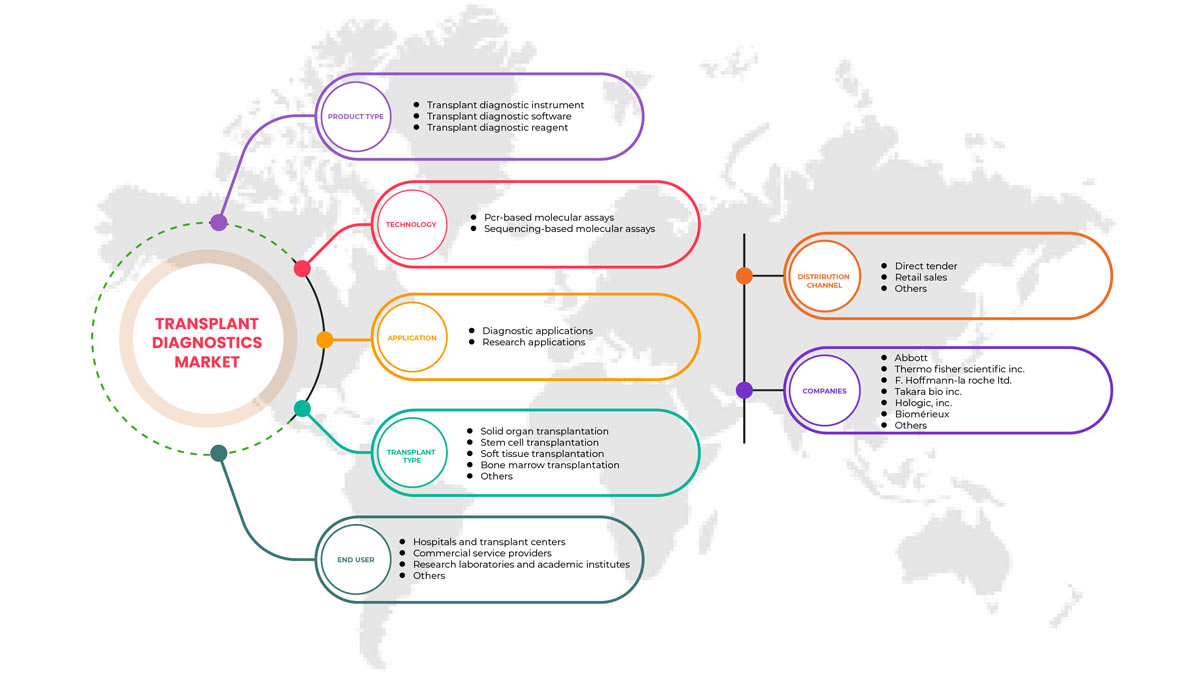

Marché nord-américain du diagnostic de transplantation, par type de produit (instrument de diagnostic de transplantation, logiciel de diagnostic de transplantation, réactif de diagnostic de transplantation), technologie (dosages moléculaires basés sur la PCR, dosages moléculaires basés sur le séquençage), type de transplantation (transplantation d'organe solide, transplantation de cellules souches, transplantation de tissus mous, transplantation de moelle osseuse, autres transplantations), application (applications de diagnostic, applications de recherche), utilisateur final (laboratoires de recherche et instituts universitaires, centres hospitaliers et de transplantation, prestataires de services commerciaux, autres), canal de distribution (appel d'offres direct, ventes au détail, autres) Tendances de l'industrie et prévisions jusqu'en 2029.

Analyse et perspectives du marché des diagnostics de transplantation en Amérique du Nord

Le diagnostic de transplantation est une procédure de diagnostic généralement divisée en procédures pré-transplantation et post-transplantation. Elle permet d'analyser l'état de santé du patient. Si cela est évité, la personne immunodéprimée risque de développer une infection nosocomiale ou pire, ce qui peut entraîner la mort. La procédure est une collaboration harmonieuse entre les professionnels de la santé et les experts de laboratoire, garantissant de meilleurs résultats pour les patients. En outre, une correspondance étroite des marqueurs HLA du donneur et du receveur est importante. Cela augmente la probabilité de survie du greffon et minimise les complications graves de la transplantation immunologique. La prévalence accrue des maladies chroniques au sein de la population mondiale est susceptible de stimuler l'expansion du marché au cours des années de prévision. En outre, l'utilisation croissante de la thérapie par cellules souches et des médicaments personnalisés gagne en popularité. L'utilisation de nouvelles techniques de diagnostic a amélioré les résultats médicaux des transplantations d'organes. Le taux de rejet d'organes peut être réduit en faisant correspondre la compatibilité du donneur et du receveur avant la transplantation.

Cependant, le coût élevé des procédures associées aux instruments de diagnostic PCR et NGS est l'un des plus importants. Par conséquent, la croissance du marché pourrait être entravée à long terme. Le coût des équipements médicaux est l'un des éléments qui peuvent poser problème aux fournisseurs d'appareils de diagnostic de transplantation essentiels.

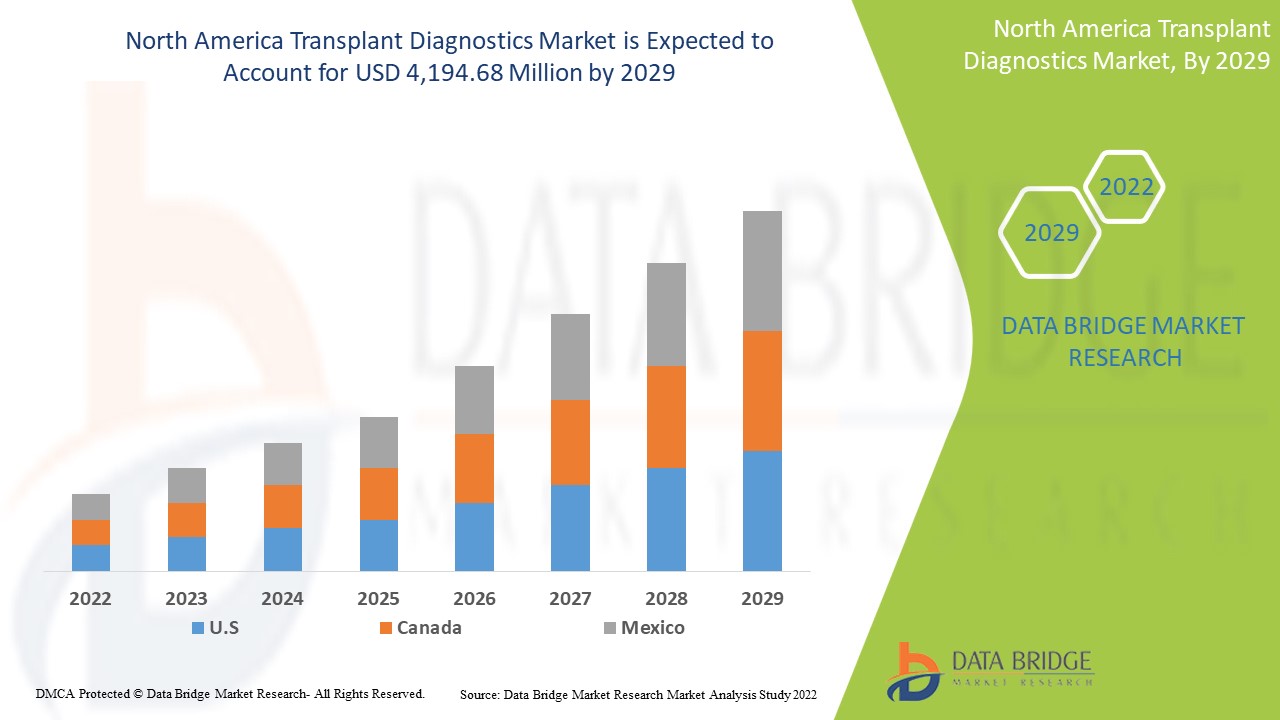

Data Bridge Market Research estime que le marché nord-américain du diagnostic de transplantation devrait atteindre une valeur de 4 194,68 millions USD d'ici 2029, à un TCAC de 6,9 % au cours de la période de prévision. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type de produit (instrument de diagnostic de transplantation, logiciel de diagnostic de transplantation, réactif de diagnostic de transplantation), technologie ( analyses moléculaires basées sur la PCR , analyses moléculaires basées sur le séquençage), type de transplantation (transplantation d'organe solide, transplantation de cellules souches, transplantation de tissus mous , transplantation de moelle osseuse , autre), application (applications de diagnostic, applications de recherche), utilisateur final (laboratoires de recherche et instituts universitaires, centres hospitaliers et de transplantation, prestataires de services commerciaux, autres), canal de distribution (appel d'offres direct, vente au détail et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Hologic, Inc., Biofortuna Limited, Takara Bio Inc., Abbott, Diagnóstica Longwood SL, Adaptive Biotechnologies, NanoString, Arquer Diagnostics Ltd, altona Diagnostics GmbH, ELITechGroup, DiaSorin SpA, Horiba Ltd, EUROFINS VIRACOR, CareDx Inc., Laboratory Corporation of America Holdings., Randox Laboratories Ltd., Thermo Fisher Scientific Inc., Preservation Solutions, Inc., TransMedics, Transonic, Stryker, Bio-Rad Laboratories, Inc., Zimmer Biomet, QIAGEN, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Illumina, Inc., Luminex Corporation (une filiale de DiaSorin Company), IMMUCOR, entre autres |

Définition du marché

Le diagnostic de transplantation est l'immunogénétique et l'histocompatibilité des transplantations d'organes et de cellules souches hématopoïétiques. Ces diagnostics aident les professionnels de la santé à déterminer la compatibilité entre les receveurs potentiels et les donneurs d'organes. Ils sont utilisés dans diverses disciplines, telles que l'immunogénétique, la pathologie et les maladies infectieuses, entre autres. Les diagnostics de transplantation sont utilisés pour déterminer si le donneur et le receveur de l'organe sont compatibles avant ou après la transplantation. Avec l'introduction des diagnostics de transplantation, la prévalence des maladies pouvant entraîner une défaillance d'organe, y compris le dépistage avant et après la transplantation, devrait exploser. Le marché a suscité l'intérêt des professionnels de la santé en raison des nombreux avantages que ces tests offrent pour vérifier l'aptitude à une procédure de transplantation. La transplantation d'organes est l'une des options de traitement les plus populaires pour de nombreux patients atteints d'insuffisance rénale terminale sous dialyse continue.

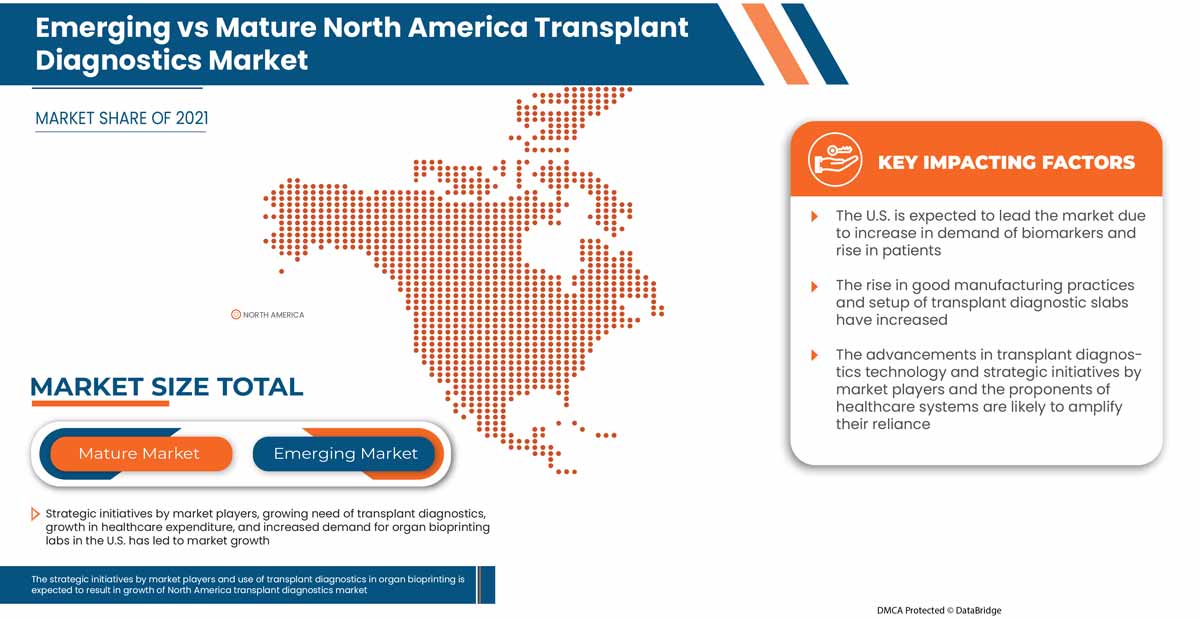

En outre, il est possible d’étudier la transplantation d’organes dans les cas impliquant le cœur, le foie ou la moelle osseuse. Cependant, dans de nombreux cas, il existe une forte association entre l’insuffisance rénale et la transplantation hépatique, y compris en cas d’insuffisance rénale terminale. De nouveaux indicateurs transcriptomiques, protéomiques et génomiques dans le diagnostic moléculaire peuvent aider à mieux adapter le traitement de transplantation et à détecter précocement les événements de rejet. En outre, les initiatives stratégiques des acteurs du marché, les progrès technologiques dans le diagnostic de transplantation, l’assurance d’une stérilité élevée et l’augmentation des investissements dans les infrastructures de soins de santé augmentent la demande de diagnostics de transplantation.

Dynamique du marché des diagnostics de transplantation en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation du nombre de transplantations

La demande de transplantation d’organes a rapidement augmenté dans le monde entier au cours de la dernière décennie en raison de l’incidence accrue des défaillances d’organes vitaux et de l’amélioration des résultats post-transplantation. La demande de transplantation de rein, de cœur, de foie et de poumons est très élevée. La consommation d’alcool, le manque d’exercice et la toxicomanie sont les principales causes de défaillance d’organes. Le nombre de transplantations à partir de donneurs vivants a été affecté par la pandémie de COVID-19. Mais les transplantations à partir de donneurs vivants ont augmenté de 14,2 % par rapport à 2020.

- En outre, la transplantation d’organes améliore la survie et la qualité de vie des patients et a un impact positif majeur sur la santé publique et sur le fardeau socio-économique de la défaillance d’organes. L’Union européenne (UE) a une approche relativement uniforme et structurée de la transplantation d’organes, des programmes nationaux bien développés, des systèmes internationaux pour faciliter le partage d’organes et des politiques d’échange bien définies, ce qui fait de l’Europe un leader dans ce domaine.

Ainsi, le nombre croissant de procédures de transplantation à travers le monde et l’augmentation des transplantations réussies devraient stimuler le marché du diagnostic de transplantation en Amérique du Nord.

- Augmentation des avancées technologiques dans le domaine des transplantations

Les nouvelles technologies modifient rapidement les approches traditionnelles de la transplantation d'organes. Les principaux défis de la transplantation d'organes sont de savoir comment identifier au mieux et, si possible, éliminer le besoin d'immunosuppression à vie et comment élargir le bassin de donneurs aptes à la transplantation humaine. Les chercheurs ont mis au point un système avancé qui permet de prolonger le temps de transport en faisant croire aux organes du donneur qu'ils sont toujours à l'intérieur du corps. Ce système permet au sang oxygéné de circuler dans les organes pour retarder la mort des tissus. Une machine de perfusion normothermique imite le corps humain, assurant un flux sanguin constant vers l'organe. La machine peut également administrer des médicaments ou d'autres nutriments pour maintenir le foie dans un état optimal avant la transplantation.

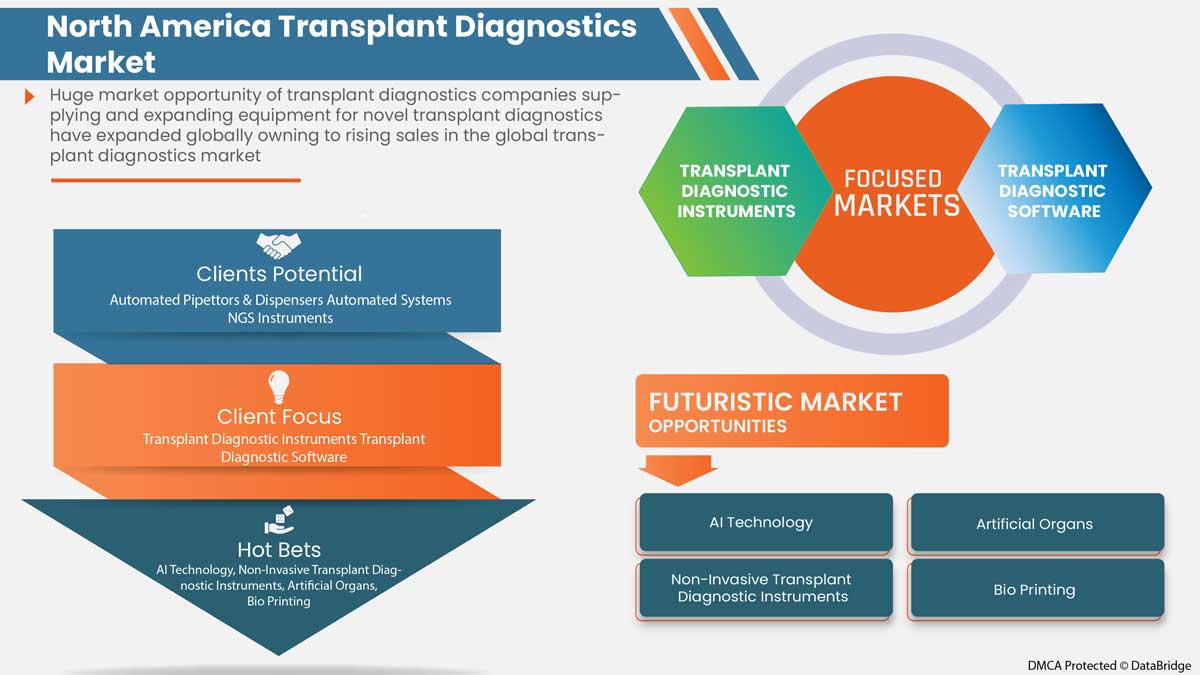

En outre, les techniques de production d’organes bio-artificiels sont une gamme de techniques habilitantes qui peuvent être utilisées pour produire des organes humains sur la base de principes bioniques. Au cours des dix dernières années, des progrès significatifs ont été réalisés dans le développement de diverses technologies de fabrication d’organes. La dernière décennie a vu d’énormes progrès dans les nouvelles technologies telles que le séquençage d’ARN à cellule unique, la nanobiotechnologie et l’édition génétique CRISPR-Cas9. Cependant, les applications créatives de ces nouvelles et puissantes technologies pour améliorer la transplantation clinique ne font que commencer. Grâce à de tels outils, il existe désormais de bonnes opportunités de réaliser des percées majeures dans la définition et la fourniture de soins optimisés et individualisés pour toutes les transplantations d’organes.

Retenue

- Coût élevé de la transplantation d’organes

La transplantation d'organes fait appel à des produits hautement avancés sur le plan technologique. Le développement de ces produits nécessite des recherches et un développement rigoureux de la part des acteurs en développement. Ainsi, les procédures et le coût des produits restent élevés, ce qui augmente proportionnellement le coût des tests. En outre, les transplantations d'organes sont coûteuses car elles nécessitent énormément de ressources et impliquent des médecins bien payés, des transports et des médicaments coûteux.

- Des thérapies de désensibilisation ont également été utilisées pour réaliser une transplantation à partir d'un donneur incompatible. Cependant, ces procédures sont très coûteuses et peuvent être associées à des complications et à des résultats à long terme plus défavorables.

Ainsi, le coût élevé de la transplantation et du traitement utilisant des modalités et des produits technologiques avancés constituera un facteur limitant majeur pour la croissance du marché nord-américain du diagnostic de transplantation.

Opportunité

-

Initiatives stratégiques des acteurs du marché

L'essor du marché nord-américain du diagnostic de transplantation accroît le besoin d'idées commerciales stratégiques. Cela comprend un partenariat, une expansion commerciale et d'autres développements. La forte demande d'organes de donneurs augmente considérablement la demande de kits de diagnostic de transplantation. Les stratégies planifiées permettent aux acteurs du marché de s'aligner sur les activités fonctionnelles de l'organisation pour atteindre les objectifs fixés. Elles guident les discussions et la prise de décision de l'entreprise pour déterminer les besoins en ressources et en budget pour atteindre les objectifs, augmentant ainsi l'efficacité opérationnelle.

Ces initiatives stratégiques, telles que les lancements de produits, les accords et l'expansion commerciale des principaux acteurs du marché, stimuleront la croissance du marché et devraient constituer une opportunité pour le marché nord-américain du diagnostic de transplantation. Les initiatives stratégiques devraient favoriser la croissance et améliorer le portefeuille de produits de l'entreprise, ce qui, à terme, générera davantage de revenus. Par conséquent, ces initiatives stratégiques des acteurs du marché peuvent être considérées comme une opportunité qui les aide à stimuler le marché nord-américain du diagnostic de transplantation.

Défi

- Défis éthiques rencontrés lors de la transplantation d’organes

L’augmentation du nombre de cas de défaillance d’organes vitaux et l’insuffisance de l’offre d’organes ont créé un écart important entre l’offre et la demande d’organes. Ce problème a entraîné de longs délais d’approbation pour recevoir un organe et une augmentation du nombre de décès. Les événements, qui se sont produits au cours des années précédentes et qui se poursuivent aujourd’hui, ont soulevé de nombreuses questions éthiques, morales et sociétales concernant l’offre, les méthodes d’attribution des organes et le recours à des donneurs vivants comme volontaires, y compris des mineurs.

En raison du manque de précision des rapports, les organes donnés ne peuvent pas être fournis et les procédures qui ne soulagent pas la souffrance ni ne prolongent la vie sont rapidement identifiées.

Des problèmes tels que le manque d'approvisionnement en organes, l'acceptation religieuse, la mort cérébrale et les idées fausses liées au don et à la transplantation d'organes sont toujours présents à de nombreux niveaux éthiques personnels et communautaires, même au sein de la communauté médicale. Les divers aspects de nature éthique, culturelle et religieuse ne devraient pas constituer un obstacle à l'acte de don et de transplantation d'organes. Tous ces problèmes doivent être résolus. Par conséquent, les défis éthiques rencontrés lors de la transplantation d'organes devraient entraver la croissance du marché.

Impact de la pandémie de COVID-19 sur le marché nord-américain des diagnostics de transplantation

Le marché nord-américain du diagnostic de transplantation a été gravement touché par le COVID-19. Les admissions à l'hôpital ont été limitées aux traitements non essentiels et les cliniques ont été temporairement fermées pendant la pandémie. La mise en œuvre de la distanciation sociale, le blocage de la population et l'accès limité aux cliniques ont grandement affecté le marché. Le ralentissement des flux de patients et des orientations a également affecté la croissance du marché. Cependant, le marché continuera de croître après la pandémie en raison de l'assouplissement des restrictions précédemment imposées.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D, de lancements de produits et de partenariats stratégiques pour améliorer la technologie et les résultats des tests sur le marché nord-américain du diagnostic de transplantation.

Développements récents

- En juillet 2022, Horiba Medical a lancé un tout nouveau produit dans sa catégorie Hématologie Yumizen. Le produit présente des caractéristiques nouvelles et avancées pour satisfaire aux besoins de diverses exigences cliniques et de laboratoire. Cela a aidé l'entreprise à diversifier son offre de produits

- En janvier 2022, Hoffmann-La Roche Ltd a lancé Cobas Infinity edge, une plateforme de point de service basée sur le cloud accessible. Grâce à sa technologie avancée, les professionnels de la santé peuvent gérer les données des patients. Cela a aidé l'entreprise à diversifier sa gamme de produits

Portée du marché du diagnostic de transplantation en Amérique du Nord

Le marché nord-américain du diagnostic de transplantation est segmenté en type de produit, technologie, type de transplantation, application, utilisateur final et canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Type de produit

- Instrument de diagnostic de transplantation

- Logiciel de diagnostic de transplantation

- Réactif de diagnostic de transplantation

Sur la base du type de produit, le marché nord-américain du diagnostic de transplantation est segmenté en instrument de diagnostic de transplantation, logiciel de diagnostic de transplantation et réactif de diagnostic de transplantation.

Technologie

- Dosages moléculaires basés sur la PCR

- Dosages moléculaires basés sur le séquençage

Sur la base de la technologie, le marché nord-américain du diagnostic de transplantation est segmenté en tests moléculaires basés sur la PCR et en tests moléculaires basés sur le séquençage.

Type de greffe

- Transplantation d'organes solides

- Transplantation de cellules souches

- Transplantation de tissus mous

- Transplantation de moelle osseuse

- Autres transplantations

Sur la base du type de transplantation, le marché nord-américain du diagnostic de transplantation est segmenté en transplantation d'organes solides, transplantation de cellules souches, transplantation de tissus mous, transplantation de moelle osseuse et autres transplantations.

Application

- Applications diagnostiques

- Applications de recherche

Sur la base des applications, le marché nord-américain du diagnostic de transplantation est segmenté en applications de diagnostic et en applications de recherche.

Utilisateur final

- Laboratoires de recherche et instituts universitaires

- Hôpitaux et centres de transplantation

- Prestataires de services commerciaux

- Autres

Sur la base de l'utilisateur final, le marché nord-américain du diagnostic de transplantation est segmenté en laboratoires de recherche et instituts universitaires, hôpitaux et centres de transplantation, prestataires de services commerciaux et autres.

Canal de distribution

- Appel d'offres direct

- Ventes au détail

- Autres

Sur la base du canal de distribution, le marché nord-américain du diagnostic de transplantation est segmenté en appels d'offres directs, ventes au détail et autres.

Analyse/perspectives régionales du marché du diagnostic de transplantation en Amérique du Nord

Le marché nord-américain du diagnostic de transplantation est analysé et des informations sur la taille du marché sont fournies par pays, type de produit, technologie, type de transplantation, application, utilisateur final et canal de distribution.

Certains pays couverts par le marché du diagnostic de transplantation en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain du diagnostic de transplantation en raison de la présence d’acteurs clés du marché sur le plus grand marché de consommation avec un PIB élevé.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation nationale qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales et de l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du diagnostic de transplantation en Amérique du Nord

Le paysage concurrentiel du marché nord-américain du diagnostic de transplantation fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché nord-américain du diagnostic de transplantation.

Français Certains des principaux acteurs opérant sur le marché du diagnostic de transplantation en Amérique du Nord sont Hologic, Inc., Biofortuna Limited, Takara Bio Inc., Abbott, Diagnóstica Longwood SL, Adaptive Biotechnologies, NanoString, Arquer Diagnostics Ltd, altona Diagnostics GmbH, ELITechGroup, DiaSorin SpA, Horiba Ltd, EUROFINS VIRACOR, CareDx Inc., Laboratory Corporation of America Holdings., Randox Laboratories Ltd., Thermo Fisher Scientific Inc., Preservation Solutions, Inc., TransMedics, Transonic, Stryker, Bio-Rad Laboratories, Inc., Zimmer Biomet, QIAGEN, F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Illumina, Inc., Luminex Corporation (Une filiale de DiaSorin Company), IMMUCOR, entre autres.

Méthodologie de recherche : Marché nord-américain des diagnostics de transplantation

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent une grille de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, une grille de positionnement des entreprises, une analyse des parts de marché des entreprises, des normes de mesure, l'Amérique du Nord par rapport aux régions et une analyse des parts des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 SOURCE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 EPIDEMOLOGY

3.2 PESTEL_ANALYSIS

3.3 PORTER'S FIVE FORCE

3.4 TECHNOLOGICAL INNOVATIONS

4 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: REGULATIONS

5 KEY STRATEGIC INITIATIVES

6 INDUSTRIAL INSIGHTS:

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISING NUMBER OF TRANSPLANT PROCEDURES

7.1.2 INCREASE IN THE TECHNOLOGICAL ADVANCEMENTS IN THE FIELD OF TRANSPLANTS

7.1.3 RISING HEALTHCARE SPENDING

7.1.4 ADOPTION OF CROSS-MATCHING AND CHIMERISM TESTING DURING PRE- AND POST-TRANSPLANTATION

7.2 RESTRAINTS

7.2.1 HIGH COST OF ORGAN TRANSPLANTATION

7.2.2 THE RISKS AND DIFFICULTIES OF ORGAN TRANSPLANTATION

7.3 OPPORTUNITIES

7.3.1 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.2 RISE IN PUBLIC, PRIVATE, AND GOVERNMENT FUNDING FOR ORGAN TRANSPLANTATION

7.3.3 SURGE IN AWARENESS ABOUT THE IMPORTANCE OF ORGAN TRANSPLANTATION

7.4 CHALLENGES

7.4.1 ETHICAL CHALLENGES FACED DURING ORGAN TRANSPLANTATION

7.4.2 LACK OF ORGAN DONORS OR GAP BETWEEN ORGAN DONORS AND ORGANS NEEDED ANNUALLY

8 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 TRANSPLANT DIAGNOSTIC INSTRUMENTS

8.2.1 AUTOMATED PIPETTORS & DISPENSERS

8.2.2 AUTOMATED SYSTEMS

8.2.2.1 NUCLEIC ACID EXTRACTION SYSTEM

8.2.2.2 PCR SETUP

8.2.2.3 OTHERS

8.2.3 NGS INSTRUMENTS

8.2.4 READERS & ANALYZERS

8.2.5 TRANSPLANT DIAGNOSTIC KITS

8.2.5.1 ASPERGILLUS SPP KITS

8.2.5.2 P. JIROVECII KITS

8.2.5.3 CMV KITS

8.2.5.4 EBV KITS

8.2.5.5 BKV KITS

8.2.5.6 VZV KITS

8.2.5.7 HSV1 KITS

8.2.5.8 HSV2 KITS

8.2.5.9 PARVOVIRUS B19 KITS

8.2.5.10 ADENOVIRUS KITS

8.2.5.11 ENTEROVIRUS KITS

8.2.5.12 JCV KITS

8.2.5.13 HHV6 KITS

8.2.5.14 HHV7 KITS

8.2.5.15 HHV8 KITS

8.2.5.16 TOXOPLASMA GONDII KITS

8.2.5.17 HEPATITIS E KITS

8.2.5.18 OTHER KITS

8.2.6 OTHER KITS

8.3 TRANSPLANT DIAGNOSTIC SOFTWARE’S

8.3.1 DNA SOFTWARE

8.3.2 NGS SOFTWARE

8.3.3 DATA MANAGEMENT SOFTWARE

8.3.4 OTHER SOFTWARE’S

8.4 TRANSPLANT DIAGNOSTIC REAGENTS

8.4.1 MONOCLONAL ANTIBODIES

8.4.2 CYTOTOXIC CONTROLS

8.4.3 HUMAN SERUM

8.4.4 OTHER REAGENTS

9 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 PCR-BASED MOLECULAR ASSAYS

9.2.1 REAL TIME PCR

9.2.2 SEQUENCE-SPECIFIC PRIMER-PCR

9.2.3 SEQUENCE-SPECIFIC OLIGONUCLEOTIDE-PCR

9.2.4 RESTRICTION FRAGMENT LENGTH POLYMORPHISM (RFLP)

9.2.5 OTHER-PCR BASED MOLECULAR ASSAYS

9.3 SEQUENCING-BASED MOLECULAR ASSAYS

9.3.1 SANGER SEQUENCING

9.3.2 NEXT GENERATION SEQUENCING

9.3.3 OTHER SEQUENCING-BASED MOLECULAR ASSAYS.

10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE

10.1 OVERVIEW

10.2 SOLID ORGAN TRANSPLANTATION

10.2.1 KIDNEY TRANSPLANTATION

10.2.2 LIVER TRANSPLANTATION

10.2.3 HEART TRANSPLANTATION

10.2.4 LUNG TRANSPLANTATION

10.2.5 PANCREAS TRANSPLANTATION

10.2.6 OTHER ORGAN TRANSPLANTATIONS

10.3 STEM CELL TRANSPLANTATION

10.3.1 BONE MARROW TRANSPLANT (BMT)

10.3.2 PERIPHERAL BLOOD STEM CELL TRANSPLANT

10.3.3 CORD BLOOD TRANSPLANT

10.3.4 OTHER STEM CELL TRANSPLANTS

10.4 SOFT TISSUE TRANSPLANTATION

10.4.1 SKIN GRAFT

10.4.2 CARTILAGE TRANSPLANTATION

10.4.3 ADRENAL AUTOGRAFTING

10.4.4 OTHER SOFT TISSUE TRANSPLANTATION.

10.5 BONE MARROW TRANSPLANTATION

10.5.1 AUTOLOGOUS BONE MARROW TRANSPLANT

10.5.2 ALLOGENEIC BONE MARROW TRANSPLANT

10.5.3 UMBILICAL CORD BLOOD TRANSPLANT.

10.6 OTHERS

11 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 DIAGNOSTIC APPLICATIONS

11.2.1 TRANSPLANT DIAGNOSTIC INSTRUMENT

11.2.1.1 AUTOMATED PIPETTORS & DISPENSERS

11.2.1.2 AUTOMATED SYSTEMS

11.2.1.3 NGS INSTRUMENTS

11.2.1.4 READERS & ANALYZERS

11.2.1.5 TRANSPLANT DIAGNOSTIC KITS

11.2.1.6 OTHERS

11.2.2 TRANSPLANT DIAGNOSTIC SOFTWARE

11.2.2.1 DNA SOFTWARE

11.2.2.2 NGS SOFTWARE

11.2.2.3 DATA MANAGEMENT SOFTWARE

11.2.2.4 OTHER SOFTWARES

11.2.3 TRANSPLANT DIAGNOSTIC REAGENT

11.2.3.1 MONOCLONAL ANTIBODIES

11.2.3.2 CYTOTOXIC CONTROLS

11.2.3.3 HUMAN SERUM

11.2.3.4 OTHER REAGENTS

11.3 RESEARCH APPLICATIONS

11.3.1 TRANSPLANT DIAGNOSTIC INSTRUMENT

11.3.1.1 AUTOMATED PIPETTORS & DISPENSERS

11.3.1.2 AUTOMATED SYSTEMS

11.3.1.3 NGS INSTRUMENTS

11.3.1.4 READERS & ANALYZERS

11.3.1.5 TRANSPLANT DIAGNOSTIC KITS

11.3.1.6 OTHERS

11.3.2 TRANSPLANT DIAGNOSTIC SOFTWARE

11.3.2.1 DNA SOFTWARE

11.3.2.2 NGS SOFTWARE

11.3.2.3 DATA MANAGEMENT SOFTWARE

11.3.2.4 OTHER SOFTWARES

11.3.3 TRANSPLANT DIAGNOSTIC REAGENT

11.3.3.1 MONOCLONAL ANTIBODIES

11.3.3.2 CYTOTOXIC CONTROLS

11.3.3.3 HUMAN SERUM

11.3.3.4 OTHER REAGENTS

12 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS AND TRANSPLANT CENTERS

12.3 COMMERCIAL SERVICE PROVIDERS

12.4 RESEARCH LABORATORIES AND ACADEMIC INSTITUTES

12.5 OTHERS

13 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 RETAIL SALES

13.4 OTHERS

14 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY REGION

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 ABBOTT

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 F. HOFFMANN LA ROCHE LTD

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TAKARA BIO INC.

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 HOLOGIC, INC

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ADAPTIVE BIOTECHNOLOGIES

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ALTONA DIAGNOSTICS

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 ARQUER DIAGNOSTICS LTD

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 BAG DIAGNOSTICS GMBH

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BIOFORTUNA LIMITED

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 BIOMÉRIEUX

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENTS

17.12 BIO-RAD LABORATORIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 BIOTYPE GMBH

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 CAREDX INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENTS

17.15 CLONIT SRL

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 DIAGNOSTICA LONGWOOD SL

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 DIASORIN S.P.A.

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ELITECHGROUP

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 EUROFINS VIRACOR

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

17.2 HORIBA LTD

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

17.21 ILLUMINA, INC.

17.21.1 COMPANY SNAPSHOT

17.21.2 REVENUE ANALYSIS

17.21.3 PRODUCT PORTFOLIO

17.21.4 RECENT DEVELOPMENTS

17.22 IMMUCOR

17.22.1 COMPANY SNAPSHOT

17.22.2 PRODUCT PORTFOLIO

17.22.3 RECENT DEVELOPMENTS

17.23 LABORATORY CORPORATION OF AMERICA HOLDINGS.

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 LUMINEX CORPORATION. (A SUBSIDIARY OF DIASORIN)

17.24.1 COMPANY SNAPSHOT

17.24.2 REVENUE ANALYSIS

17.24.3 PRODUCT PORTFOLIO

17.24.4 RECENT DEVELOPMENT

17.25 NANOSTRING

17.25.1 COMPANY SNAPSHOT

17.25.2 REVENUE ANALYSIS

17.25.3 PRODUCT PORTFOLIO

17.25.4 RECENT DEVELOPMENT

17.26 PATHONOSTICS

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 PRESERVATION SOLUTIONS, INC.

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 QIAGEN

17.28.1 COMPANY SNAPSHOT

17.28.2 REVENUE ANALYSIS

17.28.3 PRODUCT PORTFOLIO

17.28.4 RECENT DEVELOPMENTS

17.29 RANDOX LABORATORIES LTD.

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 STRYKER

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENT

17.31 TRANSMEDICS

17.31.1 COMPANY SNAPSHOT

17.31.2 REVENUE ANALYSIS

17.31.3 PRODUCT PORTFOLIO

17.31.4 RECENT DEVELOPMENTS

17.32 TRANSONIC.

17.32.1 COMPANY SNAPSHOT

17.32.2 PRODUCT PORTFOLIO

17.32.3 RECENT DEVELOPMENT

17.33 ZIMMER BIOMET

17.33.1 COMPANY SNAPSHOT

17.33.2 REVENUE ANALYSIS

17.33.3 PRODUCT PORTFOLIO

17.33.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE’S IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE’S IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SEQUENCING-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SEQUENCING-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA BONE MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA BONE MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA DIAGNOSTIC APPLICATIONS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA DIAGNOSTIC APPLICATIONS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA RESEARCH APPLICATIONS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA RESEARCH APPLICATIONS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA TRANSPLANT DIAGNOSTIC INSTRUMENTS IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA HOSPITALS AND TRANSPLANT CENTERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA COMMERCIAL SERVICE PROVIDERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA RESEARCH LABORATORIES AND ACADEMIC INSTITUTES IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA DIRECT TENDER IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA RETAIL SALES IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN TRANSPLANT DIAGNOSTICS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 74 U.S. AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 75 U.S. AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 77 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 78 U.S. TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 79 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 80 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 82 U.S. TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 83 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 U.S. TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 86 U.S. TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 87 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 U.S. PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 89 U.S. SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 91 U.S. SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 92 U.S. STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 93 U.S. SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 94 U.S. BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 95 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 U.S. DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 U.S. RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 U.S. TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 U.S. TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 U.S. TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 105 U.S. TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 106 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 CANADA AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 109 CANADA AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 110 CANADA AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 CANADA TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 112 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 113 CANADA TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 114 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 115 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 117 CANADA TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 118 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 CANADA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 121 CANADA TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 122 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 CANADA PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 124 CANADA SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 126 CANADA SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 127 CANADA STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 128 CANADA SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 129 CANADA BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 130 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 CANADA DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 135 CANADA RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 CANADA TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 CANADA TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 CANADA TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 140 CANADA TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 141 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 MEXICO AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 VOLUME (UNITS)

TABLE 144 MEXICO AUTOMATED PIPETTORS & DISPENSERS, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 145 MEXICO AUTOMATED SYSTEMS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 MEXICO TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 147 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 148 MEXICO TRANSPLANT DIAGNOSTIC INSTUMENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 149 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 150 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 151 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 152 MEXICO TRANSPLANT DIAGNOSTIC KITS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 153 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 155 MEXICO TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 VOLUMES (UNITS)

TABLE 156 MEXICO TRANSPLANT DIAGNOSTIC REAGENTS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 ASP (USD)

TABLE 157 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 MEXICO PCR-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 159 MEXICO SEQUENCE-BASED MOLECULAR ASSAYS IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 160 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 161 MEXICO SOLID ORGAN TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 162 MEXICO STEM CELL TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 163 MEXICO SOFT TISSUE TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 164 MEXICO BONE-MARROW TRANSPLANTATION IN TRANSPLANT DIAGNOSTICS MARKET, BY TRANSPLANT TYPE, 2020-2029 (USD MILLION)

TABLE 165 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 MEXICO DIAGNOSTICS APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 167 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 169 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 MEXICO RESEARCH APPLICATIONS TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 MEXICO TRANSPLANT DIAGNOSTICS INSTRUMENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 MEXICO TRANSPLANT DIAGNOSTIC SOFTWARE IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 MEXICO TRANSPLANT DIAGNOSTIC REAGENT IN TRANSPLANT DIAGNOSTICS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 MEXICO TRANSPLANT DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 INCREASING USE OF TRANSPLANT DIAGNOSTICS IS EXPECTED TO DRIVE THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET IN THE FORECAST PERIOD

FIGURE 12 TRANSPLANT DIAGNOSTIC INSTRUMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET

FIGURE 14 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, 2021

FIGURE 19 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, 2021

FIGURE 23 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, 2022-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY TRANSPLANT TYPE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, 2021

FIGURE 31 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET : BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: SNAPSHOT (2021)

FIGURE 39 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2021)

FIGURE 40 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 NORTH AMERICA TRANSPLANT DIAGNOSTICS MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.