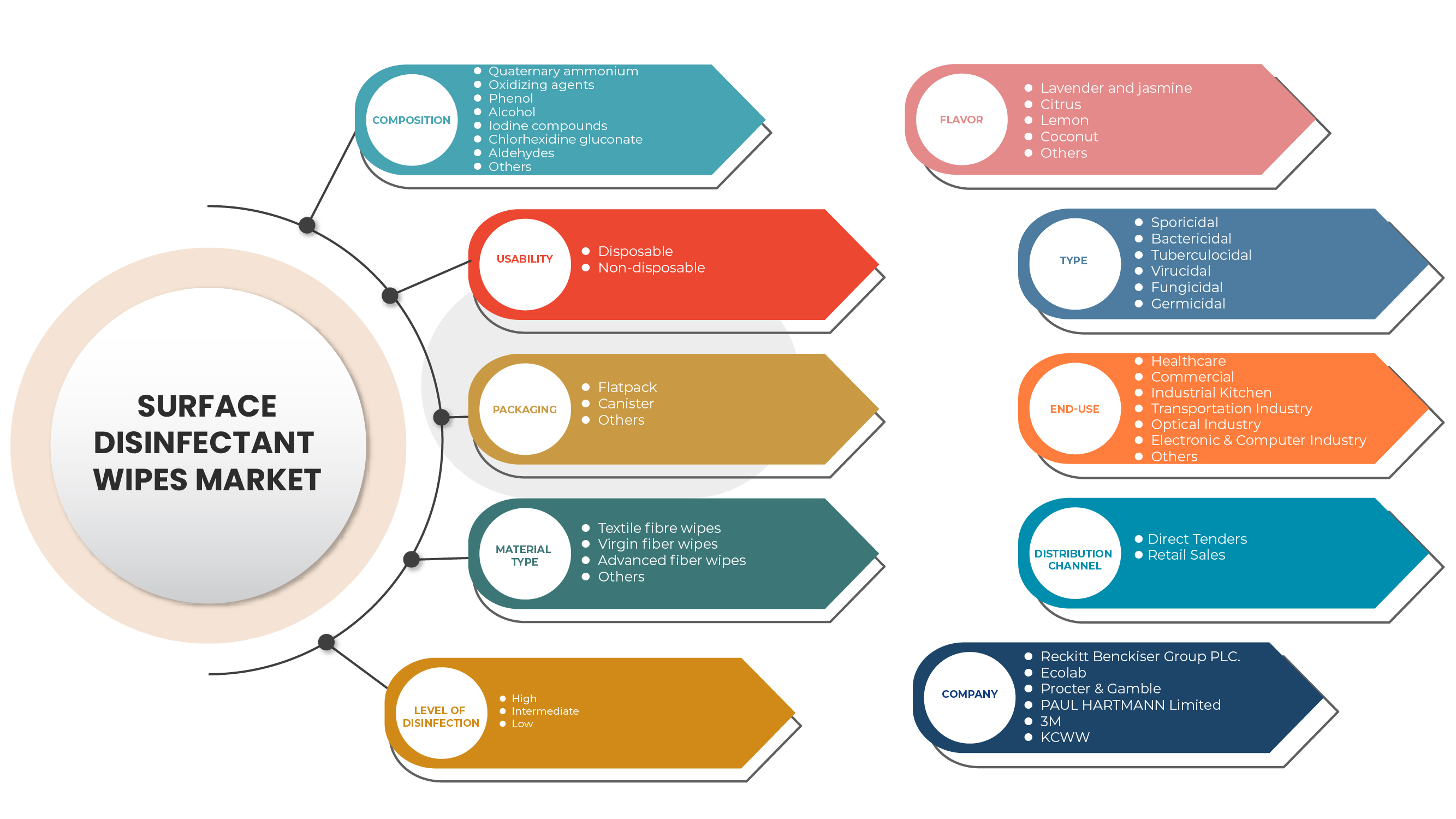

North America Surface Disinfectant Wipes Market, By Composition (Quaternary Ammonium, Oxidizing Agents, Phenol, Alcohol, Chlorine Compounds, Iodine Compounds, Chlorhexidine Gluconate, Aldehydes, And Others), Usability (Disposable And Non-Disposable), Packaging (Flatpack, Canister And Others), Material Type (Textile Fiber Wipes, Virgin Fiber Wipes, Advanced Fiber Wipes And Others), Levels Of Disinfection (High, Intermediate And Low), Flavor (Lavender And Jasmine, Citrus, Lemon, Coconut And Others), Type (Sporicidal, Bactericidal, Tuberculocidal, Virucidal, Fungicidal And Germicidal), End-Use (Healthcare, Commercial, Industrial Kitchen, Transportation Industry, Optical Industry, Electronic And Computer Industry And Others), Distribution Channel (Direct Tenders And Retail Sales), Industry Trends and Forecast to 2029

Market Analysis and Insights

Surface infecting wipes give a simple method to keep practically any kind of hard, non-permeable surface clean for use, sterilize, and wipe the thing or surface, permitting the territory scrubbed to stay soggy for around 30 seconds before drying. Ledges, apparatuses, sinks, installations (light and water), door handles, entryway handles, balustrades, tile, rock, earthenware production, phones, toys, and consoles are the average things or areas where surface disinfecting wipes can be utilized for cleaning and sterilizing.

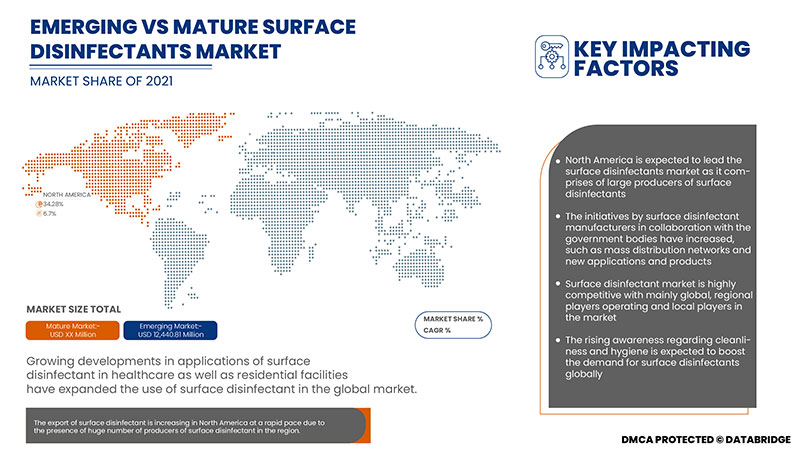

The rise in demand for surface disinfectant wipes in commercial applications such as hospitals, the F&B sector, institutions and household applications is a major factor propelling the growth of the surface disinfectant wipes market.

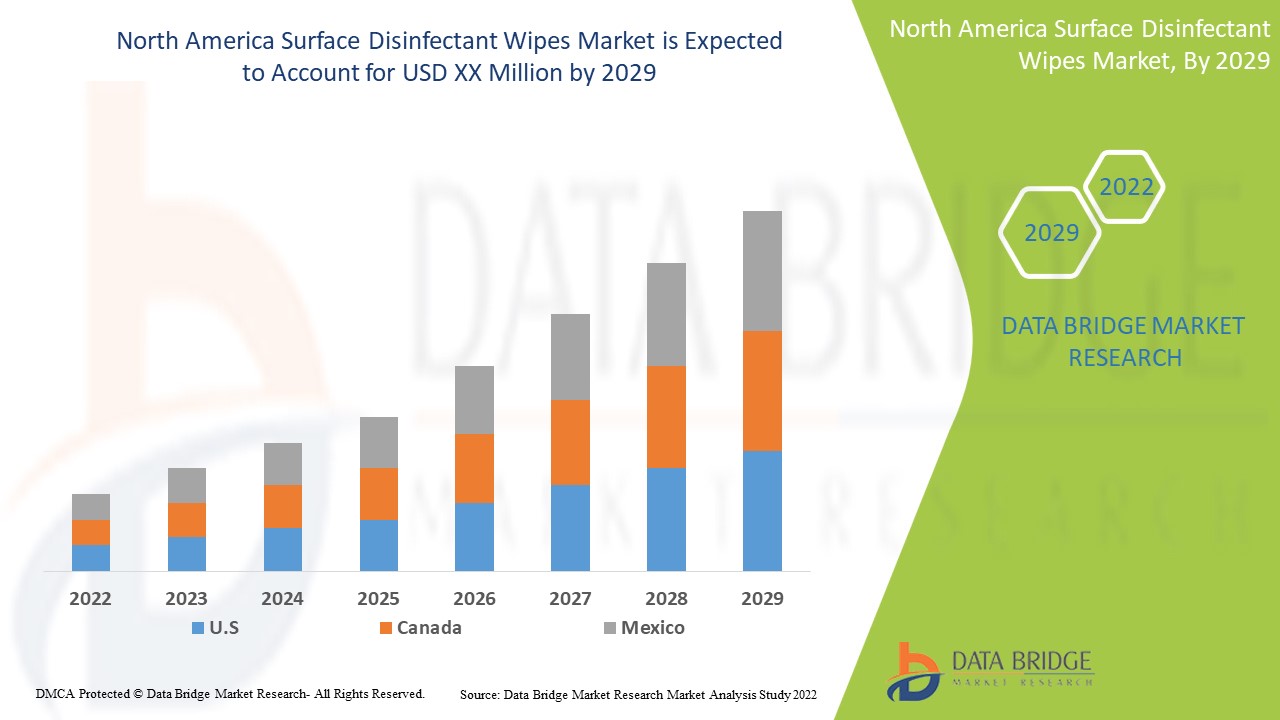

Data Bridge Market Research analyses that the surface disinfectant wipes will grow at a CAGR of 6.8% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2020 - 2015) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Composition (Quaternary Ammonium, Oxidizing Agents, Phenol, Alcohol, Chlorine Compounds, Iodine Compounds, Chlorhexidine Gluconate, Aldehydes, And Others), Usability (Disposable And Non-Disposable), Packaging (Flatpack, Canister And Others), Material Type (Textile Fiber Wipes, Virgin Fiber Wipes, Advanced Fiber Wipes And Others), Levels Of Disinfection (High, Intermediate And Low), Flavor (Lavender And Jasmine, Citrus, Lemon, Coconut And Others), Type (Sporicidal, Bactericidal, Tuberculocidal, Virucidal, Fungicidal And Germicidal), End-Use (Healthcare, Commercial, Industrial Kitchen, Transportation Industry, Optical Industry, Electronic And Computer Industry And Others), Distribution Channel (Direct Tenders And Retail Sales), Industry Trends and Forecast to 2029 |

|

Countries Covered |

U.S., Canada, Mexico |

|

Market Players Covered |

Français Zep Inc., Whiteley, The Claire Manufacturing Company, STERIS, Spartan Chemical Company, Inc., Seventh Generation Inc., SC Johnson & Son, Inc., Reckitt Benckiser Group PLC., Procter & Gamble, PDI, Inc., Pal International, Ecolab, 3M, Cantel Medical., Contec, Inc., Betco, CleanWell, GOJO Industries, Inc., PDI, Inc, Parker Laboratories, Inc., Metrex Research, LLC., Diversey Holdings LTD., Dreumex USA Inc., KCWW, Inc et Medline Industries, LP., entre autres. |

Définition du marché

Les petites serviettes ou lingettes humides sont utilisées pour nettoyer les surfaces afin d'éliminer les saletés et les microbes, comme les staphylocoques et les salmonelles, qui peuvent avoir été déposés sur la surface affectée par des aliments, des personnes ou des animaux. Souvent parfumées avec une odeur agréable, comme les agrumes ou le pin, on les appelle lingettes.

Les lingettes désinfectantes pour surfaces offrent une méthode simple pour garder pratiquement tout type de surface dure et non perméable propre pour l'utilisation, pour stériliser, essuyer l'objet ou la surface, permettant à la zone frottée de rester humide pendant environ 30 secondes avant de sécher. Les rebords, les appareils, les éviers, les installations (éclairage et eau), les poignées de porte, les poignées de porte, les balustrades, les carreaux, la pierre, la production de faïence, les téléphones, les jouets et les consoles sont quelques-uns des objets ou des zones courants où les lingettes désinfectantes pour surfaces peuvent être utilisées pour nettoyer et stériliser .

Dynamique du marché des lingettes désinfectantes pour surfaces en Amérique du Nord

Conducteurs

-

Utilisation croissante des lingettes désinfectantes de surface pour les applications commerciales

Les désinfectants de surface sont des composés chimiques utilisés pour détruire les agents pathogènes et autres micro-organismes via un processus appelé désinfection. Les lingettes désinfectantes de surface aident à inhiber la croissance d'agents pathogènes tels que les bactéries, les virus et les champignons, ce qui conduit à diverses formes de contamination et d'infections. Ces désinfectants de surface sont constitués de divers composés chimiques tels que l'ammonium quaternaire ou quats, les composés chlorés, les composés phénoliques , les agents oxydants, l'alcool, les composés amphotères et même leur combinaison. L'essor des lingettes désinfectantes de surface est observé dans diverses applications commerciales, à savoir la maison, la cuisine, le secteur alimentaire et agricole et l'hôtellerie, pour éviter toute contamination.

-

Sensibiliser les consommateurs à l’hygiène et aux soins préventifs

La sensibilisation et l'éducation du public sont un aspect essentiel des efforts visant à réduire la charge mondiale des maladies infectieuses et d'autres sources de contamination. Une bonne sensibilisation des populations leur permet de comprendre l'importance de la santé et de l'hygiène à l'avance, réduisant ainsi les risques d'infection. Comme il est dit à juste titre que mieux vaut prévenir que guérir, de grands efforts sont déployés par diverses organisations gouvernementales et non gouvernementales pour sensibiliser à l'hygiène et aux soins de santé préventifs. Ainsi, la sensibilisation croissante des consommateurs à l'hygiène et aux soins de santé préventifs stimule la demande du marché des lingettes désinfectantes pour surfaces.

-

Forte prévalence des infections nosocomiales (IN)

Les infections nosocomiales sont également appelées infections nosocomiales. Ces infections sont généralement contractées lors de visites dans des établissements de santé et des hôpitaux, entre autres. La plupart des personnes contractent des infections nosocomiales dans l'unité de soins intensifs (USI). Avec l'augmentation des soins médicaux et l'utilisation d' antibiotiques , on observe que le nombre de cas d'infections nosocomiales augmente.

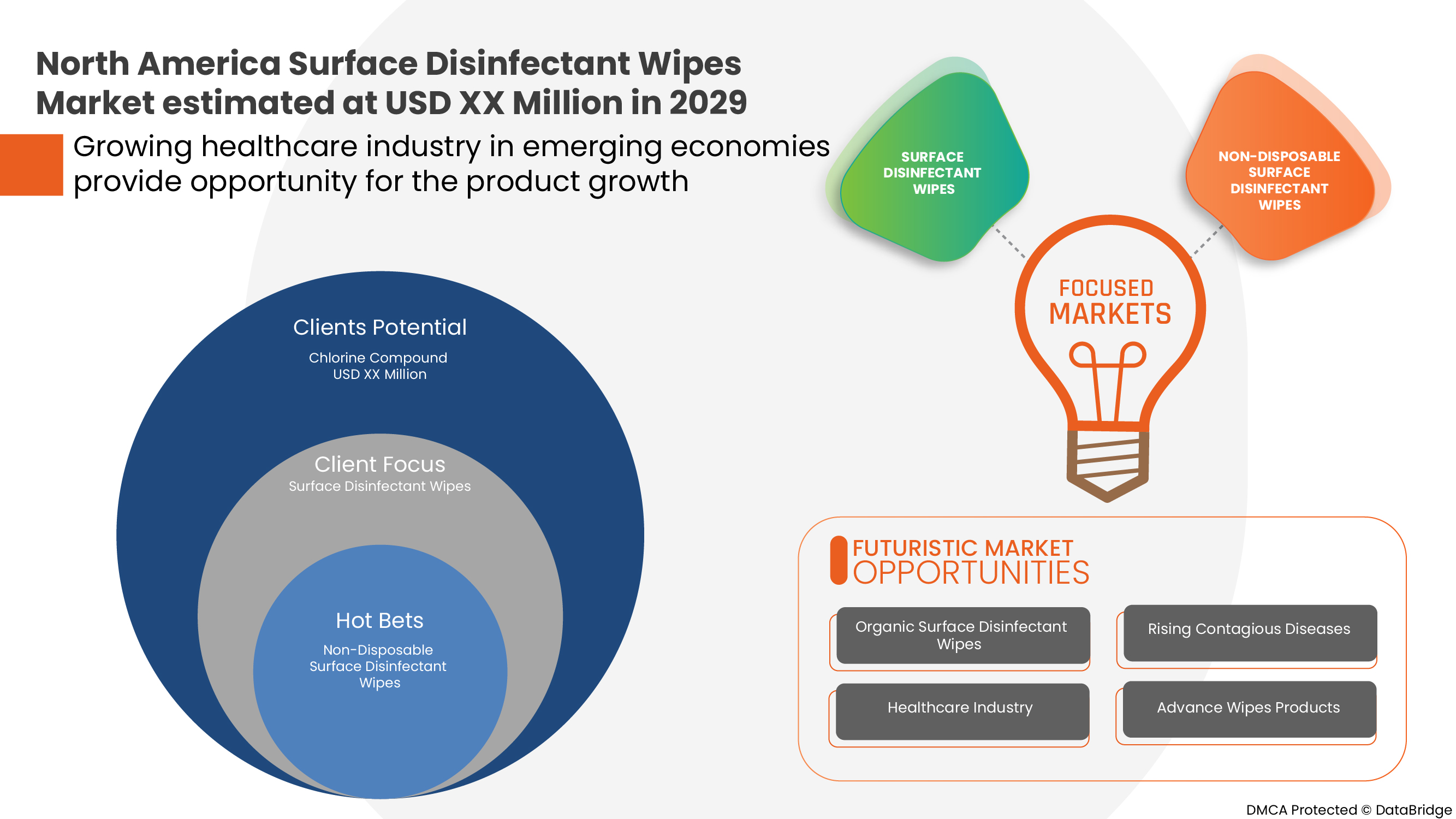

Opportunité

-

Stratégies des principaux acteurs du marché

La demande de lingettes désinfectantes pour surfaces a considérablement augmenté dans le monde entier en raison de la sensibilisation croissante des consommateurs à l'hygiène et aux soins de santé préventifs. Récemment, la demande mondiale de lingettes désinfectantes pour surfaces a augmenté en raison de l'épidémie de COVID-19. De plus, de nombreux hôpitaux du monde entier augmentent considérablement le besoin de lingettes désinfectantes pour surfaces. Ces facteurs positifs augmentent la demande de lingettes désinfectantes pour surfaces et, pour répondre à la demande du marché, les petits et grands acteurs du marché utilisent diverses stratégies.

Retenue/Défi

Les acteurs du marché des lingettes désinfectantes pour surfaces ont du mal à anticiper le risque de forte fluctuation du coût des matières premières. L'augmentation du coût des matières premières a souvent un impact significatif sur les ventes du produit, car la fabrication est directement entravée par l'augmentation du coût de la matière première. Ainsi, le succès d'un produit ou d'une entreprise est fortement menacé par les fluctuations des coûts des matières premières et leur gestion des prix. Les entreprises compétitives adoptent diverses stratégies pour faire face à la fluctuation des prix des matières premières, notamment en remplaçant l'ingrédient par un autre ingrédient.

Impact post-COVID-19 sur le marché des lingettes désinfectantes pour surfaces

La pandémie de COVID-19 a fait de la propreté et de la stérilisation une nécessité prédominante dans le mode de vie humain. L'hygiène personnelle est devenue vitale car elle augmente les chances de protéger une personne contre le COVID-19, devenant une stratégie de survie plutôt qu'une bonne habitude. Alors que les vaccins sont en phase de développement, les scientifiques et les chercheurs du monde entier adoptent diverses mesures pour contrôler la propagation du virus. Les environnements stériles, l'utilisation de désinfectants de surface, le respect de la sécurité des produits et d'autres mesures sont adoptés pour empêcher la propagation du virus. Par conséquent, le COVID-19 stimule considérablement la demande pour le marché des lingettes désinfectantes

Développements récents

- En novembre 2020, The Clorox Company a annoncé dans ses résultats du premier trimestre de l'exercice 2020 que les ventes de son segment santé et bien-être constitué de produits de désinfection et de nettoyage ont enregistré une hausse de 28 %. Cette augmentation est en grande partie due à l'importance de la santé et de l'hygiène en raison de l'émergence de la COVID-19.

- En octobre 2020, Reckitt Benckiser Group plc a annoncé ses résultats semestriels montrant une augmentation significative des revenus de son segment d'hygiène, démontrant la demande accrue pour les différentes lingettes et fournitures désinfectantes sur le marché.

- En avril 2020, Schülke & Mayr GmbH a annoncé le lancement de sa nouvelle filiale, Schulke Chemical (Shanghai) Co, Ltd., à Shanghai, en Chine, axée sur les soins personnels et l'hygiène industrielle. Cette nouvelle filiale ouverte par l'entreprise lors de l'émergence de la pandémie de COVID-19 a renforcé sa crédibilité sur le marché, ce qui a conduit à une augmentation des ventes et des revenus à l'avenir.

Le rythme effréné de la vie quotidienne et l’emploi du temps chargé des gens conduisent à des innovations. Les lingettes désinfectantes pour surfaces ne sont rien de moins que n’importe quelle innovation en matière de désinfection. De plus, l’émergence de la COVID-19 a encore accru la demande de désinfection pratique pendant les périodes les plus stressantes. Les désinfectants de surface sont des antimicrobiens utilisés pour tuer ou éliminer les germes, bactéries et autres agents pathogènes ou microbes nocifs présents sur diverses surfaces. Ils sont donc le plus souvent utilisés pour désinfecter des surfaces telles que les carreaux de sol, les toilettes, les meubles et les instruments médicaux, entre autres.

Portée du marché des lingettes désinfectantes pour surfaces en Amérique du Nord

Le marché nord-américain des lingettes désinfectantes pour surfaces est segmenté en neuf segments notables en fonction de la composition, de la facilité d'utilisation, de l'emballage, du type de matériau, du niveau de désinfection, de la saveur, du type, de l'utilisation finale et du canal de distribution. La croissance parmi ces segments vous aidera à analyser les principaux segments de croissance de l'industrie et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Composition

- Composés chlorés

- Ammonium quaternaire

- Agents oxydants

- Phénol

- Alcool

- Composés d'iode

- Gluconate de chlorhexidine

- Aldéhydes

- Autres

En fonction de la composition, le marché nord-américain des lingettes désinfectantes pour surfaces est segmenté en composés chlorés, ammonium quaternaire, agents oxydants, phénol, alcool, composés iodés, aldéhydes, gluconate de chlorhexidine et autres.

Facilité d'utilisation

- Jetable

- Non jetable

En fonction de la facilité d’utilisation, le marché nord-américain des lingettes désinfectantes pour surfaces est segmenté en lingettes jetables et non jetables.

Conditionnement

- Emballage en kit

- Boîte

- Autres

En fonction de l'emballage, le marché nord-américain des lingettes désinfectantes pour surfaces est segmenté en emballages plats, en bidons et autres.

Type de matériau

- Lingettes en fibres textiles

- Lingettes en fibres vierges

- Lingettes en fibres avancées

- Autres

En fonction du type de matériau, le marché nord-américain des lingettes désinfectantes pour surfaces est segmenté en lingettes en fibres textiles, lingettes en fibres vierges, lingettes en fibres avancées et autres.

Niveau de désinfection

- Haut

- Intermédiaire

- Faible

En fonction des niveaux de désinfection, le marché nord-américain des lingettes désinfectantes pour surfaces est segmenté en élevé, intermédiaire et faible.

Saveur

- Lavande et jasmin

- Agrumes

- Citron

- Noix de coco

- Autres

En fonction de la saveur, le marché nord-américain des lingettes désinfectantes de surface est segmenté en lavande et jasmin, agrumes, citron, noix de coco et autres.

Taper

- Sporicide

- Bactéricide

- Tuberculicide

- Virucide

- Fongicide

- Germicide

En fonction du type, le marché nord-américain des lingettes désinfectantes de surface est segmenté en sporicides, bactéricides, tuberculocides, virucides, fongicides et germicides.

Utilisation finale

- Soins de santé

- Commercial

- Cuisine industrielle

- Secteur des transports

- Industrie optique

- Industrie électronique et informatique

- Autres

En fonction du segment d'utilisation finale, le marché nord-américain des lingettes désinfectantes pour surfaces est segmenté en soins de santé, commerce, cuisine industrielle, industrie du transport, industrie optique, industrie électronique et informatique, et autres.

Canal de distribution

- Appels d'offres directs

- Ventes au détail

En fonction du canal de distribution, le marché nord-américain des lingettes désinfectantes pour surfaces est segmenté en appels d'offres directs et ventes au détail.

Analyse/perspectives régionales du marché des lingettes désinfectantes pour surfaces en Amérique du Nord

Le marché nord-américain des lingettes désinfectantes de surface est analysé et des informations sur la taille du marché et les tendances sont fournies par composition, facilité d'utilisation, emballage, type de matériau, niveaux de désinfection, saveur, type, utilisation finale et canal de distribution.

Les États-Unis dominent le marché nord-américain des lingettes désinfectantes pour surfaces au cours de la période de prévision.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Les points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques mondiales et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales et l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des lingettes désinfectantes pour surfaces

Le paysage concurrentiel du marché des lingettes désinfectantes pour surfaces fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence mondiale, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus ne concernent que les entreprises qui se concentrent sur le marché des lingettes désinfectantes pour surfaces.

Français Certains des principaux acteurs opérant sur le marché nord-américain des lingettes désinfectantes pour surfaces sont Zep Inc., Whiteley, The Claire Manufacturing Company, STERIS, Spartan Chemical Company, Inc., Seventh Generation Inc., SC Johnson & Son, Inc., Reckitt Benckiser Group PLC., Procter & Gamble, PDI, Inc., Pal International, Ecolab, 3M, Cantel Medical., Contec, Inc., Betco, CleanWell, GOJO Industries, Inc., PDI, Inc, Parker Laboratories, Inc., Metrex Research, LLC., Diversey Holdings LTD., Dreumex USA Inc., KCWW, Inc et Medline Industries, LP., entre autres.

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. Les données du marché sont analysées et estimées à l'aide de modèles statistiques et cohérents du marché. En outre, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. La principale méthodologie de recherche utilisée par l'équipe de recherche DBMR est la triangulation des données, qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). En dehors de cela, les modèles de données comprennent des grilles de positionnement des fournisseurs, une analyse de la chronologie du marché, un aperçu et un guide du marché, une grille de positionnement de l'entreprise, une analyse des parts de marché de l'entreprise, des normes de mesure, une analyse de la part de marché de l'Amérique du Nord par rapport à la région et des fournisseurs. Veuillez demander un appel d'analyste en cas de demande de renseignements supplémentaires.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 COMPOSITION LIFELINE CURVE

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 MARKET PRODUCT TYPE COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.1.1 POLITICS:

4.1.2 ECONOMIC:

4.1.3 SOCIAL:

4.1.4 TECHNOLOGY:

4.1.5 ENVIRONMENTAL:

4.1.6 LEGAL:

4.2 PORTER ANALYSIS

4.2.1 THREATS OF NEW ENTRANTS

4.2.2 BARGAINING POWER OF SUPPLIERS

4.2.3 BARGAINING POWER OF BUYERS

4.2.4 THREATS OF SUBSTITUTE PRODUCTS

4.2.5 RIVALRY AMONG THE EXISTING COMPETITORS

4.3 INDUSTRIAL INSIGHTS:

4.3.1 KEY PRICING STRATEGIES:

4.3.2 PRICES OF RAW MATERIALS:

4.3.3 FLUCTUATION IN DEMAND AND SUPPLY

4.3.4 LEVELS OF DISINFECTION

4.3.5 QUALITY:

4.3.6 CONCLUSION:

4.4 SURFACE DISINFECTANT WIPES ANALYSIS: BY USABILITY

5 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: REGULATIONS

6 EPIDERMIOLOGY

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING USE OF SURFACE DISINFECTANT WIPES FOR COMMERCIAL APPLICATIONS

7.1.2 INCREASING CONSUMER AWARENESS ABOUT HYGIENE AND PREVENTIVE HEALTHCARE

7.1.3 EMERGENCE OF COVID-19

7.1.4 HIGH PREVALENCE OF HOSPITAL-ACQUIRED INFECTIONS (HAIS)

7.1.5 HIGH DEMAND FOR QUICK AND CONVENIENT DISINFECTION OPTIONS

7.2 RESTRAINTS

7.2.1 SIDE EFFECTS OF USING SURFACE DISINFECTANT WIPES

7.2.2 FLUCTUATION IN THE PRICES OF RAW MATERIAL

7.2.3 EMERGING ALTERNATIVE TECHNOLOGIES

7.3 OPPORTUNITIES

7.3.1 STRATEGIES BY MAJOR MARKET PLAYERS

7.3.2 INCREASING NUMBER OF PRODUCT APPROVAL AND LAUNCHES

7.3.3 GROWING HEALTHCARE EXPENDITURE

7.3.4 INCREASING CHRONIC AND CONTAGIOUS DISEASES

7.4 CHALLENGES

7.4.1 LACK OF ACCESSIBILITY

7.4.2 ESCALATION IN HEALTHCARE WASTE

8 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION

8.1 OVERVIEW

8.2 CHLORINE COMPOUNDS

8.3 QUATERNARY AMMONIUM

8.4 OXIDIZING AGENTS

8.5 PHENOL

8.6 ALCOHOL

8.7 IODINE COMPOUNDS

8.8 CHLORHEXIDINE GLUCONATE

8.9 ALDEHYDES

8.1 OTHERS

9 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY

9.1 OVERVIEW

9.2 DISPOSABLE

9.3 NON-DISPOSABLE

10 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING

10.1 OVERVIEW

10.2 FLATPACK

10.3 CANISTER

10.4 OTHERS

11 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE

11.1 OVERVIEW

11.2 TEXTILE FIBER WIPES

11.3 VIRGIN FIBER WIPES

11.4 ADVANCED FIBER WIPES

11.5 OTHERS

12 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVEL OF DISINFECTION

12.1 OVERVIEW

12.2 HIGH

12.3 INTERMEDIATE

12.4 LOW

13 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR

13.1 OVERVIEW

13.2 LAVENDER & JASMINE

13.3 LEMON

13.4 CITRUS

13.5 COCONUT

13.6 OTHERS

14 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE

14.1 OVERVIEW

14.2 BACTERICIDAL

14.3 VIRUCIDAL

14.4 SPORICIDAL

14.5 TUBERCULOCIDAL

14.6 FUNGICIDAL

14.7 GERMICIDAL

15 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END USE

15.1 OVERVIEW

15.2 HEALTHCARE

15.3 COMMERCIAL

15.4 INDUSTRIAL KITCHEN

15.5 TRANSPORTATION INDUSTRY

15.6 OPTICAL INDUSTRY

15.7 ELECTRONIC & COMPUTER INDUSTRY

15.8 OTHERS

16 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL

16.1 OVERVIEW

16.2 DIRECT TENDERS

16.3 RETAIL SALES

17 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY REGION

17.1 NORTH AMERICA

17.1.1 U.S.

17.1.2 CANADA

17.1.3 MEXICO

18 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY LANDSCAPE

18.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

19 SWOT ANALYSIS

20 COMPANY PROFILE

20.1 RECKITT BENCKISER GROUP PLC

20.1.1 COMPANY SNAPSHOT

20.1.2 REVENUE ANALYSIS

20.1.3 COMPANY SHARE ANALYSIS

20.1.4 PRODUCT PORTFOLIO

20.1.5 RECENT DEVELOPMENTS

20.2 ECOLAB

20.2.1 COMPANY SNAPSHOT

20.2.2 REVENUE ANALYSIS

20.2.3 COMPANY SHARE ANALYSIS

20.2.4 PRODUCT PORTFOLIO

20.2.5 RECENT DEVELOPMENT

20.3 PROCTER & GAMBLE

20.3.1 COMPANY SNAPSHOT

20.3.2 REVENUE ANALYSIS

20.3.3 COMPANY SHARE ANALYSIS

20.3.4 PRODUCT PORTFOLIO

20.3.5 RECENT DEVELOPMENT

20.4 PAUL HARTMANN LIMITED

20.4.1 COMPANY SNAPSHOT

20.4.2 COMPANY SHARE ANALYSIS

20.4.3 PRODUCT PORTFOLIO

20.4.4 RECENT DEVELOPMENT

20.5 3M

20.5.1 COMPANY SNAPSHOT

20.5.2 REVENUE ANALYSIS

20.5.3 COMPANY SHARE ANALYSIS

20.5.4 PRODUCT PORTFOLIO

20.5.5 RECENT DEVELOPMENT

20.6 BETCO

20.6.1 COMPANY SNAPSHOT

20.6.2 PRODUCT PORTFOLIO

20.6.3 RECENT DEVELOPMENT

20.7 CANTEL MEDICAL

20.7.1 COMPANY SNAPSHOT

20.7.2 REVENUE ANALYSIS

20.7.3 PRODUCT PORTFOLIO

20.8 CLEANWELL, LLC.

20.8.1 COMPANY SNAPSHOT

20.8.2 PRODUCT PORTFOLIO

20.8.3 RECENT DEVELOPMENT

20.9 COLGATE-PALMOLIVE COMPANY

20.9.1 COMPANY SNAPSHOT

20.9.2 REVENUE ANALYSIS

20.9.3 PRODUCT PORTFOLIO

20.9.4 RECENT DEVELOPMENTS

20.1 CONTEC, INC.

20.10.1 COMPANY SNAPSHOT

20.10.2 PRODUCT PORTFOLIO

20.10.3 RECENT DEVELOPMENT

20.11 DIVERSEY HOLDINGS LTD (2021)

20.11.1 COMPANY SNAPSHOT

20.11.2 REVENUE ANALYSIS

20.11.3 PRODUCT PORTFOLIO

20.11.4 RECENT DEVELOPMENTS

20.12 DREUMEX

20.12.1 COMPANY SNAPSHOT

20.12.2 PRODUCT PORTFOLIO

20.12.3 RECENT DEVELOPMENTS

20.13 GOJO INDUSTRIES, INC.

20.13.1 COMPANY SNAPSHOT

20.13.2 PRODUCT PORTFOLIO

20.13.3 RECENT DEVELOPMENT

20.14 KCWW

20.14.1 COMPANY SNAPSHOT

20.14.2 REVENUE ANALYSIS

20.14.3 PRODUCT PORTFOLIO

20.14.4 RECENT DEVELOPMENTS

20.15 MEDLINE INDUSTRIES, LP

20.15.1 COMPANY SNAPSHOT

20.15.2 PRODUCT PORTFOLIO

20.15.3 RECENT DEVELOPMENTS

20.16 METREX RESEARCH, LLC.

20.16.1 COMPANY SNAPSHOT

20.16.2 PRODUCT PORTFOLIO

20.16.3 RECENT DEVELOPMENTS

20.17 PAL INTERNATIONAL

20.17.1 COMPANY SNAPSHOT

20.17.2 PRODUCT PORTFOLIO

20.17.3 RECENT DEVELOPMENTS

20.18 PARKER LABORATORIES, INC

20.18.1 COMPANY SNAPSHOT

20.18.2 PRODUCT PORTFOLIO

20.18.3 1.18.3 RECENT DEVELOPMENT

20.19 PDI, INC.

20.19.1 COMPANY SNAPSHOT

20.19.2 PRODUCT PORTFOLIO

20.19.3 RECENT DEVELOPMENTS

20.2 JOHNSON & SON INC.

20.20.1 COMPANY SNAPSHOT

20.20.2 PRODUCT PORTFOLIO

20.20.3 RECENT DEVELOPMENTS

20.21 SEVENTH GENERATION INC.

20.21.1 COMPANY SNAPSHOT

20.21.2 PRODUCT PORTFOLIO

20.21.3 RECENT DEVELOPMENTS

20.22 SPARTAN CHEMICAL COMPANY, INC.

20.22.1 COMPANY SNAPSHOT

20.22.2 PRODUCT PORTFOLIO

20.22.3 RECENT DEVELOPMENTS

20.23 STERIS

20.23.1 COMPANY SNAPSHOT

20.23.2 REVENUE ANALYSIS

20.23.3 PRODUCT PORTFOLIO

20.23.4 RECENT DEVELOPMENTS

20.24 THE CLAIRE MANUFACTURING COMPANY

20.24.1 COMPANY SNAPSHOT

20.24.2 PRODUCT PORTFOLIO

20.24.3 RECENT UPDATE

20.25 WHITELEY

20.25.1 COMPANY SNAPSHOT

20.25.2 PRODUCT PORTFOLIO

20.25.3 RECENT UPDATE

20.26 WIPESPLUS

20.26.1 COMPANY SNAPSHOT

20.26.2 PRODUCT PORTFOLIO

20.26.3 RECENT DEVELOPMENT

20.27 ZEP INC.

20.27.1 COMPANY SNAPSHOT

20.27.2 PRODUCT PORTFOLIO

20.27.3 RECENT DEVELOPMENT

21 QUESTIONNAIRE

22 RELATED REPORTS

Liste des tableaux

TABLE 1 COMPARATIVE TABLE OF THE IDENTIFIED KEY ASPECTS OF SURFACE DISINFECTANTS THROUGHOUT THE REGULATORY FRAMEWORK

TABLE 2 REGULATIONS SET BY THE U.K. GOVERNMENT FOR THE IMPROVEMENT OF DISINFECTANT WIPES

TABLE 3 TESTS ASSOCIATED WITH DISINFECTANT WIPES

TABLE 4 PREVALENCE OF DIABETES

TABLE 5 POVERTY RATES IN ENGLAND, WALES, SCOTLAND, AND NORTHERN IRELAND AFTER HOUSING COSTS (AHC)

TABLE 6 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CHLORINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA QUATERNARY AMMONIUM IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA OXIDIZING AGENTS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA PHENOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA ALCOHOL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA IODINE COMPOUNDS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA CHLORHEXIDINE GLUCONATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA ALDEHYDES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA NON-DISPOSABLE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA FLATPACK IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA CANISTER IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA TEXTILE FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA VIRGIN FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA ADVANCED FIBER WIPES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA HIGH IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA INTERMEDIATE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA LOW IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA LAVENDER & JASMINE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA LEMON IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA CITRUS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA COCONUT IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA BACTERICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA VIRUCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA SPORICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA TUBERCULOCIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA FUNGICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA GERMICIDAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA HEALTHCARE IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA COMMERCIAL IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 NORTH AMERICA INDUSTRIAL KITCHEN IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 NORTH AMERICA TRANSPORTATION INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA OPTICAL INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA ELECTRONIC & COMPUTER INDUSTRY IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA OTHERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA DIRECT TENDERS IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA RETAIL SALES IN SURFACE DISINFECTANT WIPES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 59 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 60 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 62 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 63 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 66 U.S. SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 67 U.S. SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 68 U.S. SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 69 U.S. SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 70 U.S. SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 71 U.S. SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 72 U.S. SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 74 U.S. SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 75 CANADA SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 76 CANADA SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 77 CANADA SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 78 CANADA SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 79 CANADA SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 80 CANADA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 81 CANADA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 82 CANADA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 83 CANADA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 84 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY COMPOSITION, 2020-2029 (USD MILLION)

TABLE 85 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY USABILITY, 2020-2029 (USD MILLION)

TABLE 86 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY PACKAGING, 2020-2029 (USD MILLION)

TABLE 87 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 88 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY LEVELS OF DISINFECTION, 2020-2029 (USD MILLION)

TABLE 89 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2020-2029 (USD MILLION)

TABLE 90 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 91 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2020-2029 (USD MILLION)

TABLE 92 MEXICO SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COUNTRY VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: MARKET END USE COVERAGE GRID

FIGURE 10 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SEGMENTATION

FIGURE 11 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 AN INCREASE IN THE PREVALENCE OF HOSPITAL ACQUIRED INFECTIONS (HAIS) LEADS TO INCREASED ADOPTION OF DISINFECTANT WIPES TO DRIVE THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 CHLORINE COMPOUNDS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET IN 2022 & 2029

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET

FIGURE 15 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE PROVIDERS IN THE U.K. IN 2018

FIGURE 16 GOVERNMENT HEALTHCARE EXPENDITURE BY SHARE OF HEALTHCARE FUNCTIONS IN THE U.K. IN 2018

FIGURE 17 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION, 2021

FIGURE 18 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY USABILITY, 2021

FIGURE 19 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY PACKAGING, 2021

FIGURE 20 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY MATERIAL TYPE, 2021

FIGURE 21 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY LEVEL OF INDISFECTION, 2021

FIGURE 22 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY FLAVOR, 2021

FIGURE 23 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY TYPE, 2021

FIGURE 24 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY END-USE, 2021

FIGURE 25 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET, BY DISTRIBUTION CHANNEL, 2020

FIGURE 26 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: SNAPSHOT (2021)

FIGURE 27 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021)

FIGURE 28 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 29 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 30 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: BY COMPOSITION (2022 & 2029)

FIGURE 31 NORTH AMERICA SURFACE DISINFECTANT WIPES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.