Saudi Arabia Glass Market

Taille du marché en milliards USD

TCAC :

%

USD

1.53 Billion

USD

2.50 Billion

2024

2032

USD

1.53 Billion

USD

2.50 Billion

2024

2032

| 2025 –2032 | |

| USD 1.53 Billion | |

| USD 2.50 Billion | |

|

|

|

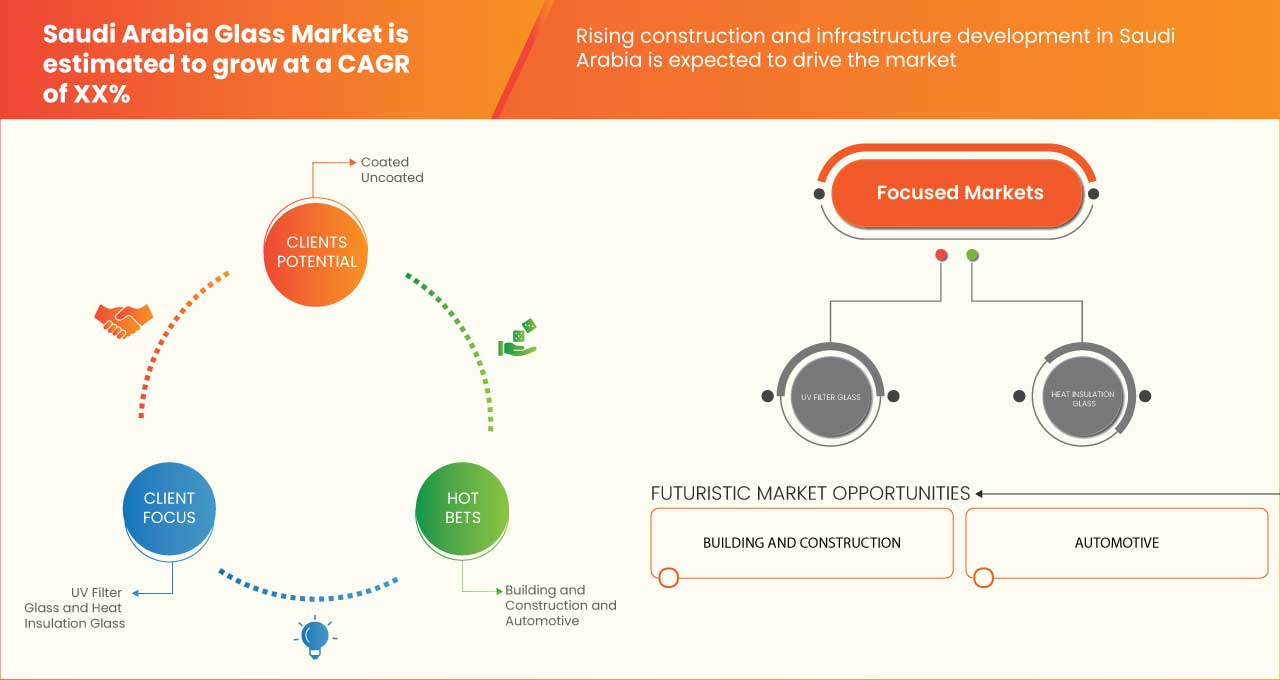

Segmentation du marché du verre en Arabie saoudite, par type (verre flotté, verre coulé, verre teinté, verre architectural , verre trempé, verre feuilleté, verre à double vitrage, verre de sécurité, verre à motifs ou verre texturé, verre armé, verre extra clair, verre soufflé, verre de puits de lumière, verre sablé, verre coupe-feu ou résistant, verre spécial, verre décoratif, verre clair, verre d'impression numérique et autres), produit (revêtu et non revêtu), fonction (verre filtrant UV, verre d'isolation thermique, vitrage de sécurité, vitrage insonorisé, verre autonettoyant, verre échangeur d'ions et autres), épaisseur (4 mm, 5 mm, 6 mm, 8 mm, 2 mm, 3 mm, 10 mm, 12 mm et plus de 12 mm), application (bâtiment et construction, automobile, aérospatiale, appareils électroniques, énergie solaire et autres) - Tendances et prévisions de l'industrie jusqu'en 2032

Analyse du marché du verre

Le marché du verre en Arabie saoudite connaît une croissance en raison de la demande accrue dans les secteurs de la construction, de l'automobile et de l'emballage. Sous l'effet des projets de développement des infrastructures, notamment Vision 2030, la demande du secteur de la construction en verre architectural, tel que le verre économe en énergie et le verre décoratif, est en hausse. Le secteur automobile contribue également de manière significative à l'augmentation de la production de véhicules. De plus, la demande croissante des consommateurs pour les produits emballés stimule le marché de l'emballage en verre. Les tendances en matière de durabilité et l'adoption de technologies respectueuses de l'environnement dans la production de verre deviennent également des facteurs importants. La production locale est en croissance, plusieurs fabricants de verre investissant dans des technologies de pointe, tandis que les importations restent importantes, en particulier pour les produits en verre spécialisés.

Taille du marché du verre

Le marché du verre en Arabie saoudite devrait atteindre 2,50 milliards USD d’ici 2032, contre 1,53 milliard USD en 2024, avec un TCAC substantiel de 6,4 % au cours de la période de prévision de 2025 à 2032. En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d’approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire.

Tendances du marché du verre

« Demande croissante de produits en verre économes en énergie et esthétiques »

Le marché du verre en Arabie saoudite connaît une croissance constante, tirée par l'essor des secteurs de la construction et de l'immobilier. La demande croissante de produits en verre économes en énergie et esthétiques, tels que le verre trempé, feuilleté et isolant, alimente l'expansion du marché. L'impulsion donnée par le gouvernement pour des projets d'infrastructures à grande échelle, notamment des villes intelligentes et des complexes commerciaux, accélère encore la consommation de verre. En outre, l'essor des tendances en matière de construction écologique et des initiatives de développement durable stimule la demande de solutions de verre respectueuses de l'environnement et à hautes performances. Les principaux acteurs du marché se concentrent sur l'innovation et les avancées technologiques pour répondre à ces exigences. Avec l'urbanisation continue et l'accent mis sur la modernisation, le marché du verre en Arabie saoudite devrait poursuivre sa trajectoire positive.

Portée du rapport et segmentation du marché du verre

|

Attributs |

Informations clés sur le marché du verre |

|

Segments couverts |

|

|

Principaux acteurs du marché |

Guardian Industries Holdings Site (États-Unis), IKKGlass (Arabie saoudite), AGC Inc. (Japon), Saint-Gobain (France), Obeikan Glass Company (Arabie saoudite), Alma (Arabie saoudite), United float glass (Arabie saoudite), ARABIAN PROCESSING GLASS CO. (Arabie saoudite) et REGION GLASS (Arabie saoudite) entre autres |

|

Opportunités de marché |

|

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché du verre

Le marché du verre désigne l'industrie mondiale impliquée dans la production, la distribution et la consommation de produits en verre. Ce marché englobe différents types de verre, tels que le verre flotté, le verre trempé, le verre feuilleté et le verre spécial, qui sont utilisés dans des secteurs tels que la construction, l'automobile, l'emballage, l'électronique et les biens de consommation. Le marché est influencé par des facteurs tels que les avancées technologiques, la disponibilité des matières premières, les réglementations environnementales et la demande des consommateurs pour des solutions de verre durables et innovantes. Les principaux acteurs du marché du verre sont les fabricants, les distributeurs et les utilisateurs finaux, qui contribuent tous à la croissance et à la diversification du secteur.

Dynamique du marché du verre

Conducteurs

- Urbanisation rapide et développement des infrastructures

L’urbanisation rapide et le développement des infrastructures sont des moteurs importants du marché du verre, façonnant le paysage de la construction et du design modernes dans la région. Alors que le Royaume continue de diversifier son économie pour s’affranchir de sa dépendance au pétrole, des projets à grande échelle dans le cadre d’initiatives telles que Saudi Vision 2030 ont catalysé une poussée du développement urbain. L’un des aspects clés de cette urbanisation est la croissance des mégalopoles et des centres urbains, en particulier dans des villes comme Riyad, Djeddah et Dammam. L’augmentation de la population et la demande de logements, d’espaces commerciaux et d’infrastructures publiques entraînent le besoin de solutions architecturales modernes, où le verre joue un rôle crucial. Les façades en verre sont non seulement esthétiques, mais améliorent également la fonctionnalité des bâtiments en laissant entrer la lumière naturelle, en améliorant l’efficacité énergétique et en fournissant une isolation thermique. Outre le développement résidentiel et commercial, les secteurs florissants de l’éducation et de la santé stimulent également la demande de verre. Les écoles et les hôpitaux modernes intègrent de plus en plus le verre pour l’esthétique du design, l’amélioration de l’éclairage naturel et les fonctions de sécurité renforcées. Cette croissance holistique dans divers secteurs souligne le rôle vital du verre dans la transformation urbaine de l’Arabie saoudite.

Par exemple,

Selon un blog du Programme des Nations Unies pour les établissements humains, le programme Future Saudi Cities, une collaboration entre le ministère saoudien des Affaires municipales et rurales et ONU-Habitat, vise à améliorer les politiques urbaines dans 17 grandes villes en promouvant un développement régional équilibré. L'initiative met l'accent sur l'engagement communautaire, en impliquant notamment les femmes et les jeunes dans la planification urbaine, par le biais de profils stratégiques et de projets pilotes.

- L'accent est mis de plus en plus sur les objectifs de développement durable et les initiatives en matière de construction écologique

Le marché saoudien du verre connaît une croissance significative, principalement tirée par l'accent croissant mis sur les objectifs de durabilité et les initiatives de construction écologique. Alors que le pays évolue vers un avenir plus durable, le verre joue un rôle crucial dans l'amélioration de l'efficacité énergétique, la réduction de l'empreinte carbone et la promotion de pratiques de construction respectueuses de l'environnement. L'un des principaux moteurs du marché du verre est sa capacité inhérente à améliorer l'efficacité énergétique des bâtiments. Le verre haute performance, comme les unités à faible émissivité (low-E) et à triple vitrage, peut réduire considérablement la consommation d'énergie en minimisant le transfert de chaleur. Dans un pays comme l'Arabie saoudite, où les températures peuvent grimper en flèche, le vitrage à haut rendement énergétique contribue à maintenir des environnements intérieurs confortables, réduisant ainsi la dépendance aux systèmes de climatisation. Cela permet non seulement de réduire les factures d'énergie des consommateurs, mais contribue également aux efforts nationaux visant à réduire la consommation globale d'énergie, conformément aux objectifs de la Vision 2030 de l'Arabie saoudite. L'accent mis sur les certifications de construction écologique, telles que LEED (Leadership in Energy and Environmental Design) et BREEAM (Building Research Establishment Environmental Assessment Method), alimente encore davantage la demande de verre. Les bâtiments qui intègrent des matériaux durables, notamment du verre écologique, sont plus susceptibles d’obtenir ces certifications, ce qui améliore leur valeur marchande et leur valeur. Alors que l’Arabie saoudite continue d’investir dans des mégaprojets tels que NEOM et le projet de la mer Rouge, qui privilégient la conception durable, la demande de solutions de verre innovantes devrait augmenter.

Opportunités

- Progrès technologiques et innovations dans la fabrication du verre

Le marché saoudien du verre est sur le point de connaître une transformation importante, portée par les avancées technologiques et les innovations dans la fabrication du verre. Avec l'initiative nationale Vision 2030 qui promeut la diversification et le développement durable, il existe une demande croissante de solutions de verre haute performance qui améliorent l'efficacité énergétique et l'attrait esthétique de l'architecture moderne. Des innovations telles que les revêtements à faible émissivité (Low-E) et les unités de vitrage isolant avancées améliorent non seulement les performances thermiques, mais contribuent également à réduire la consommation d'énergie, conformément aux tendances mondiales en matière de durabilité. En outre, l'introduction de technologies de verre intelligent, qui peuvent ajuster la transparence en fonction des conditions environnementales, offre aux architectes une flexibilité de conception sans précédent tout en améliorant le confort de l'utilisateur.

Par exemple,

En mai 2024, un article publié par Centuro Global affirmait que Vision 2030 visait à diversifier l'économie saoudienne pour la rendre moins dépendante du pétrole, en tenant compte des prévisions de pic pétrolier. Sous la direction du prince héritier MBS, l'initiative promeut également les réformes sociales, notamment le développement culturel. À mi-chemin, les progrès sont évidents, mais des défis subsistent pour atteindre pleinement ces objectifs ambitieux.

- Initiatives gouvernementales croissantes en faveur du développement urbain

Le marché saoudien du verre est sur le point de connaître une croissance significative, stimulée par une augmentation des initiatives gouvernementales axées sur le développement urbain. La stratégie Saudi Vision 2030 met l'accent sur la diversification et la modernisation, visant à transformer les villes en centres urbains durables et technologiquement avancés. Cette évolution génère une demande accrue de solutions architecturales innovantes, en particulier dans la fabrication du verre, qui joue un rôle crucial dans l'amélioration de la fonctionnalité et de l'esthétique des bâtiments modernes. Les investissements gouvernementaux dans des mégaprojets, tels que NEOM et le projet de la mer Rouge, entre autres, soulignent la nécessité de produits en verre haute performance qui répondent à des normes de durabilité strictes. Ces projets donnent la priorité à l'efficacité énergétique et aux solutions de verre architectural telles que le verre à faible émissivité (Low-E) et le verre isolant, qui sont essentiels pour minimiser la consommation d'énergie et optimiser la climatisation. En outre, la tendance vers les villes intelligentes intègre des technologies de verre avancées qui permettent un contrôle dynamique de la lumière et de la consommation d'énergie, s'alignant davantage sur les objectifs nationaux de durabilité.

Contraintes/Défis

- Coûts initiaux élevés des verres architecturaux avancés

La demande sur le marché saoudien du verre est confrontée à des perturbations importantes en raison des coûts initiaux élevés des verres architecturaux avancés. Ces produits avancés comprennent des technologies de verre à haut rendement énergétique, de contrôle solaire et intelligent, qui offrent de nombreux avantages tels que l'isolation thermique, la protection UV et l'attrait esthétique. Cependant, les coûts élevés associés à leur production et à leur installation peuvent constituer un obstacle considérable à la croissance du marché. La production de verre architectural avancé implique des processus de fabrication sophistiqués et des technologies de pointe, qui nécessitent des investissements en capital substantiels. Le besoin de matières premières de haute qualité, d'ingénierie précise et d'installations de pointe contribue aux coûts de production élevés. Ces dépenses peuvent être particulièrement lourdes pour les petites et moyennes entreprises (PME) qui tentent de pénétrer le marché, car elles peuvent manquer de ressources financières pour investir dans ces technologies avancées.

- Réglementations environnementales et normes de sécurité des bâtiments strictes

Le marché du verre en Arabie saoudite est confronté à des défis importants en raison de réglementations environnementales et de normes de sécurité des bâtiments strictes. Alors que le pays accorde de plus en plus d’importance à la durabilité, les fabricants et les constructeurs sont tenus de se conformer à des directives rigoureuses visant à réduire l’impact environnemental. Si ces réglementations favorisent l’innovation dans les produits verriers économes en énergie et durables, elles imposent également des contraintes sur les processus de production et les matériaux, ce qui peut augmenter les coûts pour les fabricants. La demande de verre haute performance répondant aux nouvelles normes d’efficacité énergétique est devenue primordiale. Les revêtements à faible émissivité (Low-E) et les vitrages isolants sont désormais essentiels dans les projets architecturaux, car ils contribuent à minimiser la consommation d’énergie et à améliorer le confort thermique. Cependant, le développement et l’intégration de ces technologies avancées nécessitent des investissements importants dans la recherche et le développement, ce qui peut être difficile pour les petites entreprises.

Ce rapport de marché fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et local, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact et scénario actuel du marché en cas de pénurie de matières premières et de retards d'expédition

Data Bridge Market Research propose une analyse de haut niveau du marché et fournit des informations en tenant compte de l'impact et de l'environnement actuel du marché en matière de pénurie de matières premières et de retards d'expédition. Cela se traduit par l'évaluation des possibilités stratégiques, la création de plans d'action efficaces et l'assistance aux entreprises dans la prise de décisions importantes.

Outre le rapport standard, nous proposons également une analyse approfondie du niveau d'approvisionnement à partir des retards d'expédition prévus, de la cartographie des distributeurs par région, de l'analyse des produits de base, de l'analyse de la production, des tendances de la cartographie des prix, de l'approvisionnement, de l'analyse des performances des catégories, des solutions de gestion des risques de la chaîne d'approvisionnement, de l'analyse comparative avancée et d'autres services d'approvisionnement et de soutien stratégique.

Impact attendu du ralentissement économique sur les prix et la disponibilité des produits

Lorsque l'activité économique ralentit, les industries commencent à souffrir. Les effets prévus du ralentissement économique sur les prix et l'accessibilité des produits sont pris en compte dans les rapports d'analyse du marché et les services de renseignements fournis par DBMR. Grâce à cela, nos clients peuvent généralement garder une longueur d'avance sur leurs concurrents, projeter leurs ventes et leurs revenus et estimer leurs dépenses de profits et pertes.

Portée du marché du verre

Le marché est segmenté en fonction du type, du produit, de l'épaisseur, de la fonction et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Verre flotté

- Verre coulé

- Verre teinté

- Vitrage plat teinté à contrôle solaire

- Aluminium

- Argent

- Verre architectural

- Verre trempé

- Verre feuilleté

- Double vitrage

- Verre de sécurité

- Verre pare-balles

- Verre coupe-feu

- Verre antidéflagrant

- Verre anti-attaque

- Autres

- Verre à motifs ou verre texturé

- Verre armé

- Verre extra clair

- Verre soufflé

- Puits de lumière en verre

- Sablage du verre

- Verre coupe-feu ou résistant

- Verre spécial

- Verre décoratif

- Verre clair

- Impression numérique sur verre

- Autres

Produit

- Recouvert

- Revêtement par revêtement de résine

- Polyuréthane

- Acrylique

- Époxy

- Résine alkyde

- Résine de silicone

- Autres

- Revêtement, par technologie de revêtement

- À base de solvant

- À base d'eau

- Revêtements nano

- Revêtement, procédé de revêtement

- Dépôt physique en phase vapeur (PVD) (pulvérisation magnétron)

- Sol-Gel

- Dépôt chimique en phase vapeur (CVD) (pyrolytique)

- Dépôt chimique en phase vapeur (CVD) (pyrolytique), par type

- Plasma amélioré (PECVD)

- Pression atmosphérique (APCVD)

- Basse pression (LPCVD)

- Dépôt chimique en phase vapeur (CVD) (pyrolytique), par type

- Revêtement par revêtement de résine

- Non revêtu

Fonction

- Verre filtrant UV

- Verre isolant thermique

- Vitrage de sécurité

- Vitrage insonorisé

- Verre autonettoyant

- Verre échangeur d'ions

- Autres

Épaisseur

- 4 mm

- 5 mm

- 6 mm

- 8 mm

- 2 mm

- 3 mm

- 10 mm

- 12 mm

- Plus de 12 mm

Application

- Bâtiment et construction

- Résidentiel

- Commercial

- Industriel

- Institutionnel

- Automobile

- Fabricant d'équipement d'origine

- Pièces de rechange

- Aérospatial

- Appareils électroniques

- Énergie solaire

- Verre photovoltaïque

- Système d'énergie solaire concentrée

- Autres

Part de marché du verre

Le paysage concurrentiel du marché fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Les leaders du marché du verre opérant sur le marché sont :

- Site de Guardian Industries Holdings (États-Unis)

- IKKGlass (Arabie Saoudite)

- AGC Inc. (Japon)

- Saint-Gobain (France)

- Obeikan Glass Company (Arabie Saoudite)

- Alma (Arabie Saoudite)

- Verre flotté uni (Arabie Saoudite)

- ARABIAN PROCESSING GLASS CO. (Arabie Saoudite)

- REGION GLASS (Arabie Saoudite)

Les derniers développements sur le marché du verre

- En septembre 2024, Guardian Industries Holdings Site s'est récemment associé à Privacy Glass Solutions pour commercialiser une technologie d'occultation totale. Ce développement se concentre sur l'amélioration des caractéristiques d'intimité du verre, permettant une opacité complète lorsque cela est nécessaire, idéale pour les applications architecturales dynamiques. La technologie vise à commercialiser une solution de verre haute performance pour les façades de bâtiments et autres environnements où l'intimité est cruciale

- En avril 2024, Guardian Industries Holdings Site a lancé Guardian CrystalClear, un verre à teneur réduite en fer qui offre une clarté et une transmission de la lumière supérieures. Ce nouveau produit est conçu pour les applications architecturales et intérieures, offrant une transparence et une précision des couleurs exceptionnelles. Il est idéal pour les applications telles que les fenêtres, les façades et les puits de lumière, contribuant à maximiser la lumière naturelle tout en améliorant l'attrait esthétique de tout espace. Le verre améliore également l'efficacité énergétique grâce à sa haute qualité optique

- En novembre 2024, AGC Inc. a récemment franchi une étape importante en nommant ses substrats en verre de la série M100/200 pour les lunettes AR/MR parmi les « lauréats » des CES 2025 Innovation Awards. Cette prestigieuse reconnaissance souligne les contributions innovantes d'AGC dans la catégorie « Technologies XR et accessoires »

- En février 2023, AGC et Saint-Gobain, fabricants mondiaux de verre plat leaders en matière de développement durable, ont annoncé leur collaboration à la conception d'une ligne pilote de verre plat révolutionnaire qui devrait réduire considérablement ses émissions directes de CO2.

- En février 2022, Obeikan Glass Company détient 50 % du marché saoudien du verre flotté et se concentre sur de nouvelles industries transformatrices. Cela a aidé l'entreprise à élargir son portefeuille de produits dans plusieurs secteurs

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 CURRENCY AND PRICING

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 DBMR MARKET POSITION GRID

2.8 MARKET APPLICATION COVERAGE GRID

2.9 DBMR VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.1.1 THREAT OF NEW ENTRANTS

4.1.2 THREAT OF SUBSTITUTES

4.1.3 BARGAINING POWER OF SUPPLIERS

4.1.4 BARGAINING POWER OF BUYERS

4.1.5 COMPETITIVE RIVALRY

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 TECHNOLOGICAL FACTORS

4.2.5 ENVIRONMENTAL FACTORS

4.2.6 LEGAL FACTORS

4.3 IMPORT EXPORT SCENARIO

4.4 PRICING ANALYSIS

4.5 PRODUCTION CONSUMPTION ANALYSIS

4.6 VENDOR SELECTION CRITERIA

4.6.1 QUALITY AND CONSISTENCY

4.6.2 TECHNICAL EXPERTISE

4.6.3 SUPPLY CHAIN RELIABILITY

4.6.4 COMPLIANCE AND SUSTAINABILITY

4.6.5 COST AND PRICING STRUCTURE

4.6.6 FINANCIAL STABILITY

4.6.7 FLEXIBILITY AND CUSTOMIZATION

4.6.8 RISK MANAGEMENT AND CONTINGENCY PLANS

4.7 CLIMATE CHANGE SCENARIO FOR SAUDI ARABIA GLASS MARKET

4.7.1 IMPACT OF CLIMATE CHANGE ON SAUDI ARABIA GLASS MARKET

4.7.2 RISING TEMPERATURES AND ENERGY EFFICIENCY DEMANDS

4.7.3 DEMAND FOR SOLAR CONTROL AND UV FILTER GLASS

4.7.4 THE ROLE OF COATED AND INSULATED GLASS

4.7.5 ENVIRONMENTAL REGULATIONS AND SUSTAINABILITY

4.7.6 URBANIZATION AND THE CONSTRUCTION BOOM

4.7.7 CONCLUSION

4.8 PRODUCTION CAPACITY OVERVIEW

4.9 RAW MATERIAL COVERAGE

4.9.1 KEY RAW MATERIALS FOR GLASS

4.9.2 SOURCING AND SUPPLY CHAIN CONSIDERATIONS

4.9.3 CHALLENGES AND OPPORTUNITIES

4.9.4 CONCLUSION

4.1 SUPPLY CHAIN ANALYSIS

4.10.1 OVERVIEW

4.10.2 LOGISTIC COST SCENARIO

4.10.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.10.4 CONCLUSION

4.11 SUPPLY AND DEMAND ANALYSIS

4.11.1 DEMAND DYNAMICS

4.11.2 SUPPLY TRENDS

4.11.3 IMPORT AND EXPORT BALANCE

4.11.4 FACTORS IMPACTING SUPPLY AND DEMAND

4.12 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.12.1 LOW-EMISSIVITY (LOW-E) GLASS

4.12.2 SMART GLASS INTEGRATION

4.12.3 SOLAR CONTROL GLASS

4.12.4 LAMINATED SAFETY GLASS

4.12.5 INSULATED GLASS UNITS (IGUS)

5 REGULATION COVERAGE

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT

6.1.2 RISING FOCUS ON SUSTAINABILITY GOALS AND GREEN BUILDING INITIATIVES

6.1.3 RAPIDLY GROWING TOURISM AND HOSPITALITY INDUSTRY

6.2 RESTRAINTS

6.2.1 HIGH INITIAL COSTS OF ADVANCED ARCHITECTURAL GLASSES

6.2.2 STIFF COMPETITION FROM ALTERNATIVE MATERIALS

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS AND INNOVATIONS IN GLASS MANUFACTURING

6.3.2 RISING GOVERNMENT INITIATIVES FOR URBAN DEVELOPMENT

6.4 CHALLENGES

6.4.1 STRINGENT ENVIRONMENTAL REGULATIONS AND BUILDING SAFETY STANDARDS

6.4.2 FLUCTUATING RAW MATERIAL PRICES

7 SAUDI ARABIA GLASS MARKET, BY TYPE

7.1 OVERVIEW

7.2 FLOAT GLASS

7.3 CAST GLASS

7.4 TINTED GLASS

7.5 ARCHITECTURAL GLASS

7.6 TEMPERED GLASS

7.7 LAMINATED GLASS

7.8 DOUBLE GLAZING GLASS

7.9 SECURITY GLASS

7.1 PATTERNED GLASS OR TEXTURED GLASS

7.11 WIRED GLASS

7.12 EXTRA CLEAR GLASS

7.13 BLOWN GLASS

7.14 SKYLIGHTS GLASS

7.15 SAND BLASTING GLASS

7.16 FIRE-RATED OR RESISTANCE GLASS

7.17 SPECIAL GLASS

7.18 DECORATIVE GLASS

7.19 CLEAR GLASS

7.2 DIGITAL PRINTING GLASS

7.21 OTHERS

8 SAUDI ARABIA GLASS MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 COATED

8.3 UNCOATED

9 SAUDI ARABIA GLASS MARKET, BY FUNCTION

9.1 OVERVIEW

9.2 UV FILTER GLASS

9.3 HEAT INSULATION GLASS

9.4 SAFETY GLAZING

9.5 SOUNDPROOFED GLAZING

9.6 SELF-CLEANING GLASS

9.7 ION EXCHANGE GLASS

9.8 OTHERS

10 SAUDI ARABIA GLASS MARKET, BY THICKNESS

10.1 OVERVIEW

10.2 4 MM

10.3 5 MM

10.4 6 MM

10.5 8 MM

10.6 2 MM

10.7 3 MM

10.8 10 MM

10.9 12 MM

10.1 MORE THAN 12 MM

11 SAUDI ARABIA GLASS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 BUILDING AND CONSTRUCTION

11.3 AUTOMOTIVE

11.4 AEROSPACE

11.5 ELECTRONIC APPLIANCES

11.6 SOLAR ENERGY

11.7 OTHERS

12 SAUDI ARABIA GLASS MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 GUARDIAN INDUSTRIES HOLDINGS SITE

14.1.1 COMPANY SNAPSHOT

14.1.2 PRODUCT PORTFOLIO

14.1.3 RECENT DEVELOPMENTS

14.2 IKKGLASS

14.2.1 COMPANY SNAPSHOT

14.2.2 PRODUCT PORTFOLIO

14.2.3 RECENT DEVELOPMENT

14.3 AGC INC.

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 PRODUCT PORTFOLIO

14.3.4 RECENT DEVELOPMENTS

14.4 SAINT-GOBAIN

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 PRODUCT PORTFOLIO

14.4.4 RECENT DEVELOPMENT

14.5 OBEIKAN GLASS COMPANY

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 PRODUCT PORTFOLIO

14.5.4 RECENT DEVELOPMENT

14.6 ALMA

14.6.1 COMPANY SNAPSHOT

14.6.2 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENT

14.7 ARABIAN PROCESSING GLASS CO.

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENT

14.8 REGIONGLASS

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENT

14.9 UNITED FLOAT GLASS

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENT

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPANIES ESTIMATED PRODUCTION CAPACITY OVERVIEW, 2023 (THOUSAND SQUARE METER)

TABLE 2 REGULATORY COVERAGE

TABLE 3 SAUDI ARABIA GLASS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 SAUDI ARABIA GLASS MARKET, BY TYPE, 2018-2032 (THOUSAND SQUARE METER)

TABLE 5 SAUDI ARABIA TINTED GLASS IN GLASS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 SAUDI ARABIA SECURITY GLASS IN GLASS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 7 SAUDI ARABIA GLASS MARKET, BY PRODUCT, 2018-2032 (USD THOUSAND)

TABLE 8 SAUDI ARABIA COATED IN GLASS MARKET, BY COATING RESIN, 2018-2032 (USD THOUSAND)

TABLE 9 SAUDI ARABIA COATED IN GLASS MARKET, BY COATING TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 10 SAUDI ARABIA COATED IN GLASS MARKET, BY COATING PROCESS, 2018-2032 (USD THOUSAND)

TABLE 11 SAUDI ARABIA CHEMICAL VAPOR DEPOSITION (CVD) (PYROLYTIC) IN GLASS MARKET, BY TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 SAUDI ARABIA GLASS MARKET, BY FUNCTION, 2018-2032 (USD THOUSAND)

TABLE 13 SAUDI ARABIA GLASS MARKET, BY THICKNESS, 2018-2032 (USD THOUSAND)

TABLE 14 SAUDI ARABIA GLASS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 15 SAUDI ARABIA BUILDING AND CONSTRUCTION IN GLASS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 16 SAUDI ARABIA AUTOMOTIVE IN GLASS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 17 SAUDI ARABIA SOLAR ENERGY IN GLASS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 SAUDI ARABIA GLASS MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA GLASS MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA GLASS MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA GLASS MARKET: COUNTRY-WISE MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA GLASS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA GLASS MARKET: MULTIVARIATE MODELLING

FIGURE 7 SAUDI ARABIA GLASS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 SAUDI ARABIA GLASS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 SAUDI ARABIA GLASS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 SAUDI ARABIA GLASS MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 SAUDI ARABIA GLASS MARKET: SEGMENTATION

FIGURE 12 SAUDI ARABIA GLASS MARKET:-EXECUTIVE SUMMARY

FIGURE 13 TWENTY SEGMENTS COMPRISE THE SAUDI ARABIA GLASS MARKET, BY TYPE (2024)

FIGURE 14 SAUDI ARABIA GLASS MARKET:-STRATEGIC DECISIONS

FIGURE 15 RAPID URBANIZATION AND INFRASTRUCTURE DEVELOPMENT IN SAUDI ARABIA IS EXPECTED TO DRIVE THE SAUDI ARABIA GLASS MARKET IN THE FORECAST PERIOD

FIGURE 16 THE FLOAT GLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA GLASS MARKET IN 2025 AND 2032

FIGURE 17 PORTER’S FIVE FORCES

FIGURE 18 PESTEL ANALYSIS

FIGURE 19 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 20 SAUDI ARABIA GLASS MARKET, 2024-2032, AVERAGE SELLING PRICE (USD/SQUARE METER)

FIGURE 21 PRODUCTION CONSUMPTION ANALYSIS: SAUDI ARABIA GLASS MARKET

FIGURE 22 VENDOR SELECTION CRITERIA

FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR SAUDI ARABIA GLASS MARKET

FIGURE 24 SAUDI ARABIA GLASS MARKET: BY TYPE, 2024

FIGURE 25 SAUDI ARABIA GLASS MARKET: BY PRODUCT, 2024

FIGURE 26 SAUDI ARABIA GLASS MARKET: BY FUNCTION, 2024

FIGURE 27 SAUDI ARABIA GLASS MARKET: BY THICKNESS, 2024

FIGURE 28 SAUDI ARABIA GLASS MARKET: BY APPLICATION, 2024

FIGURE 29 SAUDI ARABIA GLASS MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.