Marché du traitement des maladies veineuses en Amérique du Nord, par type de produit (injection de sclérothérapie, dispositifs d'ablation, produits de fermeture veineuse, stents veineux, médicaments et autres), type de maladie (thrombose veineuse profonde (TVP), insuffisance veineuse chronique (IVC), embolie pulmonaire, thrombophlébite superficielle, varices et autres), type de traitement (sclérothérapie, thérapie par ablation par radiofréquence, traitement au laser, phlébectomie ambulatoire, ligature et décapage des veines, angioplastie ou stenting, chirurgies, thérapie par compression, médicaments veinoactifs, filtre de veine cave et autres thérapies), utilisateur final (hôpitaux, cliniques, centres de chirurgie ambulatoire et autres), canal de distribution (appel d'offres direct, ventes au détail et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du traitement des maladies veineuses en Amérique du Nord

Les maladies veineuses incluent des caillots sanguins dans les jambes, les bras, le cerveau, les poumons ou les organes internes tels que les reins, la rate, le foie, la thrombose veineuse profonde, l'insuffisance veineuse chronique, les varices et les veines, ainsi que les ulcères dans les veines. Le traitement de cette maladie comprend une pharmacothérapie, l'ablation endogène au laser ou l'ablation par radiofréquence (RFA), la sclérothérapie et la chirurgie.

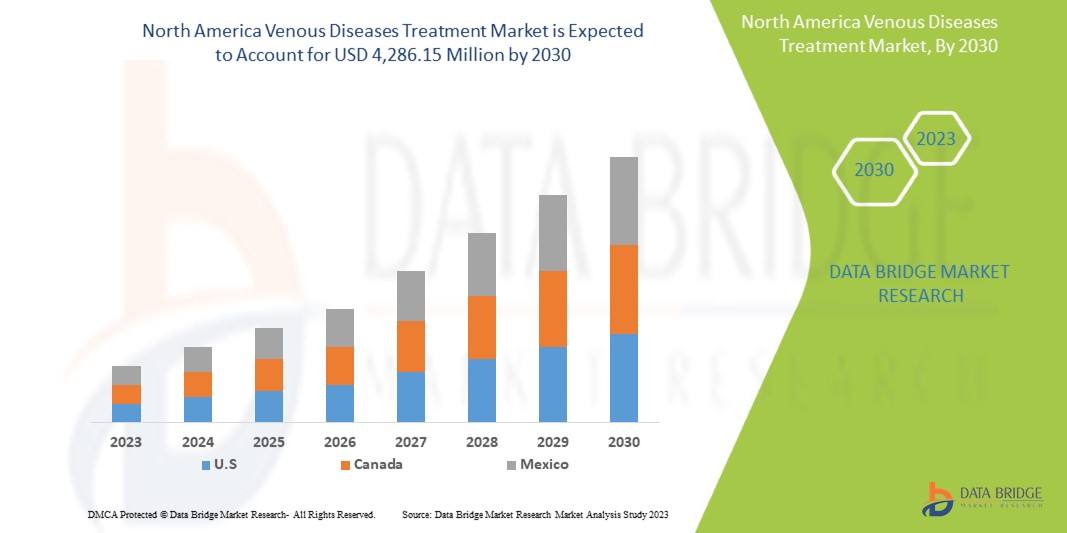

Data Bridge Market Research estime que le marché nord-américain du traitement des maladies veineuses devrait atteindre la valeur de 4 286,15 millions USD d'ici 2030, à un TCAC de 7,4 % au cours de la période de prévision. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable jusqu'au 2020-1015) |

|

Unités quantitatives |

Chiffre d'affaires en millions, prix en USD |

|

Segments couverts |

Par type de produit (injection de sclérothérapie, dispositifs d'ablation, produits de fermeture veineuse, stents veineux, médicaments et autres), type de maladie (thrombose veineuse profonde (TVP), insuffisance veineuse chronique (IVC), embolie pulmonaire, thrombophlébite superficielle, varices et autres), type de traitement (sclérothérapie, thérapie d'ablation par radiofréquence, traitement au laser, phlébectomie ambulatoire, ligature et stripping des veines, angioplastie ou stenting, chirurgies, thérapie par compression, médicaments veinoactifs, filtre de veine cave et autres thérapies), utilisateur final (hôpitaux, cliniques, centres de chirurgie ambulatoire et autres), canal de distribution (appel d'offres direct, vente au détail et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Français Abbott, Imricor, Baylis Medical Company, Inc., Theraclion, Sonablate, plusmedica.de, Boston Scientific Corporation, Olympus Corporation, Smith + Nephew, Cook, Scitech, Carl Zeiss Meditec AG, Teleflex incorporated, Alma Lasers, BD, B.Braun SE, Medtronic, Stryker, Koninklijke Philips NV, Varian Medical Systems, Candela Corporation, Teromo corporation, Angiodynamics, optimed Medizinische Instrumente GmbH, Merit Medical Systems et Bolitec Laser entre autres. |

Définition du marché du traitement des maladies veineuses en Amérique du Nord

Les crises cardiaques et les accidents vasculaires cérébraux sont généralement des événements aigus et sont principalement causés par un blocage qui bloque le flux sanguin vers le cœur ou le cerveau. La cause la plus courante est l'accumulation de dépôts graisseux dans la paroi des vaisseaux sanguins qui alimentent le cœur ou le cerveau. Un accident vasculaire cérébral peut être causé par un saignement ou des caillots sanguins dans un vaisseau sanguin du cerveau.

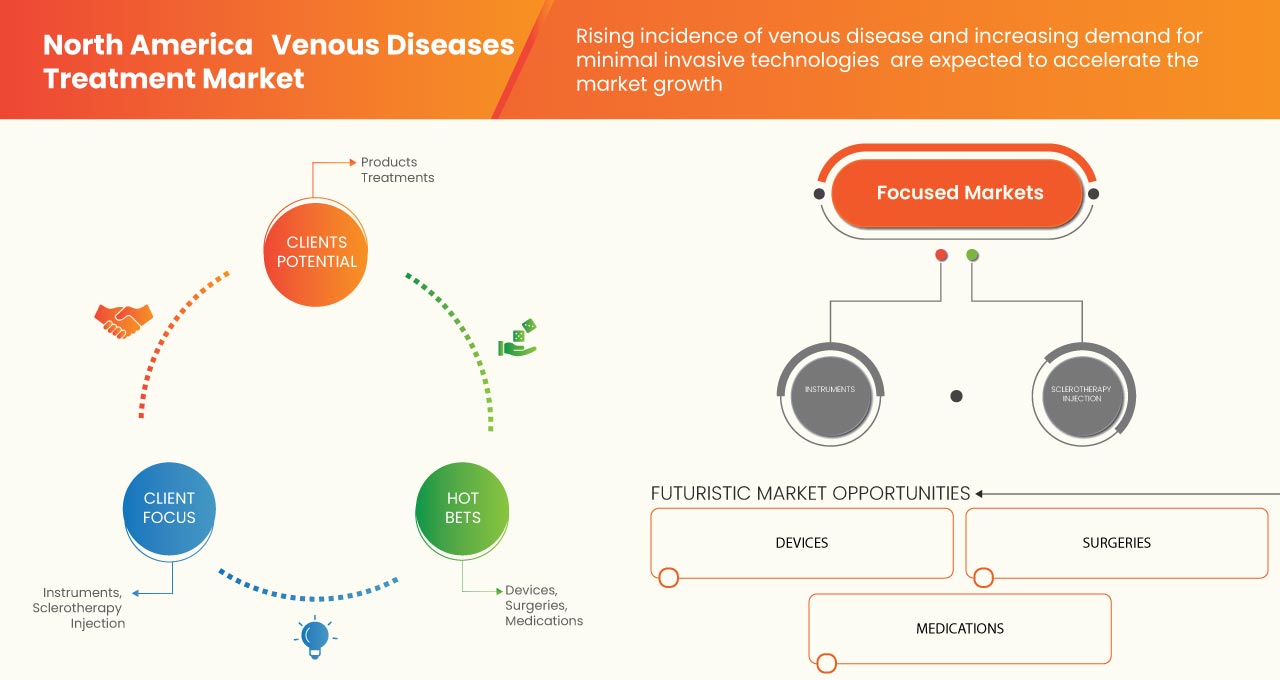

Les progrès technologiques dans le domaine des stents vasculaires, l'augmentation de la demande de procédures mini-invasives et l'augmentation de la population gériatrique stimulent le marché nord-américain. De plus, les entreprises élargissent leur portefeuille de produits pour offrir les meilleurs services de traitement des maladies veineuses. Les dispositifs médicaux tels que les dispositifs d'ablation sont utilisés dans les procédures mini-invasives pour retirer ou exciser des tissus corporels anormaux à des fins thérapeutiques. Ces systèmes utilisent la chaleur générée par la radiofréquence, l'énergie, le froid extrême ou un laser pour provoquer de petites brûlures. L'adoption croissante des technologies robotiques pour l'expansion des applications des produits et l'intégration de technologies de pointe dans les dispositifs d'ablation pour améliorer la sécurité des patients et l'efficacité des procédures devraient stimuler le marché.

Dynamique du marché du traitement des maladies veineuses en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de l'incidence des maladies veineuses

Les maladies veineuses sont des affections qui endommagent les veines du corps. Les parois endommagées des vaisseaux sanguins empêchent le système circulatoire de fonctionner, ce qui provoque une accumulation et un reflux du sang (vers l'arrière) lorsque les muscles se relâchent. Cela provoque une accumulation anormalement élevée de pression dans les veines. Cette accumulation provoque un resserrement et une torsion des veines, un gonflement accru, une insuffisance valvulaire accrue, un ralentissement du flux sanguin et d'éventuels caillots sanguins. Enfin, cette affection peut entraîner diverses maladies appelées maladies veineuses.

En raison de divers facteurs de risque tels que le vieillissement, l'obésité, l'hypertension artérielle ou les antécédents familiaux de maladie veineuse, le nombre de patients atteints de maladies veineuses est en augmentation dans le monde et constitue un problème socio-économique majeur. Ainsi, le nombre croissant de patients atteints de maladies veineuses augmente la demande de traitement des maladies veineuses, ce qui constitue un moteur pour le marché du traitement des maladies veineuses en Amérique du Nord.

- Les changements rapides du mode de vie conduisent à l’obésité et donc à des maladies veineuses

Les changements de mode de vie tels que le tabagisme, une alimentation malsaine et l’inactivité physique entraînent le développement de maladies chroniques, en particulier les maladies cardiaques, les accidents vasculaires cérébraux, le diabète, l’obésité et le syndrome métabolique qui peuvent éventuellement entraîner des maladies veineuses.

L'activité physique est essentielle et de nombreuses pathologies sont le résultat direct d'un mode de vie sédentaire. Un mode de vie sédentaire peut entraîner une prise de poids, une fatigue rapide et des douleurs inexpliquées qui peuvent entraîner des maladies chroniques, notamment des maladies cardiovasculaires et veineuses, allant de modérées à sévères, voire mortelles.

Selon l'article de ScienceDirect, la maladie veineuse était cliniquement plus grave chez les membres obèses que chez les non-obèses. Ainsi, en raison de l'adoption croissante d'un mode de vie malsain, on assiste à une augmentation rapide de la population obèse et à une augmentation des maladies veineuses. Ainsi, les changements rapides de mode de vie conduisent à l'obésité, ce qui entraîne des maladies veineuses, ce qui augmente la demande de traitement des maladies veineuses et constitue un moteur du marché du traitement des maladies veineuses en Amérique du Nord.

Retenue

- Manque de professionnels qualifiés et certifiés

Le besoin de professionnels qualifiés et certifiés constitue un frein important pour le marché du traitement des maladies veineuses. La demande de traitement des maladies veineuses augmente en raison de l'augmentation des cas de maladies veineuses en Europe, mais le nombre réduit de professionnels qualifiés présents dans les centres de soins de santé freine la croissance du marché.

La maladie veineuse chronique (MCV) est souvent négligée par les professionnels de santé car ils ne comprennent pas l’ampleur et l’impact du problème, et les différentes manifestations de la maladie veineuse primaire et secondaire ne sont pas pleinement reconnues. L’importance des maladies cardiovasculaires est liée au nombre de patients et aux conséquences socio-économiques de ses manifestations les plus graves.

Opportunité

- Sensibilisation accrue aux troubles veineux

Les traitements médicamenteux et les changements de mode de vie peuvent être utilisés pour traiter les problèmes veineux. Les médicaments, l'exercice et les bas de contention peuvent être bénéfiques pour vos veines, mais les problèmes veineux nécessitent parfois un traitement plus approfondi pour restaurer la santé et la performance de vos veines. Le traitement est déterminé par le type et la gravité de la maladie veineuse. Le nombre de patients souffrant de troubles vasculaires a considérablement augmenté au cours des dernières décennies, le diabète étant le facteur de risque le plus flagrant. Contrairement à d'autres problèmes de santé, les troubles vasculaires et la chirurgie vasculaire sont inconnus d'environ 80 % de la population. Les attitudes et les comportements des gens à l'égard de certaines maladies peuvent changer considérablement grâce à une sensibilisation accrue à la santé.

Plusieurs programmes de sensibilisation sont menés par diverses sociétés, instituts gouvernementaux et autres. Ces initiatives permettront de sensibiliser davantage les gens à leur santé et de poser un diagnostic précoce pour un meilleur traitement et des précautions. Pour cette raison, la sensibilisation croissante aux troubles veineux devrait constituer une opportunité pour accroître la demande du marché nord-américain du traitement des maladies veineuses.

Défi

- Coût élevé associé au traitement des maladies veineuses

Aux États-Unis, plus de 25 millions de personnes souffrent d’insuffisance veineuse chronique (IVC), dont plus de 6 millions souffrent d’une maladie veineuse avancée. Le système de santé américain est lourdement grevé financièrement en raison de la forte incidence de l’IVC et de l’augmentation des coûts des soins de santé. De nombreux problèmes de santé répandus sont causés par une mauvaise circulation veineuse. Les douleurs dans les jambes, l’œdème et la lourdeur sont quelques-uns des premiers signes de maladie veineuse chronique (MCV), et ils peuvent être présents toute la journée ou devenir plus prononcés le soir. Les patients recherchent souvent un traitement initial pour les symptômes qui peuvent survenir avec ou sans varices, ainsi que pour l’élimination esthétique des varices. Les deux principaux facteurs de risque de MCV sont l’âge avancé et une masse corporelle élevée.

Impact post-COVID-19 sur le marché nord-américain du traitement des maladies veineuses

La pandémie a eu des répercussions négatives sur les fabricants ainsi que sur les utilisateurs. Les interventions sur les varices n'étant pas urgentes, le volume des interventions a considérablement diminué. La réduction des interventions chirurgicales ou des interventions pour le traitement des varices en raison des restrictions de voyage a également eu un impact sur les ventes des fabricants.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D, de lancement de produits et de partenariats stratégiques pour améliorer la technologie et les résultats des tests impliqués dans le marché des arômes et ingrédients pour aliments pour animaux de compagnie.

Développements récents

- En juillet 2022, Smith+Nephew, l'entreprise nord-américaine de technologie médicale, a lancé l'application Clinical Support pour aider à réduire les variations de pratique dans le traitement des plaies. L'application Clinical Support WOUND COMPASS est un outil d'assistance numérique complet destiné aux professionnels de la santé qui facilite l'évaluation des plaies et la prise de décision afin de réduire les variations de pratique. Cela a aidé l'entreprise à attirer les clients du secteur de la santé et à élargir son portefeuille de produits

- En avril 2022, Carl Zeiss Meditec a annoncé l'acquisition de deux fabricants d'instruments chirurgicaux (Kogent Surgical, LLC et Katalyst Surgical, LLC) pour renforcer encore son positionnement en tant que fournisseur de solutions. Cela a aidé l'entreprise à développer ses activités

Portée du marché du traitement des maladies veineuses en Amérique du Nord

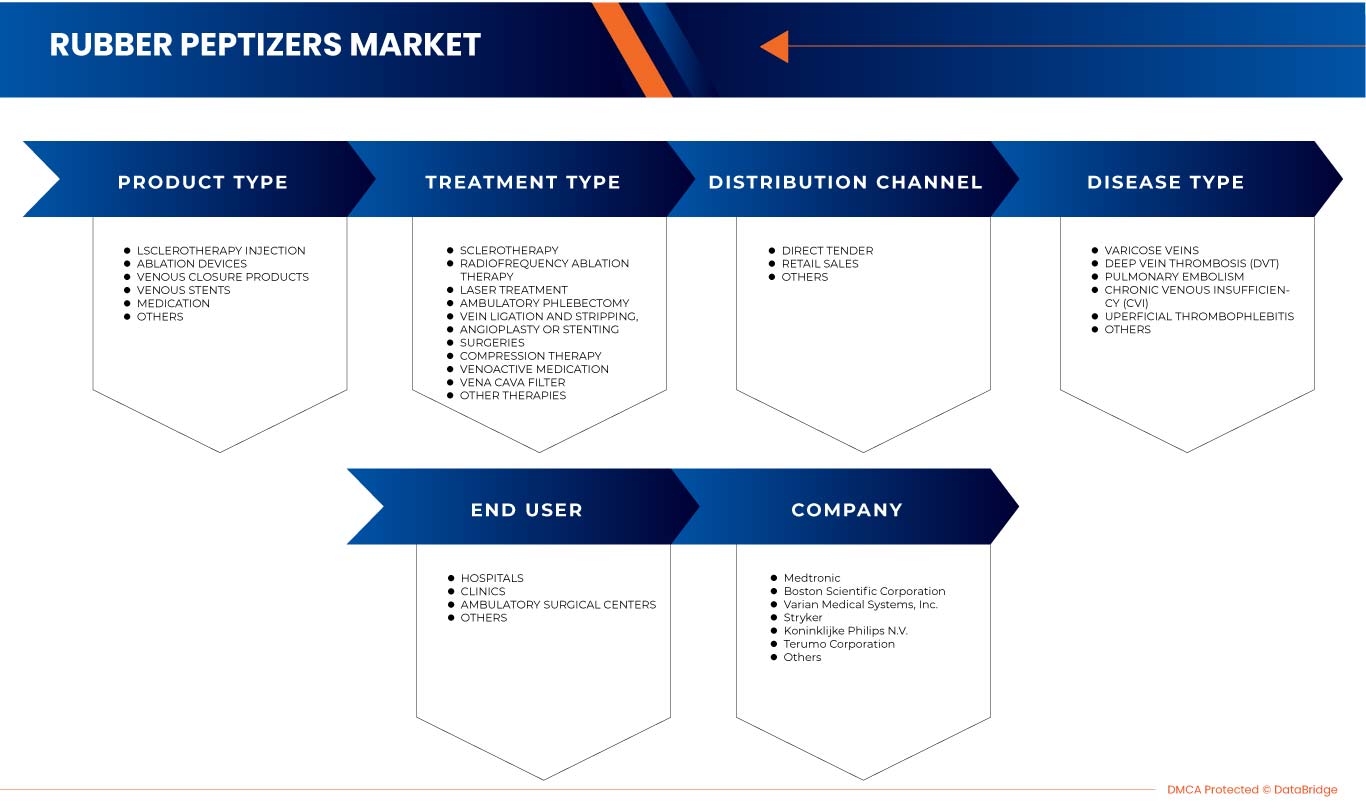

Le marché nord-américain du traitement des maladies veineuses est segmenté en type de produit, type de maladie, type de traitement, utilisateur final et canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

MARCHÉ DU TRAITEMENT DES MALADIES VEINEUSES EN AMÉRIQUE DU NORD, PAR TYPE DE PRODUIT

- DISPOSITIFS D'ABLATION

- STENTS VEINEUX

- PRODUITS DE FERMETURE VEINEUX

- INJECTION DE SCLÉROTHÉRAPIE

- MÉDICAMENTS

- AUTRES

Sur la base du type de produit, le marché nord-américain du traitement des maladies veineuses est segmenté en dispositifs d'ablation, stents veineux, produits de fermeture veineuse, injection de sclérothérapie, médicaments et autres.

MARCHÉ DU TRAITEMENT DES MALADIES VEINEUSES EN AMÉRIQUE DU NORD, PAR TYPE DE MALADIE

- THROMBOSE VEINEUSE PROFONDE (TVP)

- INSUFFISANCE VEINEUSE CHRONIQUE (IVC)

- EMBOLIE PULMONAIRE

- THROMBOPHLÉBITE SUPERFICIELLE

- VARICES

- AUTRES

Sur la base du type de maladie, le marché nord-américain du traitement des maladies veineuses est segmenté en thrombose veineuse profonde (TVP), insuffisance veineuse chronique (IVC), embolie pulmonaire, thrombophlébite superficielle, varices et autres.

MARCHÉ DU TRAITEMENT DES MALADIES VEINEUSES EN AMÉRIQUE DU NORD, PAR TYPE DE TRAITEMENT

- THÉRAPIE PAR COMPRESSION

- MÉDICAMENT VENO ACTIF

- INTERVENTIONS CHIRURGICALES

- SCLÉROTHÉRAPIE

- ANGIOPLASTIE OU STENTING

- LIGATURE ET STRIPPING DES VEINES

- FILTRE À VEINE CAVE

- PHLÉBECTOMIE AMBULATOIRE

- THÉRAPIE PAR ABLATION PAR RADIOFREQUENCE

- TRAITEMENT AU LASER

- AUTRES THÉRAPIES

Sur la base du type de traitement, le marché nord-américain du traitement des maladies veineuses est segmenté en thérapie par compression, médicaments veinoactifs, chirurgies, scelrothérapie, angioplastie ou stenting, légation et stripping veineux, filtre de veine cave, phlébectomie ambulatoire, thérapie par ablation par radiofréquence, traitement au laser et autres thérapies.

MARCHÉ DU TRAITEMENT DES MALADIES VEINEUSES EN AMÉRIQUE DU NORD, PAR UTILISATEUR FINAL

- HÔPITAUX

- CLINIQUES

- CENTRES DE CHIRURGIES AMBULATOIRES

- AUTRES

Sur la base de l'utilisateur final, le marché nord-américain du traitement des maladies veineuses est segmenté en hôpitaux, cliniques, centres de chirurgie ambulatoire et autres

MARCHÉ DES TRAITEMENTS DES MALADIES VEINEUSES EN AMÉRIQUE DU NORD, PAR CANAL DE DISTRIBUTION

- APPEL D'OFFRES DIRECT

- VENTES AU DÉTAIL

- AUTRES

Sur la base du canal de distribution, le marché nord-américain du traitement des maladies veineuses est segmenté en appels d'offres directs, ventes au détail et autres

Analyse/perspectives régionales du marché du traitement des maladies veineuses en Amérique du Nord

Le marché du traitement des maladies veineuses en Amérique du Nord est analysé et des informations sur la taille du marché sont fournies : type de produit, type de maladie, type de traitement, utilisateur final et canal de distribution.

Les pays couverts par ce rapport de marché sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent l'Amérique du Nord en raison de la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. Les États-Unis devraient croître grâce à leurs dernières technologies de pointe et à leurs inventions dans le traitement des maladies veineuses.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, and impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Venous Diseases Treatment Market Share Analysis

North America venous diseases treatment market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America venous diseases treatment market.

Some of the major players operating in the North America venous diseases treatment market are Abbott, Imricor, Baylis Medical Company, Inc., Theraclion, Sonablate, plusmedica.de, Boston Scientific Corporation, Olympus Corporation, Smith + Nephew, Cook, Scitech, Carl Zeiss Meditec AG, Teleflex incorporated, Alma Lasers, BD, B.Braun SE, Medtronic, Stryker, Koninklijke Philips N.V., Varian Medical Systems, Candela Corporation, Teromo corporation, Angiodynamics, optimed Medizinische Instrumente GmbH, Merit Medical Systems, Bolitec Laser among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA VENOUS DISEASES TREATMENT MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET END USER COVERAGE GRID

2.8 INSTRUMENT BASED LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER'S FIVE FORCES

5 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, INDUSTRY INSIGHTS

6 EPIDEMIOLOGY

7 REGULATORY FRAMEWORK

8 MARKET OVERVIEW

8.1 DRIVERS

8.1.1 RISING INCIDENCES OF VENOUS DISEASES

8.1.2 RAPID CHANGES IN LIFESTYLE LEAD TO OBESITY RESULTING IN VENOUS DISEASES

8.1.3 INCREASE IN THE GERIATRIC POPULATION

8.1.4 TECHNOLOGICALLY ADVANCEMENT IN THE TREATMENT OF VENOUS DISEASES

8.2 RESTRAINTS

8.2.1 LACK OF SKILLED AND CERTIFIED PROFESSIONALS

8.2.2 INADEQUATE REIMBURSEMENT COVERAGE

8.3 OPPORTUNITIES

8.3.1 RISING AWARENESS TOWARDS VENOUS DISORDERS

8.3.2 NEED FOR PROPER DIAGNOSIS AND TREATMENT OF VENOUS DISEASES

8.3.3 GROWING PREFERENCE FOR MINIMALLY INVASIVE PROCEDURES

8.3.4 OCCUPATIONAL LIFESTYLE INCREASES THE NEED FOR VENOUS DISEASE TREATMENT

8.4 CHALLENGES

8.4.1 HIGH COST ASSOCIATED WITH VENOUS DISEASE TREATMENT

8.4.2 SIDE EFFECTS AND RISK ASSOCIATED WITH DIFFERENT TREATMENT MODES

9 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 SCLEROTHERAPY INJECTION

9.2.1 SCLEROTHERAPY, BY TYPE

9.2.1.1 INTRAVENOUS

9.2.1.2 INTRADERMAL

9.2.1.3 SUBCUTANEOUS

9.2.2 SUBCUTANEOUS, BY APPLICATION

9.2.2.1 MALFORMED LYMPHED VESSELS

9.2.2.2 HEMORRHOIDS

9.2.2.3 HYDROCELES

9.2.2.4 OTHERS

9.3 ABLATION DEVICES

9.3.1 THERMAL ABLATION

9.3.1.1 RADIOFREQUENCY

9.3.1.1.1 CATHETER MANIPULATION SYSTEMS

9.3.1.1.2 TEMPERATURE CONTROLLED

9.3.1.1.3 FLUID COOLED

9.3.1.2 LIGHT

9.3.1.2.1 EXCIMER LASERS

9.3.1.2.2 COLD LASERS

9.3.1.3 ULTRASOUND

9.3.1.3.1 HIGH INTENSITY FOCUSED ULTRASOUND (HIFU)

9.3.1.3.2 SHOCK WAVE LITHOTRIPSY

9.3.1.3.3 MAGNETIC RESONANCE IMAGING GUIDED FOCUSED ULTRASOUND (MRI-FUS)

9.3.1.3.4 ULTRASONIC SURGICAL SYSTEMS

9.3.1.4 RADIATION

9.3.1.4.1 STEREOTACTIC BODY RADIATION THERAPY

9.3.1.4.2 INTENSITY-MODULATED RADIATION THERAPY

9.3.1.4.3 STEREOTACTIC RADIOTHERAPY & RADIOSURGERY

9.3.1.4.4 IMAGE GUIDED RADIATION THERAPY

9.3.1.4.5 INTRAVASCULAR BRACHYTHERAPY

9.3.1.4.6 PROTON BEAM THERAPY

9.3.1.5 ELECTRICAL

9.3.1.5.1 ELECTRICAL ABLATORS

9.3.1.5.2 ELECTRONIC BRACHYTHERAPY

9.3.1.6 MICROWAVE

9.3.1.7 HYDROTHERMAL

9.3.2 NON-THERMAL ABLATION

9.3.2.1 CRYOABLATION

9.3.2.1.1 EPIDERMAL AND SUBCUTANEOUS CRYOABLATION DEVICES

9.3.2.1.2 CRYOGEN SPRAY PROBE

9.3.2.1.3 TISSUE CONTACT PROBE

9.3.2.2 HYDROMECHANICAL ABLATION

9.4 VENOUS CLOSURE PRODUCTS

9.4.1 VENOUS CLOSURE PRODUCTS, BY PROCEDURE

9.4.1.1 INTERVENTIONAL CARDIOLOGY

9.4.1.2 INTERVENTIONAL RADIOLOGY

9.4.2 VENOUS CLOSURE PRODUCTS, BY TECHNOLOGY

9.4.2.1 FEMORAL ACCESS TECHNIQUE

9.4.2.2 RADIAL ACCESS TECHNIQUE

9.5 VENOUS STENTS

9.5.1 VENOUS STENTS, BY TECHNOLOGY

9.5.1.1 WALLSTENT TECHNOLOGY

9.5.1.2 ILIAC VEIN STENT TECHNOLOGY

9.5.2 VENOUS STENTS, BY APPLICATION

9.5.2.1 LEG

9.5.2.2 CHEST

9.5.2.3 ABDOMEN

9.5.2.4 OTHERS

9.6 MEDICATION

9.7 OTHERS

10 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE

10.1 OVERVIEW

10.2 VARICOSE VEINS

10.3 DEEP VEIN THROMBOSIS (DVT)

10.4 PULMONARY EMBOLISM

10.5 CHRONIC VENOUS INSUFFICIENCY (CVI)

10.6 SUPERFICIAL THROMBOPHLEBITIS

10.7 OTHERS

11 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE

11.1 OVERVIEW

11.2 SCLEROTHERAPY

11.3 RADIOFREQUENCY ABLATION THERAPY

11.4 LASER TREATMENT

11.5 AMBULATORY PHLEBECTOMY

11.6 VEIN LIGATION AND STRIPPING

11.7 ANGIOPLASTY OR STENTING

11.8 SURGERIES

11.9 COMPRESSION THERAPY

11.1 VEINACTIVE MEDICATION

11.11 VENA CAVA FILTER

11.12 OTHER THERAPIES

12 NORTH AMERICA VENOUS TREATMENT DISEASES MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.3 CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 OTHERS

13 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.4 OTHERS

14 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 MEDTRONIC

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 BOSTON SCIENTIFIC CORPORATION

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 VARIAN MEDICAL SYSTEMS, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 COMPANY SHARE ANALYSIS

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT DEVELOPMENT

17.4 STRYKER

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 KONINKLIJKE PHILIPS N.V.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 ABBOTT

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ALMA LASERS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 ANGIODYNAMICS

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENT

17.9 B.BRAUN MELSUNGEN AG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 BAYLIS MEDICAL COMPANY, INC

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 BD

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 CANDELA MEDICAL

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 CARL ZEISS MEDITEC AG

17.13.1 COMPANYSNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT DEVELOPMENT

17.14 COOK

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 IMRICOR

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENT

17.16 OLYMPUS CORPORATION

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOILIO

17.16.4 RECENT DEVELOPMENT

17.17 OPTIMED MEDIZINISCHE INSTRUMENTE GMBH

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 PLUSMEDICA.DE

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 SCITECH

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 SMITH + NEPHEW

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 SONABLATE

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENT

17.22 THERACLION

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENT

17.23 TELEFLEX INCORPORATED

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 TERUMO CORPORATION

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ILIAC VEIN STENT TECHNOLOGY IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA MEDICATION IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA VARICOSE VEINS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA DEEP VEIN THROMBOSIS (DVT) IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA PULMONARY EMBOLISM IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA CHRONIC VENOUS INSUFFICIENCY (CVI) IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA SUPERFICIAL THROMBOPHLEBITIS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA SCELEROTHERAPY IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA RADIOFREQUENCY ABLATION THERAPY IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA LASER TREATMENT IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA AMBULATORY PHELEBECTOMY IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA VEIN LIGATION AND STRIPPING IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA ANGIOPLASTY OR STENTING IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA SURGERIES IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA COMPRESSION THERAPY IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA VEINACTIVE MEDICATION IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA VENA CAVA FILTER IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA OTHER THERAPIES IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA HOSPITALS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA CLINICS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA OTHERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA DIRECT TENDER IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 49 NORTH AMERICA RETAIL SALES IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 50 NORTH AMERICA OTHERS IN VENOUS DISEASES TREATMENT MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 51 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 52 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 53 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 NORTH AMERICA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 55 NORTH AMERICA ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 56 NORTH AMERICA THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 57 NORTH AMERICA RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 58 NORTH AMERICA LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 59 NORTH AMERICA ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 NORTH AMERICA RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 61 NORTH AMERICA ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 62 NORTH AMERICA NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 63 NORTH AMERICA CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 64 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 65 NORTH AMERICA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 66 NORTH AMERICA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 67 NORTH AMERICA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 68 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 69 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 70 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 71 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 72 U.S. VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 73 U.S. SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 U.S. SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 75 U.S. ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 U.S. THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 77 U.S. RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 78 U.S. LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 79 U.S. ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 80 U.S. RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 81 U.S. ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 82 U.S. NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 83 U.S. CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 U.S. VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 85 U.S. VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 86 U.S. VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 87 U.S. VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 88 U.S. VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 89 U.S. VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 90 U.S. VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 91 U.S. VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 92 CANADA VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 93 CANADA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 94 CANADA SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 95 CANADA ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 96 CANADA RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 97 CANADA LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 98 CANADA ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 99 CANADA RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 CANADA ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 101 CANADA NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 102 CANADA CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 103 CANADA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 104 CANADA VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 105 CANADA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 106 CANADA VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 107 CANADA VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 108 CANADA VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 109 CANADA VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 110 CANADA VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 111 MEXICO VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 112 MEXICO SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 MEXICO SCLEROTHERAPY INJECTION IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 114 MEXICO ABLATION DEVICES IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 115 MEXICO THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 116 MEXICO RADIOFREQUENCY IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 117 MEXICO LIGHT IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 118 MEXICO ULTRASOUND IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 119 MEXICO RADIATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 120 MEXICO ELECTRICAL IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 121 MEXICO NON-THERMAL ABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 122 MEXICO CRYOABLATION IN VENOUS DISEASES TREATMENT MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 123 MEXICO VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY PROCEDURE, 2021-2030 (USD MILLION)

TABLE 124 MEXICO VENOUS CLOSURE PRODUCTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 125 MEXICO VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 126 MEXICO VENOUS STENTS IN VENOUS DISEASES TREATMENT MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 127 MEXICO VENOUS DISEASES TREATMENT MARKET, BY DISEASE TYPE, 2021-2030 (USD MILLION)

TABLE 128 MEXICO VENOUS DISEASES TREATMENT MARKET, BY TREATMENT TYPE, 2021-2030 (USD MILLION)

TABLE 129 MEXICO VENOUS DISEASES TREATMENT MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 130 MEXICO VENOUS DISEASES TREATMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: MARKET END USER COVERAGE GRID

FIGURE 8 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: SEGMENTATION

FIGURE 11 GROWING AWARENESS ABOUT VENOUS DISEASES TREATMENTS AND INCREASING HEALTHCARE EXPENDITURE IS EXPECTED TO DRIVE THE GROWTH OF THE NORTH AMERICA VENOUS DISEASES TREATMENT MARKET FROM 2023 TO 2030

FIGURE 12 THE ABLATION DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA VENOUS DISEASES TREATMENT MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF THE NORTH AMERICA VENOUS DISEASES TREATMENT MARKET

FIGURE 14 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY PRODUCT TYPE, 2022

FIGURE 15 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY PRODUCT TYPE, 2023-2030 (USD MILLION)

FIGURE 16 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY PRODUCT TYPE, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY DISEASE TYPE, 2022

FIGURE 19 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY DISEASE TYPE, 2023-2030 (USD MILLION)

FIGURE 20 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY DISEASE TYPE, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY DISEASE TYPE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY TREATMENT TYPE, 2022

FIGURE 23 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY TREATMENT TYPE, 2023-2030 (USD MILLION)

FIGURE 24 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY TREATMENT TYPE, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY TREATMENT TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY END USER, 2023-2030 (USD MILLION)

FIGURE 28 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY END USER, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY DISTRIBUTION CHANNEL, 2022

FIGURE 31 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 32 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 34 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: SNAPSHOT (2022)

FIGURE 35 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY COUNTRY (2022)

FIGURE 36 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 37 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 38 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: PRODUCT TYPE (2023-2030)

FIGURE 39 NORTH AMERICA VENOUS DISEASES TREATMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.