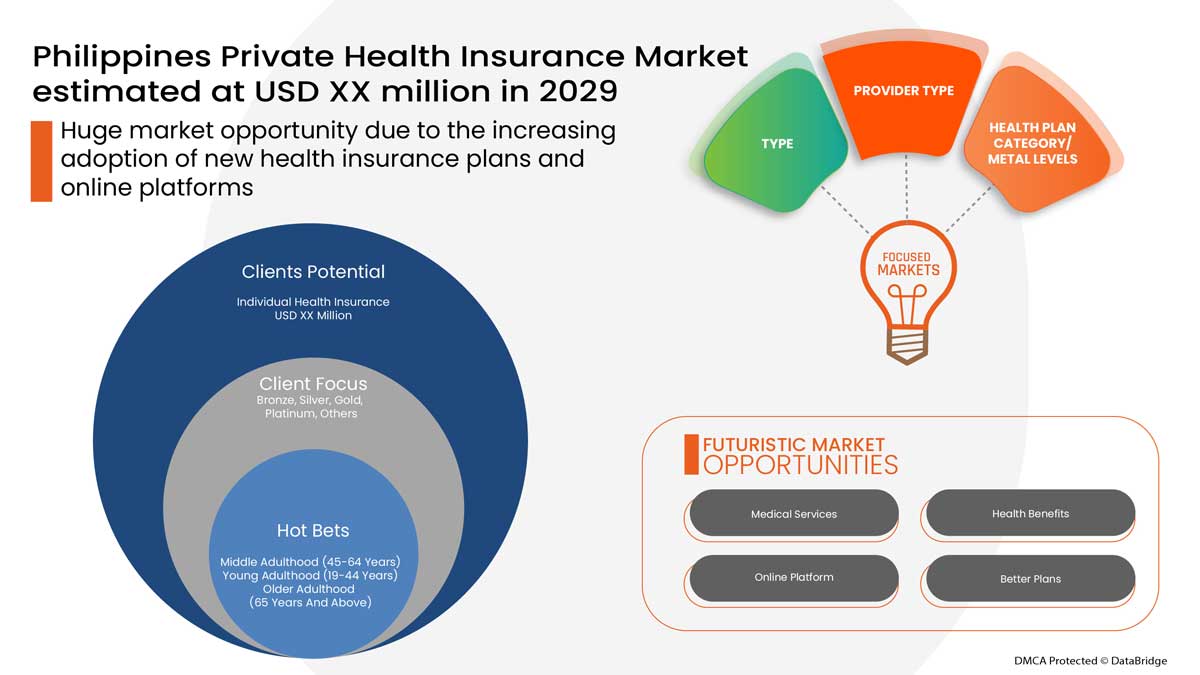

Marché de l'assurance maladie privée aux Philippines, par type (assurance maladies graves, assurance maladie individuelle, assurance maladie familiale, assurance maladie spécifique et autres), catégorie de régime de santé/niveaux de métal (Bronze, Argent, Or Platine et autres), type de fournisseur (organisations de maintien de la santé (HMOS), organisations de fournisseurs privilégiés (PPOS), organisations de fournisseurs exclusifs (EPOS), plans de point de service (POS), plans de santé à franchise élevée (HDHPS) et autres), groupe d'âge (jeune adulte (19-44 ans), âge moyen (45-64 ans) et âge adulte plus avancé (65 ans et plus)), canal de distribution (compagnies d'assurance directe, agrégateurs d'assurance et autres) - Tendances et prévisions du secteur jusqu'en 2029.

Analyse et taille du marché

Une police d'assurance santé comprend plusieurs types de prestations et d'avantages. Elle offre une couverture financière aux assurés contre certains traitements. Elle offre également des avantages tels que l'hospitalisation sans espèces, la couverture du remboursement avant et après l'hospitalisation et divers compléments.

Dans le cadre du régime d'assurance maladie, plusieurs types de couvertures sont disponibles, notamment les demandes de remboursement et les demandes de remboursement sans espèces. La prestation sans espèces est disponible lorsque l'assuré se fait soigner dans les hôpitaux du réseau de la compagnie d'assurance. Si l'assuré se fait soigner dans les hôpitaux qui ne font pas partie du réseau répertorié, dans ce cas, l'assuré prend en charge tous les frais médicaux et demande ensuite le remboursement à la compagnie d'assurance en soumettant toutes les factures médicales. Cette assurance maladie privée apporte un soutien financier à l'assuré car elle couvre tous les frais médicaux lorsque l'assuré est hospitalisé pour un traitement.

Selon les analyses de Data Bridge Market Research, le marché de l’assurance maladie privée aux Philippines devrait atteindre la valeur de 1 273,12 millions USD d’ici 2029, à un TCAC de 1,2 % au cours de la période de prévision. « L’assurance maladie individuelle » représente le segment de type le plus important sur le marché concerné en raison de l’augmentation de l’assurance maladie privée. Le rapport de marché élaboré par l’équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (assurance maladies graves, assurance santé individuelle, assurance santé familiale, assurance maladie spécifique et autres), catégorie de régime de santé/niveaux de métal (Bronze, Argent, Or, Platine et autres), type de fournisseur (organismes de maintien de la santé (HMOS), organismes de fournisseurs privilégiés (PPOS), organismes de fournisseurs exclusifs (EPOS), plans de point de service (POS), régimes de santé à franchise élevée (HDHPS) et autres), groupe d'âge (jeune adulte (19-44 ans), âge moyen (45-64 ans) et âge adulte plus avancé (65 ans et plus)), canal de distribution (compagnies d'assurance directe, agrégateurs d'assurance et autres) |

|

Pays couverts |

Philippines |

|

Acteurs du marché couverts |

Aetna Inc. (filiale de CVS Health) (États-Unis), AIA Group Limited (Hong Kong), Allianz (Allemagne), HSBC Group (Hong Kong), Pacific Cross (Philippines), ASSICURAZIONI GENERALI SPA (Italie) |

Définition du marché

L'assurance maladie couvre tous les types de frais chirurgicaux ainsi que les traitements médicaux résultant d'une maladie ou d'une blessure. L'assurance maladie s'applique à une gamme complète ou limitée de services médicaux, offrant une couverture totale ou partielle des coûts de services spécifiques. L'assurance maladie fournit un soutien financier à l'assuré car elle couvre tous les frais médicaux lorsque l'assuré est hospitalisé pour le traitement. L'assurance maladie couvre également les frais avant et après l'hospitalisation.

Cadre réglementaire

Règles et règlements de la loi sur l'assurance maladie nationale de 2013

Dans la poursuite de ce principe, les Règles et règlements d'application (RRI) du Programme national d'assurance maladie (PNAM), ci-après dénommé le Programme, adopteront les principes directeurs suivants :

Affectation des ressources nationales à la santé – Le programme soulignera l’importance pour le gouvernement d’accorder la priorité à la santé comme stratégie pour accélérer le développement économique et améliorer la qualité de vie ;

Universalité – Le programme doit fournir à tous les citoyens un mécanisme leur permettant d’accéder financièrement aux services de santé, en combinaison avec d’autres programmes de santé publics. Le programme doit accorder la plus haute priorité à la couverture de l’ensemble de la population par un ensemble minimum de prestations d’assurance maladie ;

Équité – Le programme doit prévoir des prestations de base uniformes. L’accès aux soins doit être fonction des besoins de santé d’une personne plutôt que de sa capacité à payer;

Le COVID-19 a eu un impact minime sur le marché de l'assurance maladie privée

La COVID-19 a eu un impact sur diverses industries manufacturières et de services au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, le déséquilibre entre l'offre et la demande et son impact sur les prix sont considérés comme à court terme et devraient se rétablir à la fin de cette pandémie. En raison de l'épidémie de COVID-19 dans le monde entier, la demande d'assurance maladie privée a considérablement augmenté. De plus, la peur de la pandémie et l'augmentation du coût des services médicaux ont contribué à la croissance du marché de l'assurance maladie pendant la pandémie. En outre, les compagnies d'assurance maladie ont introduit des packages et des solutions pour couvrir les frais médicaux liés au traitement des assureurs infectés par la COVID-19. Ainsi, même si les autres industries ont beaucoup souffert pendant l'épidémie de COVID-19, le secteur de l'assurance maladie privée a connu une croissance significative.

La dynamique du marché de l’assurance maladie privée comprend :

Facteurs moteurs/opportunités sur le marché de l'assurance santé privée

- Augmentation du coût des services médicaux

L'assurance maladie apporte un soutien financier en cas de maladie grave ou d'accident. L'augmentation des coûts des services médicaux pour les opérations chirurgicales et les séjours à l'hôpital a créé une nouvelle épidémie financière dans le monde. Le coût des services médicaux comprend le coût de l'opération chirurgicale, les honoraires du médecin, le coût du séjour à l'hôpital, le coût des urgences et le coût des tests de diagnostic, entre autres. Par conséquent, cette augmentation du coût des services médicaux propulse la croissance du marché.

- Nombre croissant de procédures de garderie

Les interventions de jour sont des types d'interventions médicales ou chirurgicales qui nécessitent principalement un séjour moins long à l'hôpital. Dans le cadre d'une intervention de jour, les patients doivent rester à l'hôpital pendant une courte période. La plupart des compagnies d'assurance maladie couvrent désormais les interventions de jour dans leurs plans d'assurance, et pour la demande de remboursement de ces types d'interventions, il n'y a aucune obligation de passer 24 heures à l'hôpital, ce qui est le séjour minimum à l'hôpital pour demander une couverture. Alors que la plupart des plans d'assurance maladie couvrent les séjours à l'hôpital et les interventions chirurgicales majeures, les assurés peuvent également demander des interventions de jour dans le cadre de leur police d'assurance maladie, ce qui stimule la demande du marché.

- Option obligatoire pour une assurance maladie dans les secteurs public et privé

L'achat d'une police d'assurance maladie est une disposition obligatoire pour les employés du secteur public comme du secteur privé. L'assurance maladie offre des avantages médicaux essentiels dont l'employé peut bénéficier lorsqu'il travaille dans une entreprise. En cas d'urgence ou de problèmes médicaux, la couverture d'assurance maladie est très utile pour couvrir les frais de traitement. L'assurance maladie de l'employé est une prestation complémentaire, accordée par l'employeur individuel à ses employés. L'assurance maladie fournie couvre non seulement l'employé, mais également les membres de sa famille dans le cadre du même régime d'assurance. De plus, dans certains cas, l'employeur peut payer une partie d'une prime ou d'une couverture d'assurance de la police d'assurance maladie.

- Augmentation de la population âgée

Les personnes âgées sont susceptibles d'avoir davantage de problèmes de santé en raison du vieillissement et d'un système immunitaire faible, qui peuvent inclure des problèmes dentaires, des problèmes cardiaques, des problèmes de cancer et des maladies en phase terminale. Une bonne assurance santé pour les personnes âgées peut aider les personnes âgées à opter pour de bons services d'assurance santé afin de réduire les soucis financiers futurs. Ainsi, un nombre croissant de personnes âgées peut stimuler la croissance du marché de l'assurance santé.

- Sensibiliser davantage aux avantages de l'assurance maladie

En cas d’urgence médicale, l’assurance maladie permet aux consommateurs de ne plus penser au stress lié aux coûts des soins de santé et de se concentrer sur le traitement grâce à l’assurance maladie. Les urgences médicales peuvent survenir à tout moment, indépendamment de notre bonne santé actuelle ou de notre mode de vie discipliné. Il est donc important de planifier et de protéger nos familles et nous-mêmes contre toute situation médicale imprévue, en particulier lorsque des parents âgés sont à la maison, car ils sont plus sensibles aux infections ou à d’autres maladies.

Contraintes et défis rencontrés par le marché de l'assurance maladie privée aux Philippines

- Coût élevé des primes

L'assurance maladie couvre tous les types de frais de traitement médical. Elle apporte un soutien financier à l'assuré puisqu'elle couvre tous les frais médicaux lorsque l'assuré est hospitalisé pour le traitement. L'assurance maladie couvre également les frais avant et après l'hospitalisation. Pour souscrire une assurance maladie, l'assuré doit payer régulièrement des primes d'assurance pour maintenir la police d'assurance maladie active. Le coût de la prime d'assurance est élevé dans la majorité des cas en fonction du régime d'assurance, ce qui freine la croissance du marché.

- Manque de sensibilisation à l'assurance maladie

Dans le domaine de la santé, une grande partie de la population mondiale n’est toujours pas consciente des avantages des polices d’assurance maladie. Les dépenses de soins médicaux augmentent partout dans le monde avec les progrès réalisés dans le domaine. Grâce aux progrès technologiques, le secteur de la santé est l’un des segments en croissance, cependant, le taux de pénétration des polices d’assurance maladie reste faible en raison d’un manque de sensibilisation aux avantages qu’elles offrent

Ce rapport sur le marché de l'assurance maladie privée aux Philippines fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans la réglementation du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'assurance maladie privée, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développements récents

- En février 2022, Assicuranzioni Generali SPA a signé un accord pour l'acquisition de La Me´dicale, une compagnie d'assurance destinée aux professionnels de la santé. Ce développement prévoit également la vente du portefeuille de couverture décès de Predica1, commercialisé et géré par La Me´dicale.

- En mars 2022, Allianz Real Estate, l'un des plus grands gestionnaires d'investissement immobilier au monde, a conclu un accord visant à acquérir un portefeuille d'actifs résidentiels multifamiliaux de premier ordre à Tokyo pour environ 90 millions de dollars US, pour le compte du fonds Allianz Real Estate Asia-Pacific Japan Multi-Family Fund. Cela a permis à l'entreprise de réaliser davantage de bénéfices à long terme.

Portée du marché de l'assurance maladie privée aux Philippines

Le marché de l'assurance maladie privée aux Philippines est segmenté en fonction du type, de la catégorie de régime d'assurance maladie/des niveaux de métal, du type de prestataire, de la tranche d'âge et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Taper

- Assurance maladies graves

- Assurance santé individuelle

- Assurance santé familiale

- Assurance maladie spécifique

- Autres

Sur la base du type, le marché de l'assurance maladie privée aux Philippines est segmenté en assurance maladies graves, assurance maladie individuelle, assurance maladie familiale, assurance maladie spécifique et autres.

Catégorie de régime d'assurance maladie/Niveaux de métaux

- Bronze

- Argent

- Or

- Platine

- Autres

Sur la base de la catégorie de plan de santé/des niveaux de métal, le marché de l'assurance maladie privée aux Philippines est segmenté en bronze, argent, or, platine et autres.

Type de fournisseur

- Organisations de maintien de la santé (HMOS)

- Organisations de fournisseurs privilégiés (PPOS)

- Organisations de fournisseurs exclusifs (EPOS)

- Plans de point de service (POS)

- Régimes de santé à franchise élevée (HDHPS)

- Autres

Sur la base du type de fournisseur, le marché de l'assurance maladie privée des Philippines est segmenté en organisations de maintien de la santé (HMOS), organisations de fournisseurs privilégiés (PPOS), organisations de fournisseurs exclusifs (EPOS), plans de point de service (POS), plans de santé à franchise élevée (HDHPS) et autres.

Groupe d'âge

- Jeunes adultes (19-44 ans)

- Âge adulte moyen (45-64 ans)

- Âge adulte avancé (65 ans et plus)

Sur la base de la tranche d'âge, le marché de l'assurance maladie privée aux Philippines est segmenté en jeunes adultes (19-44 ans), adultes moyens (45-64 ans) et adultes plus âgés (65 ans et plus).

Canal de distribution

- Compagnies d'assurance directes

- Agrégateurs d'assurance

- Autres

Sur la base du canal de distribution, le marché de l'assurance maladie privée aux Philippines est segmenté en compagnies d'assurance directes, agrégateurs d'assurance et autres.

Analyse du paysage concurrentiel et des parts de marché de l'assurance maladie privée

Le paysage concurrentiel du marché de l'assurance maladie privée aux Philippines fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence aux Philippines, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liées au marché de l'assurance maladie privée aux Philippines.

Certains des principaux acteurs opérant sur le marché de l'assurance maladie privée sont Aetna Inc. (une filiale de CVS Health) (États-Unis), AIA Group Limited (Hong Kong), Allianz (Allemagne), HSBC Group (Hong Kong), Pacific Cross (Philippines), ASSICURAZIONI GENERALI SPA (Italie), entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF PHILIPPINES PRIVATE HEALTH INSURANCE MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 AGE GROUP LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET- PESTEL ANALYSIS

4.1.1 OVERVIEW

4.1.2 POLITICAL FACTORS

4.1.3 ENVIRONMENTAL FACTORS

4.1.4 SOCIAL FACTORS

4.1.5 TECHNOLOGICAL FACTORS

4.1.6 ECONOMICAL FACTORS

4.1.7 LEGAL FACTORS

4.1.8 CONCLUSION

4.2 PORTER’S FIVE FORCES:

4.2.1 THREAT OF NEW ENTRANTS:

4.2.2 THREAT OF SUBSTITUTES:

4.2.3 CUSTOMER BARGAINING POWER:

4.2.4 SUPPLIER BARGAINING POWER:

4.2.5 INTERNAL COMPETITION (RIVALRY):

4.3 SOUTH EAST ASIA INSURANCE SCENARIO VS GLOBAL

4.4 CUSTOMIZED DELIVERABLE

4.4.1 HOW ARE INSURANCE CLAIMS EVALUATED (I.E., PROCESS FOR FILING FROM HOSPITALS, PHYSICIAN JUSTIFICATION)

4.4.2 DATA INTERPRETATION

5 INDUSTRY INSIGHTS

5.1 DEMOGRAPHIC TRENDS:-

5.1.1 AGE

5.1.2 GENDER

5.1.3 OCCUPATION

5.1.4 FAMILY SIZE

5.2 NUMBER OF CLAIMS BY TYPE

5.2.1 CASHLESS VS. REIMBURSEMENT CLAIMS

5.3 EXTRA CARE/TOP-UP INSURANCE OFFERINGS BY COMPANIES

5.4 INVESTMENT & FUNDING

5.5 PENETRATION OF PRIVATE INSURANCE & DENSITY

5.6 INTERVIEWS WITH KEY HOSPITALS AND INSURANCE COMPANIES

5.7 POLICY SUPPORT FOR LIFE INSURANCE IN SOUTH EAST ASIA

5.7.1 MALAYSIA

5.7.2 PHILIPPINES

5.7.3 THAILAND

5.7.4 VIETNAM

5.8 PUBLIC VS PRIVATE HEALTH INSURANCE

5.9 OTHER KOL SNAPSHOTS

5.1 PREMIUM/COPAY/COINSURANCE

6 REGULATORY FRAMWORK

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING COST FOR MEDICAL SERVICES

7.1.2 GROWING NUMBER OF DAY CARE PROCEDURES

7.1.3 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR

7.1.4 INCREASING OLD AGE POPULATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF PREMIUM

7.2.2 STRICT DOCUMENTATION PROCESS FOR CLAIM REIMBURSEMENT

7.3 OPPORTUNITIES

7.3.1 INCREASING AWARENESS ABOUT THE BENEFITS OF HEALTH INSURANCE

7.3.2 INCREASING HEALTH CARE EXPENDITURE

7.3.3 GROWING MEDICAL TOURISM AMONG COUNTRIES

7.4 CHALLENGE

7.4.1 LACK OF AWARENESS REGARDING HEALTH INSURANCE

8 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY TYPE

8.1 OVERVIEW

8.2 INDIVIDUAL HEALTH INSURANCE

8.3 FAMILY HEALTH INSURANCE

8.4 CRITICAL ILLNESS INSURANCE

8.5 DISEASE-SPECIFIC INSURANCE

8.6 OTHERS

9 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS

9.1 OVERVIEW

9.2 BRONZE

9.3 SILVER

9.4 GOLD

9.5 PLATINUM

9.6 OTHERS

10 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE

10.1 OVERVIEW

10.2 HEALTH MAINTENANCE ORGANIZATIONS (HMOS)

10.3 PREFERRED PROVIDER ORGANIZATIONS (PPOS)

10.4 EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS)

10.5 POINT-OF-SERVICE (POS) PLANS

10.6 HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS)

10.7 OTHERS

11 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 MIDDLE ADULTHOOD (45-64 YEARS)

11.3 YOUNG ADULTHOOD (19-44 YEARS)

11.4 OLDER ADULTHOOD (65 YEARS AND ABOVE)

12 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT INSURANCE COMPANIES

12.3 INSURANCE AGGREGATORS

12.4 OTHERS

13 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY

13.1 PHILIPPINES

14 PHILIPPINES PRIVATE HEALTH INSURANCE THERMAL INSULATION PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: PHILIPPINES

14.2 MERGER & ACQUISITION

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENT

14.5 PARTNERSHIP

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 AETNA INC. (A SUBSIDIARY OF CVS HEALTH)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 CIGNA

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 AIA GROUP LIMITED

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT UPDATE

16.4 HCF

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT UPDATES

16.5 ALLIANZ

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT UPDATES

16.6 SUNCORP GROUP

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT UPDATES

16.7 MEDIBANK PRIVATE LIMITED

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 DAI-ICHI LIFE VIETNAM

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 HSBC GROUP

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT UPDATE

16.1 ACCURO HEALTH INSURANCE

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATE

16.11 AIG ASIA PACIFIC INSURANCE PTE. LTD

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 ASSICURANZIONI GENERALI S.P.A.

16.12.1 COMPANY SNAPSHOT

16.12.2 FINANCIAL ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT UPDATES

16.13 AXA

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT UPDATE

16.14 BNI LIFE

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT UPDATES

16.15 BUPA GLOBAL

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATE

16.16 ETIQA

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATE

16.17 GREAT EASTERN HOLDINGS LIMITED

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATE

16.18 HONG LEONG ASSURANCE BERHAD

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATES

16.19 INCOME

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATES

16.2 MANULIFE HOLDINGS BERHAD

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT UPDATES

16.21 NIB NZ LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT UPDATE

16.22 NOW HEALTH INTERNATIONAL

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENTS

16.23 PACIFIC CROSS

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT UPDATE

16.24 PARTNERS LIFE

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT UPDATES

16.25 PRUDENTIAL ASSURANCE MALAYSIA BERHAD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT UPDATE

16.26 RAFFLES MEDICAL GROUP

16.26.1 COMPANY SNAPSHOT

16.26.2 REVENUE ANALYSIS

16.26.3 PRODUCT PORTFOLIO

16.26.4 RECENT UPDATE

16.27 SOUTHERN CROSS

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT UPDATES

16.28 THE ROYAL AUTOMOBILE CLUB OF WA (INC.).

16.28.1 COMPANY SNAPSHOT

16.28.2 PRODUCT PORTFOLIO

16.28.3 RECENT UPDATES

16.29 TOKIO MARINE

16.29.1 COMPANY SNAPSHOT

16.29.2 PRODUCT PORTFOLIO

16.29.3 RECENT UPDATE

16.3 UNIMED

16.30.1 COMPANY SNAPSHOT

16.30.2 PRODUCT PORTFOLIO

16.30.3 RECENT UPDATES

16.31 ZURICH

16.31.1 COMPANY SNAPSHOT

16.31.2 REVENUE ANALYSIS

16.31.3 PRODUCT PORTFOLIO

16.31.4 RECENT UPDATES

17 QUESTIONNAIRES

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY AGE GROUP, MILLION, 2021

TABLE 2 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY INSURANCE COMPANY, MILLION, 2021

TABLE 3 NUMBER OF ADULTS HAVE PRIVATE HEALTH INSURANCE, BY PROVIDER TYPE, MILLION, 2021

TABLE 4 NEW ZEALAND PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 5 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 6 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 7 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 8 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 9 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 10 DETAILS OF AETNA INC. (A SUBSIDIARY OF CVS HEALTH) OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 11 DETAILS OF CIGNA OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 12 DETAILS OF CIGNA OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 13 DETAILS OF CIGNA OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 14 DETAILS OF CIGNA OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 15 DETAILS OF CIGNA OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 16 DETAILS OF CIGNA OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 17 DETAILS OF AIA GROUP LIMITED OF HEALTH MAINTENANCE ORGANIZATIONS (HMOS), BY TYPE , USD MILLION, 2021

TABLE 18 DETAILS OF AIA GROUP LIMITED OF PREFERRED PROVIDER ORGANIZATIONS (PPOS), BY TYPE , USD MILLION, 2021

TABLE 19 DETAILS OF AIA GROUP LIMITED OF EXCLUSIVE PROVIDER ORGANIZATIONS (EPOS), BY TYPE , USD MILLION, 2021

TABLE 20 DETAILS OF AIA GROUP LIMITED OF POINT-OF-SERVICE (POS) PLANS, BY TYPE , USD MILLION, 2021

TABLE 21 DETAILS OF AIA GROUP LIMITED OF HIGH-DEDUCTIBLE HEALTH PLANS (HDHPS), BY TYPE , USD MILLION, 2021

TABLE 22 DETAILS OF AIA GROUP LIMITED OF OTHERS, BY TYPE , USD MILLION, 2021

TABLE 23 CHIEF MEDICAL OFFICER

TABLE 24 LIST OF DAY CARE PROCEDURES

TABLE 25 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 26 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 27 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 28 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 29 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 30 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 31 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 32 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY HEALTH PLAN CATEGORY/METAL LEVELS, 2020-2029 (USD MILLION)

TABLE 33 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY PROVIDER TYPE, 2020-2029 (USD MILLION)

TABLE 34 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 35 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 2 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: DATA TRIANGULATION

FIGURE 3 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: DROC ANALYSIS

FIGURE 4 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: PHILIPPINES VS. REGIONAL MARKET ANALYSIS

FIGURE 5 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: THE AGE GROUP LIFE LINE CURVE

FIGURE 7 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: MULTIVARIATE MODELLING

FIGURE 8 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: DBMR MARKET POSITION GRID

FIGURE 10 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: SEGMENTATION

FIGURE 13 MANDATORY OPTING FOR HEALTH INSURANCE IN PUBLIC AND PRIVATE SECTOR IS DRIVING THE PHILIPPINES PRIVATE HEALTH INSURANCE MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 INDIVIDUAL HEALTH INSURANCE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE PHILIPPINES PRIVATE HEALTH INSURANCE MARKET IN 2022 & 2029

FIGURE 15 SOUTH EAST ASIA PRIVATE HEALTH INSURANCE MARKET: PESTEL ANALYSIS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF PHILIPPINES PRIVATE HEALTH INSURANCE MARKET

FIGURE 17 HEALTHCARE EXPENDITURE IN MALAYSIA, (RM MILLION)

FIGURE 18 MALAYSIA REVENUE TRAVEL INDUSTRY SIZE, BY REVENUE (RM MILLION)

FIGURE 19 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY TYPE, 2021

FIGURE 20 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY HEALTH PLAN CATEGORY/METAL LEVELS, 2021

FIGURE 21 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY PROVIDER TYPE, 2021

FIGURE 22 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY AGE GROUP, 2021

FIGURE 23 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 24 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: SNAPSHOT (2021)

FIGURE 25 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2021)

FIGURE 26 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: BY TYPE (2022-2029)

FIGURE 29 PHILIPPINES PRIVATE HEALTH INSURANCE MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.