North America Track And Trace Solutions Market

Taille du marché en milliards USD

TCAC :

%

USD

2.31 Billion

USD

9.84 Billion

2024

2032

USD

2.31 Billion

USD

9.84 Billion

2024

2032

| 2025 –2032 | |

| USD 2.31 Billion | |

| USD 9.84 Billion | |

|

|

|

Marché des solutions de suivi et de traçabilité en Amérique du Nord, par produit (composants logiciels, composants matériels et plate-forme autonome), solution (sérialisation au niveau de la ligne et du site, traçabilité au niveau de l'entreprise dans le cloud, solution de distribution et d'entrepôt, réseau de partage de données de la chaîne d'approvisionnement et autres), application (sérialisation, impression, inspection de l'étiquetage et de l'emballage, agrégation, suivi, traçabilité et création de rapports), technologie (codes-barres 2D, identification par radiofréquence (RFID) et codes-barres linéaires/1D), utilisateur final (sociétés pharmaceutiques et biopharmaceutiques, biens de consommation emballés, produits de luxe, aliments et boissons, sociétés de dispositifs médicaux, organisations de fabrication sous contrat, reconditionneurs, sociétés de cosmétiques et autres), canal de distribution (ventes directes et distributeurs tiers) - Tendances et prévisions de l'industrie jusqu'en 2032

Analyse du marché des solutions de suivi et de traçabilité en Amérique du Nord

Le suivi et la traçabilité des médicaments pour améliorer l’accessibilité des produits dans la chaîne d’approvisionnement des médicaments sur ordonnance ne sont pas un phénomène nouveau. En réalité, le concept de sérialisation fait l’objet de débats depuis plus de 15 ans. En 1999, après une étude menée par le US College of Medicine, le président Bill Clinton a mis la protection des patients (notamment en évitant les erreurs au moment de la délivrance des médicaments) à l’ordre du jour du gouvernement fédéral et a commencé à plaider en faveur d’une réforme après sa présidence. En 2003, la Food and Drug Administration (FDA) des États-Unis a exigé l’utilisation de codes-barres au niveau des unités et, la même année, l’Organisation mondiale de la santé (OMS) a publié une étude soulignant l’ampleur du problème de la contrefaçon de médicaments, affirmant que 10 % des médicaments dans le monde étaient contrefaits. Un changement majeur dans la sérialisation a eu lieu vers 2005 et de nombreux pays ont commencé à fixer des objectifs d’adoption. Cependant, après avoir pris plusieurs mesures pour protéger la chaîne d’approvisionnement, le défi est devenu moins préoccupant après la crise financière de 2008.

L’économie mondiale a évolué et les priorités ont progressivement changé. La Turquie a adopté des normes de sérialisation en 2010 et des règles sont en vigueur sur d’autres marchés tels que la Chine, la Corée du Sud et l’Inde. Avec l’entrée en vigueur de la directive européenne sur les médicaments falsifiés (FMD) en février 2019 et l’adoption par les États-Unis d’une législation dans le cadre de la loi sur la sécurité de la chaîne d’approvisionnement des médicaments (DSCSA) en novembre 2017, plus de 75 % des médicaments nord-américains doivent être protégés par une forme de réglementation de surveillance et de traçabilité d’ici 2019. Le marché des solutions de suivi et de traçabilité revêt une importance capitale dans divers secteurs, allant des produits pharmaceutiques aux dispositifs médicaux, en passant par les aliments et les boissons, entre autres.

La demande croissante de solutions de suivi et de traçabilité dans les établissements de santé est due aux lois strictes formulées pour la sérialisation et l'étiquetage, ce qui conduit à la croissance lucrative des solutions de suivi et de traçabilité sur le marché. Le vaste portefeuille de produits avec d'énormes options pour presque toutes les grandes industries telles que l'alimentation et les boissons, les cosmétiques et les dispositifs médicaux, entre autres, stimule davantage la croissance des solutions de suivi et de traçabilité sur le marché des solutions de suivi et de traçabilité en Amérique du Nord.

Taille du marché des solutions de suivi et de traçabilité en Amérique du Nord

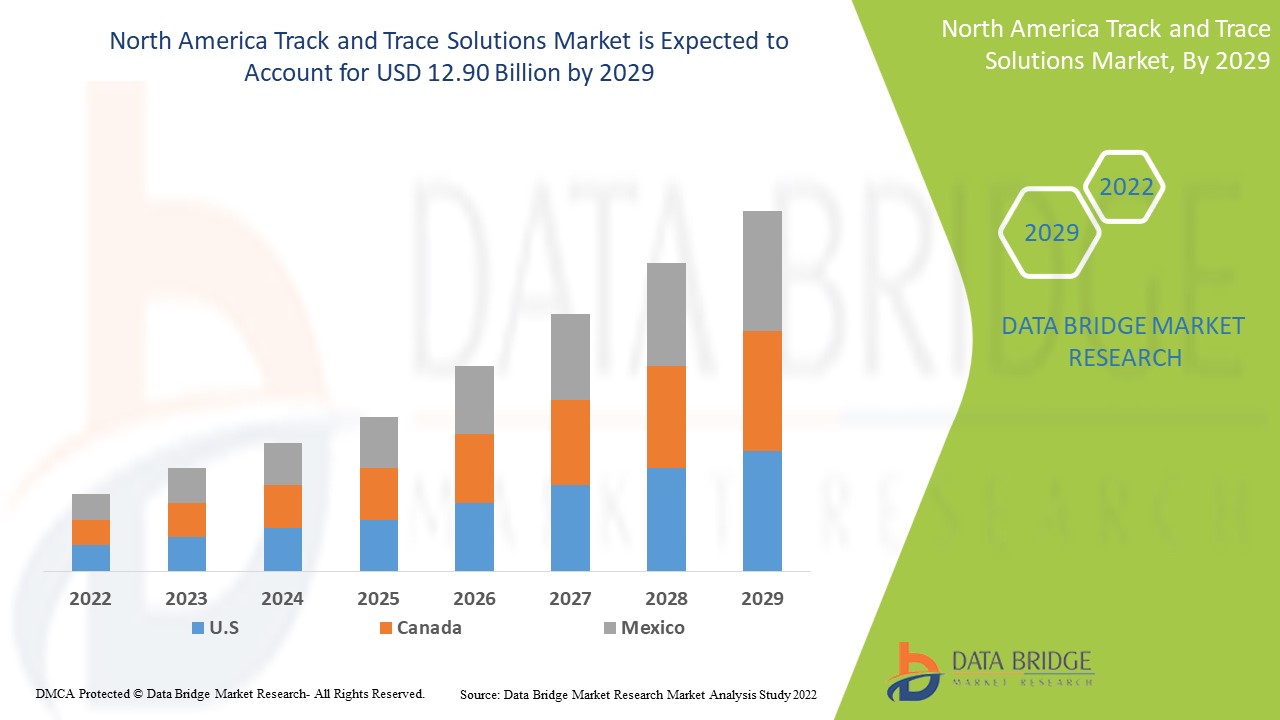

Français La taille du marché des solutions de suivi et de traçabilité en Amérique du Nord était évaluée à 2,31 milliards USD en 2024 et devrait atteindre 9,84 milliards USD d'ici 2032, avec un TCAC de 19,9 % au cours de la période de prévision de 2025 à 2032. En plus des informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire.

Tendances du marché des solutions de suivi et de traçabilité en Amérique du Nord

« Demande accrue de transparence de la chaîne d’approvisionnement »

La demande de solutions de suivi et de traçabilité est particulièrement forte en raison de la nécessité de garantir la sécurité des patients, l’intégrité des produits et la conformité réglementaire. Les technologies de suivi et de traçabilité permettent de surveiller le mouvement des produits pharmaceutiques, des dispositifs médicaux et des vaccins tout au long de la chaîne d’approvisionnement, de minimiser le risque de contrefaçon de médicaments et de garantir que les produits sont stockés et transportés dans des conditions appropriées. De plus, avec le besoin croissant de médecine personnalisée et une plus grande responsabilisation des soins de santé, ces solutions permettent aux prestataires de soins de santé de suivre les produits de la production à l’utilisation finale, en s’assurant qu’ils parviennent aux bons patients de manière sûre et efficace. Les organismes de réglementation, tels que la FDA, exigent des mesures de traçabilité strictes, ce qui fait des systèmes de suivi et de traçabilité un élément essentiel des opérations de soins de santé.

Portée du rapport et segmentation du marché des solutions de suivi et de traçabilité en Amérique du Nord

|

Attributs |

Marché des solutions de suivi et de traçabilité en Amérique du Nord |

|

Segments couverts |

|

|

Région couverte |

États-Unis, Canada et Mexique |

|

Principaux acteurs du marché |

SAP SE (Allemagne), Zebra Technologies Corp. (États-Unis), Videojet Technologies, Inc. (États-Unis), METTLER TOLEDO (États-Unis), Tracelink Inc. (États-Unis), Siemens (Allemagne), Domino Printing Sciences plc (Royaume-Uni), Laetus GmbH (Allemagne), Xyntek Incorporated (États-Unis), IBM Corporation (États-Unis), WIPOTEC-OCS GmbH (Allemagne), 3Keys (Allemagne), ACG (Inde), NJM Packaging Inc. (États-Unis), OPTEL GROUP (Canada), Systech (Inde), Robert Bosch Manufacturing Solutions GmbH (Allemagne), ANTARES VISION SpA (Italie), Uhlmann (Inde), SEA VISION Srl (Italie), Jekson Vision (Inde), Kevision Systems (Inde), Arvato Systems (Allemagne), Grant-Soft Ltd. (Turquie), PharmaSecure Inc. (États-Unis), Axyway (France), SL Controls Ltd. (États-Unis) et entre autres |

|

Opportunités de marché |

Expansion du commerce en Amérique du Nord |

|

Ensembles d'informations sur les données à valeur ajoutée |

Outre les informations sur les scénarios de marché tels que la valeur marchande, le taux de croissance, la segmentation, la couverture géographique et les principaux acteurs, les rapports de marché organisés par Data Bridge Market Research comprennent également une analyse des importations et des exportations, un aperçu de la capacité de production, une analyse de la consommation de production, une analyse des tendances des prix, un scénario de changement climatique, une analyse de la chaîne d'approvisionnement, une analyse de la chaîne de valeur, un aperçu des matières premières/consommables, des critères de sélection des fournisseurs, une analyse PESTLE, une analyse Porter et un cadre réglementaire. |

Définition du marché des solutions de suivi et de traçabilité en Amérique du Nord

La méthode d'identification de la position actuelle et historique (et d'autres informations) d'un objet ou d'une propriété particulière implique le stockage et le transport de plusieurs types d'articles, la surveillance et le suivi ou la traçabilité. Cette définition peut être suivie par l'estimation et l'enregistrement de l'emplacement des voitures et des conteneurs, par exemple, enregistrés dans une base de données en temps réel. Cette méthode pose le défi de rédiger une description cohérente des notes d'avancement correspondantes. Le suivi et la traçabilité consistent à relier les machines à l'informatique et au partage de données à tous les niveaux. Cela comprend des modules de périphériques de suite matérielle puissants ou des systèmes autonomes. L'objectif principal des solutions de suivi et de traçabilité est de déconstruire la chaîne des médicaments contrefaits et des produits contrefaits à travers le monde et d'assurer une circulation fluide et une traçabilité des marchandises à chaque point.

Dynamique du marché des solutions de suivi et de traçabilité en Amérique du Nord

Conducteurs

- Réglementations et normes strictes pour la mise en œuvre de la sérialisation

L’arrivée de la sérialisation obligatoire a complètement transformé le marché pharmaceutique. Avec la mise en place de la Drug Supply Chain Security Act (DSCSA) aux États-Unis et de la Falsified Medicines Directive (FMD) de l’Union Asie-Pacifique, la chaîne d’approvisionnement des produits pharmaceutiques est désormais liée à des produits et des données sérialisés. En y regardant de plus près, un programme de sérialisation réussi implique bien plus que le simple apposition de numéros de série sur les emballages. Les réglementations varient d’un marché à l’autre et peuvent souvent changer, ce qui signifie que les professionnels de la réglementation doivent être prêts à ajuster les procédures, les processus et les dépôts pour suivre le rythme. Étant donné que la loi sur l’étiquetage et la sérialisation des médicaments est relativement récente, elle est soumise à une plus grande complexité en Asie-Pacifique et varie plus souvent que les autres réglementations. De plus, comme la chaîne d’approvisionnement des produits pharmaceutiques authentiques s’est allongée, cela crée une opportunité pour les contrefacteurs à chaque étape de la chaîne d’approvisionnement. Par conséquent, des réglementations et une normalisation strictes sont mises en place afin de protéger les marchandises.

- En juillet 2024, selon l'article publié par la Food and Drug Administration, la loi sur la sécurité de la chaîne d'approvisionnement des médicaments (DSCSA) impose l'identification et le traçage électroniques des médicaments sur ordonnance au niveau de l'emballage pour empêcher les médicaments nocifs de pénétrer dans la chaîne d'approvisionnement américaine. Cette réglementation stricte entraîne le besoin de solutions avancées de suivi et de traçabilité pour garantir la conformité, protéger les patients et permettre des réponses rapides aux menaces, agissant ainsi comme un moteur clé pour le marché de la région Asie-Pacifique

- En février 2022, selon l'article publié par le programme de chaîne d'approvisionnement sanitaire de l'USAID en Asie-Pacifique, la State Food and Drug Administration chinoise a rendu obligatoire la sérialisation de 502 médicaments pharmaceutiques figurant sur la liste des médicaments essentiels, garantissant ainsi la traçabilité et l'authenticité. Cette réglementation stricte stimule la demande de solutions de suivi et de traçabilité pour se conformer aux exigences de sérialisation. En conséquence, elle agit comme un moteur clé pour le marché de l'Asie-Pacifique, poussant à une adoption plus large des technologies de suivi avancées

La question des médicaments et de leur falsification est une préoccupation de la région Asie-Pacifique depuis des décennies. Alimentés par des chaînes d'approvisionnement physiques et informatiques non sécurisées en Asie-Pacifique, des ventes sur Internet et des sanctions minimes, le gouvernement et diverses sociétés pharmaceutiques du monde entier estiment que la mise en œuvre de la sérialisation pourrait réduire et mettre fin aux problèmes liés à la contrefaçon. Cela fait des réglementations et des normes strictes pour la mise en œuvre de la sérialisation un moteur pour le marché des solutions de suivi et de traçabilité en Asie-Pacifique.

- Inquiétudes croissantes concernant la contrefaçon

Les inquiétudes croissantes concernant les produits contrefaits sont devenues un problème majeur, en particulier dans les secteurs pharmaceutique et de la santé, où la présence de faux médicaments peut avoir de graves conséquences sur la santé et la sécurité des patients. Les médicaments contrefaits compromettent non seulement l'intégrité du système de santé, mais augmentent également les risques d'effets indésirables, de résistance aux médicaments et d'échecs thérapeutiques. En réponse à cette menace croissante, les régulateurs et les acteurs du secteur font pression pour que des mesures de traçabilité et de sérialisation plus strictes soient mises en place. Ces mesures contribuent à garantir l'authenticité des produits en permettant aux fabricants, aux distributeurs et aux détaillants de suivre le mouvement des marchandises tout au long de la chaîne d'approvisionnement. Des technologies telles que la RFID, le code-barres et la blockchain sont de plus en plus utilisées pour lutter contre la contrefaçon, permettant de surveiller et de vérifier les produits à chaque étape de la chaîne d'approvisionnement, de la fabrication au consommateur final. Avec l'expansion du commerce mondial et la complexification des chaînes d'approvisionnement, le risque de voir des produits contrefaits pénétrer les marchés est devenu plus prononcé, ce qui accroît encore la nécessité de systèmes de traçabilité améliorés. Cette prise de conscience accrue des risques de contrefaçon constitue un moteur essentiel du marché mondial des solutions de suivi et de traçabilité, car les entreprises et les gouvernements recherchent des systèmes robustes pour authentifier les produits, maintenir la conformité réglementaire et protéger les consommateurs contre les produits contrefaits potentiellement dangereux.

Par exemple,

- En mai 2024, selon un article publié par la Food and Drug Administration, les médicaments contrefaits, qui peuvent contenir des ingrédients incorrects, insuffisants ou nocifs, présentent de graves risques pour la santé tout en étant faussement commercialisés comme authentiques. Cette préoccupation croissante concernant la sécurité et l'efficacité des produits pharmaceutiques conduit à l'adoption de solutions de suivi et de traçabilité pour garantir l'authenticité des produits. En conséquence, les préoccupations croissantes concernant les produits contrefaits constituent un moteur important pour le marché mondial des solutions de suivi et de traçabilité

- En octobre 2024, selon l’article publié par Science Direct, les médicaments falsifiés et contrefaits, notamment lors des voyages internationaux, représentent un risque grave pour la santé publique. Avec l’augmentation des cas signalés à l’échelle mondiale, les inquiétudes concernant la propagation de médicaments contrefaits se sont considérablement accrues. Cela a conduit à un besoin accru de systèmes de traçabilité pour garantir l’authenticité des produits. En conséquence, les inquiétudes croissantes concernant les médicaments contrefaits constituent un moteur clé pour le marché mondial des solutions de suivi et de traçabilité

Les inquiétudes concernant les produits contrefaits, en particulier dans les secteurs pharmaceutique et de la santé, sont devenues un problème majeur en raison des dommages potentiels que les faux médicaments peuvent causer aux patients. Les médicaments contrefaits peuvent conduire à des traitements inefficaces et à des risques pour la santé, ce qui entraîne une demande accrue de solutions de traçabilité. En utilisant des technologies telles que la RFID, les codes-barres et la blockchain, les entreprises peuvent suivre les produits tout au long de la chaîne d'approvisionnement pour garantir leur authenticité. À mesure que les chaînes d'approvisionnement mondiales deviennent plus complexes, le risque d'entrée de produits contrefaits sur le marché augmente, ce qui entraîne le besoin de systèmes de suivi plus solides. Cette demande de solutions de traçabilité sûres et fiables constitue un moteur majeur du marché mondial des solutions de suivi et de traçabilité.

Opportunités

- Croissance du secteur du commerce électronique

La croissance rapide du secteur du commerce électronique représente une opportunité considérable pour le marché des solutions de suivi et de traçabilité en Asie-Pacifique en raison de la complexité et de l'ampleur croissantes des opérations de vente au détail en ligne. Alors que de plus en plus de consommateurs se tournent vers les achats en ligne, les entreprises doivent s'assurer que leurs processus logistiques et de chaîne d'approvisionnement sont efficaces et transparents. Les solutions de suivi et de traçabilité facilitent la surveillance en temps réel des niveaux de stock, du statut des expéditions et des processus de livraison, permettant aux entreprises de fournir des informations précises aux clients concernant leurs commandes. Ce niveau de transparence accru renforce la confiance des clients et améliore l'expérience d'achat globale, ce qui rend les entreprises de commerce électronique plus compétitives sur un marché encombré.

Par exemple,

- En juillet 2024, selon un article intitulé « Impact du commerce électronique sur la logistique : Adaptation à la demande », publié dans le Marketplace Digest, la mise en œuvre de solutions avancées de suivi et de visibilité améliore les solutions de suivi et de visibilité et est essentielle pour répondre aux demandes du commerce électronique. La technologie de suivi en temps réel permet aux transporteurs de fournir des estimations et des mises à jour de livraison précises, améliorant ainsi la transparence et la confiance des clients.

- En avril 2023, selon un article intitulé « Identification des avantages, des défis et des voies dans les industries du commerce électronique », publié dans ScienceDirect : Un modèle intégré de prise de décision en deux phases, le secteur du commerce électronique a connu une croissance significative au cours de la dernière décennie, car il se concentre sur la commodité et l'accessibilité, ce qui a entraîné une augmentation des achats en ligne avec un plus grand nombre de consommateurs qui l'optent

De plus, avec l’essor du commerce électronique, les risques de vol, de fraude et de contrefaçon augmentent, ce qui nécessite des systèmes de suivi et de traçabilité robustes capables d’atténuer ces défis. La mise en œuvre de technologies avancées telles que la RFID, la blockchain et les systèmes de suivi automatisés permet aux entreprises de commerce électronique de maintenir l’intégrité de leurs produits de l’entrepôt à la livraison. Ces solutions permettent en outre aux entreprises de se conformer aux exigences réglementaires et aux normes du secteur liées à la responsabilité et à la sécurité des produits. À mesure que le commerce électronique continue de se développer, la demande de solutions de suivi et de traçabilité fiables va augmenter, créant des opportunités de marché importantes pour les fournisseurs de ces technologies.

- Expansion du commerce mondial

L’expansion du commerce mondial crée une opportunité considérable pour le marché mondial des solutions de suivi et de traçabilité, stimulée par la complexité croissante des chaînes d’approvisionnement qui traversent les frontières internationales. Les entreprises s’appuyant de plus en plus sur des réseaux mondiaux pour s’approvisionner en matériaux et distribuer leurs produits, le besoin de systèmes de suivi efficaces devient primordial. Les solutions de suivi et de traçabilité permettent aux entreprises de surveiller les expéditions en temps réel, garantissant ainsi la transparence et l’efficacité tout au long du processus logistique. Cette capacité améliore l’efficacité opérationnelle et aide les organisations à se conformer aux réglementations et normes internationales, ce qui renforce la confiance entre les partenaires et les clients. À mesure que le commerce mondial continue de se développer, la demande de technologies de suivi sophistiquées capables de gérer diverses exigences réglementaires et d’offrir une visibilité sur plusieurs juridictions est susceptible d’augmenter.

Par exemple,

- En mai 2024, selon un article publié dans le Forum économique mondial, on s’attend à ce que le commerce mondial de biens et de services augmente de 2,3 % cette année et de 3,3 % en 2025, soit plus du double de la croissance de 1 % observée en 2023.

De plus, l’essor du commerce électronique et de la vente au détail en ligne a encore accéléré la demande de solutions de suivi et de traçabilité, car les consommateurs s’attendent à des livraisons rapides et à une transparence concernant leurs commandes. Avec de grandes quantités de marchandises transportées à travers le monde, les entreprises ont besoin de systèmes robustes pour suivre avec précision leurs stocks et leurs expéditions. Cette demande a stimulé l’innovation sur le marché du suivi et de la traçabilité, encourageant le développement de technologies avancées telles que la blockchain, l’IoT et l’intelligence artificielle. Ces innovations améliorent les capacités des solutions de suivi et de traçabilité et offrent la possibilité de se différencier sur un marché encombré. Alors que le commerce mondial continue de croître et d’évoluer, le marché des solutions de suivi et de traçabilité est prêt à capitaliser sur cette tendance, en fournissant des outils essentiels qui aident les entreprises à naviguer dans les complexités de la gestion moderne de la chaîne d’approvisionnement tout en répondant aux exigences des consommateurs en matière de transparence et de responsabilité.

Contraintes/Défis

- Risques associés à la contamination des échantillons

Data security and privacy concerns represent a significant challenge for the Asia-Pacific track and trace solutions market, as these systems often involve the collection, storage, and transmission of sensitive information. This can include personal data, product details, and supply chain information, which, if inadequately protected, pose risks to both consumers and businesses. Breaches in data security can lead to financial losses, reputational damage, and legal ramifications, particularly in light of increasingly stringent regulations such as the GDPR in Asia-Pacific and various data protection laws Asia-Pacificly. As organizations implement track and trace technologies, they must ensure robust security measures, which can increase costs and complicate the deployment process, potentially deterring companies from adopting these solutions.

For instance,

- In August 2024, according to an article, ‘Top Challenges in Implementing Track and Trace Solutions in Supply Chain Management’, published by Shriram Veritech Solutions Pvt. Ltd., with the implementation of track and trace solutions, businesses handle a vast amount of sensitive data, including proprietary information, customer details, and real-time location tracking. Track and trace systems are vulnerable to cyberattacks.

Moreover, consumer awareness regarding data privacy is growing, leading to heightened scrutiny of businesses that handle personal information. Organizations are under pressure to demonstrate compliance with data protection regulations and to build trust with their customers. If businesses cannot confidently assure stakeholders of their ability to safeguard data, they risk losing market share and facing backlash from consumers. This climate of concern can limit the willingness of companies to fully invest in and adopt advanced track and trace solutions that may require extensive data handling and processing. Consequently, the market may show slower growth as organizations navigate these complexities, seeking to balance the benefits of enhanced tracking capabilities with the imperative of maintaining data privacy and security.

- Damage To Tracking Tags During Delivery

Damage to tracking tags during delivery significantly impacts the effectiveness of track and trace solutions in the global market. When tracking tags, such as RFID labels or barcodes, are damaged during transit, it leads to data inaccuracies, loss of product visibility, and delays in tracking. This compromises the reliability of supply chain operations, especially in industries that depend on precise product movement and compliance. In the pharmaceutical sector, for instance, damaged tags disrupt critical traceability processes, increasing the risk of counterfeit products and regulatory non-compliance. Such issues result in inefficiencies, higher operational costs, and a decrease in customer confidence, acting as a significant restraint on the global track and trace solutions market.

For instance,

- In August 2024, according to the article published by encstorge.com, RFID tags are vulnerable to damage during delivery, caused by factors like water, excessive heat, chemicals, or physical breakage in the chip or antenna lines. Understanding these risks is crucial for optimizing RFID performance in different environments. Such damage disrupts track and trace systems, leading to inaccuracies and inefficiencies, which act as a significant restraint on the global market's growth

- In August 2023, according to the article published by Lexicon Tech Solutions, Barcodes can be damaged during delivery due to exposure to moisture, oils, or rough surfaces, leading to issues such as smudging or tearing. This damage makes the barcode unreadable, disrupting the tracking process. Such issues with barcode integrity can cause delays, inaccuracies, and inefficiencies in supply chains, acting as a significant restraint to the global track and trace solutions market

Damage to tracking tags during delivery hinders the effectiveness of track and trace systems in the global market. Damaged RFID labels or barcodes result in tracking errors, loss of visibility, and delays, affecting supply chain accuracy. In sectors such as pharmaceuticals, this disrupts compliance and traceability, leading to inefficiencies, higher costs, and reduced trust, which restraints market growth.

North America Track and Trace Solutions Market Scope

The market is segmented on the basis of product, solution, application, technology, end user, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Software Components

- Plant Manager

- Line Controller

- Enterprise And Network Manager

- Bundle Tracking

- Case Tracking

- Warehouse And Shipment Manager

- Pallet Tracking

- Others

- Hardware Components

- Printing And Marking

- Barcode Scanner

- Monitoring And Verification

- Labeler

- Checkweigher

- Rfid Reader

- Others

- Standalone Platform

Solution

- Line And Site-Level Serialization

- Cloud Enterprise-Level Traceability

- Distribution And Warehouse Solution

- Supply Chain Data-Sharing Network

- Others

Application

- Serialization

- Carton Serialization

- Bottle Serialization

- Medical Device Serialization

- Vial And Ampoule Serialization

- Blister Serialization

- Printing

- Labeling And Packaging Inspection

- Aggregation

- Bundle Aggregation

- Case Aggregation

- Pallet Aggregation

- Tracking

- Tracing

- Reporting

Technology

- 2d Barcodes

- Radiofrequency Identification (Rfid)

- Linear/1d Barcodes

End User

- Pharmaceutical And Biopharmaceutical Companies

- Consumer Packaged Goods

- Luxury Goods

- Food And Beverage

- Medical Device Companies

- Contract Manufacturing Organizations

- Repackagers

- Cosmetics Companies

- Others

Distribution Channel

- Direct Sales

- Third Party Distributors

North America Track and Trace Solutions Market Regional Analysis

The market is analyzed and market size insights and trends are provided country, product, solution, application, technology, end user, and distribution channel as referenced above.

The country covered in the market are U.S., Canada, and Mexico.

U.S. is expected to dominate and be fastest growing country due to its advanced healthcare infrastructure, high levels of investment in medical research and development, and a large aging population. The U.S. healthcare system supports widespread access to cutting-edge ophthalmic treatments and technologies, including laser surgeries, AI-powered diagnostics, and personalized therapies. The increasing prevalence of age-related eye diseases, such as macular degeneration, cataracts, and glaucoma, is driving demand for innovative treatments. Additionally, the U.S. is home to some of the world’s leading ophthalmology companies, contributing to the rapid development and adoption of new therapies and devices.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

North America Track and Trace Solutions Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, North America presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

North America Track and Trace Solutions Market Leaders Operating in the Market Are:

- SAP SE (Germany)

- Zebra Technologies Corp. (U.S.)

- Videojet Technologies, Inc. (U.S.)

- METTLER TOLEDO (U.S.)

- Tracelink Inc. (U.S.)

- Siemens (Germany)

- Domino Printing Sciences plc (U.K.)

- Laetus GmbH (Germany)

- Xyntek Incorporated (U.S.)

- IBM Corporation (U.S.)

- WIPOTEC-OCS GmbH (Germany)

- 3Keys (Germany)

- ACG (India)

- NJM Packaging Inc. (U.S.)

- OPTEL GROUP (Canada)

- Systech (India)

- Robert Bosch Manufacturing Solutions GmbH (Germany)

- ANTARES VISION S.p.A. (Italy)

- Uhlmann (India)

- SEA VISION S.r.l. (Italy)

- Jekson Vision (India)

- Kevision Systems (India)

- Arvato Systems (Germany)

- Grant-Soft Ltd. (Turkey)

- PharmaSecure Inc. (U.S.)

- Axyway (France)

- SL Controls Ltd. (U.S.)

Latest Developments in North America Track and Trace Solution Market

- En mai 2024, Videojet a lancé le laser CO2 3350 de 30 watts, conçu pour fournir un marquage permanent de haute qualité pour une variété de matériaux. Cette solution laser avancée améliore l'efficacité opérationnelle et réduit les temps d'arrêt grâce à ses performances fiables et à grande vitesse. Elle est particulièrement adaptée aux industries nécessitant un marquage de précision, comme l'alimentation, les boissons et les produits pharmaceutiques

- En mai 2019, METTLER TOLEDO a ouvert son nouveau centre de test d'inspection de produits pour les transformateurs alimentaires et pharmaceutiques nord-américains à Barcelone. Ce nouveau centre de test ouvert par l'entreprise renforce sa crédibilité sur le marché, ce qui entraîne une augmentation de la demande et des ventes de ses produits à l'avenir.

- En février 2020, ACG a lancé une plateforme de marque innovante basée sur la blockchain. Cette nouvelle plateforme introduite par l'entreprise augmentera sa demande sur le marché

- En novembre 2019, ACG a présenté la série NXT, des machines prêtes pour l'avenir qui offriront une expérience utilisateur intelligente à nos clients. Dans le cadre de la série NXT, les machines incluses sont Protab 300 NXT, Protab 700 NXT, BMax NXT, KartonX NXT, Verishield CS18 NXT au PMEC 2019. Ces nouveaux produits lancés par ACG augmenteront la demande pour ses produits sur le marché

- En juillet 2020, Axyway a reçu la désignation AWS Healthcare Competency et la désignation AWS Life Sciences Competency d'Amazon Web Services (AWS) pour ses solutions utilisées dans de nombreux secteurs. Cette reconnaissance reçue par l'entreprise va renforcer sa crédibilité sur le marché

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 PRODUCTS LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTAL ANALYSIS

4.2 PORTERS FIVE FORCES ANALYSIS

5 NORTH AMERICA TRACK & TRACE SOLUTIONS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION

6.1.2 RISING COUNTERFEIT CONCERNS

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN TRACK AND TRACE SOLUTIONS

6.1.4 COMPLEXITY IN NORTH AMERICA SUPPLY CHAIN

6.2 RESTRAINTS

6.2.1 RESISTANCE FROM SMALL BUSINESSES

6.2.2 DAMAGE TO TRACKING TAGS DURING DELIVERY

6.3 OPPORTUNITIES

6.3.1 GROWTH IN THE E-COMMERCE SECTOR

6.3.2 INCREASING FOCUS ON DATA ANALYTICS

6.3.3 EXPANSION IN NORTH AMERICA TRADE

6.4 CHALLENGES

6.4.1 HIGH IMPLEMENTATION COSTS

6.4.2 DATA SECURITY AND PRIVACY CONCERNS

7 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS

7.1 OVERVIEW

7.2 SOFTWARE COMPONENTS

7.2.1.1 PLANT MANAGER

7.2.1.2 ENTERPRISE & NETWORK MANAGER

7.2.1.3 BUNDLE TRACKING

7.2.1.4 PALLET TRACKING

7.2.1.5 CASE TRACKING

7.2.1.6 WAREHOUSE & SHIPMENT MANAGER

7.2.1.7 LINE CONTROLLER

7.2.1.8 OTHERS

7.3 HARDWARE COMPONENTS

7.3.1.1 PRINTING & MARKING

7.3.1.2 LABELER

7.3.1.3 BARCODE SCANNER

7.3.1.4 RFID READER

7.3.1.5 CHECKWEIGHER

7.3.1.6 MONITORING & VERIFICATION

7.3.1.7 OTHERS

7.4 STANDALONE PLATFORMS

8 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION

8.1 OVERVIEW

8.2 LINE & SITE LEVEL SERIALIZATION

8.3 CLOUD ENTERPRISE-LEVEL TRACEABILITY

8.4 DISTRIBUTION & WAREHOUSE SOLUTION

8.5 SUPPLY CHAIN DATA-SHARING NETWORK

8.6 OTHERS

9 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 2D BARCODES

9.3 RADIOFREQUENCY IDENTIFICATION (RFID)

9.4 LINEAR/1D BARCODESS

10 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SERIALIZATION

10.3 PRINTING

10.4 LABELING & PACKAGING INSPECTION

10.5 AGGREGATION

10.6 TRACKING

10.7 TRACING

10.8 REPORTING

11 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER

11.1 OVERVIEW

11.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE

11.3 CONSUMER PACKAGED GOODS

11.4 LUXURY GOODS

11.5 FOOD & BEVERAGE

11.6 MEDICAL DEVICE COMPANIES

11.7 CONTRACT MANUFACTURING ORGANIZATIONS

11.8 REPACKAGERS

11.9 COSMETICS COMPANIES

11.1 OTHERS

12 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT SALES

12.3 THIRD PARTY DISTRIBUTORS

13 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SAP SE

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENT

16.2 ZEBRA TECHNOLOGIES CORP.

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT DEVELOPMENT

16.3 TRACELINK INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 VIDEOJET TECHNOLOGIES, INC.

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 METTLER TOLEDO

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENT

16.6 ACG

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 AXYWAY

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENT

16.8 ANTARES VISION S.P.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 ARVATO SYSTEMS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENT

16.1 DOMINO PRINTING SCIENCES PLC

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 GRANT-SOFT LTD.

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 IBM CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENT

16.13 JEKSON VISION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENTS

16.14 3KEYS

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 KEVISION SYSTEMS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT DEVELOPMENT

16.16 LAETUS GMBH

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 NJM PACKAGING INC.

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT DEVELOPMENTS

16.18 OPTEL GROUP

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 PHARMADECURE INC.

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENT

16.2 ROBERT BOSCH MANUFACTURING SOLUTIONS GMBH

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SEA VISION S.R.L.

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENT

16.22 SIEMENS

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENT

16.23 SL CONTROLS LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 SYSTECH

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 UHLMANN

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENTS

16.26 WIPOTEC-OCS GMBH

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENT

16.27 XYNTEK INCORPORATED

16.27.1 COMPANY SNAPSHOT

16.27.2 PRODUCT PORTFOLIO

16.27.3 RECENT DEVELOPMENT

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 2 NORTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 NORTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 4 NORTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 5 NORTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 6 NORTH AMERICA STANDALONE PLATFORMS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 8 NORTH AMERICA LINE & SITE LEVEL SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 NORTH AMERICA CLOUD ENTERPRISE-LEVEL TRACEABILITY IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 10 NORTH AMERICA DISTRIBUTION & WAREHOUSE SOLUTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 NORTH AMERICA SUPPLY CHAIN DATA-SHARING NETWORK IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 12 NORTH AMERICA OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 13 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 14 NORTH AMERICA 2D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 15 NORTH AMERICA RADIOFREQUENCY IDENTIFICATION (RFID) IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 16 NORTH AMERICA LINEAR/1D BARCODES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 17 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 18 NORTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 19 NORTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 NORTH AMERICA PRINTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 NORTH AMERICA LABELING & PACKAGING INSPECTION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 NORTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 NORTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 24 NORTH AMERICA TRACKING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 NORTH AMERICA TRACING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 NORTH AMERICA REPORTING IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 28 NORTH AMERICA PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 29 NORTH AMERICA CONSUMER PACKAGED GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 NORTH AMERICA LUXURY GOODS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 NORTH AMERICA FOOD & BEVERAGE IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 NORTH AMERICA MEDICAL DEVICE COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 NORTH AMERICA CONTRACT MANUFACTURING ORGANIZATIONS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 34 NORTH AMERICA REPACKAGERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 NORTH AMERICA COSMETICS COMPANIES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 NORTH AMERICA OTHERS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 37 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 38 NORTH AMERICA DIRECT SALES IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032(USD THOUSAND)

TABLE 39 NORTH AMERICA THIRD-PARTY DISTRIBUTORS IN TRACK AND TRACE SOLUTIONS MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 40 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 41 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 42 NORTH AMERICA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 43 NORTH AMERICA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 44 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 45 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 47 NORTH AMERICA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 48 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 49 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 50 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 51 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 52 U.S. SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 53 U.S. HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 54 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 55 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 56 U.S. SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 57 U.S. AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 58 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 59 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 60 U.S. TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 61 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 62 CANADA SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 63 CANADA HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 64 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 65 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 66 CANADA SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 67 CANADA AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 68 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 69 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 70 CANADA TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 71 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 72 MEXICO SOFTWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 73 MEXICO HARDWARE COMPONENTS IN TRACK AND TRACE SOLUTIONS MARKET, BY PRODUCTS, 2018-2032 (USD THOUSAND)

TABLE 74 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY SOLUTION, 2018-2032 (USD THOUSAND)

TABLE 75 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 76 MEXICO SERIALIZATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 77 MEXICO AGGREGATION IN TRACK AND TRACE SOLUTIONS MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 78 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY TECHNOLOGY, 2018-2032 (USD THOUSAND)

TABLE 79 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 80 MEXICO TRACK AND TRACE SOLUTIONS MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: SEGMENTATION

FIGURE 11 STRINGENT REGULATIONS & STANDARDS FOR THE IMPLEMENTATION OF SERIALIZATION IS EXPECTED TO DRIVE THE NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET IN THE FORECAST PERIOD OF 2025 TO 2032

FIGURE 12 SOFTWARE COMPONENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET IN 2025 & 2032

FIGURE 13 DROC ANALYSIS

FIGURE 14 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2024

FIGURE 15 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, 2025-2032 (USD THOUSAND)

FIGURE 16 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, CAGR (2025-2032)

FIGURE 17 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY PRODUCTS, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2024

FIGURE 19 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, 2025-2032 (USD THOUSAND)

FIGURE 20 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, CAGR (2025-2032)

FIGURE 21 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY SOLUTION, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2024

FIGURE 23 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, 2025-2032 (USD THOUSAND)

FIGURE 24 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, CAGR (2025-2032)

FIGURE 25 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2024

FIGURE 27 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 28 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 29 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2024

FIGURE 31 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 32 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, CAGR (2025-2032)

FIGURE 33 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 35 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 36 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 37 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET SNAPSHOT

FIGURE 39 NORTH AMERICA TRACK AND TRACE SOLUTIONS MARKET: COMPANY SHARE 2024 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.