Marché des lubrifiants marins synthétiques et biodégradables en Amérique du Nord par produit ( huile moteurfluide hydraulique , huiles système, huiles pour cylindres, huile pour engrenages, graisse, huile pour tube d'étambot, huiles pour turbines, huiles de transmission, fluides de transfert de chaleur, compresseurs de réfrigération et autres), utilisateur final (navires, bateaux, structures civiles offshore, navires de haute mer, yachts côtiers, conteneurs, pétroliers, vraquiers, cargos et paquebots de croisière), canal de distribution (direct et indirect) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des lubrifiants marins synthétiques et biodégradables en Amérique du Nord

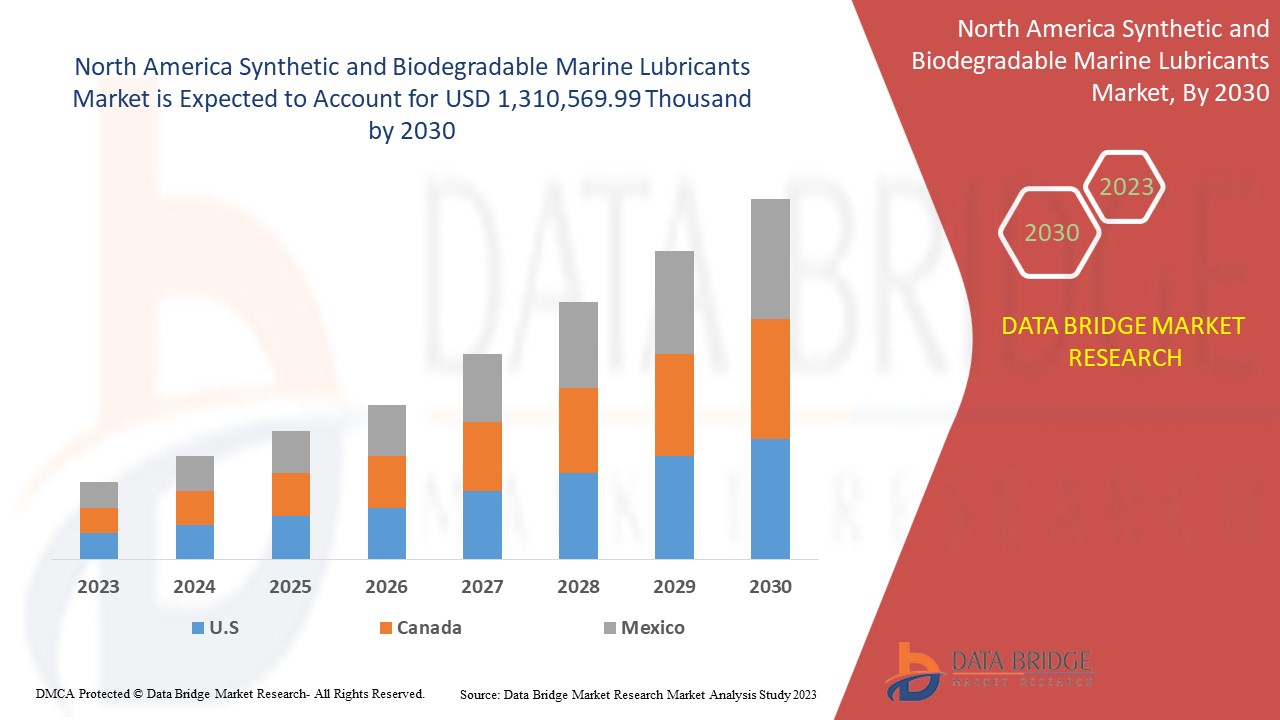

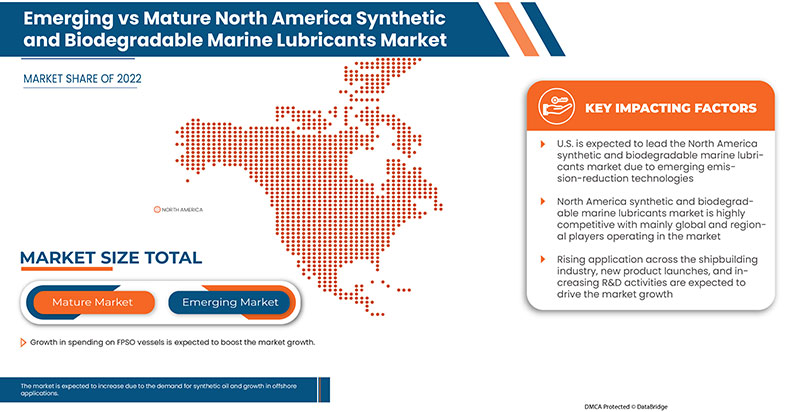

Français Le marché nord-américain des lubrifiants marins synthétiques et biodégradables devrait connaître une croissance significative au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 6,0 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 1 310 569,99 milliers USD d'ici 2030. Le principal facteur à l'origine de la croissance du marché des lubrifiants marins synthétiques et biodégradables est l'augmentation des applications dans l'ensemble de l' industrie de la construction navale , le lancement de nouveaux produits et l'augmentation des activités de R&D, l'émergence de technologies de réduction des émissions et la croissance des dépenses consacrées aux navires FPSO.

Le rapport sur le marché des lubrifiants marins synthétiques et biodégradables en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Par produit (huile moteur, fluide hydraulique, huiles système, huiles cylindre, huile pour engrenages, graisse, huile pour tube d'étambot, huiles pour turbines, huiles de transmission, fluides caloporteurs, compresseurs de réfrigération et autres), utilisateur final (navires, bateaux, structures civiles offshore, navires de haute mer, yachts côtiers, conteneurs, pétroliers, vraquiers, cargos et paquebots de croisière), canal de distribution (direct et indirect) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

RSC Bio Solutions, PANOLIN AG, LanoPro, Klüber Lubrication, Ferryl, Chevron Corporation, LUKOIL Marine Lubricants DMCC, Exxon Mobil Corporation, TotalEnergies.com, FUCHS, Gulf Oil Marine Ltd., CASTROL LIMITED, Shell plc et Croda International Plc. entre autres |

Définition du marché

Les lubrifiants marins sont une classe spéciale de lubrifiants fabriqués pour répondre aux performances robustes requises dans les navires pour des opérations optimisées. Divers composants de machines dans les systèmes marins nécessitent des lubrifiants pour un meilleur fonctionnement, une meilleure protection et des cycles de vie prolongés. Compte tenu de cela, l'adoption de lubrifiants marins joue un rôle important dans l'industrie du transport maritime. Selon les statistiques de l' Organisation maritime internationale (OMI) , environ 90 % du commerce mondial s'effectue par transport maritime. Cela est soutenu par les constructeurs de navires et les organismes gouvernementaux qui contribuent à accroître le commerce maritime en développant de nouveaux terminaux et en créant des détroits plus grands ainsi qu'en en élargissant de nouveaux. L'utilisation de lubrifiants marins a augmenté avec ces développements stratégiques, car les navires plus grands nécessitent l'utilisation de plus de lubrifiants dans chaque pièce mécanique. Ces lubrifiants sont directement responsables de l'augmentation de la durée de vie des composants mécaniques des navires. Ainsi, la demande croissante de lubrifiants marins devrait propulser la croissance du marché des lubrifiants marins synthétiques et biodégradables.

Dynamique du marché des lubrifiants marins synthétiques et biodégradables en Amérique du Nord

Conducteurs

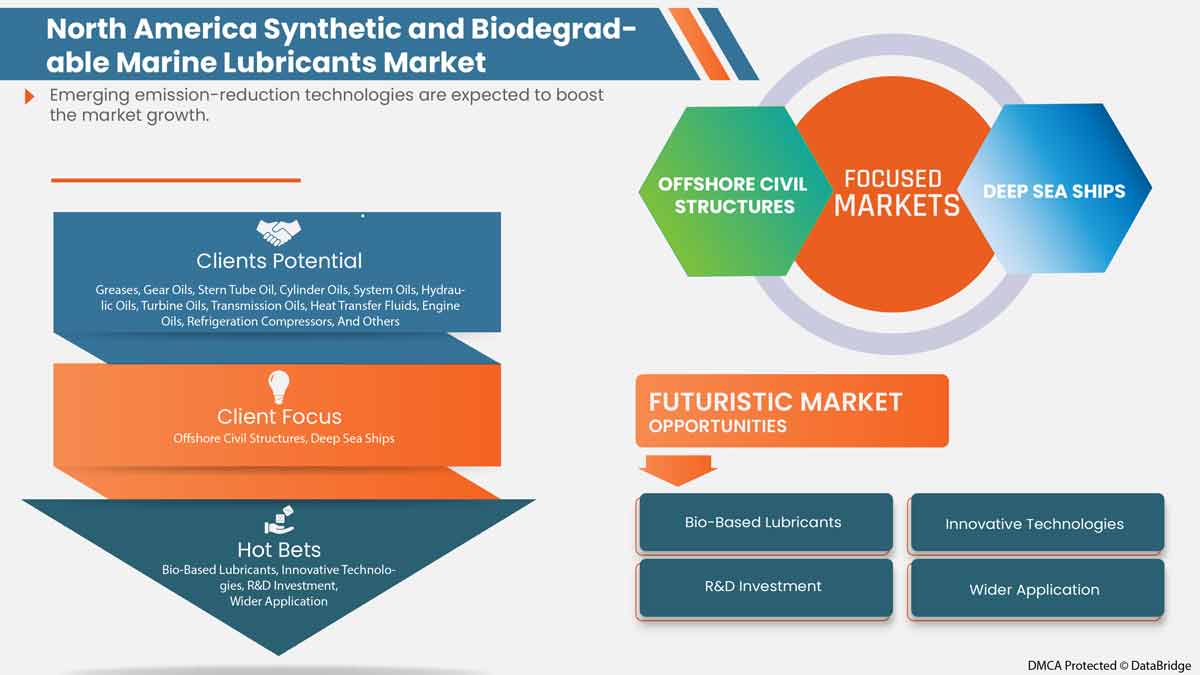

- Une demande croissante dans l'industrie de la construction navale

Les lubrifiants marins sont fréquemment utilisés dans l'industrie du transport maritime pour protéger et augmenter les performances des moteurs et des équipements. Ils sont spécifiquement développés pour offrir des performances optimales dans des tâches telles que l'allongement de la durée de vie du moteur et la protection des composants à haute température, l'augmentation de l'efficacité et de la fiabilité des machines, l'amélioration de la protection contre l'usure mécanique et la prévention de la corrosion à froid.

Le lubrifiant réduit les frottements et l'usure en créant une couche entre les surfaces de contact mobiles. Les principaux rôles d'un lubrifiant sont de minimiser les frottements, de prévenir l'usure, de protéger l'équipement contre la corrosion, de gérer la température en dispersant la chaleur, de contrôler la pollution vers un filtre et de transmettre la puissance tout en assurant une étanchéité fluide. L'huile et la graisse sont les types les plus répandus. Les huiles peuvent être synthétiques, végétales (également appelées lubrifiants écologiquement acceptables - EAL), minérales ou un mélange des trois. Par conséquent, l'augmentation des applications dans l'industrie de la construction navale devrait stimuler la croissance du marché.

- Lancement de nouveaux produits et augmentation des activités de R&D

Les lubrifiants marins sont utilisés pour maintenir les moteurs et les équipements en bon état de fonctionnement et pour augmenter l'efficacité globale. Dans les opérations maritimes, ces lubrifiants aident également à prévenir l'usure entre les surfaces en contact et les composants en mouvement relatif. Il existe aujourd'hui des produits plus innovants pour répondre aux règles environnementales strictes imposées par les gouvernements et les principaux fabricants du monde entier augmentent leurs investissements dans les efforts de recherche et développement pour répondre à la demande du secteur maritime. La recherche et développement devient de plus en plus importante pour lancer de nouveaux produits sophistiqués et développer l'industrie des lubrifiants marins grâce à des partenariats ou des collaborations entre les grandes entreprises. Ainsi, les lancements de nouveaux produits et l'augmentation des activités de recherche et développement agissent comme des moteurs potentiels du marché.

- Technologies émergentes de réduction des émissions

L'augmentation des émissions des navires a entraîné des réglementations supplémentaires de la part de l'EPA, de MARPOL et d'autres autorités réglementaires. Cela a entraîné le développement de nouvelles technologies dans l'industrie maritime, telles que le carburant à faible teneur en soufre, la navigation lente, la réduction catalytique sélective (SCR), les épurateurs ou les systèmes de nettoyage des gaz d'échappement (EGCS), le mélange à bord, la réduction des émissions en tant que service (ERaaS) et la recirculation des gaz d'échappement. L'augmentation des émissions dangereuses d'azote et d'oxyde de soufre dans l'eau a incité les entreprises de transport maritime à mettre en œuvre des technologies de pointe afin de se conformer aux nouvelles lois. La réduction des émissions dangereuses des navires se traduira par une amélioration des performances et de la durabilité des lubrifiants marins, ce qui prolongera la durée de vie des équipements mécaniques des navires.

Opportunités

- Demande de pétrole synthétique et croissance des applications offshore

Les lubrifiants synthétiques, notamment ceux utilisés dans les applications de lubrification industrielle, sont facilement accessibles et ont plusieurs applications à bord des navires. Les lubrifiants synthétiques ont été historiquement développés en réponse à des demandes spécifiques. Les lubrifiants conventionnels à base d'huile minérale, par exemple, ne pouvaient pas répondre aux critères sévères d'activités à basse température (Arctique) ou à haute température et de résistance au feu. Un mélange complexe d'hydrocarbures et d'huiles de base synthétiques est le résultat d'un processus de réaction chimique hautement géré qui donne un produit chimique « pur » de composition présélectionnée. Ce processus chimique donne un nombre infini de produits.

- Les lubrifiants biosourcés deviennent de plus en plus populaires

Les biolubrifiants dérivés de la biomasse et d’autres déchets ont le potentiel de réduire l’empreinte carbone des opérations de fabrication et du secteur maritime. Les biolubrifiants surpassent les lubrifiants traditionnels en termes de qualités lubrifiantes et ils sont renouvelables et biodégradables. Les huiles végétales, les polysaccharides polymères végétaux et les esters de cire sont des sources courantes de biolubrifiants. Les biolubrifiants offrent des possibilités intéressantes car ils sont renouvelables et ne produisent aucune émission de gaz à effet de serre.

Contraintes/Défis

- Carburants alternatifs et nouvelles technologies

La décision de l’OMI (Organisation maritime internationale) de limiter la teneur en soufre du carburant des navires à 0,5 % à compter du 1er janvier 2020 dans la région Asie-Pacifique, ainsi que la résolution récemment approuvée visant à réduire les émissions de gaz à effet de serre (GES) de 50 % d’ici 2050, modifieront radicalement le futur mix de carburants des navires. Par conséquent, des carburants marins alternatifs sont nécessaires pour atténuer les conséquences environnementales et climatiques du transport maritime à court et à long terme.

- Des réglementations environnementales strictes et des administrations en constante réforme

Le fait que la quasi-totalité de la planète dépende du pétrole brut et des produits dérivés du pétrole brut est la principale cause de la pollution croissante. La graisse biosourcée est considérée comme un marché potentiel par les fabricants de lubrifiants marins. Plusieurs directives réglementaires émises par diverses organisations gouvernementales freinent la croissance de l'industrie des lubrifiants marins.

Développement récent

- En avril 2022, ExxonMobil a créé Mobilgard 540 AC, une huile pour cylindre marin 40BN de qualité supérieure approuvée par MAN ES pour une utilisation dans ses moteurs marins à 2 temps Mark 9 et supérieurs. Le lubrifiant haut de gamme a été développé pour offrir une propreté accrue afin de satisfaire aux exigences de ces moteurs modernes

- En juin 2020, Total Lubmarine a étendu la portée mondiale de ses services d'assistance technique avec l'inauguration d'un nouveau laboratoire Diagomar Plus à Chicago, aux États-Unis. Le nouveau laboratoire de Chicago propose des évaluations standard pour l'huile moteur, l'huile non moteur, l'huile de vidange, l'huile thermique, l'huile de tube d'étambot et l'EAL (lubrifiant écologiquement acceptable).

Portée du marché nord-américain des lubrifiants marins synthétiques et biodégradables

Le marché nord-américain des lubrifiants marins synthétiques et biodégradables est classé en fonction des produits, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Produit

- Huile moteur

- Fluide hydraulique

- Huiles système

- Huiles pour cylindres

- Huile pour engrenages

- Graisse

- Huile pour tube d'étambot

- Huiles pour turbines

- Huiles de transmission

- Fluides de transfert de chaleur

- Compresseurs de réfrigération

- Autres

Sur la base des produits, le marché nord-américain des lubrifiants marins synthétiques et biodégradables est classé en huile moteur, fluide hydraulique, huiles système, huiles cylindres, huile pour engrenages, graisse, huile pour tube d'étambot, huiles pour turbines, huiles de transmission, fluides de transfert de chaleur, compresseurs de réfrigération et autres.

Utilisateur final

- Navires

- Bateaux

- Ouvrages civils offshore

- Navires de haute mer

- Yachts côtiers

- Conteneurs

- Pétroliers

- Vraquiers

- Navires cargos

- Paquebots de croisière

En fonction de l'utilisateur final, le marché nord-américain des lubrifiants marins synthétiques et biodégradables est classé en navires, bateaux, structures civiles offshore, navires de haute mer, yachts côtiers, conteneurs, pétroliers, vraquiers, cargos et paquebots de croisière.

Canal de distribution

- Vente directe

- Vente indirecte

En fonction de la catégorie, le marché nord-américain des lubrifiants marins synthétiques et biodégradables est classé en vente directe et vente indirecte.

Analyse/perspectives régionales du marché des lubrifiants marins synthétiques et biodégradables en Amérique du Nord

Le marché nord-américain des lubrifiants marins synthétiques et biodégradables est segmenté en fonction du produit, de l’utilisateur final et du canal de distribution.

Les pays du marché nord-américain des lubrifiants marins synthétiques et biodégradables sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des lubrifiants marins synthétiques et biodégradables en raison de l’émergence de technologies de réduction des émissions dans la région.

La section par pays du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse de la concurrence et des parts de marché des lubrifiants marins synthétiques et biodégradables en Amérique du Nord

Le paysage concurrentiel du marché des lubrifiants marins synthétiques et biodégradables en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont l'aperçu de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de durée de vie du produit. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des lubrifiants marins synthétiques et biodégradables en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché nord-américain des lubrifiants marins synthétiques et biodégradables sont RSC Bio Solutions, PANOLIN AG, Klüber Lubrication, Ferryl, Chevron Corporation, LUKOIL Marine Lubricants DMCC, Exxon Mobil Corporation, TotalEnergies.com, FUCHS, Gulf Oil Marine Ltd., CASTROL LIMITED, Shell plc et Croda International Plc.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 DBMR MARKET CHALLENGE MATRIX

2.11 MARKET APPLICATION COVERAGE GRID

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER'S FIVE FORCES:

4.1.1 THREAT OF NEW ENTRANTS:

4.1.2 THREAT OF SUBSTITUTES:

4.1.3 CUSTOMER BARGAINING POWER:

4.1.4 SUPPLIER BARGAINING POWER:

4.1.5 INTERNAL COMPETITION (RIVALRY):

4.2 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, PESTEL ANALYSIS

4.2.1 OVERVIEW

4.2.2 POLITICAL FACTORS

4.2.3 ENVIRONMENTAL FACTORS

4.2.4 SOCIAL FACTORS

4.2.5 TECHNOLOGICAL FACTORS

4.2.6 ECONOMICAL FACTORS

4.2.7 LEGAL FACTORS

4.2.8 CONCLUSION

4.3 SUPPLY CHAIN ANALYSIS

4.3.1 RAW MATERIAL PROCUREMENT

4.3.2 MANUFACTURING AND PACKING

4.3.3 MARKETING AND DISTRIBUTION

4.3.4 END USERS

4.4 VENDOR SELECTION CRITERIA

4.5 RAW MATERIAL PRODUCTION COVERAGE

4.6 TECHNOLOGICAL ADVANCEMENTS BY MANUFACTURERS

4.7 CLIMATE CHANGE SCENARIO

4.7.1 ENVIRONMENTAL CONCERNS

4.7.2 INDUSTRY RESPONSE

4.7.3 GOVERNMENT’S ROLE

4.7.4 ANALYST RECOMMENDATION

4.8 IMPORT-EXPORT SCENARIO

4.9 PRODUCTION AND CONSUMPTION ANALYSIS

4.1 REGULATORY FRAMEWORK AND GUIDELINES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISING APPLICATION ACROSS THE SHIPBUILDING INDUSTRY

5.1.2 NEW PRODUCT LAUNCHES AND INCREASING R&D ACTIVITIES

5.1.3 EMERGING EMISSION-REDUCTION TECHNOLOGIES

5.1.4 GROWTH IN SPENDING ON FPSO VESSELS

5.2 RESTRAINTS

5.2.1 ALTERNATIVE FUELS AND NEW TECHNOLOGIES

5.2.2 MARINE LUBRICANTS ARE IN SHORT SUPPLY

5.3 OPPORTUNITIES

5.3.1 DEMAND FOR SYNTHETIC OIL AND GROWTH IN OFFSHORE APPLICATIONS

5.3.2 BIO-BASED LUBRICANTS ARE BECOMING INCREASINGLY POPULAR

5.3.3 INCREASED USE OF MARINE LUBRICANTS ON CARGO SHIPS, BULK CARRIERS, AND OTHER SHIPS

5.4 CHALLENGES

5.4.1 ENVIRONMENTAL REGULATIONS THAT ARE STRICT AND ADMINISTRATIONS THAT ARE CONSTANTLY REFORMING

5.4.2 VOLATILITY IN RAW MATERIAL PRICES

6 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT

6.1 OVERVIEW

6.2 ENGINE OIL

6.2.1 SLOW-SPEED ENGINE OIL

6.2.2 MEDIUM-SPEED ENGINE OIL

6.2.3 HIGH-SPEED ENGINE OIL

6.2.4 DIESEL ENGINE OIL

6.2.5 OTHERS

6.3 HYDRAULIC FLUID

6.4 SYSTEM OILS

6.5 CYLINDER OILS

6.6 GEAR OILS

6.7 GREASE

6.7.1 CALCIUM GREASE

6.7.2 LITHIUM GREASE

6.7.3 ALUMINUM COMPLEX GREASE

6.7.4 BARIUM COMPLEX GREASE

6.7.5 BENTONE (CLAY) GREASE

6.7.6 POLYUREA GREASE

6.7.7 SODIUM GREASE

6.7.8 OTHERS

6.8 STERN TUBE OIL

6.9 TURBINE OILS

6.1 TRANSMISSION OILS

6.11 HEAT TRANSFER FLUIDS

6.12 REFRIGERATION COMPRESSORS

6.13 OTHERS

7 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY END-USER

7.1 OVERVIEW

7.2 SHIPS

7.2.1 SHIPS, BY PRODUCT

7.2.1.1 ENGINE OIL

7.2.1.2 HYDRAULIC FLUID

7.2.1.3 SYSTEM OILS

7.2.1.4 CYLINDER OILS

7.2.1.5 GEAR OILS

7.2.1.6 GREASE

7.2.1.7 STERN TUBE OIL

7.2.1.8 TURBINE OILS

7.2.1.9 TRANSMISSION OILS

7.2.1.10 HEAT TRANSFER FLUIDS

7.2.1.11 REFRIGERATION COMPRESSORS

7.2.1.12 OTHERS

7.3 BOATS

7.3.1 BOATS, BY PRODUCT

7.3.1.1 ENGINE OIL

7.3.1.2 HYDRAULIC FLUID

7.3.1.3 SYSTEM OILS

7.3.1.4 CYLINDER OILS

7.3.1.5 GEAR OILS

7.3.1.6 GREASE

7.3.1.7 STERN TUBE OIL

7.3.1.8 TURBINE OILS

7.3.1.9 TRANSMISSION OILS

7.3.1.10 HEAT TRANSFER FLUIDS

7.3.1.11 REFRIGERATION COMPRESSORS

7.3.1.12 OTHERS

7.4 OFFSHORE CIVIL STRUCTURES

7.4.1 OFFSHORE CIVIL STRUCTURES, BY PRODUCT

7.4.1.1 ENGINE OIL

7.4.1.2 HYDRAULIC FLUID

7.4.1.3 SYSTEM OILS

7.4.1.4 CYLINDER OILS

7.4.1.5 GEAR OILS

7.4.1.6 GREASE

7.4.1.7 STERN TUBE OIL

7.4.1.8 TURBINE OILS

7.4.1.9 TRANSMISSION OILS

7.4.1.10 HEAT TRANSFER FLUIDS

7.4.1.11 REFRIGERATION COMPRESSORS

7.4.1.12 OTHERS

7.5 DEEP SEA SHIPS

7.5.1 DEEP SEA SHIPS, BY PRODUCT

7.5.1.1 ENGINE OIL

7.5.1.2 HYDRAULIC FLUID

7.5.1.3 SYSTEM OILS

7.5.1.4 CYLINDER OILS

7.5.1.5 GEAR OILS

7.5.1.6 GREASE

7.5.1.7 STERN TUBE OIL

7.5.1.8 TURBINE OILS

7.5.1.9 TRANSMISSION OILS

7.5.1.10 HEAT TRANSFER FLUIDS

7.5.1.11 REFRIGERATION COMPRESSORS

7.5.1.12 OTHERS

7.6 COASTAL YACHTS

7.6.1 COASTAL YACHTS, BY PRODUCT

7.6.1.1 ENGINE OIL

7.6.1.2 HYDRAULIC FLUID

7.6.1.3 SYSTEM OILS

7.6.1.4 CYLINDER OILS

7.6.1.5 GEAR OILS

7.6.1.6 GREASE

7.6.1.7 STERN TUBE OIL

7.6.1.8 TURBINE OILS

7.6.1.9 TRANSMISSION OILS

7.6.1.10 HEAT TRANSFER FLUIDS

7.6.1.11 REFRIGERATION COMPRESSORS

7.6.1.12 OTHERS

7.7 CONTAINERS

7.7.1 CONTAINERS, BY PRODUCT

7.7.1.1 ENGINE OIL

7.7.1.2 HYDRAULIC FLUID

7.7.1.3 SYSTEM OILS

7.7.1.4 CYLINDER OILS

7.7.1.5 GEAR OILS

7.7.1.6 GREASE

7.7.1.7 STERN TUBE OIL

7.7.1.8 TURBINE OILS

7.7.1.9 TRANSMISSION OILS

7.7.1.10 HEAT TRANSFER FLUIDS

7.7.1.11 REFRIGERATION COMPRESSORS

7.7.1.12 OTHERS

7.8 OIL TANKERS

7.8.1 OIL TANKERS, BY PRODUCT

7.8.1.1 ENGINE OIL

7.8.1.2 HYDRAULIC FLUID

7.8.1.3 SYSTEM OILS

7.8.1.4 CYLINDER OILS

7.8.1.5 GEAR OILS

7.8.1.6 GREASE

7.8.1.7 STERN TUBE OIL

7.8.1.8 TURBINE OILS

7.8.1.9 TRANSMISSION OILS

7.8.1.10 HEAT TRANSFER FLUIDS

7.8.1.11 REFRIGERATION COMPRESSORS

7.8.1.12 OTHERS

7.9 BULK CARRIERS

7.9.1 BULK CARRIERS, BY PRODUCT

7.9.1.1 ENGINE OIL

7.9.1.2 HYDRAULIC FLUID

7.9.1.3 SYSTEM OILS

7.9.1.4 CYLINDER OILS

7.9.1.5 GEAR OILS

7.9.1.6 GREASE

7.9.1.7 STERN TUBE OIL

7.9.1.8 TURBINE OILS

7.9.1.9 TRANSMISSION OILS

7.9.1.10 HEAT TRANSFER FLUIDS

7.9.1.11 REFRIGERATION COMPRESSORS

7.9.1.12 OTHERS

7.1 CARGO SHIPS

7.10.1 CARGO SHIPS, BY PRODUCT

7.10.1.1 ENGINE OIL

7.10.1.2 HYDRAULIC FLUID

7.10.1.3 SYSTEM OILS

7.10.1.4 CYLINDER OILS

7.10.1.5 GEAR OILS

7.10.1.6 GREASE

7.10.1.7 STERN TUBE OIL

7.10.1.8 TURBINE OILS

7.10.1.9 TRANSMISSION OILS

7.10.1.10 HEAT TRANSFER FLUIDS

7.10.1.11 REFRIGERATION COMPRESSORS

7.10.1.12 OTHERS

7.11 CRUISE LINERS

7.11.1 CRUISE LINERS, BY PRODUCT

7.11.1.1 ENGINE OIL

7.11.1.2 HYDRAULIC FLUID

7.11.1.3 SYSTEM OILS

7.11.1.4 CYLINDER OILS

7.11.1.5 GEAR OILS

7.11.1.6 GREASE

7.11.1.7 STERN TUBE OIL

7.11.1.8 TURBINE OILS

7.11.1.9 TRANSMISSION OILS

7.11.1.10 HEAT TRANSFER FLUIDS

7.11.1.11 REFRIGERATION COMPRESSORS

7.11.1.12 OTHERS

8 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY DISTRIBUTION CHANNEL

8.1 OVERVIEW

8.2 DIRECT

8.3 INDIRECT

9 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION

9.1 NORTH AMERICA

9.1.1 U.S.

9.1.2 CANADA

9.1.3 MEXICO

10 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, COMPANY LANDSCAPE

10.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

10.1.1 PARTNERSHIPS

10.1.2 NEW PRODUCT DEVELOPMENTS

11 SWOT ANALYSIS

12 COMPANY PROFILES

12.1 CASTROL LIMITED

12.1.1 COMPANY SNAPSHOT

12.1.2 COMPANY SHARE ANALYSIS

12.1.3 PRODUCT PORTFOLIO

12.1.4 RECENT UPDATES

12.2 EXXON MOBIL CORPORATION

12.2.1 COMPANY SNAPSHOT

12.2.2 COMPANY SHARE ANALYSIS

12.2.3 PRODUCT PORTFOLIO

12.2.4 RECENT UPDATES

12.3 GULF OIL MARINE LTD.

12.3.1 COMPANY SNAPSHOT

12.3.2 COMPANY SHARE ANALYSIS

12.3.3 PRODUCT PORTFOLIO

12.3.4 RECENT UPDATES

12.4 TOTALENERGIES.COM

12.4.1 COMPANY SNAPSHOT

12.4.2 COMPANY SHARE ANALYSIS

12.4.3 PRODUCT PORTFOLIO

12.4.4 RECENT UPDATES

12.5 CHEVRON CORPORATION

12.5.1 COMPANY SNAPSHOT

12.5.2 COMPANY SHARE ANALYSIS

12.5.3 PRODUCT PORTFOLIO

12.5.4 RECENT UPDATES

12.6 CRODA INTERNATIONAL PLC (2022)

12.6.1 COMPANY SNAPSHOT

12.6.2 REVENUE ANALYSIS

12.6.3 PRODUCT PORTFOLIO

12.6.4 RECENT UPDATES

12.7 FERRYL

12.7.1 COMPANY SNAPSHOT

12.7.2 PRODUCT PORTFOLIO

12.7.3 RECENT UPDATES

12.8 FUCHS

12.8.1 COMPANY SNAPSHOT

12.8.2 PRODUCT PORTFOLIO

12.8.3 RECENT UPDATES

12.9 KLÜBER LUBRICATION

12.9.1 COMPANY SNAPSHOT

12.9.2 PRODUCT PORTFOLIO

12.9.3 RECENT UPDATES

12.1 LANOPRO

12.10.1 COMPANY SNAPSHOT

12.10.2 PRODUCT PORTFOLIO

12.10.3 RECENT UPDATES

12.11 LUKOIL MARINE LUBRICANTS DMCC

12.11.1 COMPANY SNAPSHOT

12.11.2 PRODUCT PORTFOLIO

12.11.3 RECENT UPDATES

12.12 PANOLIN AG

12.12.1 COMPANY SNAPSHOT

12.12.2 PRODUCT PORTFOLIO

12.12.3 RECENT UPDATES

12.13 RSC BIO SOLUTIONS

12.13.1 COMPANY SNAPSHOT

12.13.2 PRODUCT PORTFOLIO

12.13.3 RECENT UPDATES

12.14 SHELL PLC (2022)

12.14.1 COMPANY SNAPSHOT

12.14.2 REVENUE ANALYSIS

12.14.3 PRODUCT PORTFOLIO

12.14.4 RECENT UPDATES

13 QUESTIONNAIRE

14 RELATED REPORTS

Liste des tableaux

TABLE 1 REGULATORY FRAMEWORK

TABLE 2 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 4 NORTH AMERICA ENGINE OIL IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA ENGINE OIL IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA HYDRAULIC FLUID IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SYSTEM OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA CYLINDER OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA GEAR OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA GREASE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA GREASE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA STERN TUBE OIL IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA TURBINE OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA TRANSMISSION OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA HEAT TRANSFER FLUIDS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA REFRIGERATION COMPRESSORS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA OTHERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY END-USER, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA BOATS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA BOATS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA OFFSHORE CIVIL STRUCTURES IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA OFFSHORE CIVIL STRUCTURES IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA DEEP SEA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA DEEP SEA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA COASTAL YACHTS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA COASTAL YACHTS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA CONTAINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA CONTAINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA OIL TANKERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA OIL TANKERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA BULK CARRIERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA BULK CARRIERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA CARGO SHIPS SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA CARGO SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA CRUISE LINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA CRUISE LINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA DIRECT IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA INDIRECT IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, 2021-2030

TABLE 43 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY COUNTRY, 2021-2030 (THOUSAND LITERS)

TABLE 45 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 47 NORTH AMERICA GREASE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA ENGINE OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY END - USER, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT 2021-2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA BOATS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA OFFSHORE CIVIL STRUCTURE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA DEEP SEA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA COASTAL YACHTS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA CONTAINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA OIL TANKERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA BULK CARRIERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA CARGO SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA CRUISE LINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 61 U.S. SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 62 U.S. SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 63 U.S. GREASE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 64 U.S. ENGINE OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 65 U.S. SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY END - USER, 2021-2030 (USD THOUSAND)

TABLE 66 U.S. SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT 2021-2030 (USD THOUSAND)

TABLE 67 U.S. BOATS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 68 U.S. OFFSHORE CIVIL STRUCTURE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 69 U.S. DEEP SEA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 70 U.S. COASTAL YACHTS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 71 U.S. CONTAINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 72 U.S. OIL TANKERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 73 U.S. BULK CARRIERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 74 U.S. CARGO SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 75 U.S. CRUISE LINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 76 U.S. SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 77 CANADA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 78 CANADA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 79 CANADA GREASE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 80 CANADA ENGINE OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 81 CANADA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY END - USER, 2021-2030 (USD THOUSAND)

TABLE 82 CANADA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT 2021-2030 (USD THOUSAND)

TABLE 83 CANADA BOATS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 84 CANADA OFFSHORE CIVIL STRUCTURE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 85 CANADA DEEP SEA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 86 CANADA COASTAL YACHTS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 87 CANADA CONTAINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 88 CANADA OIL TANKERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 89 CANADA BULK CARRIERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 90 CANADA CARGO SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 91 CANADA CRUISE LINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 92 CANADA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 93 MEXICO SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 94 MEXICO SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (THOUSAND LITERS)

TABLE 95 MEXICO GREASE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 96 MEXICO ENGINE OILS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 97 MEXICO SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY END - USER, 2021-2030 (USD THOUSAND)

TABLE 98 MEXICO SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT 2021-2030 (USD THOUSAND)

TABLE 99 MEXICO BOATS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 100 MEXICO OFFSHORE CIVIL STRUCTURE IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 101 MEXICO DEEP SEA SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 102 MEXICO COASTAL YACHTS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 103 MEXICO CONTAINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 104 MEXICO OIL TANKERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 105 MEXICO BULK CARRIERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 106 MEXICO CARGO SHIPS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 107 MEXICO CRUISE LINERS IN SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY PRODUCT, 2021-2030 (USD THOUSAND)

TABLE 108 MEXICO SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET

FIGURE 2 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: THE PRODUCT LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: SEGMENTATION

FIGURE 14 DEMAND FOR SYNTHETIC OIL AND GROWTH IN OFFSHORE APPLICATIONS IS EXPECTED TO DRIVE NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET GROWTH IN THE FORECAST PERIOD

FIGURE 15 ENGINE OILS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET IN 2023 & 2030

FIGURE 16 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: PESTEL ANALYSIS

FIGURE 17 SUPPLY CHAIN ANALYSIS – NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET

FIGURE 18 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: PRODUCTION AND CONSUMPTION ANALYSIS, 2021-2023 (THOUSAND LITERS)

FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET

FIGURE 20 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: BY PRODUCT, 2022

FIGURE 21 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: BY END-USER, 2022

FIGURE 22 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 23 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: SNAPSHOT (2022)

FIGURE 24 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: BY COUNTRY (2022)

FIGURE 25 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: BY COUNTRY (2023 & 2030)

FIGURE 26 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: BY COUNTRY (2022 & 2030)

FIGURE 27 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: BY PRODUCT (2023-2030)

FIGURE 28 NORTH AMERICA SYNTHETIC AND BIODEGRADABLE MARINE LUBRICANTS MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.