Marché nord-américain des serviettes en papier, par type de produit (serviettes en rouleau, serviettes pliées, serviettes de table et serviettes de luxe, serviettes en boîte), utilisation finale (soins personnels, soins à domicile, soins de santé, hôtellerie, commerce, autres), canal de distribution (ventes directes, commerce électronique, magasins de détail, autres) – Tendances et prévisions de l’industrie jusqu’en 2029.

Analyse et taille du marché

Le marché mondial des serviettes en papier devrait connaître une croissance significative dans un avenir proche en raison de la prise de conscience accrue des problèmes de santé et d'hygiène. Le marché des serviettes en papier devrait se développer en raison de l'augmentation du nombre de troubles congénitaux, de l'évolution des conditions climatiques et de l'urbanisation croissante. Par conséquent, la croissance du marché devrait s'épanouir largement au cours de la période prévue.

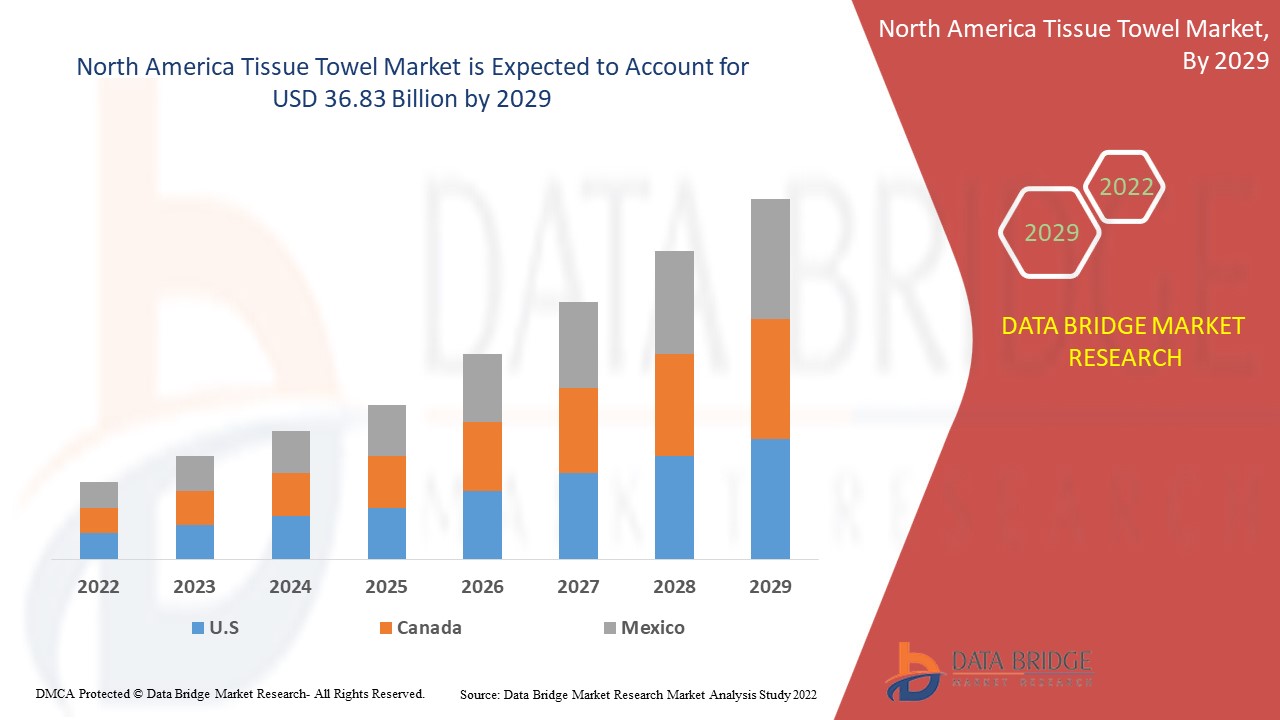

Le marché nord-américain des serviettes en papier était évalué à 25 milliards USD en 2021 et devrait atteindre 36,83 milliards USD d’ici 2029, enregistrant un TCAC de 4,40 % en 2022-2029. Le rapport de marché élaboré par l’équipe de recherche sur le marché de Data Bridge comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

Définition du marché

Les serviettes en papier sont des essuie-tout utilisés pour nettoyer les surfaces telles que les sols, les fenêtres et d'autres surfaces, ainsi que pour sécher les mains. En raison de leur technologie d'absorption rapide, ces articles offrent des avantages tels que la prévention et la propreté grâce au recyclage de ces serviettes. On les appelle également serviettes en papier jetables car elles ne sont censées être utilisées qu'une seule fois, puis jetées.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

|

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

KALSINT (États-Unis), Queenex (Émirats arabes unis), American waste & Textiles, LLC (États-Unis), Riverside Paper Co. lnc. (États-Unis), National Wiper Alliance lnc. (États-Unis), Larsen Packaging Products, lnc. (États-Unis), Ovasco Industries (États-Unis), Carl Hubenthal GmbH & Co. KG. (Allemagne), Georgia-Pacific (États-Unis), METSÄ TISSUE (Finlande), Procter & Gamble (États-Unis), KCWW (États-Unis), CARE Ratings Limited (Inde), HengAn (Chine), SHP Group (Slovaquie), Grigeo (Lituanie), Essity Aktiebolag (publ) (Suède) |

|

Opportunités de marché |

|

Dynamique du marché des serviettes en papier

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Augmentation de la demande de serviettes en papier

Le marché des serviettes en papier est en pleine croissance en raison des conditions climatiques changeantes, de la demande croissante dans d'autres secteurs tels que la construction et des conditions météorologiques changeantes. Cette hausse influence le marché des serviettes en papier dans la demande de serviettes en papier dans les secteurs émergents tels que les activités de plein air et les nouvelles régions, l'expansion dans les foyers en raison des conditions climatiques changeantes et l'augmentation des cas de grippe et de rhume, ce qui augmente la demande de serviettes en papier.

Les facteurs tels que les divers avantages associés à l'utilisation des serviettes en papier, notamment la prévention de la transmission des infections, l'augmentation du secteur du tourisme et de l'hôtellerie et le nombre croissant de femmes qui travaillent, vont encore accélérer le taux de croissance du marché des serviettes en papier. En outre, la prise de conscience croissante de la population en matière de santé, l'utilisation élevée de ces serviettes en papier en raison de leur rentabilité et de l'évolution généralisée du mode de vie des consommateurs, combinée à l'urbanisation rapide, vont également stimuler la croissance de la valeur marchande. L'expansion du secteur de l'hôtellerie et l'augmentation du revenu disponible des personnes devraient stimuler la croissance du marché.

Opportunités

- Mouchoirs écologiques et abordables

En outre, le développement de mouchoirs jetables biodégradables respectueux de l'environnement offre des opportunités rentables aux acteurs du marché au cours de la période de prévision de 2022 à 2029. De plus, le développement de mouchoirs en comprimés abordables pour les pays en développement renforcera encore la croissance future du marché des serviettes en papier.

Contraintes/Défis

- Préoccupations concernant l'environnement

Les préoccupations croissantes concernant la production de ces serviettes, qui incluent de nombreux aspects polluants qui nuisent à l'environnement, tels que l'élimination des déchets dangereux et la déforestation, devraient freiner l'expansion du marché des serviettes en papier.

- Des réglementations strictes

En outre, le renforcement des réglementations en matière de déforestation devrait également entraver la croissance du marché mondial des serviettes en papier.

- Prix des matières premières

En outre, la fluctuation des prix des matières premières, qui a un impact sur les résultats financiers des fabricants, devrait être un inconvénient pour le marché des serviettes en papier. Par conséquent, cela mettra à mal le taux de croissance du marché des serviettes en papier.

Ce rapport sur le marché des serviettes en papier fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des serviettes en papier, contactez Data Bridge Market Research pour un briefing d'analyste, notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Impact du COVID-19 sur le marché des serviettes en papier

La récente épidémie de coronavirus a eu un impact positif sur le marché des serviettes en papier, car la demande pour ces produits était énorme. L'augmentation de la demande de serviettes en papier peut être attribuée à la sensibilisation accrue des consommateurs à la nécessité de propreté et de désinfection, qui peuvent être obtenues à l'aide de serviettes en papier. Elles étaient principalement utilisées pour essuyer et sécher rapidement les mains et essuyer les zones potentiellement contaminées ou régulièrement manipulées par plusieurs personnes, telles que les poignées de porte et les tasses. Ce produit est devenu un incontournable dans la liste des produits des consommateurs en raison de sa facilité d'utilisation, de son taux d'absorption élevé et de son utilisation unique. De plus, le fait que plusieurs utilisateurs utilisent la même serviette en tissu augmente le risque de contamination virale, ce qui fait de la serviette en papier une alternative meilleure et plus sûre.

Portée du marché des serviettes en papier en Amérique du Nord

Le marché des serviettes en papier est segmenté en fonction du type de produit, de l'utilisation finale et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de produit

- Serviettes roulées

- Serviettes pliées

- Serviettes et serviettes de luxe

- Serviettes en boîte

Utilisation finale

- Soins personnels

- Soins à domicile

- Soins de santé

- Hospitalité

- Commercial

- Autres

Canal de distribution

- Vente directe

- Commerce électronique

- Magasins de détail

- Autres

Analyse/perspectives régionales du marché des serviettes en papier

Le marché des serviettes en papier est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type, type de produit, utilisation finale et canal de distribution comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des serviettes en papier sont les États-Unis, le Canada et le Mexique en Amérique du Nord.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des serviettes en papier

Le paysage concurrentiel du marché des serviettes en papier fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des serviettes en papier.

Certains des principaux acteurs opérant sur le marché des serviettes en papier sont

- KALSINT (États-Unis)

- Queenex (EAU)

- Déchets américains et textiles, LLC (États-Unis)

- Riverside Paper Co. lnc. (États-Unis)

- National Wiper Alliance lnc. (États-Unis)

- Produits d'emballage Larsen, Inc. (États-Unis)

- Ovasco Industries (États-Unis)

- Carl Hubenthal GmbH & Co. KG. (Allemagne)

- Géorgie-Pacifique (États-Unis)

- METSÄ TISSUE (Finlande)

- Procter & Gamble (États-Unis)

- KCWW (États-Unis)

- CARE Ratings Limited (Inde)

- HengAn (Chine)

- Groupe SHP (Slovaquie)

- Grigeo (Lituanie)

- Essity Aktiebolag (publ) (Suède)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA TISSUE TOWEL MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USE COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 IMPORT-EXPORT DATA

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH LEVEL OF ABSORBENCY AS COMPARED TO OTHER ALTERNATIVES INCLUDING HOT AIR DRYERS

5.1.2 PAPER TOWEL IS MORE ENVIRONMENTALLY EFFICIENT AS COMPARED TO ELECTRIC AIR DRYERS

5.1.3 INCREASING HEALTH AWARENESS AND PREVENTION FROM CROSS-CONTAMINATION

5.2 RESTRAINTS

5.2.1 ENVIRONMENTAL DEGRADATION CAUSED DUE TO TISSUE INDUSTRIES

5.2.2 ENVIRONMENTAL CONCERNS DUE TO CUTTING DOWN OF TREES IMPACTING URBAN ECOSYSTEM

5.2.3 STRENGTHENING OF REGULATIONS TOWARDS DEFORESTATION

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF ECO-FRIENDLY BIODEGRADABLE DISPOSABLE TISSUES

5.3.2 DEVELOPMENT OF AFFORDABLE TABLET TISSUES FOR DEVELOPING COUNTRIES

5.4 CHALLENGE

5.4.1 FLUCTUATION IN RAW MATERIAL PRICES IMPACTING BOTTOM LINE OF MANUFACTURERS

6 IMPACT OF COVID-19 PANDEMIC ON THE NORTH AMERICA TISSUE TOWEL MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA TISSUE TOWEL MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA TISSUE TOWEL MARKET

6.3 STRATERGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 ROLLED TOWELS

7.2.1 STANDARD ROLLS

7.2.2 CENTER PULL ROLLS

7.3 FOLDED TOWELS

7.3.1 CENTREFOLD

7.3.2 MULTI-FOLD

7.4 BOXED TOWELS

7.5 NAPKINS AND LUXURY TOWELS

8 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE

8.1 OVERVIEW

8.2 HOME CARE

8.3 COMMERCIAL

8.3.1 OFFICE

8.3.2 RESTAURANTS

8.4 PERSONAL CARE

8.5 HEALTH CARE

8.6 HOSPITALITY

8.7 OTHERS

8.7.1 EDUCATION & RESEARCH INSTITUTES

8.7.2 PUBLIC WASHROOMS

9 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 RETAIL STORES

9.2.1 HYPERMARKETS

9.2.2 SUPERMARKETS

9.2.3 WHOLESALE STORE

9.2.4 SPECIALTY STORES

9.2.5 OTHERS

9.3 E-COMMERCE

9.4 DIRECT SALES

9.5 OTHERS

10 NORTH AMERICA TISSUE TOWEL MARKET BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA TISSUE TOWEL MARKET, COMPANY LANDSCAPE

11.1 MERGERS & ACQUISITIONS

11.2 EXPANSIONS

11.3 NEW PRODUCT DEVELOPMENTS

11.4 PARTNERSHIP

12 SWOT AND DATABRIDGE MARKET RESEARCH ANALYSIS: NORTH AMERICA TISSUE TOWEL MARKET

12.1 SWOT ANALYSIS

12.1.1 STRENGTH: - STRONG GEOGRAPHICAL PRESENCE

12.1.2 WEAKNESS: - VOLATILE INPUT PRICES

12.1.3 OPPORTUNITY: - STRATEGIC ACQUISITIONS

12.1.4 THREAT: - AVAILABLITY OF SUBSTITUTES

12.2 DATABRIDGE MARKET RESEARCH ANALYSIS: NORTH AMERICA TISSUE TOWEL MARKET

13 COMPANY PROFILE

13.1 GEORGIA-PACIFIC

13.1.1 COMPANY SNAPSHOT

13.1.2 PRODUCT PORTFOLIO

13.1.3 RECENT UPDATES

13.2 PROCTER & GAMBLE

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 KCWW

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 KP TISSUE INC.

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 METSÄ TISSUE (A SUBSIDIARY OF METSÄ GROUP)

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATE

13.6 CASCADES INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATE

13.7 IRVING CONSUMER PRODUCTS LIMITED.

13.7.1 COMPANY SNAPSHOT

13.7.2 BRAND PORTFOLIO

13.7.3 RECENT UPDATES

13.8 ASALEO CARE LIMITED

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 BRAND PORTFOLIO

13.8.4 RECENT UPDATE

13.9 BLUE RIDGE TISSUE CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT UPDATE

13.1 ESSITY AKTIEBOLAG (PUBL).

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 BRAND PORTFOLIO

13.10.4 RECENT UPDATES

13.11 FLOWER CITY TISSUE MILLS CO

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT UPDATE

13.12 GLOBAL TISSUE GROUP, INC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT UPDATE

13.13 GORHAM PAPER & TISSUE.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT UPDATE

13.14 NOVA TISSUE

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT UPDATE

13.15 WEPA HYGIENEPRODUKTE GMBH

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT UPDATE

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF TOILET OR FACIAL TISSUE STOCK, TOWEL OR NAPKIN STOCK AND SIMILAR PAPER FOR HOUSEHOLD OR SANITARY PURPOSES, CELLULOSE WADDING AND WEBS OF CELLULOSE FIBRES, WHETHER OR NOT CREPED, CRINKLED, EMBOSSED, PERFORATED, SURFACE-COLOURED, SURFACE-DECORATED OR PRINTED, IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE: 4803 (USD THOUSAND)

TABLE 2 EXPORT DATA OF TOILET OR FACIAL TISSUE STOCK, TOWEL OR NAPKIN STOCK AND SIMILAR PAPER FOR HOUSEHOLD OR SANITARY PURPOSES, CELLULOSE WADDING AND WEBS OF CELLULOSE FIBRES, WHETHER OR NOT CREPED, CRINKLED, EMBOSSED, PERFORATED, SURFACE-COLOURED, SURFACE-DECORATED OR PRINTED, IN ROLLS OF A WIDTH > 36 CM OR IN SQUARE OR RECTANGULAR SHEETS WITH ONE SIDE > 36 CM AND THE OTHER SIDE > 15 CM IN THE UNFOLDED STATE; HS CODE: 4803 (USD THOUSAND)

TABLE 3 SUMMARY OF PRIMARY OR ESSENTIAL PROPERTIES OF AWAY FROM HOME (AFH) TISSUE PRODUCTS IN THE U.S. MARKET (2005)

TABLE 4 RANK ORDER 0F ENVIRONMEMNTAL IMPACT OF THE PRODUCTS

TABLE 5 NORTH AMERICA TREE GRADES CONSUMPTION, BY TISSUE TOWEL TYPE (2019)

TABLE 6 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 7 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 8 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 9 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 10 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 11 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 12 NORTH AMERICA FOLDED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 13 NORTH AMERICA FOLDED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 14 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 15 NORTH AMERICA FOLDED TOWEL IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 16 NORTH AMERICA BOXED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 17 NORTH AMERICA BOXED TOWEL PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 18 NORTH AMERICA NAPKINS AND LUXURY TOWELS PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 19 NORTH AMERICA NAPKINS AND LUXURY TOWELS PRODUCT TYPE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 20 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 21 NORTH AMERICA HOME CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 22 NORTH AMERICA COMMERCIAL END-USE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 23 NORTH AMERICA COMMERCIAL END-USE IN TISSUE TOWEL MARKET, BY COMMERCIAL TYPE, 2019-2027 (USD MILLION)

TABLE 24 NORTH AMERICA PEESONAL CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 25 NORTH AMERICA HEALTH CARE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 26 NORTH AMERICA HOSPITALITY IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 28 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 29 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 30 NORTH AMERICA RETAIL STORE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 31 NORTH AMERICA RETAIL STORE IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLIO N)

TABLE 32 NORTH AMERICA E-COMMERCE IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 33 NORTH AMERICA DIRECT SALES IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 34 NORTH AMERICA OTHERS IN TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 35 NORTH AMERICA TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (THOUSAND TONS)

TABLE 36 NORTH AMERICA TISSUE TOWEL MARKET, BY COUNTRY, 2019-2027 (USD MILLION)

TABLE 37 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 38 NORTH AMERICA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 39 NORTH AMERICA ROLLED TOWELS IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 40 NORTH AMERICA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 41 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027, 2019-2027 (THOUSAND TONS)

TABLE 42 NORTH AMERICA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 43 NORTH AMERICA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 44 NORTH AMERICA COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 45 NORTH AMERICA COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 46 NORTH AMERICA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 47 NORTH AMERICA RETAIL STORE TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 48 U.S. TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 49 U.S. TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 50 U.S. ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 51 U.S ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 52 U.S. FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 53 U.S FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 54 U.S. TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 55 U.S. COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 56 U.S. COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 57 U.S. TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 58 U.S. RETAIL STORE IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 59 CANADA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 60 CANADA TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 61 CANADA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 62 CANADA ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 63 CANADA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 64 CANADA FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 65 CANADA TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 66 CANADA COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 67 CANADA COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 68 CANADA TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 69 CANADA RETAIL STORES IN TISSUE TOWEL MARKET, BY RETAIL STORES DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 70 MEXICO TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 71 MEXICO TISSUE TOWEL MARKET, BY PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 72 MEXICO ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 73 MEXICO ROLLED TOWEL IN TISSUE TOWEL MARKET, BY ROLLED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 74 MEXICO FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (THOUSAND TONS)

TABLE 75 MEXICO FOLDED TOWELS IN TISSUE TOWEL MARKET, BY FOLDED TOWELS PRODUCT TYPE, 2019-2027 (USD MILLION)

TABLE 76 MEXICO TISSUE TOWEL MARKET, BY END-USE, 2019-2027 (USD MILLION)

TABLE 77 MEXICO COMMERCIAL TISSUE TOWEL MARKET, BY COMMERCIAL END-USE, 2019-2027 (USD MILLION)

TABLE 78 MEXICO COMMERCIAL TISSUE TOWEL MARKET, BY OTHERS END-USE, 2019-2027 (USD MILLION)

TABLE 79 MEXICO TISSUE TOWEL MARKET, BY DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

TABLE 80 MEXICO RETAIL STORES IN TISSUE TOWEL MARKET, BY RETAIL STORE DISTRIBUTION CHANNEL, 2019-2027 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA TISSUE TOWEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TISSUE TOWEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TISSUE TOWEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TISSUE TOWEL MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TISSUE TOWEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TISSUE TOWEL MARKET: PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA TISSUE TOWEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA TISSUE TOWEL MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TISSUE TOWEL MARKET: MARKET END-USE COVERAGE GRID

FIGURE 10 NORTH AMERICA TISSUE TOWEL MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA TISSUE TOWEL MARKET: SEGMENTATION

FIGURE 12 HIGH LEVEL OF ABSORBENCY AS COMPARED TO OTHER ALTERNATIVES INCLUDING HOT AIR DRYERS IS DRIVING THE NORTH AMERICA TISSUE TOWEL MARKET IN THE FORECAST PERIOD OF 2021 TO 2027

FIGURE 13 ROLLED TOWELS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TISSUE TOWEL MARKET IN 2021 & 2027

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA TISSUE TOWEL MARKET

FIGURE 15 GLOBAL PER CAPITA TOILET PAPER ROLLS CONSUMPTION, BY COUNTRY (2019)

FIGURE 16 GLOBAL FOREST COVER LOSS, SQ. KM (2000-2005)

FIGURE 17 GLOBAL PER CAPITA CONSUMPTION OF TISSUE, BY REGIONS, 2017 (KG)

FIGURE 18 NORTH AMERICA TISSUE TOWEL MARKET: BY PRODUCT TYPE, 2020

FIGURE 19 NORTH AMERICA TISSUE TOWEL MARKET: BY END-USE, 2020

FIGURE 20 NORTH AMERICA TISSUE TOWEL MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 21 NORTH AMERICA TISSUE TOWEL MARKET: SNAPSHOT (2020)

FIGURE 22 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2020)

FIGURE 23 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2021 & 2027)

FIGURE 24 NORTH AMERICA TISSUE TOWEL MARKET: BY COUNTRY (2020 & 2027)

FIGURE 25 NORTH AMERICA TISSUE TOWEL MARKET: BY PRODUCT TYPE (2020-2027)

FIGURE 26 NORTH AMERICA TISSUE TOWEL MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.