Marché des emballages d’isolation thermique en Amérique du Nord, marché des emballages d’isolation thermique , par produit (boîtes, sacs, doublures en carton, coussins à bulles et autres), type d’emballage (emballage passif, emballage actif et stockage à froid), matériau (polystyrène, polyuréthane (PUR), polyéthylène, panneaux isolés sous vide (VIP), polylactique (PLA), carton ondulé et autres), plage de température (réfrigérée, congelée et ambiante), application (produits pharmaceutiques, aliments et boissons, produits chimiques, produits horticoles, électronique et autres) – Tendances et prévisions de l’industrie jusqu’en 2029.

Analyse et taille du marché des emballages d'isolation thermique en Amérique du Nord

Les matériaux d'isolation thermique agissent comme une barrière empêchant le transfert de chaleur entre des objets de températures différentes. L'emballage thermique permet de préserver la composition chimique des produits pharmaceutiques, garantissant ainsi qu'aucune perte d'efficacité ne soit constatée pendant le transport. Il est important de connaître le temps maximum que peut prendre une expédition, en fonction duquel l'isolation doit maintenir correctement les températures contrôlées jusqu'à ce que le produit atteigne sa destination. Ces matériaux sont utilisés dans les emballages dans le cadre d'une chaîne du froid pour aider à maintenir la fraîcheur et l'efficacité du produit.

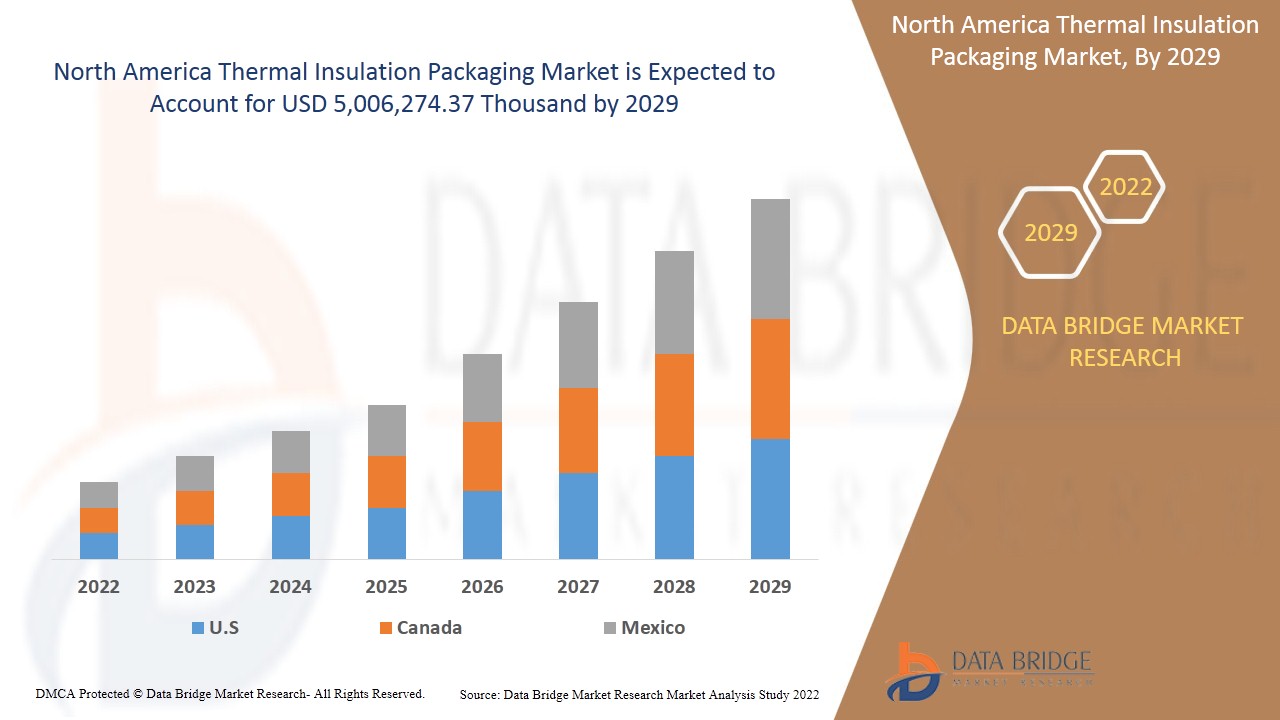

Selon les analyses de Data Bridge Market Research, le marché des emballages d'isolation thermique devrait atteindre la valeur de 5 006 274,37 milliers de dollars d'ici 2029, à un TCAC de 6,8 % au cours de la période de prévision. Les « boîtes » représentent le segment de produits le plus important sur le marché concerné en raison de l'augmentation de la demande de produits sensibles à la température. Le rapport de marché élaboré par l'équipe de Data Bridge Market Research comprend une analyse approfondie des experts, une analyse des importations/exportations, une analyse des prix, une analyse de la consommation de production et un scénario de chaîne climatique.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en unités, prix en dollars américains |

|

Segments couverts |

Produit (boîte, sacs, doublures en carton, coussins à bulles et autres), type d'emballage (emballage passif, emballage actif et stockage à froid), matériau (polystyrène, polyuréthane (PUR), polyéthylène, panneaux isolés sous vide (VIP), polylactique (PLA), carton ondulé et autres), plage de températures (réfrigérée, congelée et ambiante), application (produits pharmaceutiques, aliments et boissons, produits chimiques, produits horticoles, électronique et autres) |

|

Pays couvert |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Parmi d'autres, citons Thermal Ice, QProducts & Services, Nordic Cold Chain Solutions, Biobright, Sealed Air, ABBE, DUFAYLITE, Cellulose Material Solutions, LLC, Cold Chain Technologies, Sonoco Products Company, SOFRIGAM, The Wool Packaging Company Limited, Insulated Products Corporation, Cryopak, DS Smith, Intelsius, Softbox, WestRock Company et Avantor, Inc. |

Définition du marché

L'emballage thermique est un produit qui agit comme un isolant entre un produit expédié et l'air extérieur. Il permet d'expédier un produit chaud en hiver ou un produit froid en été. Les conteneurs d'expédition isothermes sont un type d'emballage utilisé pour expédier des produits sensibles à la température tels que les aliments, les produits pharmaceutiques, les organes, le sang, les matières biologiques, les vaccins et les produits chimiques. Ils sont utilisés dans le cadre d'une chaîne du froid pour aider à maintenir la fraîcheur et l'efficacité des produits.

Cadre réglementaire

- La norme ou méthode d'essai américaine ASTM (American Society for Testing and Materials) D3103-07 porte sur la détermination de la qualité de l'isolation thermique d'un emballage et de la stabilité thermique de son contenu lorsqu'il est exposé à des conditions de température ambiante variables. Cette norme ne prétend pas répondre à tous les problèmes de sécurité, le cas échéant, associés à son utilisation. Il incombe à l'utilisateur de cette norme d'établir des pratiques appropriées en matière de sécurité, de santé et d'environnement et de déterminer l'applicabilité des limitations réglementaires avant utilisation.

- AFNOR (Association Française de Normalisation) - NF S99-700, norme française et méthode de qualification des performances thermiques pour valider les conteneurs isothermes et réfrigérants pour produits de santé.

Le COVID-19 a eu un impact minimal sur le marché nord-américain des emballages d'isolation thermique

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, un impact significatif a été constaté sur le marché des emballages d'isolation thermique. Les opérations et la chaîne d'approvisionnement des produits d'emballage thermique, avec plusieurs installations de fabrication, étaient toujours en activité dans la région. Les prestataires de services ont continué à proposer des produits d'emballage thermique en suivant les mesures d'hygiène et de sécurité dans le scénario post-COVID.

La dynamique du marché des emballages d'isolation thermique en Amérique du Nord comprend :

- Demande croissante de produits alimentaires prêts à consommer

Les aliments prêts à cuire nécessitent des solutions d'emballage parfaites pour les protéger de la contamination biologique et des influences physiques. Cela a à son tour augmenté la demande de matériaux d'emballage isolants thermiques et a ainsi contribué à la croissance du marché nord-américain des emballages isolants thermiques.

- Augmentation de l'utilisation des applications dans l'industrie pharmaceutique

L'augmentation des applications des matériaux d'emballage isolants thermiques dans le secteur pharmaceutique est l'un des principaux moteurs du marché des emballages isolants thermiques. De plus, un système d'emballage isolant thermique est nécessaire pour maintenir l'intégrité et la sécurité des produits médicaux, ce qui augmente à son tour la demande de matériaux d'emballage isolants thermiques, contribuant ainsi à la croissance du marché nord-américain des emballages isolants thermiques.

- La préférence des consommateurs évolue vers les produits sensibles à la température

La demande croissante de produits sensibles à la température a également entraîné une augmentation de la demande de matériaux d'emballage isolants pour conserver les produits en toute sécurité et au frais. Cela augmente à son tour la demande de matériaux d'emballage isolants thermiques et contribue ainsi à la croissance du marché nord-américain des emballages isolants thermiques.

- Augmentation des dépenses consacrées au système de livraison de la chaîne du froid

Les produits pharmaceutiques et alimentaires de la chaîne du froid nécessitent une infrastructure fiable, comme des installations d'emballage et de stockage isothermes, pour maintenir une plage de température précise lors du transport du fabricant au consommateur. Cela augmente à son tour la demande de matériaux d'emballage isolants thermiques, contribuant ainsi à la croissance du marché nord-américain des emballages isolants thermiques.

- Perspectives positives pour le secteur du commerce électronique

Les tendances en constante évolution du secteur du commerce électronique ont ouvert de nombreuses opportunités aux fournisseurs de solutions d'emballage à isolation thermique pour adopter des technologies et des conceptions innovantes afin d'accroître leur part de marché. Cela augmente à son tour la demande de matériaux d'emballage à isolation thermique et augmente donc la croissance du marché nord-américain des emballages à isolation thermique.

- Progrès technologiques dans la production de produits d'emballage thermique

L'évolution rapide et croissante de la technologie de production d'emballages isolants thermiques aidera les fabricants à réaliser davantage de bénéfices et à accroître leurs capacités de production, ce qui, à son tour, répondra à la demande croissante de matériaux d'emballage isolants thermiques. Cela constituera une opportunité majeure pour l'expansion et la croissance du marché nord-américain des emballages isolants thermiques.

Contraintes/défis rencontrés par le marché nord-américain des emballages d'isolation thermique

- Mise en œuvre de réglementations gouvernementales strictes

Les vagues de chaleur et les climats chauds peuvent aggraver les processus photochimiques et favoriser la production d'ozone de faible niveau. Par conséquent, les gouvernements de divers pays ont défini des règles et réglementations strictes pour les unités de fabrication d'emballages, en tenant compte des préoccupations environnementales et de la pollution, ce qui à son tour fait chuter la demande d'emballages isolants thermiques, affectant la croissance du marché nord-américain des emballages isolants thermiques .

- Volatilité des prix des matières premières

En outre, une plus grande fluctuation du prix des matières premières pourrait entraîner des pertes pour les fabricants. Les fluctuations du marché créeront un marché instable, où non seulement les fabricants mais aussi les fournisseurs et les utilisateurs finaux subiront un impact négatif. Ainsi, la fluctuation des prix des matières premières constitue un défi pour le marché nord-américain des emballages d'isolation thermique.

Ce rapport sur le marché des emballages d'isolation thermique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché des rodenticides, contactez Data Bridge Market Research pour un briefing d'analyste. Notre équipe vous aidera à prendre une décision éclairée sur le marché pour atteindre la croissance du marché.

Développements récents

- En juillet 2022, Nordic Cold Chain Solutions a présenté les méthodes et l'importance de l'utilisation du processus de la chaîne du froid. Cela a aidé l'entreprise à attirer davantage de clients dans la région.

- En février 2022, Cryopak a inventé CryoEco, une solution d'emballage réfrigéré en papier ajoutée à son portefeuille de solutions durables. Le lancement de ce produit a encore stimulé les ventes de l'entreprise.

- En décembre 2021, Avantor, Inc. a conclu un accord de distribution pour fournir les produits chimiques et les fournitures de la division Agilent Technologies aux États-Unis et au Canada. Cela a permis à l'entreprise de générer des revenus à long terme.

Portée du marché nord-américain des emballages d'isolation thermique

Le marché nord-américain des emballages d'isolation thermique est segmenté en fonction du produit, du type d'emballage, du matériau, de la plage de température et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Produit

- Boîte

- Sacs

- Doublures en carton

- Amorti à bulles

- Autres

Sur la base du produit, le marché nord-américain des emballages d'isolation thermique est segmenté en boîtes, sacs, doublures en carton, coussins à bulles et autres. Les boîtes représentent le plus grand marché et devraient connaître une forte croissance car les boîtes conservent mieux la fraîcheur des produits par rapport aux autres produits, ce qui augmente sa demande dans la région.

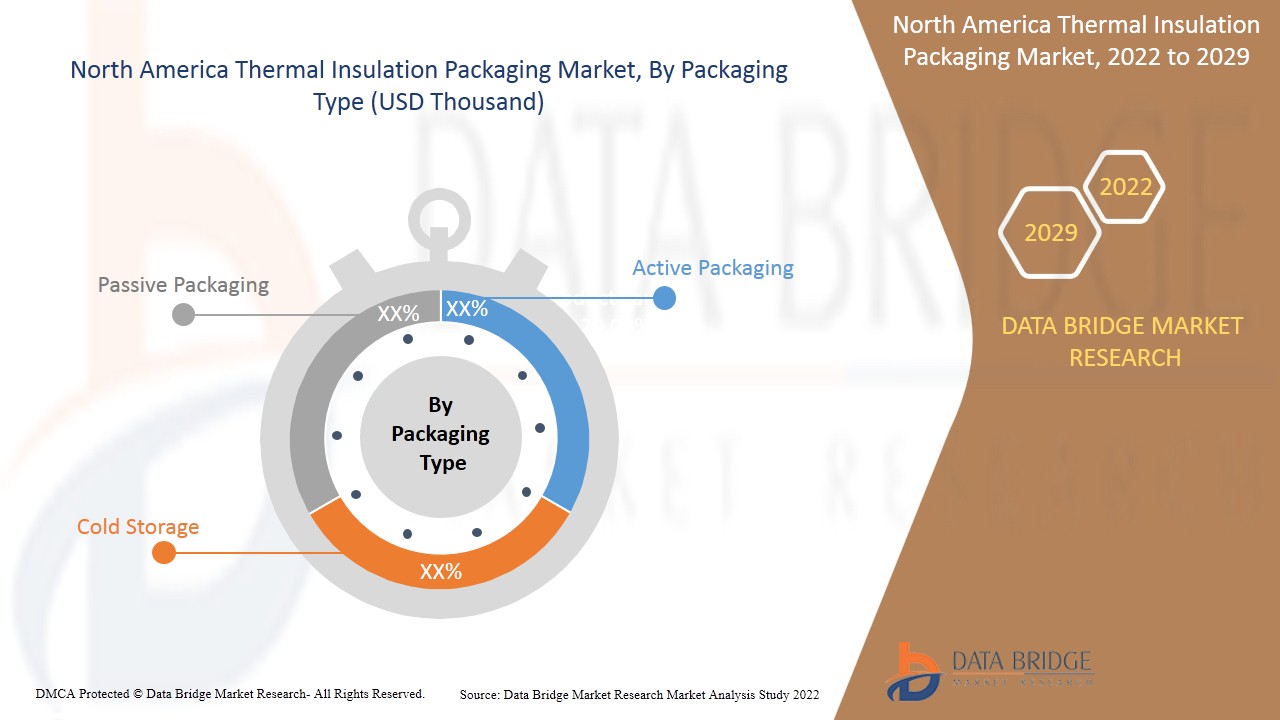

Type d'emballage

- Emballage passif

- Emballage actif

- Entreposage frigorifique

En fonction du type d'emballage, le marché nord-américain des emballages d'isolation thermique est segmenté en emballages passifs, emballages actifs et stockage à froid. Les emballages passifs représentent le plus grand marché et devraient connaître une forte croissance car ils sont légers et aident à protéger les marchandises contre les dommages extérieurs, ce qui augmente leur demande dans la région.

Matériel

- Polystyrène

- Polyuréthane (PUR)

- Polyéthylène

- Panneaux isolés sous vide (VIP)

- Polylactique (PLA)

- Carton ondulé en fibre de verre

- Autres

Sur la base des matériaux, le marché nord-américain des emballages d'isolation thermique est segmenté en polystyrène, polyuréthane (PUR), polyéthylène, panneaux isolés sous vide (VIP), polylactique (PLA), carton ondulé et autres. Le segment du polystyrène devrait connaître une croissance rapide car le polystyrène est facile à mouler et possède une bonne stabilité dimensionnelle, ce qui augmente sa demande dans la région.

Plage de température

- Réfrigéré

- Congelé

- Ambiant

En fonction de la plage de température, le marché nord-américain des emballages d'isolation thermique est segmenté en réfrigérés, congelés et ambiants. Le segment réfrigéré devrait croître à un rythme élevé car la température réfrigérée ralentit la croissance bactérienne, ce qui augmente sa demande dans la région.

Application

- Pharmaceutique

- Alimentation et boissons

- Produits chimiques

- Produits horticoles

- Électronique

- Autres

En fonction des applications, le marché nord-américain des emballages isolants thermiques est segmenté en produits pharmaceutiques, aliments et boissons, produits chimiques, produits horticoles, électroniques et autres. Le segment pharmaceutique devrait connaître une croissance rapide, car les emballages isolants thermiques réduisent les mouvements de chaleur et la condensation de vapeur, ce qui augmente sa demande dans la région.

Analyse du paysage concurrentiel et des parts de marché des emballages d'isolation thermique en Amérique du Nord

Le paysage concurrentiel du marché des emballages d'isolation thermique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination de l'application. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des emballages d'isolation thermique.

Certains des principaux acteurs opérant sur le marché des emballages d'isolation thermique sont Thermal Ice, produits & Services, Nordic Cold Chain Solutions, Biobright, Sealed Air, ABBE, DUFAYLITE, Cellulose Material Solutions, LLC, Cold Chain Technologies, Sonoco Products Company, SOFRIGAM, CSafe Middle East and Africa, Insulated Products Corporation, Cryopak, DS Smith, Intelsius, The Wool Packaging Company Limited, WestRock Company et Avantor, Inc. entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA THERMAL INSULATION PACKAGING MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PACKAGING TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 LIST OF KEY PATENTS LAUNCHED

4.2 TECHNOLOGICAL ADVANCEMENT

4.3 PORTER’S FIVE FORCES:

4.3.1 THE THREAT OF NEW ENTRANTS:

4.3.2 THE THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 VENDOR SELECTION CRITERIA

4.5 PESTLE ANALYSIS

4.5.1 POLITICAL FACTORS:

4.5.2 ECONOMIC FACTORS:

4.5.3 SOCIAL FACTORS:

4.5.4 TECHNOLOGICAL FACTORS:

4.5.5 LEGAL FACTORS:

4.5.6 ENVIRONMENTAL FACTORS:

4.6 REGULATION COVERAGE

4.6.1 CERTIFIED STANDARDS

4.6.2 SAFETY STANDARDS

4.6.2.1 MATERIAL HANDLING & STORAGE

4.6.2.2 TRANSPORT & PRECAUTIONS

4.6.2.3 HAZARD IDENTIFICATION

4.7 LEGISLATION ISSUE

5 SUPPLY CHAIN ANALYSIS

5.1 OVERVIEW

5.2 LOGISTIC COST SCENARIO

5.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

6 CLIMATE CHANGE SCENARIO

6.1 ENVIRONMENTAL CONCERNS:

6.2 INDUSTRY RESPONSE

6.3 G O V E R NME N T’ S ROLE

6.4 ANALYST RECOMMENDATION

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 GROWING DEMAND FOR READY-TO-EAT FOOD PRODUCTS

7.1.2 RISE IN APPLICATION USAGE IN PHARMACEUTICAL INDUSTRY

7.1.3 SHIFTING CONSUMER’S PREFERENCE TOWARDS TEMPERATURE-SENSITIVE GOODS

7.1.4 INCREASING SPENDING TOWARDS COLD-CHAIN DELIVERY SYSTEM

7.2 RESTRAINT

7.2.1 VOLATILITY IN PRICES OF RAW MATERIALS

7.3 OPPORTUNITIES

7.3.1 POSITIVE OUTLOOK TOWARDS E-COMMERCE INDUSTRY

7.3.2 ADVANCES IN TECHNOLOGY FOR PRODUCING THERMAL PACKAGING PRODUCTS

7.4 CHALLENGES

7.4.1 EXTENSIVE COST REQUIRED FOR ADHERING TO QUALIFICATION STANDARDS IN INSULATED PACKAGING

7.4.2 IMPLEMENTATION OF STRICT GOVERNMENT REGULATIONS

8 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 BOX

8.3 BAGS

8.4 CARTON LINERS

8.5 BUBBLE CUSHIONING

8.6 OTHERS

9 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE

9.1 OVERVIEW

9.2 PASSIVE PACKAGING

9.3 ACTIVE PACKAGING

9.4 COLD STORAGE

10 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL

10.1 OVERVIEW

10.2 POLYSTYRENE

10.2.1 EXTRUDED POLYSTYRENE

10.2.2 EXPANDED POLYSTYRENE FOAM (EPS)

10.3 POLYURETHANE (PUR)

10.4 POLYETHYLENE

10.5 VACUUM INSULATED PANELS (VIP)

10.6 POLYLACTIC (PLA)

10.7 CORRUGATED FIBRE BOARD

10.8 OTHERS

11 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE

11.1 OVERVIEW

11.2 REFRIGERATED

11.3 FROZEN

11.4 AMBIENT

12 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 PHARMACEUTICAL

12.2.1 BY PRODUCT

12.2.1.1 BOX

12.2.1.2 BAGS

12.2.1.3 CARTON LINERS

12.2.1.4 BUBBLE CUSHIONING

12.2.1.5 OTHERS

12.2.2 BY SEGMENT

12.2.2.1 PHARMA MANUFACTURING

12.2.2.2 CONTRACT PACKAGING

12.2.2.3 RETAIL PHARMACY

12.2.2.4 INSTITUTIONAL PHARMACY

12.3 FOOD & BEVERAGE

12.3.1 BY PRODUCT

12.3.1.1 BOX

12.3.1.2 BAGS

12.3.1.3 CARTON LINERS

12.3.1.4 BUBBLE CUSHIONING

12.3.1.5 OTHERS

12.3.2 BY TYPE

12.3.2.1 BEVERAGES

12.3.2.2 PROCESSED FOOD

12.3.2.2.1 MEAT & POULTRY

12.3.2.2.2 READY MEALS

12.3.2.2.3 BAKERY PRODUCTS

12.3.2.2.4 PIZZA

12.3.2.2.5 SOUP & NOODLES

12.3.2.2.6 OTHERS

12.3.2.3 SEA FOOD

12.3.2.3.1 FISH

12.3.2.3.2 CRABS

12.3.2.3.3 SHRIMPS

12.3.2.3.4 PRAWNS

12.3.2.3.5 OTHERS

12.4 CHEMICALS

12.4.1 BY PRODUCT

12.4.1.1 BOX

12.4.1.2 BAGS

12.4.1.3 CARTON LINERS

12.4.1.4 BUBBLE CUSHIONING

12.4.1.5 OTHERS

12.5 HORTICULTURE PRODUCTS

12.5.1 BY PRODUCT

12.5.1.1 BOX

12.5.1.2 BAGS

12.5.1.3 CARTON LINERS

12.5.1.4 BUBBLE CUSHIONING

12.5.1.5 OTHERS

12.5.2 BY SEGMENT

12.5.2.1 FRUITS

12.5.2.2 VEGETABLES

12.5.2.3 FLOWER & ORNAMENTAL PLANTS

12.5.2.4 OTHERS

12.6 ELECTRONICS

12.6.1 BY PRODUCT

12.6.1.1 BOX

12.6.1.2 BAGS

12.6.1.3 CARTON LINERS

12.6.1.4 BUBBLE CUSHIONING

12.6.1.5 OTHERS

12.6.2 BY SEGMENT

12.6.2.1 CONSUMER ELECTRONICS

12.6.2.2 INDUSTRIAL ELECTRONICS

12.7 OTHERS

12.7.1 BY PRODUCT

12.7.2 BOX

12.7.3 BAGS

12.7.4 CARTON LINERS

12.7.5 BUBBLE CUSHIONING

12.7.6 OTHERS

13 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY REGION

13.1 NORTH AMERICA

13.1.1 U.S.

13.1.2 CANADA

13.1.3 MEXICO

14 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.2 MERGERS & ACQUISITIONS

14.3 EXPANSIONS

14.4 NEW PRODUCT DEVELOPMENTS

14.5 PARTNERSHIPS

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 SONOCO PRODUCTS COMPANY

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT UPDATES

16.2 DS SMITH

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 COMPANY SHARE ANALYSIS

16.2.4 PRODUCT PORTFOLIO

16.2.5 RECENT UPDATES

16.3 AVANTOR, INC.

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 COMPANY SHARE ANALYSIS

16.3.4 PRODUCT PORTFOLIO

16.3.5 RECENT UPDATES

16.4 WESTROCK COMPANY

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 COMPANY SHARE ANALYSIS

16.4.4 PRODUCT PORTFOLIO

16.4.5 RECENT UPDATES

16.5 SEALED AIR

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT UPDATES

16.6 CSAFE NORTH AMERICA

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT UPDATES

16.7 ABBE

16.7.1 COMPANY SNAPSHOT

16.7.2 PRODUCT PORTFOLIO

16.7.3 RECENT UPDATES

16.8 BIOBRIGHT

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT UPDATE

16.9 CELLULOSE MATERIAL SOLUTIONS, LLC

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT UPDATE

16.1 COLD CHAIN TECHNOLOGIES

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT UPDATES

16.11 CRYOPAK

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT UPDATE

16.12 DUFAYLITE

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT UPDATE

16.13 INSULATED PRODUCTS CORPORATION

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT UPDATE

16.14 INTELSIUS

16.14.1 COMPANY SNAPSHOT

16.14.2 PRODUCT PORTFOLIO

16.14.3 RECENT UPDATE

16.15 NORDIC COLD CHAIN SOLUTIONS

16.15.1 COMPANY SNAPSHOT

16.15.2 PRODUCT PORTFOLIO

16.15.3 RECENT UPDATE

16.16 QPRODUCTS & SERVICES

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT UPDATE

16.17 SOFRIGAM

16.17.1 COMPANY SNAPSHOT

16.17.2 PRODUCT PORTFOLIO

16.17.3 RECENT UPDATES

16.18 THE WOOL PACKAGING COMPANY LIMITED

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT UPDATE

16.19 THERMAL ICE

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT UPDATE

17 QUESTIONNAIRE

18 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD THOUSAND)

TABLE 2 EXPORT DATA OF BOXES, CASES, CRATES AND SIMILAR ARTICLES FOR THE CONVEYANCE OR PACKAGING OF GOODS, OF PLASTICS, HS CODE - 392310 (USD THOUSAND)

TABLE 3 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 5 NORTH AMERICA BOX IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA BOX IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 7 NORTH AMERICA BAGS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA BAGS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 9 NORTH AMERICA CARTON LINERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA CARTON LINERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 11 NORTH AMERICA BUBBLE CUSHIONING IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA BUBBLE CUSHIONING IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 13 NORTH AMERICA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (THOUSAND UNITS)

TABLE 15 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA PASSIVE PACKAGING IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA ACTIVE PACKAGING IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA COLD STORAGE IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA POLYURETHANE (PUR) IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA POLYETHYLENE IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA VACUUM INSULATED PANELS (VIP) IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA POLYLACTIC (PLA) IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA CORRUGATED FIBRE BOARD IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA REFRIGERATED IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA FROZEN IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA AMBIENT IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA PHARMACEUTICALS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA OTHERSS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY COUNTRY, 2020-2029 (THOUSAND UNITS)

TABLE 53 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 55 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 72 U.S. THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 73 U.S. THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 74 U.S. THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 U.S. THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 76 U.S. POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 U.S. THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 U.S. PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 81 U.S. FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 82 U.S. FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 83 U.S. PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 84 U.S. SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 85 U.S. CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 86 U.S. HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 87 U.S. HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 88 U.S. ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 89 U.S. ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 90 U.S. OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND

TABLE 91 CANADA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 92 CANADA THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 93 CANADA THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 94 CANADA THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 95 CANADA POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 CANADA THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 97 CANADA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 98 CANADA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 99 CANADA PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 100 CANADA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 101 CANADA FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 CANADA PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 103 CANADA SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 104 CANADA CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 105 CANADA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 106 CANADA HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 107 CANADA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 108 CANADA ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 109 CANADA OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 110 MEXICO THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 111 MEXICO THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (THOUSAND UNITS)

TABLE 112 MEXICO THERMAL INSULATION PACKAGING MARKET, BY PACKAGING TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 MEXICO THERMAL INSULATION PACKAGING MARKET, BY MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 114 MEXICO POLYSTYRENE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 115 MEXICO THERMAL INSULATION PACKAGING MARKET, BY TEMPERATURE RANGE, 2020-2029 (USD THOUSAND)

TABLE 116 MEXICO THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 117 MEXICO PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 118 MEXICO PHARMACEUTICAL IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 119 MEXICO FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 120 MEXICO FOOD & BEVERAGE IN THERMAL INSULATION PACKAGING MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 MEXICO PROCESSED FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 122 MEXICO SEA FOOD IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 123 MEXICO CHEMICALS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 124 MEXICO HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 125 MEXICO HORTICULTURE PRODUCTS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 126 MEXICO ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

TABLE 127 MEXICO ELECTRONICS IN THERMAL INSULATION PACKAGING MARKET, BY SEGMENT, 2020-2029 (USD THOUSAND)

TABLE 128 MEXICO OTHERS IN THERMAL INSULATION PACKAGING MARKET, BY PRODUCT, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: PACKAGING TYPE LIFE LINE CURVE

FIGURE 7 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: SEGMENTATION

FIGURE 14 EUROPE IS EXPECTED TO DOMINATE THE NORTH AMERICA THERMAL INSULATION PACKAGING MARKET AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 RISE IN APPLICATION USAGE IN PHARMACEUTICAL INDUSTRY IS DRIVING THE NORTH AMERICA THERMAL INSULATION PACKAGING MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 16 BOX IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA THERMAL INSULATION PACKAGING MARKET IN 2022 & 2029

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA THERMAL INSULATION PACKAGING MARKET

FIGURE 18 RETAIL E-COMMERCE SALES WORLDWIDE, (USD BILLION)

FIGURE 19 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: BY PRODUCT, 2021

FIGURE 20 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: BY PACKAGING TYPE, 2021

FIGURE 21 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: BY MATERIAL, 2021

FIGURE 22 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: BY TEMPERATURE RANGE, 2021

FIGURE 23 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET, BY APPLICATION, 2021

FIGURE 24 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: SNAPSHOT (2021)

FIGURE 25 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: BY COUNTRY (2021)

FIGURE 26 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 27 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 28 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: BY PRODUCT (2022-2029)

FIGURE 29 NORTH AMERICA THERMAL INSULATION PACKAGING MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.