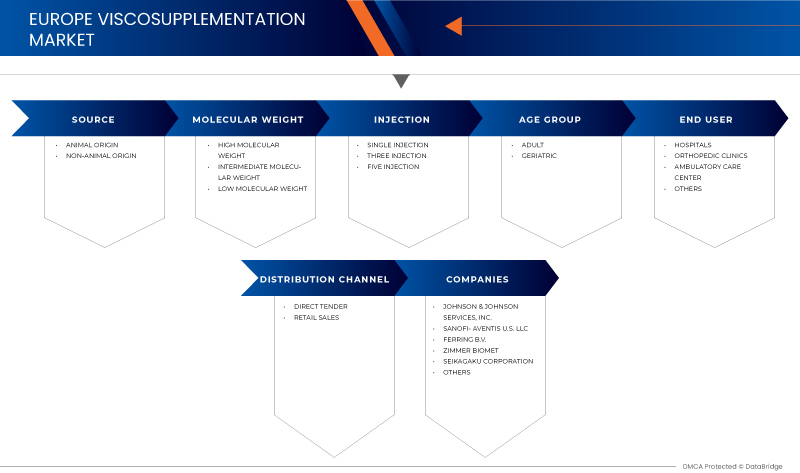

Marché de la viscosupplémentation en Amérique du Nord, par source (origine animale et non animale), groupe d'âge (gériatrique et adultes), injection (injection unique, trois injections et cinq injections), poids moléculaire (poids moléculaire intermédiaire, faible poids moléculaire et poids moléculaire élevé), utilisateur final (hôpital, cliniques orthopédiques, centres de soins ambulatoires et autres), canal de distribution (appel d'offres direct et vente au détail) - Tendances et prévisions de l'industrie jusqu'en 2029.

Analyse et perspectives du marché de la viscosupplémentation en Amérique du Nord

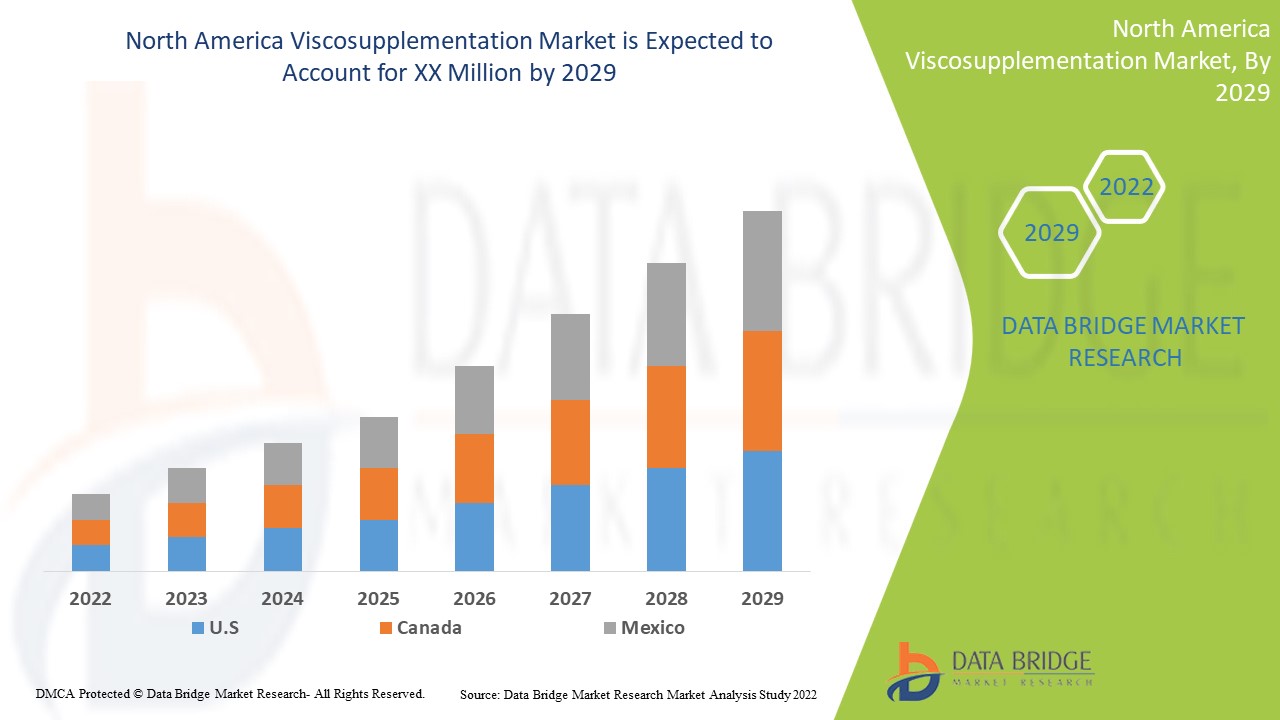

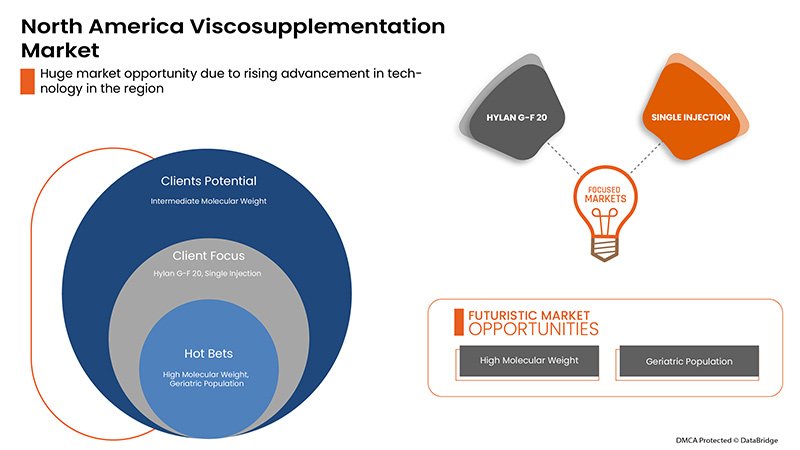

Le marché nord-américain de la viscosupplémentation devrait croître au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,7 % au cours de la période de prévision de 2022 à 2029. Les avancées technologiques dans les traitements de viscosupplémentation en Amérique du Nord et l'augmentation dans le secteur de la santé sont un autre facteur qui stimule la croissance du marché nord-américain de la viscosupplémentation au cours de la période de prévision.

Cependant, le coût élevé associé aux traitements et aux effets secondaires tels que l'injection temporaire, la douleur au site d'injection, le gonflement, la chaleur et la perte de rougeur freineront la croissance du marché. L'adoption d'alliances stratégiques telles que les partenariats et les acquisitions par des acteurs clés du marché constitue une opportunité pour la croissance du marché nord-américain de la viscosupplémentation.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD Volumes en unités, prix en USD |

|

Segments couverts |

Par source (origine animale et non animale), groupe d'âge (gériatrique et adultes), injection (injection unique, trois injections et cinq injections), poids moléculaire (poids moléculaire intermédiaire, faible poids moléculaire et poids moléculaire élevé), utilisateur final (hôpital, cliniques orthopédiques, centres de soins ambulatoires et autres), canal de distribution (vente directe et vente au détail) |

|

Pays couverts |

États-Unis, Canada, Mexique, Panama, Jamaïque et République dominicaine |

|

Acteurs du marché couverts |

Certains des principaux acteurs opérant sur le marché de la viscosupplémentation en Amérique du Nord sont Anika Therapeutics, Inc., SEIKAGAKU CORPORATION, Bioventus, Fidia Farmaceutici SPA, Ferring BV, sanofi-aventis US LLC, Zimmer Biomet, OrthogenRx, Inc. (une filiale d'AVNS). , APTISSEN, Johnson & Johnson Services, Inc., LG Chem., Viatris Inc., IBSA Institut Biochimique SA, Ortobrand International, TRB CHEMEDICA SA, Teva Pharmaceutical Industries Ltd., Lifecore (une filiale de Landec Corporation), VIRCHOW BIOTECH, Zuventus HealthCare Ltd. (une filiale d'Emcure Pharmaceuticals), entre autres. |

Définition du marché

Le développement du paradigme thérapeutique de la viscosupplémentation pour le soulagement durable de la douleur dans les articulations humaines et animales souffrant d'arthrose ou d'arthrite traumatique s'est basé sur la découverte que dans les conditions arthritiques, le poids moléculaire moyen et la concentration de l'acide hyaluronique diminuent. Par conséquent, les propriétés élastovisqueuses du liquide synovial sont considérablement réduites. La viscosupplémentation est un processus thérapeutique dans lequel le liquide synovial pathologique ou l'épanchement est retiré de l'articulation par arthrocentèse et remplacé par une solution d'acide hyaluronique hautement purifiée dont la concentration est 16 à 30 fois supérieure à celle du liquide articulaire pathologique et 2 à 5 fois supérieure à celle de l'acide hyaluronique dans le liquide synovial sain. Dans certaines préparations d'acide hyaluronique utilisées aujourd'hui à des fins thérapeutiques, les propriétés rhéologiques (viscosité et élasticité) sont faibles. Par conséquent, l'élastoviscosité du liquide est similaire à celle du liquide retiré d'une articulation arthritique. Une autre préparation disponible pour les patients du monde entier est composée de dérivés d'acide hyaluronique (hylanes) avec une élastoviscosité nettement supérieure à celle des solutions d'acide hyaluronique. Ses propriétés rhéologiques sont comparables à celles du liquide présent chez les individus jeunes et en bonne santé. Le bénéfice clinique de la viscosupplémentation est un soulagement durable de la douleur dans les articulations arthritiques.

En outre, la demande croissante de traitements non chirurgicaux pour l’arthrose, la prévalence des troubles liés au mode de vie et les progrès dans le développement de thérapies à base d’acide hyaluronique sont quelques-uns des facteurs qui devraient stimuler le marché.

Dynamique du marché

Conducteurs

- Augmentation de la population gériatrique

L'âge croissant s'accompagne d'une augmentation réciproque du nombre de patients âgés admis dans les hôpitaux en raison de blessures traumatiques mortelles. La prévalence croissante des maladies liées à l'arthrose du genou entraîne une demande croissante de diagnostic et de traitement. Avec la croissance de la population, la pression sur le système de santé augmente. Le besoin croissant de traitement approprié augmente proportionnellement la demande de soins, de services et de technologies pour la prévention et le traitement des maladies liées à l'arthrose du genou telles que la sarcopénie, l'ostéoporose, l'ostéopénie et d'autres complications. La population âgée est plus sujette à ces maladies, ce qui entraîne une fragilité des os et des articulations. Chez ces patients, la viscosupplémentation est utilisée dans la procédure pour leur fournir des avantages immédiats et efficaces associés à leur corps.

Avec l'âge et la prévalence croissante de l'arthrose, la demande de diagnostic précoce de ces maladies augmente également. Par conséquent, la demande de viscosupplémentation pour le traitement dans le système de santé à travers le monde augmente.

- Risque croissant d’ostéoporose et d’arthrose

L'ostéoporose est une maladie des os qui progresse en raison d'une diminution de la densité minérale osseuse et de la masse osseuse ou en raison d'une variation de la qualité ou de la structure de l'os. L'ostéoporose peut augmenter le risque de fractures entraînant des fractures osseuses en raison d'une diminution de la résistance osseuse. Elle est plus observée chez les femmes que chez les hommes. Les femmes post-menstruelles souffrent souvent de fractures osseuses dues à l'ostéoporose car la maladie est silencieuse et ne présente généralement aucun symptôme. La plupart des personnes âgées sont plus sujettes à l'ostéoporose. L'arthrose est une maladie articulaire ou une inflammation des articulations et des tissus environnants. La mobilité d'une personne est affectée lorsque de telles conditions surviennent.

Les maladies silencieuses telles que l'ostéoporose et l'arthrose ne présentent aucun symptôme et fragilisent les os de la personne, ce qui entraîne des décès majeurs tels que des malformations de la colonne vertébrale, des fractures, des chutes soudaines ou des ruptures osseuses, entre autres. Ainsi, les risques accrus de ces pathologies augmentent directement la demande de viscosupplémentation nécessaire pour traiter les malformations dues à ces pathologies. Par conséquent, le risque croissant d'ostéoporose et d'arthrose devrait stimuler la croissance du marché de la viscosupplémentation en Amérique du Nord.

Retenue

- Manque d'expertise technique

La première étape pour constituer un vivier d’ingénieurs et de techniciens professionnels consiste à trouver, attirer et embaucher des talents. Même dans les meilleures circonstances, cette procédure peut s’avérer difficile. La main-d’œuvre existante dans le secteur manufacturier vieillit et part rapidement à la retraite. Dans le secteur médical, les compétences en STEM (sciences, technologie, ingénierie et mathématiques) sont rares. Bien que la demande de travailleurs qualifiés (techniciens) et de compétences de premier et de deuxième cycle (ingénieurs) reste forte dans le secteur manufacturier, le nombre de personnes possédant les compétences nécessaires se réduit de plus en plus. Seuls des professionnels qualifiés devraient pratiquer la viscosupplémentation, mais ce nombre est bien moindre dans le monde entier car ces procédures sont complexes.

Cependant, constituer une bonne équipe de fabrication additive (FA) ne se résume pas à trouver et recruter des candidats qualifiés. Les employés doivent être qualifiés pour rester à jour et maintenir les compétences requises à mesure que la technologie évolue et se développe. Même avec leur formation axée sur les STEM, les nouveaux ingénieurs auront certainement besoin d'une formation pratique aux techniques de FA, ce qui constitue l'un des principaux défis de leur recrutement et de leur embauche. En effet, de nombreux programmes d'ingénierie de premier cycle offrent peu de formation spécifique à la FA et, par conséquent, de nombreux diplômés peuvent ne pas avoir les compétences en FA que recherchent les employeurs.

Ainsi, le manque d’expertise technique peut constituer un frein à la croissance du marché.

Opportunité

- Sécurité et efficacité de l'acide hyaluronique intra-articulaire (IAHA)

Il existe plusieurs types d'injections d'acide hyaluronique, également appelées viscosupplémentation, qui sont utilisées pour l'arthrose du genou. Elles sont fabriquées à partir de crêtes de coq ou de poulet ou sont dérivées de bactéries et sont injectées directement dans l'articulation. L'acide hyaluronique intra-articulaire est un traitement approuvé par la Food and Drug Administration américaine pour l'arthrose du genou (OA). L'injection intra-articulaire d'acide hyaluronique (IAHA) présente une option de traitement local alternative offrant un bénéfice symptomatique sans les effets indésirables systémiques associés aux corticostéroïdes IA. De nombreux ECR et méta-analyses ont cherché à évaluer l'efficacité et la sécurité de l'IAHA, avec des résultats et des conclusions mitigés. Il a été démontré que l'IAHA a un effet positif sur la douleur et la fonction articulaire. De plus en plus de données montrent également que plusieurs cycles d'IAHA peuvent avoir un impact sur les résultats à long terme, notamment une réduction de l'utilisation concomitante d'analgésiques et un retard dans la nécessité d'une arthroplastie totale du genou.

Défi

- Politiques gouvernementales strictes concernant l'UTILISATION de la viscosupplémentation

La commercialisation de la viscosupplémentation à travers le monde par divers acteurs clés du marché est facilitée par le respect des cadres réglementaires établis par de nombreux pays à travers le monde. L'approbation préalable à la mise sur le marché de divers dispositifs médicaux varie d'un pays à l'autre. La loi américaine sur les aliments, les médicaments et les cosmétiques (« FD&C Act ») classe les dispositifs médicaux aux États-Unis. L'Union européenne (UE) réglemente les dispositifs médicaux en Europe. Cependant, le développement rapide des politiques et réglementations de confidentialité est en cours dans la région Asie-Pacifique et EMEA, notamment en Inde, en Russie, en Chine, en Corée du Sud, à Singapour, à Hong Kong et en Australie.

La viscosupplémentation est réglementée par un ensemble de lois, de règles et de réglementations vastes et complexes visant à les protéger de toute utilisation dans le cadre de tout traitement potentiellement nocif.

La viscosupplémentation agit comme un remplacement des parties du corps endommagées, blessées ou infectées en cas d'arthrose ou d'accidents sportifs chez les patients, tout en maintenant la demande du patient en matière de mouvement corporel. Cependant, toute erreur d'orientation affectera la sécurité et la structure corporelle du patient.

Par conséquent, les règles et réglementations strictes concernant l’utilisation de la viscosupplémentation peuvent constituer un défi à la croissance du marché.

Impact post-COVID-19 sur le marché nord-américain de la viscosupplémentation

La COVID-19 a entraîné une augmentation substantielle de la demande de fournitures médicales de la part des professionnels de la santé et du grand public pour des mesures de précaution. Les fabricants de ces articles ont la possibilité de profiter de la demande accrue de fournitures médicales en garantissant un approvisionnement constant d'équipements de protection individuelle sur le marché. La COVID-19 devrait avoir un impact considérable sur le marché nord-américain de la viscosupplémentation.

Portée et taille du marché de la viscosupplémentation en Amérique du Nord

Le marché nord-américain de la viscosupplémentation est segmenté en fonction de la source, de la tranche d'âge, du poids moléculaire, de l'injection, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PAR SOURCE

- ORIGINE ANIMALE

- ORIGINE NON ANIMALE

Sur la base de la source, le marché de la viscosupplémentation est segmenté en origine animale et origine non animale.

PAR POIDS MOLÉCULAIRE

- POIDS MOLÉCULAIRE ÉLEVÉ

- FAIBLE POIDS MOLÉCULAIRE

- POIDS MOLÉCULAIRE INTERMÉDIAIRE

Sur la base du poids moléculaire, le marché de la viscosupplémentation est segmenté en poids moléculaire intermédiaire, faible poids moléculaire et poids moléculaire élevé.

PAR INJECTION

- INJECTION UNIQUE

- TROIS INJECTIONS

- CINQ INJECTIONS

Sur la base de l’injection, le marché de la viscosupplémentation est segmenté en injection unique, trois injections et cinq injections.

PAR GROUPE D'ÂGE

- ADULTES

- GÉRIATRIE

Sur la base de la tranche d’âge, le marché de la viscosupplémentation est segmenté en gériatrie et adultes.

UTILISATEUR FINAL

- HÔPITAUX

- CLINIQUE ORTHOPEDIQUE

- SOINS DE SANTÉ À DOMICILE

- AUTRES

Sur la base de l’utilisateur final, le marché de la viscosupplémentation est segmenté en hôpitaux, cliniques orthopédiques, centres de soins ambulatoires et autres.

PAR CANAL DE DISTRIBUTION

- APPEL D'OFFRES DIRECT

- VENTES AU DÉTAIL

Sur la base du canal de distribution, le marché de la viscosupplémentation est segmenté en appels d'offres directs et ventes au détail.

Analyse du marché de la viscosupplémentation au niveau des pays

Le marché de la viscosupplémentation est analysé et des informations sur la taille du marché sont fournies par source, groupe d’âge, poids moléculaire, injection, utilisateur final et canal de distribution.

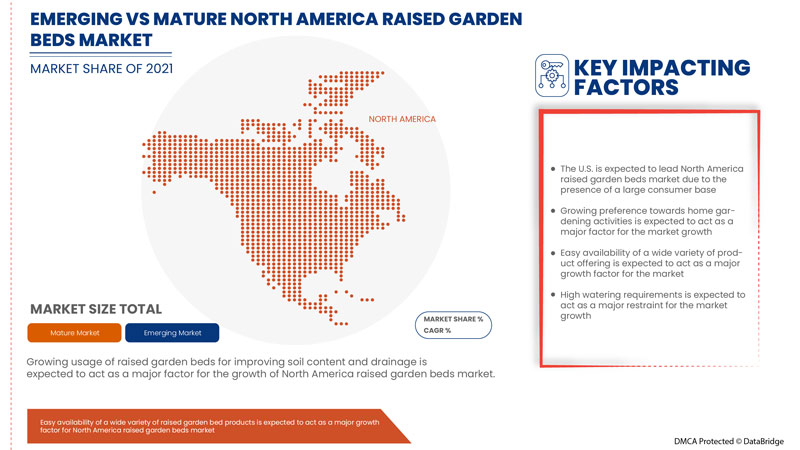

Les pays couverts dans le rapport sur le marché de la viscosupplémentation en Amérique du Nord sont les États-Unis, le Canada, le Mexique, le Panama, la Jamaïque et la République dominicaine.

En 2022, les États-Unis dominent le marché en raison de la préférence croissante pour les corticostéroïdes alternatifs pour les options de traitement des douleurs articulaires. Les États-Unis devraient connaître une croissance en raison de l'augmentation des progrès technologiques dans les traitements médicamenteux.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales sur les canaux de vente sont prises en compte lors de l'analyse prévisionnelle des données nationales.

North America viscosupplementation market also provides you with a detailed market analysis of every country growth in the healthcare industry. Moreover, it provides detailed information regarding healthcare services and treatments, the impact of regulatory scenarios, and trending parameters regarding the North America viscosupplementation market.

Competitive Landscape and North America Viscosupplementation Market Share Analysis

North America Viscosupplementation market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to viscosupplementation treatments.

The major companies which are dealing in the viscosupplementation market are Anika Therapeutics, Inc., SEIKAGAKU CORPORATION, Bioventus, Fidia Farmaceutici S.P.A, Ferring B.V, sanofi-aventis U.S. LLC, Zimmer Biomet, OrthogenRx, Inc. (a subsidiary of AVNS), APTISSEN, Johnson & Johnson Services, Inc., LG Chem., Viatris Inc., IBSA Institut Biochimique SA, Ortobrand International, TRB CHEMEDICA SA, Teva Pharmaceutical Industries Ltd., Lifecore (a subsidiary of Landec Corporation), VIRCHOW BIOTECH, Zuventus HealthCare Ltd. (a subsidiary of Emcure Pharmaceuticals), among others

Strategic alliances like mergers, acquisitions, and agreements by the key market players are further expected to accelerate the growth of viscosupplementation treatments.

For instance,

- In May, 2022, Fidia Farmaceutici S.p.A. harnesses the regenerative power of hyaluronic acid with its innovative portfolio launched in Spain

Fidia Farmaceutici S.p.A. presented its Aesthetic Care portfolio with a scientific symposium on its innovative ACP (Auto-Crosslinked Polymer) technology at the 20th Aesthetic & Anti-aging Medicine World Congress 2022 (AMWC) in Monte Carlo. The company has launched its complete Hyal System and Hy-Tissue portfolio in Spain. This has helped the company to showcase its research for hyaluronic acid

- In June 2022, Johnson & Johnson announced new data from Phase 3 studies demonstrating patients treated with medicine achieved consistent, long-term efficacy through two years across the domains of active psoriatic arthritis (PsA) – including joint, skin, enthesitis, a dactylitis,b spinal pain, and disease severityc endpoints – irrespective of baseline characteristics. This has helped company to showcase its progress

- En novembre 2021, LG Chem a lancé le développement clinique d'un nouveau traitement de nouvelle génération contre l'arthrose. LG Chem a annoncé que la société avait reçu l'approbation du ministère coréen de la sécurité alimentaire et pharmaceutique pour les essais cliniques de phase 1b/2 sur la base des résultats précliniques positifs de LG00034053, un nouveau candidat médicament pour le traitement de l'arthrose. LG Chem prévoit d'accélérer le développement de nouveaux médicaments en concevant des essais cliniques reliant les phases 1 et 2.

Cela a aidé l'entreprise à se lancer dans de nouveaux médicaments pour le traitement de l'arthrose

- En novembre 2020, Viatris Inc. a lancé avec succès une fusion entre Mylan NV et l'entreprise Upjohn de Pfizer. En combinant ces deux sociétés complémentaires, Viatris dispose de l'expertise scientifique, de fabrication et de distribution ainsi que de capacités réglementaires, médicales et commerciales éprouvées en Amérique du Nord pour fournir des médicaments de haute qualité aux patients dans plus de 165 pays et territoires. Cela a aidé l'entreprise à développer ses activités.

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché renforcent l'empreinte de l'entreprise sur le marché nord-américain de la viscosupplémentation, ce qui profite également à la croissance des bénéfices de l'organisation.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données comprennent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des parts de marché des entreprises, les normes de mesure, l'Amérique du Nord par rapport aux régions et l'analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA VISCOSUPPLEMENTATION MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 INDUSTRIAL INSIGHTS

7 PIPELINE ANALYSIS FOR NORTH AMERICA VISCOSUPPLEMENTATION MARKET

8 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: REGULATIONS

9 MARKET OVERVIEW

9.1 DRIVERS

9.1.1 RISING GERIATRIC POPULATION

9.1.2 INCREASING RISK OF OSTEOPOROSIS AND OSTEOARTHRITIS

9.1.3 TECHNOLOGICAL ADVANCEMENT IN VISCOSUPPLEMENTATION

9.1.4 LOW PRODUCTION COST OF VISCOSUPPLEMENTATION PRODUCTS

9.2 RESTRAINTS

9.2.1 LACK OF TECHNICAL EXPERTISE

9.2.2 PRODUCT RECALL PROCEDURES

9.2.3 LIMITED APPLICATIONS OF VISCOSUPPLEMENTATION

9.3 OPPORTUNITIES

9.3.1 SAFETY AND EFFECTIVENESS OF INTRA-ARTICULAR HYALURONIC ACID (IAHA)

9.3.2 RISING HEALTHCARE INFRASTRUCTURE

9.3.3 INCREASE IN DEMAND FOR MINIMALLY INVASIVE PROCEDURES

9.3.4 INCREASING NUMBER OF JOINT REPLACEMENTS AND SPORTS ACCIDENT

9.4 CHALLENGES

9.4.1 STRINGENT GOVERNMENT POLICIES FOR THE USE OF VISCOSUPPLEMENTATION

9.4.2 SIDE-EFFECTS OF VISCOSUPPLEMENTATION

10 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY SOURCE

10.1 OVERVIEW

10.2 NON-ANIMAL ORIGIN

10.2.1 ORTHOVISC

10.2.2 EUFLEXXA

10.2.3 MONOVISC

10.2.4 DUROLANE

10.2.5 GEL-ONE

10.2.6 SUPARTZ

10.2.7 GELSYN-3

10.2.8 CINGAL

10.2.9 SULPLASYN

10.2.10 VISCOSEAL

10.2.11 OSTEONIL

10.2.12 OTHERS

10.3 ANIMAL ORIGIN

10.3.1 HYLAN G-F 20

10.3.2 SYNVIC ONE

10.3.3 SYNVIC

10.3.4 OTHERS

10.3.5 HYALURONANS

10.3.6 HYALGAN

10.3.7 OTHERS

11 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT

11.1 OVERVIEW

11.2 INTERMEDIATE MOLECULAR WEIGHT

11.2.1 ORTHOVISC

11.2.2 EUFLEXXA

11.2.3 MONOVISC

11.2.4 DUROLANE

11.2.5 VISCOSEAL

11.2.6 OSTEONIL

11.2.7 OTHERS

11.3 LOW MOLECULAR WEIGHT

11.3.1 HYLAGAN

11.3.2 SUPARTZ

11.3.3 GELSYN-3

11.3.4 CINGAL

11.3.5 SULPLASYN

11.3.6 OTHERS

11.4 HIGH MOLECULAR WEIGHT

11.4.1 SYNVIC ONE

11.4.2 SYNVIC

11.4.3 OTHERS

12 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY INJECTION

12.1 OVERVIEW

12.2 SINGLE INJECTION

12.3 THREE INJECTION

12.4 FIVE INJECTION

13 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP

13.1 OVERVIEW

13.2 ADULTS

13.3 GERIATRIC

14 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY END USER

14.1 OVERVIEW

14.2 HOSPITALS

14.3 ORTHOPEDIC CLINICS

14.4 AMBULATORY CARE CENTERS

14.5 OTHERS

15 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL

15.1 OVERVIEW

15.2 RETAIL SALES

15.3 DIRECT TENDER

16 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY REGION

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

16.1.4 PANAMA

16.1.5 JAMAICA

16.1.6 DOMINICAN REPUBLIC

17 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 JOHNSON & JOHNSON SERVICES, INC.

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENTS

19.2 BIOVENTUS

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 FERRING B.V.

19.3.1 COMPANY SNAPSHOT

19.3.2 COMPANY SHARE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT DEVELOPMENT

19.4 SANOFI-AVENTIS U.S. LLC

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ZIMMER BIOMET

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENTS

19.6 SEIKAGAKU CORPORATION

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENTS

19.7 ANIKA THERAPEUTICS, INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 PRODUCT PORTFOLIO

19.7.4 RECENT DEVELOPMENTS

19.8 FIDIA FARMACEUTICI S.P.A

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT DEVELOPMENT

19.9 APTISSEN

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENT

19.1 IBSA INSTITUT BIOCHIMIQUE SA

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 LG CHEM.

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 PRODUCT PORTFOLIO

19.11.4 RECENT DEVELOPMENTS

19.12 LIFECORE (A SUBSIDIARY OF LANDEC CORPORATION)

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 ORTHOGENRX, INC. (A SUBSIDIARY OF AVNS)

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 PRODUCT PORTFOLIO

19.13.4 RECENT DEVELOPMENTS

19.14 ORTOBRAND INTERNATIONAL

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENT

19.15 TEVA PHARMACEUTICAL INDUSTRIES LTD.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 PRODUCT PORTFOLIO

19.15.4 RECENT DEVELOPMENTS

19.16 TRB CHEMEDICA SA

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT DEVELOPMENTS

19.17 VIATRIS INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 PRODUCT PORTFOLIO

19.17.4 RECENT DEVELOPMENTS

19.18 VIRCHOW BIOTECH

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 ZUVENTUS HEALTHCARE LTD. (A SUBSIDIARY OF EMCURE PHARMACEUTICALS)

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 PRODUCT PORTFOLIO

19.19.4 RECENT DEVELOPMENT

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA NON-ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 5 NORTH AMERICA ANIMAL IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 9 NORTH AMERICA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 11 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA SINGLE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA THREE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA FIVE INJECTION IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ADULT IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA GERIATRIC IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA ORTHOPEADIC CLINICS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA AMBULATORY CARE CENTERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RETAIL SALES IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA DIRECT TENDER IN VISCOSUPPLEMENTATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 37 NORTH AMERICA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 40 NORTH AMERICA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 42 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 50 U.S. VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 51 U.S. NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 52 U.S. NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 53 U.S. NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 54 U.S. ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 U.S. HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 56 U.S. HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 57 U.S. HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 58 U.S. VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 59 U.S. INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 60 U.S. LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 61 U.S. HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 62 U.S. VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 63 U.S. VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 64 U.S. VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 65 U.S. VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 CANADA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 67 CANADA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 68 CANADA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 69 CANADA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 70 CANADA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 CANADA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 72 CANADA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 73 CANADA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 74 CANADA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 75 CANADA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 76 CANADA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 77 CANADA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 78 CANADA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 79 CANADA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 80 CANADA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 81 CANADA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 82 MEXICO VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 83 MEXICO NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 84 MEXICO NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 85 MEXICO NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 86 MEXICO ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 87 MEXICO HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 88 MEXICO HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 89 MEXICO HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 90 MEXICO HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 91 MEXICO HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 92 MEXICO HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 93 MEXICO VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 94 MEXICO INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 95 MEXICO LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 96 MEXICO HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 97 MEXICO VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 98 MEXICO VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 99 MEXICO VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 MEXICO VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 PANAMA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 102 PANAMA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 103 PANAMA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 104 PANAMA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 105 PANAMA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 PANAMA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 107 PANAMA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 108 PANAMA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 109 PANAMA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 110 PANAMA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 111 PANAMA HYALURONANS IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 112 PANAMA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 113 PANAMA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 114 PANAMA LOW MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 115 PANAMA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 116 PANAMA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 117 PANAMA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 118 PANAMA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 PANAMA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 120 JAMAICA VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 121 JAMAICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 122 JAMAICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 123 JAMAICA NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 124 JAMAICA ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 JAMAICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 126 JAMAICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 127 JAMAICA HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 128 JAMAICA VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 129 JAMAICA INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 130 JAMAICA HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 131 JAMAICA VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 132 JAMAICA VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 133 JAMAICA VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 134 JAMAICA VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 135 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY SOURCE, 2020-2029 (USD MILLION)

TABLE 136 DOMINICAN REPUBLIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 137 DOMINICAN REPUBLIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 138 DOMINICAN REPUBLIC NON-ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 139 DOMINICAN REPUBLIC ANIMAL ORIGIN IN VISCOSUPPLEMENTATION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 DOMINICAN REPUBLIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 141 DOMINICAN REPUBLIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (UNITS)

TABLE 142 DOMINICAN REPUBLIC HYLAN G-F 20 IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (ASP, USD)

TABLE 143 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY MOLECULAR WEIGHT, 2020-2029 (USD MILLION)

TABLE 144 DOMINICAN REPUBLIC INTERMEDIATE MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 145 DOMINICAN REPUBLIC HIGH MOLECULAR WEIGHT IN VISCOSUPPLEMENTATION MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 146 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY INJECTION, 2020-2029 (USD MILLION)

TABLE 147 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY AGE GROUP, 2020-2029 (USD MILLION)

TABLE 148 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 149 DOMINICAN REPUBLIC VISCOSUPPLEMENTATION MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA VISCOSUPPLEMENTATION MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 THE INCREASING DEMAND FOR NON-SURGICAL TREATMENTS FOR OSTEOARTHRITIS AND ADVANCEMENTS IN THE DEVELOPMENT OF HYALURONIC ACID-BASED THERAPIES IS EXPECTED TO DRIVE THE NORTH AMERICA VISCOSUPPLEMENTATION MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 NON-ANIMAL ORIGIN IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA VISCOSUPPLEMENTATION MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA VISCOSUPPLEMENTATION MARKET

FIGURE 15 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2021

FIGURE 16 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE, 2022-2029 (USD MILLION)

FIGURE 17 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE, CAGR (2022-2029)

FIGURE 18 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE, LIFELINE CURVE

FIGURE 19 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2021

FIGURE 20 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, 2022-2029 (USD MILLION)

FIGURE 21 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, CAGR (2022-2029)

FIGURE 22 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY MOLECULAR WEIGHT, LIFELINE CURVE

FIGURE 23 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2021

FIGURE 24 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY INJECTION, 2022-2029 (USD MILLION)

FIGURE 25 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY INJECTION, CAGR (2022-2029)

FIGURE 26 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY INJECTION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2021

FIGURE 28 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, 2022-2029 (USD MILLION)

FIGURE 29 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, CAGR (2022-2029)

FIGURE 30 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 31 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY END USER, 2021

FIGURE 32 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 33 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 34 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 35 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 36 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 37 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 38 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 39 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: SNAPSHOT (2021)

FIGURE 40 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021)

FIGURE 41 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 42 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 43 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: BY SOURCE (2022-2029)

FIGURE 44 NORTH AMERICA VISCOSUPPLEMENTATION MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.