Marché des logiciels de trésorerie en Amérique du Nord, par système d'exploitation (Windows, Linux, IOS, Android, MAC), application (gestion des liquidités et de la trésorerie, gestion des investissements, gestion de la dette, gestion des risques financiers, gestion de la conformité, planification fiscale, autres), mode de déploiement (sur site, cloud), taille de l'organisation (grandes entreprises et petites et moyennes entreprises), secteur vertical (banque, services financiers et assurances, gouvernement, fabrication, soins de santé, biens de consommation, produits chimiques , énergie et autres) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des logiciels de trésorerie en Amérique du Nord

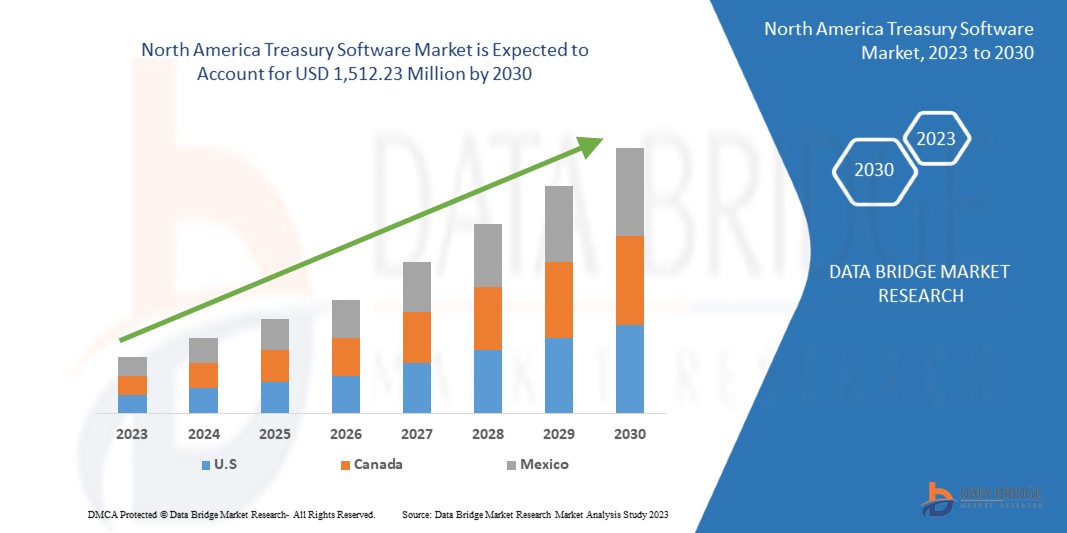

Le marché nord-américain des logiciels de trésorerie devrait connaître une croissance du marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 512,23 millions USD d'ici 2030. L'augmentation de l'exigence d'un processus de prise de décision rapide dans la biotechnologie devrait stimuler considérablement la croissance du marché.

Le rapport sur le marché nord-américain des logiciels de trésorerie détaille les parts de marché, les nouveautés et l'analyse du portefeuille de produits, l'impact des acteurs nationaux et locaux, ainsi que les opportunités en termes de revenus émergents, d'évolution de la réglementation, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques. Pour comprendre l'analyse et le contexte du marché, contactez Data Bridge Market Research pour obtenir un briefing d'analyste. Notre équipe vous aidera à élaborer une solution d'impact sur les revenus pour atteindre vos objectifs.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, prix en dollars américains |

|

Segments couverts |

Système d'exploitation (Windows, Linux, iOS, Android, MAC), application (gestion des liquidités et de la trésorerie, gestion des investissements, gestion de la dette, gestion des risques financiers, gestion de la conformité, planification fiscale, autres), mode de déploiement (sur site, cloud), taille de l'organisation (grandes et moyennes entreprises), secteur vertical (banque, services financiers et assurances, gouvernement, industrie manufacturière, santé, biens de consommation, produits chimiques, énergie, etc.) |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX SAS, EdgeVerve Systems Limited (filiale à 100 % d'Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc., ION, SAP, Solomon Software, ABM CLOUD et entre autres |

Définition du marché

Un logiciel de trésorerie est une application qui automatise les activités financières d'une entreprise, telles que la trésorerie, les actifs et les investissements. Il offre un système de gestion de trésorerie qui suit la capacité d'une entreprise à convertir ses actifs en liquidités pour honorer ses obligations financières. Les responsables financiers et les comptables utilisent un logiciel de gestion de trésorerie pour surveiller les liquidités et la capacité à convertir les actifs en liquidités pour honorer leurs obligations financières. Ce logiciel automatise et rationalise les fonctions de gestion de trésorerie, réduisant ainsi les risques financiers et de réputation, réduisant les coûts et améliorant l'efficacité opérationnelle. La visibilité, les analyses et les prévisions accrues offertes par le système de gestion de trésorerie améliorent la prise de décision et contribuent à l'élaboration de stratégies financières organisationnelles.

Dynamique du marché des logiciels de trésorerie en Amérique du Nord

Cette section vise à comprendre les moteurs, les avantages, les opportunités, les contraintes et les défis du marché. Tous ces éléments sont détaillés ci-dessous :

Conducteurs

- Demande croissante de systèmes avancés de gestion de trésorerie pour améliorer l'expérience client

Les systèmes de gestion de trésorerie (TMS) sont des logiciels qui automatisent les processus manuels de trésorerie. En offrant une meilleure visibilité sur la trésorerie et les liquidités, tout en maîtrisant les comptes bancaires, en maintenant la conformité et en gérant les transactions financières, la satisfaction client s'est améliorée. Le système de gestion de trésorerie offre sept avantages clés pour l'organisation, notamment :

- Augmenter la productivité

- Disponibilité des données précises et en temps réel

- Réduction des erreurs de saisie manuelle et de calcul

- Limitez les coûts bancaires et de change redondants

- Suivi détaillé de l'activité

- Flexibilité bancaire et connectivité

- Conformité réglementaire et atténuation des risques

Selon Coupa Software Inc., l'adoption de solutions TMS peut être affectée par divers facteurs tels que la volatilité des changes de 52 %, l'exposition aux risques de trésorerie et financiers de 43 %, le rapatriement d'espèces de 40 %, l'infrastructure de trésorerie inadéquate de 30 %, l'impact de la réforme fiscale en Amérique du Nord de 24 %, le risque opérationnel et de fraude dû aux méthodes traditionnelles de 20 %, le coût opérationnel de la trésorerie de 12 % et d'autres facteurs de 12 %.

- Adoption rapide de l'intelligence artificielle dans la gestion de trésorerie

L'intelligence artificielle a récemment joué un rôle essentiel dans le renforcement et la transformation des industries du monde entier. Des organismes gouvernementaux aux grandes organisations, en passant par les petites entreprises en ligne, l'intelligence artificielle (IA) est utilisée par de multiples entités sur de multiples plateformes à travers le monde.

En 2020, selon une enquête menée par NewVantage, 91,5 % des grandes entreprises investissaient massivement dans l'IA. Bien que les entreprises ayant investi dans l'IA utilisent ces technologies à un rythme modéré, seulement 14,6 % d'entre elles les utilisent largement au sein de leur organisation. Parmi elles, plus de la moitié, soit 51,2 %, ont déployé l'IA en production limitée et 26,8 % la testent. Cela témoigne de la croissance du nombre de technologies d'IA et de leur adoption croissante par les entreprises.

L'intelligence artificielle (IA) a déjà démontré son incroyable potentiel en matière de gestion de trésorerie et de prévision. Elle tente de résoudre des problèmes que l'on croyait auparavant pouvoir résoudre uniquement par l'intervention humaine.

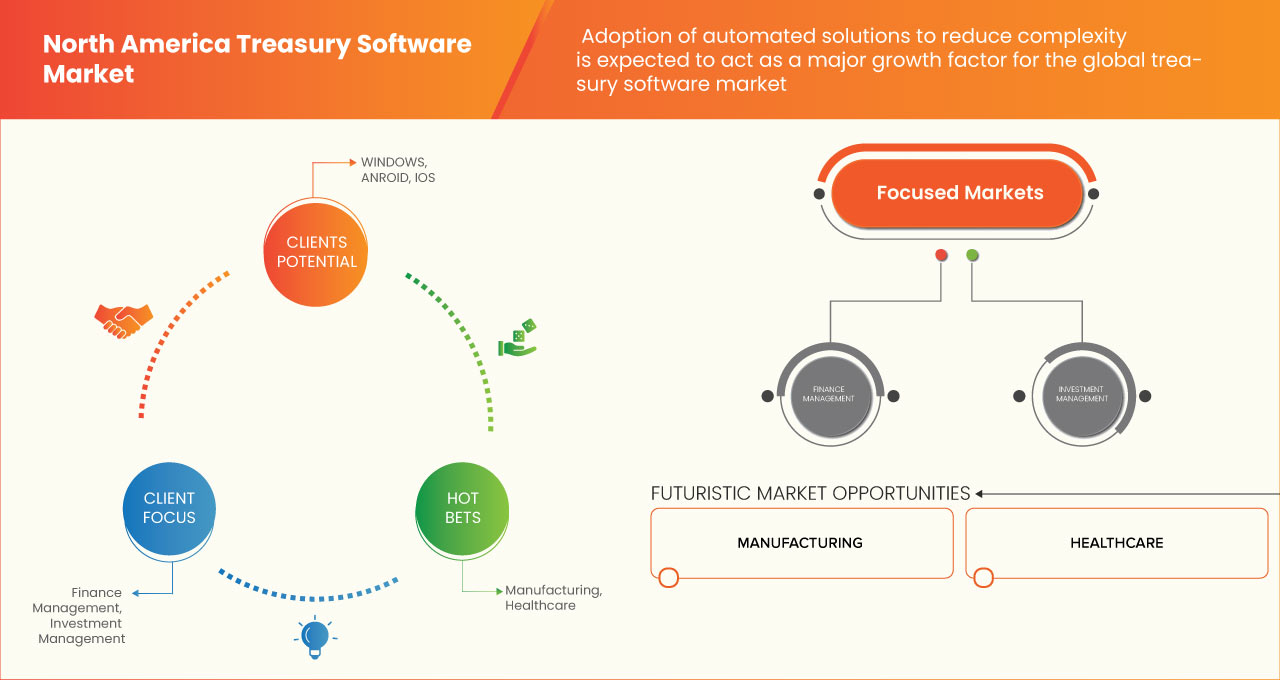

Opportunités

- Pénétration des solutions d'analyse avancées dans le secteur bancaire

De nos jours, les banques ont de plus en plus recours à l'analyse pour acquérir un avantage concurrentiel et tirer des conclusions et des analyses fondées sur les informations et les données collectées. L'analyse avancée permet de prédire le comportement et les préférences des clients et d'améliorer l'évaluation des risques. Les données générées par les secteurs bancaire et financier sont parfois volumineuses, et les banques ne peuvent pas les traiter avec leurs bases de données traditionnelles. L'analyse a donc ouvert la voie au traitement simultané d'un grand nombre de données dans le secteur financier.

De plus, le monde numérique a révolutionné le secteur bancaire. La plupart des solutions d'analyse bancaire avancées comprennent quatre composantes : le reporting, l'analyse descriptive, l'analyse prédictive et l'analyse prescriptive. Les institutions financières peuvent désormais cibler et interagir avec leurs clients en continu, et pas seulement lorsqu'ils se rendent en agence. Leur portée s'étend désormais aux utilisateurs d'applications mobiles, de distributeurs automatiques de billets et d'applications bancaires en ligne. Les banques peuvent également utiliser l'analyse pour proposer des produits, des services et des offres personnalisés à leurs clients en fonction de leur profil et de leur historique. De plus, l'analyse bancaire permet d'identifier et de prévenir la fraude. Les banques utilisent l'analyse avancée pour comparer les habitudes d'utilisation des clients à leurs propres indicateurs de fraude et peuvent agir immédiatement lorsqu'une activité potentiellement frauduleuse est détectée. La pénétration globale de l'analyse dans le secteur bancaire est encore relativement faible par rapport à d'autres secteurs. Cependant, elle crée de nombreuses opportunités de croissance pour le marché des logiciels de trésorerie.

Contraintes/Défis

- Augmentation des cybermenaces et des violations de données

En raison du COVID-19, la cybercriminalité et les problèmes de cybersécurité ont augmenté de 600 % en 2020. Les failles de sécurité du réseau sont exploitées par les pirates pour effectuer des actions non autorisées au sein d'un système.

Selon Purple Sec LLC, en 2018, les variantes de logiciels malveillants mobiles ont augmenté de 54 %, dont 98 % ciblant divers appareils Android. On estime que 25 % des entreprises ont été victimes de cryptojacking. Parmi ces entreprises figurent des banques et des équipes de gestion financière de divers secteurs d'activité.

Ces derniers temps, les entreprises et les secteurs d'activité adoptent massivement la numérisation. Les secteurs de la banque, du commerce, du voyage, entre autres, évoluent vers des modèles numériques pour améliorer l'expérience client. La numérisation génère une quantité considérable de données et d'informations clients. Cela soulève des préoccupations en matière de sécurité, et ces données ont toujours été plus exposées aux cyberattaques et aux violations de données. Grâce à ces informations et données, il devient facile pour les fraudeurs et les cyberattaquants d'imiter ou de voler l'identité d'une personne, ce qui peut être utilisé pour commettre divers crimes.

Selon une étude de S&P North America sur la part des incidents de cyberattaques en Amérique du Nord dans les différents secteurs au cours des cinq dernières années, de 2016 à 2021, les institutions financières sont en tête de liste avec 26 % d'incidents de cybersécurité, suivies par les soins de santé avec 11 %, les logiciels et les services technologiques avec 7 % et le commerce de détail avec 6 %.

Impact post-COVID-19 sur le marché nord-américain des logiciels de trésorerie

La pandémie de COVID-19 a eu un impact considérable sur le marché nord-américain des logiciels de trésorerie. Elle a provoqué des perturbations majeures dans les chaînes d'approvisionnement, les marchés financiers et l'activité économique nord-américains, entraînant une modification des priorités et des stratégies des services de trésorerie du monde entier.

L'un des impacts les plus significatifs de la pandémie sur le marché des logiciels de trésorerie a été la demande accrue de solutions cloud. La pandémie a contraint de nombreuses organisations à adopter rapidement le télétravail, soulignant l'importance de disposer de solutions de trésorerie cloud sécurisées, accessibles et évolutives. Par conséquent, la demande de solutions logicielles de trésorerie cloud a fortement augmenté.

Un autre impact de la pandémie sur le marché des logiciels de trésorerie est l'importance accrue accordée aux prévisions de trésorerie et à la gestion des liquidités. La pandémie a engendré des incertitudes et des risques importants pour les entreprises, rendant la précision des prévisions de trésorerie et de la gestion des liquidités essentielle à leur survie. Les solutions logicielles de trésorerie capables de fournir des prévisions de trésorerie, une gestion des liquidités et une évaluation des risques précises et en temps réel sont devenues de plus en plus essentielles.

Globalement, la pandémie de COVID-19 a accéléré l'adoption de solutions de trésorerie numériques, entraînant une croissance significative du marché nord-américain des logiciels de trésorerie. La demande de solutions cloud, de prévision de trésorerie et de gestion des liquidités, ainsi que de capacités avancées d'automatisation et d'intégration, devrait se maintenir après la pandémie, les organisations cherchant à améliorer leur agilité, leur résilience et leur efficacité.

Développements récents

- En mars 2022, ZenTreasury et son partenaire local MCA ont fourni à Redington Gulf un logiciel de comptabilité des contrats de location conforme à la norme IFRS-16. Désormais, les clients n'ont plus besoin d'importer des données provenant de sources multiples et de les stocker sur différentes plateformes. Tout est géré par un seul logiciel.

- En septembre 2022, TIS et Delega ont collaboré pour offrir à leurs clients une gestion automatisée des droits de signature multi-bancaire de nouvelle génération. Grâce à cet accord (eBAM), les clients de TIS et Delega peuvent bénéficier d'une gestion électronique de comptes bancaires de nouvelle génération.

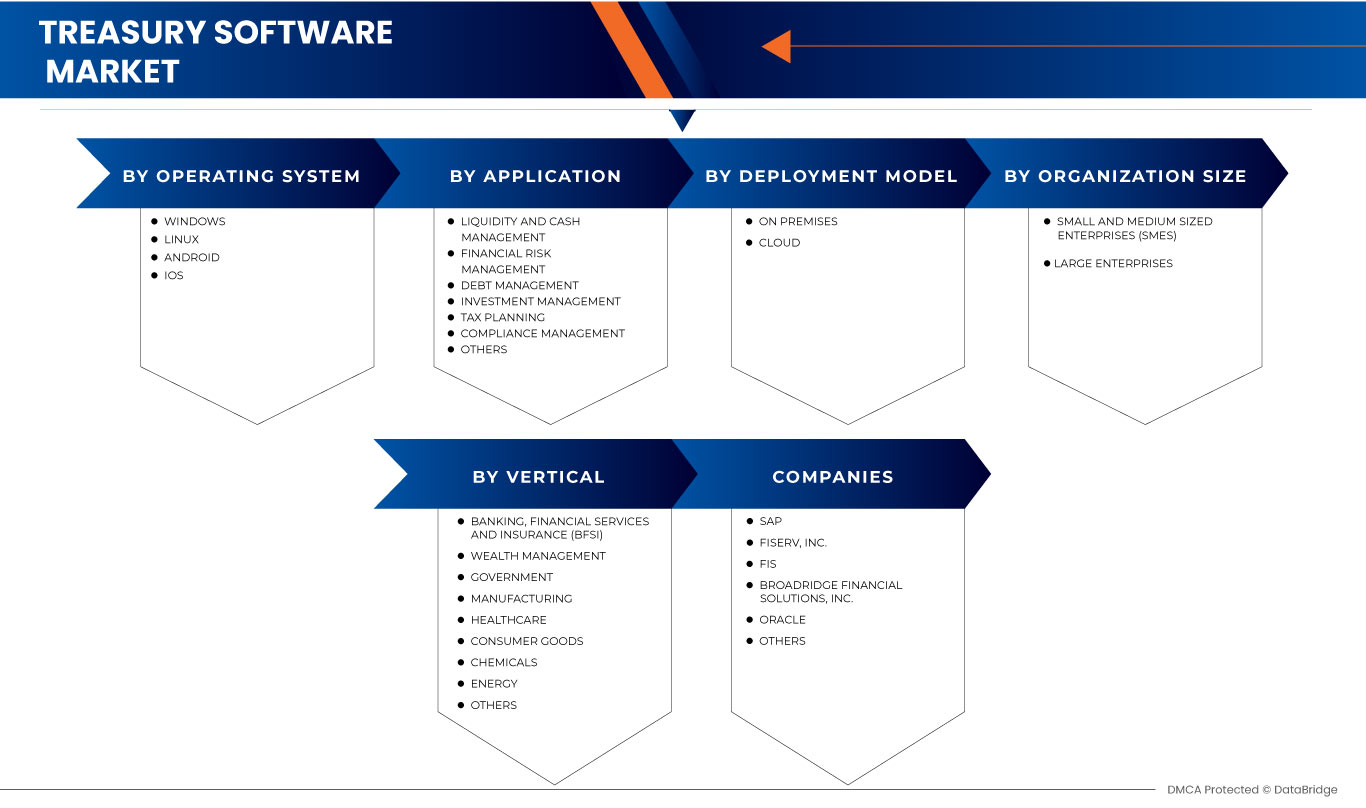

Portée du marché des logiciels de trésorerie en Amérique du Nord

Le marché nord-américain des logiciels de trésorerie est segmenté selon le système d'exploitation, l'application, le modèle de déploiement, la taille de l'organisation et le secteur d'activité. La croissance de ces segments vous permettra d'analyser les segments à faible croissance des secteurs et de fournir aux utilisateurs une vue d'ensemble et des informations précieuses sur le marché, facilitant ainsi la prise de décisions stratégiques pour identifier les applications clés du marché.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN AMÉRIQUE DU NORD, PAR SYSTÈME D'EXPLOITATION

- MAC

- FENÊTRES

- iOS

- ANDROÏDE

- LINUX

Sur la base du système d'exploitation, le marché des logiciels de trésorerie en Amérique du Nord est segmenté en Windows, Linux, MAC, Android et iOS.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN AMÉRIQUE DU NORD, PAR APPLICATION

- GESTION DES LIQUIDITÉS ET DE LA TRÉSORERIE

- GESTION DES RISQUES FINANCIERS

- GESTION DE LA DETTE

- GESTION DES INVESTISSEMENTS

- PLANIFICATION FISCALE

- GESTION DE LA CONFORMITÉ

- AUTRES

Sur la base de l'application, le marché nord-américain des logiciels de trésorerie est segmenté en gestion des liquidités et de la trésorerie, gestion des investissements, gestion de la dette, gestion des risques financiers, gestion de la conformité, planification fiscale et autres.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN AMÉRIQUE DU NORD, PAR MODÈLE DE DÉPLOIEMENT

- SUR PLACE

- NUAGE

Sur la base du mode de déploiement, le marché nord-américain des logiciels de trésorerie est segmenté en cloud et sur site.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN AMÉRIQUE DU NORD, PAR TAILLE D'ORGANISATION

- PETITES ET MOYENNES ENTREPRISES (PME)

- GRANDES ENTREPRISES

Sur la base de la taille de l'organisation, le marché nord-américain des logiciels de trésorerie est segmenté en grandes entreprises et en petites et moyennes entreprises.

MARCHÉ DES LOGICIELS DE TRÉSORERIE EN AMÉRIQUE DU NORD, PAR VERTICAL

- BANQUE, SERVICES FINANCIERS ET ASSURANCES (BFSI)

- GESTION DE PATRIMOINE

- GOUVERNEMENT

- FABRICATION

- SOINS DE SANTÉ

- BIENS DE CONSOMMATION

- PRODUITS CHIMIQUES

- ÉNERGIE

- AUTRES

Sur la base de la verticale, le marché nord-américain des logiciels de trésorerie est segmenté en services bancaires, services financiers et assurances (BFSI), gouvernement, fabrication, soins de santé, biens de consommation, produits chimiques, énergie et autres.

Analyse et perspectives régionales du marché des logiciels de trésorerie en Amérique du Nord

Le marché des logiciels de trésorerie en Amérique du Nord est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, système d'exploitation, application, modèle de déploiement, taille de l'organisation et vertical comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des logiciels de trésorerie en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer la région Amérique du Nord en raison de la forte adoption de technologies de pointe et de la présence d’acteurs majeurs dans la région.

La section pays du rapport présente également les facteurs d'impact sur les marchés individuels et les évolutions de la réglementation qui influencent les tendances actuelles et futures du marché. Des données telles que l'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. De plus, la présence et la disponibilité des marques nord-américaines et les difficultés auxquelles elles sont confrontées en raison de la forte ou de la faible concurrence des marques locales et nationales, de l'impact des tarifs douaniers nationaux et des routes commerciales sont prises en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des logiciels de trésorerie en Amérique du Nord

Le paysage concurrentiel du marché nord-américain des logiciels de trésorerie fournit des informations détaillées par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives, sa présence en Amérique du Nord, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que la prédominance de ses applications. Les données ci-dessus concernent uniquement les entreprises du marché nord-américain des logiciels de trésorerie.

Certains des principaux acteurs opérant sur le marché des logiciels de trésorerie en Amérique du Nord sont Finastra, ZenTreasury Ltd, Emphasys Software, SS&C Technologies, Inc., CAPIX, Adenza, Coupa Software Inc., DataLog Finance, FIS, Access Systems (UK) Limited, Treasury Software Corp., MUREX SAS, EdgeVerve Systems Limited (une filiale à 100 % d'Infosys), Financial Sciences Corp., Broadridge Financial Solutions, Inc., CashAnalytics, Oracle, Fiserv, Inc, ION, SAP, Solomon Software, ABM CLOUD et entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TREASURY SOFTWARE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 MULTIVARIATE MODELING

2.8 OPERATING SYSTEM TIMELINE CURVE

2.9 MARKET APPLICATION COVERAGE GRID

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 KEY PRIMARY INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING ADOPTION OF SMART ELECTRONIC PAYMENT MANAGEMENT TOOLS

5.1.2 GROWING DEMAND FOR ADVANCED TREASURY MANAGEMENT SYSTEM FOR ENHANCING CUSTOMER EXPERIENCE

5.1.3 HEAVING ADOPTION OF ARTIFICIAL INTELLIGENCE IN TREASURY MANAGEMENT

5.1.4 ADOPTION OF CLOUD BASED SOLUTION IN TREASURY MANAGEMENT

5.2 RESTRAINTS

5.2.1 INCREASING CYBER THREATS AND DATA BREACHES

5.2.2 HIGH COST ASSOCIATED WITH TREASURY MANAGEMENT SYSTEMS

5.2.3 CONTINUOUS CHANGES IN REGULATORY FRAMEWORK IN TREASURER MANAGEMENT

5.3 OPPORTUNITIES

5.3.1 PENETRATION OF ADVANCED ANALYTICS SOLUTIONS IN THE BANKING SECTOR

5.3.2 ADOPTION OF AUTOMATED SOLUTIONS TO REDUCE COMPLEXITY

5.3.3 RISE IN STRATEGIC PARTNERSHIP & COLLABORATION AMONG THE ORGANIZATION

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS AMONG CONSUMERS REGARDING THE BENEFITS OF TREASURY SOFTWARE

5.4.2 FACTORS LIKE COMPLEXITIES, INADEQUATE INFRASTRUCTURE, AND FX VOLATILITY HAMPERS TMS EFFICIENCY

6 IMPACT OF COVID-19 ON THE NORTH AMERICA TREASURY SOFTWARE MARKET

7 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM

7.1 OVERVIEW

7.2 WINDOWS

7.3 LINUX

7.4 MAC

7.5 ANDROID

7.6 IOS

8 NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 LIQUIDITY AND CASH MANAGEMENT

8.3 INVESTMENT MANAGEMENT

8.4 DEBT MANAGEMENT

8.5 FINANCIAL RISK MANAGEMENT

8.6 COMPLIANCE MANAGEMENT

8.7 TAX PLANNING MANAGEMENT

8.8 OTHERS

9 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE ENTERPRISES

9.3 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

10 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL

10.1 OVERVIEW

10.2 CLOUD

10.2.1 PUBLIC

10.2.2 HYBRID

10.2.3 PRIVATE

10.3 ON-PREMISES

11 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL

11.1 OVERVIEW

11.2 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

11.2.1 WEALTH MANAGEMENT

11.2.2 BANKING

11.2.3 CAPITAL MARKET

11.2.4 OTHERS

11.3 GOVERNMENT

11.4 MANUFACTURING

11.5 HEALTHCARE

11.6 CONSUMER GOODS

11.7 CHEMICALS

11.8 ENERGY

11.9 OTHERS

12 NORTH AMERICA TREASURY SOFTWARE MARKET , BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA TREASURY SOFTWARE MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILING

15.1 SAP

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 APPLICATION PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 FISERV, INC.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 FIS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 SOLUTION PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 BROADRIDGE FINANCIAL SOLUTIONS, INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 SOLUTION PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 ORACLE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 ABM CLOUD

15.6.1 COMPANY SNAPSHOT

15.6.2 SERVICE PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ACCESS SYSTEMS (UK) LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 SOLUTION PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ADENZA

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 CAPIX

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 CASHANALYTICS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 COUPA SOFTWARE INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT DEVELOPMENTS

15.12 DATALOG FINANCE

15.12.1 COMPANY SNAPSHOT

15.12.2 SOLUTION PORTFOLIO

15.12.3 RECENT DEVELOPMENT

15.13 EDGEVERVE SYSTEMS LIMITED (A WHOLLY OWNED SUBSIDIARY OF INFOSYS)

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 EMPHASYS SOFTWARE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 ERNST & YOUNG

15.15.1 COMPANY SNAPSHOT

15.15.2 SERVICE PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 FINASTRA

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 FINANCIAL SCIENCES CORP.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 ION

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 MUREX S.A.S

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 NOMENTIA

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENTS

15.21 SOLOMON SOFTWARE

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 SS&C TECHNOLOGIES, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TREASURY INTELLIGENCE SOLUTIONS

15.23.1 COMPANY SNAPSHOT

15.23.2 SERVICE PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 TREASURY SOFTWARE CORP

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

15.25 ZENTREASURY LTD

15.25.1 COMPANY SNAPSHOT

15.25.2 SOLUTION PORTFOLIO

15.25.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA WINDOWS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 NORTH AMERICA LINUX IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA MAC IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA ANDROID IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA IOS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA TREASURY SOFTWARE MARKET, APPLICATION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA LIQUIDITY AND CASH MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA INVESTMENT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA DEBT MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA FINANCIAL RISK MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA COMPLIANCE MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TAX PLANNING MANAGEMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA LARGE ENTERPRISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA SMALL AND MEDIUM SIZED ENTERPRISES (SMES) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA ON-PREMISES IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA GOVERNMENT IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA MANUFACTURING IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA HEALTHCARE IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA CONSUMER GOODS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA CHEMICALS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA ENERGY IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN TREASURY SOFTWARE MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TREASURY SOFTWARE MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 41 U.S. TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 42 U.S. TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 43 U.S. CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 44 U.S. TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 45 U.S. TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 46 U.S. BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 CANADA TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 48 CANADA TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 49 CANADA TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 50 CANADA CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CANADA TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 52 CANADA TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 53 CANADA BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 MEXICO TREASURY SOFTWARE MARKET, BY OPERATING SYSTEM, 2021-2030 (USD MILLION)

TABLE 55 MEXICO TREASURY SOFTWARE MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 56 MEXICO TREASURY SOFTWARE MARKET, BY DEPLOYMENT MODEL, 2021-2030 (USD MILLION)

TABLE 57 MEXICO CLOUD IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 MEXICO TREASURY SOFTWARE MARKET, BY ORGANIZATION SIZE, 2021-2030 (USD MILLION)

TABLE 59 MEXICO TREASURY SOFTWARE MARKET, BY VERTICAL, 2021-2030 (USD MILLION)

TABLE 60 MEXICO BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI) IN TREASURY SOFTWARE MARKET, BY TYPE, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TREASURY SOFTWARE MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TREASURY SOFTWARE MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TREASURY SOFTWARE MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA TREASURY SOFTWARE MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TREASURY SOFTWARE MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TREASURY SOFTWARE MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA TREASURY SOFTWARE MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TREASURY SOFTWARE MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TREASURY SOFTWARE MARKET: SEGMENTATION

FIGURE 11 SURGING UTILITY IN THE MILITARY AND DEFENSE SECTOR IS EXPECTED TO DRIVE THE NORTH AMERICA TREASURY SOFTWARE MARKET IN THE FORECAST PERIOD

FIGURE 12 TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TREASURY SOFTWARE MARKET IN 2023 & 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA TREASURY SOFTWARE MARKET

FIGURE 14 MOBILE PAYMENTS SHARE (%) BY COUNTRY

FIGURE 15 FACTORS AFFECTING THE TMS AND CUSTOMER EXPERIENCE

FIGURE 16 THREE WAYS ARTIFICIAL INTELLIGENCE IS TRANSFORMING TREASURY

FIGURE 17 CYBER-ATTACKS INCIDENTS ACROSS INDUSTRIES FROM 2016 TO 2021

FIGURE 18 CYBER-ATTACKS INCIDENTS BY COUNTRY AND REGION IN 2020

FIGURE 19 TREASURY DEPARTMENT CURRENTLY USING

FIGURE 20 ANALYTICS ADOPTION BY SECTOR, FROM THE YEAR 2019 TO 2021 AT INDIAN FIRMS

FIGURE 21 NORTH AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM, 2022

FIGURE 22 NORTH AMERICA TREASURY SOFTWARE MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA TREASURY SOFTWARE MARKET: BY ORGANIZATION SIZE, 2022

FIGURE 24 NORTH AMERICA TREASURY SOFTWARE MARKET: BY DEPLOYMENT MODEL, 2022

FIGURE 25 NORTH AMERICA TREASURY SOFTWARE MARKET: BY VERTICAL, 2022

FIGURE 26 NORTH AMERICA TREASURY SOFTWARE MARKET : SNAPSHOT (2022)

FIGURE 27 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022)

FIGURE 28 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2023 & 2030)

FIGURE 29 NORTH AMERICA TREASURY SOFTWARE MARKET: BY COUNTRY (2022 & 2030)

FIGURE 30 NORTH AMERICA TREASURY SOFTWARE MARKET: BY OPERATING SYSTEM (2023 & 2030)

FIGURE 31 NORTH AMERICA TREASURY SOFTWARE MARKET: COMPANY SHARE 2022(%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.