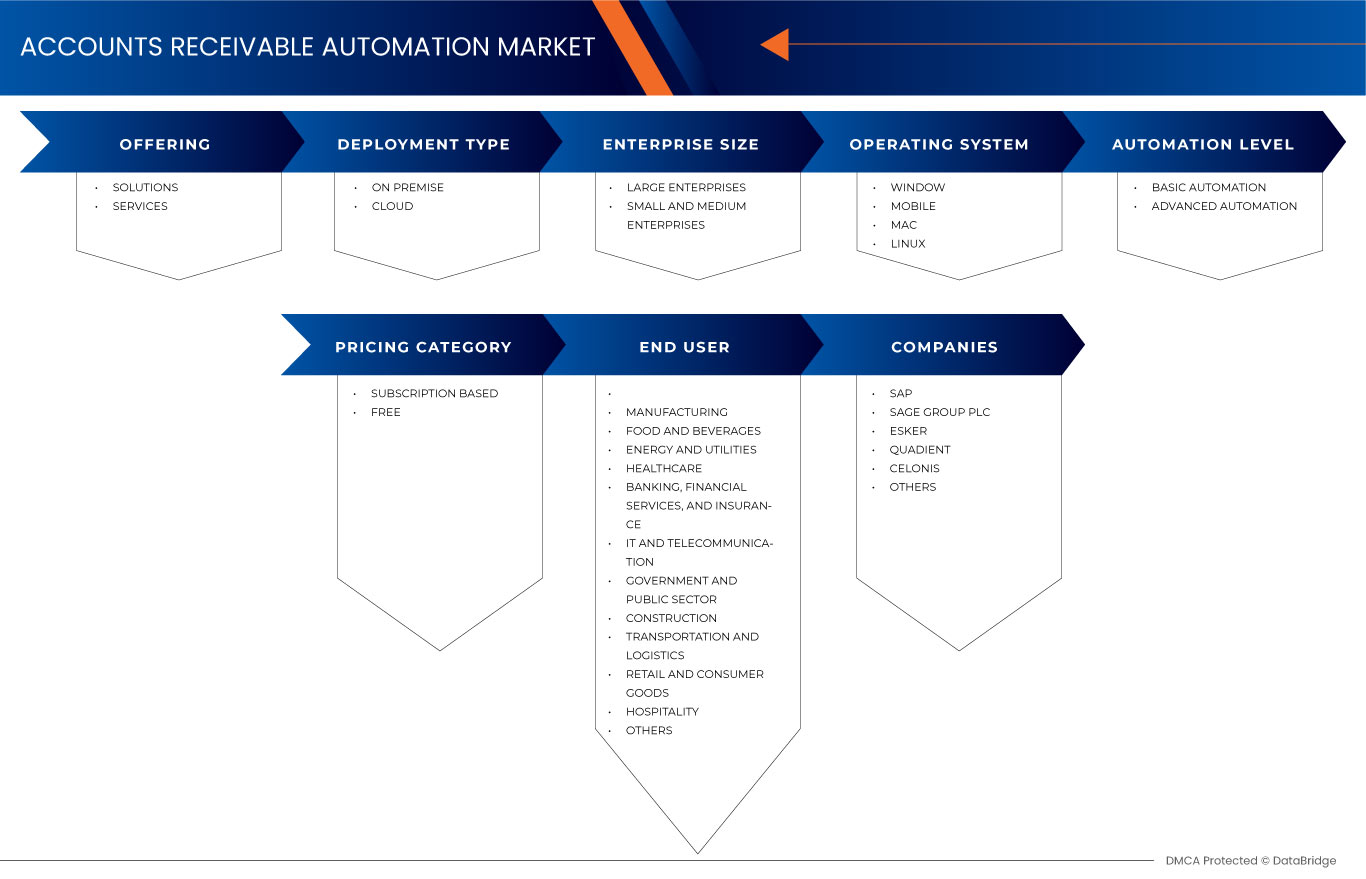

Marché espagnol de l'automatisation des comptes clients, par offre (solutions et services), type de déploiement (sur site, cloud), taille de l'entreprise (grande et petite entreprise), système d'exploitation (Windows, mobile, Mac et Linux), niveau d'automatisation (automatisation de base et automatisation avancée), catégorie de prix (par abonnement et gratuit), utilisateur final (fabrication, alimentation et boissons, énergie et services publics, soins de santé, banque, services financiers et assurances, informatique et télécommunications, gouvernement et secteur public, construction, transport et logistique, vente au détail et biens de consommation, hôtellerie et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de l'automatisation des comptes clients en Espagne

Les principaux facteurs qui devraient stimuler la croissance du marché de l'automatisation des comptes clients au cours de la période de prévision sont l'augmentation de plusieurs applications industrielles, notamment l'aérospatiale, l'acier, l'énergie, la chimie et d'autres. En outre, la résistance accrue aux variations de charge est l'avantage de l'automatisation des comptes clients, qui devrait encore propulser la croissance du marché de l'automatisation des comptes clients.

Data Bridge Market Research estime que le marché espagnol de l'automatisation des comptes clients devrait atteindre la valeur de 234,76 millions USD d'ici 2030, à un TCAC de 12,6 % au cours de la période de prévision. Le rapport sur le marché de l'automatisation des comptes clients couvre également l'analyse des prix, l'analyse des brevets et les avancées technologiques en profondeur.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Offre (solutions et services), type de déploiement (sur site, cloud), taille de l'entreprise (grande et petite entreprise), système d'exploitation (Windows, mobile, Mac et Linux), niveau d'automatisation (automatisation de base et automatisation avancée), catégorie de prix (abonnement et gratuit), utilisateur final (fabrication, alimentation et boissons, énergie et services publics, soins de santé, banque, services financiers et assurances, informatique et télécommunications, gouvernement et secteur public, construction, transport et logistique, vente au détail et biens de consommation, hôtellerie et autres) |

|

Pays couvert |

Espagne |

|

Acteurs du marché couverts |

SAP, Sage Group plc, Esker, Quadient, celonis, EDICOM, BlackLine Inc., Certinia Inc., le groupe de sociétés QUALCO, Pagero, Iron Mountain, Inc., Zoho Corporation Pvt. Ltd., Serrala, Dynatos, et entre autres |

Définition du marché de l'automatisation des comptes clients en Espagne

Les solutions d’automatisation de la réalité augmentée basées sur le cloud réduisent généralement le besoin d’une infrastructure sur site étendue et les coûts de maintenance permanents. Cela peut particulièrement intéresser les entreprises qui cherchent à contrôler les dépenses et à allouer les ressources de manière plus stratégique. L’évolutivité des solutions cloud permet également aux entreprises de s’adapter à l’évolution des charges de travail et des besoins commerciaux sans les contraintes des systèmes traditionnels sur site. Les entreprises espagnoles reconnaissent les avantages de l’automatisation de la réalité augmentée basée sur le cloud qui devrait stimuler la croissance du marché.

Dynamique du marché de l'automatisation des comptes clients en Espagne

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Adoption croissante des solutions d'automatisation de la réalité augmentée basées sur le cloud

Les entreprises espagnoles reconnaissent les avantages de l'automatisation de la réalité augmentée basée sur le cloud, qui offre flexibilité, évolutivité et accessibilité. Les entreprises peuvent gérer efficacement leurs processus de réalité augmentée depuis n'importe quel endroit disposant d'une connexion Internet, facilitant ainsi le travail à distance et permettant un accès en temps réel aux données financières en exploitant les solutions cloud. Cela améliore l'efficacité opérationnelle et contribue à une meilleure gestion des flux de trésorerie et à une prise de décision plus rapide, qui sont essentielles dans l'environnement commercial dynamique d'aujourd'hui.

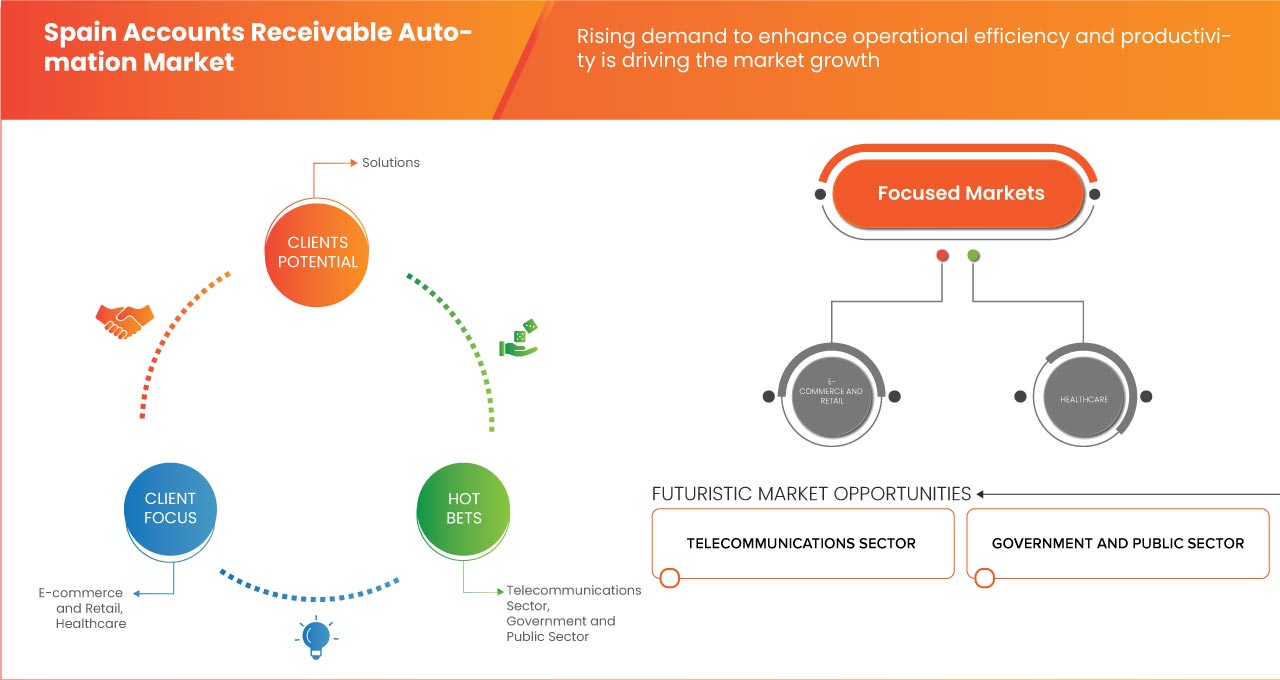

- Demande croissante d'amélioration de l'efficacité opérationnelle et de la productivité

Les entreprises reconnaissent l’importance d’automatiser leurs processus de comptes clients pour rationaliser et optimiser leurs opérations financières. En adoptant l’automatisation, les entreprises peuvent réduire considérablement les charges de travail manuelles, minimiser les erreurs et accélérer les tâches de traitement des factures et de recouvrement des paiements. Cela conduit à une efficacité opérationnelle améliorée et permet aux organisations d’allouer leurs ressources de manière plus stratégique, améliorant ainsi la productivité globale.

Opportunité

- Les initiatives du gouvernement espagnol en plein essor, comme la promotion des technologies numériques

Le gouvernement espagnol, comme de nombreux autres gouvernements à travers le monde, pourrait lancer des initiatives favorisant l’adoption des technologies numériques et de l’automatisation dans les entreprises. Ces initiatives peuvent inclure des incitations fiscales, des subventions ou des aides pour encourager les entreprises à investir dans des solutions d’automatisation de la réalité augmentée. Le gouvernement vise à améliorer l’efficacité et la compétitivité globales des entreprises, contribuant ainsi à terme à la croissance économique.

Contraintes/Défis

- Considérations relatives à la sécurité des données associées aux processus AR automatisés

Les entreprises confient des données financières sensibles à ces systèmes, ce qui fait de la sécurité des données une préoccupation majeure avec l’adoption croissante des solutions d’automatisation. Toute vulnérabilité perçue ou réelle dans la sécurité des solutions d’automatisation des comptes clients peut dissuader les entreprises d’adopter ces technologies, en particulier dans les secteurs où la confidentialité des données et le respect des réglementations telles que le RGPD sont essentiels.

- Coût élevé de la mise en œuvre de l'automatisation de la RA

L'investissement initial requis peut décourager de nombreuses entreprises, en particulier les plus petites, alors que l'automatisation offre de nombreux avantages, notamment une efficacité accrue et une amélioration des flux de trésorerie. Les dépenses comprennent l'acquisition de logiciels, l'intégration aux systèmes existants et la formation du personnel, ce qui en fait un engagement financier substantiel que certaines entreprises peuvent trouver prohibitif.

Développement récent

- En septembre 2023, SAP et LeanIX GmbH ont acquis LeanIX, un pionnier des logiciels de gestion de l'architecture d'entreprise (EAM). SAP a élargi son offre complète de transformation pour aider les clients à gérer efficacement le changement et à améliorer en permanence leurs processus métier. LeanIX a étendu les capacités de transformation en offrant aux clients SAP une visibilité unique sur les paysages informatiques. Cela a aidé SAP à élargir son portefeuille de transformation d'entreprise, en donnant aux clients l'accès aux outils nécessaires à la transformation continue de l'entreprise et en facilitant l'optimisation des processus basée sur l'IA.

- En août 2023, Sage Group plc a acquis Lockstep. Sage a soutenu l'investissement de Lockstep dans des solutions créatives, l'expansion de ses API de développement et le développement de connecteurs comptables pour les tiers afin de créer de nouvelles applications et de favoriser le choix. Cette acquisition a apporté les ressources de Sage à Lockstep, ce qui a accéléré son objectif d'automatisation des opérations comptables dans les entreprises. Elle a fourni à Sage des outils et des capacités de soutien pour concrétiser son ambition de devenir le réseau de confiance des PME. L'entreprise a enrichi son portefeuille d'offres, en faisant progresser ses capacités numériques et en facilitant l'automatisation et la personnalisation.

Portée du marché de l'automatisation des comptes clients en Espagne

Le marché espagnol de l'automatisation des comptes clients est segmenté en fonction de l'offre, du type de déploiement, de la taille de l'entreprise, du système d'exploitation, du niveau d'automatisation, de la catégorie de prix et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Solutions

- Services

Sur la base de l'offre, le marché espagnol de l'automatisation des comptes clients est segmenté en solutions et services.

Type de déploiement

- Sur place

- Nuage

Sur la base du type de déploiement, le marché espagnol de l'automatisation des comptes clients est segmenté en sur site et dans le cloud.

Taille de l'entreprise

- Grande entreprise

- Petite entreprise

Sur la base de la taille de l'entreprise, le marché espagnol de l'automatisation des comptes clients est segmenté en grandes entreprises et petites entreprises.

Système opérateur

- Fenêtre

- Mobile

- Mac

- Linux

Sur la base du système d'exploitation, le marché espagnol de l'automatisation des comptes clients est segmenté en Windows, mobile, Mac et Linux.

Niveau d'automatisation

- Automatisation de base

- Automatisation avancée

Sur la base du niveau d’automatisation, le marché espagnol de l’automatisation des comptes clients est segmenté en automatisation de base et automatisation avancée.

Catégorie de prix

- Basé sur l'abonnement

- Gratuit

Sur la base de la catégorie de prix, le marché espagnol de l'automatisation des comptes clients est segmenté en abonnement et gratuit.

Utilisateur final

- Fabrication

- Alimentation et boissons

- Énergie et services publics

- Santé, Banque

- Services financiers et assurances

- Informatique et télécommunication

- Gouvernement et secteur public

- Construction

- Transport et logistique

- Commerce de détail et biens de consommation

- Hospitalité

- Autres

Sur la base de l'utilisateur final, le marché espagnol de l'automatisation des comptes clients est segmenté en fabrication, alimentation et boissons, énergie et services publics, soins de santé, banque, services financiers et assurances, informatique et télécommunications, gouvernement et secteur public, construction, transport et logistique, vente au détail et biens de consommation, hôtellerie et autres.

Paysage concurrentiel et analyse des parts de marché de l'automatisation des comptes clients en Espagne

Le paysage concurrentiel du marché espagnol de l'automatisation des comptes clients fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise par rapport au marché espagnol de l'automatisation des comptes clients.

Certains des principaux acteurs opérant sur le marché espagnol de l'automatisation des comptes clients sont SAP, Sage Group plc, Esker, Quadient, celonis, EDICOM, BlackLine Inc., Certinia Inc., QUALCO Group of companies, Pagero, Iron Mountain, Inc., Zoho Corporation Pvt. Ltd., Serrala, Dynatos, et entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 END USER COVERAGE GRID

2.8 MULTIVARIATE MODELLING

2.9 OFFERING TIME LINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES MODEL

4.2 TECHNOLOGICAL TRENDS

4.2.1 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING

4.2.2 ROBOTIC PROCESS AUTOMATION (RPA)

4.2.3 BLOCKCHAIN TECHNOLOGY

4.2.4 CLOUD-BASED SOLUTIONS

4.2.5 MOBILE INTEGRATION

4.2.6 DATA ANALYTICS AND BUSINESS INTELLIGENCE

4.2.7 ELECTRONIC PAYMENTS AND E-INVOICING

4.2.8 INTEGRATION WITH ERP SYSTEMS

4.3 CASE STUDY

4.4 COMPANY COMPARATIVE ANALYSIS

4.5 PENETRATION BY SECTOR OF ACTIVITY

4.5.1 FOOD AND BEVERAGES SECTOR:

4.5.2 MANUFACTURING SECTOR:

4.5.3 ENERGY AND UTILITIES SECTOR:

4.5.4 HEALTHCARE SECTOR:

4.6 VALUE CHAIN ANALYSIS

4.6.1 INNOVATIVE TECHNOLOGY PROVIDERS

4.6.2 SYSTEM INTEGRATION, IMPLEMENTATION SERVICES, TRAINING, AND SUPPORT SERVICES

4.7 PRICING ANALYSIS

4.8 GENERAL DATA PROTECTION REGULATION (GDPR)

4.8.1 E-INVOICING DIRECTIVE

4.8.2 ANTI-MONEY LAUNDERING (AML) AND COUNTER-TERRORISM FINANCING (CTF) REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF CLOUD-BASED AR AUTOMATION SOLUTIONS

5.1.2 RISING DEMAND TO ENHANCE OPERATIONAL EFFICIENCY AND PRODUCTIVITY

5.1.3 INCREASE IN THE USE OF AUTOMATED AR PLATFORMS

5.1.4 SURGING DIGITAL INFRASTRUCTURE ACROSS THE COUNTRY

5.2 RESTRAINTS

5.2.1 DATA SECURITY CONSIDERATIONS ASSOCIATED WITH AUTOMATED AR PROCESSES

5.2.2 HIGH COST OF IMPLEMENTATION OF AR AUTOMATION

5.3 OPPORTUNITIES

5.3.1 RISING SPAIN GOVERNMENT INITIATIVES SUCH AS PROMOTING DIGITAL TECHNOLOGIES

5.3.2 GROWING TREND OF COLLABORATION AND STRATEGIC ALLIANCES AMONG INDUSTRY STAKEHOLDERS

5.3.3 GROWING NEED FOR AR AUTOMATION SOLUTIONS IN VARIOUS INDUSTRIES

5.4 CHALLENGES

5.4.1 LESS AWARENESS OF AR AUTOMATION IN SMALLER BUSINESSES

5.4.2 INTEGRATION CONCERNS RELATED TO ACCOUNT RECEIVABLE PLATFORMS

6 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 BILLING AND INVOICING

6.2.2 CREDIT & RISK MANAGEMENT

6.2.3 CUSTOMER STATEMENT

6.2.4 RECEIVABLE LEDGER

6.2.5 COLLECTION MANAGEMENT

6.2.6 AGING TRACKING

6.2.7 ONLINE PAYMENTS

6.2.8 OTHERS

6.3 SERVICES

6.3.1 IMPLEMENTATION

6.3.2 CONSULTING

6.3.3 SUPPORT AND MAINTENANCE

7 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE

7.1 OVERVIEW

7.2 ON PREMISE

7.3 CLOUD

8 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY ENTERPRISE SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISE

8.2.1 BY DEPLOYMENT TYPE

8.2.1.1 ON PREMISE

8.2.1.2 CLOUD

8.3 SMALL AND MEDIUM ENTERPRISE

8.3.1 BY DEPLOYMENT TYPE

8.3.1.1 ON PREMISE

8.3.1.2 CLOUD

9 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OPERATING SYSTEM

9.1 OVERVIEW

9.2 WINDOWS

9.3 MOBILE

9.3.1 BY TYPE

9.3.1.1 ANDROID

9.3.1.2 IPHONE

9.3.1.3 IPAD

9.4 MAC

9.5 LINUX

10 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY AUTOMATION LEVEL

10.1 OVERVIEW

10.2 BASIC AUTOMATION

10.2.1 BY FUNCTION

10.2.1.1 INVOICE GENERATION

10.2.1.2 TRANSACTION TRACKING

10.2.1.3 PAYMENT REMINDER

10.3 ADVANCED AUTOMATION

11 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY PRICING CATEGORY

11.1 OVERVIEW

11.2 SUBSCRIPTION BASED

11.2.1 ANNUAL SUBSCRIPTION

11.2.2 MONTHLY SUBSCRIPTION

11.3 FREE

12 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY END USER

12.1 OVERVIEW

12.2 MANUFACTURING

12.2.1 BY OFFERING

12.2.1.1 SOLUTIONS

12.2.1.2 SERVICES

12.3 FOOD AND BEVERAGES

12.3.1 BY OFFERING

12.3.1.1 SOLUTIONS

12.3.1.2 SERVICES

12.4 ENERGY AND UTILITIES

12.4.1 BY OFFERING

12.4.1.1 SOLUTIONS

12.4.1.2 SERVICES

12.5 HEALTHCARE

12.5.1 BY OFFERING

12.5.1.1 SOLUTIONS

12.5.1.2 SERVICES

12.6 BANKING, FINANCIAL SERVICES, AND INSURANCE

12.6.1 BY OFFERING

12.6.1.1 SOLUTIONS

12.6.1.2 SERVICES

12.7 IT AND TELECOMMUNICATION

12.7.1 BY OFFERING

12.7.1.1 SOLUTIONS

12.7.1.2 SERVICES

12.8 GOVERNMENT AND PUBLIC SECTOR

12.8.1 BY OFFERING

12.8.1.1 SOLUTIONS

12.8.1.2 SERVICES

12.9 CONSTRUCTION

12.9.1 BY OFFERING

12.9.1.1 SOLUTIONS

12.9.1.2 SERVICES

12.1 TRANSPORTATION AND LOGISTICS

12.10.1 BY OFFERING

12.10.1.1 SOLUTIONS

12.10.1.2 SERVICES

12.11 RETAIL AND CONSUMER GOODS

12.11.1 BY OFFERING

12.11.1.1 SOLUTIONS

12.11.1.2 SERVICES

12.12 HOSPITALITY

12.12.1 BY OFFERING

12.12.1.1 SOLUTIONS

12.12.1.2 SERVICES

12.13 OTHERS

12.13.1 BY OFFERING

12.13.1.1 SOLUTIONS

12.13.1.2 SERVICES

13 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SPAIN

14 SWOT ANALYSIS

15 COMPANY PROFILINGS

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 SAGE GROUP PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 SOLUTION PORTFOLIO

15.2.4 RECENT DEVELOPMENT

15.3 ESKER

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 SOLUTION PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 QUADIENT

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 SOLUTION PORTFOLIO

15.4.4 RECENT DEVELOPMENT

15.5 CELONIS

15.5.1 COMPANY SNAPSHOT

15.5.2 SOLUTION PORTFOLIO

15.5.3 RECENT DEVELOPMENT

15.6 BLACKLINE INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 SOLUTION PORTFOLIO

15.6.4 RECENT DEVELOPMENT

15.7 CERTINIA (BY FINANCIAL FORCE)

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DYNATOS

15.8.1 COMPANY SNAPSHOT

15.8.2 SOLUTION PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 EDICOM

15.9.1 COMPANY SNAPSHOT

15.9.2 SOLUTION PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 IRON MOUNTAIN, INC.

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 SOLUTION PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 PAGERO

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 SOLUTION PORTFOLIO

15.11.4 RECENT DEVELOPMENT

15.12 QUALCO GROUP OF COMPANIES

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 SERRALA

15.13.1 COMPANY SNAPSHOT

15.13.2 SOLUTION PORTFOLIO

15.13.3 RECENT DEVELOPMENT

15.14 ZOHO CORPORATION PVT. LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 BRAND PORTFOLIO

15.14.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 2 SPAIN SOLUTIONS IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY TYPE, 2020-2030

TABLE 3 SPAIN SERVICES IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY TYPE, 2020-2030

TABLE 4 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2030 (USD MILLION)

TABLE 5 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY ENTERPRISE SIZE, 2020-2030 (USD MILLION)

TABLE 6 SPAIN LARGE ENTERPRISE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2030 (USD MILLION)

TABLE 7 SPAIN SMALL AND MEDIUM ENTERPRISE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY DEPLOYMENT TYPE, 2020-2030 (USD MILLION)

TABLE 8 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OPERATING SYSTEM, 2020-2030 (USD MILLION)

TABLE 9 SPAIN MOBILE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY TYPE, 2020-2030 (USD MILLION)

TABLE 10 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY AUTOMATION LEVEL, 2020-2030 (USD MILLION)

TABLE 11 SPAIN BASIC AUTOMATION IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY FUNCTION, 2020-2030 (USD MILLION)

TABLE 12 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY PRICING CATEGORY, 2020-2030 (USD MILLION)

TABLE 13 SPAIN SUBSCRIPTION BASED IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY TYPE, 2020-2030 (USD MILLION)

TABLE 14 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY END USER, 2020-2030 (USD MILLION)

TABLE 15 SPAIN MANUFACTURING IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 16 SPAIN FOOD AND BEVERAGES IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 17 SPAIN ENERGY AND UTILITIES IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 18 SPAIN HEALTHCARE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 19 SPAIN BANKING, FINANCIAL SERVICES, AND INSURANCE IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 20 SPAIN IT AND TELECOMMUNICATION IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 21 SPAIN GOVERNMENT AND PUBLIC SECTOR IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 22 SPAIN CONSTRUCTION IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 23 SPAIN TRANSPORTATION AND LOGISTICS IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 24 SPAIN RETAIL AND CONSUMER GOODS IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 25 SPAIN HOSPITALITY IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

TABLE 26 SPAIN OTHERS IN ACCOUNTS RECEIVABLE AUTOMATION MARKET, BY OFFERING, 2020-2030 (USD MILLION)

Liste des figures

FIGURE 1 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: SEGMENTATION

FIGURE 2 SPAIN ACCOUNTS RECEIABLE AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: END USER COVERAGE GRID ANALYSIS

FIGURE 9 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: MULTIVARIATE MODELLING

FIGURE 10 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: OFFERING TIME LINE CURVE

FIGURE 11 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: SEGMENTATION

FIGURE 12 INCREASING ADOPTION OF CLOUD-BASED AR AUTOMATION SOLUTIONS IS EXPECTED TO BE KEY DRIVER FOR SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 13 SOLUTION IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 PORTER’S FIVE FORCES MODEL

FIGURE 15 PENETRATION BY SECTOR OF ACTIVITY FOR SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET

FIGURE 16 VALUE CHAIN FOR SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET

FIGURE 18 ADVANTAGES OF AUTOMATED ARM

FIGURE 19 USE OF AUTOMATED AR SOLUTIONS IN VARIOUS INDUSTRIES

FIGURE 20 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY OFFERING, 2022

FIGURE 21 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY DEPLOYMEN TYPE, 2022

FIGURE 22 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY ENTERPRISE SIZE, 2022

FIGURE 23 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY OPERATING SYSTEM, 2022

FIGURE 24 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY AUTOMATION LEVEL, 2022

FIGURE 25 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY PRICING CATEGORY, 2022

FIGURE 26 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: BY END USER, 2022

FIGURE 27 SPAIN ACCOUNTS RECEIVABLE AUTOMATION MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.