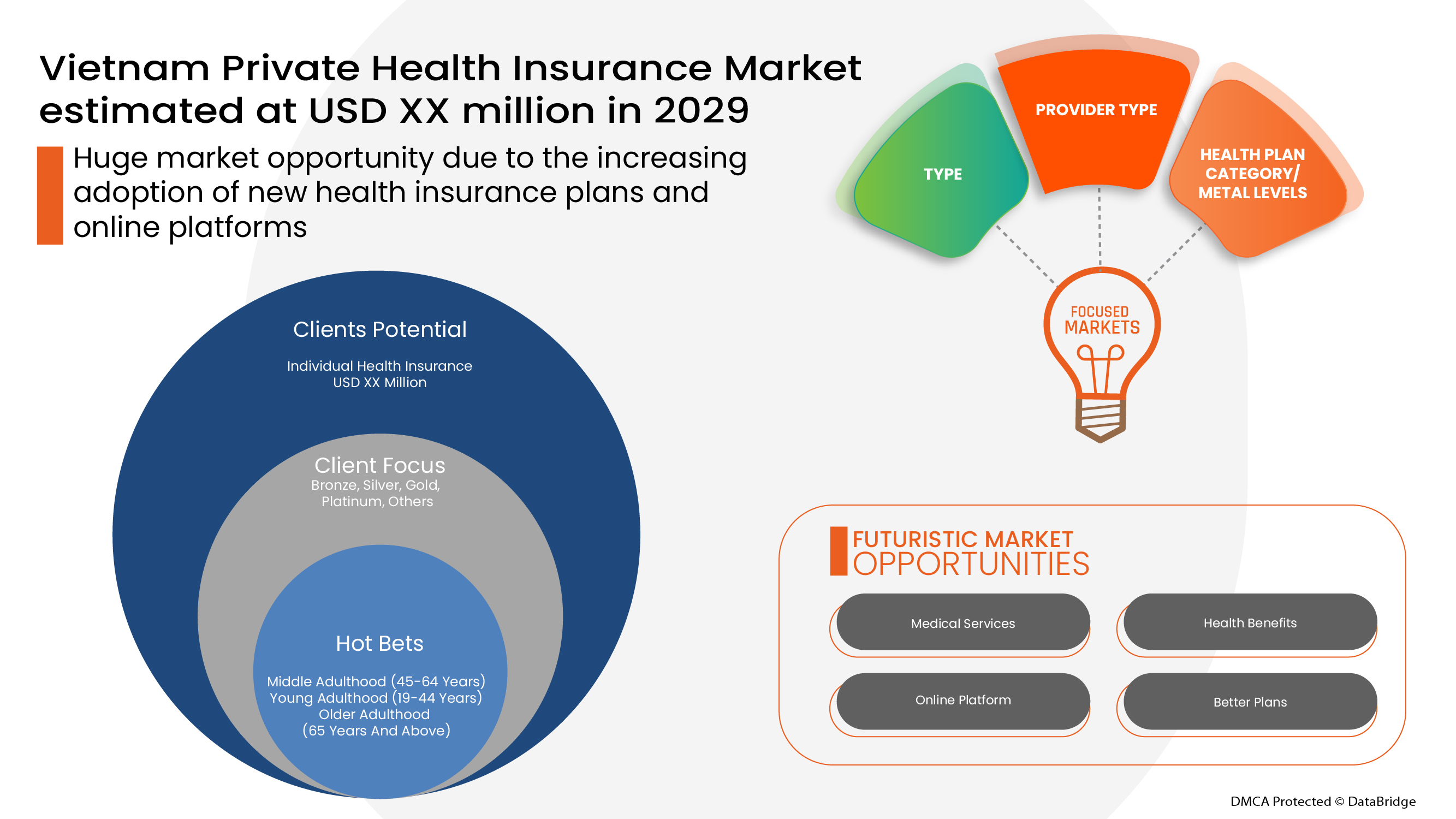

Selon Data Bridge Market Research, le marché vietnamien de l'assurance maladie privée devrait atteindre 1 516,75 millions de dollars américains d'ici 2029, avec un TCAC de 1,4 % sur la période de prévision. L'assurance maladie individuelle représente le segment le plus important du marché en raison de la croissance de l'assurance maladie privée. Le rapport de marché élaboré par l'équipe Data Bridge Market Research comprend des analyses approfondies d'experts, des analyses import/export, des analyses de prix, des analyses de production et de consommation, ainsi que des scénarios de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (assurance maladies graves, assurance santé individuelle, assurance santé familiale, assurance maladie spécifique et autres), catégorie de régime de santé/niveaux de métal (Bronze, Argent, Or, Platine et autres), type de fournisseur (organismes de maintien de la santé (HMOS), organismes de fournisseurs privilégiés (PPOS), organismes de fournisseurs exclusifs (EPOS), plans de point de service (POS), régimes de santé à franchise élevée (HDHPS) et autres), tranche d'âge (jeune adulte (19-44 ans), adulte moyen (45-64 ans) et adulte plus âgé (65 ans et plus)), canal de distribution (compagnies d'assurance directe, agrégateurs d'assurance et autres) |

|

Pays couverts |

Vietnam |

|

Acteurs du marché couverts |

Aetna Inc. (filiale de CVS Health) (États-Unis), AIA Group Limited (Hong Kong), HSBC Group (Hong Kong), Tokio Marine (Japon), Pacific Cross (Philippines), Great Eastern Holdings Limited (Malaisie), ASSICURAZIONI GENERALI SPA (Italie), Raffles Medical Group (Singapour), Dai-ichi Life Vietnam (Vietnam) |

Définition du marché

L'assurance maladie couvre tous les types de frais chirurgicaux ainsi que les traitements médicaux liés à une maladie ou à une blessure. Elle couvre une gamme complète ou limitée de services médicaux et prend en charge tout ou partie des coûts de certains services. L'assurance maladie apporte un soutien financier à l'assuré en prenant en charge tous les frais médicaux liés à son hospitalisation. Elle couvre également les frais pré et post-hospitalisation.

Cadre réglementaire

Conformément à la Constitution de 1992 de la République socialiste du Vietnam, modifiée et complétée par la résolution n° 51/2001/QH10 ; L'Assemblée nationale promulgue la loi sur l'assurance maladie.

1. La présente loi prévoit le régime et les politiques d'assurance maladie, y compris les participants, les taux de prime, les responsabilités et les méthodes de paiement des primes d'assurance maladie ; les cartes d'assurance maladie ; les bénéficiaires éligibles de l'assurance maladie ; les soins médicaux pour les assurés ; le paiement des frais de soins médicaux couverts par l'assurance maladie ; le fonds d'assurance maladie ; et les droits et responsabilités des parties impliquées dans l'assurance maladie.

2. La présente loi s’applique aux organisations et aux particuliers nationaux et étrangers au Vietnam qui sont impliqués dans l’assurance maladie.

3. La présente loi ne s’applique pas à l’assurance maladie commerciale.

La COVID-19 a eu un impact minimal sur le marché de l'assurance maladie privée

La COVID-19 a impacté divers secteurs de l'industrie manufacturière et des services en 2020-2021, entraînant la fermeture d'entreprises, la perturbation des chaînes d'approvisionnement et des restrictions de transport. Cependant, le déséquilibre entre l'offre et la demande et son impact sur les prix sont considérés comme temporaires et devraient se résorber avec la fin de la pandémie. En raison de l'épidémie mondiale de COVID-19, la demande d'assurance maladie privée a considérablement augmenté. De plus, la crainte de la pandémie et la hausse du coût des services médicaux ont favorisé la croissance du marché de l'assurance maladie pendant la pandémie. De plus, les compagnies d'assurance maladie ont mis en place des formules et des solutions pour couvrir les frais médicaux des assurés infectés par la COVID-19. Ainsi, malgré les lourdes conséquences de la pandémie sur d'autres secteurs, le secteur de l'assurance maladie privée vietnamien a connu une croissance significative.

La dynamique du marché de l’assurance maladie privée comprend :

Moteurs/Opportunités

- Augmentation du coût des services médicaux

L'assurance maladie offre un soutien financier en cas de maladie grave ou d'accident. L'augmentation du coût des interventions chirurgicales et des séjours hospitaliers a engendré une nouvelle épidémie financière mondiale. Le coût des services médicaux comprend, entre autres, le coût de l'intervention, les honoraires du médecin, le coût du séjour hospitalier, le coût des urgences et le coût des examens diagnostiques. Par conséquent, cette augmentation du coût des services médicaux stimule la croissance du marché.

- Nombre croissant de procédures de garderie

Les interventions ambulatoires sont des actes médicaux ou chirurgicaux nécessitant une hospitalisation de courte durée. L'hospitalisation de jour est généralement de courte durée. La plupart des compagnies d'assurance maladie prennent désormais en charge ces interventions dans leurs régimes d'assurance. Pour ces interventions, il n'est pas obligatoire de rester 24 heures à l'hôpital, durée minimale d'hospitalisation. Si la plupart des régimes d'assurance maladie couvrent les hospitalisations et les interventions chirurgicales majeures, les assurés peuvent également les prendre en charge dans leur contrat d'assurance maladie, ce qui stimule la demande.

- Option obligatoire pour l'assurance maladie dans les secteurs public et privé

Souscrire une assurance maladie est obligatoire pour les salariés du secteur public comme du secteur privé. L'assurance maladie offre des prestations médicales essentielles dont les salariés peuvent bénéficier lorsqu'ils travaillent en entreprise. En cas d'urgence ou de problème médical, la couverture maladie est très utile pour couvrir les frais de traitement. L'assurance maladie est une garantie complémentaire offerte par l'employeur à ses salariés . L'assurance maladie proposée couvre non seulement le salarié, mais également les membres de sa famille au titre du même contrat. De plus, dans certains cas, l'employeur peut prendre en charge une partie de la prime ou de la couverture maladie.

- Augmentation de la population âgée

Les personnes âgées sont susceptibles de souffrir davantage de problèmes de santé liés au vieillissement et à la faiblesse de leur système immunitaire, notamment de problèmes dentaires, cardiaques, de cancer et de maladies incurables. Une bonne assurance santé senior peut les aider à choisir des services d'assurance santé de qualité et à réduire leurs soucis financiers futurs. Ainsi, l'augmentation du nombre de personnes âgées peut stimuler la croissance du marché de l'assurance santé.

- Sensibiliser davantage aux avantages de l'assurance maladie

En cas d'urgence médicale, l'assurance maladie permet aux consommateurs de se libérer du stress lié aux frais de santé et de se concentrer sur le traitement. Une urgence médicale peut survenir à tout moment, quel que soit notre état de santé actuel ou notre mode de vie rigoureux. Il est donc important de se préparer et de se protéger, ainsi que sa famille, contre toute situation médicale imprévue, surtout lorsque des parents âgés restent à la maison, car ils sont plus vulnérables aux infections ou autres maladies.

Contraintes/Défis rencontrés par le marché de l'assurance maladie privée

- Coût élevé des primes

L'assurance maladie couvre tous les types de soins médicaux. Elle apporte un soutien financier à l'assuré en prenant en charge tous les frais médicaux liés à son hospitalisation. Elle couvre également les frais pré et post-hospitalisation. Pour souscrire une assurance maladie, l'assuré doit payer régulièrement des primes d'assurance afin de maintenir son contrat actif. Le coût des primes d'assurance est généralement élevé, selon le régime d'assurance choisi, ce qui freine la croissance du marché.

- Manque de sensibilisation à l'assurance maladie

Dans le domaine de la santé, une grande partie de la population mondiale ignore encore les avantages des assurances maladie. Les dépenses de santé augmentent partout dans le monde grâce aux progrès réalisés dans ce domaine. Grâce aux avancées technologiques, le secteur de la santé est en pleine croissance. Cependant, le taux de pénétration des assurances maladie reste faible en raison d'une méconnaissance des avantages qu'elles offrent.

Ce rapport sur le marché vietnamien de l'assurance maladie privée détaille les évolutions récentes, la réglementation commerciale, l'analyse des importations et exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs nationaux et locaux, l'analyse des opportunités de revenus émergents, l'évolution de la réglementation, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination du marché, les approbations de produits, les lancements de produits, les expansions géographiques et les innovations technologiques. Pour plus d'informations sur le marché de l'assurance maladie privée, contactez Data Bridge Market Research pour obtenir un briefing d'analyste. Notre équipe vous aidera à prendre une décision éclairée pour stimuler votre croissance.

Développements récents

- En février 2022, Assicuranzioni Generali SPA a signé un accord pour l'acquisition de La Médicale, compagnie d'assurance destinée aux professionnels de santé. Ce projet prévoit également la cession du portefeuille de couverture décès de Predica, commercialisé et géré par La Médicale.

- En mai 2021, Aetna Inc. a remporté pour la première fois le prix du « Meilleur prestataire de soins de santé international individuel » aux UK Health & Protection Awards. L'entreprise a également été saluée par le jury pour le prix du « Meilleur prestataire d'assurance médicale privée internationale collective ». Pendant huit années consécutives (2013-2020), l'entreprise a été sélectionnée pour le prix du « Meilleur prestataire d'assurance médicale privée internationale collective » aux Health Insurance and Protection Awards. Cette distinction lui a valu une reconnaissance internationale.

Portée du marché de l'assurance maladie privée au Vietnam

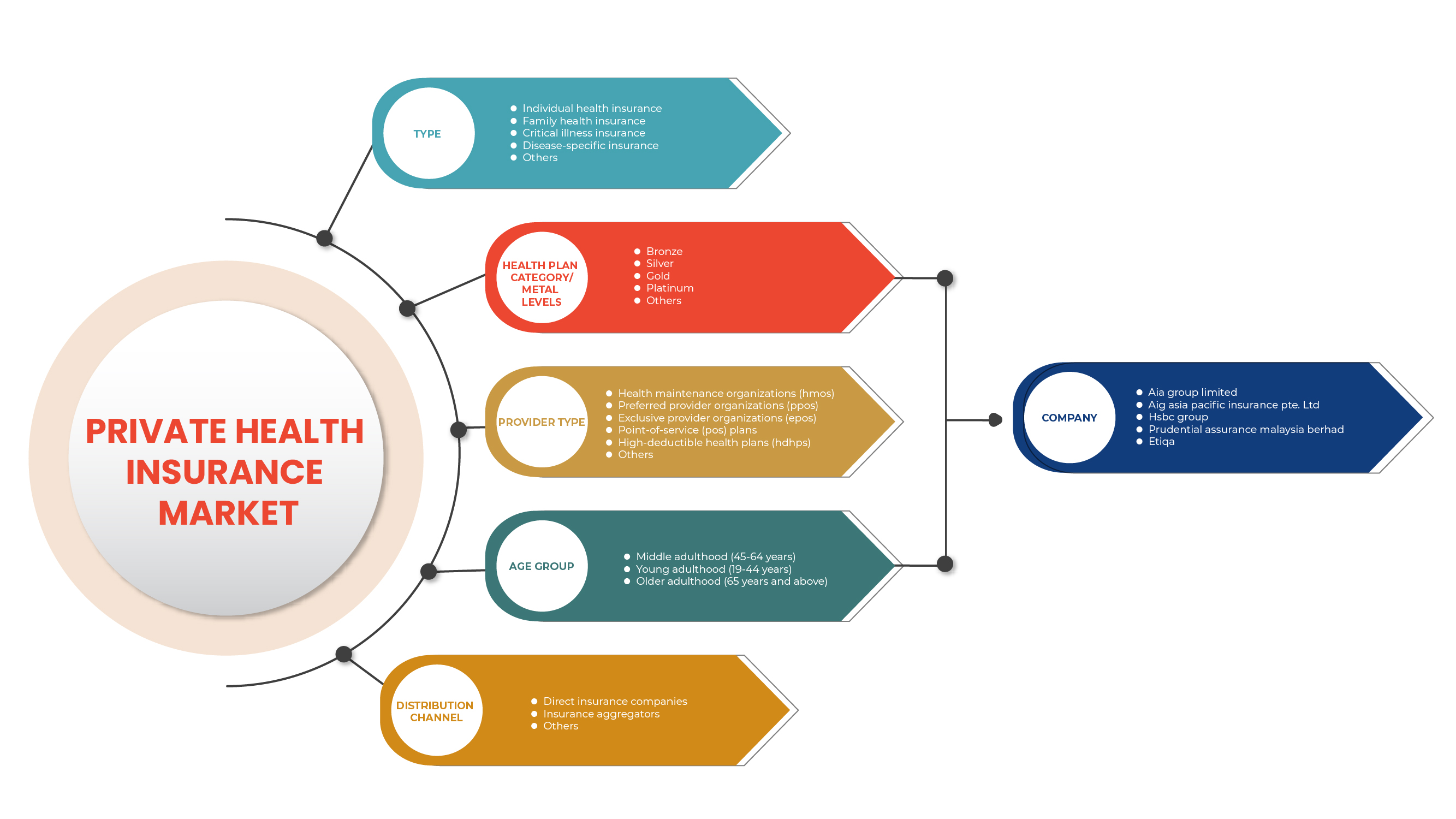

Le marché vietnamien de l'assurance santé privée est segmenté selon le type, la catégorie de régime/niveau de couverture, le type de prestataire, la tranche d'âge et le canal de distribution. La croissance de ces segments vous permettra d'analyser les segments de croissance des secteurs et de fournir aux utilisateurs une vue d'ensemble et des informations précieuses sur le marché, facilitant ainsi la prise de décisions stratégiques pour identifier les applications clés du marché.

Taper

- Assurance maladies graves

- Assurance santé individuelle

- Assurance maladie familiale

- Assurance maladie spécifique

- Autres

Sur la base du type, le marché de l'assurance maladie privée au Vietnam est segmenté en assurance maladies graves, assurance maladie individuelle, assurance maladie familiale, assurance spécifique à une maladie et autres.

Catégorie de régime de santé/Niveaux de métaux

- Bronze

- Argent

- Or

- Platine

- Autres

Sur la base de la catégorie de régime de santé/des niveaux de métal, le marché de l'assurance maladie privée au Vietnam est segmenté en bronze, argent, or, platine et autres.

Type de fournisseur

- Organismes de maintien de la santé (HMOS)

- Organisations de fournisseurs privilégiés (PPOS)

- Organisations de fournisseurs exclusifs (EPOS)

- Plans de point de service (POS)

- Régimes de santé à franchise élevée (HDHPS)

- Autres

Sur la base du type de fournisseur, le marché vietnamien de l'assurance maladie privée est segmenté en organisations de maintien de la santé (HMOS), organisations de fournisseurs privilégiés (PPOS), organisations de fournisseurs exclusifs (EPOS), plans de point de service (POS), plans de santé à franchise élevée (HDHPS) et autres.

Groupe d'âge

- Jeune adulte (19-44 ans)

- Âge adulte moyen (45-64 ans)

- Âge adulte avancé (65 ans et plus)

Sur la base de la tranche d'âge, le marché de l'assurance maladie privée au Vietnam est segmenté en jeunes adultes (19-44 ans), adultes moyens (45-64 ans) et adultes plus âgés (65 ans et plus).

Canal de distribution

- Compagnies d'assurance directe

- Agrégateurs d'assurance

- Autres

Sur la base du canal de distribution, le marché de l'assurance maladie privée au Vietnam est segmenté en compagnies d'assurance directes, agrégateurs d'assurance et autres.

Analyse du paysage concurrentiel et des parts de marché de l'assurance maladie privée

Le paysage concurrentiel du marché vietnamien de l'assurance maladie privée fournit des informations détaillées par concurrent. Il comprend une présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives, sa présence au Vietnam, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la prédominance de ses applications. Les données ci-dessus concernent uniquement les entreprises du marché vietnamien de l'assurance maladie privée.

Certains des principaux acteurs opérant sur le marché de l'assurance maladie privée sont Aetna Inc. (une filiale de CVS Health) (États-Unis), AIA Group Limited (Hong Kong), HSBC Group (Hong Kong), Tokio Marine (Japon), Pacific Cross (Philippines), Great Eastern Holdings Limited (Malaisie), ASSICURAZIONI GENERALI SPA (Italie), Raffles Medical Group (Singapour), Dai-ichi Life Vietnam (Vietnam) entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF VIETNAM PRIVATE HEALTH INSURANCE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE VIETNAM PRIVATE HEALTH INSURANCE MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 SALES VALUE AND VOLUME

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 VIETNAM PRIVATE HEALTH INSURANCE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6. INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7. INTELLECTUAL PROPERTY (IP) PORTFOLIO

7.1 PATENT QUALITY AND STRENGTH

7.2 PATENT FAMILIES

7.3 LICENSING AND COLLABORATIONS

7.4 COMPETITIVE LANDSCAPE

7.5 IP STRATEGY AND MANAGEMENT

7.6 OTHER

8. TECHNONLOGY ROADMAP

9. INSURANCE PLAN LANDSCAPE

9.1 INTERNATIONAL HEALTH PLAN

9.2 TRAVEL INSURANCE

9.3 HEALTH INSURANCE

10. INNOVATION TRACKER AND STRATEGIC ANALYSIS

10.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

10.1.1 JOINT VENTURES

10.1.2 MERGERS AND ACQUISITIONS

10.1.3 LICENSING AND PARTNERSHIP

10.1.4 TECHNOLOGY COLLABORATIONS

10.1.5 STRATEGIC DIVESTMENTS

10.2 NUMBER OF PRODUCTS IN DEVELOPMENT

10.3 STAGE OF DEVELOPMENT

10.4 TIMELINES AND MILESTONES

10.5 INNOVATION STRATEGIES AND METHODOLOGIES

10.6 RISK ASSESSMENT AND MITIGATION

10.7 FUTURE OUTLOOK

11. REGULATORY COMPLIANCE

11.1 REGULATORY AUTHORITIES

11.2 REGULATORY CLASSIFICATIONS

11.3 REGULATORY SUBMISSIONS

11.4 INTERNATIONAL HARMONIZATION

11.5 COMPLIANCE AND QUALITY MANAGEMENT SYSTEMS

11.6 REGULATORY CHALLENGES AND STRATEGIES

12. OPPUTUNITY MAP ANALYSIS

13. VALUE CHAIN ANALYSIS

14. HEALTHCARE ECONOMY

14.1 HEALTHCARE EXPENDITURE

14.2 CAPITAL EXPENDITURE

14.3 CAPEX TRENDS

14.4 CAPEX ALLOCATION

14.5 FUNDING SOURCES

14.6 INDUSTRY BENCHMARKS

14.7 GDP RATION IN OVERALL GDP

14.8 HEALTHCARE SYSTEM STRUCTURE

14.9 GOVERNMENT POLICIES

14.10 ECONOMIC DEVELOPMENT

15. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY TYPE

15.1 OVERVIEW

15.2 SOLUTION

15.2.1 INTELLIGENT CASE MANAGEMENT SOLUTIONS

15.2.2 ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

15.2.3 VALUE-BASED PAYMENTS SOLUTIONS

15.2.4 CLAIMS ADMINISTRATION CLOUD SOLUTIONS

15.2.5 INSURANCE CLOUD SOLUTIONS

15.2.6 ROBOTIC PROCESS AUTOMATION

15.2.7 REVENUE MANAGEMENT & BILLING SOLUTIONS

15.2.8 LEAD GENERATION SOLUTIONS

15.2.9 OTHERS

15.3 PRODUCT

15.3.1 PERMANENT HEALTH INSURANCE

15.3.2 UNIT LINKED HEALTH PLANS

15.3.3 CRITICAL ILLNESS INSURANCE

15.3.4 SENIOR CITIZEN COVERAGE INSURANCE

15.3.5 HOSPITALIZATION COVERAGE INSURANCE

15.3.6 FAMILY FLOATER COVERAGE INSURANCE

15.3.7 INDIVIDUAL COVERAGE INSURANCE

15.3.8 MEDICLAIM INSURANCE

15.3.9 OTHERS

16. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS

16.1 OVERVIEW

16.2 BRONZE

16.3 SILVER

16.4 GOLD

16.5 PLATINUM

16.6 OTHERS

17. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE

17.1 OVERVIEW

17.2 HEALTH MAINTENANCE ORGANIZATIONS (HMOS)

17.3 PREFERRED PROVIDER ORGANIZATIONS (PPOS)

17.4 EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

17.5 POINT-OF-SERVICE (POS) PLANS

17.6 HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS)

17.7 OTHERS

18. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY ASSISTANCE/SERVICE TYPE

18.1 OVERVIEW

18.2 MEDICAL ASSURANCE

18.3 OUTPATIENT TREATMENT

18.4 INPATIENT TREATMENT

18.5 OTHERS

19. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP

19.1 OVERVIEW

19.2 YOUNG ADULTHOOD (19-44 YEARS)

19.3 MIDDLE ADULTHOOD (45-64 YEARS)

19.4 OLDER ADULTHOOD (65 YEARS AND ABOVE)

20. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY COVERAGE TYPE

20.1 OVERVIEW

20.2 LIFETIME COVERAGE

20.2.1 YOUNG ADULTHOOD (19-44 YEARS)

20.2.2 MIDDLE ADULTHOOD (45-64 YEARS)

20.2.3 OLDER ADULTHOOD (65 YEARS AND ABOVE)

20.3 TERM COVERAGE

20.3.1 YOUNG ADULTHOOD (19-44 YEARS)

20.3.2 MIDDLE ADULTHOOD (45-64 YEARS)

20.3.3 OLDER ADULTHOOD (65 YEARS AND ABOVE)

21. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY PRICING CATEGORY

21.1 OVERVIEW

21.2 LOW

21.3 HIGH

21.4 MODERATE

22. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY END USER

22.1 OVERVIEW

22.2 FAMILY

22.2.1 SOLUTION

22.2.1.1. INTELLIGENT CASE MANAGEMENT SOLUTIONS

22.2.1.2. ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

22.2.1.3. VALUE-BASED PAYMENTS SOLUTIONS

22.2.1.4. CLAIMS ADMINISTRATION CLOUD SOLUTIONS

22.2.1.5. INSURANCE CLOUD SOLUTIONS

22.2.1.6. ROBOTIC PROCESS AUTOMATION

22.2.1.7. REVENUE MANAGEMENT & BILLING SOLUTIONS

22.2.1.8. LEAD GENERATION SOLUTIONS

22.2.1.9. OTHERS

22.2.2 PRODUCT

22.2.2.1. PERMANENT HEALTH INSURANCE

22.2.2.2. UNIT LINKED HEALTH PLANS

22.2.2.3. CRITICAL ILLNESS INSURANCE

22.2.2.4. SENIOR CITIZEN COVERAGE INSURANCE

22.2.2.5. HOSPITALIZATION COVERAGE INSURANCE

22.2.2.6. FAMILY FLOATER COVERAGE INSURANCE

22.2.2.7. INDIVIDUAL COVERAGE INSURANCE

22.2.2.8. MEDICLAIM INSURANCE

22.2.2.9. OTHERS

22.3 CORPORATE

22.3.1 SOLUTION

22.3.1.1. INTELLIGENT CASE MANAGEMENT SOLUTIONS

22.3.1.2. ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

22.3.1.3. VALUE-BASED PAYMENTS SOLUTIONS

22.3.1.4. CLAIMS ADMINISTRATION CLOUD SOLUTIONS

22.3.1.5. INSURANCE CLOUD SOLUTIONS

22.3.1.6. ROBOTIC PROCESS AUTOMATION

22.3.1.7. REVENUE MANAGEMENT & BILLING SOLUTIONS

22.3.1.8. LEAD GENERATION SOLUTIONS

22.3.1.9. OTHERS

22.3.2 PRODUCT

22.3.2.1. PERMANENT HEALTH INSURANCE

22.3.2.2. UNIT LINKED HEALTH PLANS

22.3.2.3. CRITICAL ILLNESS INSURANCE

22.3.2.4. SENIOR CITIZEN COVERAGE INSURANCE

22.3.2.5. HOSPITALIZATION COVERAGE INSURANCE

22.3.2.6. FAMILY FLOATER COVERAGE INSURANCE

22.3.2.7. INDIVIDUAL COVERAGE INSURANCE

22.3.2.8. MEDICLAIM INSURANCE

22.3.2.9. OTHERS

22.4 INDIVIDUAL

22.4.1 SOLUTION

22.4.1.1. INTELLIGENT CASE MANAGEMENT SOLUTIONS

22.4.1.2. ARTIFICIAL INTELLIGENCE & BLOCKCHAIN SOLUTIONS

22.4.1.3. VALUE-BASED PAYMENTS SOLUTIONS

22.4.1.4. CLAIMS ADMINISTRATION CLOUD SOLUTIONS

22.4.1.5. INSURANCE CLOUD SOLUTIONS

22.4.1.6. ROBOTIC PROCESS AUTOMATION

22.4.1.7. REVENUE MANAGEMENT & BILLING SOLUTIONS

22.4.1.8. LEAD GENERATION SOLUTIONS

22.4.1.9. OTHERS

22.4.2 PRODUCT

22.4.2.1. PERMANENT HEALTH INSURANCE

22.4.2.2. UNIT LINKED HEALTH PLANS

22.4.2.3. CRITICAL ILLNESS INSURANCE

22.4.2.4. SENIOR CITIZEN COVERAGE INSURANCE

22.4.2.5. HOSPITALIZATION COVERAGE INSURANCE

22.4.2.6. FAMILY FLOATER COVERAGE INSURANCE

22.4.2.7. INDIVIDUAL COVERAGE INSURANCE

22.4.2.8. MEDICLAIM INSURANCE

22.4.2.9. OTHERS

22.5 OTHERS

23. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

23.1 OVERVIEW

23.2 DIRECT INSURANCE COMPANIES

23.3 INSURANCE AGGREGATORS

23.4 OTHERS

24. VIETNAM PRIVATE HEALTH INSURANCE MARKET, BY GEOGRAPHY

24.1 VIETNAM PRIVATE HEALTH INSURANCE MARKET (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 VIETNAM

24.1.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25. VIETNAM PRIVATE HEALTH INSURANCE MARKET, COMPANY LANDSCAPE

25.1 COMPANY SHARE ANALYSIS: VIETNAM

25.2 ANALYSIS OF KEY PLAYERS BY COUNTRY

25.3 MERGERS & ACQUISITIONS

25.4 NEW PRODUCT DEVELOPMENT & APPROVALS

25.5 EXPANSIONS

25.6 REGULATORY CHANGES

25.7 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

26. VIETNAM PRIVATE HEALTH INSURANCE MARKET, SWOT AND DBMR ANALYSIS

27. VIETNAM PRIVATE HEALTH INSURANCE MARKET, COMPANY PROFILE

27.1 GLOBAL COMPANIES

27.1.1 ALLIANZ CARE

27.1.1.1. COMPANY SNAPSHOT

27.1.1.2. REVENUE ANALYSIS

27.1.1.3. GEOGRAPHIC PRESENCE

27.1.1.4. PRODUCT PORTFOLIO

27.1.1.5. RECENT DEVELOPMENT

27.1.2 AETNA INC.

27.1.2.1. COMPANY SNAPSHOT

27.1.2.2. REVENUE ANALYSIS

27.1.2.3. GEOGRAPHIC PRESENCE

27.1.2.4. PRODUCT PORTFOLIO

27.1.2.5. RECENT DEVELOPMENT

27.1.3 AIA GROUP LIMITED AND ITS SUBSIDIARIES

27.1.3.1. COMPANY OVERVIEW

27.1.3.2. REVENUE ANALYSIS

27.1.3.3. GEOGRAPHIC PRESENCE

27.1.3.4. PRODUCT PORTFOLIO

27.1.3.5. RECENT DEVELOPMENTS

27.1.4 LIBERTY INSURANCE LIMITED

27.1.4.1. COMPANY OVERVIEW

27.1.4.2. COMPANY SNAPSHOT

27.1.4.3. REVENUE ANALYSIS

27.1.4.4. PRODUCT PORTFOLIO

27.1.4.5. RECENT DEVELOPMENTS

27.1.5 AMERICAN INTERNATIONAL GROUP, INC.

27.1.5.1. COMPANY OVERVIEW

27.1.5.2. REVENUE ANALYSIS

27.1.5.3. GEOGRAPHIC PRESENCE

27.1.5.4. PRODUCT PORTFOLIO

27.1.5.5. RECENT DEVELOPMENTS

27.1.6 THE MANUFACTURERS LIFE INSURANCE COMPANY

27.1.6.1. COMPANY OVERVIEW

27.1.6.2. REVENUE ANALYSIS

27.1.6.3. GEOGRAPHIC PRESENCE

27.1.6.4. PRODUCT PORTFOLIO

27.1.6.5. RECENT DEVELOPMENTS

27.1.7 AXA

27.1.7.1. COMPANY OVERVIEW

27.1.7.2. REVENUE ANALYSIS

27.1.7.3. GEOGRAPHIC PRESENCE

27.1.7.4. PRODUCT PORTFOLIO

27.1.7.5. RECENT DEVELOPMENTS

27.1.8 GREAT EASTERN HOLDINGS LIMITED

27.1.8.1. COMPANY OVERVIEW

27.1.8.2. REVENUE ANALYSIS

27.1.8.3. GEOGRAPHIC PRESENCE

27.1.8.4. PRODUCT PORTFOLIO

27.1.8.5. RECENT DEVELOPMENTS

27.1.9 LUMAHEALTH.COM

27.1.9.1. COMPANY OVERVIEW

27.1.9.2. REVENUE ANALYSIS

27.1.9.3. GEOGRAPHIC PRESENCE

27.1.9.4. PRODUCT PORTFOLIO

27.1.9.5. RECENT DEVELOPMENTS

27.1.10 PACIFIC PRIME INSURANCE BROKERS LIMITED (PPIB)

27.1.10.1. COMPANY OVERVIEW

27.1.10.2. REVENUE ANALYSIS

27.1.10.3. GEOGRAPHIC PRESENCE

27.1.10.4. PRODUCT PORTFOLIO

27.1.10.5. RECENT DEVELOPMENTS

27.1.11 MSIG INSURANCE VIETNAM CO., LTD.

27.1.11.1. COMPANY SNAPSHOT

27.1.11.2. REVENUE ANALYSIS

27.1.11.3. GEOGRAPHIC PRESENCE

27.1.11.4. PRODUCT PORTFOLIO

27.1.11.5. RECENT DEVELOPMENT

27.1.12 NOW HEALTH INTERNATIONAL

27.1.12.1. COMPANY SNAPSHOT

27.1.12.2. REVENUE ANALYSIS

27.1.12.3. GEOGRAPHIC PRESENCE

27.1.12.4. PRODUCT PORTFOLIO

27.1.12.5. RECENT DEVELOPMENT

27.1.13 CHUBB

27.1.13.1. COMPANY OVERVIEW

27.1.13.2. REVENUE ANALYSIS

27.1.13.3. GEOGRAPHIC PRESENCE

27.1.13.4. PRODUCT PORTFOLIO

27.1.13.5. RECENT DEVELOPMENTS

27.1.14 CIGNA

27.1.14.1. COMPANY OVERVIEW

27.1.14.2. REVENUE ANALYSIS

27.1.14.3. GEOGRAPHIC PRESENCE

27.1.14.4. PRODUCT PORTFOLIO

27.1.14.5. RECENT DEVELOPMENTS

27.1.15 FOYER LUXEMBOURG

27.1.15.1. COMPANY OVERVIEW

27.1.15.2. REVENUE ANALYSIS

27.1.15.3. GEOGRAPHIC PRESENCE

27.1.15.4. PRODUCT PORTFOLIO

27.1.15.5. RECENT DEVELOPMENTS

27.1.16 MSH INTERNATIONAL

27.1.16.1. COMPANY OVERVIEW

27.1.16.2. REVENUE ANALYSIS

27.1.16.3. GEOGRAPHIC PRESENCE

27.1.16.4. PRODUCT PORTFOLIO

27.1.16.5. RECENT DEVELOPMENTS

27.1.17 SUN LIFE VIETNAM INSURANCE COMPANY LIMITED

27.1.17.1. COMPANY OVERVIEW

27.1.17.2. REVENUE ANALYSIS

27.1.17.3. GEOGRAPHIC PRESENCE

27.1.17.4. PRODUCT PORTFOLIO

27.1.17.5. RECENT DEVELOPMENTS

27.1.18 APRIL INTERNATIONAL

27.1.18.1. COMPANY OVERVIEW

27.1.18.2. REVENUE ANALYSIS

27.1.18.3. GEOGRAPHIC PRESENCE

27.1.18.4. PRODUCT PORTFOLIO

27.1.18.5. RECENT DEVELOPMENTS

27.1.19 ASSICURAZIONI GENERALI S.P.A

27.1.19.1. COMPANY OVERVIEW

27.1.19.2. REVENUE ANALYSIS

27.1.19.3. GEOGRAPHIC PRESENCE

27.1.19.4. PRODUCT PORTFOLIO

27.1.19.5. RECENT DEVELOPMENTS

27.2 LOCAL COMPANIES

27.2.1 BAOVIET BANK

27.2.1.1. COMPANY OVERVIEW

27.2.1.2. COMPANY SNAPSHOT

27.2.1.3. REVENUE ANALYSIS

27.2.1.4. PRODUCT PORTFOLIO

27.2.1.5. RECENT DEVELOPMENTS

27.2.2 PACIFIC CROSS VIETNAM

27.2.2.1. COMPANY OVERVIEW

27.2.2.2. COMPANY SNAPSHOT

27.2.2.3. REVENUE ANALYSIS

27.2.2.4. PRODUCT PORTFOLIO

27.2.2.5. RECENT DEVELOPMENTS

27.2.3 DAI-ICHI LIFE VIETNAM FUND MANAGEMENT COMPANY

27.2.3.1. COMPANY OVERVIEW

27.2.3.2. COMPANY SNAPSHOT

27.2.3.3. REVENUE ANALYSIS

27.2.3.4. PRODUCT PORTFOLIO

27.2.3.5. RECENT DEVELOPMENTS

27.2.4 TOKIO MARINE INSURANCE VIETNAM COMPANY LIMITED.

27.2.4.1. COMPANY OVERVIEW

27.2.4.2. COMPANY SNAPSHOT

27.2.4.3. REVENUE ANALYSIS

27.2.4.4. PRODUCT PORTFOLIO

27.2.4.5. RECENT DEVELOPMENTS

27.2.5 PTI LIMITED AND ITS SUBSIDIARIES

27.2.5.1. COMPANY OVERVIEW

27.2.5.2. COMPANY SNAPSHOT

27.2.5.3. REVENUE ANALYSIS

27.2.5.4. PRODUCT PORTFOLIO

27.2.5.5. RECENT DEVELOPMENTS

27.2.6 FWD VIETNAM

27.2.6.1. COMPANY OVERVIEW

27.2.6.2. COMPANY SNAPSHOT

27.2.6.3. REVENUE ANALYSIS

27.2.6.4. PRODUCT PORTFOLIO

27.2.6.5. RECENT DEVELOPMENTS

28. CONCLUSION

29. QUESTIONNAIRE

30. ABOUT DATA BRIDGE MARKET RESEARCH

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.