Marché de la gestion des crypto-actifs aux États-Unis et en Europe, par solution (gestion de portefeuille, solutions de garde), mode de déploiement (cloud, sur site), type d'application (mobile, Web), système d'exploitation (Android, IOS et autres), utilisateur final (individuel, entreprise), vertical (BFSI, soins de santé, gouvernement, vente au détail et commerce électronique, voyages et hôtellerie, médias et divertissement, et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché de la gestion des crypto-actifs aux États-Unis et en Europe

Les cryptomonnaies et autres actifs sont désormais plus faciles à acquérir et à vendre que par le passé. Pour acheter ou vendre des actifs cryptographiques, vous devez ouvrir un compte auprès de la bourse de votre choix et sélectionner un portefeuille qu'elle prend en charge.

En raison de la facilité avec laquelle les crypto-actifs peuvent être obtenus, il est essentiel de disposer d'une méthode de gestion de ces actifs, similaire à celle dont vous géreriez les investissements traditionnels dans un portefeuille. De nombreuses personnes et entreprises ont pris conscience de ce besoin et ont développé des outils et des applications qui sont désormais la norme sur les marchés financiers plus traditionnels : les applications et services de gestion d'actifs.

Au lieu de gérer plusieurs comptes et portefeuilles provenant de différentes bourses tout en jonglant avec les actifs traditionnels, les systèmes de gestion d'actifs cryptographiques simplifient le processus en aidant les utilisateurs à consolider leurs divers avoirs tout en offrant des capacités de gestion de portefeuille supérieures.

Data Bridge Market Research analyse que le marché de la gestion d'actifs cryptographiques aux États-Unis et en Europe connaîtra un TCAC de 30,7 % entre 2023 et 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2016) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par solution (gestion de portefeuille, solutions de garde), mode de déploiement (cloud, sur site), type d'application (mobile, Web), système d'exploitation (Android, IOS et autres), utilisateur final (particulier, entreprise), secteur vertical (BFSI, santé, gouvernement, vente au détail et commerce électronique, voyages et hôtellerie, médias et divertissement, et autres) |

|

Régions couvertes |

États-Unis, Royaume-Uni, Allemagne, France, Espagne, Italie, Pays-Bas, Suisse, Russie, Belgique, Turquie et le reste de l'Europe |

|

Acteurs du marché couverts |

Coinbase Global, Inc., Gemini Trust Company, LLC., Crypto Finance Group, Genesis Global Trading, Inc., Bakkt Holdings, Inc., BitGo Inc., Ledger SAS., Xapo Holdings Limited, Paxos Trust Company, LLC, Blockdaemon, Binance (Services Holdings) Limited, CoinStats Inc, Fireblocks, Bankex, copper.co et CYBAVO Pte. Ltd, entre autres. |

Définition du marché

La gestion des actifs cryptographiques est l'activité d'achat et de vente d'actifs numériques destinés à être utilisés comme investissements tout en gérant un portefeuille pour obtenir une croissance globale de la valeur. Une solution logicielle et système connue sous le nom de DAM peut stocker, organiser, gérer, récupérer et diffuser efficacement les actifs numériques d'une organisation. Grâce aux fonctionnalités DAM, de nombreuses entreprises peuvent créer une zone centralisée où elles peuvent accéder à leurs actifs numériques. La gestion des actifs cryptographiques est la version crypto-monnaie de la gestion des actifs numériques. Les investisseurs peuvent accéder à la chaîne de blocs ou aux actifs cryptographiques via une variété de canaux avec l'aide de la gestion des actifs cryptographiques, qui est souvent proposée sous forme de solution de services complète ou partielle. Ces services peuvent être fournis directement par des organisations de gestion d'actifs cryptographiques ou par l'intermédiaire d'un fournisseur de services tiers. Ces organisations sont chargées de sélectionner les meilleurs actifs cryptographiques pour les portefeuilles de leurs clients, de surveiller et d'analyser les performances de ces actifs, d'aider les investisseurs débutants sur le marché des crypto-monnaies et de fournir un soutien complet selon les besoins.

Dynamique du marché de la gestion des crypto-actifs aux États-Unis et en Europe

Conducteur

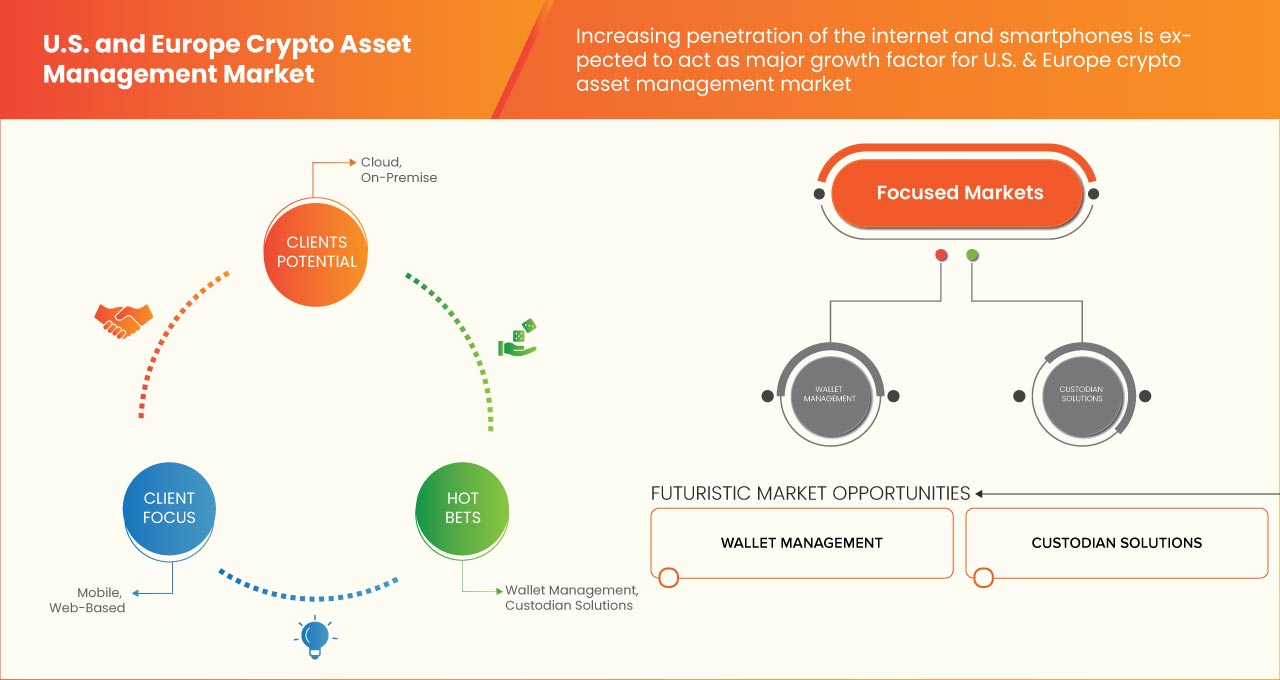

- Adoption croissante des crypto-monnaies sur le marché financier

Les cryptomonnaies et le secteur de la blockchain ont gagné en popularité ces dernières années. Les investisseurs sont de plus en plus en mesure d'obtenir des services de garde de qualité institutionnelle à mesure que l'infrastructure financière la plus nécessaire est en cours de construction. Les investisseurs professionnels et individuels ont progressivement accès aux outils et aux machines dont ils ont besoin pour gérer et protéger leurs avoirs en cryptomonnaies.

Opportunité

- Augmentation de diverses décisions stratégiques telles que les partenariats et les acquisitions

Les partenariats stratégiques et les acquisitions aident les entreprises à travailler pour atteindre l'objectif souhaité. Alors que le marché change et évolue, les clients recherchent constamment des produits nouveaux et avancés qui peuvent les aider efficacement sur le marché de la gestion des actifs cryptographiques aux États-Unis et en Europe. En outre, ils recherchent des plateformes qui peuvent les aider à recevoir différents services concernant le marché.

Retenue/Défi

- Frais de transaction élevés

Les frais de transaction élevés des crypto-monnaies ont un impact considérable sur la croissance du marché. Les transactions Bitcoin ont commencé à fluctuer de manière significative à mesure que de plus en plus de personnes s'intéressaient aux crypto-monnaies. Les frais de transaction font référence à l'argent payé aux mineurs de Bitcoin pour que les transactions soient approuvées, et les coûts peuvent augmenter à mesure que le nombre d'utilisateurs augmente. Étant donné que la blockchain dispose d'une quantité limitée d'espace pour traiter toutes les transactions, elle devient encombrée. L'augmentation des frais de transaction représente à la fois le nombre de transactions Bitcoin dans une file d'attente à traiter et une incitation pour les mineurs à gérer les transactions particulièrement importantes, qui sont plus rentables pour eux.

Développement récent

- En janvier 2023, Copper.co a annoncé son partenariat stratégique avec Bybit, la troisième bourse de crypto-monnaies la plus visitée au monde. La société renforce ses solutions institutionnelles de conservation et de négociation d'actifs numériques auprès des clients institutionnels de Bybit via le service ClearLoop, leader du marché, de Copper. Cela a aidé l'entreprise à accroître sa présence sur le marché.

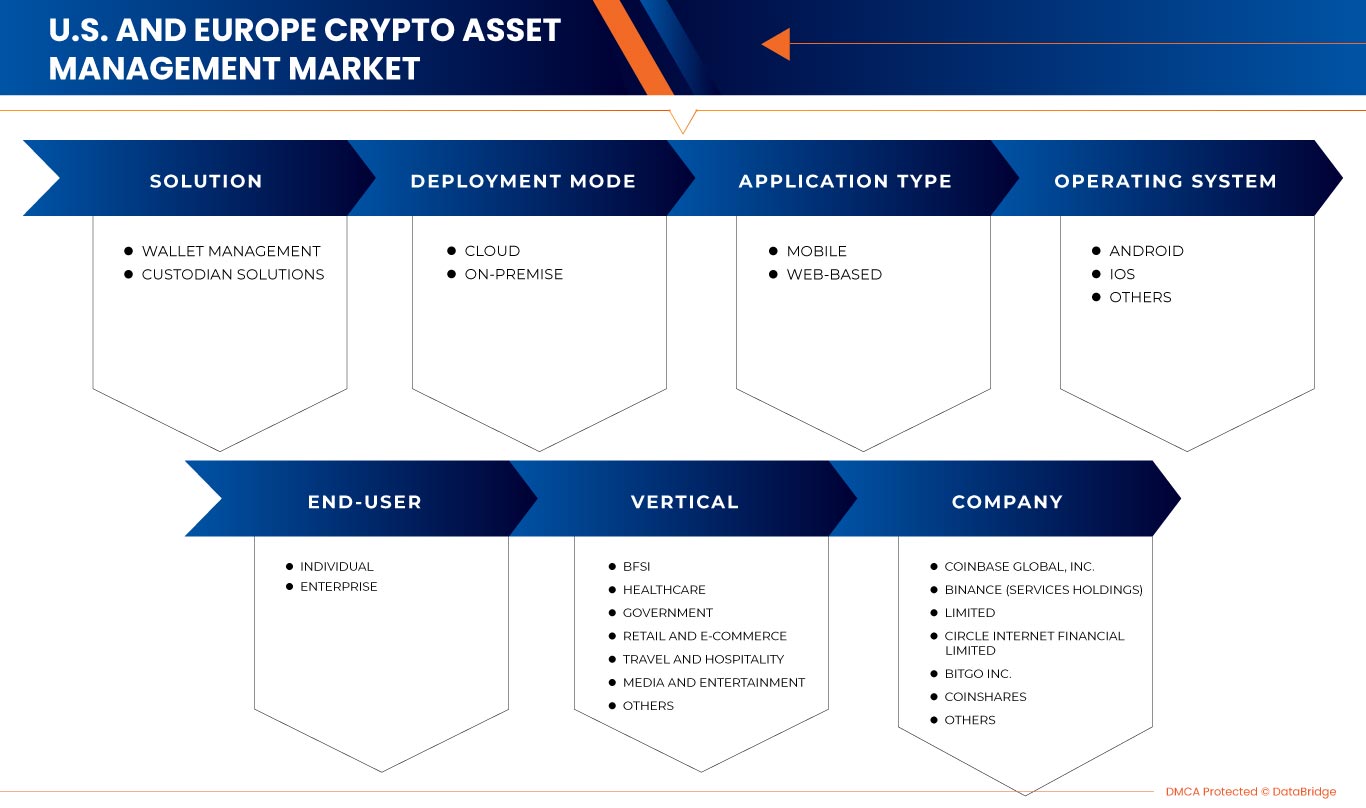

Portée du marché de la gestion des crypto-actifs aux États-Unis et en Europe

Le marché de la gestion des crypto-actifs aux États-Unis et en Europe est segmenté en fonction de la solution, du déploiement, du type d'application, du système d'exploitation et de l'utilisateur final, selon le secteur vertical. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Solution

- Gestion du portefeuille

- Solutions de garde

Sur la base de la solution, le marché américain et européen de la gestion des crypto-actifs est segmenté en solutions de gestion de portefeuille et de garde.

Mode de déploiement

- Nuage

- Sur site

Sur la base du mode de déploiement, le marché de la gestion des crypto-actifs aux États-Unis et en Europe est segmenté en cloud et sur site.

Type d'application

- Mobile

- Basé sur le Web

Sur la base du type d'application, le marché de la gestion des crypto-actifs aux États-Unis et en Europe est segmenté en mobile et en Web.

Système opérateur

- Androïde

- IOS

- Autres

Sur la base du système d'exploitation, le marché de la gestion des actifs cryptographiques aux États-Unis et en Europe est segmenté en Android, iOS et autres.

Utilisateur final

- Individuel

- Entreprise

Sur la base de l'utilisateur final, le marché de la gestion des crypto-actifs aux États-Unis et en Europe est segmenté en individuel et en entreprise.

Verticale

- BFSI

- Soins de santé

- Gouvernement

- Commerce de détail et e-commerce

- Voyages et hospitalité

- Médias et divertissement

- Autres

Sur la base de la verticale, le marché de la gestion des crypto-actifs aux États-Unis et en Europe est segmenté en BFSI, soins de santé, gouvernement, vente au détail et commerce électronique, voyages et hôtellerie, médias et divertissement, et autres.

Analyse/perspectives régionales du marché de la gestion des crypto-actifs aux États-Unis et en Europe

Le marché de la gestion des actifs cryptographiques est analysé et des informations sur la taille et les tendances du marché sont fournies par la solution, le déploiement, le type d'application, le système d'exploitation et l'utilisateur final, le secteur vertical et les pays comme référencé ci-dessus.

Le marché américain et européen comprend les États-Unis, le Royaume-Uni, l'Allemagne, la France, l'Espagne, l'Italie, les Pays-Bas, la Suisse, la Russie, la Belgique, la Turquie et le reste de l'Europe.

L'Allemagne devrait dominer le marché de la gestion des actifs cryptographiques aux États-Unis et en Europe, car l'Allemagne est leader régional dans l'adoption d'applications de gestion d'actifs.

La section pays du rapport sur le marché de la gestion des crypto-actifs fournit également des facteurs d'impact individuels sur le marché et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des indicateurs importants utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la gestion des crypto-actifs aux États-Unis et en Europe

Le paysage concurrentiel du marché de la gestion des actifs cryptographiques aux États-Unis et en Europe détaille les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'accent mis par les entreprises sur le marché de la gestion des actifs cryptographiques aux États-Unis et en Europe.

Certains des fabricants opérant sur le marché sont Coinbase Global, Inc., Gemini Trust Company, LLC., Crypto Finance Group, Genesis Global Trading, Inc., Bakkt Holdings, Inc., BitGo Inc., Ledger SAS., Xapo Holdings Limited, Paxos Trust Company, LLC, Blockdaemon, Binance (Services Holdings) Limited, CoinStats Inc, Fireblocks, Bankex, copper.co et CYBAVO Pte. Ltd entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE TIMELINE CURVE

2.7 MARKET APPLICATION COVERAGE GRID

2.8 MULTIVARIATE MODELING

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 VENDOR SHARE ANALYSIS

2.12 HE MARKET CHALLENGE MATRIX

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING POPULARITY OF U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET TOOLS

5.1.2 INCREASING ADOPTION OF CRYPTOCURRENCY IN THE FINANCIAL MARKET

5.1.3 INCREASING DEMAND FOR CRYPTOCURRENCY-SPECIFIC SOFTWARE

5.1.4 INCREASING PENETRATION OF THE INTERNET AND SMARTPHONES

5.2 RESTRAINTS

5.2.1 HIGH TRANSACTION FEES

5.2.2 HIGH IT INFRASTRUCTURE COST FOR CRYPTO ASSET MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 INCREASE IN VARIOUS STRATEGIC DECISIONS SUCH AS PARTNERSHIP AND ACQUISITION

5.3.2 DEVELOPMENTS IN THE HARDWARE AND SOFTWARE

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL IMPACT OF CRYPTOCURRENCY

5.4.2 MISUSE OF VIRTUAL CURRENCY AND SECURITY ATTACK

6 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION

6.1 OVERVIEW

6.2 WALLET MANAGEMENT

6.3 CUSTODIAN SOLUTIONS

7 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE

7.1 OVERVIEW

7.2 CLOUD

7.3 ON-PREMISE

8 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE

8.1 OVERVIEW

8.2 MOBILE

8.3 WEB-BASED

9 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM

9.1 OVERVIEW

9.2 ANDROID

9.3 IOS

9.4 OTHERS

10 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY END USER

10.1 OVERVIEW

10.2 INDIVIDUAL

10.3 ENTERPRISE

11 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BFSI

11.3 HEALTHCARE

11.4 GOVERNMENT

11.5 RETAIL AND E-COMMERCE

11.6 TRAVEL AND HOSPITALITY

11.7 MEDIA AND ENTERTAINMENT

11.8 OTHERS

12 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY COUNTRY

12.1 GERMANY

12.2 U.K.

12.3 FRANCE

12.4 ITALY

12.5 SPAIN

12.6 TURKEY

12.7 RUSSIA

12.8 NETHERLANDS

12.9 BELGIUM

12.1 SWITZERLAND

12.11 REST OF EUROPE

13 U.S. AND EUROPE CRYPTO ASSET MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: U.S.

13.2 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 COINBASE GLOBAL, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENTS

15.2 BINANCE (SERVICES HOLDINGS) LIMITED

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENT

15.3 BITGO INC.

15.3.1 COMPANY SNAPSHOT

15.3.2 PRODUCT PORTFOLIO

15.3.3 RECENT DEVELOPMENT

15.4 CIRCLE INTERNET FINANCIAL LIMITED

15.4.1 COMPANY SNAPSHOT

15.4.2 SOLUTION PORTFOLIO

15.4.3 RECENT DEVELOPMENTS

15.5 COINSHARES

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 BLOCKDAEMON

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 BOSONIC, INC.

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 BAKKT HOLDINGS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 SOLUTION PORTFOLIO

15.8.4 RECENT DEVELOPMENT

15.9 BITCOIN SUISSE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 BLOCKCHAIN.COM, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 BANKEX

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENT

15.12 COINSTATS INC

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 COPPER.CO

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 CYBAVO PTE. LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 SERVICE PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 CRYPTO FINANCE GROUP

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 EXODUS MOVEMENT, INC.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT DEVELOPMENTS

15.17 FIREBLOCKS

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 GEMINI TRUST COMPANY, LLC

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 GENESIS GLOBAL TRADING, INC.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 ICONOMI

15.20.1 COMPANY SNAPSHOT

15.20.2 PLATFORM PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 LEDGER SAS.

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 METACO SA.

15.22.1 COMPANY SNAPSHOT

15.22.2 PLATFORM PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

15.23 NYDIG.

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENT

15.24 PAXOS TRUST COMPANY, LLC

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENT

15.25 SYGNUM

15.25.1 COMPANY SNAPSHOT

15.25.2 PRODUCT PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

15.26 XAPO BANK LIMITED

15.26.1 COMPANY SNAPSHOT

15.26.2 PRODUCT PORTFOLIO

15.26.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 2 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 3 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 4 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 5 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 6 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 7 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 8 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 9 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 10 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 11 U.S. CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 12 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 13 EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 14 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 15 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 16 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 17 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 18 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 19 GERMANY CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 20 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 21 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 22 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 23 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 24 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 25 U.K. CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 26 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 27 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 28 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 29 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 30 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 31 FRANCE CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 32 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 33 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 34 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 35 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 36 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 37 ITALY CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 38 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 39 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 40 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 41 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 42 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 SPAIN CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 44 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 45 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 46 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 47 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 49 TURKEY CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 50 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 51 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 52 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 53 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 54 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 55 RUSSIA CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 56 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 57 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 58 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 59 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 60 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 61 NETHERLANDS CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 62 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 63 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 64 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 65 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 66 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 67 BELGIUM CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 68 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

TABLE 69 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2021-2030 (USD MILLION)

TABLE 70 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE, 2021-2030 (USD MILLION)

TABLE 71 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 72 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 73 SWITZERLAND CRYPTO ASSET MANAGEMENT MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 74 REST OF EUROPE CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: SOLUTION TIMELINE CURVE

FIGURE 7 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: APPLICATION COVERAGE GRID

FIGURE 8 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: MULTIVARIATE MODELLING

FIGURE 9 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 10 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 11 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR CRYPTOCURRENCY SPECIFIC SOFTWARE IS DRIVING THE U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 WEALTH MANAGEMENT ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE U.S. & EUROPE CRYPTO ASSET MANAGEMENT MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE U.S. & EUROPE CRYPTO ASSET MANAGEMENT

FIGURE 16 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY SOLUTION, 2022

FIGURE 17 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY SOLUTION, 2022

FIGURE 18 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY DEPLOYMENT MODE, 2022

FIGURE 19 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY DEPLOYMENT MODE, 2022

FIGURE 20 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY APPLICATION TYPE, 2022

FIGURE 21 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY APPLICATION TYPE, 2022

FIGURE 22 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY OPERATING SYSTEM, 2022

FIGURE 23 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY OPERATING SYSTEM, 2022

FIGURE 24 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY END-USER, 2022

FIGURE 25 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY END-USER, 2022

FIGURE 26 U.S. CRYPTO ASSET MANAGEMENT MARKET: BY VERTICAL, 2022

FIGURE 27 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY VERTICAL, 2022

FIGURE 28 EUROPE CRYPTO ASSET MANAGEMENT MARKET: SNAPSHOT (2022)

FIGURE 29 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY COUNTRY (2022)

FIGURE 30 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 31 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 32 EUROPE CRYPTO ASSET MANAGEMENT MARKET: BY SOLUTION (2023-2030)

FIGURE 33 U.S. CRYPTO ASSET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

FIGURE 34 EUROPE CRYPTO ASSET MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.