North America Trauma Fixation Market

Taille du marché en milliards USD

TCAC :

%

USD

5.65 Billion

USD

12.38 Billion

2024

2032

USD

5.65 Billion

USD

12.38 Billion

2024

2032

| 2025 –2032 | |

| USD 5.65 Billion | |

| USD 12.38 Billion | |

|

|

|

|

Segmentation du marché nord-américain de la fixation des traumatismes , par type de produit (fixateurs internes et externes), matériau (implants métalliques (acier, titane et autres), fibre de carbone ( thermoplastique ), implants hybrides, biorésorbables, greffes et orthobiologie), application (épaule et coude, main et poignet, bassin, hanche et fémur, tibia, cranio-maxillo-facial, genou, pied et cheville, colonne vertébrale et autres), utilisateur final (hôpitaux, centres de chirurgie ambulatoire, centres de traumatologie et autres), canal de distribution (appel d'offres direct, vente au détail et vente en ligne) Tendances et prévisions du secteur jusqu'en 2032

Taille du marché de la fixation des traumatismes en Amérique du Nord

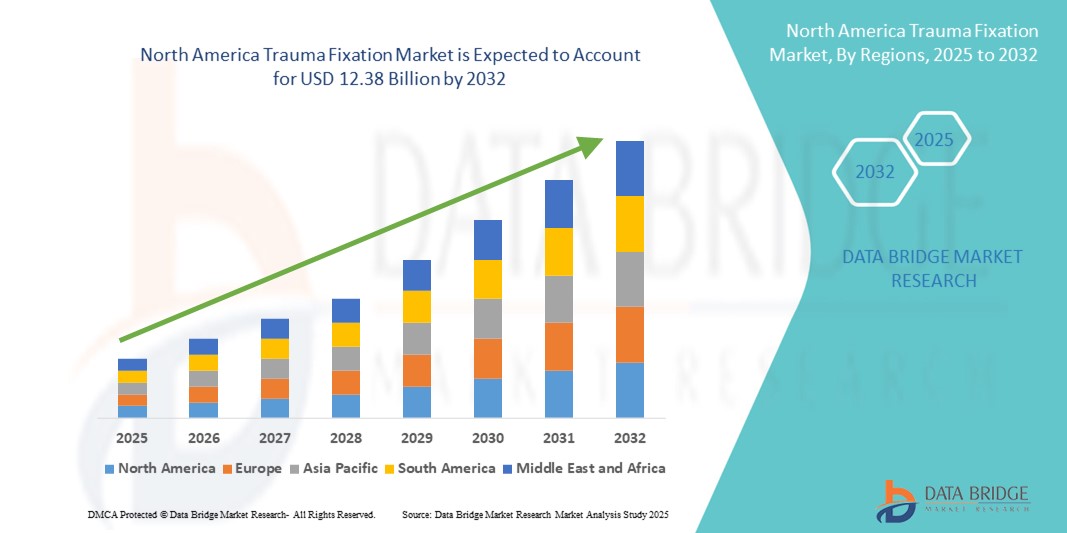

- La taille du marché nord-américain de la fixation des traumatismes était évaluée à 5,65 milliards USD en 2024 et devrait atteindre 12,38 milliards USD d'ici 2032 , à un TCAC de 10,3 % au cours de la période de prévision.

- La croissance du marché est largement alimentée par l'augmentation de l'incidence des traumatismes liés aux accidents de la route, aux chutes et aux blessures liées au sport, une tendance amplifiée par l'urbanisation, l'utilisation croissante des véhicules et le vieillissement de la population. Ces facteurs stimulent la demande de dispositifs de fixation efficaces pour les traumatismes, capables de stabiliser les fractures et de favoriser la récupération.

- En outre, l’innovation technologique joue un rôle crucial : des avancées telles que les techniques chirurgicales mini-invasives, les matériaux bioabsorbables dans les fixateurs internes, les implants personnalisés imprimés en 3D et les revêtements de dispositifs intelligents améliorent l’efficacité des dispositifs, réduisent le temps de récupération et améliorent les résultats pour les patients.

Analyse du marché nord-américain de la fixation des traumatismes

- Les dispositifs de fixation pour traumatismes connaissent une forte adoption en Amérique du Nord, stimulée par l'incidence croissante des traumatismes, la croissance de la population gériatrique et l'augmentation du recours à la chirurgie orthopédique. En 2024, l'Amérique du Nord représentait environ 41,5 % du chiffre d'affaires mondial du marché de la fixation pour traumatismes, grâce à une infrastructure de santé de pointe, une forte sensibilisation aux techniques de fixation innovantes et des cadres de remboursement solides dans toute la région.

- La prévalence croissante des accidents de la route, des blessures sportives et des maladies osseuses liées à l'âge stimule la demande de dispositifs de fixation internes et externes fiables. Les hôpitaux, les centres de traumatologie et les centres de chirurgie ambulatoire d'Amérique du Nord investissent activement dans des solutions de fixation des traumatismes afin d'améliorer les résultats des patients, de réduire le temps de récupération et de minimiser les complications. En 2024, le segment hospitalier a contribué à environ 72,3 % du chiffre d'affaires total du marché de la fixation des traumatismes en Amérique du Nord, reflétant la concentration des soins complexes en traumatologie en milieu hospitalier.

- Les États-Unis ont dominé le marché nord-américain de la fixation des traumatismes, représentant la plus grande part de revenus de 85,4 % en 2024. Cela est attribué à l'infrastructure de chirurgie orthopédique bien établie du pays, aux progrès technologiques continus dans les dispositifs de fixation et à la présence d'acteurs clés du marché dont le siège social est aux États-Unis. Les investissements continus dans la recherche sur les soins traumatologiques et l'augmentation de la couverture d'assurance renforcent encore la domination du marché.

- Le Canada devrait connaître la croissance la plus rapide sur le marché nord-américain de la fixation des traumatismes, avec un TCAC estimé à 10,9 % de 2025 à 2032. Cette croissance est stimulée par l'augmentation des dépenses publiques en santé, l'expansion des établissements de soins de traumatologie et l'adoption accrue des techniques de fixation mini-invasives en chirurgie orthopédique. La croissance de la population gériatrique et la sensibilisation croissante aux options de fixation avancées en milieu rural soutiennent également cette tendance.

- Le segment des dispositifs de fixation interne a dominé le marché nord-américain de la fixation des traumatismes avec 61,4 % des parts de marché en 2024, grâce à leur capacité à fournir une fixation stable, à permettre une mobilisation précoce et à réduire les temps de récupération des patients souffrant de fractures complexes.

Portée du rapport et segmentation du marché nord-américain de la fixation des traumatismes

|

Attributs |

Aperçu du marché de la fixation des traumatismes en Amérique du Nord |

|

Segments couverts |

|

|

Pays couverts |

Amérique du Nord

|

|

Principaux acteurs du marché |

|

|

Opportunités de marché |

|

|

Ensembles d'informations de données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse approfondie des experts, une analyse des prix, une analyse de la part de marque, une enquête auprès des consommateurs, une analyse démographique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Tendances du marché de la fixation des traumatismes en Amérique du Nord

L'essor des techniques de fixation des traumatismes mini-invasives et centrées sur le patient

- Une tendance importante et croissante sur le marché nord-américain de la fixation des traumatismes est l'adoption croissante des procédures chirurgicales mini-invasives (CMI). Ces approches, telles que la fixation percutanée, l'enclouage centromédullaire et les systèmes de plaques avancés, sont de plus en plus adoptées car elles réduisent les traumatismes tissulaires, diminuent les risques d'infection et raccourcissent considérablement le temps de récupération des patients, permettant une sortie d'hôpital plus rapide et de meilleurs résultats cliniques.

- Par exemple, DePuy Synthes propose le système de plaque périprothétique VA LCP, conçu pour les applications MIS, qui minimise l'exposition chirurgicale tout en maintenant une fixation rigide pour les fractures complexes. De même, le clou intertrochantérien TRIGEN INTERTAN de Smith+Nephew permet la stabilisation des fractures grâce à des incisions plus petites, ce qui réduit les pertes sanguines et accélère la mobilisation.

- Les systèmes de fixation hybrides, combinant des éléments de fixation interne et externe, gagnent également en popularité car ils offrent des stratégies de stabilisation personnalisées pour les fractures complexes. Par exemple, le Galaxy Fixation Gemini d'Orthofix permet aux chirurgiens de passer d'une fixation externe à une fixation interne sans supprimer complètement la stabilisation, ce qui permet une adaptation aux besoins spécifiques du patient.

- Une autre avancée majeure est l'essor des implants sur mesure, produits grâce à l'imagerie haute résolution et à la fabrication additive (impression 3D). Par exemple, Materialise et Johnson & Johnson ont collaboré pour produire des plaques CMF personnalisées, adaptées à l'anatomie unique de chaque patient, améliorant ainsi l'ajustement des implants, les performances biomécaniques et la satisfaction des patients.

- L'adoption de biomatériaux avancés transforme également le marché. Le titane reste la référence en matière de résistance et de biocompatibilité, tandis que les matériaux bioabsorbables comme le PLA et le PGA gagnent en popularité, notamment en pédiatrie, éliminant ainsi la nécessité d'une seconde intervention chirurgicale pour le retrait de l'implant. La mousse bioactive Vitoss de Stryker est un exemple de biomatériau qui favorise la régénération osseuse tout en étant résorbable au fil du temps.

- La tendance vers des dispositifs de fixation adaptés aux centres de chirurgie ambulatoire (CCA) s'accélère également. Les produits conçus pour les interventions ambulatoires, comme le système de plaque de verrouillage périarticulaire de Zimmer Biomet, favorisent une récupération plus rapide, une réduction des séjours hospitaliers et des risques d'infection, répondant ainsi à l'importance croissante accordée par les systèmes de santé à la rentabilité et au confort des patients.

Dynamique du marché nord-américain de la fixation des traumatismes

Conducteur

Besoin croissant en raison de l'incidence croissante des blessures orthopédiques et des progrès des procédures chirurgicales

- La prévalence croissante des blessures orthopédiques, des fractures et des traumatismes causés par les accidents de la route, les incidents liés à la pratique d'un sport et la dégénérescence osseuse liée à l'âge est un facteur majeur de la demande de dispositifs de fixation pour traumatismes en Amérique du Nord. Les pays développés comme en développement constatent une augmentation des cas nécessitant une intervention chirurgicale pour la stabilisation et l'alignement osseux.

- Par exemple, en mai 2024, une étude a proposé un algorithme génétique automatique pour l'optimisation des plans chirurgicaux tridimensionnels pour les ostéotomies correctives de l'avant-bras. Ce cadre utilise des modèles 3D spécifiques au patient et une optimisation multi-objectifs pour déterminer la position et l'orientation optimales du plan d'ostéotomie et du matériel de fixation, afin d'améliorer les résultats chirurgicaux.

- Alors que les professionnels de la santé cherchent à améliorer les temps de récupération et à réduire les complications post-chirurgicales, les dispositifs de fixation des traumatismes, tels que les plaques, les vis, les tiges et les fixateurs externes, sont de plus en plus préférés pour leur capacité à assurer une stabilité osseuse immédiate et à faciliter la mobilisation précoce des patients.

- De plus, les progrès constants en chirurgie orthopédique mini-invasive et le développement de matériaux de fixation biocompatibles rendent les solutions de fixation post-traumatique plus efficaces et plus sûres. Ces innovations contribuent également à réduire la durée d'hospitalisation et à améliorer la qualité de vie des patients.

- La demande croissante de dispositifs de fixation personnalisés, la disponibilité de l'impression 3D dans la fabrication médicale et le nombre croissant d'unités spécialisées en soins orthopédiques traumatologiques alimentent davantage l'expansion du marché de la fixation des traumatismes dans les cliniques de type résidentiel et dans les hôpitaux à grande échelle.

Retenue/Défi

Préoccupations concernant les risques chirurgicaux et les coûts initiaux élevés

- Malgré un fort potentiel de marché, l'adoption de la fixation post-traumatique est confrontée à des difficultés en raison des risques chirurgicaux tels que l'infection, le rejet d'implant et la nécessité de révisions chirurgicales. Ces complications peuvent affecter la confiance des patients et influencer les recommandations des chirurgiens, en particulier dans les régions où l'accès aux soins postopératoires avancés est limité.

- Par exemple, des rapports cliniques très médiatisés sur des complications post-chirurgicales, telles que le descellement d'implants ou la défaillance du matériel, ont sensibilisé à l'importance de l'assurance qualité dans la fabrication de fixations pour traumatismes et l'amélioration des compétences chirurgicales.

- La gestion de ces risques nécessite l'utilisation de matériaux biocompatibles de haute qualité, le respect de protocoles de stérilisation stricts et la formation continue des chirurgiens orthopédistes. Des entreprises comme Stryker et Zimmer Biomet soulignent leurs efforts soutenus en R&D pour produire des systèmes de fixation offrant une durabilité accrue, un risque d'infection réduit et une meilleure compatibilité avec les patients.

- Un autre obstacle majeur est le coût initial relativement élevé des systèmes avancés de fixation des traumatismes par rapport aux méthodes de réparation orthopédique traditionnelles. Dans les régions sensibles aux prix, notamment dans les pays à revenu faible ou intermédiaire, cela peut dissuader les hôpitaux et les patients d'adopter des solutions haut de gamme. Si les dispositifs de fixation de base deviennent plus abordables, les systèmes avancés, intégrés à des outils de navigation ou fabriqués à partir d'alliages spécialisés, restent coûteux.

- Surmonter ces défis nécessite non seulement de rendre les systèmes de fixation des traumatismes plus rentables, mais également de mettre en œuvre des politiques de santé publique qui soutiennent les soins orthopédiques subventionnés, d'étendre la couverture d'assurance maladie et de sensibiliser davantage les patients aux avantages à long terme des dispositifs de fixation des traumatismes de haute qualité.

Portée du marché nord-américain de la fixation des traumatismes

Le marché est segmenté en fonction du type de produit, du matériau, de l’application, de l’utilisateur final et du canal de distribution.

- Par type de produit

En fonction du type de produit, le marché de la fixation traumatique est segmenté en fixateurs internes et fixateurs externes. Le segment des fixateurs internes représentait 61,4 % du chiffre d'affaires du marché en 2024, grâce à sa capacité à assurer une fixation stable, à permettre une mobilisation précoce et à réduire le temps de récupération des patients souffrant de fractures complexes. Les dispositifs tels que les plaques, les vis, les tiges et les clous sont largement privilégiés en chirurgie orthopédique, tant élective qu'en urgence, en raison de leurs résultats prouvés à long terme et de leur compatibilité avec les techniques mini-invasives. Ce segment bénéficie également d'une innovation continue en matière de conception, notamment des plaques anatomiques et des systèmes de vis de verrouillage qui améliorent la précision chirurgicale.

Le segment des fixateurs externes devrait connaître le TCAC le plus rapide, soit 7,9 % entre 2025 et 2032, grâce à leur polyvalence dans le traitement des fractures ouvertes, des déformations osseuses complexes et des traumatismes graves où la fixation interne n'est pas viable. La demande croissante de fixateurs externes modulaires et légers, ainsi que leur adoption croissante dans les environnements à faibles ressources grâce à leur réutilisabilité, alimentent l'expansion du marché.

- Par matériau

En fonction du matériau, le marché de la fixation des traumatismes est segmenté en implants métalliques (acier, titane et autres), en fibre de carbone (thermoplastique), en implants hybrides, en matériaux biorésorbables, ainsi qu'en greffes et produits orthobiologiques. Le segment des implants métalliques détenait 54,8 % de parts de marché en 2024, le titane occupant une place prépondérante en raison de sa biocompatibilité, de sa résistance à la corrosion et de sa capacité à s'intégrer au tissu osseux. L'acier inoxydable reste une option rentable, notamment dans les économies émergentes, pour les applications porteuses à haute résistance.

Le segment de la fibre de carbone (thermoplastique) devrait connaître une croissance annuelle composée (TCAC) record de 8,4 % entre 2025 et 2032, grâce à sa radiotransparence, qui permet une imagerie claire et sans interférence, et à sa légèreté qui améliore le confort des patients. Le développement d'implants hybrides combinant des matériaux métalliques et composites, ainsi que l'adoption croissante d'implants biorésorbables qui éliminent le recours à une intervention chirurgicale pour leur retrait, transforment le paysage des matériaux utilisés dans la fixation des traumatismes.

- Par application

En fonction des applications, le marché de la fixation des traumatismes est segmenté en : épaule et coude, main et poignet, bassin, hanche et fémur, tibia, craniomaxillo-facial, genou, pied et cheville, rachis, etc. Le segment hanche et fémur a représenté la plus grande part de chiffre d’affaires, avec 28,3 % en 2024, en raison de la forte incidence des fractures chez les personnes âgées et de l’augmentation du nombre d’interventions de prothèse totale et partielle de hanche dans le monde. Ces blessures nécessitent souvent des systèmes de fixation robustes pour restaurer la mobilité et réduire le risque de complications.

Le segment craniomaxillo-facial devrait enregistrer le TCAC le plus rapide de 9,1 % entre 2025 et 2032, alimenté par les progrès de la technologie d'impression 3D pour les implants spécifiques aux patients et la demande croissante de chirurgies reconstructives après un traumatisme ou des malformations congénitales.

- Par utilisateur final

En fonction de l'utilisateur final, le marché de la fixation traumatique est segmenté en hôpitaux, centres de chirurgie ambulatoire, centres de traumatologie et autres. En 2024, le segment hospitalier a dominé le marché avec 66,5 % de parts de marché, grâce à ses infrastructures de pointe, à la compétence de ses chirurgiens orthopédistes et à sa capacité à gérer des traumatismes complexes nécessitant une prise en charge multidisciplinaire. Les hôpitaux sont également à l'avant-garde de l'adoption de nouvelles technologies chirurgicales et de systèmes de fixation haut de gamme grâce à des collaborations avec des fabricants de dispositifs médicaux.

Le segment des centres chirurgicaux ambulatoires devrait connaître le TCAC le plus rapide de 8,2 % entre 2025 et 2032, grâce au passage aux procédures orthopédiques ambulatoires, à la rentabilité et à la réduction des temps d'attente des patients.

- Par canal de distribution

En fonction du canal de distribution, le marché de la fixation des traumatismes est segmenté en appels d'offres directs, ventes au détail et ventes en ligne. Le segment des appels d'offres directs a représenté 72,8 % du chiffre d'affaires en 2024, soutenu par les achats groupés des hôpitaux et des établissements de santé publics, garantissant un approvisionnement régulier et des économies de coûts.

Le segment des ventes en ligne devrait connaître le TCAC le plus rapide de 9,4 % entre 2025 et 2032, en raison de l'acceptation croissante des plateformes d'approvisionnement numériques, de la visibilité accrue des produits et des prix compétitifs.

Analyse régionale du marché nord-américain de la fixation des traumatismes

- Le marché nord-américain de la fixation des traumatismes représentait 47 % du chiffre d'affaires mondial en 2024, porté par l'augmentation du nombre de cas de traumatismes, les dépenses de santé élevées et les solides cadres de remboursement soutenant les technologies de fixation avancées dans les hôpitaux, les centres de traumatologie et les cliniques orthopédiques. L'Amérique du Nord bénéficie d'une infrastructure de santé mature, d'une adoption généralisée des techniques chirurgicales mini-invasives et d'une innovation continue dans les dispositifs de soins traumatologiques.

- La prévalence croissante des blessures orthopédiques dues aux accidents de la route, aux traumatismes liés au sport et aux fractures liées à l'âge accélère l'adoption de systèmes de fixation interne et externe dans la région. Les investissements dans l'innovation chirurgicale et les initiatives de rétablissement des patients stimulent la demande, notamment dans les centres orthopédiques et les hôpitaux à forte activité. Le segment des fixateurs internes a dominé le chiffre d'affaires en 2024, reflétant la préférence pour des solutions de stabilisation osseuse stables et durables.

- Les avancées technologiques en matière de matériaux et de conception de dispositifs, notamment les systèmes de plaques en titane et verrouillées, les implants personnalisables et l'instrumentation chirurgicale simplifiée, stimulent encore la croissance du marché, en particulier dans les établissements soucieux d'améliorer les résultats cliniques et de réduire les délais de récupération. Le leadership nord-américain repose sur une R&D solide, des autorisations réglementaires rapides et une collaboration entre fabricants et prestataires de soins de santé.

Aperçu du marché américain de la fixation des traumatismes

Le marché américain de la fixation des traumatismes continue de dominer le marché nord-américain de la fixation des traumatismes, s'adjugeant la plus grande part de chiffre d'affaires, soit environ 85,4 % en 2024. Ce leadership repose sur l'infrastructure de chirurgie orthopédique hautement développée du pays, qui comprend un vaste réseau de centres de traumatologie spécialisés, des installations chirurgicales de pointe et un solide écosystème de rééducation postopératoire. Les États-Unis abritent également plusieurs acteurs mondialement reconnus, tels que Johnson & Johnson (DePuy Synthes), Stryker et Zimmer Biomet, dont les sièges sociaux et les centres de R&D jouent un rôle essentiel dans l'innovation des dispositifs de fixation des traumatismes. Les avancées technologiques, notamment les implants sur mesure, les plaques de verrouillage en titane, les vis biodégradables et la navigation chirurgicale assistée par ordinateur, ont considérablement amélioré la précision chirurgicale et les résultats de récupération des patients. De plus, les investissements continus dans la recherche en traumatologie, associés à une large couverture d'assurance pour les interventions orthopédiques, permettent un taux d'adoption plus élevé des solutions de fixation traditionnelles et de nouvelle génération. La forte incidence des accidents de la route, des blessures liées au sport et des cas de fractures parmi la population âgée dans le pays soutient encore davantage la demande de dispositifs de fixation avancés.

Aperçu du marché canadien de la fixation des traumatismes

Le marché canadien de la fixation des traumatismes est celui qui connaît la croissance la plus rapide en Amérique du Nord, avec un TCAC prévu de 10,9 % de 2025 à 2032. Cette solide trajectoire de croissance est soutenue par l'augmentation des dépenses publiques en santé visant à moderniser les infrastructures de soins de traumatologie et à assurer l'accessibilité des soins dans les hôpitaux urbains et les établissements médicaux éloignés. L'expansion des unités de traumatologie spécialisées, ainsi que l'intégration de technologies chirurgicales avancées telles que les techniques de fixation mini-invasives et les systèmes de plaques hybrides, transforment la prestation des soins orthopédiques au pays. De plus, le Canada connaît une évolution démographique marquée par une population gériatrique en croissance rapide, plus vulnérable aux fractures liées à l'ostéoporose et à d'autres lésions squelettiques. Les campagnes de sensibilisation du public, en particulier dans les régions rurales et mal desservies, encouragent également un diagnostic et un traitement précoces, ce qui conduit à une plus grande adoption des solutions de fixation avancées. Le contexte de remboursement favorable et les efforts de collaboration entre les hôpitaux canadiens et les fabricants mondiaux de dispositifs orthopédiques accélèrent encore l'adoption de dispositifs de fixation des traumatismes de pointe.

Part de marché de la fixation des traumatismes en Amérique du Nord

L'industrie de la fixation des traumatismes est principalement dirigée par des entreprises bien établies, notamment :

- Groupe Weigao (Chine)

- Orthofix Medical Inc. (États-Unis)

- CONMED Corporation (États-Unis)

- Wright Medical Group NV (Pays-Bas)

- OsteoMed (États-Unis)

- Invibio Ltd. (Royaume-Uni)

- Medtronic (Irlande)

- Smith + Nephew (Royaume-Uni)

- Zimmer Biomet (États-Unis)

- B. Braun SE (Allemagne)

- Stryker (États-Unis)

- Implantate AG (Allemagne)

- Johnson & Johnson et ses filiales (États-Unis)

- Inion OY (Finlande)

- Arthrex Inc. (États-Unis)

- Jeil Medical Corporation (Corée du Sud)

- Bioretec Ltd. (Finlande)

Derniers développements sur le marché nord-américain de la fixation des traumatismes

- En août 2021, Zimmer Biomet Holdings Inc. a annoncé avoir reçu l'autorisation de la FDA pour le système ROSA Hip pour le traitement des arthroplasties totales de la hanche. Ce système robotisé est conçu pour aider les chirurgiens à évaluer et à exécuter leur plan chirurgical tout en mesurant l'orientation de la cupule, la longueur de la jambe et le décalage peropératoire.

- En mars 2024, Stryker Corporation a lancé le SmartScrew Pro, un dispositif avancé de fixation des traumatismes doté de fonctions de surveillance en temps réel de la cicatrisation osseuse. Cette innovation vise à améliorer les résultats pour les patients en fournissant aux chirurgiens un retour immédiat sur le processus de cicatrisation, améliorant ainsi la précision chirurgicale et les délais de récupération.

- En janvier 2024, Zimmer Biomet a lancé le système résorbable BioFIX, un système de plaques biorésorbables principalement conçu pour les traumatismes pédiatriques. Des essais cliniques menés dans l'Union européenne ont démontré une réduction de 42 % du recours à des interventions chirurgicales secondaires, soulignant le potentiel du système pour améliorer la récupération des patients et réduire les coûts de santé.

- En septembre 2023, Orthofix a annoncé le lancement commercial complet de son système de fixation Galaxy Gemini. Conçu pour les interventions orthopédiques en traumatologie, ce système offre une stabilité et une flexibilité accrues pour le traitement des fractures des membres inférieurs et supérieurs. Ce lancement témoigne de l'engagement d'Orthofix à faire progresser la prise en charge des traumatismes grâce à des solutions innovantes.

- En octobre 2024, une étude a présenté le système « StraightTrack », un système de navigation en réalité mixte conçu pour faciliter le placement précis des broches de Kirschner (broches K) lors d'une chirurgie percutanée des traumatismes pelviens. Ce système offre une visualisation et un guidage 3D en temps réel, améliorant la précision du placement des broches et réduisant les complications liées à un mauvais positionnement.

- En mai 2024, une étude a proposé un algorithme génétique automatique pour l'optimisation des plans chirurgicaux tridimensionnels pour les ostéotomies correctrices de l'avant-bras. Ce cadre utilise des modèles 3D spécifiques au patient et une optimisation multi-objectifs pour déterminer la position et l'orientation optimales du plan d'ostéotomie et du matériel de fixation, afin d'améliorer les résultats chirurgicaux.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.