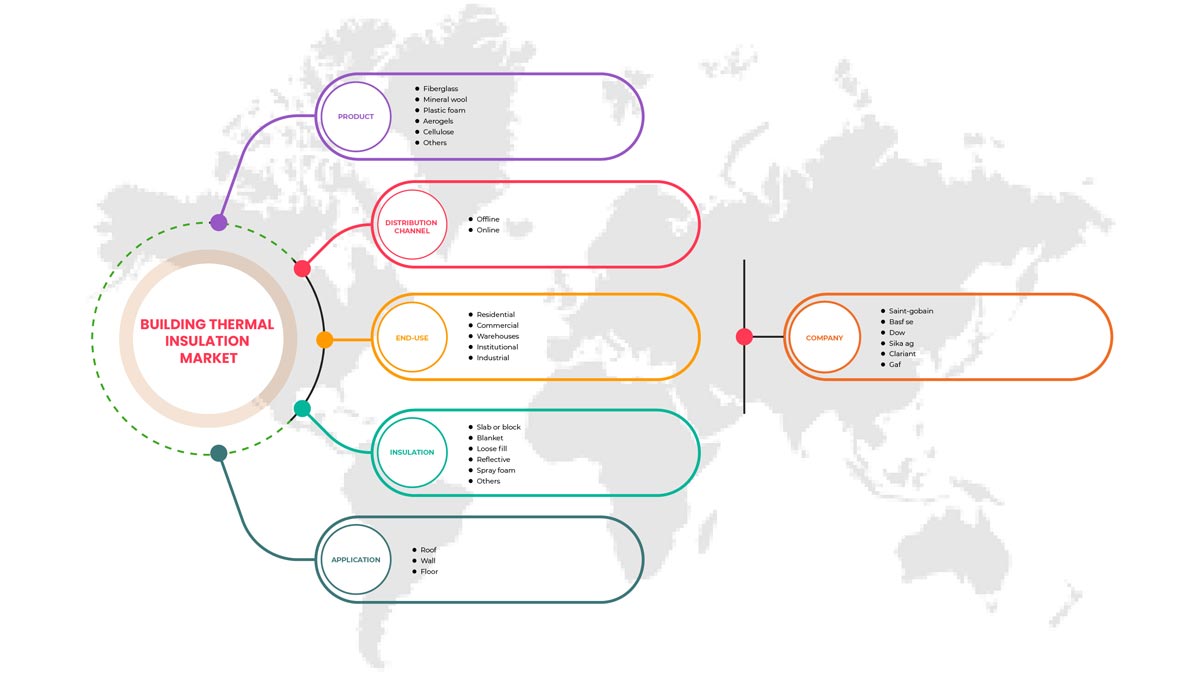

Saudi Arabia Building Thermal Insulation Market, By Product (FiberglassMineral Wool, Plastic Foam, Aerogels, Cellulose, and Others), Insulation (Slab or Block, Blanket, Loose Fill, Reflective, Spray Foam, and Others), Distribution Channel (Offline and Online), Application (Roof, Wall, and Floor), End-use (Residential, Commercial, Warehouses, Institutional, and Industrial) Industry Trends and Forecast to 2029.

Saudi Arabia Building Thermal Insulation Market Analysis and Insights

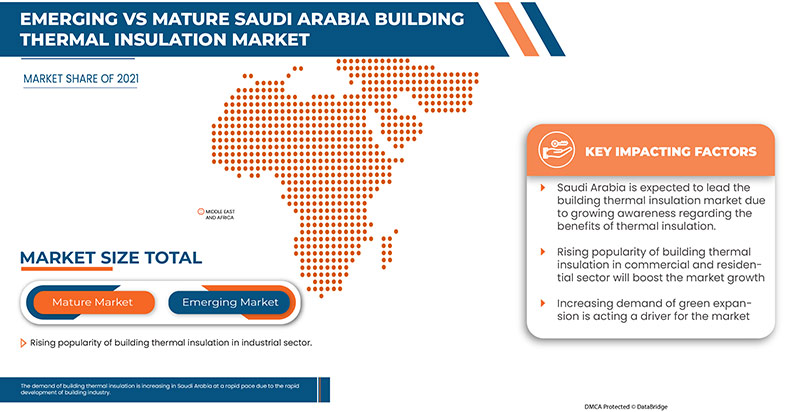

The Saudi Arabia building thermal insulation market is expected to gain significant growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyzes that the market is growing with a CAGR of 7.0% in the forecast period of 2022 to 2029 and is expected to reach USD 437,612.95 thousand by 2029. The major factor driving the growth market is the growing popularity of plastic foam as a lightweight material in building and construction, the expansion of green buildings, and rising importance of rooftop insulation.

Building thermal insulation products have been gaining popularity and are widely used in the building and construction industry, especially in residential, commercial, and industrial sectors. On account of the rising investments in infrastructure development and supportive government initiatives toward sustainability in the country are expected to provide an opportunity for bolstering the market growth. Furthermore, several market players are investing in R&D activities to launch new products to cater to the requirements of the infrastructure sector.

Saudi Arabia building thermal insulation market report provides details of market share, new developments, and the impact of domestic and localized market players, analyzes opportunities in terms of emerging revenue pockets, changes in market regulations, products approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

By Product (Fiberglass, Mineral Wool, Plastic Foam, Aerogels, Cellulose, and Others), Insulation (Slab or Block, Blanket, Loose Fill, Reflective, Spray Foam, and Others), Distribution Channel (Offline and Online), Application (Roof, Wall, and Floor), End-use (Residential, Commercial, Warehouses, Institutional, and Industrial). |

|

Countries Covered |

Saudi Arabia |

|

Market Players Covered |

Saudi Rock Wool Factory, Arabian Fiberglass Insulation Company Ltd., BASF SE, SAINT-GOBAIN, Dow, DuPont, Wanhua Chemical Group Co., Ltd, MASCO, Clariant, PPG Industries, Inc., Fahad International Group, Saudi Vetonit Co. Ltd, Nippon Sheet Glass Co., Ltd, Sika AG, Fletcher Building, and GAF |

Market Definition

Building thermal insulation is a technology that helps in reducing energy consumption in buildings by preventing the amount of heat loss/gain through the building envelope. Thermal insulation is made up of different materials such as fiberglass, mineral wool, plastic foam, aerogels, cellulose, and others. Mineral wool is further segmented into stone wool and glass wool. These materials have great thermal insulation properties due to which they have a wide range of applications in heating buildings in Saudi Arabia. Thermal insulation made with mineral wool helps in maintaining the required temperature by preventing heat loss. On the other hand, fiberglass thermal insulation is one of the most popular insulation materials because of its cost-effectiveness and eco-friendliness. It is made up of recycled glass which makes it an eco-friendly option. Thermal insulation manufactured by using a variety of materials has extensive applications in industrial, commercial, and residential complexes.

Saudi Arabia Building Thermal Insulation Market Dynamics

DRIVERS

- Expansion of green building

Green buildings are less toxic to the environment than standard structures. Their development limits nearby reviewing, saves normal assets by utilizing elective building materials, and reuses development squander instead of sending many trucks to landfills. In a greater part of a green building, inside spaces have normal lighting and outside sees. At the same time, profoundly productive central air (warming, ventilating, and cooling) frameworks and low-Volatile Organic Compound (VOC) (unpredictable natural compound) materials such as furniture, paint, and flooring make unrivaled indoor air quality.

A sustainable or green building is a structure that, due to its development and construction, can improve or maintain the standard of the environment in which it is found. For accomplishing an elevated degree of proficiency, decreasing the utilization of energy, water, and different assets to limit pollution is fundamental. Green buildings are also called maintainable or elite execution structures. They include making designs and use of harmless materials to the ecosystem and asset productive all through the existing pattern of a building, including operation, deconstruction, construction, maintenance renovation, designing, and siting.

The UAE has the most raised pace of imperativeness usage in the Gulf Cooperation Council (GCC) zone and one of the most surprising essentialness usages per unit in the world.

Presenting the ideas of green structures, natural security, an earth-wide temperature boost, and manageability in schools and college educational plans can bring issues to light. Moreover, gatherings and shows on green structures will help raise public mindfulness and mindfulness among field professionals. These mindfulness-raising estimates will assist in making a general public fan of green structures and open doors to cooperation and information sharing. Protection from change is hard to miss on the lookout and requires government mediation, which remembers starting to lead the pack to develop new green structures and present new guidelines (for example, punishments and impetuses).

- Growing popularity of plastic foam as a lightweight material in building construction

Plastic becomes foam when responded to by the blowing specialist. Plastic foam is non-fibrous; individual protection instrument is not needed during mounting. Various plastic foams include phenolic, Polyisocyanurate (PIR), polystyrene, elastomeric, and Polyurethane (PUR). The enormous market of plastic froth is attributable to its application in different temperature ranges. Likewise, the better life pattern of the material makes it reasonable for applications such as walls, floors, and rooftops. Its high warm opposition, adaptability, strength, and life expectancy drive its interest. As it is light weighted, most of the building companies in Saudi Arabia use plastic foam during construction.

Plastic foams are treated by similar surface-planning techniques utilized for the base polymer. This is especially valid for the thermoplastic "primary" foams, for example, polycarbonate and altered polyphenylene oxide. At times, these thermoplastic foams might be dissolvable and solidified. The thermosetting foams most usually experienced is polyurethane, accessible in flexible, rigid, and semi-rigid foam. The rigid foam is realistic in a large number of densities. With their expanded surface area of genuine material uncovered, the denser grades will be simpler to plan by the standard procedure of sanding softly and afterward eliminating the subsequent residue by vacuum or brushing off.

Insulation systems with polyethylene foam make it conceivable to address a complex of undertakings that, to some degree, guarantee the energy effectiveness of building, lodging, and special objects. The execution of the idea of consistent protection coatings empowers acknowledgment of the accompanying energy effectiveness parts. As a matter of some importance, it is the end of direct intensity misfortunes through the protecting covering or, on the other hand, chilly conservation in the protected item. Furthermore, the insurance of designs from outer climatic effects or forceful inward conditions contributes to the durability of these designs.

Thirdly, it makes it conceivable to construct an ideal interior microclimate, contingent upon the utilitarian reason for the article. The economy portions where the frameworks of consistent protection made of polyethylene froth are utilized address private and modern developments, erection of farming offices, protection of sports offices, and such an imaginative region as snow preservation. Protection frameworks using polyethylene foam with a consistent joint showed great outcomes in the protection of carports, stockrooms of farming items, and livestock facilities. In the considered frameworks, it is feasible to recognize properties both normal of a wide range of items and specific ones, which should be carried out to tackle explicit functional issues.

- Rising importance of rooftop insulation

The demand is assessed to surge for the level of rooftop protection due to the quickly extending development industry. Private and non-private ventures in nations such as China, Saudi Arabia, India, and the U.S. are driving the market or level rooftop protection market. The restoration and remodel drive the market in this fragment. The materials utilized for rooftop protection incorporate stone fleece, PUR and PIR froth, EPS froth and XPS foam, stone wool, EPS foam, PUR and PIR foam, and XPS foam. Guidelines for developing energy-effective buildings are supposed to impel the market in the private building section. Properties of building thermal insulation on materials such as fire security and high warm effectiveness are additionally assessed to expand their interest.

Green rooftops enjoy numerous biological benefits. They give protection and cooling and diminish metropolitan intensity in urban communities. They conceal a critical cooling impact and diminish the temperature. Besides, the intensity is not keeping up within green rooftop equivalent to customary rooftops. Then again, they are viable in the sound protection of the structures, which is a significant point in metropolitan regions, and what's more, they upgrade a natural life propensity. Green rooftops likewise clean the air and save energy. They play a critical part in stormwater the board and their effect on carbon dioxide decrease. In addition, they are useful in food creation and tasteful angles. The creation and upkeep of the green rooftops need a few particular offices. The green rooftop can be based on the assortments of the rooftop; however, in the greater parts of cases, they are developed on level rooftops.

Notwithstanding various rooftops, they have various styles of building frameworks and utilized materials. There is a procedure to build green rooftops on any rooftop. However, the most well-known issue is the limit of the weight carriage. The most fitting time for building a green rooftop is the hour of developing another structure or at the point when the top of a current structure needs fixes or to be supplanted; in both circumstances, a primary expert ought to be employed for discussion to decide the proper methodology that is required in building a proper green rooftop.

Green rooftops are great material covers that forestall heat transition through the rooftop. They comprise protection materials that are sheets set over the rooftop surface. These covers are set beneath or above water evidence and roofing materials. If it is set above, it should be made of material fit for uncovering a wet condition. Then again, we want a defensive layer once in a while since some protection layers cannot avoid high temperatures. Polyisocyanates, extruder polystyrene, extended polystyrene, and fresco sheets are the most renowned rooftop encasing materials.

- Increasing demand for mineral wool insulation

Mineral wool is a natural material produced from the melting of natural minerals in furnaces, and the product is fabricated. It has very low thermal conductivity. Mineral wool insulation represented a significant development over the gauge period, attributable to the product's predominant qualities, including ecological compatibility, fire safety, dimensional stability, and efficient heat barrier. Expanding mineral wool in warm obstruction applications will drive its development over the estimated period. It is light in weight, strong, and easy to handle and cut to suit intricate shapes. It has a maximum service temperature of up to 8000°C.

Mineral wool insulation is produced using a combination of slag and stone, which is the reason it is likewise called Rockwool protection, stone wool protection, or slag wool protection. The stone or slag is warmed in a heater until it becomes liquid. Then, at that point, in a cycle like assembling cotton sweets, the liquid stone or slag is turned until it cools in the development of long, flimsy strands. The strands are then thickly stuffed on top of one another. Mineral wool insulation is utilized in structures and designs because of multiple factors. As a matter of some importance, it does not lead to heat well. This is significant while attempting to keep a structure hotter or cooler than the external climate. Since flames are dependably a worry for structures, the way that mineral wool needs combustibility makes it a magnificent choice as an encasing. Likewise, mineral fleece is a magnificent acoustic dampener if clamor is a worry while building a construction.

The primary wool protection is mainly produced using regular stone filaments such as liquid basalt or diabase. This mineral wool is obtained from volcanic stone, softened at around 1,600°C. This dissolved stone is turned into "fleece" and bound together by various tars and oils. The second is produced using turning slag. Slag is a byproduct of the creation of steel. Producers can make it from regular stone or a blend of liquid slag, normal stone, and glass. Regularly, mineral or stone protection contains up to 90% reused content.

OPPORTUNITY

- Supportive government policies aimed at enhancing manufacturing output on a domestic level

Mandeli (2008) states that the Saudi government has started privatizing a portion of its region's jobs, for example, recreational facilities, city cleaning, outsourcing vehicle supply, pest control, and different administrations. There is no question a tremendous benefit for the Saudi government to begin laying out association contracts with the confidential area. However, the issue is the absence of vital information base for surveying the upsides of public-private associations that have influenced the powerlessness of both focal and nearby specialists to foster an unmistakable legitimate structure, execution aspects, or hazard assessments in regards to these open doors acquired from a privatized program. Besides, the restricted ?scal and lawful force of nearby specialists intensified by a deficiency of staff restricts the extension after which metropolitan endeavor can create (Mandeli, 2008). The Saudi government can immediately impact the execution of supportable structures through the Saudi Construction standard.

The government assumes a huge part in advancing or downgrading thermal insulation. They are equipped to set various guidelines that favor energy preservation and proficiency, which makes the general population obliged to green structure applications. Simultaneously, the converse result can be acknowledged when no serious consideration is given to energy guidelines. Subsequently, the inaccessibility or restricted presence of an administration strategy structure for energy preservation and productivity addresses a hindrance to green structure improvement. Implementing guidelines is fundamental for the progress of government systems.

RESTRAINTS/CHALLENGES

- Rising concerns regarding environmental issues associated with building insulation product form

The market is projected to be hampered by serious health worries about thermal protection. Long haul openness to glass wool during the establishment interaction, for instance, aggravates the eyes and respiratory framework. A few examinations have shown that the extension and expulsion processes used to create polystyrene can bring about the arrival of styrene, which is cancer-causing. These well-being-related issues are projected to enhance market extension and subsequently, limit reception rates.

Fiberglass insulation is helpless against dampness. Unlike options, for example, foams board or showered foam insulation, wet fiberglass protection loses all R-values and has practically no protecting properties until it dries out. Dampness might pollute protection in storage rooms, an essential area for fiberglass batts, because of constant rooftop releases or basic buildup as soggy warm air from living spaces underneath gathers in the loft and consolidates when temperatures decrease around evening time, soaking the protection. At the point when dampness is present in fiberglass insulation, mold development often follows. This is more common in fiberglass than in choices such as free-fill cellulose since cellulose doesn't permit the free progression of air that transports shape spores and conveys dampness. Airborne form spores that get comfortable, the strands of fiberglass protection flourish when presented to dampness from water fume in the air or buildup. The shape can be a good spring of undesirable indoor air quality and produce hypersensitive side effects in defenseless people.

One of the best techniques for protecting structures is PUR froth warm protection. An evident detriment of this protection technique may be its cost — contrasted with different strategies, which could appear to be excessively costly. It just so happens that its cost is equivalent to elective protection strategies. All costs will be recuperated over the following couple of years, and the solidness of the PUR foam insulation is astonishingly lengthy. When you look at each of the upsides of polyurethane froth protection, the hindrance as far as cost becomes immaterial.

- Volatility in raw material prices

The market for building thermal insulation compounds experiences factors, including the unpredictability of energy and natural substance costs and the fluctuating economy. Thus, these variables dial back the market's pace of extension for building construction compounds. Furthermore, it is assumed that the market development would be hampered by the vulnerability encompassing the change of legislative principles and guidelines, which broadens the distributed time for project execution.

Recent Development

- In September 2022, Saudi energy efficiency center requested the citizens of the country to ensure thermal insulation in buildings and save energy. The use of thermal insulation can cut electrical energy consumption by nearly 30% to 40%. This initiative taken by the government is projected to have a positive impact on the overall market growth across the nation.

Saudi Arabia Building Thermal Insulation Market Scope

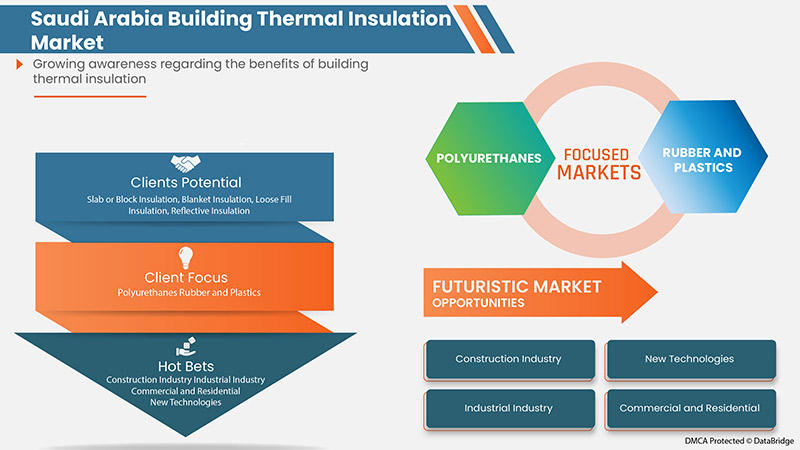

The Saudi Arabia building thermal insulation market is segmented based on product, insulation, distribution channel, application, and end-use. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product

- FIBERGLASS

- PLASTIC FOAM

- MINERAL WOOL

- AEROGELS

- CELLULOSE

- OTHERS

Based on product, the market is segmented into fiberglass, mineral wool, plastic foam, aerogels, cellulose, and others.

Insulation

- SLAB OR BLOCK

- BLANKET

- LOOSE FILL

- REFLECTIVE

- SPRAY FOAM

- OTHERS

Based on insulation, the market is segmented into slab or block, blanket, loose fill, reflective, spray foam, and others.

Distribution Channel

- OFFLINE

- ONLINE

Based on distribution channel, the market is segmented into offline and online.

Application

- ROOF

- WALL

- FLOOR

Based on application, the market is segmented into roof, wall, and floor.

End-Use

- RESIDENTIAL

- COMMERCIAL

- WAREHOUSES

- INSTITUTIONAL

- INDUSTRIAL

Based on end-use, the market is segmented into commercial, residential, warehouses, industrial, and institutional.

Saudi Arabia Building Thermal Insulation Market Regional Analysis/Insights

Saudi Arabia building thermal insulation market is segmented into five notable segments based on product, insulation type, distribution channel, application, and end-use.

The report also provides market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for Saudi Arabia. Also, the presence and availability of Saudi Arabia brands and their challenges faced due to large or scarce competition from local and domestic brands, and the impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Saudi Arabia Building Thermal Insulation Market Share Analysis

The Saudi Arabia building thermal insulation market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, and technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Saudi Arabia building thermal insulation market.

Some of the prominent participants operating in the market are Saudi Rock Wool Factory, Arabian Fiberglass Insulation Company Ltd., BASF SE, SAINT-GOBAIN, Dow, DuPont, Wanhua Chemical Group Co., Ltd, MASCO, Clariant, PPG Industries, Inc., Fahad International Group, Saudi Vetonit Co. Ltd, Nippon Sheet Glass Co., Ltd, Sika AG, Fletcher Building, and GAF.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include Vendor Positioning grids, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grids, Company Market Share Analysis, Standards of Measurement, Global Vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF SAUDI ARABIA BUILDING THERMAL INSULATION MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 SUSTAINABILITY SCENARIO

4.3 STANDARDS / CERTIFICATIONS

4.3.1 THE SAUDI STANDARDS, METROLOGY AND QUALITY ORGANIZATION (SASO)

4.3.2 ISO (INTERNATIONAL ORGANIZATION FOR STANDARDIZATION) CERTIFICATIONS

4.3.3 SAUDI PRODUCT CERTIFICATE OF CONFORMITY (PCOC)

4.3.4 FM APPROVAL

4.3.5 GREEN CERTIFICATION

5 REGULATORY

6 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, COUNTRY WRITE-UP

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 EXPANSION OF GREEN BUILDING

7.1.2 GROWING POPULARITY OF PLASTIC FOAM AS A LIGHTWEIGHT MATERIAL IN BUILDING CONSTRUCTION

7.1.3 RISING IMPORTANCE OF ROOFTOP INSULATION

7.1.4 INCREASING DEMAND FOR MINERAL WOOL INSULATION

7.2 RESTRAINT

7.2.1 HIGH PRICES OF BUILDING THERMAL INSULATION PRODUCT FORM

7.3 OPPORTUNITIES

7.3.1 SUPPORTIVE GOVERNMENT POLICIES AIMED AT ENHANCING MANUFACTURING OUTPUT ON A DOMESTIC LEVEL

7.3.2 EASY ACCESS TO CHEMICAL BASED RAW MATERIAL

7.4 CHALLENGES

7.4.1 RISING CONCERNS REGARDING ENVIRONMENTAL ISSUES ASSOCIATED WITH BUILDING INSULATION PRODUCT FORM

7.4.2 VOLATILITY IN RAW MATERIAL PRICES

8 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 FIBERGLASS

8.2.1 PLASTIC FOAM

8.2.1.1 POLYSTYRENE

8.2.1.1.1 EXPANDED POLYSTYRENE (EPS)

8.2.1.1.2 CROSS-LINKED POLYSTYRENE (XPS)

8.2.1.2 PUR

8.2.1.3 POLYISOCYANURATE (PIR)

8.2.1.4 ELASTOMERIC FOAM

8.2.1.5 OTHERS

8.2.2 MINERAL WOOL

8.2.2.1 STONE WOOL

8.2.2.2 GLASS WOOL

8.3 AEROGEL

8.4 CELLULOSE

8.5 OTHERS

9 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY INSULATION

9.1 OVERVIEW

9.2 SLAB OR BLOCK

9.2.1 BLANKET

9.2.1.1 ROLLED

9.2.1.2 BATT

9.3 LOOSE FILL

9.4 REFLECTIVE

9.5 SPRAY FOAM

9.6 OTHERS

10 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY APPLICATION

11.1 OVERVIEW

11.1.1 ROOF

11.1.1.1 FLAT

11.1.1.2 PITCHED

11.1.2 WALL

11.1.2.1 INTERNAL

11.1.2.2 EXTERNAL

11.1.2.3 CAVITY

11.1.3 FLOOR

11.1.3.1 CONCRETE FLOOR

11.1.3.2 RAISED TIMBER FLOOR

12 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY END-USE

12.1 OVERVIEW

12.2 COMMERCIAL

12.2.1 COMMERCIAL, BY PRODUCT

12.2.1.1 FIBERGLASS

12.2.1.2 PLASTIC FOAM

12.2.1.3 MINERAL WOOL

12.2.1.4 AEROGEL

12.2.1.5 CELLULOSE

12.2.1.6 OTHERS

12.2.2 COMMERCIAL, BY SEGMENT

12.2.2.1 OFFICES

12.2.2.2 STADIUMS

12.2.2.3 HOSPITALS

12.2.2.4 SHOPPING CENTERS

12.2.2.5 MULTIPLEXES

12.2.2.6 LEISURE BUILDINGS

12.2.2.7 OTHERS

12.3 RESIDENTIAL

12.3.1 RESIDENTIAL, BY PRODUCT

12.3.1.1 FIBERGLASS

12.3.1.2 PLASTIC FOAM

12.3.1.3 MINERAL WOOL

12.3.1.4 AEROGEL

12.3.1.5 CELLULOSE

12.3.1.6 OTHERS

12.4 INDUSTRIAL

12.4.1 INDUSTRIAL, BY PRODUCT

12.4.1.1 FIBERGLASS

12.4.1.2 PLASTIC FOAM

12.4.1.3 MINERAL WOOL

12.4.1.4 AEROGEL

12.4.1.5 CELLULOSE

12.4.1.6 OTHERS

12.5 WAREHOUSES

12.5.1 WAREHOUSES, BY PRODUCT

12.5.1.1 FIBERGLASS

12.5.1.2 PLASTIC FOAM

12.5.1.3 MINERAL WOOL

12.5.1.4 AEROGEL

12.5.1.5 CELLULOSE

12.5.1.6 OTHERS

12.6 INSTITUTIONAL

12.6.1 INSTITUTIONAL, BY PRODUCT

12.6.1.1 FIBERGLASS

12.6.1.2 PLASTIC FOAM

12.6.1.3 MINERAL WOOL

12.6.1.4 AEROGEL

12.6.1.5 CELLULOSE

12.6.1.6 OTHERS

12.6.2 INSTITUTIONAL, BY SEGMENT

12.6.2.1 SCHOOLS

12.6.2.2 UNIVERSITIES

12.6.2.3 OTHERS

13 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: SAUDI ARABIA

13.1.1 EXPANSION AND AGREEMENT

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 SAINT-GOBAIN

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT UPDATES

15.2 BASF SE

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT UPDATES

15.3 DOW

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT UPDATES

15.4 SIKA AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT UPDATES

15.5 CLARIANT AG

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT UPDATE

15.6 GAF

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATES

15.7 DUPONT

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATES

15.8 PPG INDUSTRIES, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 REVENUE ANALYSIS

15.8.3 PRODUCT PORTFOLIO

15.8.4 RECENT UPDATES

15.9 SAUDI ROCK WOOL FACTORY

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATES

15.1 FAHAD INTERNATIONAL GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT UPDATES

15.11 ARABIAN FIBERGLASS INSULATION COMPANY LTD.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT UPDATES

15.12 SAUDI VETONIT CO. LTD.

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 NIPPON SHEET GLASS CO., LTD.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT UPDATE

15.14 WANHUA CHEMICAL GROUP CO.LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCT PORTFOLIO

15.14.4 RECENT UPDATE

15.15 MASCO CORP.

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT UPDATE

15.16 FLECTCHER BUILDING LTD.

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 2 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY PRODUCT, 2020-2029 (TONS)

TABLE 3 SAUDI ARABIA PLASTIC FOAM IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 4 SAUDI ARABIA POLYSTYRENE IN PLASTIC FOAM IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 5 SAUDI ARABIA MINERAL WOOL IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 6 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY INSULATION, 2020-2029 (USD THOUSAND)

TABLE 7 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY INSULATION, 2020-2029 (TONS)

TABLE 8 SAUDI ARABIA BLANKET IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 9 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 10 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY INSULATION, 2020-2029 (TONS)

TABLE 11 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 12 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY APPLICATION, 2020-2029 (TONS)

TABLE 13 SAUDI ARABIA ROOF IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 14 SAUDI ARABIA WALL IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 15 SAUDI ARABIA FLOOR IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 16 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY END-USE, 2020-2029 (USD THOUSAND)

TABLE 17 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET, BY END-USE, 2020-2029 (TONS)

TABLE 18 SAUDI ARABIA COMMERCIAL IN BUILDING THERMAL INSULATION MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 19 SAUDI ARABIA COMMERCIAL IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 20 SAUDI ARABIA RESIDENTIAL IN BUILDING THERMAL INSULATION MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 21 SAUDI ARABIA INDUSTRIAL IN BUILDING THERMAL INSULATION MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 22 SAUDI ARABIA WAREHOUSES IN BUILDING THERMAL INSULATION MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 23 SAUDI ARABIA INSTITUTIONAL IN BUILDING THERMAL INSULATION MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 24 SAUDI ARABIA INSTITUTIONAL IN BUILDING THERMAL INSULATION MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: SEGMENTATION

FIGURE 2 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: DATA TRIANGULATION

FIGURE 3 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: DROC ANALYSIS

FIGURE 4 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: SAUDI ARABIA MARKET ANALYSIS

FIGURE 5 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: THE PRODUCT LIFELINE CURVE

FIGURE 7 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: MULTIVARIATE MODELLING

FIGURE 8 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: SEGMENTATION

FIGURE 14 INCREASING SPENDING ON MAJOR COMMERCIAL AND SPORTING INFRASTRUCTURE IS EXPECTED TO DRIVE SAUDI ARABIA BUILDING THERMAL INSULATION MARKET IN THE FORECAST PERIOD

FIGURE 15 FIBERGLASS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE SAUDI ARABIA BUILDING THERMAL INSULATION MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINT, OPPORTUNITIES, AND CHALLENGES OF THE SAUDI ARABIA BUILDING THERMAL INSULATION MARKET

FIGURE 17 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: BY PRODUCT, 2021

FIGURE 18 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: BY INSULATION, 2021

FIGURE 19 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 20 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: BY APPLICATION, 2021

FIGURE 21 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: BY END-USE, 2021

FIGURE 22 SAUDI ARABIA BUILDING THERMAL INSULATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.