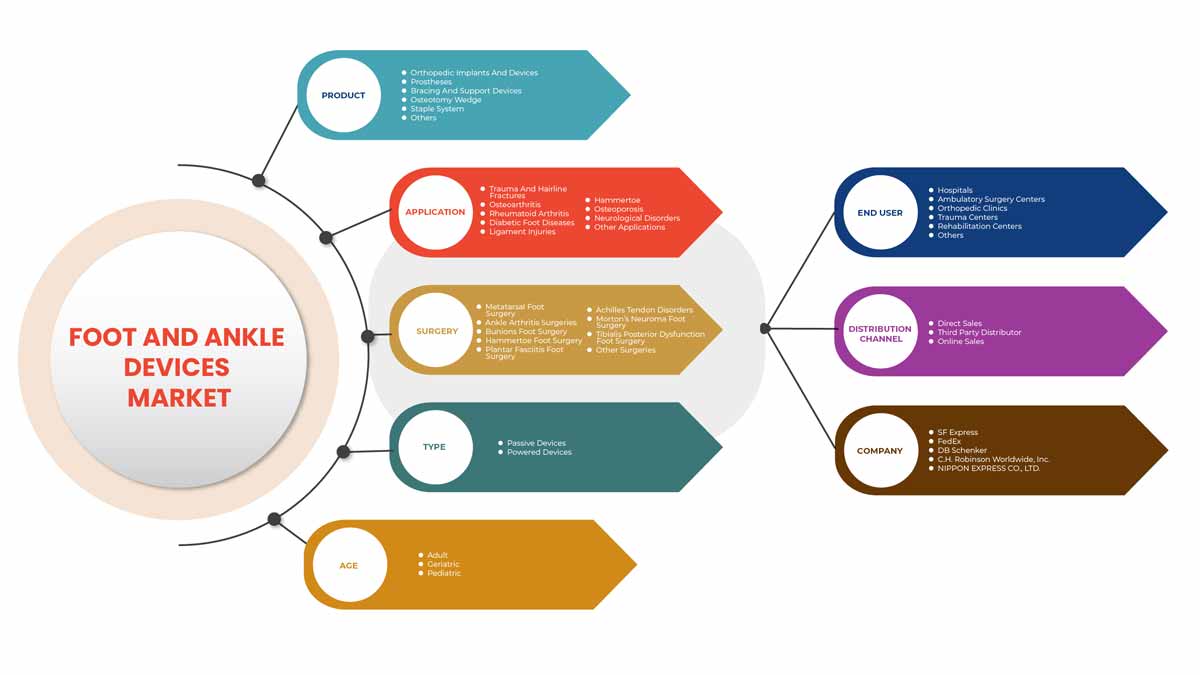

Switzerland Foot and Ankle Devices Market, By Product (Orthopedic Implants and Devices, Prostheses, Bracing and Support Devices, Osteotomy Wedge, Staple System and Others), Application (Trauma and Hairline Fractures, Osteoarthritis, Rheumatoid Arthritis, Diabetic Foot Diseases, Ligament Injuries, Neurological Disorders, Hammertoe, Osteoporosis and Other Applications), Surgery (Metatarsal Foot Surgery, Bunions Foot Surgery, Hammertoe Foot Surgery, Plantar Fasciitis Foot Surgery, Ankle Arthritis Surgeries, Achilles Tendon Disorders, Morton’s Neuroma Foot Surgery, Tibialis Posterior Dysfunction Foot Surgery and Other Surgeries), Type (Passive Devices and Powered Devices), Age (Pediatric, Adult, Geriatric), End User (Hospitals, Ambulatory Surgery Centers, Orthopedic Clinics, Trauma Centers, Rehabilitation Centers and Others) Distribution Channel (Direct Sales, Third Party Distributor and Online Sales) Industry Trends & Forecast to 2029.

Switzerland Foot and Ankle Devices Market Analysis and Insights

The foot and ankle devices are used to treat and heal various foot and ankle fractures due to conditions such as trauma and hairline fractures, osteoarthritis, rheumatoid arthritis, diabetic foot diseases, ligament injuries, neurological disorders, hammertoe, and osteoporosis. The foot and ankle devices cure. An orthotic (foot and ankle orthoses) is a device that can be placed in the shoes' sole to correct any abnormality in the feet and ankles. Foot orthotics lessen the foot pain caused by medical conditions such as arthritis, bunions, plantar fasciitis, flat feet, and diabetes. These foot devices can offset stress levels as pressure is exerted on them, allowing feet to function properly.

The advantages offered by the foot and ankle devices are superior comfort, improvement in balance and gait, aids in absorbance of shock, redirect pressure away from painful areas in the foot and ankle and improved athletic performance, and lowered the risk of injury.

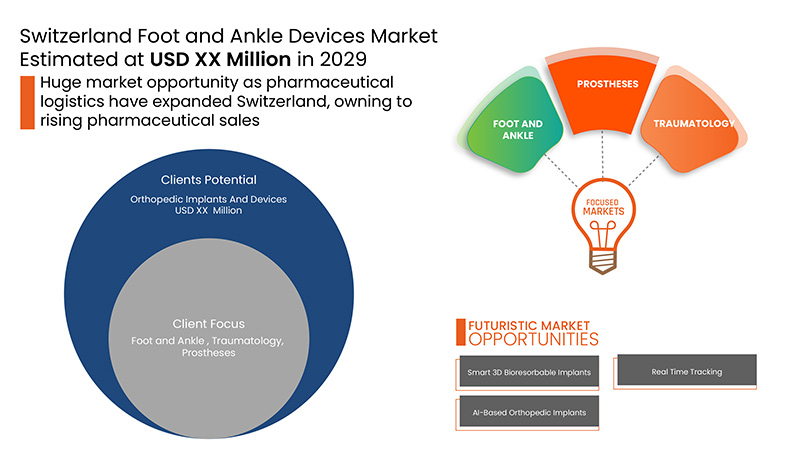

Switzerland foot and ankle devices is supportive and aims to reduce the severity of the symptoms. Data Bridge Market Research analyses that the Switzerland foot and ankle devices market will grow at a CAGR of 4.8% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

Par produit (implants et dispositifs orthopédiques, prothèses, dispositifs d'attelle et de soutien, coin d'ostéotomie, système d'agrafes et autres), application (traumatismes et fractures capillaires, arthrose, polyarthrite rhumatoïde, maladies du pied diabétique, lésions ligamentaires, troubles neurologiques, orteil en marteau, ostéoporose et autres applications), chirurgie (chirurgie du pied métatarsien, chirurgie du pied pour oignons, chirurgie du pied pour orteils en marteau, chirurgie du pied pour fasciite plantaire, chirurgies de l'arthrite de la cheville, troubles du tendon d'Achille, chirurgie du pied pour névrome de Morton, chirurgie du pied pour dysfonctionnement du tibial postérieur et autres chirurgies.), type (dispositifs passifs et appareils motorisés), âge (pédiatrique, adulte, gériatrique), utilisateur final (hôpitaux, centres de chirurgie ambulatoire, cliniques orthopédiques, centres de traumatologie, centres de rééducation et autres.) Canal de distribution (ventes directes, distributeurs tiers et ventes en ligne) |

|

Pays couvert |

Suisse |

|

Acteurs du marché couverts |

Smith+Nephew (Royaume-Uni), Össur (Islande), OTTOBOCK (Allemagne), Globus Medical (États-Unis), Medartis AG (Bâle), DePuy Synthes (une filiale de Johnson & Johnson Private Limited) (États-Unis), GROUP FH ORTHO (France), Stryker (États-Unis), Zimmer Biomet (États-Unis), Arthrex, Inc. (États-Unis) et DJO, LLC (États-Unis) entre autres. |

Dynamique du marché suisse des dispositifs pour les pieds et les chevilles

Conducteurs

- Augmentation de la prévalence et de l’incidence des affections chroniques du pied et de la cheville

Les maladies orthopédiques continuent d'augmenter dans le monde entier. Des affections telles que l'arthrite, les excroissances osseuses, les oignons et les pieds plats augmentent de jour en jour. Les entorses et les fractures sont les blessures de la cheville les plus courantes. En Suisse, les troubles du pied et de la cheville sont courants et leur incidence a également augmenté. L'augmentation de la population, l'obésité et une participation plus répandue aux activités sportives sont les principales causes de l'incidence des troubles du pied et de la cheville en Suisse. Les fractures de la cheville sont légèrement plus fréquentes chez les hommes (53 %) que chez les femmes (47 %). Elles constituent donc un moteur majeur qui entraînera l'expansion du taux de croissance du marché.

Par exemple,

Selon le rapport du Centre national d'information sur la biotechnologie (NCBI), plus de 2,2 millions de personnes en Suisse souffrent de maladies musculo-squelettiques, l'arthrite étant la plus fréquente. Environ 6 000 enfants de moins de 16 ans souffrent d'arthrite rhumatismale

- L'augmentation des lancements de produits

Un autre facteur important influençant le taux de croissance des dispositifs pour le pied et la cheville en Suisse est le lancement de nouveaux produits, tels que le lancement de nouvelles orthèses pour le pied et la cheville (implants et dispositifs orthopédiques, système de fixation interne des tendons, vis de compression, allogreffes), qui devraient améliorer la croissance des industries et augmenter les ventes et la distribution des dispositifs pour le pied et la cheville. Le lancement de nouveaux produits générera de nouveaux partenariats et collaborations commerciales

- La croissance des développements technologiques dans le domaine des dispositifs pour le pied et la cheville

Des progrès technologiques ont été réalisés dans le domaine des dispositifs pour le pied et la cheville. Les avancées technologiques récentes ont favorisé les avancées médicales, notamment dans le domaine des orthèses et des prothèses. La collaboration avec divers acteurs du marché et les récentes approches technologiques ont mis en évidence l'impact de la nouvelle technologie sur les opérations de gestion clinique, telles que la réduction de la douleur chronique, une meilleure démarche et une meilleure posture. Cela renforcera encore la croissance du marché suisse des dispositifs pour le pied et la cheville.

En outre, les progrès de la technologie médicale, les initiatives croissantes des organisations publiques et privées pour sensibiliser et le financement croissant du gouvernement sont les facteurs qui élargiront le marché. D'autres facteurs tels que l'augmentation de la demande de thérapies efficaces et la sensibilisation croissante au diagnostic rapide auront un impact positif sur le taux de croissance du marché suisse des dispositifs pour le pied et la cheville. En outre, le revenu disponible élevé, le nombre croissant de cas de crises et l'évolution du mode de vie entraîneront l'expansion du marché suisse des dispositifs pour le pied et la cheville.

Opportunités

- Les dépenses de santé comprennent tous les services de santé, les appareils de test, les activités de planification familiale et l'aide d'urgence destinés à la santé, mais excluent l'eau potable et l'assainissement. Les facteurs déterminants des dépenses de santé d'un pays sont le revenu (PIB par habitant), le progrès technologique et la variation des pratiques médicales, ainsi que les caractéristiques des systèmes de santé. L'augmentation des dépenses de santé en Suisse devrait accroître les investissements dans le développement d'appareils pour le pied et la cheville par les acteurs du marché basés en Suisse, renforcer le capital humain et améliorer la productivité, et financer le traitement des maladies du pied et de la cheville en créant des centres de réadaptation, d'orthopédie et de traumatologie et en améliorant la couverture des services et la protection financière. Les ménages privés en Suisse contribuent le plus au financement du système de santé suisse en payant environ 64 %.

De plus, l'augmentation des activités de recherche et développement et l'augmentation des investissements du gouvernement et des organisations privées stimuleront de nouvelles opportunités pour le taux de croissance du marché.

En outre, le lancement de thérapies efficaces et la poursuite des essais cliniques offriront des opportunités bénéfiques pour le marché suisse des dispositifs pour le pied et la cheville au cours de la période de prévision 2022-2029. En outre, les besoins non satisfaits importants en matière de technologies de santé actuelles et les développements en la matière augmenteront le taux de croissance du marché suisse des dispositifs pour le pied et la cheville à l'avenir.

Contraintes/Défis

Cependant, le coût élevé associé à la disponibilité et au manque d'infrastructures dans les pays à faible revenu freinera le taux de croissance du marché suisse des dispositifs pour le pied et la cheville. De plus, les risques encourus lors de l'utilisation des dispositifs orthopédiques freineront la croissance du marché suisse des dispositifs pour le pied et la cheville. L'absence de traitement pour cette maladie neurologique et la méconnaissance des maladies génétiques et rares constitueront un défi supplémentaire pour le marché au cours de la période de prévision mentionnée ci-dessus.

Le rapport sur le marché suisse des dispositifs pour le pied et la cheville fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché suisse des dispositifs pour le pied et la cheville, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Analyse épidémiologique des patients

L'orthèse du pied et de la cheville en Suisse est une affection chronique du pied relativement rare et dont l'incidence est inconnue. L'étude menée par l'Académie américaine et des chirurgiens orthopédiques affirme que 25 % des blessures sportives sont liées au pied et à la cheville, en particulier dans les sports qui nécessitent de sauter et de courir, comme le football, le baseball, le soccer, la course à pied et le hockey.

Le marché suisse des dispositifs pour le pied et la cheville vous fournit également une analyse de marché détaillée pour l'analyse des patients, le pronostic et les traitements. La prévalence, l'incidence, la mortalité et les taux d'adhésion sont quelques-unes des variables de données disponibles dans le rapport. Les analyses d'impact directes ou indirectes de l'épidémiologie sur la croissance du marché sont analysées pour créer un modèle statistique multivarié de cohorte plus robuste pour prévoir le marché pendant la période de croissance.

Impact du COVID-19 sur le marché suisse des dispositifs pour les pieds et les chevilles

La COVID-19 a eu un impact négatif sur le marché. Les confinements et l'isolement pendant les pandémies compliquent la gestion du diagnostic et le traitement. Le manque d'accès aux établissements de santé pour l'administration de routine et de médicaments affectera davantage le marché. L'isolement social augmente le stress, le désespoir et le soutien social, ce qui peut entraîner une réduction de l'observance des médicaments anticonvulsivants pendant la pandémie. L'initiative stratégique des acteurs du marché devrait augmenter la taille du marché.

Développement récent

- En mai 2021, Stryker a annoncé son acquisition avec Wright Medical pour présenter sa nouvelle gamme combinée de produits pour le pied et la cheville intégrant les produits de Wright Medical. Cette acquisition a aidé l'entreprise à développer son portefeuille de produits et à introduire de nouveaux produits pour le pied et la cheville dans le monde entier.

Portée du marché suisse des dispositifs pour les pieds et les chevilles

Le marché suisse des dispositifs pour le pied et la cheville est segmenté en fonction du produit, de l'application, de la chirurgie, du type, de l'âge, de l'utilisateur final et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Implants et dispositifs orthopédiques

- Prothèses

- Dispositifs de soutien et d'appui

- Coin d'ostéotomie

- Système d'agrafes

- Autres

Sur la base du produit, les implants et dispositifs orthopédiques sont sous-segmentés en implants et dispositifs orthopédiques, prothèses, dispositifs de renfort et de soutien, cale d'ostéotomie, système d'agrafes et autres.

Application

- Traumatismes et fractures capillaires

- Arthrose

- Polyarthrite rhumatoïde

- Maladies du pied diabétique

- Blessures ligamentaires

- Orteil en marteau

- Ostéoporose

- Troubles neurologiques

- Autres applications

Sur la base des applications, le marché suisse des dispositifs pour le pied et la cheville est segmenté en traumatismes et fractures capillaires, arthrose, polyarthrite rhumatoïde, maladies du pied diabétique, lésions ligamentaires, troubles neurologiques, orteils en marteau , ostéoporose et autres applications.

Chirurgie

- Chirurgie métatarsienne du pied

- Chirurgies pour l'arthrite de la cheville

- Chirurgie des oignons du pied

- Chirurgie du pied en marteau

- Chirurgie du pied pour fasciite plantaire

- Troubles du tendon d'Achille

- Chirurgie du pied pour le névrome de Morton

- Chirurgie du pied pour dysfonctionnement du muscle tibial postérieur

- Autres interventions chirurgicales

Sur la base de la chirurgie, le marché suisse des dispositifs pour le pied et la cheville est segmenté en chirurgie du pied métatarsien, chirurgie du pied pour oignons, chirurgie du pied en marteau, chirurgie du pied pour fasciite plantaire, chirurgies de l'arthrite de la cheville, troubles du tendon d'Achille, chirurgie du pied pour névrome de Morton, chirurgie du pied pour dysfonctionnement du tibial postérieur et autres chirurgies.

Taper

- Dispositifs passifs

- Appareils alimentés

Sur la base du type, le marché suisse des appareils pour le pied et la cheville est segmenté en appareils passifs et appareils motorisés

Âge

- Adulte

- Gériatrie

- Pédiatrique

Sur la base de l'âge, le marché suisse des dispositifs pour le pied et la cheville est segmenté en pédiatrique, adulte et gériatrique.

Utilisateur final

- Hôpitaux

- Centres de chirurgie ambulatoire

- Cliniques orthopédiques

- Centres de traumatologie

- Centres de réadaptation

- Autres

Sur la base de l'utilisateur final, le marché suisse des dispositifs pour le pied et la cheville est segmenté en hôpitaux, centres de chirurgie ambulatoire, cliniques orthopédiques, centres de traumatologie, centres de rééducation et autres.

Canal de distribution

- Vente directe

- Distributeur tiers

- Ventes en ligne

Sur la base du canal de distribution, le marché suisse des appareils pour le pied et la cheville est segmenté en ventes directes, distributeurs tiers et ventes en ligne.

Analyse/perspectives du marché suisse des dispositifs pour les pieds et les chevilles

Le marché suisse des dispositifs pour le pied et la cheville est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, produit, application, chirurgie, type, âge, utilisateur final et canal de distribution comme référencé ci-dessus.

Le pays couvert par le rapport sur le marché des appareils pour les pieds et les chevilles en Suisse est la Suisse.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des dispositifs pour les pieds et les chevilles en Suisse

Le paysage concurrentiel du marché suisse des dispositifs pour le pied et la cheville fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché suisse des dispositifs pour le pied et la cheville.

Certains des principaux acteurs opérant sur le marché suisse des dispositifs pour le pied et la cheville sont Smith+Nephew, Össur, OTTOBOCK, Globus Medical, Medartis AG, DePuy Synthes (une filiale de Johnson & Johnson Services, Inc), GROUP FH ORTHO, Stryker, Zimmer Biomet., Arthrex, Inc., DJO, LLC et acumed, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SWITZERLAND FOOT AND ANKLE DEVICES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT SEGMENT LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 MARKET END USER COVERAGE GRID

2.1 SECONDARY SOURCES

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SWITZERLAND FOOT AND ANKLE DEVICES MARKET (2020-2029) , NUMBER OF SURGERIES (IN THOUSANDS)

4.2 PESTEL

4.3 PORTER'S FIVE FORCES

5 SUMMARY WRITE UP (SWITZERLAND)

5.1 OVERVIEW

6 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: REGULATIONS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN INCIDENCE OF ORTHOPEDIC DISEASES AND FOOT AND ANKLE DISORDERS

7.1.2 RISE IN NUMBER OF ROAD ACCIDENTS AND SPORTS ACTIVITIES

7.1.3 GROWING AWARENESS IN PUBLIC AND PRIVATE INSTITUTES RELATED TO TREATMENT AND POST-OPERATIVE CARE

7.1.4 RISE IN PRODUCT LAUNCHES

7.1.5 TECHNOLOGICAL PROGRESS IN FOOT AND ANKLE DEVICES

7.2 RESTRAINTS

7.2.1 RISE IN COST OF FOOT AND ANKLE DEVICES

7.2.2 PROBLEMS FACED WHILE USING FOOT AND ANKLE DEVICES

7.2.3 RISE IN PRODUCT RECALL

7.2.4 RISE IN CONCERN REGARDING METAL SENSITIVITY IN PATIENTS WITH FOOT AND ANKLE DEVICES

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.2 RISE IN HEALTHCARE EXPENDITURE

7.3.3 USE OF BIORESORBABLE AND 3D-PRINTED IMPLANTS

7.4 CHALLENGES

7.4.1 LACK OF SKILLED PROFESSIONALS

7.4.2 STRINGENT REGULATIONS

8 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 ORTHOPEDIC IMPLANTS AND DEVICES

8.2.1 FIXATION DEVICES

8.2.1.1 INTERNAL FIXATION DEVICES

8.2.1.1.1 PLATES

8.2.1.1.1.1 MEDIAL DISTAL TIBIA PLATES

8.2.1.1.1.2 ANTEROLATERAL DISTAL TIBIA PLATES

8.2.1.1.1.3 DISTAL TIBIA T AND L PLATES

8.2.1.1.1.4 LATERAL DISTAL FIBULA PLATES

8.2.1.1.1.5 OTHERS

8.2.1.1.2 SCREWS

8.2.1.1.2.1 BY TYPE

8.2.1.1.2.1.1 CANNULATED SCREW

8.2.1.1.2.1.2 HEADLESS COMPRESSION SCREW

8.2.1.1.2.1.3 HEADED-FOREFOOT COMPRESSION SCREWS

8.2.1.1.2.1.4 SNAP-OFF SCREWS

8.2.1.1.2.1.5 OTHERS

8.2.1.1.2.2 BY MATERIAL

8.2.1.1.2.2.1 STAINLESS STEEL

8.2.1.1.2.2.2 TITANIUM

8.2.1.1.2.2.3 OTHERS

8.2.1.1.3 FUSION NAILS

8.2.1.1.3.1 WITH INTERNAL COMPRESSION

8.2.1.1.3.2 WITHOUT INTERNAL COMPRESSION

8.2.1.1.3.3 WIRES & PINS

8.2.1.1.3.4 OTHERS

8.2.1.2 EXTERNAL FIXATION DEVICES

8.2.1.2.1 RING ANKLE FIXATORS

8.2.1.2.2 UNILATERAL FIXATORS

8.2.1.2.3 HYBRID FIXATORS

8.2.1.2.4 CIRCULAR FIXATORS

8.2.2 JOINT IMPLANTS

8.2.2.1 ANKLE IMPLANTS (ANKLE REPLACEMENT DEVICES)

8.2.2.2 PHALANGEAL IMPLANTS

8.2.2.3 SUBTALAR JOINT IMPLANTS (SUBTALAR JOINT RECONSTRUCTION DEVICES)

8.2.2.4 OTHERS

8.2.3 SOFT-TISSUE ORTHOPEDIC DEVICES

8.2.3.1 MUSCULOSKELETAL REINFORCEMENT DEVICES

8.2.3.2 ARTIFICIAL TENDONS AND LIGAMENTS

8.2.3.3 HIGH STRENGTH SUTURES

8.2.3.4 OTHERS

8.3 PROSTHESES

8.3.1 SOLID ANKLE CUSHION HEEL PROSTHESES

8.3.2 ELASTIC (FLEXIBLE) KEEL FOOT

8.3.3 SINGLE AXIAL PROSTHESES

8.3.4 MULTIAXIAL PROSTHESES

8.3.5 DYNAMIC RESPONSE/ ENERGY STORING PROSTHESES

8.3.6 MICROPROCESSOR-CONTROLLED PROSTHESES

8.4 BRACING AND SUPPORT DEVICES

8.4.1 SOFT BRACES AND SUPPORT DEVICES

8.4.2 HARD BRACES AND SUPPORT DEVICES

8.4.3 HINGED BRACES AND SUPPORT DEVICES

8.4.4 DYNAMIC ANKLE FOOT ORTHOTIC

8.4.5 OTHERS

8.5 OSTEOTOMY WEDGE

8.5.1 ALLOGRAFT BONE

8.5.2 WEDGE SYSTEM

8.5.3 OTHERS

8.6 STAPLE SYSTEM

8.7 OTHERS

9 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 TRAUMA AND HAIRLINE FRACTURES

9.3 OSTEOARTHRITIS

9.4 RHEUMATOID ARTHRITIS

9.5 DIABETIC FOOT DISEASES

9.6 LIGAMENT INJURIES

9.7 HAMMERTOE

9.8 OSTEOPOROSIS

9.9 NEUROLOGICAL DISORDERS

9.1 OTHER APPLICATIONS

10 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY SURGERY

10.1 OVERVIEW

10.2 METATARSAL FOOT SURGERY

10.3 ANKLE ARTHRITIS SURGERIES

10.4 BUNIONS FOOT SURGERY

10.5 HAMMERTOE FOOT SURGERY

10.6 PLANTAR FASCIITIS FOOT SURGERY

10.7 ACHILLES TENDON DISORDERS

10.8 MORTON’S NEUROMA FOOT SURGERY

10.9 TIBIALIS POSTERIOR DYSFUNCTION FOOT SURGERY

10.1 OTHER SURGERIES

11 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY TYPE

11.1 OVERVIEW

11.2 PASSIVE DEVICES

11.3 POWERED DEVICES

12 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY AGE

12.1 OVERVIEW

12.2 ADULT

12.3 GERIATRIC

12.4 PEDIATRIC

13 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY END USER

13.1 OVERVIEW

13.2 HOSPITALS

13.3 AMBULATORY SURGERY CENTERS

13.4 ORTHOPEDIC CLINICS

13.5 TRAUMA CENTERS

13.6 REHABILITATION CENTERS

13.7 OTHERS

14 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 DIRECT SALES

14.3 THIRD PARTY DISTRIBUTOR

14.4 ONLINE SALES

15 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: SWITZERLAND

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 DEPUY SYNTHES (A SUBSIDIARY OF JOHNSON & JOHNSON SERVICES, INC)

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.1.4.1 ACQUISITION

17.2 STRYKER

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.2.4.1 ACQUISITION

17.3 ARTHREX, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 MEDARTIS AG

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.4.4.1 ACQUISITION

17.5 ZIMMER BIOMET

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.5.4.1 ACQUISITION

17.6 ÖSSUR

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENTS

17.6.4.1 PRODUCT LAUNCH

17.7 DJO, LLC

17.7.1 COMPANY SNAPSHOT

17.7.2 1.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.7.3.1 ACQUISITION

17.8 SMITH & NEPHEW

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 OTTOBOCK

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.9.3.1 PARTNERSHIP

17.1 ACUMED

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 GROUP FH ORTHO

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 GLOBUS MEDICAL, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.12.4.1 ACQUISITION

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 2 SWITZERLAND ORTHOPEDIC IMPLANTS AND DEVICES IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 3 SWITZERLAND FIXATION DEVICES IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 4 SWITZERLAND INTERNAL FIXATION DEVICES IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 5 SWITZERLAND PLATES IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 SWITZERLAND SCREWS IN FOOT AND ANKLE DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 SWITZERLAND SCREWS IN FOOT AND ANKLE DEVICES MARKET, BY MATERIAL, 2020-2029 (USD MILLION)

TABLE 8 SWITZERLAND FUSION NAILS IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 SWITZERLAND EXTERNAL FIXATION DEVICES IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 10 SWITZERLAND JOINT IMPLANTS IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 SWITZERLAND SOFT-TISSUE ORTHOPEDIC DEVICES IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 12 SWITZERLAND PROSTHESES IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 13 SWITZERLAND BRACING AND SUPPORT DEVICES IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 14 SWITZERLAND OSTEOTOMY WEDGE IN FOOT AND ANKLE DEVICES MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 15 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 16 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY SURGERY, 2020-2029 (USD MILLION)

TABLE 17 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 18 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 19 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 20 SWITZERLAND FOOT AND ANKLE DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: SEGMENTATION

FIGURE 2 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: DROC ANALYSIS

FIGURE 4 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: DBMR POSITION GRID

FIGURE 8 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: END USER COVERAGE GRID

FIGURE 9 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: SEGMENTATION

FIGURE 10 INCREASED PREVALENCE OF CHRONIC FOOT AND ANKLE DISORDERS, RISE IN TECHNOLOGICAL DEVELOPMENTS, INCREASED PREFERENCE FOR BIORESORBABLE IMPLANTS, AND PRODUCT APPROVAL IS EXPECTED TO DRIVE SWITZERLAND FOOT AND ANKLE DEVICES MARKET FROM 2022 TO 2029

FIGURE 11 PRODUCT SEGMENT IS EXPECTED TO HAVE THE LARGEST SHARE OF THE SWITZERLAND FOOT AND ANKLE DEVICES MARKET FROM 2022 & 2029

FIGURE 12 NUMBER OF SURGERIES (IN THOUSANDS)

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SWITZERLAND FOOT AND ANKLE DEVICES MARKET

FIGURE 14 TOTAL ANKLE REPLACEMENT SURGERIES IN SWITZERLAND FROM 2000- 2010

FIGURE 15 TOTAL ANKLE REPLACEMENT SURGERIES IN SWITZERLAND FROM 2018-2020

FIGURE 16 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY PRODUCT, 2021

FIGURE 17 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY PRODUCT, 2022-2029 (USD MILLION)

FIGURE 18 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY PRODUCT, CAGR (2022-2029)

FIGURE 19 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY PRODUCT, LIFELINE CURVE

FIGURE 20 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY APPLICATION, 2021

FIGURE 21 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 22 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 23 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 24 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY SURGERY, 2021

FIGURE 25 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY SURGERY, 2022-2029 (USD MILLION)

FIGURE 26 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY SURGERY, CAGR (2022-2029)

FIGURE 27 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY SURGERY, LIFELINE CURVE

FIGURE 28 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY TYPE, 2021

FIGURE 29 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY TYPE, 2022-2029 (USD MILLION)

FIGURE 30 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 31 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY TYPE, LIFELINE CURVE

FIGURE 32 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY AGE, 2021

FIGURE 33 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY AGE, 2022-2029 (USD MILLION)

FIGURE 34 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY AGE, CAGR (2022-2029)

FIGURE 35 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY AGE, LIFELINE CURVE

FIGURE 36 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY END USER, 2021

FIGURE 37 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 38 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 SWITZERLAND FOOT AND ANKLE DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.