Marché des réactifs et équipements de transfection en Amérique du Nord, par produits (réactifs et kits et instruments), stade (recherche, phases précliniques, cliniques et commerciales), type (réactif et équipement de transfection transitoire, réactif et équipement de transfection stable), méthodes (méthodes non virales et méthodes virales), types de molécules (ADN plasmidique, petit ARN interférent (siRNA), protéines, oligonucléotides d'ADN, complexes ribonucléoprotéiques (RNP) et autres), organisme (cellules de mammifères, plantes, champignons, virus et bactéries), application (application in vitro, application in vivo, bioproduction et autres), utilisateur final (biopharma, CRO, (CMO/CDMO), universités, hôpitaux, laboratoires cliniques et autres), canal de distribution (appel d'offres direct, ventes au détail et autres), tendances de l'industrie et prévisions jusqu'en 2030

Analyse et perspectives du marché des réactifs et équipements de transfection en Amérique du Nord

La transfection implique l'introduction d'acide nucléique dans les cellules eucaryotes par des méthodes virales et non virales. La méthode de transfection peut surmonter le défi du transfert de la membrane chargée négativement. Des produits chimiques tels que le phosphate de calcium et le diéthylaminoéthyl (DEAE)-dextran ou un réactif à base de lipides cationiques réagissent avec la couche externe de l'ADN. Il neutralise la charge négative globale, confère la quantité positive à la molécule et permet ainsi la délivrance de l'ADN. Des méthodes physiques telles que l'électroporation créent des pores minuscules dans la membrane cellulaire en appliquant une tension électrique, permettant l'entrée de l'ADN directement dans le cytoplasme. Le DEAE-dextran est utilisé pour la transfection transitoire ; cependant, la lipofection peut réaliser une transfection stable et peut donc être utilisée pour l'expression protéique à long terme. La transfection médiée par le phosphate de calcium peut également être utilisée pour une transfection stable. La méthode de transfection virale atteint une efficacité élevée et est utilisée pour plusieurs phases du développement de produits pharmaceutiques.

La méthode de transfection est utilisée dans plusieurs applications agricoles pour la protection des cultures et l'amélioration du rendement, pour la production de produits de biologie synthétique pour améliorer les saveurs et les parfums, et pour améliorer les protéines unicellulaires, entre autres. La demande de transfection a augmenté dans les pays développés et en développement, et la raison en est l'apparition croissante de maladies chroniques. Le marché de la transfection est en croissance en raison de la demande croissante de gènes chimériques et de l'utilisation de produits biopharmaceutiques dans la production de protéines. Le marché va croître au cours de la période de prévision en raison de l'exploration des marchés émergents, des initiatives stratégiques des acteurs du marché et du soutien croissant des gouvernements.

Le coût élevé des instruments, l’efficacité sélective des réactifs de transfection et les dommages cellulaires induits par les méthodes de transfection devraient freiner la croissance du marché des réactifs et équipements de transfection en Amérique du Nord.

Le marché est en croissance grâce à plusieurs initiatives stratégiques adoptées par les acteurs du marché impliquant l’acquisition, la collaboration et le partenariat.

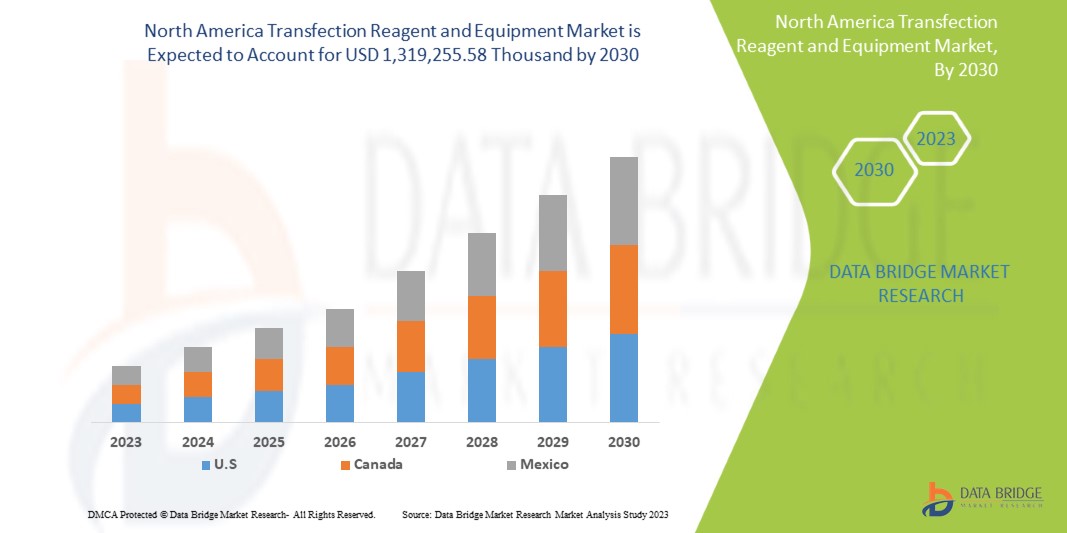

Data Bridge Market Research analyse que le marché nord-américain des réactifs et équipements de transfection devrait atteindre la valeur de 1 319 255,58 milliers USD d'ici 2030, à un TCAC de 9,9 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable pour 2020-2016) |

|

Unités quantitatives |

Chiffre d'affaires en milliers, volumes en unités, prix en USD |

|

Segments couverts |

Par produits (réactifs, kits et instruments), stade (recherche, phases précliniques, cliniques et commerciales), type (réactif et équipement de transfection transitoire, réactif et équipement de transfection stable), méthodes (méthodes non virales et méthodes virales), types de molécules (ADN plasmidique, petit ARN interférent (siRNA), protéines, oligonucléotides d'ADN, complexes ribonucléoprotéiques (RNP) et autres), organisme (cellules de mammifères, plantes, champignons, virus et bactéries), application (application in vitro, application in vivo, bioproduction et autres), utilisateur final (biopharmaceutique, CRO, (CMO/CDMO), universités, hôpitaux, laboratoires cliniques et autres), canal de distribution (appel d'offres direct, vente au détail et autres). |

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Certains des principaux acteurs opérant sur ce marché sont Mirus Bio LLC., Promega Corporation, Polyplus Transfection, Bio-Rad Laboratories, Inc., Merck KGaA, Lonza, MaxCyte, Inc., Altogen Biosystems, SBS Genetech, FUJIFILM Irvine Scientific (une filiale de FUJIFILM Holdings Corporation), Avanti Polar Lipids (une filiale de Croda International Plc), PerkinElmer chemagen Technologie GmbH (une filiale de PerkinElmer Inc.), Cytiva, Geno Technology Inc., USA, R&D Systems, Inc., Takara Bio Inc., Thermofisher Scientific Inc., Roche Molecular Systems, Inc. (une filiale de F. Hoffmann-La Roche Ltd), QIAGEN, OriGene Technologies, Inc., Applied Biological Materials Inc. (abm), Beckman Coulter, Inc. (une filiale de Danaher), Amyris, Codexis, Autolus, SignaGen Laboratories, Impossible Foods Inc., Genlantis Inc., Ginkgo Bioworks, Verve Therapeutics, Inc., Conagen, Inc., Poseida Therapeutics, Inc. et Twist Bioscience, entre autres. |

Définition du marché

La méthode de transfection est utilisée pour introduire des produits d'ARN, d'ADN ou de protéines dans les cellules afin de modifier le phénotype et le génotype de l'organisme. La méthode de transfection implique le transfert d'un nouveau gène ou le transfert d'une construction génique telle que les répétitions palindromiques courtes groupées régulièrement espacées (CRISPR) à des fins d'édition du génome. La transfection a de nombreuses applications dans le domaine de l'immunothérapie, de la thérapie génique et de la thérapie cellulaire, entre autres. La transfection implique à la fois une transfection non virale et à médiation virale. Les méthodes chimiques et physiques peuvent réaliser une transfection non virale. La méthode chimique la plus courante utilisée pour la transfection est la transfection au phosphate de calcium et la transfection aux liposomes, entre autres. La transfection virale donne des rendements de transfection élevés, et divers types de méthodes physiques utilisées pour la transfection comprennent la microinjection, l'administration de particules biolistiques et l'électroporation, parmi lesquelles l'électroporation offre une efficacité de transfection élevée. La transfection est de deux types, soit elle peut être transitoire, soit stable. Pour les études d'expression génétique à court terme telles que les études d'inactivation génétique, la méthode de transfection transitoire de production à petite échelle est préférée ; cependant, les études de recherche à long terme et les méthodes de transfection stables de production de protéines à grande échelle sont largement adoptées.

Dynamique du marché des réactifs et équipements de transfection en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- AUGMENTATION DE LA PRÉVALENCE DES MALADIES CHRONIQUES

La prévalence des maladies chroniques augmente dans le monde entier, ce qui entraîne une demande de traitement efficace et précis. La transfection est utilisée pour administrer des gènes modifiés ciblés afin de traiter plusieurs maladies génétiques. La méthode de transfection est également utilisée pour l'administration du gène CRISPR, qui peut améliorer l'immunité adaptative et protéger un individu contre différentes maladies.

L'augmentation des cas de maladies chroniques telles que la COVID-19 et d'autres maladies infectieuses a conduit à la découverte de produits de thérapie génique efficaces qui peuvent remplacer le gène défectueux par le gène correct. La méthode de transfection est largement utilisée pour la thérapie génique, entre autres. La demande de traitements efficaces et précis augmentant dans le monde entier, la demande de thérapie génique et de méthode de transfection augmente également. De plus, plusieurs recherches en cours prouvant que la thérapie génique a le potentiel de traiter les maladies chroniques augmentent également sa demande parmi les médecins et les patients. Cela signifie donc que l'augmentation de la prévalence des maladies chroniques agit comme un moteur de la croissance du marché des réactifs et équipements de transfection en Amérique du Nord.

- DÉVELOPPEMENT DE PRODUITS DE BIOLOGIE SYNTHÉTIQUE

La biologie synthétique est une nouvelle ère de la biologie qui intègre le principe d'ingénierie à la biologie. La biologie synthétique implique la synthèse chimique de l'ADN en combinant les connaissances de la génomique pour réassembler les génomes d'ADN. La biologie synthétique qui séquence les nouveaux gènes implique le génie génétique, qui intègre notamment la méthode de transfection. La demande de produits de biologie synthétique augmentant dans le monde entier, l'utilisation de produits de transfection augmente également.

La demande de produits de biologie synthétique augmente en raison de la demande croissante de produits efficaces et innovants. La fabrication de produits synthétiques augmente la demande de produits de transfection, car le transfert de gènes peut être accompagné par la méthode de transfection, entre autres. Ainsi, cela signifie que le développement de produits synthétiques stimule la croissance du marché des réactifs et équipements de transfection en Amérique du Nord.

Retenue

- DOMMAGES CELLULAIRES INDUITS PAR LA PROCÉDURE DE TRANSFECTION

Certaines méthodes de transfection sont susceptibles d'endommager les cellules, réduisant ainsi la reproductibilité de la méthode globale. Parmi les différents types de procédures de transfection, l'électroporation est susceptible d'endommager les cellules au maximum en raison de l'augmentation de la tension. Ces dommages cellulaires réduisent le taux d'efficacité et ont un impact sur le projet en cours.

L'un des effets secondaires les plus courants de la procédure de transfection est l'endommagement des cellules, qui ralentit les événements métaboliques des cellules et conduit à la mort cellulaire. Ces cellules endommagées peuvent augmenter la toxicité du milieu et donc produire des résultats inappropriés. Ainsi, cela suggère que les dommages cellulaires induits par la procédure de transfection agissent comme un frein à la croissance du marché des réactifs et équipements de transfection en Amérique du Nord.

Opportunité

-

EXPLORATION DES MARCHÉS ÉMERGENTS

Les produits de transfection se sont révélés être des outils prometteurs pour l'industrie du génie génétique et de la protéomique. Le principal marché pour les produits de transfection se trouve en Europe et en Amérique du Nord. En observant les résultats positifs de ces produits, de nombreux acteurs du marché s'implantent dans des économies en croissance, notamment en Chine et en Inde. Le marché émergent permet à ces acteurs de lutter contre les pertes qui découlent du marché bien établi.

Les marchés émergents permettent aux acteurs du marché de surmonter le ralentissement économique propre à certains marchés établis. L'investissement et l'exploration des marchés émergents permettent aux acteurs du marché de s'engager dans le développement et la fabrication de produits de transfection pour atteindre une croissance lucrative. Ainsi, cela signifie que l'exploration des marchés émergents est une opportunité de développer le marché des réactifs et équipements de transfection en Amérique du Nord.

Défi

- PROCÉDURE D'APPROBATION LONGUE

La longue procédure d'approbation des réactifs et instruments de transfection est un frein à la croissance du marché de la transfection. Les produits de transfection sont soumis à des réglementations strictes et doivent être surveillés à chaque fois. Les produits de transfection sont largement utilisés pour l'insertion de molécules génétiques souhaitées dans une lignée cellulaire particulière afin d'obtenir des protéines et d'autres composés biologiques. Ce processus est donc étudié et approuvé par des procédures réglementaires longues et strictes. Le long processus nécessaire pour obtenir un résultat positif de chaque essai clinique mené a entraîné une consommation de temps plus importante et des investissements importants de la part des acteurs du marché.

Les réactifs de transfection sont principalement soumis aux directives 21CFR parties 210 et 211 de la FDA américaine, selon lesquelles les fabricants doivent s'assurer que le réactif fabriqué répond aux caractéristiques de sécurité, d'emballage et de traitement proposées par les organismes de réglementation. Le propriétaire ou le fabricant doit soumettre des licences en vertu de l'article 351 de la loi PHS (Public Health Services), ce qui est une procédure assez fastidieuse. Ainsi, cela signifie que les longues procédures d'approbation mettent à mal la croissance du marché des réactifs et des équipements de transfection en Amérique du Nord.

Développements récents

- En août 2021, Mirus Bio a étendu la plateforme TransIT VirusGen pour la production de vecteurs viraux conformes aux bonnes pratiques de fabrication (BPF) afin de soutenir le développement de thérapies cellulaires et géniques, les opérations de traitement et la production commerciale. L'extension, appelée TransIT VirusGen GMP Transfection Reagent, est conçue pour améliorer le conditionnement et la distribution de l'ADN vecteur aux types de cellules HEK 293 en suspension et adhérentes afin d'améliorer la production de virus adéno-associés recombinants et de vecteurs lentiviraux.

- En avril 2021, BOC Sciences a annoncé le lancement de deux kits de transfection d'ARN in vivo, à savoir des kits de transfection in vivo d'ARNsi et des kits de transfection in vivo d'ARNm, adaptés respectivement à la transfection in vivo d'ARNsi et d'ARNm.

Portée du marché des réactifs et équipements de transfection en Amérique du Nord

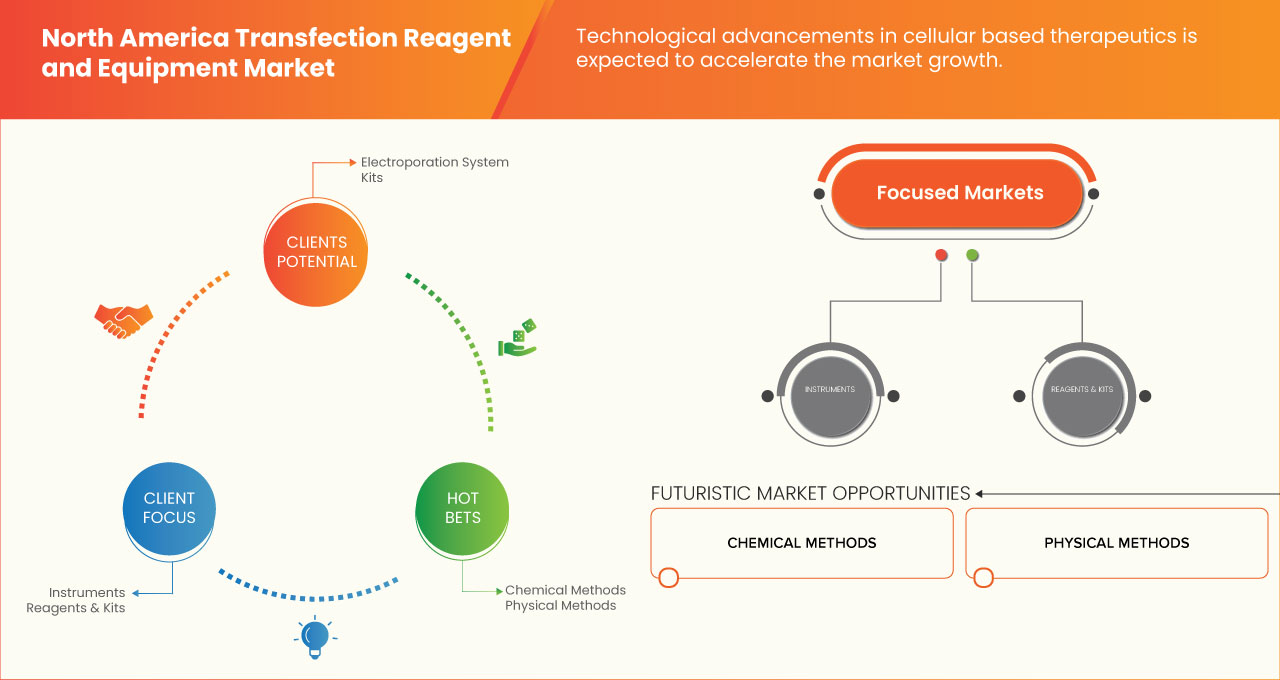

Le marché nord-américain des réactifs et équipements de transfection est segmenté en neuf segments notables tels que les produits, le stade, les méthodes, le type, les types de molécules, l'application, l'utilisateur final, l'organisme et le canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

PRODUITS

- INSTRUMENTS

- RÉACTIFS ET KITS

Sur la base des produits, le marché nord-américain des réactifs et équipements de transfection est segmenté en instruments et réactifs et kits.

SCÈNE

- RECHERCHE

- PRÉCLINIQUE

- PHASES CLINIQUES

- COMMERCIAL

Sur la base du stade, le marché nord-américain des réactifs et équipements de transfection est segmenté en phases de recherche, précliniques, cliniques et commerciales.

TAPER

- RÉACTIF ET ÉQUIPEMENT DE TRANSFECTION TRANSITOIRE

- RÉACTIF ET ÉQUIPEMENT DE TRANSFECTION STABLE

Sur la base du type, le marché nord-américain des réactifs et équipements de transfection est segmenté en réactifs et équipements de transfection transitoires et en réactifs et équipements de transfection stables.

METHODES

- METHODES NON VIRALES

- METHODES VIRALES

Sur la base des méthodes, le marché nord-américain des réactifs et équipements de transfection est segmenté en méthodes non virales et méthodes virales.

TYPES DE MOLÉCULES

- ADN PLASMIDIQUE

- OLIGONUCLEOTIDES D'ADN

- PETIT ARN INTERFÉRENT (SIRNA)

- PROTÉINES

- COMPLEXES RIBONUCLEOPROTEIQUES (RNPS)

- AUTRES

Sur la base des types de molécules, le marché nord-américain des réactifs et équipements de transfection est segmenté en ADN plasmidique, oligonucléotides d'ADN, petit ARN interférent (siRNA), protéines, complexes ribonucléoprotéiques (RNP) et autres.

ORGANISME

- BACTÉRIES

- CELLULES DE MAMMIFÈRES

- CHAMPIGNONS

- PLANTES

- VIRUS

Sur la base de l'organisme, le marché nord-américain des réactifs et équipements de transfection est segmenté en bactéries, cellules de mammifères, champignons, plantes et virus.

APPLICATION

- PAR TYPE

- APPLICATION IN VITRO

- APPLICATION IN VIVO

- BIOPRODUCTION

- AUTRES

- PAR INDUSTRIE

- AGRICULTURE

- BIOLOGIE SYNTHÉTIQUE

- AUTRES

Sur la base de l'application, le marché nord-américain des réactifs et équipements de transfection est segmenté par type en application in vitro, application in vivo, bioproduction, autres et par industrie en agriculture, biologie synthétique, autres.

UTILISATEUR FINAL

- BIOPHARMA

- CROS

- CMOS/CDMOS

- ACADÉMIE

- HÔPITAUX

- LABORATOIRES CLINIQUES

- AUTRES

Sur la base de l'utilisateur final, le marché nord-américain des réactifs et équipements de transfection est segmenté en biopharmaceutiques, CRO, CMO/CDMO, universités, hôpitaux, laboratoires cliniques et autres.

CANAL DE DISTRIBUTION

- APPEL D'OFFRES DIRECT

- VENTES AU DÉTAIL

- AUTRES

Sur la base du canal de distribution, le marché nord-américain des réactifs et équipements de transfection est segmenté en appels d'offres directs, ventes au détail et autres.

Analyse/perspectives régionales du marché des réactifs et équipements de transfection en Amérique du Nord

Le marché nord-américain des réactifs et équipements de transfection est classé en de nombreux segments notables tels que la géographie, les produits, les étapes, les méthodes, le type, les types de molécules, l'application, l'utilisateur final, l'organisme et le canal de distribution.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

En 2023, l'Amérique du Nord domine en raison de la présence d'acteurs clés du marché sur le plus grand marché de consommation avec un PIB élevé. Les États-Unis devraient connaître une croissance en raison de l'augmentation de la prévalence des maladies chroniques et rares, entraînant une augmentation de l'utilisation de réactifs et d'équipements de transfection.

L'Amérique du Nord domine le marché en raison de l'augmentation des investissements dans les soins de santé qui devraient stimuler la croissance du marché. Les États-Unis dominent la région Amérique du Nord en raison de la forte présence d'acteurs clés.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des réactifs et équipements de transfection en Amérique du Nord

Le paysage concurrentiel du marché des réactifs et équipements de transfection en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, la largeur et l'ampleur du produit, la domination des applications, la courbe de survie du type de produit. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché des réactifs et équipements de transfection en Amérique du Nord.

Certains des principaux acteurs opérant sur ce marché sont Mirus Bio LLC., Promega Corporation, Polyplus Transfection, Bio-Rad Laboratories, Inc., Merck KGaA, Lonza, MaxCyte, Inc., Altogen Biosystems, SBS Genetech, FUJIFILM Irvine Scientific (une filiale de FUJIFILM Holdings Corporation), Avanti Polar Lipids (une filiale de Croda International Plc), PerkinElmer chemagen Technologie GmbH (une filiale de PerkinElmer Inc.), Cytiva, Geno Technology Inc., USA, R&D Systems, Inc., Takara Bio Inc., Thermofisher Scientific Inc., Roche Molecular Systems, Inc. (une filiale de F. Hoffmann-La Roche Ltd), QIAGEN, OriGene Technologies, Inc., Applied Biological Materials Inc. (abm), Beckman Coulter, Inc. (une filiale de Danaher), Amyris, Codexis, Autolus, SignaGen Laboratories, Impossible Foods Inc., Genlantis Inc., Ginkgo Bioworks, Verve Therapeutics, Inc., Conagen, Inc., Poseida Therapeutics, Inc. et Twist Bioscience, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TRANSIENT TRANSFECTION OF TRANSFECTION LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 INDUSTRY INSIGHTS:

6 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET, REGULATIONS

6.1 EUROPEAN UNION REGULATORY SCENARIO

6.2 U.S. REGULATORY SCENARIO

6.3 JAPAN REGULATORY SCENARIO

6.4 CHINA REGULATORY SCENARIO

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN THE PREVALENCE OF CHRONIC DISEASES

7.1.2 DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS

7.1.3 GROWING DEMAND FOR CHIMERIC GENES

7.1.4 LARGE-SCALE TRANSFECTIONS USED IN CLINICAL RESEARCH

7.1.5 UTILIZATION OF BIOPHARMACEUTICALS IN THE PRODUCTION OF PROTEINS

7.2 RESTRAINTS

7.2.1 HIGH COST OF TRANSFECTION PRODUCTS

7.2.2 SELECTIVE EFFECTIVENESS OF TRANSFECTION REAGENTS

7.2.3 CELL DAMAGE INDUCED BY TRANSFECTION PROCEDURE

7.3 OPPORTUNITIES

7.3.1 EXPLORATION OF EMERGING MARKET

7.3.2 STRATEGIC INITIATIVES BY MARKET PLAYERS

7.3.3 SURGING LEVEL OF INVESTMENT

7.4 CHALLENGES

7.4.1 LONG APPROVAL PROCEDURE

7.4.2 LACK OF SAFETY LEVEL LAB FOR VIRUS-ASSOCIATED TRANSFECTION

7.4.3 LACK OF TRAINED PROFESSIONALS

8 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY PRODUCTS

8.1 OVERVIEW

8.2 REAGENTS & KITS

8.3 INSTRUMENTS

9 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY STAGE

9.1 OVERVIEW

9.2 RESEARCH

9.3 PRECLINICAL

9.4 CLINICAL PHASES

9.5 COMMERCIAL

10 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPE

10.1 OVERVIEW

10.2 TRANSIENT TRANSFECTION REAGENTS AND EQUIPMENT

10.3 STABLE TRANSECTION REAGENTS AND EQUIPMENT

11 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY METHODS

11.1 OVERVIEW

11.2 NON-VIRAL METHODS

11.3 VIRAL METHODS

12 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPES OF MOLECULE

12.1 OVERVIEW

12.2 PLASMID DNA

12.3 SMALL INTERFERING RNA (SIRNA)

12.4 PROTEINS

12.5 DNA OLIGONUCLEOTIDES

12.6 RIBONUCLEOPROTEIN COMPLEXES (RNPS)

12.7 OTHERS

13 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY ORGANISM

13.1 OVERVIEW

13.2 MAMMALIAN CELLS

13.3 PLANTS

13.4 FUNGI

13.5 VIRUS

13.6 BACTERIA

14 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY APPLICATION

14.1 OVERVIEW

14.2 IN VITRO APPLICATION

14.2.1 IN VIVO APPLICATION

14.2.2 BIOPRODUCTION

14.2.3 OTHERS

14.2.4 SYNTHETIC BIOLOGY

14.2.5 AGRICULTURE

14.2.6 OTHERS

15 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY END USER

15.1 OVERVIEW

15.2 BIOPHARMA

15.3 CROS

15.4 CMOS/CDMOS

15.5 ACADEMIA

15.6 HOSPITALS

15.7 CLINICAL LABS

15.8 OTHERS

16 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDER

16.3 RETAIL SALES

16.4 OTHERS

17 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET, COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 THERMO FISHER SCIENTIFIC INC.

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENT

20.2 ROCHE MOLECULAR SYSTEMS, INC. (A SUBSIDIARY OF F. HOFFMANN-LA ROCHE LTD)

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROMEGA CORPORATION

20.3.1 COMPANY SNAPSHOT

20.3.2 COMPANY SHARE ANALYSIS

20.3.3 PRODUCT PORTFOLIO

20.3.4 RECENT DEVELOPMENT

20.4 TAKARA BIO INC.

20.4.1 COMPANY SNAPSHOT

20.4.2 REVENUE ANALYSIS

20.4.3 COMPANY SHARE ANALYSIS

20.4.4 PRODUCT PORTFOLIO

20.4.5 RECENT DEVELOPMENT

20.5 BIO-RAD LABORATORIES, INC.

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANANLYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 ALTOGEN BIOSYSTEMS

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 APPLIED BIOLOGICAL MATERIALS INC. (ABM)

20.7.1 COMPANY SNAPSHOT

20.7.2 PRODUCT PORTFOLIO

20.7.3 RECENT DEVELOPMENT

20.8 AVANTI POLAR LIPIDS (A SUBSIDIARY OF CRODA INTERNATIONAL PLC)

20.8.1 COMPANY SNAPSHOT

20.8.2 REVENUE ANALYSIS

20.8.3 PRODUCT PORTFOLIO

20.8.4 RECENT DEVELOPMENT

20.9 BECKMAN COULTER, INC. (A SUBSIDIARY OF DANAHER)

20.9.1 COMPANY SNAPSHOT

20.9.2 PRODUCT PORTFOLIO

20.9.3 RECENT DEVELOPMENT

20.1 CYTIVA

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 FUJIFILM IRVINE SCIENTIFIC (A SUBSIDIARY OF FUJIFILM HOLDINGS CORPORATION)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANANLYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENT

20.12 GENLANTIS INC.

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENT

20.13 GENO TECHNOLOGY INC., USA

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 GINKGO BIOWORKS

20.14.1 COMPANY SNAPSHOT

20.14.2 PRODUCT PORTFOLIO

20.14.3 RECENT DEVELOPMENTS

20.15 LONZA

20.15.1 COMPANY SNAPSHOT

20.15.2 REVENUE ANANLYSIS

20.15.3 PRODUCT PORTFOLIO

20.15.4 RECENT DEVELOPMENT

20.16 MAXCYTE, INC.

20.16.1 COMPANY SNAPSHOT

20.16.2 REVENUE ANALYSIS

20.16.3 PRODUCT PORTFOLIO

20.16.4 RECENT DEVELOPMENT

20.17 MERCK KGAA

20.17.1 COMPANY SNAPSHOT

20.17.2 REVENUE ANALYSIS

20.17.3 PRODUCT PORTFOLIO

20.17.4 RECENT DEVELOPMENT

20.18 MIRUS BIO LLC.

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 RECENT DEVELOPMENT

20.19 ORIGENE TECHNOLOGIES, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENT

20.2 PERKINELMER CHEMAGEN TECHNOLOGIE GMBH (A SUBSIDIARY OF PERKINELMER INC.)

20.20.1 COMPANY SNAPSHOT

20.20.2 REVENUE ANALYSIS

20.20.3 PRODUCT PORTFOLIO

20.20.4 RECENT DEVELOPMENT

20.21 POLYPLUS TRANSFECTION

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENT

20.22 R&D SYSTEMS, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENT

20.23 SBS GENETECH

20.23.1 COMPANY SNAPSHOT

20.23.2 PRODUCT PORTFOLIO

20.23.3 RECENT DEVELOPMENT

20.24 SIGNAGEN LABORATORIES

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY PRODUCTS, 2021-2030 (USD THOUSAND)

TABLE 2 NORTH AMERICA REAGENT AND KITS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA INSTRUMENTS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY STAGE, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA RESEARCH IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA PRECLINICAL IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA CLINICAL PHASES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA COMMERCIAL IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA TRANSIENT TRANSFECTION REAGENTS AND EQUIPMENT IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA STABLE TRANSFECTION REAGENTS AND EQUIPMENT IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET, BY METHODS, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA NON-VIRAL METHODS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA VIRAL METHODS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY TYPES OF MOLECULE, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA PLASMID DNA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA SMALL INTERFERING RNA (SIRNA) IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA PROTEINS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA DNA OLIGONUCLEOTIDES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA RIBONUCLEOPROTEIN COMPLEXES (RNPS) IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY ORGANISM, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA MAMMALIAN CELLS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA PLANTS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA FUNGI IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA VIRUS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA BACTERIA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET , BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA IN VITRO APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA IN VIVO APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA BIOPRODUCTION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA APPLICATION IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY INDUSTRY, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA BIOPHARMA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA CROS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA CMOS/CDMOS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA ACADEMIA IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA HOSPITALS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA CLINICAL LABS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA DIRECT TENDER IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA RETAIL SALES IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA OTHERS IN TRANSFECTION REAGENT AND EQUIPMENT MARKET, BY REGION, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA TRANSFECTION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: SEGMENTATION

FIGURE 12 INCREASING OCCURENCE OF CHRONIC DISEASES AND DEVELOPMENT OF SYNTHETIC BIOLOGY PRODUCTS IS DRIVING THE NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2030

FIGURE 13 THE TRANSIENT TRANSFECTION SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET IN 2022 & 2030

FIGURE 14 APPROVAL PROCESS FOR GENE THERAPY IN CHINA

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET

FIGURE 16 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, 2023

FIGURE 17 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, 2023-2030 (USD THOUSAND)

FIGURE 18 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, CAGR (2023-2030)

FIGURE 19 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 20 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, 2023

FIGURE 21 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, 2023-2030 (USD THOUSAND)

FIGURE 22 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, CAGR (2023-2030)

FIGURE 23 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY STAGE, LIFELINE CURVE

FIGURE 24 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, 2023

FIGURE 25 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, 2023-2030 (USD THOUSAND)

FIGURE 26 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 27 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPE, LIFELINE CURVE

FIGURE 28 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, 2022

FIGURE 29 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, 2023-2030 (USD THOUSAND)

FIGURE 30 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, CAGR (2023-2030)

FIGURE 31 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: BY METHODS, LIFELINE CURVE

FIGURE 32 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, 2022

FIGURE 33 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, 2023-2030 (USD THOUSAND)

FIGURE 34 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, CAGR (2023-2030)

FIGURE 35 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY TYPES OF MOLECULE, LIFELINE CURVE

FIGURE 36 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, 2022

FIGURE 37 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, 2023-2030 (USD THOUSAND)

FIGURE 38 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, CAGR (2023-2030)

FIGURE 39 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY ORGANISM, LIFELINE CURVE

FIGURE 40 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, 2022

FIGURE 41 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 42 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, CAGR (2023-2030)

FIGURE 43 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET BY APPLICATION, LIFELINE CURVE

FIGURE 44 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY END USER, 2022

FIGURE 45 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 46 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, CAGR (2023-2030)

FIGURE 47 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET : BY END USER, LIFELINE CURVE

FIGURE 48 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 49 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 50 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 51 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 52 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: SNAPSHOT (2022)

FIGURE 53 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022)

FIGURE 54 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2023 & 2030)

FIGURE 55 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY COUNTRY (2022 & 2030)

FIGURE 56 NORTH AMERICA TRANSFECTION REAGENT AND EQUIPMENT MARKET: BY PRODUCTS (2023-2030)

FIGURE 57 NORTH AMERICA TRANSFECTION REAGENTS AND EQUIPMENT MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.