Marché de la gestion des effectifs en Amérique du Nord, par offre (solutions et services), taille de l'organisation (grandes entreprises et petites et moyennes entreprises), systèmes d'exploitation (Windows, Android, iOS, LINUX et autres), modèle de déploiement (cloud et sur site), utilisateur final ( banque, services financiers et assurances , automobile, télécommunications et informatique, fabrication, soins de santé, défense et gouvernement, transport et logistique, biens de consommation et vente au détail, solutions énergétiques et de services publics, et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché de la gestion des effectifs en Amérique du Nord

La gestion des effectifs fait référence aux processus et outils utilisés par les organisations pour optimiser la productivité et l’efficacité de leurs employés. Le marché de la gestion des effectifs connaît une croissance rapide, portée par l’adoption croissante de solutions basées sur le cloud et par la nécessité pour les entreprises d’améliorer leur efficacité opérationnelle. Cependant, ce marché est également confronté à plusieurs contraintes, telles que la pénurie de main-d’œuvre qualifiée et la complexité croissante des lois et réglementations du travail. Dans ce contexte, il est important de comprendre les tendances et les facteurs actuels qui façonnent le marché de la gestion des effectifs et les défis auxquels les organisations sont confrontées dans ce domaine.

Selon les analyses de Data Bridge Market Research, le marché nord-américain de la gestion des effectifs devrait atteindre 3 574 810,79 milliers de dollars d'ici 2030, à un TCAC de 10,1 % au cours de la période de prévision. Le rapport sur le marché nord-américain de la gestion des effectifs couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Offre (solutions et services), taille de l'organisation (grandes entreprises et petites et moyennes entreprises), systèmes d'exploitation (Windows, Android, iOS, LINUX et autres), modèle de déploiement (cloud et sur site), utilisateur final (banque, services financiers et assurances, automobile, télécommunications et informatique, fabrication, santé, défense et gouvernement, transport et logistique, biens de consommation et vente au détail, solutions énergétiques et de services publics, et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

UKG Inc., Reflexis Systems, Inc., SAP, Verint Systems Inc., ADP, ATOSS Software AG, NICE, Workday, Inc., Visier, Inc., Ceridian HCM, Inc., Paylocity., Paycom Payroll LLC., Sumtotal Systems, LLC, Infor, Cegid Meta4, Ramco Systems, Replicon, IBM, INFORM Software, InVision AG, Oracle |

Définition du marché

La gestion des effectifs optimise la productivité des employés, en garantissant que toutes les ressources travaillent au bon moment et au bon endroit. La gestion des effectifs comprend généralement les prévisions, la planification, la gestion des compétences, la gestion intrajournalière, le chronométrage et la présence. Les logiciels de gestion des effectifs sont souvent intégrés aux applications RH de sociétés tierces et aux technologies RH clés qui agissent comme des référentiels clés pour les informations sur l'emploi. Cela aide les RH à gérer efficacement les employés afin d'améliorer la productivité de l'organisation. La gestion des effectifs (WFM) répond efficacement aux besoins en main-d'œuvre et établit et gère les horaires des employés pour effectuer une tâche spécifique sur une base quotidienne et horaire. La gestion des effectifs introduit les technologies IoT et IA pour offrir des solutions améliorées pour la gestion des ressources humaines. Le segment du cloud est en plein essor sur le marché de la gestion des effectifs en Asie-Pacifique en raison d'avantages tels qu'une évolutivité illimitée, un contrôle et diverses applications.

Dynamique du marché de la gestion des effectifs en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

CONDUCTEURS

- Adoption croissante de l'Internet des objets (IoT) et des solutions de gestion de la main-d'œuvre basées sur le cloud

L'Internet des objets est l'une des technologies potentielles qui peuvent fournir des solutions modernes aux lieux de travail modernes pour stimuler la culture du travail et optimiser l'utilisation des ressources. L'utilisation de l'IoT et de la technologie basée sur le cloud dans la gestion des effectifs permet une meilleure connectivité, des compétences décisionnelles et une interopérabilité transparente et développe une culture du travail intelligent.

- Pénétration croissante des solutions analytiques et des applications d'appareils connectés

L'analyse des effectifs combine des logiciels et des méthodologies qui appliquent des modèles statistiques aux données liées au travail et permettent aux organisations d'optimiser les ressources humaines. Ces technologies et analyses se sont développées au fil des ans et évoluent quotidiennement avec l'augmentation de la demande sur le marché.

- Nécessité de réduire les dépenses liées aux ressources humaines

Dans le monde des affaires actuel, les entreprises travaillent dur pour améliorer leurs profits et développer leurs activités sur un marché hyperconcurrentiel, ce qui exerce une pression constante pour réduire les coûts et améliorer la rentabilité. La réduction des coûts liés aux ressources humaines joue un rôle majeur dans l'augmentation de la rentabilité des entreprises.

OPPORTUNITÉ

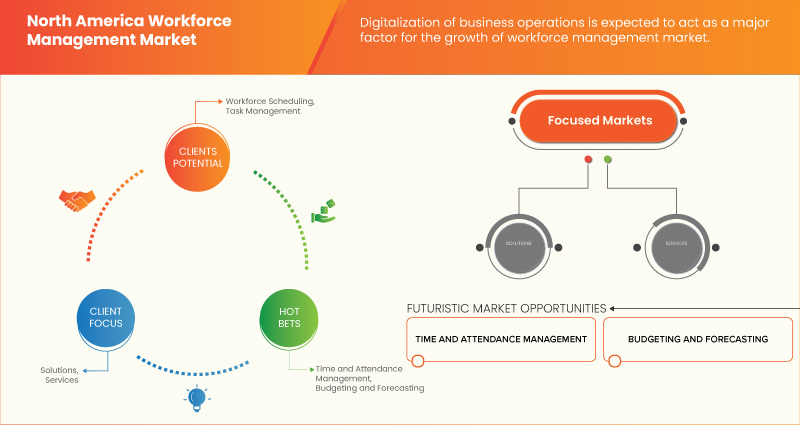

- Digitalisation des opérations commerciales

Les avancées technologiques sont à l’origine de la révolution industrielle, qui pourrait transformer les industries nord-américaines et avoir un impact social, économique et environnemental considérable, ce qui représente un énorme potentiel de croissance. La plus grande opportunité réside dans la transformation de toutes les industries et entreprises par l’amélioration des processus de production et d’affaires, ce qui favorise les investissements dans la région.

RESTRICTIONS/DÉFIS

- Manque de sensibilisation aux outils de gestion des effectifs

Le monde évolue autour de la technologie numérique et de nombreuses industries adoptent les avancées technologiques pour leur développement et leur transformation. Les avancées technologiques dans tous les secteurs ont simplifié les opérations commerciales. De même, l'intégration de logiciels et de technologies avancées dans tous les secteurs a influencé leur productivité et leur efficacité .

- Coût élevé associé à l’achat et au déploiement de solutions de gestion des effectifs

La gestion des effectifs est un terme générique qui désigne divers instruments et dispositifs utilisés par les organisations pour gérer leur main-d'œuvre, de la création de leurs listes, de l'élaboration des horaires de travail et des mouvements pour les organisations par équipes au suivi des heures de travail et à la sécurisation des preuves de travail pour les travailleurs à distance ou sur le terrain. Cette classification de logiciels consolide souvent les finances, la comptabilité et d'autres solutions RH pour garantir une gestion plus efficace des employés. De nombreux éléments et dispositifs dans un système de gestion des effectifs se croisent souvent avec les logiciels RH.

Impact de la pandémie de COVID-19 sur le marché de la gestion des effectifs en Amérique du Nord

La pandémie de COVID-19 a eu un impact considérable sur le marché de la gestion des effectifs, accélérant plusieurs tendances existantes et créant de nouveaux défis pour les organisations. Avec le passage soudain au travail à distance et la nécessité de maintenir la continuité des activités, les entreprises ont rapidement adapté leurs stratégies et outils de gestion des effectifs. Cela a conduit à une demande croissante de solutions basées sur le cloud qui permettent le travail à distance et de technologies telles que la vidéoconférence, les outils de collaboration et les plateformes de formation virtuelle. Dans le même temps, la pandémie a également mis en évidence l'importance de la gestion des effectifs pour maintenir la productivité et garantir l'engagement des employés en temps de crise. Alors que le monde se dirige vers une ère post-pandémique, le marché de la gestion des effectifs devrait continuer d'évoluer, poussé par le besoin d'une plus grande agilité et flexibilité face à l'incertitude.

Développements récents

- En mars 2022, Ceridian HCM Inc. a annoncé que Center Parcs UK & Ireland avait choisi Dayforce pour optimiser ses effectifs, stimuler l'engagement des employés et renforcer la conformité réglementaire. Cette collaboration aidera l'entreprise à renforcer ses positions sur le marché sur six sites au Royaume-Uni et en Irlande.

- En novembre 2021, Visier, Inc. a annoncé le développement d'une nouvelle plate-forme en tant que service (PaaS) Alpine Visier. Ces nouveaux services aident l'entreprise à diversifier les offres pour les clients et fournissent une solution robuste qui attire de nouveaux clients pour accélérer la croissance des revenus.

Portée du marché de la gestion des effectifs en Amérique du Nord

Le marché de la gestion des effectifs en Amérique du Nord est segmenté en fonction de l'offre, de la taille de l'organisation, des systèmes d'exploitation, du modèle de déploiement et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu et des informations précieuses sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Offre

- Solutions

- Services

Sur la base de l’offre, le marché nord-américain de la gestion des effectifs est segmenté en solutions et services.

Modèle de déploiement

- Nuage

- Sur site

Sur la base du modèle de déploiement, le marché de la gestion des effectifs en Amérique du Nord est segmenté en sur site et en cloud.

Taille de l'organisation

- Grande entreprise

- Petites et moyennes entreprises

Sur la base de la taille de l’organisation, le marché de la gestion de la main-d’œuvre en Amérique du Nord est segmenté en grandes entreprises et en petites et moyennes entreprises.

Systèmes d'exploitation

- Fenêtres

- Androïde

- iOS

- LINUX

- Autres

Sur la base des systèmes d’exploitation, le marché nord-américain de la gestion de la main-d’œuvre est segmenté en Windows, Android, iOS, Linux et autres.

Utilisateur final

- Banque, services financiers et assurances

- Automobile

- Télécom et informatique

- Fabrication

- Soins de santé

- Défense et gouvernement

- Transport et logistique

- Biens de consommation et commerce de détail

- Solutions énergétiques et de services publics

- Autres

Sur la base de l'utilisateur final, le marché de la gestion de la main-d'œuvre en Amérique du Nord est segmenté en services bancaires, services financiers et assurances, automobile, télécommunications et informatique, fabrication, soins de santé, défense et gouvernement, transport et logistique, biens de consommation et vente au détail, solutions énergétiques et de services publics, et autres.

Analyse/perspectives régionales du marché de la gestion des effectifs en Amérique du Nord

Le marché de la gestion des effectifs en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies par région, offre, taille de l'organisation, systèmes d'exploitation, modèle de déploiement et utilisateur final, comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de la gestion de la main-d'œuvre en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer la région Amérique du Nord, car ils constituent la plus grande économie du monde et disposent d'une main-d'œuvre très diversifiée qui comprend des travailleurs dans un large éventail de secteurs. Cela a créé une demande importante de solutions de gestion de la main-d'œuvre, car les entreprises cherchent à gérer leurs employés de manière plus efficace et efficiente.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données régionales.

Analyse du paysage concurrentiel et des parts de marché de la gestion des effectifs en Amérique du Nord

Le paysage concurrentiel du marché de la gestion des effectifs en Amérique du Nord fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché de la gestion des effectifs en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché de la gestion de la main-d'œuvre en Amérique du Nord sont UKG Inc., Reflexis Systems, Inc., SAP, Verint Systems Inc., ADP, ATOSS Software AG, NICE, Workday, Inc., Visier, Inc., Ceridian HCM, Inc., Paylocity., Paycom Payroll LLC., Sumtotal Systems, LLC, Infor, Cegid Meta4, Ramco Systems, Replicon, IBM, INFORM Software, InVision AG et Oracle.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 OFFERING TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S ANALYSIS

4.2 REGULATORY FRAMEWORK

4.3 TECHNOLOGICAL TRENDS

4.4 PATENT ANALYSIS

4.5 CASE STUDY

4.6 VALUE CHAIN ANALYSIS

4.7 COMPANY COMPARATIVE ANALYSIS

4.7.1 UKG INC.:

4.7.2 SAP SE:

4.7.3 WORKDAY, INC.:

4.7.4 ADP, INC.:

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING ADOPTION OF THE INTERNET OF THINGS (IOT) AND CLOUD-BASED WORKFORCE MANAGEMENT SOLUTIONS

5.1.2 INCREASING PENETRATION OF ANALYTICAL SOLUTIONS AND CONNECTED DEVICES APPLICATIONS

5.1.3 NEED FOR REDUCTION OF EXPENSES RELATED TO HUMAN RESOURCE

5.2 RESTRAINTS

5.2.1 LACK OF AWARENESS ABOUT WORKFORCE MANAGEMENT TOOLS

5.2.2 COMPLEXITIES IN THE INTEGRATION OF DIFFERENT WORKFORCE MANAGEMENT TOOLS

5.3 OPPORTUNITIES

5.3.1 DIGITALIZATION OF BUSINESS OPERATIONS

5.3.2 INCREASE IN DEMAND FOR FLEXIBLE MANAGEMENT RESOURCES

5.3.3 UPSURGE IN THE ADOPTION OF ARTIFICIAL INTELLIGENCE IN BUSINESS OPERATIONS

5.4 CHALLENGES

5.4.1 HIGH COST ASSOCIATED WITH THE PURCHASE AND DEPLOYMENT OF WORKFORCE MANAGEMENT SOLUTIONS

5.4.2 RISING NEED FOR REGULAR DATA MONITORING AND DATA INPUT SYSTEMS IN THE WORKFORCE

6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTIONS

6.2.1 TIME AND ATTENDANCE MANAGEMENT

6.2.2 LEAVE AND ABSENCE MANAGEMENT

6.2.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

6.2.4 WORKFORCE SCHEDULING

6.2.5 WORKFORCE ANALYTICS

6.2.6 BUDGETING AND FORECASTING

6.2.7 TASK MANAGEMENT

6.2.8 FATIGUE MANAGEMENT

6.2.9 OTHERS

6.3 SERVICES

6.3.1 CONSULTING

6.3.2 IMPLEMENTATION

6.3.3 TRAINING, SUPPORT AND MAINTENANCE

7 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE

7.1 OVERVIEW

7.2 LARGE ENTERPRISE

7.3 SMALL & MEDIUM ENTERPRISES

8 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS

8.1 OVERVIEW

8.2 WINDOWS

8.3 ANDROID

8.4 IOS

8.5 LINUX

8.6 OTHERS

9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL

9.1 OVERVIEW

9.2 CLOUD

9.3 ON-PREMISES

10 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER

10.1 OVERVIEW

10.2 BANKING, FINANCIAL SERVICES AND INSURANCE

10.2.1 SOLUTIONS

10.2.1.1 TIME AND ATTENDANCE MANAGEMENT

10.2.1.2 LEAVE AND ABSENCE MANAGEMENT

10.2.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.2.1.4 WORKFORCE SCHEDULING

10.2.1.5 WORKFORCE ANALYTICS

10.2.1.6 BUDGETING AND FORECASTING

10.2.1.7 TASK MANAGEMENT

10.2.1.8 FATIGUE MANAGEMENT

10.2.1.9 OTHERS

10.2.2 SERVICES

10.2.2.1 CONSULTING

10.2.2.2 IMPLEMENTATION

10.2.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.3 AUTOMOTIVE

10.3.1 SOLUTIONS

10.3.1.1 TIME AND ATTENDANCE MANAGEMENT

10.3.1.2 LEAVE AND ABSENCE MANAGEMENT

10.3.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.3.1.4 WORKFORCE SCHEDULING

10.3.1.5 WORKFORCE ANALYTICS

10.3.1.6 BUDGETING AND FORECASTING

10.3.1.7 TASK MANAGEMENT

10.3.1.8 FATIGUE MANAGEMENT

10.3.1.9 OTHERS

10.3.2 SERVICES

10.3.2.1 CONSULTING

10.3.2.2 IMPLEMENTATION

10.3.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.4 TELECOM AND IT

10.4.1 SOLUTIONS

10.4.1.1 TIME AND ATTENDANCE MANAGEMENT

10.4.1.2 LEAVE AND ABSENCE MANAGEMENT

10.4.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.4.1.4 WORKFORCE SCHEDULING

10.4.1.5 WORKFORCE ANALYTICS

10.4.1.6 BUDGETING AND FORECASTING

10.4.1.7 TASK MANAGEMENT

10.4.1.8 FATIGUE MANAGEMENT

10.4.1.9 OTHERS

10.4.2 SERVICES

10.4.2.1 CONSULTING

10.4.2.2 IMPLEMENTATION

10.4.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.5 MANUFACTURING

10.5.1 SOLUTIONS

10.5.1.1 TIME AND ATTENDANCE MANAGEMENT

10.5.1.2 LEAVE AND ABSENCE MANAGEMENT

10.5.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.5.1.4 WORKFORCE SCHEDULING

10.5.1.5 WORKFORCE ANALYTICS

10.5.1.6 BUDGETING AND FORECASTING

10.5.1.7 TASK MANAGEMENT

10.5.1.8 FATIGUE MANAGEMENT

10.5.1.9 OTHERS

10.5.2 SERVICES

10.5.2.1 CONSULTING

10.5.2.2 IMPLEMENTATION

10.5.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.6 HEALTHCARE

10.6.1 SOLUTIONS

10.6.1.1 TIME AND ATTENDANCE MANAGEMENT

10.6.1.2 LEAVE AND ABSENCE MANAGEMENT

10.6.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.6.1.4 WORKFORCE SCHEDULING

10.6.1.5 WORKFORCE ANALYTICS

10.6.1.6 BUDGETING AND FORECASTING

10.6.1.7 TASK MANAGEMENT

10.6.1.8 FATIGUE MANAGEMENT

10.6.1.9 OTHERS

10.6.2 SERVICES

10.6.2.1 CONSULTING

10.6.2.2 IMPLEMENTATION

10.6.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.7 DEFENSE AND GOVERNMENT

10.7.1 SOLUTIONS

10.7.1.1 TIME AND ATTENDANCE MANAGEMENT

10.7.1.2 LEAVE AND ABSENCE MANAGEMENT

10.7.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.7.1.4 WORKFORCE SCHEDULING

10.7.1.5 WORKFORCE ANALYTICS

10.7.1.6 BUDGETING AND FORECASTING

10.7.1.7 TASK MANAGEMENT

10.7.1.8 FATIGUE MANAGEMENT

10.7.1.9 OTHERS

10.7.2 SERVICES

10.7.2.1 CONSULTING

10.7.2.2 IMPLEMENTATION

10.7.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.8 TRANSPORTATION AND LOGISTICS

10.8.1 SOLUTIONS

10.8.1.1 TIME AND ATTENDANCE MANAGEMENT

10.8.1.2 LEAVE AND ABSENCE MANAGEMENT

10.8.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.8.1.4 WORKFORCE SCHEDULING

10.8.1.5 WORKFORCE ANALYTICS

10.8.1.6 BUDGETING AND FORECASTING

10.8.1.7 TASK MANAGEMENT

10.8.1.8 FATIGUE MANAGEMENT

10.8.1.9 OTHERS

10.8.2 SERVICES

10.8.2.1 CONSULTING

10.8.2.2 IMPLEMENTATION

10.8.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.9 CONSUMER GOODS AND RETAIL

10.9.1 SOLUTIONS

10.9.1.1 TIME AND ATTENDANCE MANAGEMENT

10.9.1.2 LEAVE AND ABSENCE MANAGEMENT

10.9.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.9.1.4 WORKFORCE SCHEDULING

10.9.1.5 WORKFORCE ANALYTICS

10.9.1.6 BUDGETING AND FORECASTING

10.9.1.7 TASK MANAGEMENT

10.9.1.8 FATIGUE MANAGEMENT

10.9.1.9 OTHERS

10.9.2 SERVICES

10.9.2.1 CONSULTING

10.9.2.2 IMPLEMENTATION

10.9.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.1 ENERGY AND UTILITIES SOLUTIONS

10.10.1 SOLUTIONS

10.10.1.1 TIME AND ATTENDANCE MANAGEMENT

10.10.1.2 LEAVE AND ABSENCE MANAGEMENT

10.10.1.3 PLANNING AND SCHEDULING (SCHEDULING OPTIMIZATION)

10.10.1.4 WORKFORCE SCHEDULING

10.10.1.5 WORKFORCE ANALYTICS

10.10.1.6 BUDGETING AND FORECASTING

10.10.1.7 TASK MANAGEMENT

10.10.1.8 FATIGUE MANAGEMENT

10.10.1.9 OTHERS

10.10.2 SERVICES

10.10.2.1 CONSULTING

10.10.2.2 IMPLEMENTATION

10.10.2.3 TRAINING, SUPPORT AND MAINTENANCE

10.11 OTHERS

11 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY REGION

11.1 NORTH AMERICA

11.1.1 U.S.

11.1.2 CANADA

11.1.3 MEXICO

12 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 UKG INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 COMPANY SHARE ANALYSIS

14.1.3 SOLUTION PORTFOLIO

14.1.4 RECENT DEVELOPMENTS

14.2 ADP, INC.

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 IBM CORPORATION

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 WORKDAY, INC.

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 ORACLE

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 SOLUTION PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ATOSS SOFTWARE AG

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 SERVICES PORTFOLIO

14.6.4 RECENT DEVELOPMENTS

14.7 CEGID META4

14.7.1 COMPANY SNAPSHOT

14.7.2 PRODUCT PORTFOLIO

14.7.3 RECENT DEVELOPMENTS

14.8 CERIDIAN HCM, INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 REVENUE ANALYSIS

14.8.3 SOLUTION PORTFOLIO

14.8.4 RECENT DEVELOPMENTS

14.9 INFOR

14.9.1 COMPANY SNAPSHOT

14.9.2 PRODUCT PORTFOLIO

14.9.3 RECENT DEVELOPMENTS

14.1 INFORM SOFTWARE

14.10.1 COMPANY SNAPSHOT

14.10.2 SERVICE PORTFOLIO

14.10.3 RECENT DEVELOPMENT

14.11 INVISION AG

14.11.1 COMPANY SNAPSHOT

14.11.2 REVENUE ANALYSIS

14.11.3 PRODUCT PORTFOLIO

14.11.4 RECENT DEVELOPMENT

14.12 NICE

14.12.1 COMPANY SNAPSHOT

14.12.2 REVENUE ANALYSIS

14.12.3 SOLUTION PORTFOLIO

14.12.4 RECENT DEVELOPMENTS

14.13 PAYCOM PAYROLL LLC

14.13.1 COMPANY SNAPSHOT

14.13.2 REVENUE ANALYSIS

14.13.3 SOLUTION PORTFOLIO

14.13.4 RECENT DEVELOPMENTS

14.14 PAYLOCITY

14.14.1 COMPANY SNAPSHOT

14.14.2 REVENUE ANALYSIS

14.14.3 SOLUTION PORTFOLIO

14.14.4 RECENT DEVELOPMENTS

14.15 QUINYX AB

14.15.1 COMPANY SNAPSHOT

14.15.2 SOLUTION PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 RAMCO SYSTEMS

14.16.1 COMPANY SNAPSHOT

14.16.2 REVENUE ANALYSIS

14.16.3 PRODUCT PORTFOLIO

14.16.4 RECENT DEVELOPMENTS

14.17 REFLEXIS SYSTEMS, INC.

14.17.1 COMPANY SNAPSHOT

14.17.2 SERVICE PORTFOLIO

14.17.3 RECENT DEVELOPMENTS

14.18 REPLICON

14.18.1 COMPANY SNAPSHOT

14.18.2 SERVICE PORTFOLIO

14.18.3 RECENT DEVELOPMENTS

14.19 SAP SE

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 COMPANY SHARE ANALYSIS

14.19.4 PRODUCT PORTFOLIO

14.19.5 RECENT DEVELOPMENTS

14.2 SUMTOTAL SYSTEMS, LLC

14.20.1 COMPANY SNAPSHOT

14.20.2 PRODUCT PORTFOLIO

14.20.3 RECENT DEVELOPMENTS

14.21 VERINT SYSTEMS INC.

14.21.1 COMPANY SNAPSHOT

14.21.2 REVENUE ANALYSIS

14.21.3 PRODUCT PORTFOLIO

14.21.4 RECENT DEVELOPMENTS

14.22 VISIER, INC.

14.22.1 COMPANY SNAPSHOT

14.22.2 SOLUTION PORTFOLIO

14.22.3 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA LARGE ENTERPRISE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA SMALL & MEDIUM ENTERPRISES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA WINDOWS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA ANDROID IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA IOS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA LINUX IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA CLOUD IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA ON-PREMISES IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA ENERGY AND UTILITIES SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA OTHERS IN WORKFORCE MANAGEMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 64 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 65 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 66 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 67 NORTH AMERICA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 68 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 69 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 70 NORTH AMERICA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 71 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 72 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 73 NORTH AMERICA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 74 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 75 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 76 NORTH AMERICA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 77 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 78 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 79 NORTH AMERICA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 80 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 81 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 82 NORTH AMERICA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 83 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 84 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 85 NORTH AMERICA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 86 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 87 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 88 NORTH AMERICA ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 89 NORTH AMERICA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 90 NORTH AMERICA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 91 U.S. WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 92 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 93 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 94 U.S. WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 95 U.S. WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 96 U.S. WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 97 U.S. WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 98 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 99 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 100 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 101 U.S. AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 102 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 103 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 104 U.S. TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 105 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 106 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 107 U.S. MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 108 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 109 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 110 U.S. HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 111 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 112 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 113 U.S. DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 114 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 115 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 116 U.S. TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 117 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 118 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 119 U.S. CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 120 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 121 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 122 U.S. ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 123 U.S. SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 124 U.S. SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 125 CANADA WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 126 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 127 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 128 CANADA WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 129 CANADA WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 130 CANADA WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 131 CANADA WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 132 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 133 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 134 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 135 CANADA AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 136 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 137 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 138 CANADA TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 139 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 140 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 141 CANADA MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 142 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 143 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 144 CANADA HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 145 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 146 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 147 CANADA DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 148 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 149 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 150 CANADA TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 151 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 152 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 153 CANADA CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 154 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 155 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 156 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 157 CANADA SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 158 CANADA SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 159 MEXICO WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 160 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 161 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 162 MEXICO WORKFORCE MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD THOUSAND)

TABLE 163 MEXICO WORKFORCE MANAGEMENT MARKET, BY OPERATING SYSTEMS, 2021-2030 (USD THOUSAND)

TABLE 164 MEXICO WORKFORCE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD THOUSAND)

TABLE 165 MEXICO WORKFORCE MANAGEMENT MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 166 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 167 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 168 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 169 MEXICO AUTOMOTIVE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 170 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 171 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 172 MEXICO TELECOM AND IT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 173 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 174 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 175 MEXICO MANUFACTURING IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 176 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 177 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 178 MEXICO HEALTHCARE IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 179 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 180 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 181 MEXICO DEFENSE AND GOVERNMENT IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 182 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 183 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 184 MEXICO TRANSPORTATION AND LOGISTICS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 185 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 186 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 187 MEXICO CONSUMER GOODS AND RETAIL IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 188 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 189 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 190 MEXICO ENERGY AND UTILITIES SOLUTION IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 191 MEXICO SOLUTIONS IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

TABLE 192 MEXICO SERVICES IN WORKFORCE MANAGEMENT MARKET, BY OFFERING, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA WORKFORCE MANAGEMENT MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: MULTIVARIATE MODELLING

FIGURE 11 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: OFFERING TIMELINE CURVE

FIGURE 12 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: SEGMENTATION

FIGURE 13 INCREASING PENETRATION OF ANALYTICAL SOLUTIONS AND CONNECTED DEVICES APPLICATIONSARE EXPECTED TO BE KEY DRIVERS FOR THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET IN THE FORECAST PERIOD 2023 TO 2030

FIGURE 14 THE SOLUTIONS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA WORKFORCE MANAGEMENT MARKET FROM 2023 TO 2030

FIGURE 15 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGE OF NORTH AMERICA WORKFORCE MANAGEMENT MARKET

FIGURE 17 ENTERPRISES USING IOT, 2021

FIGURE 18 EMPLOYMENT FOR THE AGE 20 TO 64

FIGURE 19 AI ADOPTION RATE AROUND THE WORLD

FIGURE 20 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OFFERING, 2022

FIGURE 21 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 22 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OPERATING SYSTEMS, 2022

FIGURE 23 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 24 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY END-USER, 2022

FIGURE 25 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: SNAPSHOT (2022)

FIGURE 26 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2022)

FIGURE 27 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2023-2030)

FIGURE 28 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY COUNTRY (2022-2030)

FIGURE 29 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: BY OFFERING (2023-2030)

FIGURE 30 NORTH AMERICA WORKFORCE MANAGEMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.