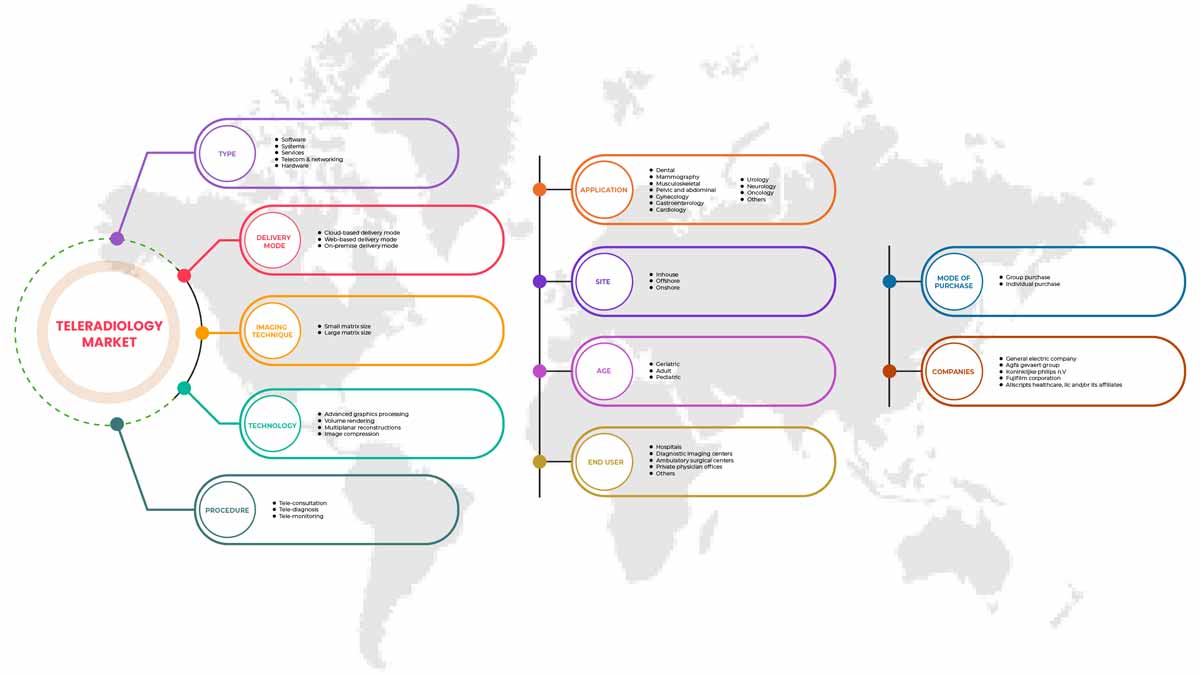

North America Teleradiology Market, By Type (Hardware, Systems, Software, Telecom, and Networking Services), Delivery Mode (Web-Based Delivery Mode, Cloud Based Delivery Mode, and On-Premise Delivery Mode), Imaging Technique (Small Matrix Size, and Large Matrix Size), Technology (Advanced Graphics Processing, Volume Rendering, Multiplanar Reconstructions, and Image Compression), Procedure (Tele-Consultation, Tele-Diagnosis, and Tele-Monitoring), Application (Cardiology, Neurology, Oncology, Musculoskeletal, Gastroenterology, Pelvic and Abdominal, Gynecology, Urology, Mammography, Dental, and Others), Site (In-House, Offshore, and Onshore), Age (Pediatric, Geriatric, and Adults), Mode of Purchase (Group Purchase, and Individual Purchase), End User (Hospitals, Ambulatory Surgical Centers, Private Physician Offices, Diagnostics Imaging Centers, and Others), Industry Trends and Forecast To 2029.

North America Teleradiology Market Analysis and Insights

Teleradiology is a branch of telemedicine in which telecommunication systems are used to transmit radiological images from one location to another. Rapid digital image processing technologies have developed to ensure effective image distribution across the regional, local, and North American levels. The emergence and acceptance of mobile technology (mHealth) to visualize and interpret images further fuels the growth of the teleradiology market in developed nations such as the U.S., Germany, the U.K., Australia, and Japan. Widespread use of smart connected devices and related solutions confirms the effective interpretation of the medical images, thereby reducing treatment time. Hence, advancements in digital technology will enhance remote patient monitoring methodologies and accessibility to radiologists’ interpretation and consultation.

In addition, according to the World Health Organization factsheet, cancer is responsible for one of every six deaths worldwide. Furthermore, approximately 70% of cancer deaths occur in low- and middle-income countries. The increase in the funding by the federal government to drive the adoption of these solutions further influence the market. Additionally, the surge in healthcare expenditure, advancements in healthcare infrastructure, and high demand for expanded care delivery positively affect the teleradiology market.

However, repayments and the growing regulatory burden are expected to dampen the growth of the teleradiology market. On the other hand, the rising cost of technology is anticipated to restrain the market growth.

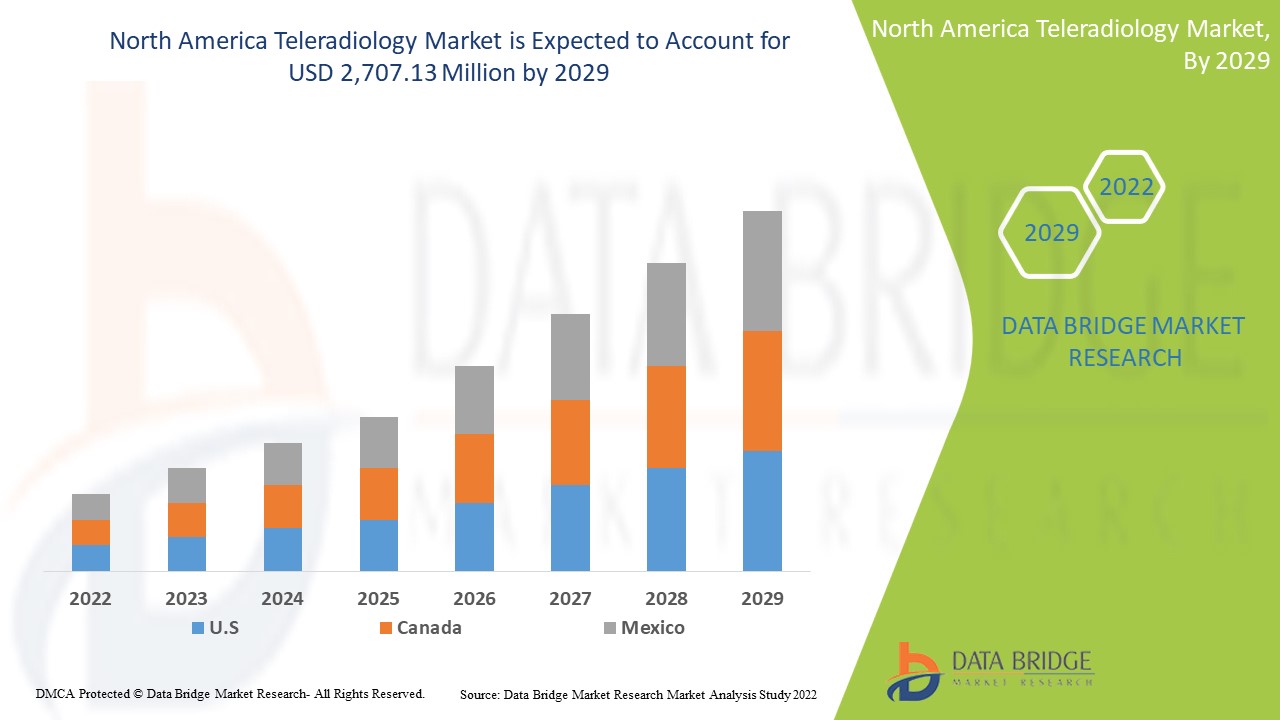

Data Bridge Market Research analyse que le marché nord-américain de la téléradiologie devrait atteindre une valeur de 2 707,13 millions USD d'ici 2029, à un TCAC de 18,5 % au cours de la période de prévision. Les services représentent le segment de type le plus important du marché en raison de l'augmentation des services de téléradiologie au sein de la population nord-américaine. Ce rapport de marché couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par type (matériel, systèmes, logiciels, services de télécommunication et de réseau), mode de livraison (mode de livraison basé sur le Web, mode de livraison basé sur le cloud et mode de livraison sur site), technique d'imagerie (taille de matrice petite et taille de matrice grande), technologie (traitement graphique avancé, rendu de volume, reconstructions multiplanaires et compression d'image), procédure (téléconsultation, télédiagnostic et télésurveillance), application (cardiologie, neurologie, oncologie, musculo-squelettique, gastroentérologie, pelvienne et abdominale, gynécologie, urologie, mammographie, dentaire et autres), site (interne, offshore et onshore), âge (pédiatrie, gériatrie et adultes), mode d'achat (achat groupé et achat individuel), utilisateur final (hôpitaux, centres de chirurgie ambulatoire , cabinets médicaux privés, centres d'imagerie diagnostique et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Clinique de télémédecine, Virtual Radiologic, RamSoft, Inc., Koninklijke Philips NV, Everlight Radiology, Teleradiology Solutions, All-American Teleradiology, Medica Group PLC, Vital Radiology Services, PMG Services, Inc., General Electric, RadNet, Inc., FUJIFILM Corporation, Agfa-Gevaert Group, USARAD.COM, TeleDiagnosys Services Pvt Ltd., ONRAD, Inc., 4ways Healthcare Limited, Allscripts Healthcare, LLC, Redox, Inc., NightHawk Radiology, NightShift Radiology et NucleusHealth, entre autres. |

Définition du marché de la téléradiologie en Amérique du Nord

La téléradiologie est une méthode médicale qui capture des images de l'anatomie interne et des fonctions du corps, ce qui facilite le processus de diagnostic ou de thérapie médicale. L'interprétation de toutes les études d'imagerie non invasives, telles que les radiographies numérisées, la tomodensitométrie, l'IRM, l'échographie et les études de médecine nucléaire, peut être réalisée de cette manière. Elle peut capturer des images médicales à un seul endroit et les faciliter ou les transmettre sur une distance afin qu'un radiologue puisse les visualiser et les interpréter à des fins de diagnostic ou de consultation. La téléradiologie est largement utilisée dans la télésurveillance, la téléconsultation et le télédiagnostic, permettant aux radiologues d'effectuer efficacement leur travail quotidien. La téléradiologie permet des solutions efficaces sur site grâce à une interprétation en temps réel et aux réseaux cloud nord-américains. La téléradiologie aide principalement le personnel médical à accéder aux informations des patients quel que soit leur emplacement, améliorant ainsi la couverture diagnostique. Les services de téléradiologie présentent de nombreuses applications permettant aux radiologues d'utiliser des services Web qui améliorent les soins et les thérapies des patients sans qu'il soit nécessaire d'être physiquement présent sur place.

En outre, la demande croissante de téléradiologie dans les cas de deuxième avis et d’urgence est l’un des moteurs de rendu à fort impact du marché. De plus, la pénurie de professionnels de la santé, en particulier dans les segments de sous-spécialité tels que la radiologie pédiatrique, neurologique et musculo-squelettique, conduit à l’adoption de services de téléradiologie.

Dynamique du marché de la téléradiologie en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

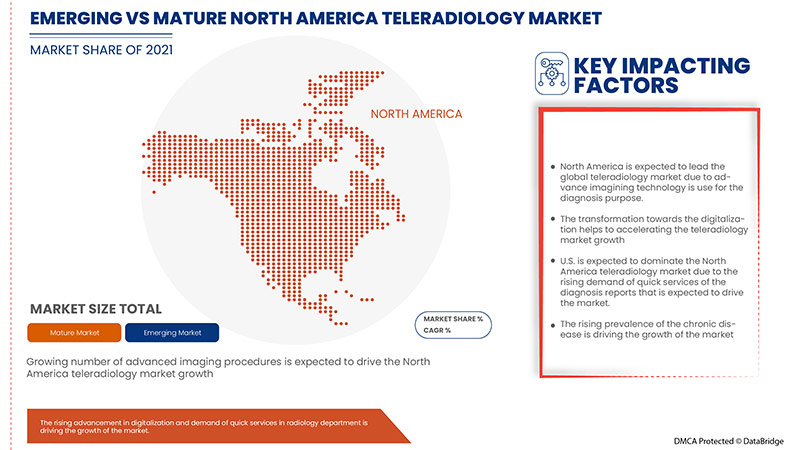

- Nombre croissant de procédures d'imagerie avancées

L’augmentation des procédures d’imagerie devrait stimuler la demande de solutions de téléradiologie pour plus de fiabilité et d’efficacité. L’imagerie diagnostique avancée, notamment l’ imagerie par résonance magnétique (IRM) , la tomodensitométrie (TDM) et l’imagerie de médecine nucléaire, comme la tomographie par émission de positons (TEP), a attiré de nombreux nouveaux prestataires. On constate une prolifération du volume de services d’imagerie médicale diagnostique prescrits par les praticiens, y compris les radiologues.

Les scanners représentent un quart de tous les Américains exposés aux radiations. Un niveau élevé d'ingénierie et d'expertise est nécessaire pour gérer des systèmes d'imagerie diagnostique avancés et sophistiqués, ce qui entraîne une complexité croissante des cas en raison du manque de ressources appropriées. L'adoption de solutions de télédétection a contribué de manière significative à réduire la disparité entre zones rurales et urbaines dans de nombreux pays émergents, dont l'Inde et le Brésil, ainsi que dans des économies développées comme les États-Unis, le Royaume-Uni et l'Allemagne. Ces solutions sont plus pratiques et économiques car elles éliminent les déplacements et permettent aux radiologues de travailler de n'importe où. La pénurie de radiologues qualifiés a encore accru la demande de services de radiologie.

Les procédures d’imagerie avancées pour la téléradiologie devraient aider le marché à obtenir rapidement des résultats plus précis et à propulser la croissance du marché nord-américain de la téléradiologie au cours de la période prévue.

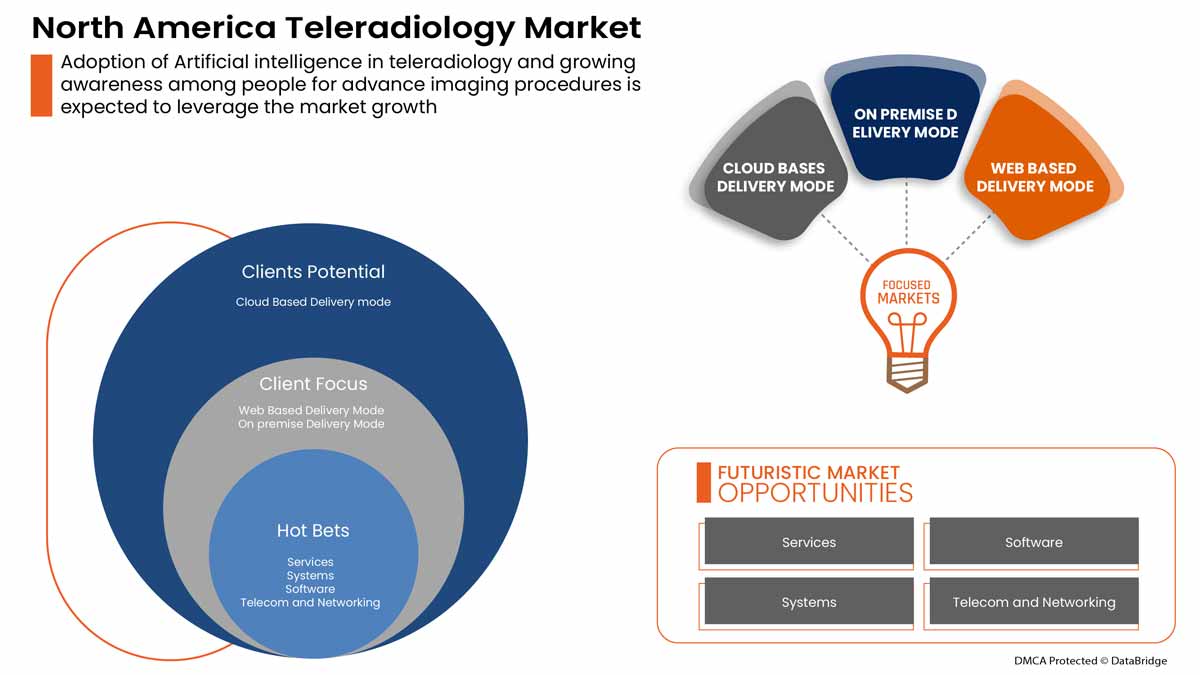

- Adoption de l'intelligence artificielle en téléradiologie

L’intelligence artificielle est l’une des avancées les plus prometteuses en téléradiologie. On estime que le nombre de publications sur l’IA en radiologie est passé d’une moyenne de 100 à 150 publications de recherche par an à 700 à 800 par an au cours de la dernière décennie. Parmi toutes les principales modalités d’imagerie, l’acceptation de l’IA est plus élevée dans les systèmes CT et IRM. Selon l’application, l’IA est également utilisée principalement en neuroradiologie. Plusieurs acteurs de ce marché élargissent leur offre d’IA.

L’IA est intégrée dans de nombreuses institutions médicales à travers le monde et s’est révélée être un partenaire précieux dans le domaine de la radiologie. North America Diagnostics Australia (GDA), une filiale d’Integral Diagnostics Group (IDG), a été l’une des premières sociétés australiennes de diagnostic à déployer l’IA dans le cadre de son flux de travail de radiologie. L’entreprise a intégré des algorithmes haut de gamme dans le parcours de gestion des soins pour accélérer les soins aux patients et le traitement des affections de la tête, du cou et de la poitrine. L’avantage supplémentaire de l’IA en téléradiologie est que l’intelligence artificielle aide les radiologues à analyser rapidement les registres d’images et de données pour mieux comprendre l’état des patients, améliorer leur rôle clinique et faire partie de l’équipe de direction principale. L’IA prend suffisamment de poids pour que le radiologue puisse se concentrer sur les cas complexes qui nécessitent son attention spécialisée.

L'intelligence artificielle (IA) peut aider à créer un système intégré qui hiérarchise les cas en fonction des exigences du protocole. Par exemple, les cas de traumatisme et d'accident vasculaire cérébral peuvent être priorisés et attribués aux listes de travail du radiologue, ce qui permet de sauver de nombreuses vies.

L’intelligence artificielle en téléradiologie permet d’obtenir de meilleurs résultats grâce à des outils automatisés et aide les radiologues à utiliser correctement leurs compétences, ce qui devrait propulser la croissance du marché.

Retenue

- Manque d'accès à l'Internet haut débit dans les zones rurales

La téléradiologie permet aux patients et aux professionnels ruraux de recevoir des conseils d’imagerie de qualité sans se déplacer dans des zones urbaines peuplées dotées de systèmes médicaux plus avancés. De plus, les radiologues travaillant à distance ont besoin d’une bonne connexion Internet. Cependant, le manque de connectivité à haut débit a eu un impact sur l’accès croissant aux services de téléradiologie dans les zones rurales.

L’accès limité aux connexions Internet à haut débit a un impact sur la capacité des radiologues à participer à des consultations vidéo, à soumettre des rapports d’imagerie médicale et à surveiller la santé des patients à distance. Lorsque des vitesses de connexion lentes créent des goulots d’étranglement dans les études à forte intensité d’images, le flux de travail peut rapidement devenir frustrant et affecter les soins aux patients. De plus, des services informatiques sont nécessaires pour garantir que les images sont soumises conformément à la loi HIPAA. Le manque de connectivité Internet fiable et la mauvaise connectivité à large bande dans les zones rurales constituent donc des obstacles majeurs à l’expansion constante du marché nord-américain.

Opportunité

-

Sensibilisation accrue des citoyens

La téléradiologie offre des options alternatives pour recevoir des services de santé en Amérique du Nord, améliorant l’accès et réduisant les coûts associés aux déplacements pour obtenir des services. Cependant, le plein potentiel de la téléradiologie n’a pas été exploité et son adoption est lente et fragmentée.

L’augmentation du programme de sensibilisation, la sensibilisation à la téléradiologie et le soutien du gouvernement ont accru l’utilisation de la téléradiologie et de la télésanté dans divers domaines.

Ces programmes et événements de sensibilisation auprès des gens augmentent leur intérêt pour leur santé et souhaitent en savoir plus sur les programmes de soins de santé et sur les nouvelles opportunités disponibles pour leur santé, ce qui augmentera à terme la croissance du marché de la téléradiologie et offrira des opportunités de croissance aux entreprises.

Défi

- Risques élevés d'erreur de diagnostic

Un examen physique permet de mieux comprendre l'état de santé réel du patient, élément crucial pour le traitement du patient. Tous les programmes de traitement et la prochaine étape du traitement peuvent être créés à l'aide d'un examen physique rapide. La même procédure doit être appliquée aux radiologues pour en savoir plus sur les problèmes et les conditions réels, et de meilleurs résultats sont obtenus lorsque les patients sont présents avec les radiologues lors des consultations. L'absence d'antécédents médicaux du patient et d'autres enregistrements nécessaires de l'examen corporel du patient pendant l'imagerie médicale est un facteur majeur dans l'incapacité du radiologue à prendre la décision optimale en téléradiologie. Par exemple, il a été démontré que la communication entre les médecins et les radiologues entraîne des révisions du diagnostic clinique dans 50 % des cas, ce qui affecte les options thérapeutiques. La précision de l'interprétation changera si les antécédents médicaux du patient sont divulgués de manière appropriée

Ainsi, les risques élevés d’erreur de diagnostic et d’examen incorrect du rapport freinent l’utilisation de la téléradiologie, qui devrait remettre en cause la croissance du marché nord-américain de la téléradiologie.

Impact post-Covid-19 sur le marché de la téléradiologie en Amérique du Nord

L'épidémie de COVID-19 a considérablement affecté les soins de santé en Amérique du Nord, le Royaume-Uni étant l'un des pays les plus durement touchés. Le coronavirus s'est propagé dans le monde entier, affectant des millions de personnes et entraînant des milliers de décès. Les cabinets médicaux de toutes tailles ont été soumis à une pression énorme en raison de l'épidémie de COVID-19 en Amérique du Nord. Le marché a souffert au début de la pandémie car les volumes de traitement médical ont considérablement diminué en raison de la révocation ou du report des procédures électives. D'autre part, les prestataires de soins de santé ont dû s'appuyer sur des solutions de téléradiologie pour lire les rapports de diagnostic et traiter les patients, ce qui a stimulé le secteur de la téléradiologie. Les solutions de téléradiologie ont amélioré l'efficacité de l'imagerie diagnostique en améliorant et en simplifiant la radiologie avec des lectures précises et moins d'erreurs manuelles. Alors que la lutte contre le COVID-19 se poursuit, les méthodes de téléradiologie sont plus largement utilisées.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de multiples activités de R&D, de lancements de produits et de partenariats stratégiques pour améliorer la technologie et les résultats des tests sur le marché des tests pharmacogénétiques.

Développements récents

- En avril 2022, 4ways a annoncé avoir été présélectionné aux Health Investor Awards 2022. 4ways est en lice pour le prix du fournisseur de diagnostics de l'année. Cette reconnaissance a célébré la croissance de 4ways, renforçant sa position de partenaire clé pour les clients. 4ways a continué d'améliorer son offre de services grâce à des innovations dans les flux de travail et à des investissements dans de nouvelles technologies. Cela a permis à 4ways de gagner en résilience en tant que plateforme de téléradiologie et a assuré la sécurité des opérations

Portée du marché de la téléradiologie en Amérique du Nord

Le marché de la téléradiologie en Amérique du Nord est segmenté en type, mode de prestation, technique d'imagerie, technologie, procédure, application, site, âge, mode d'achat et utilisateur final. La croissance entre les segments vous aide à analyser les niches de développement et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Par type

- MATÉRIEL

- SYSTÈMES

- LOGICIEL

- TÉLÉCOM & RÉSEAUX

- SERVICES

Sur la base du type, le marché nord-américain de la téléradiologie est segmenté en services de matériel, de systèmes, de logiciels, de télécommunications et de réseau.

Par mode de livraison

- MODE DE LIVRAISON PAR WEB

- MODE DE LIVRAISON BASÉ SUR LE CLOUD

- MODE DE LIVRAISON SUR PLACE

Sur la base du mode de livraison, le marché nord-américain de la téléradiologie est segmenté en mode de livraison basé sur le Web, en mode de livraison basé sur le cloud et en mode de livraison sur site.

Par technique d'imagerie

- PETITE TAILLE DE MATRICE

- GRANDE TAILLE DE MATRICE

Sur la base des techniques d’imagerie, le marché nord-américain de la téléradiologie est segmenté en matrice de petite taille et matrice de grande taille.

Par technologie

- TRAITEMENT GRAPHIQUE AVANCÉ

- RENDU VOLUMIQUE

- RECONSTRUCTIONS MULTIPLANAIRES

- COMPRESSION D'IMAGE

Sur la base de la technologie, le marché nord-américain de la téléradiologie est segmenté en traitement graphique avancé, rendu de volume, reconstructions multiplanaires et compression d'images.

Par procédure

- TÉLÉCONSULTATION

- TÉLÉDIAGNOSTIC

- TÉLÉSURVEILLANCE

Sur la base de la procédure, le marché nord-américain de la téléradiologie est segmenté en téléconsultation, télédiagnostic et télésurveillance.

Par application

- CARDIOLOGIE

- NEUROLOGIE

- ONCOLOGIE

- MUSCULOSQUELETTIQUE

- GASTRO-ENTÉROLOGIE

- PELVIEN ET ABDOMINAL

- GYNÉCOLOGIE

- UROLOGIE

- MAMMOGRAPHIE

- DENTAIRE

- AUTRES

Sur la base des applications, le marché nord-américain de la téléradiologie est segmenté en cardiologie, neurologie, oncologie, musculo-squelettique, gastro-entérologie, pelvienne et abdominale, gynécologie, urologie, mammographie, dentaire et autres.

Par site

- EN INTERNE

- À TERRE

- OFFSHORE

Sur la base du site, le marché nord-américain de la téléradiologie est segmenté en interne, en mer et à terre.

Par âge

- PÉDIATRIQUE

- ADULTE

- GÉRIATRIQUE

Sur la base de l’âge, le marché nord-américain de la téléradiologie est segmenté en pédiatrie, gériatrie et adulte.

Par mode d'achat

- ACHAT GROUPÉ

- ACHAT INDIVIDUEL

Sur la base du mode d’achat, le marché nord-américain de la téléradiologie est segmenté en achats groupés et achats individuels.

Par les utilisateurs finaux

- HÔPITAUX

- CENTRES DE CHIRURGIES AMBULATOIRES

- CABINET DE MEDECINS PRIVE

- CENTRES D'IMAGERIE DIAGNOSTIQUE

- AUTRES

Sur la base de l’utilisateur final, le marché nord-américain de la téléradiologie est segmenté en hôpitaux, centres de chirurgie ambulatoire, cabinets médicaux privés, centres d’imagerie diagnostique et autres.

Analyse/perspectives régionales du marché de la téléradiologie en Amérique du Nord

Le marché nord-américain de la téléradiologie est analysé et des informations sur la taille du marché sont fournies par type, mode de livraison, technique d'imagerie, technologie, procédure, application, site, âge, mode d'achat et utilisateur final.

Les pays couverts dans ce rapport de marché sont les États-Unis, le Canada et le Mexique.

En 2022, l'Amérique du Nord dominera le marché en raison de la présence d'acteurs clés sur le plus grand marché de consommation avec un PIB élevé. Les États-Unis devraient connaître une croissance en raison de l'augmentation des progrès technologiques dans le domaine de la téléradiologie.

La section du rapport sur les pays fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs douaniers d'import-export sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de la téléradiologie en Amérique du Nord

North America teleradiology market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus on the North America teleradiology market.

Research Methodology: North America Teleradiology Market

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include the Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, North America vs Regional, and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA TELERADIOLOGY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 MARKET APPLICATION COVERAGE GRID

2.8 TYPE LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

3.1 PESTEL_ANALYSIS

3.2 PORTER'S FIVE FORCES

3.3 INDUSTRIAL INSIGHTS:

4 REGULATIONS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING NUMBER OF ADVANCED IMAGING PROCEDURES

5.1.2 ADOPTION OF ARTIFICIAL INTELLIGENCE IN TELERADIOLOGY

5.1.3 GOVERNMENT INVESTMENTS FOR HEALTHCARE INTEROPERABILITY

5.2 RESTRAINTS

5.2.1 LACK OF ACCESS TO HIGH-SPEED INTERNET IN RURAL AREAS

5.2.2 LACK OF IMAGING DATA SECURITY

5.3 OPPORTUNITIES

5.3.1 TRANSFORMATION TOWARDS DIGITALIZATION

5.3.2 GROWING PREVALENCE OF CHRONIC DISEASES AND CONDITIONS

5.3.3 INCREASING AWARENESS AMONG PEOPLE

5.4 CHALLENGES

5.4.1 HIGH CHANCES OF MISDIAGNOSIS

5.4.2 RISING HEALTHCARE FRAUDS

5.4.3 STRINGENT REGULATORY

6 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE

6.1 OVERVIEW

6.2 SERVICES

6.2.1 BY TYPE SERVICES

6.2.1.1 NIGHT RADIOLOGY SERVICES

6.2.1.2 DAYTIME RADIOLOGY SERVICES

6.2.2 BY PROCESS SERVICES

6.2.2.1 CERTIFIED REPORTING SERVICES

6.2.2.2 PRELIMINARY REPORTING

6.3 SOFTWARE

6.3.1 BY DEPLOYMENT

6.3.1.1 INTEGRATED SOFTWARE

6.3.1.2 STANDALONE SOFTWARE

6.3.2 BY TYPE SOFTWARE

6.3.2.1 PICTURE ARCHIVING AND COMMUNICATION

6.3.2.2 RADIOLOGY INFORMATION SYSTEM

6.4 SYSTEMS

6.4.1 DIGITAL IMAGING AND COMMUNICATION IN MEDICINE (DICOM)

6.4.2 ELECTRONIC MEDICAL RECORDS (EMR) SYSTEMS

6.4.3 ELECTRONIC HEALTH RECORD (HER) SYSTEM

6.5 TELECOM & NETWORKING

6.5.1 ENTERPRISE-BASED TELERADIOLOGY SOLUTIONS

6.5.2 CLOUD-BASED TELERADIOLOGY SOLUTIONS

6.5.3 WEB-BASED TELERADIOLOGY SOLUTIONS

6.5.4 VIRTUAL PRIVATE NETWORK (VPN)

6.6 HARDWARE

6.6.1 IMAGE PRINTER

6.6.2 RADIOLOGY VIEWSTATION

6.6.3 SCANNERS

6.6.4 FILM DIGITIZER

6.6.5 MONITORS

6.6.6 IMAGE VIEWERS

6.6.7 OTHERS

7 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE

7.1 OVERVIEW

7.2 CLOUD-BASED DELIVERY MODE

7.3 WEB-BASED DELIVERY MODE

7.4 ON-PREMISE DELIVERY MODE

8 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE

8.1 OVERVIEW

8.1.1 SMALL MATRIX SIZE

8.1.1.1 MAGNETIC RESONANCE IMAGING

8.1.1.2 NUCLEAR IMAGING (SPECT/PET)

8.1.1.3 COMPUTED TOMOGRAPHY (CT) SCAN

8.1.1.4 TELE-ULTRASOUND

8.1.1.5 DIGITAL FLUOROGRAPHY

8.1.1.6 DIGITAL ANGIOGRAPHY

8.1.1.7 ECHOCARDIOGRAM

8.1.1.8 MAMMOGRAPHY

8.1.1.9 DIGITAL X-RAY IMAGING

8.2 LARGE MATRIX SIZE

8.2.1 DIGITIZED RADIOGRAPHIC FILMS

8.2.2 DIGITAL RADIOGRAPHY

9 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 ADVANCED GRAPHICS PROCESSING

9.3 VOLUME RENDERING

9.4 MULTIPLANAR RECONSTRUCTIONS

9.5 IMAGE COMPRESSION

10 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE

10.1 OVERVIEW

10.2 TELE-CONSULTATION

10.3 TELE-DIAGNOSIS

10.4 TELE-MONITORING

11 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION

11.1 OVERVIEW

11.1.1 CARDIOLOGY

11.1.1.1 SERVICES

11.1.1.2 SOFTWARE

11.1.1.3 SYSTEMS

11.1.1.4 TELECOM & NETWORKING

11.1.1.5 HARDWARE

11.1.2 ONCOLOGY

11.1.2.1 SERVICES

11.1.2.2 SOFTWARE

11.1.2.3 SYSTEMS

11.1.2.4 TELECOM & NETWORKING

11.1.2.5 HARDWARE

11.1.3 NEUROLOGY

11.1.3.1 SERVICES

11.1.3.2 SOFTWARE

11.1.3.3 SYSTEMS

11.1.3.4 TELECOM & NETWORKING

11.1.3.5 HARDWARE

11.1.4 MUSCULOSKELETAL

11.1.4.1 SERVICES

11.1.4.2 SOFTWARE

11.1.4.3 SYSTEMS

11.1.4.4 TELECOM & NETWORKING

11.1.4.5 HARDWARE

11.1.5 GASTROENTEROLOGY

11.1.5.1 SERVICES

11.1.5.2 SOFTWARE

11.1.5.3 SYSTEMS

11.1.5.4 TELECOM & NETWORKING

11.1.5.5 HARDWARE

11.1.6 PELVIC AND ABDOMINAL

11.1.6.1 SERVICES

11.1.6.2 SOFTWARE

11.1.6.3 SYSTEMS

11.1.6.4 TELECOM & NETWORKING

11.1.6.5 HARDWARE

11.1.7 GYNECOLOGY

11.1.7.1 SERVICES

11.1.7.2 SOFTWARE

11.1.7.3 SYSTEMS

11.1.7.4 TELECOM & NETWORKING

11.1.7.5 HARDWARE

11.1.8 UROLOGY

11.1.8.1 SERVICES

11.1.8.2 SOFTWARE

11.1.8.3 SYSTEMS

11.1.8.4 TELECOM & NETWORKING

11.1.8.5 HARDWARE

11.1.9 MAMMOGRAPHY

11.1.9.1 SERVICES

11.1.9.2 SOFTWARE

11.1.9.3 SYSTEMS

11.1.9.4 TELECOM & NETWORKING

11.1.9.5 HARDWARE

11.1.10 DENTAL

11.1.10.1 SERVICES

11.1.10.2 SOFTWARE

11.1.10.3 SYSTEMS

11.1.10.4 TELECOM & NETWORKING

11.1.10.5 HARDWARE

11.1.11 OTHERS

12 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE

12.1 OVERVIEW

12.1.1 INHOUSE

12.1.2 OFFSHORE

12.1.3 ONSHORE

13 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE

13.1 OVERVIEW

13.2 PEDIATRIC

13.3 ADULT

13.4 GERIATRIC

14 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE

14.1 OVERVIEW

14.2 GROUP PURCHASE

14.3 INDIVIDUAL PURCHASE

15 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER

15.1 OVERVIEW

15.2 HOSPITALS

15.2.1 PRIVATE

15.2.2 PUBLIC

15.3 DIAGNOSTICS IMAGING CENTRES

15.4 AMBULATORY SURGICAL CENTERS

15.5 PRIVATE PHYSICIAN OFFICES

15.6 OTHERS

16 NORTH AMERICA TELERADIOLOGY MARKET, BY GEOGRAPHY

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILE

19.1 GENERAL ELECTRIC COMPANY (2021)

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 AGFA GEVAERT GROUP

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 COMPANY SHARE ANALYSIS

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENTS

19.3 KONINKLIJKE PHILIPS N.V.

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 COMPANY SHARE ANALYSIS

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENTS

19.4 FUJIFILM CORPORATION

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 COMPANY SHARE ANALYSIS

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENTS

19.5 ALLSCRIPTS HEALTHCARE, LLC AND/OR ITS AFFILIATES.

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 COMPANY SHARE ANALYSIS

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 MEDNAX SERVICES, INC

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 PRODUCT PORTFOLIO

19.6.4 RECENT DEVELOPMENT

19.7 VIRTUAL RADIOLOGIC

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT DEVELOPMENTS

19.8 NUCLEUSHEALTH

19.8.1 COMPANY SNAPSHOT

19.8.2 PRODUCT PORTFOLIO

19.8.3 RECENT DEVELOPMENTS

19.9 TELERADIOLOGY SOLUTIONS

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT DEVELOPMENTS

19.1 ALL-AMERICAN TELERADIOLOGY

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT DEVELOPMENT

19.11 EVERLIGHT RADIOLOGY

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT DEVELOPMENTS

19.12 MEDICA GROUP PLC.

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 PRODUCT PORTFOLIO

19.12.4 RECENT DEVELOPMENTS

19.13 NIGHTHAWK RADIOLOGY

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT DEVELOPMENTS

19.14 NIGHTSHIFT RADIOLOGY

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT DEVELOPMENTS

19.15 ONRAD, INC.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT DEVELOPMENTS

19.16 RADNET, INC.

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 PRODUCT PORTFOLIO

19.16.4 RECENT DEVELOPMENTS

19.17 RAMSOFT, INC.

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT DEVELOPMENTS

19.18 REAL RADS

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT DEVELOPMENT

19.19 REDOX, INC

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT DEVELOPMENTS

19.2 TELEDIAGNOSYS SERVICES PVT LTD.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT DEVELOPMENT

19.21 TELEMEDICINE CLINIC

19.21.1 COMPANY SNAPSHOT

19.21.2 PRODUCT PORTFOLIO

19.21.3 RECENT DEVELOPMENTS

19.22 USARAD.COM.

19.22.1 COMPANY SNAPSHOT

19.22.2 PRODUCT PORTFOLIO

19.22.3 RECENT DEVELOPMENTS

19.23 VITAL RADIOLOGY SERVICES

19.23.1 COMPANY SNAPSHOT

19.23.2 PRODUCT PORTFOLIO

19.23.3 RECENT DEVELOPMENTS

19.24 4 WAYS

19.24.1 COMPANY SNAPSHOT

19.24.2 PRODUCT PORTFOLIO

19.24.3 RECENT DEVELOPMENTS

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA CLOUD-BASED DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA WEB-BASED DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA ON-PREMISE DELIVERY MODE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ADVANCE GRAPHICS PROCESSING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA VOLUME RENDERING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA MULTIPLANAR RECONSTRUCTIONS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA IMAGE COMPRESSION IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA TELE-CONSULTATION IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA TELE-DIAGNOSIS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA TELE-MONITORING IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA OTHERS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA INHOUSE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA OFFSHORE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA ONSHORE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA PEDIATRIC IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA ADULT IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA GERIATRIC IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA GROUP PURCHASE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA INDIVIDUAL PURCHASE IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 68 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 NORTH AMERICA DIAGNOSTICS IMAGINING CENTRES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 NORTH AMERICA AMBULATORY SURGICAL CENTRES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 72 NORTH AMERICA PRIVATE PHYSICIAN OFFICES IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 73 NORTH AMERICA OTHERS IN TELERADIOLOGY MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 74 NORTH AMERICA TELERADIOLOGY MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 75 NORTH AMERICA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 NORTH AMERICA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 77 NORTH AMERICA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 NORTH AMERICA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 79 NORTH AMERICA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 80 NORTH AMERICA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 81 NORTH AMERICA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 NORTH AMERICA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 NORTH AMERICA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 84 NORTH AMERICA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 NORTH AMERICA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 86 NORTH AMERICA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 87 NORTH AMERICA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 88 NORTH AMERICA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 89 NORTH AMERICA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 NORTH AMERICA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 91 NORTH AMERICA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 92 NORTH AMERICA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 93 NORTH AMERICA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 NORTH AMERICA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 95 NORTH AMERICA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 NORTH AMERICA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 97 NORTH AMERICA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 NORTH AMERICA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 99 NORTH AMERICA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 100 NORTH AMERICA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 101 NORTH AMERICA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 102 NORTH AMERICA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 103 NORTH AMERICA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 104 NORTH AMERICA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 105 NORTH AMERICA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 106 NORTH AMERICA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 107 U.S. TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 108 U.S. SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 109 U.S. BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 110 U.S. BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 U.S. SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 112 U.S. BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 U.S. BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 U.S. SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 115 U.S. TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 U.S. HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 117 U.S. TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 118 U.S. TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 119 U.S. SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 120 U.S. LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 121 U.S. TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 122 U.S. TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 123 U.S. TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 U.S. CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 125 U.S. ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 126 U.S. NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 127 U.S. MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 U.S. GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 129 U.S. PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 130 U.S. GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 U.S. UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 U.S. MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 133 U.S. DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 134 U.S. TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 135 U.S. TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 136 U.S. TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 137 U.S. TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 138 U.S. HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 CANADA TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 140 CANADA SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 CANADA BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 CANADA BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 143 CANADA SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 144 CANADA BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 145 CANADA BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 146 CANADA SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 147 CANADA TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 CANADA HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 CANADA TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 150 CANADA TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 151 CANADA SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 152 CANADA LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 153 CANADA TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 CANADA TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 155 CANADA TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 156 CANADA CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 157 CANADA ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 158 CANADA NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 159 CANADA MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 CANADA GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 161 CANADA PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 162 CANADA GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 163 CANADA UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 164 CANADA MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 165 CANADA DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 166 CANADA TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 167 CANADA TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 168 CANADA TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 169 CANADA TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 170 CANADA HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 171 MEXICO TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 172 MEXICO SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 173 MEXICO BY TYPE SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 174 MEXICO BY PROCESS SERVICES IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 175 MEXICO SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 MEXICO BY DEPLOYMENT SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 177 MEXICO BY TYPE SOFTWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 MEXICO SYSTEMS IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 MEXICO TELECOM & NETWORKING IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 180 MEXICO HARDWARE IN TELERADIOLOGY MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 MEXICO TELERADIOLOGY MARKET, BY DELIVERY MODE, 2020-2029 (USD MILLION)

TABLE 182 MEXICO TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 183 MEXICO SMALL MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 184 MEXICO LARGE MATRIX SIZE IN TELERADIOLOGY MARKET, BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

TABLE 185 MEXICO TELERADIOLOGY MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 MEXICO TELERADIOLOGY MARKET, BY PROCEDURE, 2020-2029 (USD MILLION)

TABLE 187 MEXICO TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 188 MEXICO CARDIOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 189 MEXICO ONCOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 190 MEXICO NEUROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 191 MEXICO MUSCULOSKELETAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 MEXICO GASTROENTEROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 193 MEXICO PELVIC AND ABDOMINAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 194 MEXICO GYNECOLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 195 MEXICO UROLOGY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 196 MEXICO MAMMOGRAPHY IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 197 MEXICO DENTAL IN TELERADIOLOGY MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 198 MEXICO TELERADIOLOGY MARKET, BY SITE, 2020-2029 (USD MILLION)

TABLE 199 MEXICO TELERADIOLOGY MARKET, BY AGE, 2020-2029 (USD MILLION)

TABLE 200 MEXICO TELERADIOLOGY MARKET, BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

TABLE 201 MEXICO TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 202 MEXICO HOSPITALS IN TELERADIOLOGY MARKET, BY END USER, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA TELERADIOLOGY MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA TELERADIOLOGY MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA TELERADIOLOGY MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA TELERADIOLOGY MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA TELERADIOLOGY MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA TELERADIOLOGY MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 8 NORTH AMERICA TELERADIOLOGY MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA TELERADIOLOGY MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA TELERADIOLOGY MARKET: SEGMENTATION

FIGURE 11 THE RISING GERIATRIC POPULATION AND THE SUBSEQUENT INCREASE IN THE PREVALENCE OF ASSOCIATED DISEASES ARE EXPECTED TO DRIVE THE NORTH AMERICA TELERADIOLOGY MARKET IN THE FORECAST PERIOD

FIGURE 12 SERVICES ARE EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA TELERADIOLOGY MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA TELERADIOLOGY MARKET

FIGURE 14 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, 2021

FIGURE 15 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, 2020-2029 (USD MILLION)

FIGURE 16 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, CAGR (2022-2029)

FIGURE 17 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE, LIFELINE CURVE

FIGURE 18 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, 2021

FIGURE 19 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, 2020-2029 (USD MILLION)

FIGURE 20 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, CAGR (2022-2029)

FIGURE 21 NORTH AMERICA TELERADIOLOGY MARKET: BY DELIVERY MODE, LIFELINE CURVE

FIGURE 22 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, 2021

FIGURE 23 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, 2020-2029 (USD MILLION)

FIGURE 24 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, CAGR (2022-2029)

FIGURE 25 NORTH AMERICA TELERADIOLOGY MARKET: BY IMAGING TECHNIQUE, LIFELINE CURVE

FIGURE 26 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, 2021

FIGURE 27 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, 2020-2029 (USD MILLION)

FIGURE 28 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 29 NORTH AMERICA TELERADIOLOGY MARKET : BY TECHNOLOGY, LIFELINE CURVE

FIGURE 30 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, 2021

FIGURE 31 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, 2020-2029 (USD MILLION)

FIGURE 32 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, CAGR (2022-2029)

FIGURE 33 NORTH AMERICA TELERADIOLOGY MARKET : BY PROCEDURE, LIFELINE CURVE

FIGURE 34 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, 2021

FIGURE 35 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, 2020-2029 (USD MILLION)

FIGURE 36 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 37 NORTH AMERICA TELERADIOLOGY MARKET : BY APPLICATION, LIFELINE CURVE

FIGURE 38 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, 2021

FIGURE 39 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, 2020-2029 (USD MILLION)

FIGURE 40 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, CAGR (2022-2029)

FIGURE 41 NORTH AMERICA TELERADIOLOGY MARKET: BY SITE, LIFELINE CURVE

FIGURE 42 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, 2021

FIGURE 43 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, 2022-2029 (USD MILLION)

FIGURE 44 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, CAGR (2022-2029)

FIGURE 45 NORTH AMERICA TELERADIOLOGY MARKET: BY AGE, LIFELINE CURVE

FIGURE 46 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, 2021

FIGURE 47 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, 2020-2029 (USD MILLION)

FIGURE 48 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, CAGR (2022-2029)

FIGURE 49 NORTH AMERICA TELERADIOLOGY MARKET: BY MODE OF PURCHASE, LIFELINE CURVE

FIGURE 50 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, 2021

FIGURE 51 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 52 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, CAGR (2022-2029)

FIGURE 53 NORTH AMERICA TELERADIOLOGY MARKET: BY END USER, LIFELINE CURVE

FIGURE 54 NORTH AMERICA TELERADIOLOGY MARKET: SNAPSHOT (2021)

FIGURE 55 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2021)

FIGURE 56 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2022 & 2029)

FIGURE 57 NORTH AMERICA TELERADIOLOGY MARKET: BY COUNTRY (2021 & 2029)

FIGURE 58 NORTH AMERICA TELERADIOLOGY MARKET: BY TYPE (2022-2029)

FIGURE 59 NORTH AMERICA TELERADIOLOGY MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.