Marché nord-américain des tomates, par type (tomates cerises, tomates raisins, tomates Roma, tomates Beefsteak, tomates anciennes, tomates sur vigne, tomates vertes et autres), type de produit (fraîches, surgelées et séchées), catégorie (conventionnelle et biologique), utilisateur final (industrie de la restauration et industrie domestique/de détail), canal de distribution (direct et indirect) Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des tomates en Amérique du Nord

Le marché nord-américain des tomates connaît une croissance significative en raison de l'utilisation accrue des tomates dans diverses cuisines et unités de transformation. Les tomates sont utilisées dans la production de différents types de produits à base de tomates et ont une forte demande sur le marché. Elles sont non seulement bonnes au goût, mais offrent également des avantages pour la santé humaine.

Les facteurs qui stimulent la croissance du marché sont la demande croissante de tomates dans les industries de transformation alimentaire ainsi que le développement et la production de nouvelles variétés de tomates sur le marché. Le facteur qui freine la croissance du marché est la fluctuation des prix des tomates, qui dépendent de divers facteurs tels que la pluie, la température et la saison. L'opportunité de croissance du marché réside dans la culture de tomates à l'aide de l'intelligence artificielle (IA). Certains des facteurs qui entravent la croissance du marché sont l'augmentation des pertes après récolte en raison du manque d'installations de stockage.

Les acteurs du marché se concentrent davantage sur le développement de nouveaux produits, les partenariats et d'autres stratégies pour augmenter leur part de marché. Par conséquent, les normes et réglementations de plus en plus strictes établies par les organismes gouvernementaux doivent être respectées par les fabricants pour vendre leurs produits sur le marché et garantir que la demande des consommateurs stimulera la croissance du marché. En revanche, le manque d'expertise technique dans les petites entreprises est susceptible de limiter la croissance du marché dans la région.

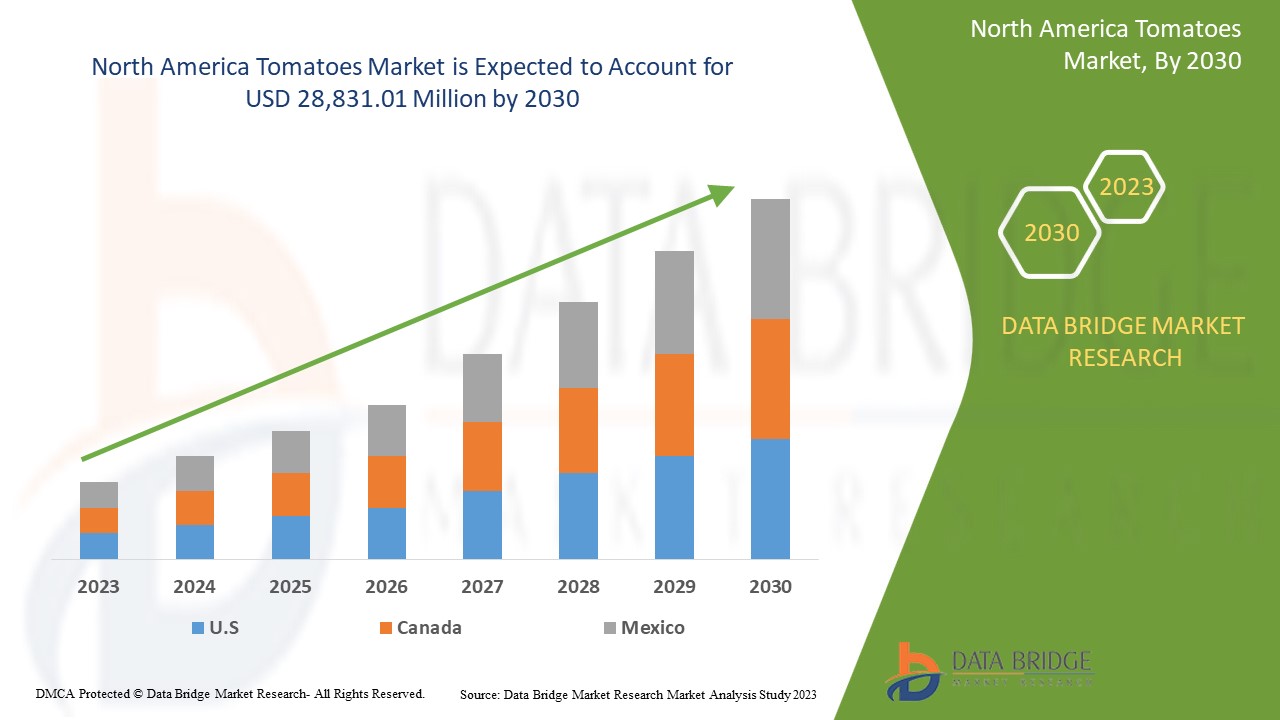

Data Bridge Market Research analyse que le marché nord-américain des tomates devrait atteindre la valeur de 28 831,01 millions USD d'ici 2030, à un TCAC de 3,0 % au cours de la période de prévision.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Année historique |

2021 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, prix en USD |

|

Segments couverts |

Par type (tomates cerises, tomates raisins, tomates Roma, tomates Beefsteak, tomates anciennes, tomates sur vigne, tomates vertes et autres), type de produit (fraîches, surgelées et séchées), catégorie (conventionnelle et biologique), utilisateur final (industrie de la restauration et industrie domestique/de détail), canal de distribution (direct et indirect). |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Houwelings, producteurs de légumes de transformation de l'Ontario, Tomato Growers Supply Company, Magic Sun, PACIFIC RIM PRODUCE, Mucci Int'l Mrktg Inc., West Coast Tomato, LLC, Royalpride, Nature Fresh Farms, RedStar Sales BV, Streef Produce Ltd., Hnatiuk Gardens, Aylmer Family Farm, Exeter Produce et AppHarvest, entre autres. |

Définition du marché

Les tomates sont des légumes de forme ronde qui peuvent être consommés cuits ou crus. Ce sont des baies pulpeuses comestibles de l'herbe Solanum lycoperscium. Elles sont de nombreuses couleurs telles que le rouge, le jaune, l'orange et bien d'autres. Il existe de nombreuses variétés ayant des goûts et des applications différents.

Les tomates sont largement utilisées dans l'industrie alimentaire et des boissons. Elles sont utilisées dans la production de soupes, de sauces, de purées, de jus et de ketchup, entre autres. Elles sont également utilisées comme légumes crus dans les hamburgers, les sandwichs, les salades, les pizzas et bien d'autres encore.

Les tomates sont une source essentielle dans les industries de transformation alimentaire, avec de nombreuses applications et contiennent également des composants essentiels utiles pour le corps humain. Elles aident à maintenir la pression artérielle et une peau saine et ont également une action anti-inflammatoire.

Dynamique du marché des tomates en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la demande nationale et internationale de tomates

L’augmentation de la demande de tomates est due à une meilleure efficacité au niveau des producteurs et des transformateurs. La consommation de fruits et légumes frais est en hausse, stimulée par une sensibilisation accrue des consommateurs aux avantages d’adopter un régime alimentaire riche en fruits et légumes et par des initiatives publiques visant à promouvoir leur consommation. La demande de tomates a augmenté de manière significative en raison de l’augmentation de la population, de la demande croissante des consommateurs pour des aliments nutritifs et sains et de l’utilisation potentielle de technologies améliorées, également en raison des développements simultanés dans les domaines de l’infrastructure de la chaîne du froid, de l’augmentation de la productivité et de la qualité grâce à la recherche et des technologies post-récolte modernes.

- Croissance fulgurante des tomates dans l'industrie agroalimentaire

Le marché B2B a besoin de tomates car elles sont utilisées comme matière première pour fabriquer d'autres produits transformés à base de tomates. Les tomates sont utilisées sous diverses formes, notamment en jus, en pâte, en purée, en dés/pelées, en ketchup, en cornichons, en sauces et en currys prêts à consommer. Les produits à base de tomates transformées ont de nombreuses utilisations dans le secteur alimentaire, notamment dans les snacks, les produits culinaires, les hôtels, les restaurants et les chaînes de restauration rapide. Elles peuvent être consommées cuites ou crues et sont très demandées sur le marché nord-américain. En raison de l'urbanisation rapide, les consommateurs des pays émergents et développés sont incités à consommer des aliments prêts à l'emploi et des produits transformés à base de tomates. Pour répondre à la demande croissante, les fabricants d'aliments transformés et les transformateurs de concentré de tomates se concentrent sur les produits prêts à consommer.

En outre, la gamme de produits alimentaires transformés à base de tomates s'élargit avec l'introduction de divers produits à base de tomates, notamment des produits à base de poudre. La pâte de tomates et la purée de tomates sont les principaux produits transformés à base de tomates. Les produits de transformation secondaires pour les tomates sont rendus possibles par la transformation de produits primaires. Le principal marché pour la pâte et la purée de tomates est le secteur du ketchup et des sauces. L'industrie des boissons et des aliments est le deuxième plus grand utilisateur de pâte et de purée de tomates.

Restrictions

- Fluctuations des prix des tomates

Les marchés nord-américains volatils et imprévisibles ont des conséquences considérables pour les entreprises industrielles. Des obstacles imprévus tels que la hausse des coûts de l’énergie et les variations inattendues des prix des matières premières perturbent les chaînes d’approvisionnement et rendent plus difficile pour les entreprises de rester rentables. Les variations des prix des matières premières utilisées pour la fabrication de sauces, vinaigrettes et condiments en bouteille à remplissage à chaud entraînent des coûts supplémentaires sur le prix du produit fini. Une récolte abondante ou une catastrophe dans une grande région de production peut faire évoluer rapidement les prix des tomates.

Les prix des tomates sont volatils car ils dépendent de divers facteurs tels que la saisonnalité de la production, les pluies hors saison et les sécheresses prolongées. Ils dépendent également de la localisation, des préférences, de l'âge des consommateurs et de leur pouvoir d'achat. En raison de sa saisonnalité, les prix augmentent lorsque le produit est hors saison et diminuent lorsqu'il est de saison.

- Augmentation des éléments environnementaux et des conditions climatiques

Les changements environnementaux affectent la durabilité du système alimentaire en influençant les moyens de subsistance des agriculteurs, les choix des consommateurs et la sécurité alimentaire par le biais de changements dans les composantes naturelles et humaines des agroécosystèmes. Les précipitations annuelles et les fortes pluies deviennent plus fréquentes, en particulier au printemps. Une quantité excessive de pluie printanière ralentit l'établissement des cultures, interrompt la plantation, augmente la prévalence de plusieurs maladies fongiques et bactériennes des cultures et peut entraîner des problèmes de main-d'œuvre en raison du retard des opérations sur le terrain. Les variations de température et de précipitations ont un impact direct sur la quantité et la qualité de la production de tomates et ont un impact indirect sur la planification des opérations agricoles importantes et sur les effets économiques des ravageurs, des mauvaises herbes et des maladies. Les conditions météorologiques défavorables entravent également la chaîne d'approvisionnement et le transport des tomates.

En outre, la hausse des températures accélère la croissance des cultures, ce qui se traduit par des saisons de culture plus courtes et des rendements plus faibles. L’augmentation de l’ozone troposphérique (ou de la couche d’ozone troposphérique) entraîne une augmentation du stress oxydatif chez les plantes, ce qui inhibe la photosynthèse et ralentit la croissance des plantes. Les événements extrêmes, en particulier les inondations et les sécheresses, peuvent nuire aux cultures et réduire les rendements, affectant à terme le marché de la tomate.

Opportunité

- Cultiver des tomates grâce à l'intelligence artificielle (IA)

L'IA est une branche de l'informatique qui vise à créer des machines intelligentes capables d'effectuer des tâches qui nécessitent généralement l'intelligence humaine. Elle fait partie intégrante de la vie quotidienne et est utilisée dans le secteur agricole. La technologie de l'IA vise à résoudre divers problèmes afin d'augmenter et d'optimiser les processus de production et d'exploitation.

Des approches informatiques avancées sont utilisées dans l'IA pour résoudre de nombreux problèmes du monde réel. Ces méthodes peuvent être utilisées dans l'industrie agricole pour mener des recherches originales qui amélioreront le type, la vitesse, la nouvelle variété et la protection. L'IA peut vérifier automatiquement la qualité des cultures, le rendement, la valeur du pH, la proportion de nutriments, la quantité d'eau nécessaire, l'humidité et les composants en oxygène. De nombreux pays utilisent des mini-robots pour évaluer la qualité et la maturité des cultures dans l'industrie agricole. Les mini-robots récoltent les fruits et légumes mûrs sans endommager la peau délicate des tomates.

Défi

Pénurie de ressources en eau et salinité des eaux souterraines

La production alimentaire est fortement impactée par la pénurie d’eau. Sans eau, les individus n’ont pas les moyens d’arroser leurs cultures et, par conséquent, ne peuvent pas nourrir une population en pleine expansion. Selon l’Institut international de gestion de l’eau, l’agriculture est en concurrence constante avec les applications domestiques, industrielles et environnementales pour un approvisionnement en eau limité, qui représente environ 70 % des prélèvements d’eau en Amérique du Nord.

La croissance du marché est donc freinée par les prix élevés des matières premières et par le coût de fabrication élevé de ces tables. Cela pourrait mettre à mal la croissance du marché nord-américain des tomates.

Impact post-COVID-19 sur le marché nord-américain des tomates

Après la pandémie, la demande de tomates a augmenté, car les fruits et légumes étaient disponibles pendant la période de confinement et la demande de légumes a augmenté à ce moment-là. De plus, la tomate ayant des propriétés d'augmentation de l'immunité a conduit à une forte demande pendant la période de COVID-19.

Développements récents

- En septembre 2022, selon un rapport de l'USDA, les partenaires des ALE (accords de libre-échange) des États-Unis ont signalé une augmentation annuelle des exportations agricoles du pays allant de 5 % (Canada) à 46,2 % (Singapour) au cours des cinq années suivant la signature de leurs accords commerciaux.

- En mars 2022, selon un article publié sur Fresh Plaza, les ventes de tomates cerises ont augmenté de 12,04 % par an de janvier à mars 2022, tandis que leur valeur a augmenté de 12,6 % par an sur le marché des fruits de Jiaxing en Chine. Le volume des transactions de tomates cerises a augmenté de 23,47 % par rapport à l'année précédente, et le volume des transactions a augmenté de 35,30 % par rapport à l'année précédente.

Portée du marché des tomates en Amérique du Nord

Le marché nord-américain des tomates est segmenté en cinq segments notables en fonction du type, du type de produit, de la catégorie, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Tomates cerises

- Tomates raisins

- Tomates Roma

- Tomates Beefsteak

- Tomates anciennes

- Tomates sur vigne

- Tomates vertes

- Autres

En fonction du type, le marché nord-américain des tomates est segmenté en tomates cerises, tomates raisins, tomates Roma, tomates Beefsteak, tomates anciennes, tomates sur vigne, tomates vertes et autres.

Type de produit

- Frais

- Congelé

- Séché

En fonction du type de produit, le marché nord-américain des tomates est segmenté en tomates fraîches, surgelées et séchées.

Catégorie

- Conventionnel

- Organique

En fonction de la catégorie, le marché des tomates en Amérique du Nord est segmenté en tomates conventionnelles et biologiques.

Utilisateur final

- Secteur de la restauration

- Ménage/Commerce de détail

En fonction de l’utilisateur final, le marché nord-américain des tomates est segmenté en industrie de la restauration et en industrie domestique/de détail.

Canal de distribution

- Direct

- Indirect

En fonction du canal de distribution, le marché nord-américain des tomates est segmenté en direct et indirect.

Analyse/perspectives régionales du marché des tomates en Amérique du Nord

Le marché des tomates en Amérique du Nord est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, type de produit, catégorie, utilisateur final et canal de distribution comme référencé ci-dessus.

Les pays couverts dans ce rapport sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des tomates en termes de part de marché et de chiffre d'affaires. Ils devraient maintenir leur domination au cours de la période de prévision en raison de la demande croissante pour ces tomates, qui est la principale raison de la croissance des tomates en Amérique du Nord.

La section régionale du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des tomates en Amérique du Nord

Le marché concurrentiel des tomates en Amérique du Nord fournit des détails sur les concurrents. Les détails comprennent un aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements en R&D, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché.

Some of the major players operating in the North America tomatoes market are Houwelings, Ontario Processing Vegetable Growers, Tomato Growers Supply Company, Magic Sun, PACIFIC RIM PRODUCE, Mucci Int'l Mrktg Inc., West Coast Tomato, LLC, Royalpride, Nature Fresh Farms, REDSTAR Sales BV, Streef Produce Ltd., Hnatiuk Gardens, Aylmer Family Farm, Exeter Produce, and AppHarvest among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA Tomatoes Market

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 CROP TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 TOP EXPORTER OF TOMATOES MARKET

4.2 TOP IMPORTER OF TOMATOES MARKET

4.3 NEW PRODUCT LAUNCH STRATEGIES

4.3.1 LAUNCHING OF DISEASE RESISTANT VARIETIES

4.3.2 PROMOTING LAUNCH BY PACKAGING STRATEGIES

4.3.3 AUNCHING ORGANIC PRODUCTS

4.3.4 CONCLUSION

5 REGULATION COVERAGES

6 SUPPLY CHAIN OF THE NORTH AMERICA TOMATOES MARKET

6.1 RAW MATERIAL PROCUREMENT

6.2 PROCESSING

6.3 MARKETING AND DISTRIBUTION

6.4 END USERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GOVERNMENT INITIATIVES TO BOOST TOMATO PRODUCTION AND THE AGRICULTURAL SECTOR

7.1.2 SURGING GROWTH FOR TOMATOES IN THE FOOD PROCESSING INDUSTRY

7.1.3 INCREASED DEVELOPMENT OF NEW TOMATO VARIETIES

7.1.4 RISING DOMESTIC AND INTERNATIONAL DEMAND FOR TOMATOES

7.2 RESTRAINTS

7.2.1 FLUCTUATIONS IN THE PRICES OF TOMATOES

7.2.2 INCREASING ENVIRONMENTAL ELEMENTS AND CLIMATE CONDITIONS

7.2.3 STRINGENT RULES AND REGULATIONS IN TRADING AND EXPORT OF TOMATOES

7.3 OPPORTUNITY

7.3.1 GROWING TOMATOES USING ARTIFICIAL INTELLIGENCE

7.3.2 WIDE RANGE OF APPLICATIONS IN THE FOOD AND BEVERAGE SECTOR

7.3.3 RISING TECHNOLOGICAL ADVANCEMENTS FOR TOMATO PRODUCTION

7.3.4 HIGH DEMAND FOR ORGANIC AND CHEMICAL-FREE TOMATOES

7.4 CHALLENGES

7.4.1 SCARCITY OF WATER RESOURCES AND SALINITY OF GROUNDWATER

7.4.2 RISING POST HARVESTING LOSSES DUE TO LACK OF STORAGE FACILITY

7.4.3 RISING USAGE OF CROP PROTECTION PRODUCTS

8 NORTH AMERICA TOMATOES MARKET, BY TYPE

8.1 OVERVIEW

8.2 CHERRY TOMATOES

8.3 GRAPE TOMATOES

8.4 ROMA TOMATOES

8.5 TOMATOES ON THE VINE

8.6 BEEFSTEAK TOMATOES

8.7 HEIRLOOM TOMATOES

8.8 GREEN TOMATOES

8.9 OTHERS

9 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE

9.1 OVERVIEW

9.2 FRESH

9.3 FROZEN

9.4 DRIED

10 NORTH AMERICA TOMATOES MARKET, BY CATEGORY

10.1 OVERVIEW

10.2 CONVENTIONAL

10.3 ORGANIC

11 NORTH AMERICA TOMATOES MARKET, BY END USER

11.1 OVERVIEW

11.2 FOOD SERVICE INDUSTRY

11.2.1 FOOD SERVICE INDUSTRY, BY TPYE

11.2.1.1 HOTELS

11.2.1.2 RESTAURANTS

11.2.1.3 CAFES

11.2.1.4 OTHERS

11.3 HOUSEHOLD/RETAIL INDUSTRY

12 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT

12.3 INDIRECT

13 NORTH AMERICA TOMATOES MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 MEXICO

13.1.3 CANADA

14 NORTH AMERICA TOMATOES MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

15 COMPANY PROFILE

15.1 APPHARVEST

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENT

15.2 MASTRONARDI PRODUCE LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 COMPANY SHARE ANALYSIS

15.2.3 PRODUCT PORTFOLIO

15.2.4 RECENT DEVELOPMENTS

15.3 CASALASCO - SOCIETÀ AGRICOLA S.P.A.

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 HOUWELINGS

15.4.1 COMPANY SNAPSHOT

15.4.2 COMPANY SHARE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 MUCCI INT’L MRKTG INC.

15.5.1 COMPANY SNAPSHOT

15.5.2 COMPANY SHARE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENTS

15.6 REDSTAR SALES BV

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENT

15.7 AYLMER FAMILY FARM

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 DUIJVESTIJN TOMATEN

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 EXETER PRODUCE

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 HNATIUK GARDENS

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENT

15.11 MAGIC SUN

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 NATURE FRESH FARMS

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 ONTARIO PROCESSING VEGETABLE GROWERS

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 PACIFIC RIM PRODUCE

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 R&L HOLT LTD.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 ROYALPRIDE

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 SAHYADRI FARMS POST HARVEST CARE LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 STREEF PRODUCE LTD

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 TOMATO GROWERS SUPPLY COMPANY

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 WEST COAST TOMATO, LLC

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 TOP EXPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 2 TOP IMPORTER OF FRESH AND CHILLED TOMATOES, HS CODE: 0702 2017-2021, VOLUME IN TONS

TABLE 3 IN CASE SIZE CODES ARE APPLIED, THE CODES AND RANGES IN THE FOLLOWING TABLE HAVE TO BE RESPECTED:

TABLE 4 NORTH AMERICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA CHERRY TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA GRAPE TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA ROMA TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA TOMATOES ON THE VINE IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA BEEFSTEAK TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA HEIRLOOM TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA GREEN TOMATOES IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 14 COMPANIES PROVIDING FRESH TOMATOES

TABLE 15 NORTH AMERICA FRESH IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA FROZEN IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA DRIED IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA CONVENTIONAL IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA ORGANIC IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA HOUSEHOLD/RETAIL INDUSTRY IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA DIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA INDIRECT IN TOMATOES MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA TOMATOES MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 35 U.S. TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 36 U.S. TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 37 U.S. TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 38 U.S. TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 39 U.S. FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 U.S. TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 41 MEXICO TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 42 MEXICO TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 44 MEXICO TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 45 MEXICO FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

TABLE 47 CANADA TOMATOES MARKET, BY TYPE 2021-2030 (USD MILLION)

TABLE 48 CANADA TOMATOES MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 49 CANADA TOMATOES MARKET, BY CATEGORY, 2021-2030 (USD MILLION)

TABLE 50 CANADA TOMATOES MARKET, BY END USER, 2021-2030 (USD MILLION)

TABLE 51 CANADA FOOD SERVICE INDUSTRY IN TOMATOES MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 52 CANADA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA TOMATOES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TOMATOES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TOMATOES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TOMATOES MARKET: NORTH AMERICA VS REGIONAL ANALYSIS

FIGURE 5 NORTH AMERICA TOMATOES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TOMATOES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TOMATOES MARKET: DBMR POSITION GRID

FIGURE 8 NORTH AMERICA TOMATOES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA TOMATOES MARKET: SEGMENTATION

FIGURE 10 RISING DEMAND OF TOMATO ON FOOD PROCESSING INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 THE CHERRY TOMATO SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TOMATOES MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 SUPPLY CHAIN OF THE NORTH AMERICA TOMATOES MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TOMATOES MARKET

FIGURE 14 THE AVERAGE CHANGE IN THE RETAIL PRICE OF TOMATO PER KG COMPARED TO THE LONG-TERM PRICE TREND

FIGURE 15 NORTH AMERICA TOMATOES MARKET, BY TYPE, 2022

FIGURE 16 NORTH AMERICA TOMATOES MARKET, BY PRODUCT TYPE, 2022

FIGURE 17 NORTH AMERICA TOMATOES MARKET, BY CATEGORY, 2022

FIGURE 18 NORTH AMERICA TOMATOES MARKET, BY END USER, 2022

FIGURE 19 NORTH AMERICA TOMATOES MARKET, BY DISTRIBUTION CHANNEL, 2022

FIGURE 20 NORTH AMERICA TOMATOES MARKET: SNAPSHOT (2022)

FIGURE 21 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2022)

FIGURE 22 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2023 & 2030)

FIGURE 23 NORTH AMERICA TOMATOES MARKET: BY COUNTRY (2022 & 2030)

FIGURE 24 NORTH AMERICA TOMATOES MARKET: BY TYPE (2023 - 2030)

FIGURE 25 NORTH AMERICA TOMATOES MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.