Marché des granulés de bois en Amérique du Nord, par qualité (granulés de bois standard, granulés de bois utilitaires et granulés de bois haut de gamme), saveurs (granulés de bois Traeger Signature, granulés de bois d'hickory, granulés de bois de pécan, granulés de bois de pommier, granulés de bois de cerisier et granulés de bois de mesquite), application (chauffage résidentiel, centrales électriques, chauffage commercial, cogénération et litière pour animaux) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des granulés de bois en Amérique du Nord

Les granulés de bois sont des particules de bois comprimées fabriquées principalement à partir de déchets de bois et de déchets agricoles tels que la paille. Comparés à la biomasse non transformée, ils sont denses, ont une faible teneur en humidité et en cendres et ont une teneur énergétique élevée. En outre, les palettes en bois sont largement utilisées dans les secteurs résidentiel et commercial pour cuisiner, griller et fournir de la chaleur en raison de leur faible coût et de leur faible entretien. Elles sont également utilisées dans les chaînes d'approvisionnement en biomasse à grande échelle pour aider à réduire les coûts de stockage, de manutention et de transport de la biomasse.

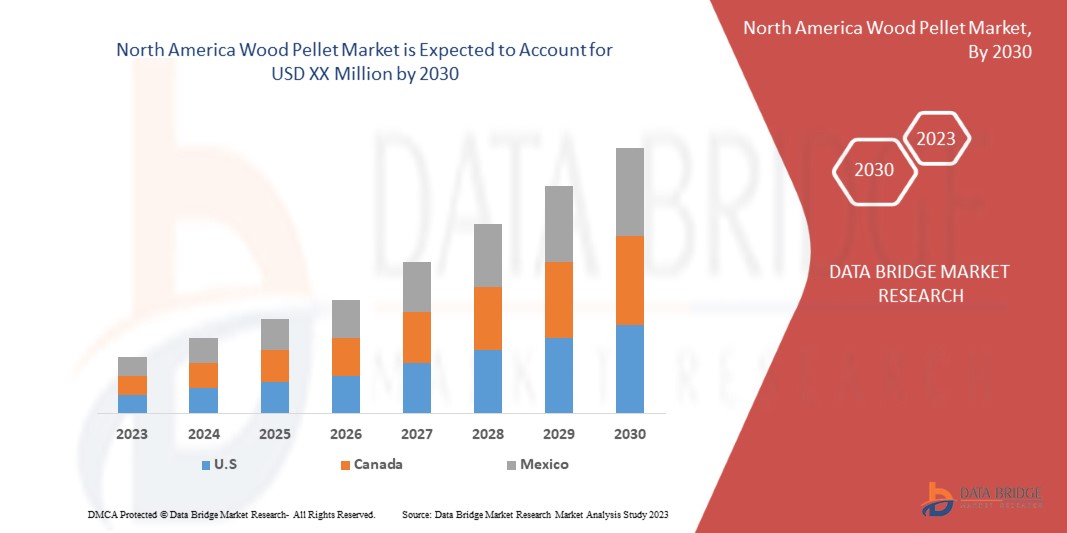

L’augmentation de la popularité des granulés de bois en tant que vecteur énergétique a un impact propositionnel sur la croissance et l’adoption des granulés de bois. En outre, une augmentation de la demande de combustible durable à travers le monde devrait stimuler la croissance du marché. Data Bridge Market Research analyse que le marché nord-américain des granulés de bois connaîtra un TCAC de 6,4 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable pour 2020-2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en tonnes |

|

Segments couverts |

Par catégorie (granulés de bois standard, granulés de bois utilitaires et granulés de bois de qualité supérieure), saveurs (granulés de bois Traeger Signature, granulés de bois de noyer, granulés de bois de pacane, granulés de bois de pommier, granulés de bois de cerisier et granulés de bois de mesquite), application (chauffage résidentiel, centrales électriques, chauffage commercial, cogénération et litière pour animaux) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Parmi les autres sociétés, on trouve AVPGroup, Drax Group plc, Energex, Enviva Inc., Erdenwerk Gregor Ziegler GmbH, German Pellets, Graanul Invest, Holzwerke Weinzierl GmbH, Land Energy, Lignetics, Mallard Creek Inc, Midland Bio Energy, Nugreen Energy, Royal Wood Shavings, RZ Pellets GmbH, Schwaiger Holzindustrie GmbH & Co. KG, Sinclar Group Forest Products, TANAC, Valfei Products Inc. et Wilhelm Hoyer GmbH & Co. KG. |

Définition du marché

Les granulés de bois sont des particules de bois comprimées fabriquées principalement à partir de déchets de bois et de déchets agricoles tels que la paille. Comparés à la biomasse non transformée, ils sont denses, ont une faible teneur en humidité et en cendres et ont une teneur énergétique élevée. En outre, les palettes en bois sont largement utilisées dans les secteurs résidentiel et commercial pour cuisiner, griller et fournir de la chaleur en raison de leur faible coût et de leur faible entretien. Elles sont également utilisées dans les chaînes d'approvisionnement en biomasse à grande échelle pour aider à réduire les coûts de stockage, de manutention et de transport de la biomasse.

Dynamique du marché des granulés de bois en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

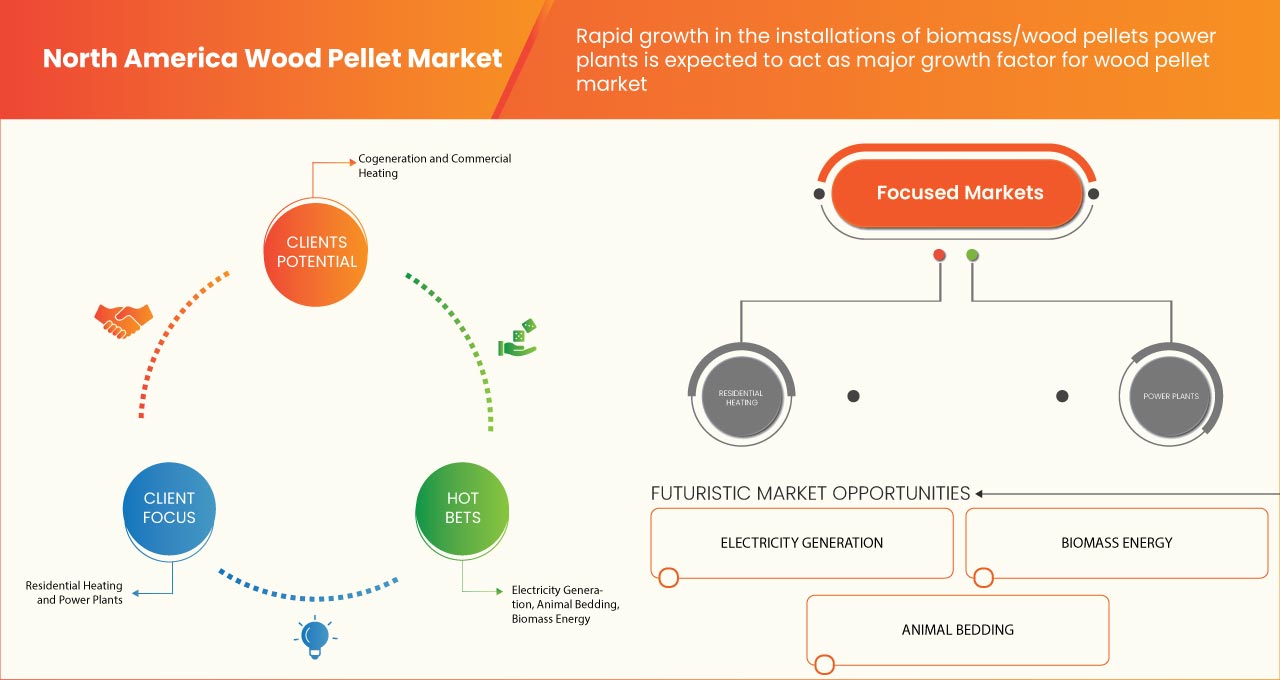

CONDUCTEURS

-

La hausse de la demande de carburant durable à travers le monde

Les carburants durables sont produits à partir de matières premières renouvelables ou alternatives, telles que des plantes, des légumes ou des déchets industriels. Ils comprennent des biocarburants tels que l'huile végétale hydrotraitée (HVO), le bioéthanol et des carburants synthétiques (synfuels) tels que l'ammoniac ou le méthanol . Ces carburants contribueront à atteindre des objectifs ambitieux de décarbonisation et devraient être supérieurs aux alternatives à long terme, utilisant du diesel 100 % renouvelable.

-

Augmentation de la popularité des granulés de bois comme vecteur d'énergie

Les granulés de bois sont un combustible solide issu de la biomasse produit à partir de résidus de bois et de sous-produits agricoles. Cependant, les combustibles bioénergétiques sont l'une des énergies renouvelables les plus importantes et connaissent une forte demande en Amérique du Nord. Ces combustibles comprennent le biogaz, les déchets solides, le bois, les produits agricoles, l'éthanol et le biodiesel.

OPPORTUNITÉ

-

Nécessité de remplacer les combustibles fossiles

À l’échelle mondiale, la demande en combustibles fossiles augmente en raison de la hausse des besoins énergétiques. Les combustibles fossiles sont des ressources non renouvelables dont l’énergie stockée est libérée par combustion, comme le charbon, le gaz naturel et le pétrole, et ils représentent près de 80 % de l’énergie utilisée dans le monde. Le remplacement des combustibles fossiles peut donc constituer une opportunité de croissance du marché.

RETENUE/DÉFI

- Disponibilité de sources alternatives de carburant/d'énergie sur le marché

Les granulés de bois sont un produit renouvelable qui comprime les déchets de bois, les herbes, les pailles, les tiges de maïs et même le papier et le carton pour les transformer en granulés denses. Ces granulés sont toutefois considérés comme durables et émettent peu d'émissions par rapport à leurs combustibles, mais il existe d'autres alternatives à ces granulés de bois, que l'on peut qualifier d'énergie renouvelable. Cela peut constituer un frein à la croissance du marché.

Impact post-Covid-19 sur le marché des granulés de bois en Amérique du Nord

La COVID-19 a eu un impact négatif sur le marché, car les granulés de bois étaient très demandés avant la pandémie. Des entreprises telles que Drax Group plc, Enviva Inc., Energex, Sinclar Group Forest Products et d'autres ont eu du mal à fournir des granulés de bois aux nouveaux et anciens clients en raison d'une pénurie de matières premières. Cela était dû à des réglementations strictes imposées par le gouvernement. De plus, l'offre limitée de matières premières a considérablement affecté l'offre de granulés de bois sur le marché.

Développements récents

- En janvier 2023, Graanul Invest a annoncé que la société avait exporté la plus grande expédition de granulés de bois de 50 042 tonnes aux États-Unis.

- En août 2022, Drax Group plc a annoncé l'acquisition d'une usine de granulés de bois à Princeton, en Colombie-Britannique, au Canada. Cette acquisition permettra à l'entreprise de produire 90 000 tonnes de granulés de bois par an.

Portée du marché des granulés de bois en Amérique du Nord

Le marché nord-américain des granulés de bois est segmenté en trois segments notables en fonction de la qualité, des saveurs et des applications. La croissance de ces segments vous aidera à analyser les segments de croissance limités dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Grade

- Granulés de bois standard

- Granulés de bois utilitaires

- Granulés de bois de qualité supérieure

En fonction du produit, le marché est segmenté en granulés de bois standard, granulés de bois utilitaires et granulés de bois haut de gamme.

Saveurs

- Granulés de bois Signature de Traeger

- Granulés de bois de noyer

- Granulés de bois de pécan

- Granulés de bois de pommier

- Granulés de bois de cerisier

- Granulés de bois de mesquite

En fonction des saveurs, le marché est segmenté en granulés de bois Traeger Signature, granulés de bois de noyer, granulés de bois de pécan, granulés de bois de pommier, granulés de bois de cerisier et granulés de bois de mesquite.

Application

- Chauffage résidentiel

- Centrales électriques

- Chauffage commercial

- Production combinée de chaleur et d'électricité (PCCE)

- Litière pour animaux

En fonction des applications, le marché est segmenté en chauffage résidentiel, centrales électriques, chauffage commercial, cogénération (CHP) et litière pour animaux.

Analyse/perspectives régionales du marché des granulés de bois en Amérique du Nord

Le marché des granulés de bois en Amérique du Nord est analysé et des informations sur la taille du marché et les tendances sont fournies par qualité, saveurs et application.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché des granulés de bois en Amérique du Nord en raison de la popularité croissante des granulés de bois comme vecteur d’énergie.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie du pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des granulés de bois en Amérique du Nord

Le paysage concurrentiel du marché des granulés de bois en Amérique du Nord fournit des détails sur les concurrents. Les détails inclus sont un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement de la solution, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché.

Certains des principaux acteurs opérant sur le marché des granulés de bois en Amérique du Nord sont AVPGroup, Drax Group plc, Energex, Enviva Inc., Erdenwerk Gregor Ziegler GmbH, German Pellets, Graanul Invest, Holzwerke Weinzierl GmbH, Land Energy, Lignetics, Mallard Creek Inc, Midland Bio Energy, Nugreen Energy, Royal Wood Shavings, RZ Pellets GmbH, Schwaiger Holzindustrie GmbH & Co. KG, Sinclar Group Forest Products, TANAC, Valfei Products Inc. et Wilhelm Hoyer GmbH & Co. KG, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA WOOD PELLET MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 MARKET APPLICATION COVERAGE GRID

2.1 GRADE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL FACTORS

4.2.2 ECONOMIC FACTORS

4.2.3 SOCIAL FACTORS

4.2.4 LEGAL FACTORS

4.2.5 TECHNOLOGICAL FACTORS

4.2.6 ENVIRONMENTAL FACTORS

4.3 CLIMATE CHANGE SCENARIO

4.4 VENDOR SELECTION CRITERIA

4.5 TECHNOLOGICAL ADVANCEMENTS FOR WOOD PELLET

4.6 IMPORT-EXPORT SCENARIO

4.7 SUPPLY CHAIN ANALYSIS

4.8 RAW MATERIAL COVERAGE

4.9 REGULATION COVERAGE

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN DEMAND FOR SUSTAINABLE FUEL ACROSS THE GLOBE

5.1.2 INCREASE IN THE POPULARITY OF WOOD PELLETS AS AN ENERGY CARRIER

5.1.3 RISE IN THE ADOPTION OF WOOD PELLETS IN COMMERCIAL AND RESIDENTIAL HEATING

5.1.4 RAPID GROWTH IN THE INSTALLATIONS OF BIOMASS/WOOD PELLETS POWER PLANTS

5.2 RESTRAINTS

5.2.1 AVAILABILITY OF ALTERNATIVE FUEL/ENERGY SOURCES IN THE MARKET

5.2.2 THE MANUFACTURING PROCESS IS PRONE TO CAUSE SEVERE HEALTH ISSUES

5.3 OPPORTUNITIES

5.3.1 NEED FOR THE REPLACEMENT OF FOSSIL FUELS

5.3.2 GOVERNMENT INITIATIVES SUPPORTING SUSTAINABLE ENERGY

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG THE PROFESSIONALS

5.4.2 REQUIREMENT OF SOPHISTICATED PROCESS FOR USAGE COMPARED TO FIREWOOD

6 NORTH AMERICA WOOD PELLET MARKET, BY APPLICATION

6.1 OVERVIEW

6.2 RESIDENTIAL HEATING

6.2.1 RESIDENTIAL HEATING, BY GRADE

6.2.1.1 STANDARD WOOD PELLET

6.2.1.2 UTILITY WOOD PELLET

6.2.1.3 PREMIUM WOOD PELLET

6.3 POWER PLANTS

6.3.1 POWER PLANTS, BY GRADE

6.3.1.1 STANDARD WOOD PELLET

6.3.1.2 UTILITY WOOD PELLET

6.3.1.3 PREMIUM WOOD PELLET

6.4 COMMERCIAL HEATING

6.4.1 COMMERCIAL HEATING, BY GRADE

6.4.1.1 STANDARD WOOD PELLET

6.4.1.2 UTILITY WOOD PELLET

6.4.1.3 PREMIUM WOOD PELLET

6.5 COMBINED HEAT AND POWER (CHP)

6.5.1 COMBINED HEAT AND POWER (CHP), BY GRADE

6.5.1.1 STANDARD WOOD PELLET

6.5.1.2 UTILITY WOOD PELLET

6.5.1.3 PREMIUM WOOD PELLET

6.6 ANIMAL BEDDING

6.6.1 ANIMAL BEDDING, BY GRADE

6.6.1.1 STANDARD WOOD PELLET

6.6.1.2 UTILITY WOOD PELLET

6.6.1.3 PREMIUM WOOD PELLET

7 NORTH AMERICA WOOD PELLET MARKET, BY GRADE

7.1 OVERVIEW

7.2 STANDARD WOOD PELLET

7.3 UTILITY WOOD PELLET

7.4 PREMIUM WOOD PELLET

8 NORTH AMERICA WOOD PELLET MARKET, BY FLAVORS

8.1 OVERVIEW

8.2 TRAEGER SIGNATURE WOOD PELLETS

8.3 HICKORY WOOD PELLETS

8.4 PECAN WOOD PELLETS

8.5 APPLE WOOD PELLETS

8.6 CHERRY WOOD PELLETS

8.7 MESQUITE WOOD PELLETS

9 NORTH AMERICA WOOD PELLET MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA WOOD PELLET MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

11 SWOT ANALYSIS

12 COMPANY PROFILE

12.1 ENVIVA INC. INC.

12.1.1 COMPANY SNAPSHOT

12.1.2 REVENUE ANALYSIS

12.1.3 COMPANY SHARE ANALYSIS

12.1.4 PRODUCT PORTFOLIO

12.1.5 RECENT DEVELOPMENTS

12.2 DRAX GROUP PLC GROUP PLC

12.2.1 COMPANY SNAPSHOT

12.2.2 REVENUE ANALYSIS

12.2.3 COMPANY SHARE ANALYSIS

12.2.4 PRODUCT PORTFOLIO

12.2.5 RECENT DEVELOPMENTS

12.3 GRAANUL INVEST

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT DEVELOPMENTS

12.4 GERMAN PELLETS

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT DEVELOPMENT

12.5 ENERGEX

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT DEVELOPMENT

12.6 AVPGROUP

12.6.1 COMPANY SNAPSHOT

12.6.2 PRODUCT PORTFOLIO

12.6.3 RECENT DEVELOPMENT

12.7 ERDENWERK GREGOR ZIEGLER GMBH

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT DEVELOPMENTS

12.8 HOLZWERKE WEINZIERL GMBH

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT DEVELOPMENT

12.9 LAND ENERGY

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT DEVELOPMENT

12.1 LIGNETICS

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT DEVELOPMENT

12.11 MALLARD CREEK INC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT DEVELOPMENT

12.12 MIDLAND BIO ENERGY

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT DEVELOPMENTS

12.13 NUGREEN ENERGY

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT DEVELOPMENT

12.14 ROYAL WOOD SHAVINGS

12.14.1 COMPANY SNAPSHOT

12.14.2 PRODUCT PORTFOLIO

12.14.3 RECENT DEVELOPMENT

12.15 RZ PELLETS GMBH

12.15.1 COMPANY SNAPSHOT

12.15.2 PRODUCT PORTFOLIO

12.15.3 RECENT DEVELOPMENT

12.16 SCHWAIGER HOLZINDUSTRIE GMBH & CO. KG

12.16.1 COMPANY SNAPSHOT

12.16.2 PRODUCT PORTFOLIO

12.16.3 RECENT DEVELOPMENT

12.17 SINCLAR GROUP FOREST PRODUCTS

12.17.1 COMPANY SNAPSHOT

12.17.2 PRODUCT PORTFOLIO

12.17.3 RECENT DEVELOPMENT

12.18 TANAC

12.18.1 COMPANY SNAPSHOT

12.18.2 PRODUCT PORTFOLIO

12.18.3 RECENT DEVELOPMENTS

12.19 VALFEI PRODUCTS INC.

12.19.1 COMPANY SNAPSHOT

12.19.2 PRODUCT PORTFOLIO

12.19.3 RECENT DEVELOPMENTS

12.2 WILHELM HOYER GMBH & CO. KG

12.20.1 COMPANY SNAPSHOT

12.20.2 PRODUCT PORTFOLIO

12.20.3 RECENT DEVELOPMENT

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (THOUSAND TONNES)

TABLE 3 NORTH AMERICA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 4 NORTH AMERICA RESIDENTIAL HEATING IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA RESIDENTIAL HEATING IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 6 NORTH AMERICA RESIDENTIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA POWER PLANTS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA POWER PLANTS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 9 NORTH AMERICA POWER PLANTS IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA COMMERCIAL HEATING IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA COMMERCIAL HEATING IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 12 NORTH AMERICA COMMERCIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA COMBINED HEAT AND POWER (CHP) IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA COMBINED HEAT AND POWER (CHP) IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 15 NORTH AMERICA COMBINED HEAT AND POWER (CHP) IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA ANIMAL BEDDING IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA ANIMAL BEDDING IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 18 NORTH AMERICA ANIMAL BEDDING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA WOOD PELLET MARKET, BY GRADE, 2021-2030 (THOUSAND TONNES)

TABLE 21 NORTH AMERICA WOOD PELLET MARKET, BY GRADE, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 22 NORTH AMERICA STANDARD WOOD PELLET IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA STANDARD WOOD PELLET IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 24 NORTH AMERICA UTILITY WOOD PELLET IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA UTILITY WOOD PELLET IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 26 NORTH AMERICA PREMIUM WOOD PELLET IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA PREMIUM WOOD PELLET IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 28 NORTH AMERICA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (THOUSAND TONNES)

TABLE 30 NORTH AMERICA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 31 NORTH AMERICA TRAEGER SIGNATURE WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TRAEGER SIGNATURE WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 33 NORTH AMERICA HICKORY WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA HICKORY WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 35 NORTH AMERICA PECAN WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA PECAN WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 37 NORTH AMERICA APPLE WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA APPLE WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 39 NORTH AMERICA CHERRY WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA CHERRY WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 41 NORTH AMERICA MESQUITE WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA MESQUITE WOOD PELLETS IN WOOD PELLET MARKET, BY REGION, 2021-2030 (THOUSAND TONNES)

TABLE 43 NORTH AMERICA WOOD PELLET MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA WOOD PELLET MARKET, BY COUNTRY, 2021-2030 (THOUSAND TONNES)

TABLE 45 NORTH AMERICA WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA WOOD PELLET MARKET, BY GRADE, 2021-2030 (THOUSAND TONNES)

TABLE 47 NORTH AMERICA WOOD PELLET MARKET, BY GRADE, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 48 NORTH AMERICA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (THOUSAND TONNES)

TABLE 50 NORTH AMERICA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 51 NORTH AMERICA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (THOUSAND TONNES)

TABLE 53 NORTH AMERICA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 54 NORTH AMERICA RESIDENTIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA POWER PLANTS IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA COMMERCIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA COMBINED HEAT AND POWER (CHP) IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA ANIMAL BEDDING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 59 U.S. WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 60 U.S. WOOD PELLET MARKET, BY GRADE, 2021-2030 (THOUSAND TONNES)

TABLE 61 U.S. WOOD PELLET MARKET, BY GRADE, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 62 U.S. WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (USD MILLION)

TABLE 63 U.S. WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (THOUSAND TONNES)

TABLE 64 U.S. WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 65 U.S. WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 66 U.S. WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (THOUSAND TONNES)

TABLE 67 U.S. WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 68 U.S. RESIDENTIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 69 U.S. POWER PLANTS IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 70 U.S. COMMERCIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 71 U.S. COMBINED HEAT AND POWER (CHP) IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 72 U.S. ANIMAL BEDDING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 73 CANADA WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 74 CANADA WOOD PELLET MARKET, BY GRADE, 2021-2030 (THOUSAND TONNES)

TABLE 75 CANADA WOOD PELLET MARKET, BY GRADE, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 76 CANADA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (USD MILLION)

TABLE 77 CANADA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (THOUSAND TONNES)

TABLE 78 CANADA WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 79 CANADA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 80 CANADA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (THOUSAND TONNES)

TABLE 81 CANADA WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 82 CANADA RESIDENTIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 83 CANADA POWER PLANTS IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 84 CANADA COMMERCIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 85 CANADA COMBINED HEAT AND POWER (CHP) IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 86 CANADA ANIMAL BEDDING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 87 MEXICO WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 88 MEXICO WOOD PELLET MARKET, BY GRADE, 2021-2030 (THOUSAND TONNES)

TABLE 89 MEXICO WOOD PELLET MARKET, BY GRADE, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 90 MEXICO WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (USD MILLION)

TABLE 91 MEXICO WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (THOUSAND TONNES)

TABLE 92 MEXICO WOOD PELLET MARKET, BY FLAVORS, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 93 MEXICO WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 94 MEXICO WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (THOUSAND TONNES)

TABLE 95 MEXICO WOOD PELLET MARKET, BY APPLICATION, 2021-2030 (AVERAGE SELLING PRICE)

TABLE 96 MEXICO RESIDENTIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 97 MEXICO POWER PLANTS IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 98 MEXICO COMMERCIAL HEATING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 99 MEXICO COMBINED HEAT AND POWER (CHP) IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

TABLE 100 MEXICO ANIMAL BEDDING IN WOOD PELLET MARKET, BY GRADE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA WOOD PELLET MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA WOOD PELLET MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA WOOD PELLET MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA WOOD PELLET MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA WOOD PELLET MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA WOOD PELLET MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA WOOD PELLET MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA WOOD PELLET MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA WOOD PELLET MARKET: MULTIVARIATE MODELING

FIGURE 10 NORTH AMERICA WOOD PELLET MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA WOOD PELLET MARKET: TYPE TIMELINE CURVE

FIGURE 12 NORTH AMERICA WOOD PELLET MARKET: SEGMENTATION

FIGURE 13 INCREASE IN THE POPULARITY OF WOOD PELLETS AS AN ENERGY CARRIER IS EXPECTED TO DRIVE NORTH AMERICA WOOD PELLET MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 STANDARD WOOD PELLET SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA WOOD PELLET MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA WOOD PELLET MARKET

FIGURE 16 RENEWABLE DIESEL CONSUMPTION BY WORLD (2010-2020)

FIGURE 17 CONSUMPTION IN TOP EUROPEAN COUNTRIES IN 2021

FIGURE 18 BIOENERGY POWER GENERATION

FIGURE 19 ELECTRICITY GENERATION FROM BIOMASS IN CONTINENTS IN 2018

FIGURE 20 PRICE INCREASING RATE FOR DIFFERENT ENERGY IN THE U.S (APRIL 2021 TO APRIL 2022)

FIGURE 21 NORTH AMERICA WOOD PELLET MARKET: BY APPLICATION, 2022

FIGURE 22 NORTH AMERICA WOOD PELLET MARKET: BY GRADE, 2022

FIGURE 23 NORTH AMERICA WOOD PELLET MARKET: BY FLAVORS, 2022

FIGURE 24 NORTH AMERICA WOOD PELLET MARKET: SNAPSHOT (2022)

FIGURE 25 NORTH AMERICA WOOD PELLET MARKET: BY COUNTRY (2022)

FIGURE 26 NORTH AMERICA WOOD PELLET MARKET: BY COUNTRY (2023 & 2030)

FIGURE 27 NORTH AMERICA WOOD PELLET MARKET: BY COUNTRY (2022 & 2030)

FIGURE 28 NORTH AMERICA WOOD PELLET MARKET: BY GRADE (2023-2030)

FIGURE 29 NORTH AMERICA WOOD PELLET MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.