North America Vitro Toxicology Testing Market

Taille du marché en milliards USD

TCAC :

%

USD

5.42 Billion

USD

15.46 Billion

2024

2032

USD

5.42 Billion

USD

15.46 Billion

2024

2032

| 2025 –2032 | |

| USD 5.42 Billion | |

| USD 15.46 Billion | |

|

|

|

|

Segmentation du marché des tests de toxicologie in vitro en Amérique du Nord, par produit et service (consommables, services, dosages, équipements et logiciels), point final et test de toxicologie (tests ADME (absorption, distribution, métabolisme et excrétion), tests de cytotoxicité, tests de génotoxicité, tests de toxicité cutanée, tests de toxicité oculaire, tests de toxicité organique, tests d'irritation, de corrosion et de sensibilisation cutanées, tests de phototoxicité et autres points finaux et tests de toxicité), technologie (technologies de culture cellulaire, technologies à haut débit, imagerie moléculaire et technologie OMICS), méthode (dosages cellulaires, dosages biochimiques, modèles ex vivo et modèles in silico), secteur ( sociétés pharmaceutiques et biopharmaceutiques , diagnostic, alimentation, produits chimiques, cosmétiques et produits ménagers), canal de distribution (appel d'offres direct, vente au détail et autres) - Tendances du secteur et Prévisions jusqu'en 2032

Taille du marché des tests de toxicologie in vitro en Amérique du Nord

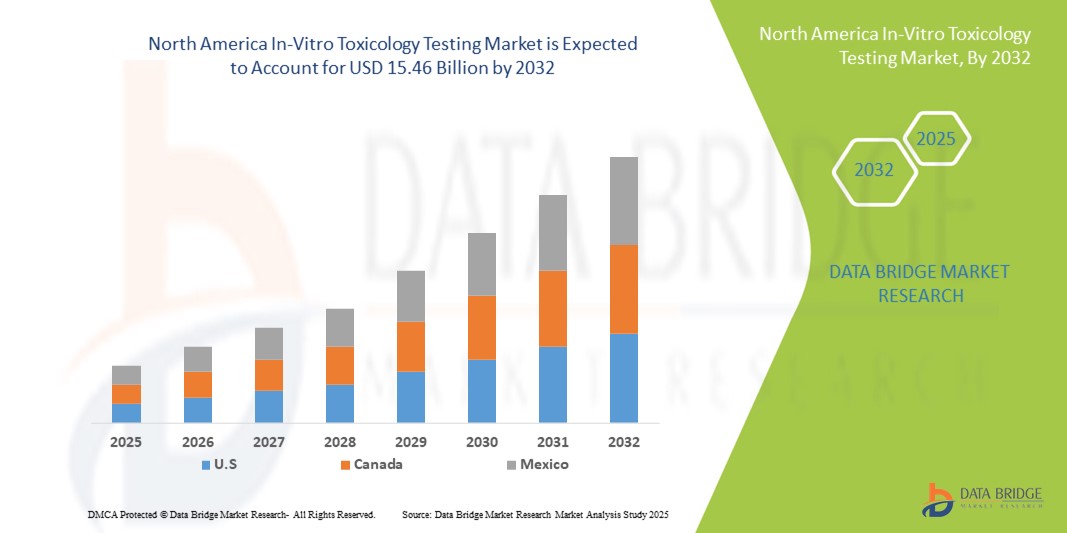

- La taille du marché des tests de toxicologie in vitro en Amérique du Nord était évaluée à 5,42 milliards USD en 2024 et devrait atteindre 15,46 milliards USD d'ici 2032 , à un TCAC de 14,00 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'adoption croissante et les progrès technologiques des solutions de tests de toxicologie in vitro, grâce aux avancées des technologies de culture cellulaire, du criblage à haut débit et des modèles de toxicologie prédictive. Ces innovations améliorent la précision des tests, réduisent la dépendance aux études animales et accélèrent le développement des médicaments dans les secteurs pharmaceutique et biotechnologique.

- De plus, le soutien réglementaire croissant aux méthodes de test alternatives, combiné à la demande croissante des industries pharmaceutique, cosmétique et chimique, fait des tests de toxicologie in vitro une solution fiable, éthique et rentable. Ces facteurs convergents accélèrent l'adoption de ces solutions, stimulant ainsi considérablement la croissance du secteur.

Analyse du marché nord-américain des tests de toxicologie in vitro

- Les tests de toxicologie in vitro, qui consistent à évaluer la sécurité et la toxicité potentielle des produits chimiques, des médicaments et d’autres substances en dehors du corps humain, deviennent un élément essentiel du développement moderne de médicaments et de l’évaluation de la sécurité chimique en raison de leur capacité à réduire le recours aux tests sur les animaux, à améliorer la précision et à améliorer la conformité réglementaire.

- La demande croissante de tests de toxicologie in vitro est principalement alimentée par la pression réglementaire croissante visant à minimiser les tests sur les animaux, l'augmentation des activités de recherche et développement dans le secteur pharmaceutique et le besoin croissant de solutions de tests rapides, rentables et à haut débit.

- Les États-Unis ont dominé le marché des tests de toxicologie in vitro, avec une part de marché record de 87,53 % en 2024, grâce à une infrastructure de santé de pointe, à des initiatives gouvernementales fortes et à la présence de sociétés pharmaceutiques et biotechnologiques de premier plan. Le pays bénéficie également de cadres réglementaires robustes et de progrès technologiques constants dans les domaines des tests cellulaires, du criblage à haut débit et des technologies d'organes sur puce, ce qui stimule une croissance significative du marché.

- Le Canada devrait connaître la croissance la plus rapide sur le marché des tests de toxicologie in vitro au cours de la période de prévision, grâce à la hausse des investissements dans les soins de santé, à l'adoption croissante de technologies de pointe et aux initiatives gouvernementales favorisant les alternatives aux tests sur les animaux. L'essor du secteur de la recherche pharmaceutique au pays et les collaborations croissantes entre les établissements universitaires et les acteurs de l'industrie accélèrent encore cette croissance.

- Le segment des sociétés pharmaceutiques et biopharmaceutiques a dominé le marché nord-américain des tests de toxicologie in vitro avec une part de revenus de 45,8 % en 2024, alimentée par le volume élevé de tests de médicaments précliniques, la nécessité de se conformer aux normes de sécurité réglementaires et l'adoption de plateformes de toxicologie in vitro avancées.

Portée du rapport et segmentation du marché des tests de toxicologie in vitro

|

Attributs |

Analyses clés du marché des tests de toxicologie in vitro |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché des tests de toxicologie in vitro en Amérique du Nord

Confort amélioré grâce à des plateformes de test avancées

- Une tendance significative et croissante sur le marché nord-américain des tests de toxicologie in vitro est l'adoption de plateformes avancées de criblage à haut débit (HTS) et de technologies de tests automatisés. Ces innovations simplifient les flux de travail en toxicologie, réduisent les interventions manuelles et fournissent des résultats plus rapides et plus fiables.

- Par exemple, les entreprises déploient de plus en plus de modèles d'organes sur puce et de technologies de culture cellulaire 3D qui reproduisent la physiologie humaine avec plus de précision que les cultures 2D conventionnelles, améliorant ainsi la valeur prédictive des évaluations de toxicité. De même, des systèmes microfluidiques sont intégrés aux flux de travail des tests toxicologiques afin d'améliorer la reproductibilité et l'évolutivité.

- L'automatisation des tests de toxicologie in vitro permet aux laboratoires de traiter de grands volumes d'échantillons tout en minimisant la variabilité et les erreurs. Par exemple, plusieurs nouveaux systèmes permettent désormais la manipulation automatisée des liquides, l'imagerie avancée et l'analyse intégrée des données, améliorant ainsi considérablement le rendement et l'efficacité des tests de sécurité pharmaceutique et chimique.

- De plus, l'intégration de techniques d'imagerie avancées et d'analyses basées sur l'IA (appliquées spécifiquement aux ensembles de données toxicologiques plutôt qu'aux applications grand public) permet aux chercheurs d'approfondir leurs connaissances sur les réponses cellulaires, les biomarqueurs et les relations dose-réponse. Cela permet d'obtenir des profils de toxicité plus complets et plus précis.

- L'intégration transparente des plateformes de toxicologie in vitro aux systèmes de gestion des informations de laboratoire (LIMS) facilite la collecte centralisée des données, la conformité réglementaire et la standardisation des rapports entre les centres de recherche et les entreprises pharmaceutiques. Grâce à une interface unique, les laboratoires peuvent gérer leurs processus de tests parallèlement à leurs autres activités de R&D, créant ainsi un flux de travail unifié pour la découverte de médicaments et l'évaluation de la sécurité chimique.

- Cette tendance vers des systèmes de tests toxicologiques plus sophistiqués, automatisés et biologiquement pertinents transforme profondément les attentes en matière de développement de médicaments et d'évaluation de la sécurité chimique. Par conséquent, des entreprises comme Eurofins Scientific et Charles River Laboratories investissent massivement dans des modèles in vitro avancés, se positionnant ainsi pour répondre à la demande croissante de solutions toxicologiques précises, éthiques et évolutives.

- La demande de plateformes avancées de tests de toxicologie in vitro augmente rapidement dans les secteurs pharmaceutique et biotechnologique, car les organisations accordent de plus en plus d'importance à la précision prédictive, à la rentabilité et à la réduction de la dépendance aux tests sur les animaux, conformément aux cadres réglementaires en constante évolution.

Dynamique du marché nord-américain des tests de toxicologie in vitro

Conducteur

Besoin croissant en raison des préoccupations croissantes en matière de sécurité et de conformité réglementaire

- Les préoccupations croissantes concernant la sécurité humaine, les problèmes éthiques liés aux tests sur les animaux et les réglementations mondiales plus strictes en matière de tests chimiques et pharmaceutiques sont les principaux facteurs qui alimentent la demande de tests de toxicologie in vitro.

- Par exemple, en avril 2024, Charles River Laboratories a annoncé l'expansion de ses capacités de toxicologie in vitro en intégrant des modèles de culture cellulaire 3D avancés à son portefeuille de tests de sécurité. Ces initiatives stratégiques menées par des entreprises leaders devraient accélérer la croissance du marché des tests de toxicologie in vitro durant la période de prévision.

- Alors que les industries, notamment pharmaceutiques, biotechnologiques et chimiques, font l'objet d'une surveillance réglementaire accrue, les méthodes de tests in vitro offrent une alternative scientifiquement solide et éthiquement fondée aux études traditionnelles sur les animaux. Ces méthodes fournissent des données de toxicité précises tout en s'inscrivant dans les efforts mondiaux visant à réduire l'utilisation des animaux en recherche.

- En outre, l’adoption croissante de technologies avancées telles que les plateformes d’organes sur puce, les modèles dérivés de cellules souches et les systèmes automatisés de criblage à haut débit fait des tests in vitro un élément central des cadres modernes d’évaluation de la sécurité.

- La capacité des plateformes de toxicologie in vitro à fournir des résultats plus rapides, une meilleure reproductibilité et des données plus pertinentes pour l'humain en fait des outils indispensables pour le développement de médicaments, les évaluations de sécurité chimique et les tests cosmétiques. De plus, la demande croissante de solutions rentables, éthiques et efficaces continue de favoriser leur adoption sur les marchés développés et émergents.

Retenue/Défi

Préoccupations concernant les coûts élevés et les limitations techniques

- Malgré leur popularité croissante, les méthodes de toxicologie in vitro se heurtent à des défis liés au coût élevé des plateformes de tests avancées et à certaines limitations techniques. Si des systèmes innovants tels que les modèles d'organes 3D et les dispositifs microfluidiques fournissent des informations précieuses, leur adoption est souvent freinée par des investissements initiaux importants, notamment dans les petites structures de recherche ou sur les marchés sensibles aux coûts.

- Par exemple, des études très médiatisées ont souligné que même si les modèles in vitro offrent une forte valeur prédictive, ils ne peuvent pas encore reproduire pleinement la complexité des réponses de l’organisme entier, ce qui rend nécessaire leur utilisation parallèlement à des méthodes de test complémentaires dans certains cas.

- Il est essentiel de surmonter ces limites grâce à de nouvelles innovations technologiques, une normalisation plus large et une acceptation réglementaire accrue pour renforcer la confiance dans les méthodes in vitro. Des entreprises comme Eurofins Scientific et Labcorp travaillent activement à la validation de nouveaux tests et au développement de services de tests abordables afin de réduire les obstacles financiers.

- De plus, les investissements importants nécessaires en équipements, consommables et expertise spécialisée peuvent freiner l'adoption de la toxicologie in vitro dans les régions en développement. Si les coûts diminuent progressivement grâce aux avancées technologiques, la perception de la toxicologie in vitro comme un service haut de gamme peut freiner sa pénétration sur les marchés à faibles revenus.

- Surmonter ces défis grâce à la collaboration industrielle, aux initiatives de formation et à l’innovation continue sera essentiel pour assurer une croissance soutenue et une acceptation mondiale plus large des tests de toxicologie in vitro.

Portée du marché nord-américain des tests de toxicologie in vitro

Le marché est segmenté sur la base du produit et du service, du point final et du test toxicologique, de la technologie, de la méthode, de l'industrie et du canal de distribution.

- Par produit et service

En Amérique du Nord, le marché des tests de toxicologie in vitro se segmente en produits et services : consommables, services, dosages, équipements et logiciels. En 2024, le segment des consommables a dominé la plus grande part de chiffre d'affaires, avec 39,5 %, grâce à la demande récurrente de réactifs, de kits et de milieux de culture pour les analyses toxicologiques de routine. Indispensables au fonctionnement quotidien des laboratoires, les consommables représentent une source de revenus constante pour les fournisseurs. L'importance croissante accordée à la reproductibilité, à la précision et à la rapidité d'exécution a stimulé la demande de consommables de haute qualité dans les secteurs pharmaceutique, biotechnologique et chimique. De plus, l'utilisation croissante de consommables de culture cellulaire 3D avancés et de kits de dosage spécialisés pour des paramètres de toxicité complexes, tels que la toxicité organique, renforce la domination de ce segment. Grâce au lancement de nouveaux produits et aux innovations continues en matière de consommables, ce segment demeure un pilier du marché.

Le segment des logiciels devrait connaître le TCAC le plus rapide, soit 12,8 % entre 2025 et 2032, grâce à l'adoption croissante des plateformes numériques pour l'analyse des données, la modélisation prédictive et la conformité réglementaire des tests toxicologiques. Les outils logiciels permettent aux chercheurs d'intégrer des ensembles de données complexes issus du criblage à haut débit, des technologies OMICS et des modèles in silico, accélérant ainsi la prise de décision et réduisant les erreurs expérimentales. Les exigences réglementaires croissantes en matière de documentation précise et le besoin d'analyses prédictives avancées dans le développement de médicaments stimulent l'adoption des logiciels. Les plateformes cloud et les outils basés sur l'IA améliorent encore l'efficacité en offrant des solutions évolutives, automatisées et collaboratives pour la recherche toxicologique. Avec la transformation numérique des laboratoires, le segment des logiciels devrait connaître une expansion rapide et remodeler l'écosystème global des tests.

- Par point final et test toxicologiques

Sur la base des critères et tests toxicologiques, le marché nord-américain des tests de toxicologie in vitro est segmenté en tests ADME (absorption, distribution, métabolisme et excrétion), tests de cytotoxicité, tests de génotoxicité, tests de toxicité cutanée, tests de toxicité oculaire, tests de toxicité organique, tests d'irritation, de corrosion et de sensibilisation cutanées, tests de phototoxicité, ainsi que d'autres critères et tests de toxicité. Le segment des tests ADME a dominé la plus grande part de marché avec 41,2 % de chiffre d'affaires en 2024, grâce à son rôle essentiel dans l'évaluation des profils pharmacocinétiques des médicaments pendant le développement préclinique. Les études ADME fournissent des informations essentielles sur l'efficacité d'absorption, la biodisponibilité, la stabilité métabolique et les voies d'élimination, essentielles pour les soumissions réglementaires. L'adoption croissante de plateformes de criblage à haut débit, de l'automatisation et des modèles in vitro prédictifs a encore renforcé ce segment. Les entreprises pharmaceutiques et biopharmaceutiques s'appuient de plus en plus sur les tests ADME pour réduire les échecs tardifs et optimiser les candidats médicaments dès le début du cycle de développement. Les améliorations continues apportées aux systèmes microfluidiques, aux modèles hépatiques 3D et aux tests de co-culture ont amélioré la précision et le débit des tests ADME.

Le segment des tests de cytotoxicité devrait connaître le TCAC le plus rapide, soit 13,4 %, entre 2025 et 2032, grâce à l'importance croissante accordée à l'évaluation de la sécurité des nouvelles entités chimiques, des produits biologiques et des ingrédients cosmétiques. Les tests de cytotoxicité permettent l'identification précoce des composés toxiques, minimisant ainsi le risque d'effets indésirables lors des essais cliniques. La demande croissante des organismes de recherche sous contrat (CRO) et des organismes de réglementation pour des données de cytotoxicité standardisées et reproductibles accélère la croissance. L'adoption de systèmes d'imagerie automatisés, du criblage à haut contenu et de modèles de culture cellulaire 3D élargit la portée et la fiabilité des tests de cytotoxicité. De plus, les mesures réglementaires visant à réduire les tests sur les animaux, conformément à la méthode des 3R (Remplacement, Réduction, Affinement), favorisent l'adoption de plateformes de cytotoxicité in vitro.

- Par technologie

Sur le plan technologique, le marché nord-américain des tests de toxicologie in vitro est segmenté en technologies de culture cellulaire, technologies à haut débit, imagerie moléculaire et technologie OMICS. Le segment des technologies de culture cellulaire a dominé le marché avec une part de chiffre d'affaires de 38,7 % en 2024, grâce à sa large application dans les tests de toxicité prédictifs et les évaluations de l'innocuité des médicaments. Les modèles de culture cellulaire 2D et 3D, notamment les cultures d'organes sur puce et les cultures sphéroïdes, sont largement utilisés pour évaluer la toxicité spécifique à un organe, la cytotoxicité et les études mécanistiques. Ce segment bénéficie de la tendance croissante à la médecine personnalisée, de l'amélioration de la reproductibilité des tests et de la réduction des tests sur les animaux. La disponibilité accrue de lignées cellulaires spécialisées, de systèmes de co-culture et de milieux sans sérum soutient également la demande en technologies de culture cellulaire avancées.

Le segment des technologies OMICS devrait connaître le TCAC le plus rapide, soit 14,1 % entre 2025 et 2032, grâce à l'utilisation croissante des plateformes de génomique, de protéomique et de métabolomique pour identifier les biomarqueurs moléculaires de toxicité. Les approches OMICS permettent un profilage complet des effets des médicaments à l'échelle moléculaire, améliorant ainsi la précision prédictive et les évaluations de sécurité. Les entreprises pharmaceutiques intègrent de plus en plus les données OMICS aux modèles in vitro afin d'accélérer la recherche préclinique et de respecter les normes réglementaires strictes. Les avancées technologiques en matière de séquençage de nouvelle génération, de spectrométrie de masse et de bioinformatique favorisent l'adoption des technologies OMICS dans les industries pharmaceutique, chimique et cosmétique.

- Par méthode

En Amérique du Nord, le marché des tests de toxicologie in vitro est segmenté en fonction de la méthode utilisée : tests cellulaires, tests biochimiques, modèles ex vivo et modèles in silico. En 2024, le segment des tests cellulaires a dominé la plus grande part de marché, avec 42,5 % de chiffre d’affaires, grâce à sa large applicabilité à l’évaluation de la viabilité cellulaire, de la cytotoxicité, de la toxicité spécifique à un organe et des réponses pharmacologiques. Les tests cellulaires sont largement privilégiés en raison de leur rapidité d’exécution, de leur reproductibilité et de leur compatibilité avec le criblage à haut débit. La pression réglementaire croissante pour remplacer les études animales et l’adoption croissante de modèles pertinents pour l’humain stimulent encore davantage ce segment. L’imagerie avancée, l’analyse automatisée et les techniques de culture cellulaire 3D améliorent l’efficacité et la précision.

Le segment des modèles in silico devrait connaître le TCAC le plus rapide, soit 13,9 %, entre 2025 et 2032, grâce à la toxicologie computationnelle et à la modélisation prédictive. Les approches in silico permettent d'évaluer les risques de toxicité, d'identifier les effets hors cible et de réduire les coûts expérimentaux. Ce segment bénéficie d'algorithmes prédictifs basés sur l'IA, de l'intégration de l'apprentissage automatique et du soutien réglementaire pour des stratégies de test alternatives. Ces modèles complètent les données expérimentales, permettant une prise de décision plus rapide et réduisant le recours aux études animales. De plus, la disponibilité croissante de bases de données toxicologiques publiques et d'outils de modélisation open source accélère encore leur adoption. La collaboration croissante entre les développeurs de logiciels, les instituts de recherche et les organismes de réglementation améliore la précision des modèles et leur acceptation réglementaire.

- Par industrie

Sur le plan sectoriel, le marché nord-américain des tests de toxicologie in vitro est segmenté en deux catégories : les entreprises pharmaceutiques et biopharmaceutiques, les diagnostics, l'agroalimentaire, les produits chimiques, les cosmétiques et les produits ménagers. En 2024, ce segment a dominé le marché avec une part de chiffre d'affaires de 45,8 %, grâce au volume important de tests précliniques de médicaments, à la nécessité de se conformer aux normes de sécurité réglementaires et à l'adoption de plateformes de toxicologie in vitro avancées. Ces entreprises utilisent les tests in vitro pour améliorer l'innocuité et l'efficacité de leurs candidats médicaments tout en réduisant le risque d'échecs en phase finale. La tendance à l'intégration du criblage à haut débit, des modèles d'organes sur puce et des plateformes automatisées renforce la domination de ce segment.

Le segment des cosmétiques et des produits ménagers devrait connaître le TCAC le plus rapide, soit 12,5 % entre 2025 et 2032, sous l'effet des exigences réglementaires visant à réduire les tests sur les animaux et de la demande croissante de produits de consommation plus sûrs. Les entreprises adoptent de plus en plus les tests in vitro de cytotoxicité, de génotoxicité et de sensibilisation cutanée afin de se conformer aux normes internationales de sécurité. Les innovations technologiques en matière de modèles de peau 3D, d'épiderme humain reconstruit et de tests organotypiques soutiennent la croissance rapide de ce secteur. De plus, la préférence croissante des consommateurs pour des produits non testés sur les animaux et respectueux de l'environnement stimule leur adoption par le marché. La collaboration entre les fabricants de cosmétiques, les entreprises de biotechnologie et les organismes de réglementation améliore la précision des tests et accélère les délais de test des produits.

- Par canal de distribution

En fonction du canal de distribution, le marché nord-américain des tests de toxicologie in vitro est segmenté en appels d'offres directs, ventes au détail et autres. Le segment des appels d'offres directs a dominé le marché avec une part de chiffre d'affaires de 41,3 % en 2024, grâce aux achats groupés des sociétés pharmaceutiques et biotechnologiques pour les tests de toxicologie de routine. Les contrats à long terme avec les fournisseurs garantissent une qualité constante, des livraisons ponctuelles et le respect des normes réglementaires. Les accords d'appel d'offres directs permettent également aux organisations de négocier les prix, de réduire les coûts opérationnels et de garantir des chaînes d'approvisionnement fiables pour les consommables, les équipements et les logiciels.

Le segment des ventes au détail devrait connaître le TCAC le plus rapide, soit 11,8 % entre 2025 et 2032, alimenté par la demande croissante de laboratoires de petite taille, d'instituts de recherche universitaires et d'organismes de recherche sous contrat nécessitant des achats individuels de kits, de réactifs et d'équipements de petite taille. Le nombre croissant de start-ups, de centres de recherche et de laboratoires spécialisés soutient la croissance via les canaux de distribution, offrant flexibilité et commodité aux opérations de petite taille. De plus, l'essor des plateformes de commerce électronique et des places de marché scientifiques en ligne facilite l'accès aux consommables et instruments essentiels. L'amélioration du service après-vente, des formations et des solutions groupées proposées par les détaillants favorise également l'adoption par les petites institutions.

Analyse régionale du marché nord-américain des tests de toxicologie in vitro

- Les États-Unis ont dominé le marché des tests de toxicologie in vitro, avec une part de marché record de 87,53 % en 2024, grâce à une infrastructure de santé de pointe, à des initiatives gouvernementales fortes et à la présence de sociétés pharmaceutiques et biotechnologiques de premier plan. Le pays bénéficie également de cadres réglementaires robustes et de progrès technologiques constants dans les domaines des tests cellulaires, du criblage à haut débit et des technologies d'organes sur puce, ce qui stimule une croissance significative du marché.

- Le Canada devrait connaître la croissance la plus rapide sur le marché des tests de toxicologie in vitro au cours de la période de prévision, grâce à la hausse des investissements dans les soins de santé, à l'adoption croissante de technologies de pointe et aux initiatives gouvernementales favorisant les alternatives aux tests sur les animaux. L'essor du secteur de la recherche pharmaceutique au pays et les collaborations croissantes entre les établissements universitaires et les acteurs de l'industrie accélèrent encore cette croissance.

Analyse du marché américain des tests de toxicologie in vitro

Le marché américain des tests de toxicologie in vitro a dominé le marché avec une part de chiffre d'affaires record de 87,53 % en 2024, grâce à une infrastructure de santé de pointe, à des initiatives gouvernementales fortes et à la présence de sociétés pharmaceutiques et biotechnologiques de premier plan. Le pays est à la pointe des innovations technologiques, notamment les tests cellulaires, le criblage à haut débit et les plateformes d'imagerie moléculaire, qui améliorent considérablement les études toxicologiques. De plus, l'augmentation des investissements dans la découverte de médicaments, les exigences réglementaires strictes et l'importance croissante accordée au remplacement des tests sur les animaux par des modèles plus prédictifs stimulent la croissance du marché. Ces facteurs font des États-Unis le leader incontesté du marché nord-américain.

Analyse du marché canadien des tests de toxicologie in vitro

Le marché canadien des tests de toxicologie in vitro devrait connaître la croissance la plus rapide au cours de la période de prévision, grâce à la hausse des investissements dans les soins de santé et aux initiatives gouvernementales favorisant des solutions de rechange éthiques et durables aux tests sur les animaux. L'essor de la recherche pharmaceutique au pays et l'adoption croissante de technologies de pointe telles que les modèles ex vivo, les méthodes in silico et les tests de toxicité organique créent d'importantes opportunités. La collaboration entre les universités, les établissements de recherche et les entreprises privées favorise l'innovation, tandis que des cadres réglementaires favorables facilitent la transition vers des modèles de tests modernes. Cette dynamique positionne le Canada comme un marché à fort potentiel de croissance en Amérique du Nord.

Part de marché des tests de toxicologie in vitro en Amérique du Nord

L’industrie des tests de toxicologie in vitro est principalement dirigée par des entreprises bien établies, notamment :

- Thermo Fisher Scientific Inc. (États-Unis)

- Labcorp (États-Unis)

- Merck KGaA (Allemagne)

- Laboratoires Charles River (États-Unis)

- Lonza (Suisse)

- Bio-Rad Laboratories, Inc. (États-Unis)

- Catalent, Inc. (États-Unis)

- SGS Société Générale de Surveillance SA (Suisse)

- Intertek Group plc (Royaume-Uni)

- Eurofins Scientifique (Luxembourg)

- Promega Corporation (États-Unis)

- Aragen Life Sciences Ltd. (Inde)

- Cyprotex Plc (Royaume-Uni)

- Shanghai Medicilon Inc. (Chine)

- Creative Biolabs (États-Unis)

- BioIVT (États-Unis)

- AAT Bioquest, Inc. (États-Unis)

- Gentronix (Royaume-Uni)

- IONTOX (États-Unis)

- InSphero (Suisse)

- Laboratoires de recherche MB (États-Unis)

- Creative Bioarray (États-Unis)

- Systèmes cellulaires préférés (États-Unis)

Derniers développements sur le marché nord-américain des tests de toxicologie in vitro

- En mars 2023, Thermo Fisher Scientific Inc., fournisseur leader d'équipements et de réactifs de laboratoire, a annoncé le lancement de sa nouvelle plateforme de tests toxicologiques in vitro à haut débit. Cette plateforme intègre des technologies de culture cellulaire avancées et des capacités de criblage automatisé, permettant aux chercheurs d'évaluer les effets toxicologiques potentiels avec plus d'efficacité et de précision. Ce lancement souligne l'engagement de Thermo Fisher à faire progresser les méthodologies de tests toxicologiques in vitro et à soutenir la conformité réglementaire dans le développement de médicaments.

- En juin 2024, Charles River Laboratories, un important organisme de recherche contractuelle, a étendu ses services de tests de toxicologie in vitro en introduisant une série de nouveaux tests axés sur la toxicité cutanée et oculaire. Ces tests utilisent des modèles d'épiderme et de cornée humains reconstitués pour fournir des prédictions plus précises du potentiel d'irritation cutanée et oculaire. Cette expansion vise à répondre à la demande croissante de méthodes de test alternatives réduisant le recours aux modèles animaux et s'alignant sur les tendances réglementaires mondiales.

- En septembre 2024, Labcorp Drug Development, organisation mondiale de recherche contractuelle, a dévoilé ses capacités améliorées de tests toxicologiques in vitro grâce à l'ajout de modèles de culture cellulaire 3D avancés. Ces modèles offrent des environnements physiologiquement plus pertinents pour l'évaluation de la toxicité induite par les médicaments, notamment en ce qui concerne les effets spécifiques à certains organes. L'intégration de systèmes de culture cellulaire 3D témoigne de la volonté de Labcorp de fournir des solutions de pointe améliorant la prévisibilité et la pertinence des évaluations toxicologiques.

- En décembre 2024, Bio-Rad Laboratories, leader mondial de la recherche en sciences de la vie et du diagnostic clinique, a lancé une nouvelle gamme de kits de tests toxicologiques in vitro conçus pour les applications de criblage à haut débit. Ces kits intègrent des tests par fluorescence pour détecter la cytotoxicité et la génotoxicité, permettant ainsi des évaluations de toxicité rapides et fiables. L'introduction de ces kits vise à aider les industries pharmaceutiques et cosmétiques à respecter des normes de sécurité strictes tout en améliorant l'efficacité des tests.

- En février 2025, Merck KGaA, Darmstadt (Allemagne), entreprise leader dans les domaines des sciences et des technologies, a annoncé un partenariat stratégique avec une société de biotechnologie américaine pour co-développer des plateformes de tests toxicologiques in vitro de nouvelle génération. Cette collaboration vise à intégrer les technologies omiques à des modèles in vitro avancés afin de fournir des données toxicologiques plus complètes et prédictives. Ce partenariat souligne l'engagement de Merck KGaA à faire progresser le domaine des tests toxicologiques in vitro grâce à l'innovation et à la collaboration.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.