North America Sustainable Aviation Fuel Market, By Fuel Type (Bio Fuel, Hydrogen Fuel, and Power to Liquid Fuel), Manufacturing Technology (Hydroprocessed Fatty Acid Esters And Fatty Acids - Synthetic Paraffinic Kerosene (HEFA-SPK), Fischer Tropsch Synthetic Paraffinic Kerosene (FT-SPK), Synthetic ISO-Paraffin From Fermented Hydroprocessed Sugar (HFS-SIP), Fischer Tropsch (FT) Synthetic Paraffinic Kerosene With Aromatics (FT-SPK/A), Alcohol To Jet SPK (ATJ-SPK) and Catalytic Hydrothermolysis Jet (CHJ)), Blending Capacity (Below 30 %, 30 % to 50 % and Above 50%), Blending Platform (Commercial Aviation, Military Aviation, Business & General Aviation, and Unmanned Aerial Vehicle) Industry Trends and Forecast to 2029.

North America Sustainable Aviation Fuel Market Analysis and Size

The aviation industry is keen on bringing down carbon footprints to achieve a sustainable environment and meet the stringent regulatory standards on emissions. Alternative solutions, such as improving aero-engine efficiency by design modifications, hybrid-electric and all-electric aircraft, renewable jet fuels, etc., are being adopted by various stakeholders of the aviation industry. However, out of these solutions, the adoption of sustainable aviation fuels such as E-fuels, synthetic fuels, green jet fuels, bio jet fuels, hydrogen fuels is one of the most feasible alternative solutions with respect to socio and economic benefits when compared to others, which contributes significantly to mitigating current and expected future environmental impacts of aviation.

Sustainable aviation fuels are a key component in meeting the aviation industry’s commitments to decouple increases in carbon emissions from traffic growth. Factors such as a rise in a number of airline passengers, growing disposable income, increase in air transportation, and increase in consumption of synthetic lubricants supplement the growth of the North America sustainable aviation fuel market. However, the lack of infrastructure act as a restraining factor for the market.

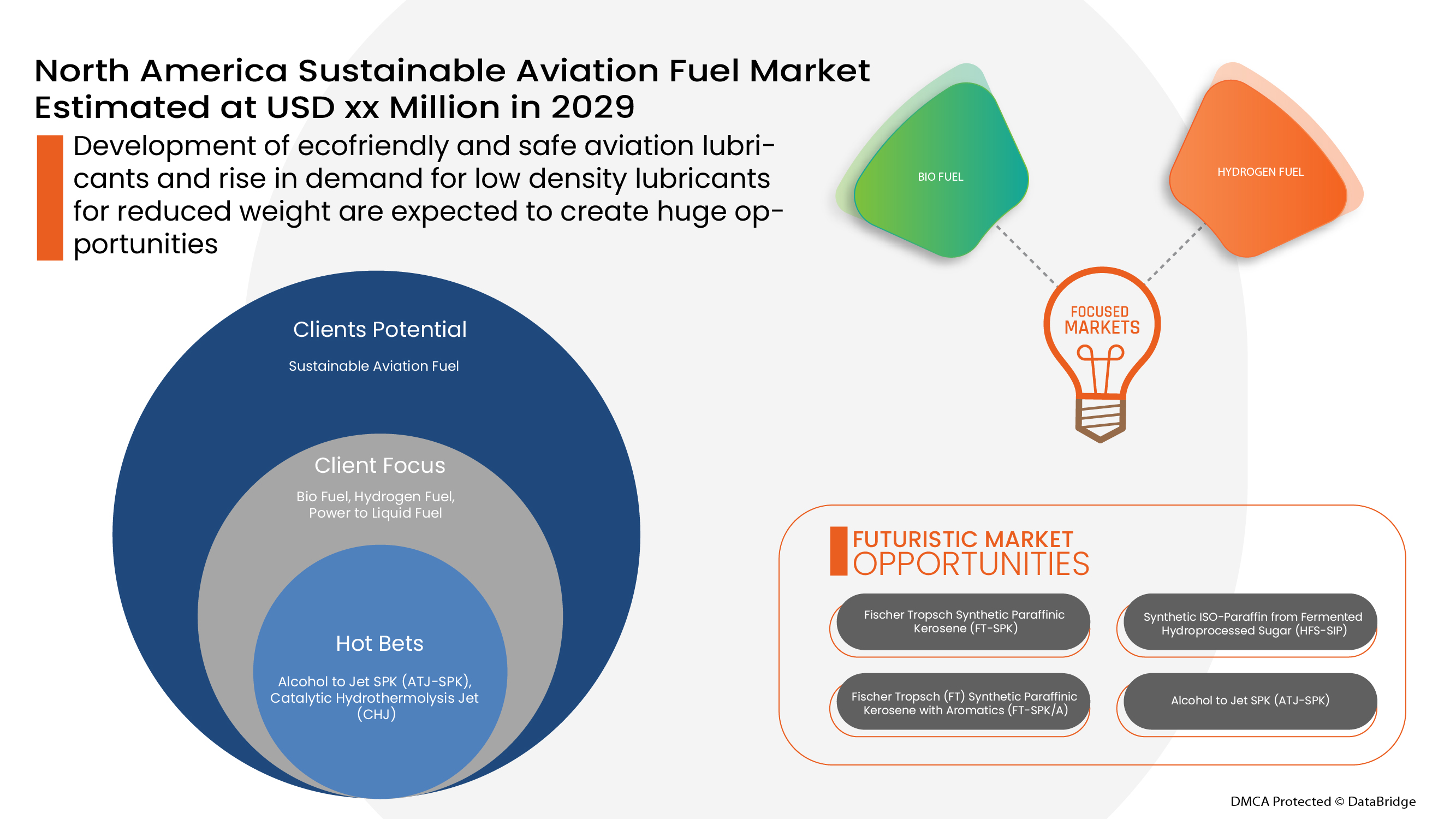

Data Bridge Market Research analyses that the Sustainable aviation fuel market is expected to reach the value of EURO 5,526.53 million by 2029, at a CAGR of 52.1% during the forecast period. “Bio Fuel" accounts for the largest technology segment in the Sustainable aviation fuel market due to rapid developments in technological pathways to commercialize the use of alternative jet fuel. The Sustainable aviation fuel market report also covers pricing analysis, patent analysis, and technological advancements in depth

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 |

|

Quantitative Units |

Chiffre d'affaires en millions d'euros, volumes en unités, prix en euros |

|

Segments couverts |

Par type de carburant (biocarburant, carburant hydrogène et carburant liquide), par technologie de fabrication (esters d'acides gras et acides gras hydrotraités - kérosène paraffinique synthétique (Hefa-Spk), kérosène paraffinique synthétique Fischer Tropsch (FT-SPK), isoparaffine synthétique issue de sucre hydrotraité fermenté (Hfs-Sip), kérosène paraffinique synthétique Fischer Tropsch (Ft) avec aromatiques (FT-SPK/A), alcool en jet Spk (ATJ-SPK) et jet d'hydrothermolyse catalytique (CHJ)), par capacité de mélange (moins de 30 %, de 30 % à 50 % et plus de 50 %), par plateforme de mélange (aviation commerciale, aviation militaire, aviation d'affaires et générale et véhicule aérien sans pilote) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord, |

|

Acteurs du marché couverts |

Gevo, Fulcrum BioEnergy, Prometheus Fuels, World Energy, Avfuel Corporation, LanzaTech, Honeywell International Inc, Chevron Corporation, Exxon Mobil Corporation, Johnson Matthey, VIRENT, INC., HyPoint Inc., entre autres. |

Définition du marché

Le carburant d'aviation durable est une forme unique de carburant conçu pour être utilisé dans les avions et qui, en même temps, augmentera les performances des avions. Les carburants d'aviation durables sont dérivés de matières premières durables et pourraient être très comparables dans leur composition chimique au carburant d'aviation fossile standard. Une augmentation de l'utilité des carburants d'aviation durables entraîne une réduction des émissions de carbone par rapport au carburant d'aviation traditionnel, car il remplace le cycle de vie du carburant.

L'industrie aéronautique est prête à réduire son empreinte carbone pour obtenir un environnement durable et satisfaire aux exigences réglementaires strictes en matière d'émissions. De plus, l'amélioration des performances des moteurs d'avion grâce à des modifications de configuration, des avions hybrides et entièrement électriques, des carburants renouvelables pour avions, sont adoptés par de nombreux acteurs de l'industrie aéronautique. Cependant, l'adoption de carburants d'aviation durables est considérée comme la solution la plus fiable et la plus viable en termes d'avantages socio-économiques par rapport à d'autres, ce qui contribue largement à atténuer les impacts environnementaux actuels et futurs de l'aviation.

Dynamique du marché des carburants d'aviation durables

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

- Besoin croissant de réduction des émissions de gaz à effet de serre dans le secteur de l'aviation

Les émissions de gaz à effet de serre (GES) d'origine humaine amplifient l'effet de serre, provoquant le changement climatique. Le dioxyde de carbone est émis principalement par la combustion de combustibles fossiles tels que le charbon, le pétrole et le gaz naturel. La Chine et la Russie comptent parmi les plus gros pollueurs. Ces pollutions sont principalement causées par les sociétés de charbon, de pétrole et de gaz appartenant à l'OPEP (Organisation des pays exportateurs de pétrole). Les niveaux de dioxyde de carbone dans l'atmosphère ont augmenté d'environ 50 % depuis l'époque préindustrielle en raison des émissions d'origine humaine.

Les émissions polluantes des moteurs d'avion sont équivalentes à celles émises par la combustion de combustibles fossiles. À haute altitude, les émissions des avions présentent une concentration plus élevée de contaminants. Ces émissions créent de graves problèmes environnementaux, tant en termes d'effets sur l'Amérique du Nord que sur la qualité de l'air local.

- Augmentation du transport aérien et de la consommation de lubrifiants synthétiques

Le transport aérien est un élément essentiel de la croissance et du développement économiques. À l'échelle nationale, régionale et mondiale, le transport aérien favorise l'intégration à l'économie nord-américaine et offre des liens cruciaux. Il contribue à la croissance du commerce, du tourisme et des possibilités d'emploi. Le système de transport aérien évolue et continuera d'évoluer. Cependant, à long terme, il sera difficile pour le système de transport aérien de s'adapter suffisamment rapidement pour répondre aux besoins changeants en termes de capacité, d'impact environnemental, de satisfaction des consommateurs, de sécurité et de sûreté, tout en maintenant la viabilité économique des fournisseurs de services.

La pandémie de Covid-19, ainsi que le soutien des gouvernements et les découvertes technologiques, notamment dans le domaine de la technologie des carburants, ont accéléré la transition de l'industrie aéronautique vers un carburant d'aviation durable (SAF). Alors que l'utilisation de carburant d'aviation durable (SAF) est en hausse, les lubrifiants non synthétiques sont en déclin. Les lubrifiants synthétiques et semi-synthétiques devraient bénéficier de la transition, car la plupart des avions utilisent des lubrifiants de qualité supérieure. Le marché mondial du carburant d'aviation durable (SAF) devrait être stimulé par ce facteur.

- Augmentation de la demande de carburant d'aviation durable par les compagnies aériennes

Le secteur de l'aviation adopte une « action urgente » pour atteindre l'objectif climatique mondial, qui comprend la réduction de la croissance du transport aérien et l'augmentation rapide de l'utilisation de carburants d'aviation durables (SAF). L'objectif des SAF est de recycler le carbone de la biomasse ou des gaz durables existants en carburant d'aviation en remplacement du carburant d'aviation fossile raffiné à partir du pétrole brut. L'objectif des SAF est de recycler le carbone de la biomasse ou des gaz durables existants en carburant d'aviation en remplacement du carburant d'aviation fossile raffiné à partir du pétrole brut. Le secteur de l'aviation dans son ensemble, ainsi que les compagnies aériennes membres de l'IATA, se sont engagés à atteindre des objectifs ambitieux de réduction des émissions. Les SAF (carburants d'aviation durables) ont été mis en avant comme un élément clé pour atteindre ces objectifs. Il faudra le soutien du gouvernement pour utiliser des carburants d'aviation durables afin de satisfaire aux objectifs climatiques de l'industrie

Alors que les principaux acteurs de l'industrie reconnaissent la nécessité de carburants d'aviation durables (SAF), les prestataires de services ont commencé à adopter diverses alternatives de carburants d'aviation durables (SAF) dans diverses compagnies aériennes, ce qui devrait stimuler davantage la croissance des carburants d'aviation durables (SAF) de manière significative.

- Disponibilité insuffisante des matières premières et des raffineries pour répondre à la demande de production durable de carburant d'aviation

Les carburants d'aviation durables (SAF), fabriqués à partir de matières premières d'origine biologique, constituent un élément important du plan visant à réduire l'empreinte carbone de l'aviation. Techniquement, il est possible de remplacer et de mélanger les SAF avec le kérosène. En fait, l'industrie aéronautique utilise des SAF depuis plus d'une décennie. Cependant, en raison des contraintes de l'offre et de la demande, les niveaux de consommation restent extrêmement faibles.

Les cultures oléagineuses, les cultures sucrières, les algues, les huiles usagées et d'autres ressources biologiques et non biologiques sont les matières premières qui jouent un rôle essentiel dans toute la chaîne de production de carburants d'aviation alternatifs tels que les carburants synthétiques, les e-carburants et les biocarburants pour avions. Le besoin de carburant d'aviation durable pourrait s'arrêter en raison d'une pénurie de matières premières nécessaires à sa fabrication. En raison d'une pénurie de matières premières nécessaires à sa fabrication, la demande de carburant d'aviation durable pourrait s'arrêter. En outre, les restrictions imposées aux raffineries, qui jouent un rôle essentiel dans l'exploitation optimale de ces matières premières, s'ajoutent au processus total de fabrication du SAF. La faible offre de carburant met également à rude épreuve la capacité de mélange du carburant, ce qui entraîne une baisse de l'efficacité.

Lorsque la concurrence du secteur de l'essence routière pour des matières premières conformes aux normes de durabilité s'intensifie, la disponibilité des matières premières devient un goulot d'étranglement. Les coûts des matières premières représentent une part importante du coût du SAF, et les fluctuations de prix peuvent entraîner des problèmes d'approvisionnement pour les producteurs de carburant. Par conséquent, une surtaxe sur le carburant plus élevée imposée par un transporteur freine encore davantage la croissance du marché dans une certaine mesure.

- Fluctuations des prix du pétrole brut et contamination des lubrifiants

La concurrence et la pression sur les coûts croissantes en Amérique du Nord obligent les entreprises et les chaînes d'approvisionnement à découvrir des potentiels de réduction des coûts non détectés. En particulier, les interfaces avec le marché du pétrole brut constituent un domaine d'amélioration prometteur. Dans l'environnement commercial actuel, chaque organisation est confrontée à un certain risque de fluctuation du prix du pétrole brut et des lubrifiants. Dans la production, les fabricants peuvent dépendre d'une quantité importante de produits pétroliers et, par conséquent, peuvent être particulièrement affectés par la volatilité des prix des produits pétroliers qu'ils achètent directement et indirectement par le biais de composants et de sous-ensembles. La volatilité et l'instabilité des marchés nord-américains ont des répercussions considérables sur les entreprises manufacturières. De la hausse des coûts de l'énergie aux fluctuations inattendues des coûts de fabrication du pétrole brut, des obstacles imprévus déstabilisent les chaînes d'approvisionnement et empêchent les fabricants de rester dans le noir. L'approvisionnement de nombreuses matières premières devenant plus difficile à sécuriser, la volatilité des prix des matières premières n'est peut-être pas un phénomène temporaire et il appartient aux fabricants d'absorber les coûts supplémentaires, de trouver de nouvelles façons d'atténuer les dépenses ou de répercuter les augmentations de prix sur les clients qui sont déjà réticents à dépenser. Les prix étant affectés par le resserrement des marchés de l’offre, cette tendance ne semble pas devoir changer dans un avenir proche. Ainsi, les fluctuations du coût du pétrole brut et d’autres lubrifiants constituent un frein majeur pour le marché nord-américain du carburant d’aviation durable (SAF).

Les fragments de carbone ne sont généralement pas assez durs ou assez gros pour provoquer une défaillance de la pompe. Ils peuvent cependant être assez gros pour bloquer de minuscules filtres ou buses. Une autre cause de contamination opérationnelle est la présence de sable, de gravier et de particules métalliques dans le système de lubrification. Cela constitue un facteur de restriction pour le marché nord-américain du carburant d'aviation durable (SAF).

- Réduction de l'empreinte carbone en raison de la faible capacité de production de carburant d'aviation durable

Le carburant d’aviation durable (SAF) réduit les émissions de carbone sur toute la durée de vie du carburant par rapport au carburant d’aviation traditionnel qu’il remplace. L’huile de cuisson et les autres huiles usagées non issues de palme provenant d’animaux ou de plantes sont des matières premières courantes, tout comme les déchets solides des maisons et des entreprises, tels que les emballages, le papier, les textiles et les restes de nourriture qui seraient autrement jetés dans des décharges ou incinérés. Les débris forestiers, tels que les déchets de bois, et les cultures énergétiques, telles que les plantes à croissance rapide et les algues, sont également des sources possibles.

En fonction de la matière première durable utilisée, du processus de production et de la chaîne d’approvisionnement de l’aéroport, le SAF peut réduire les émissions de carbone jusqu’à 80 % pendant la durée de vie du carburant par rapport au carburéacteur traditionnel qu’il remplace.

Le SAF peut être mélangé jusqu'à 50 % avec du carburant aéronautique standard et est soumis aux mêmes tests de qualité que le carburant aéronautique traditionnel. Après cela, le mélange est recertifié en tant que Jet A ou Jet A-1. Il peut être manipulé de la même manière que le carburant aéronautique standard, donc aucun changement n'est nécessaire à l'infrastructure de ravitaillement ou aux avions qui souhaitent utiliser du SAF, ce qui crée une opportunité pour la croissance du marché du carburant aéronautique durable en Amérique du Nord.

- Développement de lubrifiants aéronautiques écologiques et sûrs

Dans le monde d'aujourd'hui, l'industrie aéronautique est en plein essor, ce qui entraîne une concurrence accrue entre les producteurs de carburants d'aviation dans tous les domaines. Les sources alternatives respectueuses de l'environnement pour la production de carburants d'aviation à long terme devraient avoir une influence future sur le secteur des carburants d'aviation. Le marché des carburants d'aviation durables a connu une croissance significative au fil des ans, en raison de la tendance croissante à l'utilisation de carburants avancés dans les avions du monde entier.

La culture de biomasse pour la production durable de carburant d'aviation permet également aux agriculteurs de gagner plus d'argent hors saison en fournissant des matières premières à cette nouvelle industrie, tout en garantissant simultanément des avantages agricoles tels que la réduction des pertes de nutriments et l'amélioration de la qualité des sols. Cela crée ainsi une opportunité de croissance pour le marché nord-américain du carburant d'aviation durable (SAF).

- Le coût élevé du carburant d'aviation durable augmente les coûts d'exploitation des compagnies aériennes

Les dépenses de main-d’œuvre et de carburant sont les deux postes de dépenses les plus importants auxquels les compagnies aériennes sont confrontées. À court terme, les dépenses de main-d’œuvre sont généralement stables, mais les prix du carburant fluctuent considérablement en fonction du prix du pétrole. Le carburant représente une part importante du coût de fonctionnement d’une compagnie aérienne, représentant 20 à 30 % des dépenses totales. Les pics de prix du pétrole ont été parmi les moments les plus difficiles pour les compagnies aériennes. Les compagnies aériennes peuvent se préparer à une augmentation progressive des prix en augmentant le prix des billets ou en réduisant le nombre de vols, mais les augmentations de prix inattendues font perdre de l’argent à de nombreuses compagnies aériennes.

Les objectifs d’utilisation de carburant d’aviation durable (SAF) vont augmenter le prix du carburant cette année, ce qui compliquera encore la tâche des compagnies aériennes. Selon l’Association internationale du transport aérien (IATA), la production de SAF en Amérique du Nord ne représente qu’environ 100 millions de litres par an, soit 0,1 % de l’ensemble du carburant d’aviation utilisé. Plusieurs compagnies aériennes se sont en revanche engagées à porter ce pourcentage à 10 % d’ici 2030, un objectif véritablement ambitieux.

Malheureusement, en raison du volume limité de production, le coût est également élevé. Selon l'IATA, le coût du SAF est entre deux et quatre fois supérieur à celui des carburants fossiles, tandis qu'une récente divulgation d'Air France-KLM suggère que la disparité de coût pourrait être plus proche de quatre à huit fois celle du kérosène.

L'Association du transport aérien international (IATA) et d'autres organisations ont exhorté les gouvernements à encourager le développement du carburant d'aviation durable, mais sous la forme d'une stimulation économique. Cela ouvre la voie à une augmentation des prix du carburant d'aviation durable (SAF), ce qui constitue un défi pour le marché nord-américain du carburant d'aviation durable.

Impact de la pandémie de COVID-19 sur le marché des carburants d'aviation durables

La COVID-19 a eu un impact majeur sur le marché du carburant d'aviation durable, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises qui interviennent dans cette situation de pandémie sont les services essentiels qui sont autorisés à ouvrir et à exécuter les processus.

La croissance du marché des carburants d'aviation durables augmente en raison de la nécessité de réduire les émissions de GES dans l'industrie aéronautique. Cependant, des facteurs tels que la disponibilité inadéquate des matières premières et des raffineries pour répondre à la demande de production de carburants d'aviation durables freinent la croissance du marché. La fermeture des installations de production pendant la situation de pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans le carburant d'aviation durable. Grâce à cela, les entreprises mettront sur le marché des contrôleurs avancés et précis. En outre, l'utilisation de carburant d'aviation durable par les autorités gouvernementales dans le fret aérien a entraîné la croissance du marché.

Développement récent

- En mars 2022, Gevo et oneworld Alliance, un réseau de compagnies aériennes de classe mondiale, ont annoncé que certains membres de oneworld Oneworld prévoyaient d'acheter jusqu'à 200 millions de gallons par an de carburant d'aviation durable (« SAF ») auprès de Gevo (l'« objectif d'achat de SAF de oneworld Alliance »). La livraison du SAF devrait commencer en 2027, pour une durée de cinq ans. Cet accord contribue à améliorer les revenus de l'entreprise.

- En décembre 2021, Fulcrum BioEnergy a annoncé avoir finalisé le financement intermédiaire de son deuxième projet de transformation des déchets en combustibles, aboutissant à l'émission de 375 millions USD d'obligations de revenus pour l'amélioration de l'environnement (obligations) par l'Indiana Finance Authority par l'intermédiaire de la filiale à 100 % de Fulcrum, Fulcrum Centerpoint, LLC (Centerpoint). Ce développement commercial contribue à améliorer la présence de l'entreprise en Amérique du Nord.

Portée du marché nord-américain des carburants d'aviation durables

Le marché des carburants d'aviation durables est segmenté en fonction du type de carburant, de la technologie de fabrication, de la capacité de mélange et de la plateforme de mélange. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Type de carburant

- Biocarburant

- Hydrogène carburant

- Transformation de l'énergie en carburant liquide

Sur la base du type de carburant, le marché nord-américain des carburants d'aviation durables est segmenté en biocarburant, carburant à hydrogène et carburant liquide.

Technologie de fabrication

- Esters d'acides gras et acides gras hydrotraités - Kérosène paraffinique synthétique (HEFA-SPK)

- Kérosène paraffinique synthétique Fischer Tropsch (FT-SPK)

- Isoparaffine synthétique issue de sucre hydrotraité fermenté (HFS-SIP)

- Kérosène paraffinique synthétique Fischer Tropsch (FT) avec aromatiques (FT-SPK/A)

- De l'alcool au Jet Spk (ATJ-SPK)

- Jet d'hydrothermolyse catalytique (CHJ)

Sur la base de la technologie de fabrication, le marché nord-américain des carburants d'aviation durables a été segmenté en esters d'acides gras hydrotraités et acides gras - kérosène paraffinique synthétique (HEFA-SPK), kérosène paraffinique synthétique Fischer Tropsch (FT-SPK), iso-paraffine synthétique issue de sucre hydrotraité fermenté (HFS-SIP), kérosène paraffinique synthétique Fischer Tropsch (FT) avec aromatiques (FT-SPK/A), alcool à jet SPK (ATJ-SPK) et jet d'hydrothermolyse catalytique (CHJ).

Capacité de mélange

- Moins de 30 %

- 30 % à 50 %

- Plus de 50%

Sur la base de la capacité de mélange, le marché nord-américain des carburants d'aviation durables a été segmenté en moins de 30 %, de 30 % à 50 % et plus de 50 %.

Plateforme de mélange

- Aviation commerciale

- Aviation militaire

- Aviation d'affaires et générale

- Véhicule aérien sans pilote

Sur la base de la plateforme de mélange, le marché nord-américain des carburants d'aviation durables a été segmenté en aviation commerciale, aviation militaire, aviation d'affaires et générale et véhicules aériens sans pilote.

Analyse/perspectives régionales du marché des carburants d'aviation durables

Le marché des carburants d’aviation durables est analysé et des informations et tendances sur la taille du marché sont fournies par pays, type de carburant, technologie de fabrication, capacité de mélange et plate-forme de mélange comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des carburants d'aviation durables sont les États-Unis, le Canada et le Mexique en Amérique du Nord

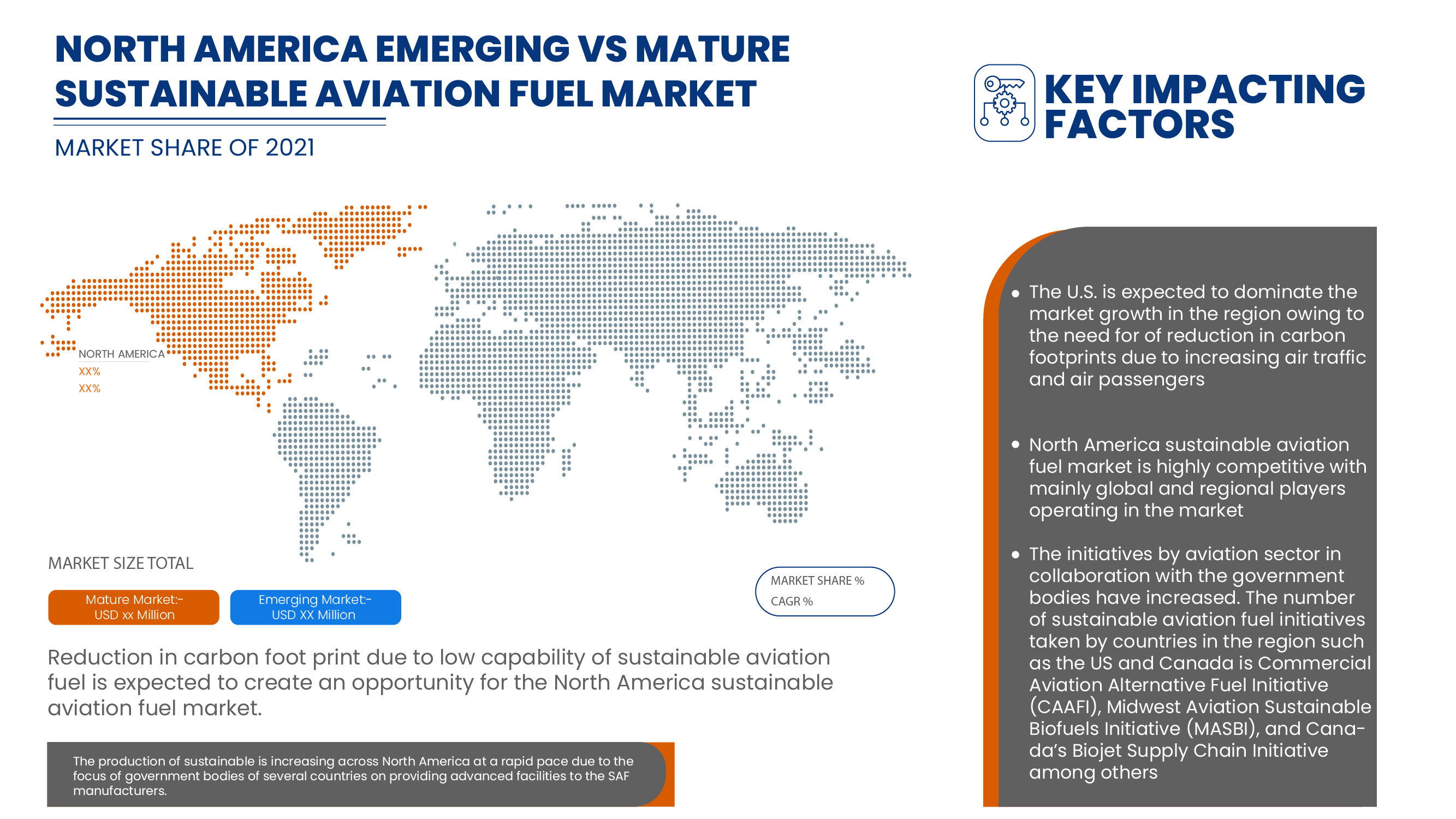

Les États-Unis dominent le marché des carburants d'aviation durables en Amérique du Nord. Cela est dû à la réduction de l'empreinte carbone due à l'augmentation du trafic aérien et du nombre de passagers aériens. Les pays internationaux tels que les États-Unis et le Canada en Amérique du Nord se concentrent sur diverses initiatives visant à utiliser le carburant d'aviation renouvelable. De plus, les réglementations et les initiatives de soutien du gouvernement stimulent le marché des carburants d'aviation durables au Canada.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces de Porter, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du carburant d'aviation durable

Le paysage concurrentiel du marché des carburants d'aviation durables fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché des carburants d'aviation durables.

Certains des principaux acteurs opérant sur le marché des carburants d'aviation durables sont Gevo, Fulcrum BioEnergy, Prometheus Fuels, World Energy, Avfuel Corporation, LanzaTech, Honeywell International Inc, Chevron Corporation, Exxon Mobil Corporation, Johnson Matthey, VIRENT, INC., HyPoint Inc., entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 FUEL TYPE TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ANALYSIS OF FUTURE APPLICATIONS

4.2 ADVANCING SUSTAINABILITY WITHIN AVIATION

4.3 ORGANIZATIONS INVOLVED IN SUSTAINABLE AVIATION FUEL PROGRAMS

4.4 RESEARCH & INNOVATION ROADMAP FOR AVIATION HYDROGEN TECHNOLOGY

4.5 RECENT SUPPLY CONTRACTS BY SHELL

4.6 STANDARDS

4.6.1 OVERVIEW

4.6.2 INTERNATIONAL CIVIL AVIATION ORGANIZATION (ICAO)

4.6.3 INTERNATIONAL AIR TRANSPORT ASSOCIATION (IATA)

4.6.4 BUREAU OF CIVIL AVIATION SECURITY

4.6.5 FEDERAL AVIATION ADMINISTRATION

4.6.6 EUROPEAN UNION AVIATION SAFETY AGENCY (EASA)

4.6.7 CIVIL AVIATION ADMINISTRATION OF CHINA (CAAC)

4.6.8 UAE GENERAL CIVIL AVIATION AUTHORITY (GCAA)

4.7 VALUE CHAIN ANALYSIS

4.7.1 OVERVIEW OF VALUE CHAIN ANALYSIS OF SUSTAINABLE AVIATION FUEL MARKET

4.8 TECHNOLOGY TRENDS

4.8.1 OVERVIEW

4.8.2 HYDROTHERMAL LIQUEFACTION (HTL)

4.8.3 PYROLYSIS PATHWAYS OR PYROLYSIS-TO-JET (PTJ)

4.8.4 TECHNOLOGICAL MATURITY - FUEL READINESS LEVEL AND FEEDSTOCK READINESS LEVEL

4.9 IMPACT OF MEGATREND

4.1 INNOVATION AND PATENT ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY

5.1.2 INCREASE IN AIR TRANSPORTATION CONSUMPTION OF SYNTHETIC LUBRICANTS

5.1.3 INCREASE IN DEMAND FOR SUSTAINABLE AVIATION FUEL BY AIRLINES

5.1.4 INCREASE IN INVESTMENTS FOR THE GROWTH OF COMMERCIAL AIRCRAFTS

5.2 RESTRAINTS

5.2.1 INADEQUATE AVAILABILITY OF FEEDSTOCK AND REFINERIES TO MEET SUSTAINABLE AVIATION FUEL PRODUCTION DEMAND

5.2.2 FLUCTUATIONS IN CRUDE OIL PRICES AND CONTAMINATION OF LUBRICANTS

5.3 OPPORTUNITIES

5.3.1 REDUCTION IN CARBON FOOTPRINT DUE TO LOW CAPABILITY OF SUSTAINABLE AVIATION FUEL

5.3.2 DEVELOPMENT OF ECO-FRIENDLY AND SAFE AVIATION LUBRICANTS

5.3.3 RISE IN DEMAND FOR LOW-DENSITY LUBRICANTS FOR REDUCED WEIGHT

5.3.4 RISE IN SAFETY REGULATIONS FOR AIRCRAFTS

5.4 CHALLENGE

5.4.1 THE HIGH COST OF SUSTAINABLE AVIATION FUEL INCREASES THE OPERATING COST OF AIRLINES

6 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE

6.1 OVERVIEW

6.2 BIOFUEL

6.3 HYDROGEN FUEL

6.4 POWER TO LIQUID FUEL

7 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY

7.1 OVERVIEW

7.2 HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK)

7.3 FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK)

7.4 SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP)

7.5 FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A)

7.6 ALCOHOL TO JET SPK (ATJ-SPK)

7.7 CATALYTIC HYDROTHERMOLYSIS JET (CHJ)

8 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY

8.1 OVERVIEW

8.2 BELOW 30%

8.3 30% TO 50%

8.4 ABOVE 50%

9 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM

9.1 OVERVIEW

9.2 COMMERCIAL AVIATION

9.2.1 BY TYPE

9.2.1.1 NARROW BODY AIRCRAFT

9.2.1.2 WIDE-BODY AIRCRAFT (WBA)

9.2.1.3 VERY LARGE AIRCRAFT (VLA)

9.2.1.4 REGIONAL TRANSPORT AIRCRAFT (RTA)

9.2.2 BY FUEL TYPE

9.2.2.1 BIOFUEL

9.2.2.2 HYDROGEN

9.2.2.3 POWER TO LIQUID FUEL

9.3 BUSINESS & GENERAL AVIATION

9.3.1 BIOFUEL

9.3.2 HYDROGEN

9.3.3 POWER TO LIQUID FUEL

9.4 MILITARY AVIATION

9.4.1 BIOFUEL

9.4.2 HYDROGEN

9.4.3 POWER TO LIQUID FUEL

9.5 UNMANNED AERIAL VEHICLE

9.5.1 BIOFUEL

9.5.2 HYDROGEN

9.5.3 POWER TO LIQUID FUEL

10 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY REGION

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT ANALYSIS

13 COMPANY PROFILES

13.1 NESTE

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 BP P.L.C.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SERVICE PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 PREEM AB.

13.3.1 COMPANY SNAPSHOT

13.3.2 COMPANY SHARE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENT

13.4 CEPSA

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 CHEVRON CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCT PORTFOLIO

13.5.5 RECENT DEVELOPMENTS

13.6 AVFUEL CORPORATION

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENT

13.7 ENI

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 EXXON MOBIL CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FULCRUM BIOENERGY

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 GEVO

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 HONEYWELL INTERNATIONAL INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 HYPOINT INC.

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 JOHNSON MATTHEY

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENT

13.14 LANZATECH

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 PROMETHEUS FUELS

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 SKYNRG

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 SASOL

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 TOTALENERGIES

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENT

13.19 VELOCYS

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.2 VIRENT, INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 WORLD ENERGY

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCT PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 ZEROAVIA, INC.

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 2 NORTH AMERICA BIOFUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 3 NORTH AMERICA HYDROGEN IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 4 NORTH AMERICA POWER TO LIQUID FUEL IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 5 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 6 NORTH AMERICA HYDROPROCESSED FATTY ACID EASTERS AND FATTY ACIDS - SYNTHETIC PARAFFINIC KEROSENE (HEFA-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 7 NORTH AMERICA FISCHER TROPSCH SYNTHETIC PARAFFINIC KEROSENE (FT-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 8 NORTH AMERICA SYNTHETIC ISO-PARAFFIN FROM FERMENTED HYDROPROCESSED SUGAR (HFS-SIP) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 9 NORTH AMERICA FISCHER TROPSCH (FT) SYNTHETIC PARAFFINIC KEROSENE WITH AROMATICS (FT-SPK/A) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 10 NORTH AMERICA ALCOHOL TO JET SPK (ATJ-SPK) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 11 NORTH AMERICA CATALYTIC HYDROTHERMOLYSIS JET (CHJ) IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 12 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 13 NORTH AMERICA BELOW 30% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 14 NORTH AMERICA 30% TO 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 15 NORTH AMERICA ABOVE 50% IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 16 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 17 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 18 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 19 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 20 NORTH AMERICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 21 NORTH AMERICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 22 NORTH AMERICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 23 NORTH AMERICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 24 NORTH AMERICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY REGION, 2020-2029 (EURO MILLION)

TABLE 25 NORTH AMERICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 26 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (EURO MILLION)

TABLE 27 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY COUNTRY, 2020-2029 (METRIC TONNES)

TABLE 28 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 29 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 30 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 31 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 32 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 33 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 34 NORTH AMERICA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 35 NORTH AMERICA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 36 NORTH AMERICA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 37 NORTH AMERICA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 38 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 39 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 40 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 41 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 42 U.S. SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 43 U.S. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 44 U.S. COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 45 U.S. BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 46 U.S. MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 47 U.S. UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 48 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 49 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 50 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 51 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 52 CANADA SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 53 CANADA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 54 CANADA COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 55 CANADA BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 56 CANADA MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 57 CANADA UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 58 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 59 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (METRIC TONNES)

TABLE 60 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY MANUFACTURING TECHNOLOGY, 2020-2029 (EURO MILLION)

TABLE 61 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING CAPACITY, 2020-2029 (EURO MILLION)

TABLE 62 MEXICO SUSTAINABLE AVIATION FUEL MARKET, BY BLENDING PLATFORM, 2020-2029 (EURO MILLION)

TABLE 63 MEXICO COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY TYPE, 2020-2029 (EURO MILLION)

TABLE 64 MEXICO COMMERCIAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 65 MEXICO BUSINESS & GENERAL AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 66 MEXICO MILITARY AVIATION IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

TABLE 67 MEXICO UNMANNED AERIAL VEHICLE IN SUSTAINABLE AVIATION FUEL MARKET, BY FUEL TYPE, 2020-2029 (EURO MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: SEGMENTATION

FIGURE 10 THE INCREASING NEED FOR REDUCTION IN GHG EMISSIONS IN THE AVIATION INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 11 BIO FUEL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND BE THE FASTEST-GROWING REGION IN THE NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET IN THE FORECAST PERIOD

FIGURE 13 VALUE CHAIN ANALYSIS FRAMEWORK

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGE OF NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET

FIGURE 15 NORTH AMERICA AIR TRANSPORT PASSENGER DEMAND

FIGURE 16 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY TECHNOLOGY, 2021

FIGURE 17 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY MANUFACTURING TECHNOLOGY, 2021

FIGURE 18 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING CAPACITY, 2021

FIGURE 19 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY BLENDING PLATFORM, 2021

FIGURE 20 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: SNAPSHOT (2021)

FIGURE 21 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021)

FIGURE 22 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 23 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 24 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: BY FUEL TYPE (2022-2029)

FIGURE 25 NORTH AMERICA SUSTAINABLE AVIATION FUEL MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.