Marché nord-américain des condensateurs synchrones, par technologie de refroidissement (condensateur synchrone refroidi à l'hydrogène, condensateur synchrone refroidi à l'air et condensateur synchrone refroidi à l'eau), méthode de démarrage (convertisseur de fréquence statique, moteur Pony et autres), puissance réactive nominale (supérieure à 200 MVAR, 101-200 MVAR, 61-100 MVAR, 31-60 MVAR et 0-30 MVAR), utilisateur final (services publics d'électricité et secteurs industriels), type (condensateur synchrone neuf et condensateur synchrone remis à neuf), conception (conception de pôles saillants et conception de rotor cylindrique), nombre de pôles (4 à 8, moins de 4 et plus de 8), type de système d'excitation (excitation statique et système d'excitation sans balais) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des condensateurs synchrones en Amérique du Nord

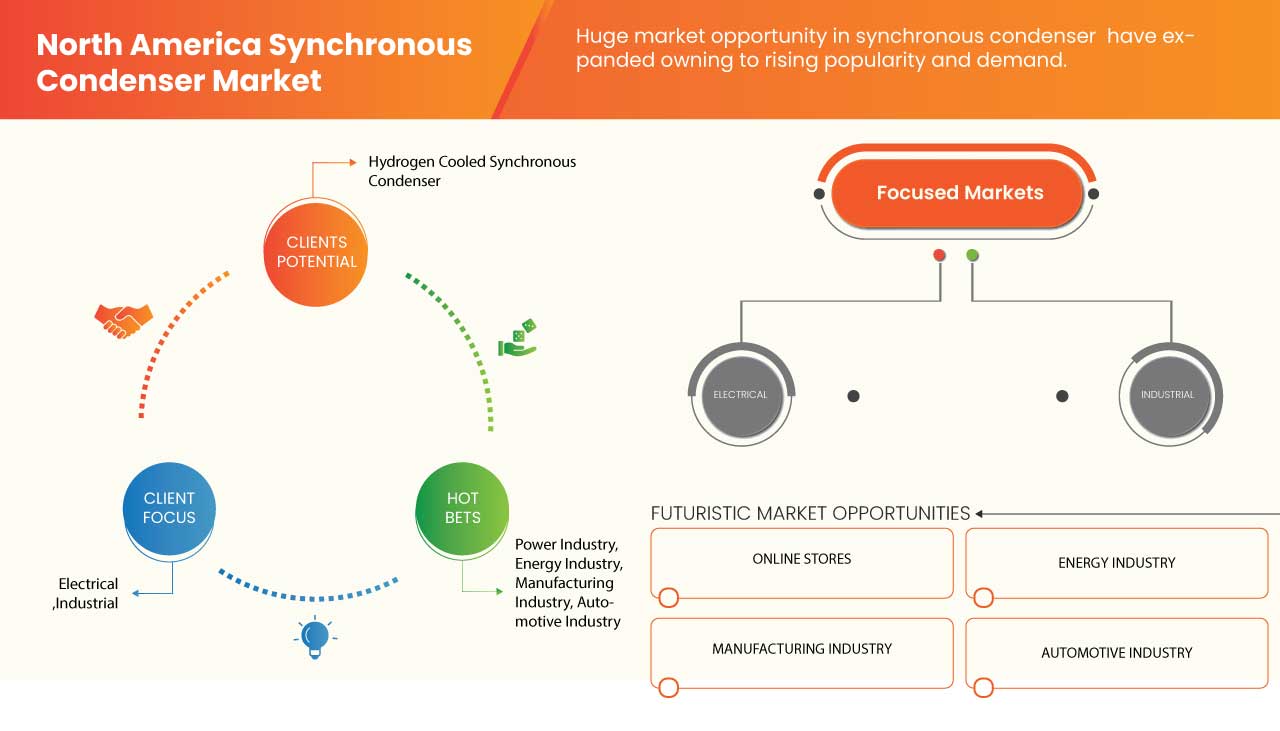

Un condensateur ou compensateur synchrone est un moteur fonctionnant sans charge fixe. Il peut générer ou consommer du voltampère réactif (VAr) en faisant varier l'excitation de son enroulement de champ. Il peut être configuré pour prendre un courant maximal avec surexcitation de son enroulement de champ. La demande croissante de condensateurs est due à l'introduction de dispositifs de compensation à semi-conducteurs, tels que le compensateur statique VAR (SVC) qui fournit une puissance réactive. La demande croissante de sources d'énergie propres et le besoin croissant de systèmes intégrés dans les centrales électriques sont les principaux facteurs qui stimulent le marché. Cependant, les prix élevés associés aux services d'installation et de maintenance freinent la croissance du marché. On estime que la montée en puissance du déclassement des sources de production d'énergie conventionnelles vieillissantes et les initiatives gouvernementales croissantes visant à réduire la pollution de l'air offrent des opportunités de croissance du marché. Cependant, l'implication de processus d'installation sophistiqués et chronophages crée un environnement difficile pour la croissance du marché.

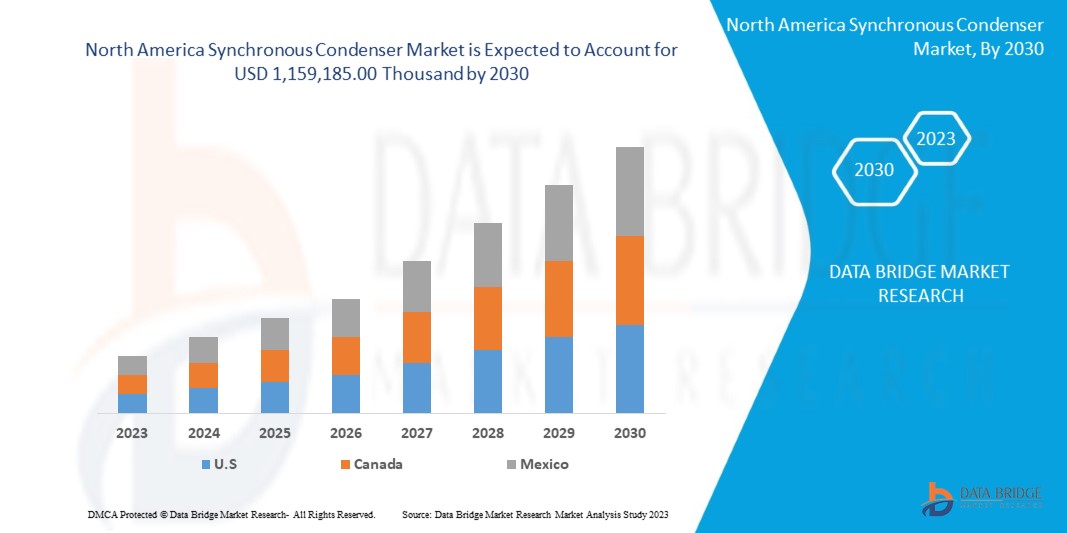

Selon les analyses de Data Bridge Market Research, le marché nord-américain des condensateurs synchrones devrait atteindre une valeur de 1 159 185,00 milliers USD d'ici 2030, à un TCAC de 3,7 % au cours de la période de prévision. Le rapport sur le marché nord-américain des condensateurs synchrones couvre également de manière exhaustive l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (Personnalisable 2015-2020) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains |

|

Segments couverts |

Technologie de refroidissement (condensateur synchrone refroidi à l'hydrogène, condenseur synchrone refroidi à l'air et condenseur synchrone refroidi à l'eau), méthode de démarrage (convertisseur de fréquence statique, moteur Pony et autres), puissance réactive nominale (supérieure à 200 MVAR, 101-200 MVAR, 61-100 MVAR, 31-60 MVAR et 0-30 MVAR), utilisateur final (services publics d'électricité et secteurs industriels), type (condensateur synchrone neuf et condensateur synchrone remis à neuf), conception (conception à pôles saillants et conception à rotor cylindrique), nombre de pôles (4 à 8, moins de 4 et plus de 8), type de système d'excitation (excitation statique et système d'excitation sans balais) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

General Electric, ABB, Siemens, Eaton, WEG, Ansaldo Energia, Shanghai Electric Power Generation Equipment Co., Ltd. (une filiale de Shanghai Electric), Ingeteam, Hitachi Energy Ltd, Voith GmbH & Co. KGaA, Mitsubishi Electric Power Products, Inc., Baker Hughes Company, Power Systems & Controls, Inc., IDEAL ELECTRIC POWER CO., Doosan Škoda Power et ANDRITZ, entre autres |

Définition du marché

Un condensateur synchrone est considéré comme un moteur synchrone à excitation CC qui ajuste la température et la puissance en fonction du transport d'énergie électrique et du réseau intelligent . Les compensateurs synchrones, également appelés condensateurs synchrones, sont conçus pour contrôler le niveau de tension dans une zone de réseau. Ils peuvent produire ou consommer de la puissance réactive en fonction de la valeur du courant d'excitation. Les condensateurs synchrones sont une alternative aux batteries de condensateurs pour la correction du facteur de puissance dans les réseaux électriques.

L'un des principaux avantages du condensateur synchrone est la quantité de puissance réactive qui peut être ajustée en continu. Le condensateur synchrone est développé avec des techniques avancées pour améliorer le facteur de puissance dans une batterie de condensateurs statiques. Les condensateurs synchrones ont traditionnellement été utilisés aux niveaux de tension de distribution et de transmission pour améliorer la stabilité et maintenir les tensions dans les limites souhaitées dans des conditions de charge changeantes et des situations d'urgence. Le condensateur synchrone se compose d'un stator et d'un rotor avec des pointes polaires intégrées solides, d'un système de refroidissement (hydrogène, air ou eau), d'un système d'excitation, d'une alimentation en huile de lubrification, d'un transformateur élévateur et d'un transformateur auxiliaire.

Un condensateur synchrone est une technologie bien connue de longue date qui offre des avantages. L'inertie élevée du système est une caractéristique inhérente à un condensateur synchrone car il s'agit d'une machine rotative. L'avantage de l'inertie est une meilleure rigidité de tension, améliorant le comportement global du système. La capacité de surcharge à court terme accrue peut fournir plus de deux fois sa valeur nominale jusqu'à quelques secondes, ce qui améliore le support du système en cas d'urgence ou d'imprévus ou même en cas d'imprévus de basse tension extrême. Il reste connecté et assure un fonctionnement fluide et fiable et une réelle résistance aux courts-circuits du réseau, améliorant la stabilité du système avec des interconnexions faibles et renforçant la protection du système.

Dynamique du marché des condensateurs synchrones en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Demande croissante de sources d’énergie propres

L'énergie propre désigne l'énergie obtenue à partir de sources qui ne rejettent pas de polluants atmosphériques. L'énergie renouvelable est l'énergie produite à partir de sources qui se renouvellent constamment. Contrairement aux combustibles fossiles et au gaz, ces ressources énergétiques renouvelables ne s'épuisent pas et comprennent l'énergie éolienne et solaire. Cependant, la plupart des sources d'énergie vertes sont renouvelables. Ainsi, l'énergie verte propre parfaite peut être qualifiée de source d'énergie renouvelable.

- Besoin croissant de systèmes intégrés dans les centrales électriques

L'intégration des systèmes énergétiques (ESI) coordonne l'exploitation et la planification des systèmes énergétiques afin de fournir des services énergétiques fiables et rentables avec un impact environnemental minimal. De tels systèmes impliquent une interaction entre des facteurs énergétiques tels que l'électricité, la chaleur, les carburants, l'eau et les émetteurs. Ainsi, l'ESI est un domaine multidisciplinaire couvrant la science, l'ingénierie et la technologie.

Opportunité

- Initiatives gouvernementales croissantes pour réduire la pollution de l'air

La consommation d'énergie augmente partout dans le monde en raison de la hausse de la demande en électricité. La production d'énergie à partir de combustibles fossiles est responsable de plus d'un tiers des émissions mondiales de gaz à effet de serre, qui sont à l'origine de la pollution et du changement climatique.

Contraintes/Défis

- Des prix plus élevés associés aux investissements et à la maintenance

Un condensateur synchrone est une solution classique utilisée depuis des décennies pour réguler la puissance. Ce type d'appareil comprend un moteur synchrone à courant alternatif qui peut fournir un contrôle continu de la puissance réactive lorsqu'il est utilisé avec un excitateur automatique approprié. Cela a conduit à une augmentation de l'utilisation de tels appareils électriques au fil des ans.

- Volatilité accrue des prix des matières premières

Les condensateurs synchrones sont associés à divers composants et systèmes, tels que les rotors, les stators et les systèmes de refroidissement. Ces systèmes sont fabriqués en aluminium, en cuivre et en acier inoxydable. De plus, la construction ou l'intégration de ce système est sophistiquée mais utile pour le système de distribution d'énergie et les modules de transistors de haute puissance.

Développements récents

- En avril 2023, Eaton a annoncé l'acquisition d'une participation de 9 % dans Jiangsu Ryan Electrical Co. Ltd., qui fabrique des transformateurs de distribution et de sous-transmission d'énergie en Chine. Cette acquisition aidera l'entreprise à se concentrer sur les produits et services électriques. De plus, elle accélère la distribution mondiale de l'entreprise, notamment en Asie-Pacifique.

- En janvier 2022, Siemens a annoncé la signature d'un accord avec Elering pour la construction de trois condensateurs synchrones dans des stations de jonction de 330 kV en Estonie d'ici 2024. Cet accord a permis à l'entreprise de gagner un chiffre d'affaires de 83,5 millions USD et une reconnaissance du marché pour les condensateurs synchrones et a renforcé ses activités en Allemagne.

Portée du marché des condensateurs synchrones en Amérique du Nord

Le marché nord-américain des condensateurs synchrones est segmenté en huit segments notables basés sur la technologie de refroidissement, la méthode de démarrage, la puissance réactive nominale, l'utilisateur final, le type, la conception, le nombre de pôles et le type de système d'excitation. La croissance parmi ces segments vous aidera à analyser les segments de faible croissance dans les industries et fournira aux utilisateurs un aperçu et des informations précieuses sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Technologie de refroidissement

- Condensateur synchrone refroidi à l'hydrogène

- Condenseur synchrone refroidi par air

- Condensateur synchrone refroidi par eau

Sur la base de la technologie de refroidissement, le marché des condenseurs synchrones en Amérique du Nord est segmenté en condenseur synchrone refroidi à l'hydrogène, condenseur synchrone refroidi à l'air et condenseur synchrone refroidi à l'eau.

Méthode de démarrage

- Convertisseur de fréquence statique

- Moteur de poney

- Autres

Sur la base de la méthode de démarrage, le marché mondial des condensateurs synchrones est segmenté en convertisseur de fréquence statique, moteur poney et autres.

Puissance réactive nominale

- Au-dessus de 200 MVAR

- 101-200 MVAR

- 61-100 MVAR

- 31-60 MVAR

- 0-30 MVAR

Sur la base de la puissance réactive nominale, le marché mondial des condensateurs synchrones est segmenté en plus de 200 MVAR, 101-200 MVAR, 61-100 MVAR, 31-60 MVAR et 0-30 MVAR.

Utilisateur final

- Services d'électricité

- Secteurs industriels

Sur la base de l’utilisateur final, le marché mondial des condensateurs synchrones est segmenté en services publics d’électricité et secteur industriel.

Taper

- Nouveau condensateur synchrone

- Condensateur synchrone remis à neuf

Sur la base du type, le marché mondial des condensateurs synchrones est segmenté en condensateurs synchrones neufs et condensateurs synchrones remis à neuf.

Nombre de pôles

- 4 à 8

- Moins de 4

- Plus de 8

Sur la base du nombre de pôles, le marché mondial des condensateurs synchrones est segmenté en 4 à 8, moins de 4 et plus de 8.

Conception

- Conception de pôles saillants

- Conception de rotor cylindrique

Sur la base de la conception, le marché mondial des condensateurs synchrones est segmenté en conception de pôles saillants et conception de rotor cylindrique.

Type de système d'excitation

- Excitation statique

- Système d'excitation sans balais

Sur la base du type de système d’excitation, le marché mondial des condensateurs synchrones est segmenté en système d’excitation statique et système d’excitation sans balais.

Analyse/perspectives régionales du marché des condensateurs synchrones en Amérique du Nord

Le marché des condensateurs synchrones en Amérique du Nord est analysé et des informations et tendances sur la taille du marché sont fournies par région, technologie de refroidissement, méthode de démarrage, puissance réactive nominale, utilisateur final, type, conception, nombre de pôles et type de système d'excitation comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché des condensateurs synchrones en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer l’Amérique du Nord en raison du besoin croissant d’énergie renouvelable, qui entraîne une demande de réseaux de transmission et de distribution d’électricité efficaces et fiables.

La section régionale du rapport fournit également des facteurs individuels ayant un impact sur le marché et des changements de réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données régionales.

Analyse du paysage concurrentiel et des parts de marché des condensateurs synchrones en Amérique du Nord

Le paysage concurrentiel du marché des condensateurs synchrones en Amérique du Nord fournit des détails sur le concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence régionale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que l'orientation des entreprises sur le marché.

Français Certains des principaux acteurs opérant sur le marché des condensateurs synchrones en Amérique du Nord sont General Electric, ABB, Siemens, Eaton, WEG, Ansaldo Energia, Shanghai Electric Power Generation Equipment Co., Ltd. (une filiale de Shanghai Electric), Ingeteam, Hitachi Energy Ltd, Voith GmbH & Co. KGaA, Mitsubishi Electric Power Products, Inc., Baker Hughes Company, Power Systems & Controls, Inc., IDEAL ELECTRIC POWER CO., Doosan Škoda Power et ANDRITZ, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SYNCHRONOUS CONDENSER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELLING

2.9 COOLING TECHNOLOGY CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 FLYWHEEL ROLE IN SYNCHRONOUS CONDENSER SYSTEMS

5 REGIONAL REASONING

5.1 NORTH AMERICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING DEMAND FOR CLEAN ENERGY SOURCES

6.1.2 GROWING NEED FOR INTEGRATED SYSTEMS IN POWER PLANTS

6.1.3 RISING DEMAND FOR SAFE AND SECURE ELECTRICAL GRID SYSTEMS

6.1.4 EXPANSION OF HVDC NETWORK ACROSS THE WORLD

6.2 RESTRAINTS

6.2.1 HIGHER PRICES ASSOCIATED WITH CAPITAL AND MAINTENANCE

6.2.2 STRINGENT STANDARDS RELATED TO SYNCHRONOUS CONDENSER

6.2.3 HIGHER PRICE VOLATILITY OF RAW MATERIALS

6.3 OPPORTUNITIES

6.3.1 RISING GOVERNMENT INITIATIVES TO REDUCE AIR POLLUTION

6.3.2 UPSURGE IN DECOMMISSIONING OF AGING AND CONVENTIONAL POWER GENERATION SOURCES

6.3.3 INCREASE IN INVESTMENTS IN R&D TO DEVELOP EFFICIENT SYNCHRONOUS CONDENSER

6.4 CHALLENGES

6.4.1 AVAILABILITY OF LOW-COST SUBSTITUTES

6.4.2 INVOLVEMENT IN SOPHISTICATED AND TIME-CONSUMING INSTALLATION PROCESS

7 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROGEN COOLED SYNCHRONOUS CONDENSER

7.3 AIR-COOLED SYNCHRONOUS CONDENSER

7.4 WATER COOLED SYNCHRONOUS CONDENSER

8 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD

8.1 OVERVIEW

8.2 STATIC FREQUENCY CONVERTOR

8.3 PONY MOTOR

8.4 OTHERS

9 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING

9.1 OVERVIEW

9.2 ABOVE 200 MVAR

9.3 101-200 MVAR

9.4 61-100 MVAR

9.5 31-60 MVAR

9.6 0-30 MVAR

10 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY END USER

10.1 OVERVIEW

10.2 ELECTRICAL UTILITIES

10.3 INDUSTRIAL SECTORS

11 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY TYPE

11.1 OVERVIEW

11.2 NEW SYNCHRONOUS CONDENSER

11.3 REFURBISHED SYNCHRONOUS CONDENSER

12 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY DESIGN

12.1 OVERVIEW

12.2 SALIENT POLE DESIGN

12.3 CYLINDRICAL ROTOR DESIGN

13 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES

13.1 OVERVIEW

13.2 4 TO 8

13.3 LESS THAN 4

13.4 MORE THAN 8

14 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE

14.1 OVERVIEW

14.2 STATIC EXCITATION

14.3 BRUSHLESS EXCITATION SYSTEM

15 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 GENERAL ELECTRIC

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 ABB

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 EATON

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 SERVICE PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 VOITH GMBH & CO. KGAA

18.4.1 COMPANY SNAPSHOT

18.4.2 COMPANY SHARE ANALYSIS

18.4.3 PRODUCT PORTFOLIO

18.4.4 RECENT DEVELOPMENTS

18.5 BAKER HUGHES COMPANY

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT & SERVICES PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ANDRITZ

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 COMPANY SHARE ANALYSIS

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 ANSALDO ENERGIA

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 PRODUCT PORTFOLIO

18.7.4 RECENT DEVELOPMENTS

18.8 DOOSAN ŠKODA POWER

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENTS

18.9 HITACHI ENERGY LTD

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 PRODUCT PORTFOLIO

18.9.4 RECENT DEVELOPMENTS

18.1 IDEAL ELECTRIC POWER CO.

18.10.1 COMPANY SNAPSHOT

18.10.2 PRODUCT PORTFOLIO

18.10.3 RECENT DEVELOPMENT

18.11 INGETEAM

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 SOLUTION PORTFOLIO

18.12.4 RECENT DEVELOPMENTS

18.13 POWER SYSTEMS & CONTROLS, INC.

18.13.1 COMPANY SNAPSHOT

18.13.2 PRODUCT PORTFOLIO

18.13.3 RECENT DEVELOPMENT

18.14 SHANGHAI ELECTRIC POWER GENERATION EQUIPMENT CO.,LTD. (A SUBSIDIARY OF SHANGHAI ELECTRIC)

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 SIEMENS

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 PRODUCT PORTFOLIO

18.15.4 RECENT DEVELOPMENTS

18.16 WEG

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 PRODUCT PORTFOLIO

18.16.4 RECENT DEVELOPMENTS

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 UNINTERRUPTED OPERATION REQUIREMENTS FOR VOLTAGE DISTURBANCES

TABLE 2 COMPARISON BETWEEN SYNCHRONOUS CONDENSER, SVC, AND SATCOM

TABLE 3 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA HYDROGEN COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA AIR-COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA WATER COOLED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA STATIC FREQUENCY CONVERTOR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA PONY MOTOR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA OTHERS IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA ABOVE 200 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 13 NORTH AMERICA 101-200 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 14 NORTH AMERICA 61-100 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 15 NORTH AMERICA 31-60 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 16 NORTH AMERICA 0-30 MVAR IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 17 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 18 NORTH AMERICA ELECTRICAL UTILITIES IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA INDUSTRIAL SECTORS IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 20 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 21 NORTH AMERICA NEW SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 22 NORTH AMERICA REFURBISHED SYNCHRONOUS CONDENSER IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 23 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 24 NORTH AMERICA SALIENT POLE DESIGN IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 25 NORTH AMERICA CYLINDRICAL ROTOR DESIGN IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA 4 TO 8 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA LESS THAN 4 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA MORE THAN 8 IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA STATIC EXCITATION IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 BRUSHLESS EXCITATION SYSTEM IN SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (UNITS)

TABLE 38 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 43 U.S. SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 44 U.S. SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 45 U.S. SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 46 U.S. SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 47 U.S. SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 48 U.S. SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 49 U.S. SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 50 U.S. SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 51 CANADA SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 52 CANADA SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 53 CANADA SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 54 CANADA SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 55 CANADA SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 56 CANADA SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 57 CANADA SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 58 CANADA SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

TABLE 59 MEXICO SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021-2030 (USD THOUSAND)

TABLE 60 MEXICO SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021-2030 (USD THOUSAND)

TABLE 61 MEXICO SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021-2030 (USD THOUSAND)

TABLE 62 MEXICO SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 63 MEXICO SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021-2030 (USD THOUSAND)

TABLE 64 MEXICO SYNCHRONOUS CONDENSER MARKET, BY DESIGN, 2021-2030 (USD THOUSAND)

TABLE 65 MEXICO SYNCHRONOUS CONDENSER MARKET, BY NO. OF POLES, 2021-2030 (USD THOUSAND)

TABLE 66 MEXICO SYNCHRONOUS CONDENSER MARKET, BY EXCITATION SYSTEM TYPE, 2021-2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: DBMR TRIPOD DATA VALIDATION MODEL

FIGURE 3 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: MULTIVARIATE MODELLING

FIGURE 10 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: COOLING TECHNOLOGY CURVE

FIGURE 11 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: SEGMENTATION

FIGURE 13 INCREASING DEMAND FOR CLEAN ENERGY SOURCES IS EXPECTED TO BE A KEY DRIVER FOR NORTH AMERICA SYNCHRONOUS CONDENSER MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 HYDROGEN COOLED SYNCHRONOUS CONDENSER IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SYNCHRONOUS CONDENSER MARKET IN 2023 TO 2030

FIGURE 15 SYNCHRONOUS CONDENSER WITH FLYWHEEL

FIGURE 16 SYNCHRONOUS CONDENSER WITH FLYWHEEL

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SYNCHRONOUS CONDENSER MARKET

FIGURE 18 SHARE OF DIFFERENT POWER GENERATING SOURCES

FIGURE 19 GENERATION OF WIND ENERGY

FIGURE 20 OPPORTUNITIES IN THE INTEGRATION OF SYSTEMS IN POWER PLANTS

FIGURE 21 AVERAGE ANNUAL INVESTMENT SPENDING ON ELECTRICITY GRIDS

FIGURE 22 PRICING LIST OF COPPER MATERIAL

FIGURE 23 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COOLING TECHNOLOGY, 2022

FIGURE 24 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY STARTING METHOD, 2022

FIGURE 25 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY REACTIVE POWER RATING, 2022

FIGURE 26 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY END USER, 2022

FIGURE 27 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY TYPE, 2022

FIGURE 28 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY DESIGN, 2022

FIGURE 29 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY NO. OF POLES, 2022

FIGURE 30 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY EXCITATION SYSTEM TYPE, 2022

FIGURE 31 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: SNAPSHOT (2022)

FIGURE 32 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2022)

FIGURE 33 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2023 & 2030)

FIGURE 34 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COUNTRY (2022 & 2030)

FIGURE 35 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: BY COOLING TECHNOLOGY (2023-2030)

FIGURE 36 NORTH AMERICA SYNCHRONOUS CONDENSER MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.