North America Wound Care Monitoring Market

Taille du marché en milliards USD

TCAC :

%

USD

2.54 Billion

USD

3.81 Billion

2024

2032

USD

2.54 Billion

USD

3.81 Billion

2024

2032

| 2025 –2032 | |

| USD 2.54 Billion | |

| USD 3.81 Billion | |

|

|

|

|

Segmentation du marché nord-américain de la surveillance des plaies, par produit (appareils et applications d'évaluation des plaies), modalité (portable et non portable), type de produit (appareils de mesure des plaies avec et sans contact), type de plaie (plaies chroniques et aiguës), application (surveillance de la cicatrisation, évaluation des plaies, détection des infections et suivi du traitement), utilisateur final (hôpitaux, cliniques, soins à domicile, établissements de soins de longue durée, centres de traumatologie, etc.), canal de distribution (appels d'offres directs et vente au détail) - Tendances et prévisions du secteur jusqu'en 2032

Taille du marché nord-américain de la surveillance des soins des plaies

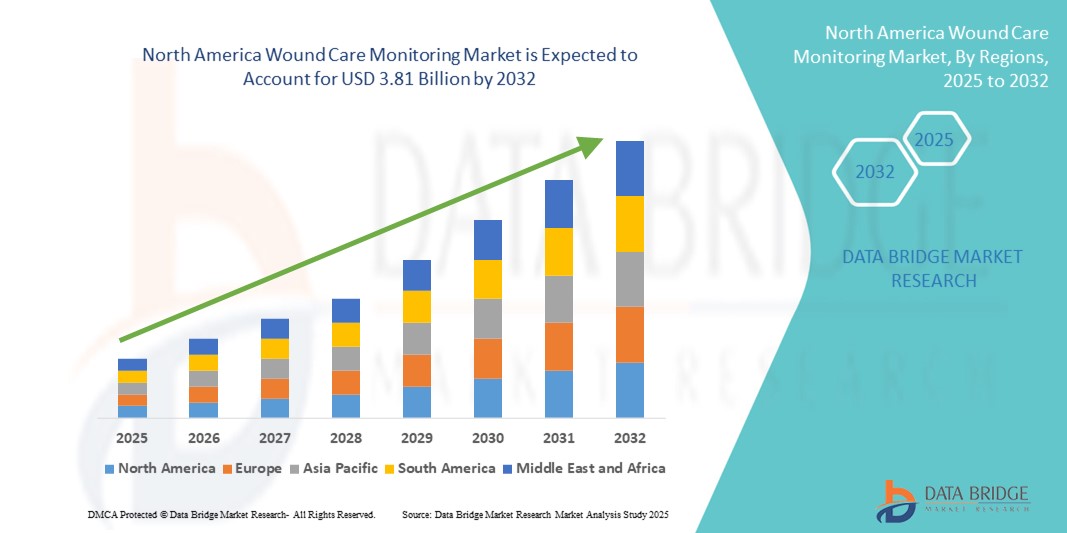

- La taille du marché nord-américain de la surveillance des soins des plaies était évaluée à 2,54 milliards USD en 2024 et devrait atteindre 3,81 milliards USD d'ici 2032 , à un TCAC de 5,20 % au cours de la période de prévision.

- La croissance du marché est en grande partie due à la prévalence croissante des plaies chroniques, à l’augmentation de la population gériatrique et au fardeau croissant du diabète et de l’obésité dans la région, en particulier aux États-Unis et au Canada.

- De plus, les progrès des technologies de surveillance des plaies par capteurs et IA, ainsi que la préférence croissante pour les soins à domicile et les solutions de télésurveillance, renforcent la demande d'appareils de surveillance des plaies. Ces facteurs synergétiques accélèrent l'expansion du marché, stimulant ainsi significativement la croissance du secteur.

Analyse du marché nord-américain de la surveillance des soins des plaies

- Les solutions de surveillance des soins des plaies, offrant des données en temps réel sur la progression des plaies et l'état de cicatrisation , deviennent des éléments essentiels des protocoles avancés de gestion des plaies dans les milieux cliniques et de soins à domicile en Amérique du Nord en raison de leur capacité à améliorer la précision du traitement et à réduire le temps de cicatrisation.

- La demande croissante de surveillance des soins des plaies est principalement motivée par la prévalence croissante des plaies chroniques, l'augmentation des populations gériatriques et diabétiques et l'évolution vers des soins basés sur la valeur mettant l'accent sur le diagnostic précoce et la surveillance à distance.

- Les États-Unis ont dominé le marché nord-américain de la surveillance des soins des plaies avec la plus grande part de revenus de 42,3 % en 2024, soutenus par des systèmes de santé avancés, une forte adoption d'outils de diagnostic basés sur l'IA et une forte présence d'innovateurs en technologie médicale axés sur les technologies d'évaluation des plaies sans contact et basées sur l'image.

- Le Canada devrait être le pays connaissant la croissance la plus rapide sur le marché nord-américain de la surveillance des soins des plaies au cours de la période de prévision, en raison de l'expansion de l'infrastructure de santé numérique et de l'importance croissante accordée aux solutions de soins des plaies à long terme et à domicile.

- Le segment des appareils a dominé le marché de la surveillance des soins des plaies avec une part de marché de 61,8 % en 2024, grâce à leurs avancées technologiques, leur intégration avec les DSE et leur utilisation croissante dans les hôpitaux et les établissements de soins de longue durée.

Portée du rapport et segmentation du marché nord-américain de la surveillance des soins des plaies

|

Attributs |

Informations clés sur le marché de la surveillance des soins des plaies en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché nord-américain de la surveillance des soins des plaies

Intégration de l'imagerie pilotée par l'IA et de la surveillance à distance

- Une tendance importante et croissante sur le marché nord-américain de la surveillance des soins des plaies est l'intégration de l'intelligence artificielle (IA) aux plateformes d'imagerie numérique et de télésanté , améliorant la précision de l'évaluation des plaies, permettant l'analyse prédictive et soutenant la coordination des soins à distance en temps réel.

- Par exemple, la plateforme d'imagerie des plaies de Swift Medical, largement utilisée dans les hôpitaux américains, exploite l'IA et les caméras des smartphones pour mesurer automatiquement les dimensions des plaies, détecter les types de tissus et suivre la cicatrisation, permettant ainsi aux cliniciens de prendre rapidement des décisions fondées sur les données. De même, les dispositifs d'imagerie par fluorescence de MolecuLight permettent de détecter la présence bactérienne de manière non invasive, améliorant ainsi la gestion des infections.

- L'intégration de l'IA permet une documentation plus précise et une détection précoce des complications de cicatrisation, permettant ainsi une intervention proactive. Ces outils prennent également en charge le partage sécurisé des données via les plateformes cloud et l'intégration des DMP, favorisant ainsi une collaboration efficace entre les professionnels de santé de tous les milieux de soins.

- L’adoption transparente de ces technologies transforme la gestion des plaies en minimisant la subjectivité, en optimisant les plans de traitement et en soutenant la continuité des soins, en particulier dans les scénarios de soins de longue durée et de surveillance à distance des patients.

- Cette tendance vers des outils intelligents de surveillance des plaies, basés sur l'imagerie et accessibles à distance, transforme les flux de travail cliniques. Par conséquent, des entreprises comme Tissue Analytics et Spectral AI développent des solutions avancées de surveillance des plaies, basées sur l'IA, adoptées par les principaux réseaux de soins de santé en Amérique du Nord.

- La demande de systèmes intégrés et intelligents de surveillance des plaies augmente rapidement dans les hôpitaux, les établissements de soins de longue durée et les établissements de soins à domicile, car les prestataires recherchent de meilleurs outils pour une gestion des soins des plaies axée sur les résultats.

Dynamique du marché nord-américain de la surveillance des soins des plaies

Conducteur

Augmentation de la prévalence des plaies chroniques et accent mis sur les soins axés sur les résultats

- La prévalence croissante des plaies chroniques, notamment des ulcères du pied diabétique, des escarres et des ulcères veineux de jambe, combinée au vieillissement de la population et à l'incidence croissante du diabète, est un facteur clé de la demande de surveillance avancée des soins des plaies en Amérique du Nord.

- Par exemple, plus de 37 millions d’Américains vivent avec le diabète, ce qui augmente considérablement le risque de plaies à cicatrisation lente qui nécessitent une évaluation continue et une planification des soins personnalisés.

- Les dispositifs avancés de surveillance des plaies offrent des fonctionnalités telles que la visualisation en temps réel, la documentation automatisée et le suivi à distance, prenant en charge des modèles de soins basés sur la valeur qui privilégient une intervention précoce, une réduction des réadmissions et un traitement rentable.

- L'importance croissante accordée aux soins de santé à domicile, ainsi que l'expansion des services de télésanté, ont encore accru le besoin d'outils de surveillance des plaies intelligents et portables, capables d'aider les cliniciens et les soignants dans divers contextes de soins.

Retenue/Défi

Coûts élevés des appareils et limitation de l'interopérabilité

- Le coût relativement élevé des technologies avancées de surveillance des soins des plaies, y compris les appareils d'imagerie alimentés par l'IA et les diagnostics par fluorescence, reste une contrainte importante, en particulier pour les petits prestataires de soins de santé et les agences de soins à domicile fonctionnant avec des contraintes budgétaires.

- Par exemple, l’acquisition et la mise en œuvre de scanners de plaies basés sur l’image peuvent nécessiter une formation spécialisée, des licences de logiciels et un support informatique, ce qui alourdit la charge financière.

- En outre, le manque d’interopérabilité transparente avec les systèmes de dossiers médicaux électroniques (DME) existants et les normes d’intégration incohérentes entre les réseaux de soins de santé créent des inefficacités opérationnelles et des silos de données.

- Les préoccupations en matière de confidentialité et de conformité réglementaire avec des normes telles que HIPAA aux États-Unis posent également des défis, en particulier lorsque les données sont transmises via des plateformes basées sur le cloud.

- Il est essentiel de résoudre ces problèmes par le biais d’innovations en matière de coûts, de protocoles d’intégration standardisés et de solutions de gestion des données sécurisées pour favoriser une adoption plus large dans toute la région.

Portée du marché nord-américain de la surveillance des soins des plaies

Le marché est segmenté sur la base du produit, de la modalité, du type de produit, du type de plaie, de l'application, de l'utilisateur final et du canal de distribution.

- Par produit

En Amérique du Nord, le marché de la surveillance des plaies se segmente en fonction des produits : appareils et applications d’évaluation des plaies. Ce segment a dominé le marché avec une part de chiffre d’affaires de 61,8 % en 2024, grâce à son adoption généralisée en milieu clinique grâce à sa précision dans la mesure des plaies et à son intégration aux systèmes d’information hospitaliers. Ces appareils incluent souvent des systèmes d’imagerie et des scanners numériques, qui permettent aux professionnels de santé de suivre la progression de la cicatrisation avec une grande précision. La demande croissante de soins des plaies fondés sur des données probantes et l’essor des services de télésanté stimulent l’adoption de ces outils de surveillance avancés.

Le segment des applications d'évaluation des plaies devrait connaître la croissance la plus rapide entre 2025 et 2032, soutenu par l'utilisation croissante des smartphones et des plateformes de santé numériques. Ces applications permettent aux soignants et aux patients de documenter l'état des plaies à distance, facilitant ainsi les consultations à distance et réduisant les visites en personne, notamment dans les établissements de soins à domicile et de soins de longue durée.

- Par modalité

En Amérique du Nord, le marché de la surveillance des plaies est segmenté en dispositifs portables et non portables. Le segment des dispositifs non portables détenait la plus grande part de marché, avec 57,6 % en 2024, principalement en raison de son utilisation intensive dans les hôpitaux et les cliniques, où l'imagerie haute résolution et les systèmes d'évaluation fixes sont privilégiés pour des évaluations cliniques cohérentes. Ces systèmes sont généralement utilisés lors des changements de pansements et offrent une grande fiabilité pour le suivi des plaies chroniques.

Le segment des dispositifs portables devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce aux innovations dans les domaines des biocapteurs flexibles et des pansements intelligents. Ces dispositifs permettent une surveillance continue et en temps réel de la température , de l'humidité et du pH des plaies, favorisant ainsi une intervention proactive et améliorant la cicatrisation des plaies en ambulatoire et à domicile.

- Par type de produit

En fonction du type de produit, le marché nord-américain de la surveillance des plaies est segmenté en dispositifs de mesure des plaies par contact et sans contact. Le segment des dispositifs de mesure des plaies sans contact dominait avec une part de marché de 53,9 % en 2024, grâce à leur risque d'infection réduit, leur simplicité d'utilisation et leur acquisition de données plus rapide sans perturber le lit de la plaie. Ces outils sont particulièrement utiles pour la prise en charge des plaies chroniques chez les patients immunodéprimés ou âgés.

Les dispositifs de mesure des plaies de contact devraient connaître la croissance la plus rapide au cours de la période de prévision, en raison de leur pertinence dans les environnements à ressources limitées ou pour certaines procédures cliniques nécessitant des mesures physiques directes, mais leur utilisation est en baisse en raison de l'accent accru mis sur l'hygiène et le confort du patient.

- Par type de plaie

En fonction du type de plaie, le marché nord-américain de la surveillance des soins des plaies est segmenté en plaies chroniques et plaies aiguës. Le segment des plaies chroniques a dominé le marché avec une part de marché de 64,2 % en 2024, en raison de l'incidence croissante du diabète, de l'obésité et du vieillissement de la population. Les plaies chroniques, telles que les ulcères du pied diabétique et les escarres, nécessitent une surveillance et une documentation continues, ce qui rend les systèmes avancés de surveillance des plaies essentiels.

Les plaies aiguës telles que les incisions chirurgicales et les blessures traumatiques devraient connaître une croissance constante au cours de la période de prévision, en raison de l'adoption de solutions de surveillance, en particulier dans les centres de traumatologie et les soins postopératoires.

- Par application

En fonction des applications, le marché nord-américain de la surveillance des plaies est segmenté en deux catégories : surveillance de la cicatrisation, évaluation des plaies, détection des infections et suivi du traitement. La surveillance de la cicatrisation a dominé ce segment avec une part de marché de 38,5 % en 2024, grâce à l'importance croissante accordée au suivi des taux de cicatrisation des plaies chroniques, permettant aux cliniciens d'ajuster proactivement les schémas thérapeutiques et de prévenir les complications.

La détection des infections devrait connaître une forte croissance au cours de la période de prévision, alimentée par les innovations en matière d'imagerie par fluorescence et d'analyse des plaies basée sur des biomarqueurs qui permettent une identification précoce de la présence bactérienne et du risque d'infection.

- Par utilisateur final

En Amérique du Nord, le marché de la surveillance des plaies est segmenté en fonction de l'utilisateur final : hôpitaux, cliniques, soins à domicile, établissements de soins de longue durée, centres de traumatologie, etc. En 2024, le segment hospitalier détenait la plus grande part de chiffre d'affaires, soit 41,1 %, grâce à la disponibilité d'équipes spécialisées en soins des plaies, à l'accès à des technologies d'imagerie avancées et au volume important de patients traités pour les plaies chroniques et chirurgicales.

Les soins de santé à domicile devraient connaître la croissance la plus rapide au cours de la période de prévision, en particulier avec l'augmentation du vieillissement de la population et l'évolution vers une prestation de soins décentralisée soutenue par des technologies de surveillance des plaies à distance.

- Par canal de distribution

En Amérique du Nord, le marché de la surveillance des plaies est segmenté en fonction du canal de distribution : appels d’offres directs et ventes au détail. En 2024, les appels d’offres directs ont dominé le marché avec une part de marché record de 63,4 %. Les hôpitaux et les grands établissements de santé achètent généralement des systèmes de surveillance des plaies par le biais d’appels d’offres négociés et de contrats institutionnels pour des achats groupés.

Le segment des ventes au détail devrait connaître une croissance régulière au cours de la période de prévision, en particulier pour les applications d'évaluation des plaies grand public et les outils numériques portables destinés aux soins à domicile et aux consultations externes.

Analyse régionale du marché nord-américain de la surveillance des soins des plaies

- Les États-Unis ont dominé le marché nord-américain de la surveillance des soins des plaies avec la plus grande part de revenus de 42,3 % en 2024, soutenus par des systèmes de santé avancés, une forte adoption d'outils de diagnostic basés sur l'IA et une forte présence d'innovateurs en technologie médicale axés sur les technologies d'évaluation des plaies sans contact et basées sur l'image.

- Les prestataires de soins de santé américains intègrent rapidement des outils d'évaluation des plaies basés sur l'IA, des systèmes d'imagerie numérique et des plateformes de surveillance à distance pour améliorer les résultats cliniques et réduire les coûts de traitement, en particulier dans les hôpitaux, les soins de longue durée et les environnements de soins à domicile.

- Cette adoption généralisée est en outre soutenue par une infrastructure de soins de santé solide, des investissements importants en R&D et la présence d'entreprises de technologie médicale de premier plan, faisant des États-Unis le centre clé de l'innovation et de la mise en œuvre de solutions de surveillance des soins des plaies dans les secteurs des soins publics et privés.

Aperçu du marché de la surveillance des soins des plaies aux États-Unis et en Amérique du Nord

Le marché américain du suivi des plaies a représenté la plus grande part de chiffre d'affaires en Amérique du Nord en 2024, porté par la prévalence croissante des plaies chroniques, telles que les ulcères du pied diabétique et les escarres, et par la demande croissante de technologies de santé numériques. Les professionnels de santé adoptent rapidement des systèmes d'imagerie basés sur l'IA, des outils de mesure des plaies sans contact et des plateformes de télésurveillance pour améliorer l'efficacité des soins et les résultats des patients. La forte présence d'infrastructures de santé de pointe, associée à des conditions de remboursement avantageuses et à une forte adoption des services de télésanté, continue de stimuler la croissance du marché dans les hôpitaux, les établissements de soins de longue durée et les soins à domicile.

Aperçu du marché canadien de la surveillance des soins des plaies

Le marché canadien de la surveillance des plaies devrait connaître une croissance substantielle au cours de la période de prévision, principalement grâce à l'augmentation des investissements gouvernementaux dans les soins de santé numériques et à la charge croissante des plaies chroniques. Le pays connaît une forte expansion du déploiement d'outils de surveillance non invasifs et d'applications mobiles d'évaluation des plaies, en particulier auprès des populations éloignées et vieillissantes. La sensibilisation croissante des professionnels de la santé aux avantages du suivi continu des plaies et de la planification des traitements basée sur les données contribue également à la croissance du marché, l'adoption de ces outils se généralisant dans les cliniques, les centres de santé communautaires et les établissements de soins de longue durée.

Aperçu du marché mexicain de la surveillance des soins des plaies

Le marché mexicain de la surveillance des plaies devrait connaître une croissance régulière au cours de la période de prévision, soutenu par la prévalence croissante des complications liées au diabète et le besoin croissant d'amélioration des soins des plaies dans les régions mal desservies. Les initiatives gouvernementales visant à renforcer les soins primaires et la prise en charge des maladies chroniques créent des opportunités pour l'adoption de solutions de surveillance des plaies abordables et portables. De plus, l'augmentation des investissements dans le secteur de la santé et les partenariats avec des entreprises internationales de technologies médicales encouragent l'intégration d'outils numériques d'évaluation des plaies dans les hôpitaux publics et les services ambulatoires, favorisant ainsi un accès plus large aux technologies avancées de soins des plaies.

Part de marché de la surveillance des soins des plaies en Amérique du Nord

L’industrie nord-américaine de la surveillance des soins des plaies est principalement dirigée par des entreprises bien établies, notamment :

- Smith+Neveu (Royaume-Uni)

- Mölnlycke Health Care AB (Suède)

- B. Braun SE (Allemagne)

- Coloplast A/S (Danemark)

- ConvaTec Group PLC (Royaume-Uni)

- Integra LifeSciences Holdings Corporation (États-Unis)

- Derma Sciences, Inc. (États-Unis)

- Organogenesis Inc. (États-Unis)

- MiMedx Group, Inc. (États-Unis)

- Hollister Incorporated (États-Unis)

- Systagenix Wound Management Ltd. (Royaume-Uni)

- Kerecis Limited (Islande)

- Essity AB (Suède)

- Medline Industries, LP (États-Unis)

- Advancis Medical (Royaume-Uni)

- Acelity LP Inc. (États-Unis)

- Urgo Médical (France)

- Swift Medical Inc. (Canada)

Quels sont les développements récents sur le marché nord-américain de la surveillance des soins des plaies ?

- En avril 2024, Swift Medical, leader américain des solutions de soins des plaies basées sur l'IA, a annoncé l'extension de sa plateforme numérique de soins des plaies à plusieurs établissements de soins de longue durée aux États-Unis. Cette initiative vise à standardiser la documentation des plaies et à permettre une surveillance en temps réel grâce à l'imagerie par smartphone, améliorant ainsi les résultats cliniques et réduisant les réadmissions à l'hôpital. Ce développement souligne l'engagement de Swift Medical à transformer le traitement des plaies chroniques grâce à des technologies évolutives et basées sur les données.

- En mars 2024, Tissue Analytics, société d'imagerie numérique des plaies acquise par Net Health, s'est associée à un important réseau hospitalier américain pour intégrer son système de surveillance des plaies aux dossiers médicaux électroniques (DME). Cette intégration permet un suivi fluide de l'évolution des plaies et assiste les cliniciens grâce à des informations générées par l'IA, renforçant ainsi la transition vers des flux de travail intelligents et efficaces pour la gestion des plaies en milieu clinique.

- En février 2024, MolecuLight Inc., société canadienne d'imagerie médicale, a obtenu une autorisation élargie de la FDA pour son dispositif d'imagerie par fluorescence i:X. Cette autorisation ouvre la voie à des applications cliniques plus larges pour la détection de la présence bactérienne dans les plaies chroniques. Cette étape importante confirme le rôle de MolecuLight dans l'amélioration du diagnostic des plaies, facilitant des interventions rapides et ciblées dans les centres de soins des plaies aux États-Unis.

- En janvier 2024, WoundVision, entreprise américaine spécialisée dans les technologies de soins des plaies, a lancé une version améliorée de son dispositif Scout, intégrant l'imagerie et l'analyse thermographiques pour une détection précoce améliorée des escarres. Cette solution est actuellement testée dans plusieurs hôpitaux américains afin de soutenir les pratiques de soins préventifs des plaies, conformément aux efforts nationaux visant à réduire les maladies nosocomiales et à améliorer la sécurité des patients.

- En janvier 2023, Spectral AI, une entreprise de diagnostic prédictif basée à Dallas, a signé un contrat avec l'Autorité américaine de recherche et développement biomédicaux avancés (BARDA) pour développer son système DeepView, basé sur l'IA, destiné à évaluer la cicatrisation des brûlures et des plaies. Cette initiative témoigne de l'investissement du gouvernement américain dans des outils de pointe pour l'évaluation des plaies, permettant des évaluations plus rapides et plus précises dans les environnements de soins civils et militaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.