Marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique, par type de gisement (carbonate de talc, chlorite de talc et autres), utilisation finale (pâte à papier et papier, industrie du plastique et des polymères, peintures et revêtements, céramique, industrie du caoutchouc, cosmétiques et soins personnels, industrie alimentaire, produits pharmaceutiques, agriculture, adhésifs et produits d'étanchéité, et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique

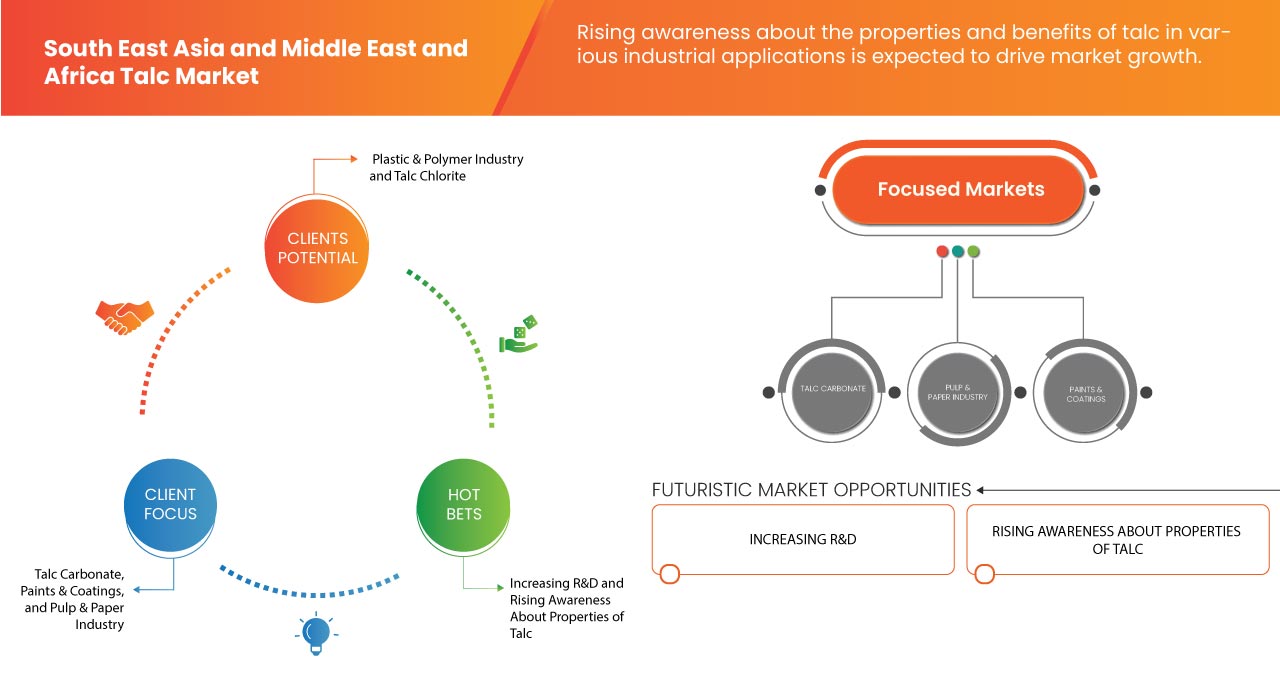

L'un des principaux facteurs à l'origine de la croissance du marché est la demande croissante de talc dans les secteurs de la céramique et de la construction. L'utilisation croissante du talc dans le secteur agricole comme charge et support dans les pesticides et les engrais conduit à l'expansion du marché. L'expansion des applications industrielles du talc dans les peintures, les revêtements, les plastiques et les produits en caoutchouc influence également le marché. Cependant, les restrictions réglementaires et les préoccupations concernant la sécurité des produits à base de talc devraient freiner la croissance du marché au cours de la période de prévision.

D’autre part, la prise de conscience croissante des propriétés et des avantages du talc dans diverses applications industrielles devrait créer une opportunité de croissance du marché. Cependant, les fluctuations des prix des matières premières et les incertitudes géopolitiques affectant la dynamique de la chaîne d’approvisionnement devraient constituer un défi pour la croissance du marché.

La demande de talc va augmenter en raison de la demande croissante de diverses industries. Diverses entreprises prennent des initiatives qui conduisent progressivement à la croissance du marché.

Data Bridge Market Research analyse que le marché du talc en Asie du Sud-Est devrait atteindre 207 805,69 milliers USD d'ici 2030, à un TCAC de 5,3 % au cours de la période de prévision. Le marché du talc au Moyen-Orient et en Afrique devrait atteindre 167 479,50 milliers USD d'ici 2030, à un TCAC de 4,5 % au cours de la période de prévision. Le carbonate de talc dans le segment de type gisement fournit la plus grande part du marché en raison de la demande croissante de talc dans les industries de la céramique et de la construction. Ce rapport de marché couvre également en profondeur l'analyse des prix et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en unités, prix en dollars américains |

|

Segments couverts |

Type de dépôt (carbonate de talc, chlorite de talc et autres), utilisation finale (pâte à papier et papier, industrie du plastique et des polymères, peintures et revêtements, céramique , industrie du caoutchouc, cosmétiques et soins personnels, industrie alimentaire, produits pharmaceutiques, agriculture, adhésifs et produits d'étanchéité, et autres) |

|

Pays couverts |

Singapour, Indonésie, Malaisie, Thaïlande, reste de l'Asie du Sud-Est, Afrique du Sud, Arabie saoudite, Émirats arabes unis, Israël, Égypte, Qatar et reste du Moyen-Orient et de l'Afrique |

|

Acteurs du marché couverts |

Imerys, Sibelco, Minerals Technologies Inc., ELEMENTIS PLC., TRIVLAB, IMI Fabi SpA, Nippon Talc Co., Ltd. et Kaolin (Malaysia) Sdn Bhd. entre autres |

Définition du marché

Le talc est couramment utilisé dans les cosmétiques, les produits de soin de la peau et les articles d'hygiène personnelle tels que le talc, les poudres corporelles et les produits de maquillage. Il est apprécié pour sa capacité à absorber l'humidité et à fournir une texture lisse. Il est utilisé dans l'industrie pharmaceutique pour ses propriétés lubrifiantes et antiadhésives. On le trouve dans divers médicaments, pilules et comprimés pour éviter le collage pendant la fabrication et assurer une bonne cohérence du dosage. Il est ajouté aux produits en plastique et en polymère pour améliorer leurs propriétés mécaniques, améliorer le traitement et réduire les coûts. Il peut fournir un renforcement, augmenter la rigidité et améliorer la stabilité dimensionnelle.

Dynamique du marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de talc dans les industries de la céramique et de la construction

Le talc est largement utilisé dans l'industrie de la céramique comme agent de remplissage et de flux. Il améliore les propriétés de la céramique, telles que la blancheur, la translucidité et la résistance thermique. La demande de produits céramiques, notamment de carrelage, d'appareils sanitaires et de vaisselle, n'a cessé d'augmenter en Asie du Sud-Est, au Moyen-Orient et en Afrique en raison de la croissance démographique, de l'urbanisation et des activités de construction. En conséquence, la demande de talc dans le secteur de la céramique est en hausse, ce qui devrait stimuler la croissance du marché.

Dans le secteur de la construction, le talc est utilisé dans divers matériaux de construction, tels que les peintures, les revêtements, les produits d'étanchéité et les adhésifs. Le talc est utilisé comme agent de remplissage fonctionnel et agent anti-blocage dans ces produits, améliorant leurs performances et leurs propriétés.

Par exemple,

- Les régions du Moyen-Orient et de l’Afrique ont connu un développement important de la construction et des infrastructures ces dernières années. Par exemple, les Émirats arabes unis ont connu un boom de la construction avec des projets tels que l’Expo 2020 de Dubaï, divers centres commerciaux géants et des projets immobiliers. De même, des pays africains comme le Kenya, le Nigéria et l’Éthiopie ont connu d’importants projets d’infrastructures, notamment des routes, des ponts et des aéroports. La demande de talc dans les matériaux de construction tels que les peintures, les revêtements et les adhésifs a augmenté en conséquence, contribuant à la croissance du marché dans ces régions.

Ainsi, la demande croissante de talc dans les industries de la céramique et de la construction crée des conditions favorables pour le marché, ce qui devrait stimuler la croissance du marché.

- Utilisation croissante du talc dans le secteur agricole comme agent de remplissage et support dans les pesticides et les engrais

Le talc agit comme un agent de remplissage et un support fonctionnel dans les produits agricoles tels que les pesticides et les engrais. Il contribue à améliorer les caractéristiques de manipulation et d'application de ces formulations en améliorant leur capacité d'écoulement et en réduisant l'agglutination. L'ajout de talc garantit que les ingrédients actifs des pesticides et des engrais sont répartis uniformément, ce qui permet une application plus efficace et plus uniforme sur les cultures.

L'Asie du Sud-Est, le Moyen-Orient et l'Afrique sont des régions où l'agriculture est importante. L'agriculture est un secteur crucial dans ces régions, contribuant de manière significative à leurs économies et à leur sécurité alimentaire. On observe parallèlement une augmentation de l'utilisation de produits agrochimiques tels que les pesticides et les engrais, car la demande de produits agricoles augmente pour répondre aux besoins croissants de la population. Cela, à son tour, stimule la demande de talc en tant que composant essentiel de ces formulations.

Opportunité

- Sensibilisation accrue aux propriétés et aux avantages du talc dans diverses applications industrielles

Le talc est utilisé comme charge dans les plastiques et les polymères pour améliorer leurs propriétés mécaniques, telles que la rigidité, la résistance aux chocs et la stabilité dimensionnelle. La demande croissante de plastiques dans diverses industries, notamment l'automobile, l'emballage et les biens de consommation, a conduit à une utilisation accrue du talc comme additif rentable et améliorant les performances.

Le talc est un composant important dans l'industrie des peintures et des revêtements, où il agit comme charge et extenseur fonctionnels. Il contribue à améliorer l'adhérence, l'opacité et la résistance aux intempéries de la peinture, ce qui en fait un choix privilégié dans les revêtements architecturaux et industriels. La demande de talc dans le secteur des peintures et des revêtements est susceptible d'augmenter à mesure que le développement de la construction et des infrastructures augmente dans la région.

Ainsi, la sensibilisation croissante aux propriétés et aux avantages du talc dans ces diverses applications industrielles devrait offrir une opportunité de croissance du marché.

Contraintes/ Défis

- Les fluctuations des prix des matières premières et les incertitudes géopolitiques affectent la dynamique de la chaîne d'approvisionnement

Le talc provient de diverses mines du monde entier et sa disponibilité et son prix peuvent être influencés par des facteurs tels que les conditions géologiques, les capacités de production et les événements géopolitiques. Les fluctuations des prix des matières premières peuvent perturber la planification de la chaîne d'approvisionnement et les stratégies de tarification des fabricants de talc. Des variations rapides des prix peuvent entraîner une augmentation des coûts de production, une réduction des marges bénéficiaires et des difficultés à maintenir la stabilité des prix pour les utilisateurs finaux.

Les incertitudes géopolitiques, les conflits commerciaux ou d’autres facteurs externes peuvent entraîner des perturbations de la chaîne d’approvisionnement sur le marché du talc. Les restrictions à l’importation et à l’exportation, les tarifs douaniers ou les tensions politiques peuvent affecter la circulation du talc à travers les frontières, provoquant potentiellement des retards et des pénuries dans la chaîne d’approvisionnement. Ces perturbations peuvent avoir un impact sur la disponibilité des produits à base de talc et entraîner une augmentation des prix pour les utilisateurs finaux.

Par exemple,

- Les incertitudes géopolitiques, notamment les différends commerciaux et les tarifs douaniers imposés par divers pays, peuvent influencer la dynamique de la chaîne d'approvisionnement du marché du talc. Par exemple, les changements de politiques commerciales et de tarifs douaniers entre les pays producteurs de talc et les régions importatrices d'Asie du Sud-Est et du Moyen-Orient peuvent entraîner des fluctuations des prix et de l'offre de talc. Les tarifs douaniers peuvent augmenter les coûts d'importation, affectant ainsi la compétitivité globale des produits à base de talc sur le marché.

Ainsi, les fluctuations des prix des matières premières et les incertitudes géopolitiques affectant la dynamique de la chaîne d’approvisionnement devraient constituer un défi à la croissance du marché.

- Restrictions réglementaires et préoccupations concernant la sécurité des produits à base de talc

Plusieurs pays d'Asie du Sud-Est, du Moyen-Orient et d'Afrique ont mis en place des réglementations strictes concernant l'utilisation du talc dans les produits de consommation, notamment dans les cosmétiques et les produits de soins personnels. Ces réglementations visent à garantir la sécurité des consommateurs et à prévenir les risques potentiels pour la santé associés à l'utilisation du talc. Certaines autorités réglementaires ont fixé des limites à la présence d'amiante, un cancérigène connu, dans les produits à base de talc. Si des produits à base de talc contiennent de l'amiante au-delà des niveaux autorisés, leur utilisation peut être interdite ou restreinte dans ces régions.

La sécurité du talc a fait l'objet de controverses en raison de son lien potentiel avec certains problèmes de santé. En particulier, le talc a été associé à un risque accru de cancer de l'ovaire lorsqu'il est utilisé dans la région génitale par les femmes. Les inquiétudes concernant la sécurité du talc ont donné lieu à des poursuites judiciaires et à une sensibilisation accrue des consommateurs aux risques potentiels liés à l'utilisation de produits contenant du talc. Ces inquiétudes ont probablement entraîné une baisse de la demande de produits à base de talc en Asie du Sud-Est et au Moyen-Orient et en Afrique.

Par exemple,

- En 2019, l'Autorité sud-africaine de réglementation des produits de santé (SAHPRA) a émis un rappel préventif de certains produits de poudre pour bébé Johnson & Johnson après avoir détecté des traces d'amiante dans le talc utilisé dans la formulation. Cet incident a suscité de vives inquiétudes quant à la sécurité des produits à base de talc dans le pays.

- La Food and Drug Administration (FDA) des Philippines a mis en place des réglementations pour garantir la sécurité des produits cosmétiques, y compris ceux contenant du talc. Les entreprises sont tenues de respecter les normes de sécurité et de fournir la preuve de l'absence d'amiante dans leurs formulations de talc.

Ces exemples démontrent que divers pays du Moyen-Orient, d’Afrique et d’Asie du Sud-Est ont pris des mesures réglementaires et mis en œuvre des mesures pour répondre aux préoccupations concernant la sécurité des produits à base de talc, ce qui devrait freiner la croissance du marché au cours de la période de prévision.

Développements récents

- En 2022, Nippon Talc Co., Ltd. a entièrement acquis la société pakistanaise FAITH MINERALS (PVT.) LTD., avec laquelle elle avait créé une coentreprise en 2015. La société est désormais une filiale à 100 % de Nippon Talc Co., Ltd. Cela renforcera la part de marché de l'entreprise et améliorera son empreinte dans l'entreprise.

- En septembre 2020, Imerys a obtenu la note Platinum d'EcoVadis en matière de développement durable. Cette note a renforcé l'image de l'entreprise sur le marché et a placé Imerys dans le top 1% des entreprises évaluées dans le monde.

Portée du marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique

Le marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique est divisé en deux segments notables en fonction du type de gisement et de l'utilisation finale. La croissance de ces segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de dépôt

- Carbonate de talc

- Chlorite de talc

- Autres

Sur la base du type de gisement, le marché est segmenté en carbonate de talc, chlorite de talc et autres.

Utilisation finale

- Pâte à papier et papier

- Industrie des plastiques et des polymères

- Peintures et revêtements

- Céramique

- Industrie du caoutchouc

- Cosmétiques et soins personnels

- Industrie alimentaire

- Médicaments

- Agriculture

- Adhésifs et produits d'étanchéité

- Autres

Sur la base de l'utilisation finale, le marché est segmenté en pâte et papier, industrie du plastique et des polymères, peintures et revêtements, céramique, industrie du caoutchouc, cosmétiques et soins personnels, industrie alimentaire, produits pharmaceutiques, agriculture, adhésifs et produits d'étanchéité, et autres.

Analyse/perspectives du marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique

Le marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique est analysé sur la base du type de gisement et de l’utilisation finale comme indiqué ci-dessus.

Les pays couverts dans ce rapport de marché sont Singapour, l’Indonésie, la Malaisie, la Thaïlande, le reste de l’Asie du Sud-Est, l’Afrique du Sud, l’Arabie saoudite, les Émirats arabes unis, Israël, l’Égypte, le Qatar et le reste du Moyen-Orient et de l’Afrique.

Singapour devrait dominer la région de l'Asie du Sud-Est en raison de la présence de nombreux acteurs majeurs opérant dans le pays. L'Afrique du Sud devrait dominer la région du Moyen-Orient et de l'Afrique en raison de l'augmentation des initiatives telles que les acquisitions, les collaborations et les lancements de produits par les fabricants pour distribuer efficacement leurs produits aux consommateurs.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Paysage concurrentiel et analyse des parts de marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique

Le paysage concurrentiel du marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise sur le marché.

Certains des principaux acteurs opérant sur le marché du talc en Asie du Sud-Est, au Moyen-Orient et en Afrique sont Imerys, Sibelco, Minerals Technologies Inc., ELEMENTIS PLC., TRIVLAB, IMI Fabi SpA, Nippon Talc Co., Ltd. et Kaolin (Malaysia) Sdn Bhd. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 SOUTH EAST AND AFRICA DEPOSIT TYPE SEGMENT LIFELINE CURVE

2.8 MIDDLE EAST AND AFRICA DEPOSIT TYPE SEGMENT LIFELINE CURVE

2.9 MARKET END USE COVERAGE GRID

2.1 DBMR MARKET POSITION GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LIST OF TOP POTENTIAL BUYERS FOR TALC

4.2 IMPORT EXPORT SCENARIO

4.2.1 THAILAND

4.2.2 MALAYSIA

4.2.3 VIETNAM

4.2.4 SINGAPORE

4.2.5 INDONESIA

4.2.6 U.A.E.

4.2.7 SAUDI ARABIA

4.2.8 EGYPT

4.2.9 SOUTH AFRICA

4.2.10 QATAR

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 LOGISTIC COST SCENARIO

4.3.2 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.4 PRODUCTION CAPACITY OUTLOOK

4.5 COUNTRY WISE PRICING ANALYSIS

5 LIST OF COMPANIES WHO USING SUBSTITUTE INSTEAD OF TALC

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 GROWING DEMAND FOR TALC IN THE CERAMICS AND CONSTRUCTION INDUSTRIES

6.1.2 INCREASING USE OF TALC IN THE AGRICULTURE SECTOR AS A FILLER AND CARRIER IN PESTICIDES AND FERTILIZERS

6.1.3 EXPANDING INDUSTRIAL APPLICATIONS OF TALC IN PAINTS, COATINGS, PLASTICS, AND RUBBER PRODUCTS

6.1.4 INCREASING USE OF TALC IN THE AUTOMOTIVE INDUSTRIES

6.2 RESTRAINTS

6.2.1 REGULATORY RESTRICTIONS AND CONCERNS OVER THE SAFETY OF TALC PRODUCTS

6.2.2 ENVIRONMENTAL CONCERNS AND PRESSURE TO FIND SUSTAINABLE ALTERNATIVES TO TALC

6.3 OPPORTUNITIES

6.3.1 RISING AWARENESS ABOUT THE PROPERTIES AND BENEFITS OF TALC IN VARIOUS INDUSTRIAL APPLICATIONS

6.3.2 DIVERSIFICATION INTO HIGH-VALUE APPLICATIONS SUCH AS PHARMACEUTICALS AND COSMETICS

6.4 CHALLENGES

6.4.1 FLUCTUATING RAW MATERIAL PRICES AND GEOPOLITICAL UNCERTAINTIES AFFECTING SUPPLY CHAIN DYNAMICS

6.4.2 RISING COMPETITION FROM IMPORTED TALC PRODUCTS

7 SOUTH EAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET, BY DEPOSIT TYPE

7.1 OVERVIEW

7.2 TALC CARBONATE

7.3 TALC CHLORITE

7.4 OTHERS

8 SOUTH EAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET, BY END USE

8.1 OVERVIEW

8.2 PULP & PAPER

8.2.1 FILLER

8.2.2 PITCH CONTROL

8.2.3 OTHERS

8.3 PLASTIC & POLYMER INDUSTRY

8.3.1 PP AUTOMOBILES

8.3.2 PP/PA APPLIANCES

8.3.3 HDPE FILMS AND PACKAGING

8.3.4 BLOWN FILMS

8.3.5 CARRY BAGS

8.3.6 PVC WIRES & CABLES

8.3.7 OTHERS

8.4 PAINTS & COATINGS

8.4.1 DECORATIVE PAINTS

8.4.2 INDUSTRIAL PAINTS

8.5 CERAMICS

8.5.1 TILES

8.5.2 SANITARY WARE

8.5.3 DINNERWARE

8.5.4 PORCELAIN

8.5.5 OTHERS

8.6 RUBBER INDUSTRY

8.6.1 LATEX GLOVES

8.6.2 TYRES

8.6.3 RUBBER SHEETS

8.6.4 PIPES

8.6.5 DIAPHRAGMS

8.6.6 SHOE SOLES

8.6.7 OTHERS

8.7 COSMETICS AND PERSONAL CARE

8.7.1 TOOTHPASTE

8.7.2 SOAPS

8.7.3 DETERGENTS

8.7.4 OTHERS

8.8 FOOD INDUSTRY

8.9 PHARMACEUTICALS

8.9.1 FILLER IN TABLETS

8.9.2 OINTMENTS

8.9.3 OTHERS

8.1 AGRICULTURE

8.10.1 ANIMAL FEED

8.10.2 FERTILIZERS

8.10.3 PESTICIDES

8.10.4 OTHERS

8.11 ADHESIVES AND SEALANTS

8.12 OTHERS

9 SOUTH EAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET :BY REGION

9.1 SOUTH EAST ASIA

9.2 MIDDLE EAST AND AFRICA

10 SOUTH EAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: SOUTH EAST ASIA

10.2 COMPANY SHARE ANALYSIS: MIDDLE EAST AND AFRICA

11 COMPANY PROFILE

11.1 IMERYS

11.1.1 COMPANY SNAPSHOT

11.1.2 REVENUE ANALYSIS

11.1.3 PRODUCT PORTFOLIO

11.1.4 RECENT DEVELOPMENT

11.2 SIBELCO

11.2.1 COMPANY SNAPSHOT

11.2.2 REVENUE ANALYSIS

11.2.3 PRODUCT PORTFOLIO

11.2.4 RECENT DEVELOPMENT

11.3 MINERALS TECHNOLOGIES INC.

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 PRODUCT PORTFOLIO

11.3.4 RECENT DEVELOPMENT

11.4 ELEMENTIS PLC.

11.4.1 COMPANY SNAPSHOT

11.4.2 REVENUE ANALYSIS

11.4.3 PRODUCT PORTFOLIO

11.4.4 RECENT DEVELOPMENT

11.5 TRIVLAB

11.5.1 COMPANY SNAPSHOT

11.5.2 PRODUCT PORTFOLIO

11.5.3 RECENT DEVELOPMENT

11.6 IMI FABI SPA

11.6.1 COMPANY SNAPSHOT

11.6.2 PRODUCT PORTFOLIO

11.6.3 RECENT DEVELOPMENT

11.7 KAOLIN (MALAYSIA) SDN BHD.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT DEVELOPMENT

11.8 NIPPON TALC CO.,LTD.

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT DEVELOPMENT

12 QUESTIONNAIRE

13 RELATED REPORTS

Liste des tableaux

TABLE 1 TOP 5 COMPANIES - PRODUCTION CAPACITY ANALYSIS

TABLE 2 COUNTRY-WISE PRICING ANALYSIS FOR THE DEPOSIT TYPE SEGMENT

TABLE 3 SOUTH EAST ASIA TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 4 MIDDLE EAST AND AFRICA TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 5 SOUTH EAST ASIA TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 6 MIDDLE EAST AND AFRICA TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 7 SOUTH EAST ASIA PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 8 MIDDLE EAST AND AFRICA PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 9 SOUTH EAST ASIA PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 MIDDLE EAST AND AFRICA PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 11 SOUTH EAST ASIA PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 12 MIDDLE EAST AND AFRICA PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 13 SOUTH EAST ASIA CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 14 MIDDLE EAST AND AFRICA CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 15 SOUTH EAST ASIA RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 16 MIDDLE EAST AND AFRICA RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 17 SOUTH EAST ASIA COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 18 MIDDLE EAST AND AFRICA COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 19 SOUTH EAST ASIA PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 20 MIDDLE EAST AND AFRICA PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 SOUTH EAST ASIA AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 22 MIDDLE EAST AND AFRICA AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 23 SOUTH EAST ASIA TALC MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 24 SINGAPORE TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 25 SINGAPORE TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 26 SINGAPORE PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 27 SINGAPORE PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 28 SINGAPORE PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 29 SINGAPORE CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 30 SINGAPORE RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 SINGAPORE COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 32 SINGAPORE PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 33 SINGAPORE AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 34 INDONESIA TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 35 INDONESIA TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 36 INDONESIA PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 37 INDONESIA PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 38 INDONESIA PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 39 INDONESIA CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 INDONESIA RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 41 INDONESIA COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 42 INDONESIA PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 INDONESIA AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 44 MALAYSIA TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 45 MALAYSIA TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 46 MALAYSIA PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 47 MALAYSIA PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 MALAYSIA PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 49 MALAYSIA CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 50 MALAYSIA RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 MALAYSIA COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 52 MALAYSIA PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 53 MALAYSIA AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 54 THAILAND TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 55 THAILAND TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 56 THAILAND PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 57 THAILAND PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 58 THAILAND PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 THAILAND CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 60 THAILAND RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 61 THAILAND COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 62 THAILAND PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 63 THAILAND AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 REST OF SOUTH EAST ASIA TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 65 MIDDLE EAST AND AFRICA TALC MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 66 SOUTH AFRICA TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 67 SOUTH AFRICA TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 68 SOUTH AFRICA PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 69 SOUTH AFRICA PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 70 SOUTH AFRICA PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 71 SOUTH AFRICA CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 72 SOUTH AFRICA RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 73 SOUTH AFRICA COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 74 SOUTH AFRICA PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 75 SOUTH AFRICA AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 76 SAUDI ARABIA TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 77 SAUDI ARABIA TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 78 SAUDI ARABIA PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 79 SAUDI ARABIA PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 80 SAUDI ARABIA PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 81 SAUDI ARABIA CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 82 SAUDI ARABIA RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 83 SAUDI ARABIA COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 84 SAUDI ARABIA PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 85 SAUDI ARABIA AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 86 U.A.E. TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 87 U.A.E. TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 88 U.A.E. PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 89 U.A.E. PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 90 U.A.E. PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 91 U.A.E. CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 92 U.A.E. RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 93 U.A.E. COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 94 U.A.E. PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 95 U.A.E. AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 96 ISRAEL TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 97 ISRAEL TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 98 ISRAEL PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 99 ISRAEL PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 100 ISRAEL PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 101 ISRAEL CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 102 ISRAEL RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 103 ISRAEL COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 104 ISRAEL PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 105 ISRAEL AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 106 EGYPT TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 107 EGYPT TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 108 EGYPT PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 109 EGYPT PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 110 EGYPT PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 111 EGYPT CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 112 EGYPT RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 113 EGYPT COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 114 EGYPT PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 115 EGYPT AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 116 QATAR TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

TABLE 117 QATAR TALC MARKET, BY END USE, 2021-2030 (USD THOUSAND)

TABLE 118 QATAR PULP & PAPER IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 119 QATAR PLASTIC & POLYMER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 120 QATAR PAINTS & COATINGS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 121 QATAR CERAMICS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 122 QATAR RUBBER INDUSTRY IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 123 QATAR COSMETIC & PERSONAL CARE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 124 QATAR PHARMACEUTICALS IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 125 QATAR AGRICULTURE IN TALC MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 126 REST OF MIDDLE EAST AND AFRICA TALC MARKET, BY DEPOSIT TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: SEGMENTATION

FIGURE 2 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: DATA TRIANGULATION

FIGURE 3 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: DROC ANALYSIS

FIGURE 4 SOUTHEAST ASIA TALC MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 MIDDLE EAST AND AFRICA TALC MARKET: REGIONAL MARKET ANALYSIS

FIGURE 6 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 7 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: MARKET END USE COVERAGE GRID

FIGURE 9 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET: SEGMENTATION

FIGURE 12 THE INCREASING USE OF TALC IN THE AGRICULTURE SECTOR AS A FILLER AND CARRIER IN PESTICIDES AND FERTILIZERS ARE EXPECTED TO DRIVE THE GROWTH OF THE SOUTHEAST ASIA TALC MARKET FROM 2023 TO 2030

FIGURE 13 GROWING DEMAND FOR TALC IN THE CERAMICS AND CONSTRUCTION INDUSTRIES IS EXPECTED TO DRIVE THE GROWTH OF THE MIDDLE EAST AND AFRICA TALC MARKET FROM 2023 TO 2030

FIGURE 14 THE TALC CARBONATE SEGMENT, IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SOUTHEAST ASIA TALC MARKET IN 2023 & 2030

FIGURE 15 THE TALC CARBONATE SEGMENT, IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE MIDDLE EAST AND AFRICA TALC MARKET IN 2023 & 2030

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE SOUTHEAST ASIA AND MIDDLE EAST AND AFRICA TALC MARKET

FIGURE 17 SOUTH EAST ASIA TALC MARKET: BY DEPOSIT TYPE, 2022

FIGURE 18 MIDDLE EAST AND AFRICA TALC MARKET: BY DEPOSIT TYPE, 2022

FIGURE 19 SOUTH EAST ASIA TALC MARKET: BY END USE, 2022

FIGURE 20 MIDDLE EAST AND AFRICA TALC MARKET: BY END USE, 2022

FIGURE 21 SOUTH EAST ASIA TALC MARKET: SNAPSHOT (2022)

FIGURE 22 SOUTH EAST ASIA TALC MARKET: BY COUNTRY (2022)

FIGURE 23 SOUTH EAST ASIA TALC MARKET: BY COUNTRY (2023 & 2030)

FIGURE 24 SOUTH EAST ASIA TALC MARKET: BY COUNTRY (2022 & 2030)

FIGURE 25 SOUTH EAST ASIA TALC MARKET: BY DEPOSIT TYPE (2023-2030)

FIGURE 26 MIDDLE EAST AND AFRICA TALC MARKET: SNAPSHOT (2022)

FIGURE 27 MIDDLE EAST AND AFRICA TALC MARKET: BY COUNTRY (2022)

FIGURE 28 MIDDLE EAST AND AFRICA TALC MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 MIDDLE EAST AND AFRICA TALC MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 MIDDLE EAST AND AFRICA TALC MARKET: BY DEPOSIT TYPE (2023-2030)

FIGURE 31 SOUTH EAST ASIA TALC MARKET: COMPANY SHARE 2022 (%)

FIGURE 32 MIDDLE EAST AND AFRICA TALC MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.