Marché des revêtements superhydrophobes en Amérique du Nord, par matière première (nanoparticules de silice, nanotubes de carbone, graphène, polystyrène à l'oxyde de manganèse, polystyrène à l'oxyde de zinc, carbonate de calcium précipité et autres), type de substrat (métal, verre, polymère, céramique, béton, textiles et autres), technologie de revêtement (procédé sol-gel, dépôt chimique en phase vapeur, séparation de phase, électrofilage et autres), couche de revêtement (monocouche et multicouche), méthode d'application (revêtement par immersion, brossage, revêtement au rouleau, pulvérisation et autres), fonction (anticorrosion, antigivrage, anti-mouillage et autonettoyant et autres), qualité (qualité alimentaire, qualité chimique et autres), canal de distribution (hors ligne et en ligne), utilisateur final (automobile, électronique, emballage, bâtiment et construction, textiles, soins de santé, aérospatiale, industrie et autres), pays (États-Unis, Canada, Mexique) Tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché nord-américain des revêtements superhydrophobes

Analyse et perspectives du marché : marché nord-américain des revêtements superhydrophobes

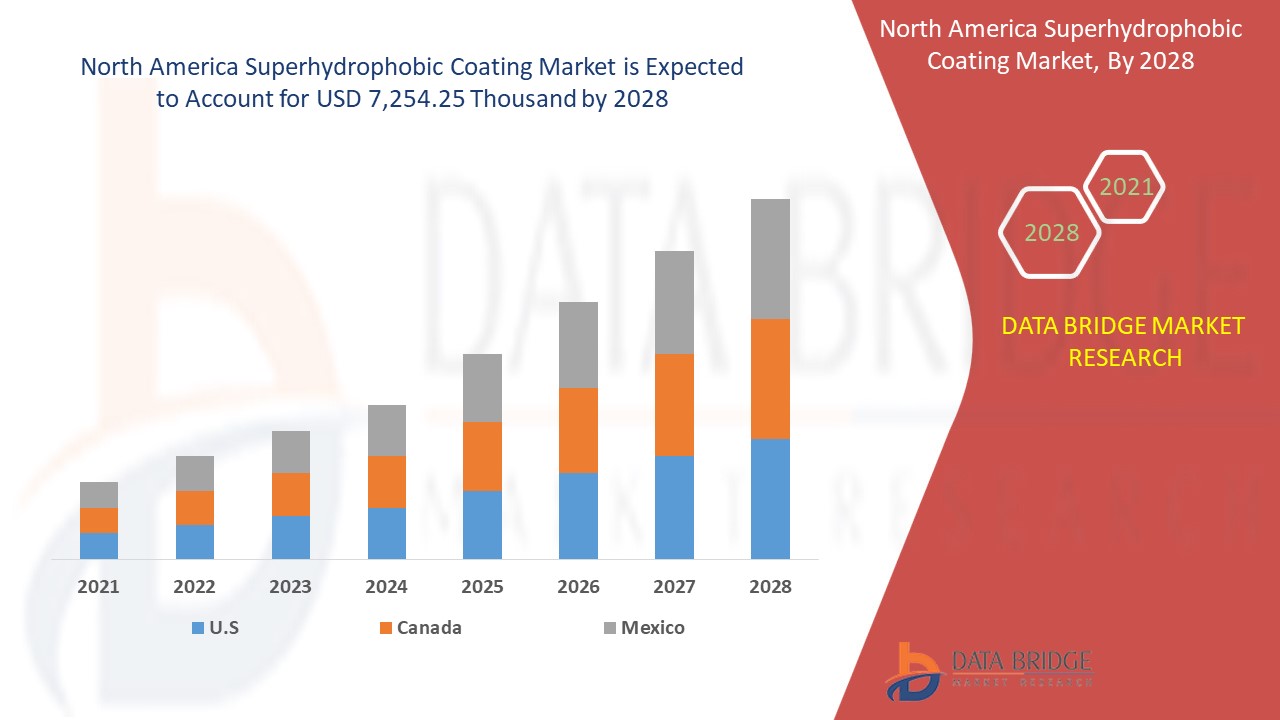

Le marché des revêtements superhydrophobes devrait connaître une croissance du marché au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché croît avec un TCAC de 9,5 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 7 254,25 milliers de dollars d'ici 2028.

Un revêtement superhydrophobe est une couche microscopiquement fine qui peut être appliquée sur une variété de surfaces et ainsi les rendre hydrofuges. Les revêtements superhydrophobes sont une forme de nanotechnologie qui pourrait être utilisée dans divers domaines industriels comme l'aérospatiale, l'automobile, la marine, l'électronique, etc. Ils peuvent être appliqués à une large gamme de produits et de matériaux tels que les matériaux de construction, les textiles , etc.

L’adoption croissante de revêtements hydrophobes dans divers domaines industriels, l’utilisation croissante de revêtements hydrophobes dans les cathéters et les fils-guides et la demande croissante de revêtements anticorrosion dans les structures marines sont les nombreux facteurs qui contribuent à stimuler la demande sur le marché.

Cependant, les politiques et lois gouvernementales strictes concernant la manipulation des produits chimiques associés et le manque de sensibilisation à la compatibilité entre le type de substrat et le revêtement devraient entraver la croissance des revêtements hydrophobes sur le marché nord-américain.

Ce rapport sur le marché des revêtements superhydrophobes fournit des détails sur la part de marché, les nouveaux développements et l'analyse du pipeline de produits, l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste, notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché des revêtements superhydrophobes en Amérique du Nord

Portée et taille du marché des revêtements superhydrophobes en Amérique du Nord

Le marché nord-américain des revêtements superhydrophobes est segmenté en neuf segments notables qui sont basés sur la matière première, le type de substrat, la technologie, la couche de revêtement, la méthode d'application, la fonction, la qualité, le canal de distribution et l'utilisateur final. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- Sur la base des matières premières, le marché nord-américain des revêtements superhydrophobes est segmenté en nanoparticules de silice, nanotubes de carbone, graphène, polystyrène à base d'oxyde de manganèse, polystyrène à base d'oxyde de zinc, carbonate de calcium précipité et autres. En 2021, le segment des nanoparticules de silice devrait dominer le marché nord-américain des revêtements superhydrophobes, car la demande pour ces revêtements est davantage concentrée dans le segment automobile qui domine la région.

- En fonction du type de substrat, le marché nord-américain des revêtements superhydrophobes est segmenté en métal, verre, polymère, céramique, béton, textiles et autres. En 2021, le segment des métaux devrait dominer le marché nord-américain des revêtements superhydrophobes, car la demande pour ces revêtements est davantage concentrée dans le secteur aérospatial, qui domine la région.

- Sur la base de la technologie, le marché nord-américain des revêtements superhydrophobes est segmenté en procédés sol-gel, dépôt chimique en phase vapeur (CVD), séparation de phase, électrofilage et autres. En 2021, le segment des procédés sol-gel devrait dominer le marché nord-américain des revêtements superhydrophobes, car la demande pour ces revêtements est davantage concentrée dans le secteur aérospatial, qui domine la région.

- Sur la base de la couche de revêtement, le marché nord-américain des revêtements superhydrophobes peut être segmenté en monocouche et multicouche. En 2021, le segment des couches multicouches devrait dominer le marché nord-américain des revêtements superhydrophobes, car la demande pour ces revêtements est davantage concentrée dans le secteur aérospatial, qui domine la région.

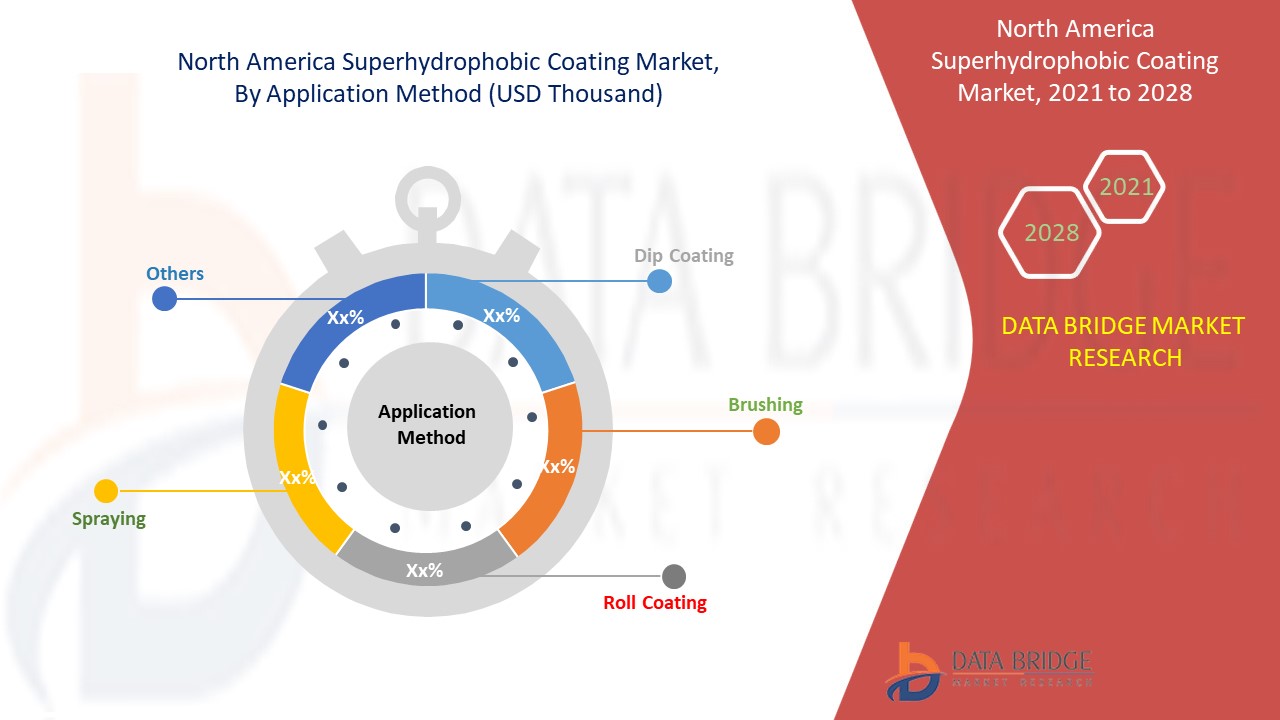

- En fonction de la méthode d'application, le marché nord-américain des revêtements superhydrophobes est segmenté en revêtement par immersion, brossage, revêtement au rouleau, pulvérisation et autres. En 2021, le segment de la pulvérisation devrait dominer le marché nord-américain des revêtements superhydrophobes en raison de l'utilisation accrue de cette technique dans le secteur automobile.

- Sur la base de la fonction, le marché nord-américain des revêtements superhydrophobes peut être segmenté en anticorrosion, antigivrage, antimouillage et autonettoyage, entre autres. En 2021, le segment anticorrosion devrait dominer le marché nord-américain des revêtements superhydrophobes en raison de l'utilisation accrue de revêtements anticorrosion dans les secteurs électronique et marin.

- Sur la base de la qualité, le marché nord-américain des revêtements superhydrophobes peut être segmenté en qualité alimentaire, qualité chimique et autres. En 2021, le segment de qualité chimique devrait dominer le marché nord-américain des revêtements superhydrophobes en raison de l'utilisation accrue de ces revêtements dans les industries de la peinture.

- Sur la base du canal de distribution, le marché nord-américain des revêtements superhydrophobes peut être segmenté en hors ligne et en ligne. En 2021, le segment hors ligne devrait dominer le marché nord-américain des revêtements superhydrophobes, car le canal de distribution hors ligne offre une relation accrue entre les entreprises et les clients de cette région.

- En fonction de l'utilisateur final, les revêtements superhydrophobes nord-américains peuvent être segmentés en automobile, électronique, emballage, bâtiment et construction, textile, santé, aérospatiale, industrie et autres. En 2021, le segment industriel devrait dominer le marché nord-américain des revêtements superhydrophobes en raison de l'utilisation accrue de divers revêtements protecteurs dans les industries automobile et marine.

Analyse du niveau régional du marché des revêtements superhydrophobes

Le marché des revêtements superhydrophobes en Amérique du Nord est analysé et des informations sur la taille du marché sont fournies par pays, matière première, type de substrat, technologie, couche de revêtement, méthode d'application, fonction, qualité, canal de distribution, utilisateur final comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des revêtements superhydrophobes sont les États-Unis, le Canada et le Mexique.

Le revêtement superhydrophobe est dominant aux États-Unis en raison de son utilisation intensive dans la production de véhicules électriques.

La section du rapport sur les pays fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario du marché pour les différents pays. En outre, la présence et la disponibilité des produits nord-américains et les défis auxquels ils sont confrontés en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Croissance de l'industrie des revêtements superhydrophobes

Le marché des revêtements superhydrophobes en Amérique du Nord vous fournit également une analyse de marché détaillée pour chaque pays, la croissance de la base installée de différents types de produits pour le marché des revêtements, l'impact de la technologie utilisant des courbes de vie et les changements dans les scénarios réglementaires des préparations pour nourrissons et leur impact sur le marché des revêtements superhydrophobes. Les données sont disponibles pour la période historique de 2010 à 2019.

Analyse du paysage concurrentiel et des parts de marché des revêtements superhydrophobes

Le paysage du marché des revêtements superhydrophobes en Amérique du Nord fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais cliniques, l'analyse de la marque, les approbations de produits, les brevets, la largeur et la portée du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise liée au marché des revêtements superhydrophobes.

Les principaux acteurs du marché des revêtements superhydrophobes en Amérique du Nord sont UltraTech International, Inc., Henkel AG & Co, Aculon, NTT Advanced Technology Corporation, Keronite, NASIOL NANO COATINGS, P2i Ltd, Nanoshel LLC, Nanorh, Cytonix, United Protective Technologies, LLC, Lotus Leaf Coatings, Inc., Advanced Nanotech Lab, Pearl Nano, Nanophyll Inc., NEI Corporation, Electrochemical Products, Inc. et NeverWet, LLC, entre autres. Les analystes de DBMR comprennent les atouts de la concurrence et fournissent une analyse concurrentielle pour chaque concurrent séparément.

Par exemple,

- En 2021, Henkel AG & Co a ajouté Extra Horizon à son écosystème de partenaires. Cette nouvelle collaboration aidera l'entreprise à accélérer davantage l'innovation dans la numérisation des soins de santé, en combinant l'expertise de Henkel en matière de solutions matérielles avancées avec les compétences médicales et techniques de pointe d'Extra Horizon.

- En 2020, UltraTech International, Inc. a introduit une nouvelle technologie de nettoyage ultra-surf utilisée pour séparer les déversements d'eau. Les déversements de pétrole dans les océans dus à des accidents et à d'autres causes constituent une menace de pollution majeure, cette technologie utilisée pour empêcher l'élimination des déversements de pétrole dans les océans. Cela contribuera à stimuler la croissance du marché de l'entreprise car cette technologie est largement utilisée par les industries marines pour diverses applications.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 LIFE LINE CURVE OF RAW MATERIAL

2.7 MULTIVARIATE MODELLING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END-USER COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR ELECTRIC VEHICLES

5.1.2 GROWING DEMAND IN AUTOMOTIVE SECTOR

5.1.3 RISING ADOPTION OF SELF-CLEANING SURFACES

5.1.4 CONSIDERABLE ADVANCEMENTS IN UNDERWATER ELECTRONICS

5.2 RESTRAINS

5.2.1 STRINGENT ENVIRONMENTAL REGULATIONS

5.2.2 HIGH RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 INCREASING DEMAND IN ACROSS VARIOUS INDUSTRIES DOMAIN (TEXTILE & LEATHER)

5.3.2 SIGNIFICANT TECHNOLOGICAL ADVANCEMENTS IN SUPER HYDROPHOBIC COATINGS

5.4 CHALLENGES

5.4.1 INSUFFICIENT MECHANICAL RESISTANCE

5.4.2 DEVEOPING AN ENVIRONMENT-FRIENDLY SUPER HYDROPHOBIC COATING PRODUCTS

6 IMPACT OF COVID-19 ON NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVES TO BOOST THE NORTH AMERICA SUPERHYDROPHOBIC INDUSTRY

6.3 STRATEGIC DECISIONS BY MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON DEMAND

6.5 IMPACT ON PRICE

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 SILICA NANOPARTICLES

7.3 MANGANESE OXIDE POLYSTYRENE

7.4 ZINC OXIDE POLYSTYRENE

7.5 CARBON NANOTUBES

7.6 GRAPHENE

7.7 PRECIPITATED CALCIUM CARBONATE

7.8 OTHERS

8 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY SUBSTRATE TYPE

8.1 OVERVIEW

8.2 METAL

8.2.1 STEEL

8.2.2 ALUMINUM

8.2.3 COPPER

8.2.4 OTHERS

8.3 GLASS

8.4 POLYMER

8.5 CERAMICS

8.6 CONCRETE

8.7 TEXTILES

8.8 OTHERS

9 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY TECHNOLOGY

9.1 OVERVIEW

9.2 SOL-GEL PROCESS

9.3 CHEMICAL VAPOR DEPOSITION (CVD)

9.4 ELECTROSPINNING

9.5 PHASE SEPARATION

9.6 OTHERS

10 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY COATING LAYER

10.1 OVERVIEW

10.2 MULTI-LAYER

10.3 SINGLE-LAYER

11 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY APPLICATION METHOD

11.1 OVERVIEW

11.2 SPRAYING

11.3 DIP COATING

11.4 ROLL COATING

11.5 BRUSHING

12 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY FUNCTION

12.1 OVERVIEW

12.2 ANTI-CORROSION

12.3 ANTI-WETTING

12.4 ANTI-ICING

12.5 SELF-CLEANING

12.6 OTHERS

13 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY GRADE

13.1 OVERVIEW

13.2 CHEMICAL GRADE

13.3 FOOD GRADE

13.4 OTHERS

14 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 OFFLINE

14.3 ONLINE

15 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY ENDUSER

15.1 OVERVIEW

15.2 INDUSTRIAL

15.2.1 INDUSTRIAL ,BY RAW MATERIAL

15.2.1.1 Silica Nanoparticles

15.2.1.2 Manganese Oxide Polystyrene

15.2.1.3 Zinc Oxide Polystyrene

15.2.1.4 Carbon Nanotubes

15.2.1.5 Graphene

15.2.1.6 Precipitated Calcium Carbonate

15.2.1.7 Others

15.3 AEROSPACE

15.3.1 AEROSPACE ,BY RAW MATERIAL

15.3.1.1 Silica Nanoparticles

15.3.1.2 Manganese Oxide Polystyrene

15.3.1.3 Zinc Oxide Polystyrene

15.3.1.4 Carbon Nanotubes

15.3.1.5 Graphene

15.3.1.6 Precipitated Calcium Carbonate

15.3.1.7 Others

15.4 ELECTRONICS

15.4.1 ELECTRONICS ,BY RAW MATERIAL

15.4.1.1 Silica Nanoparticles

15.4.1.2 Manganese Oxide Polystyrene

15.4.1.3 Zinc Oxide Polystyrene

15.4.1.4 Carbon Nanotubes

15.4.1.5 Graphene

15.4.1.6 Precipitated Calcium Carbonate

15.4.1.7 Others

15.5 AUTOMOTIVE

15.5.1 AUTOMOTIVE ,BY RAW MATERIAL

15.5.1.1 Silica Nanoparticles

15.5.1.2 Manganese Oxide Polystyrene

15.5.1.3 Zinc Oxide Polystyrene

15.5.1.4 Carbon Nanotubes

15.5.1.5 Graphene

15.5.1.6 Precipitated Calcium Carbonate

15.5.1.7 Others

15.6 BUILDING & CONSTRUCTION

15.6.1 BUILDING& CONSTRUCTION ,BY RAW MATERIAL

15.6.1.1 Silica Nanoparticles

15.6.1.2 Manganese Oxide Polystyrene

15.6.1.3 Zinc Oxide Polystyrene

15.6.1.4 Carbon Nanotubes

15.6.1.5 Graphene

15.6.1.6 Precipitated Calcium Carbonate

15.6.1.7 Others

15.7 HEALTH CARE

15.7.1 HEALTH CARE ,BY RAW MATERIAL

15.7.1.1 Silica Nanoparticles

15.7.1.2 Manganese Oxide Polystyrene

15.7.1.3 Zinc Oxide Polystyrene

15.7.1.4 Carbon Nanotubes

15.7.1.5 Graphene

15.7.1.6 Precipitated Calcium Carbonate

15.7.1.7 Others

15.8 TEXTILES

15.8.1 TEXTILES ,BY RAW MATERIAL

15.8.1.1 Silica Nanoparticles

15.8.1.2 Manganese Oxide Polystyrene

15.8.1.3 Zinc Oxide Polystyrene

15.8.1.4 Carbon Nanotubes

15.8.1.5 Graphene

15.8.1.6 Precipitated Calcium Carbonate

15.8.1.7 Others

15.9 PACKAGING

15.9.1 PACKAGING ,BY RAW MATERIAL

15.9.1.1 Silica Nanoparticles

15.9.1.2 Manganese Oxide Polystyrene

15.9.1.3 Zinc Oxide Polystyrene

15.9.1.4 Carbon Nanotubes

15.9.1.5 Graphene

15.9.1.6 Precipitated Calcium Carbonate

15.9.1.7 Others

15.1 OTHERS

15.10.1 OTHERS ,BY RAW MATERIAL

15.10.1.1 Silica Nanoparticles

15.10.1.2 Manganese Oxide Polystyrene

15.10.1.3 Zinc Oxide Polystyrene

15.10.1.4 Carbon Nanotubes

15.10.1.5 Graphene

15.10.1.6 Precipitated Calcium Carbonate

15.10.1.7 Others

16 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY GEOGRAPHY

16.1 NORTH AMERICA

16.1.1 U.S.

16.1.2 CANADA

16.1.3 MEXICO

17 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

18 SWOT ANALYSIS

19 COMPANY PROFILES

19.1 HENKEL AG & CO KGAA

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 COMPANY SHARE ANALYSIS

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT UPDATES

19.2 ADVANCED NANOTECH LAB

19.2.1 COMPANY SNAPSHOT

19.2.2 COMPANY SHARE ANALYSIS

19.2.3 PRODUCT PORTFOLIO

19.2.4 RECENT UPDATE

19.3 P2I LTD

19.3.1 COMPANY SNAPSHOT

19.3.2 COMPANY SHARE ANALYSIS

19.3.3 PRODUCT PORTFOLIO

19.3.4 RECENT UPDATES

19.4 NANORH

19.4.1 COMPANY SNAPSHOT

19.4.2 COMPANY SHARE ANALYSIS

19.4.3 PRODUCT PORTFOLIO

19.4.4 RECENT UPDATE

19.5 ULTRATECH INTERNATIONAL, INC.

19.5.1 COMPANY SNAPSHOT

19.5.2 COMPANY SHARE ANALYSIS

19.5.3 PRODUCT PORTFOLIO

19.5.4 RECENT UPDATES

19.6 ACULON

19.6.1 COMPANY SNAPSHOT

19.6.2 PRODUCT PORTFOLIO

19.6.3 RECENT UPDATES

19.7 NASIOL NANO COATINGS

19.7.1 COMPANY SNAPSHOT

19.7.2 PRODUCT PORTFOLIO

19.7.3 RECENT UPDATE

19.8 NTT ADVANCED TECHNOLOGY CORPORATION

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 PRODUCT PORTFOLIO

19.8.4 RECENT UPDATES

19.9 NANOSHEL LLC

19.9.1 COMPANY SNAPSHOT

19.9.2 PRODUCT PORTFOLIO

19.9.3 RECENT UPDATE

19.1 KERONITE

19.10.1 COMPANY SNAPSHOT

19.10.2 PRODUCT PORTFOLIO

19.10.3 RECENT UPDATES

19.11 CYTONIX

19.11.1 COMPANY SNAPSHOT

19.11.2 PRODUCT PORTFOLIO

19.11.3 RECENT UPDATES

19.12 ELECTROCHEMICAL PRODUCTS, INC.

19.12.1 COMPANY SNAPSHOT

19.12.2 PRODUCT PORTFOLIO

19.12.3 RECENT UPDATES

19.13 JONINN

19.13.1 COMPANY SNAPSHOT

19.13.2 PRODUCT PORTFOLIO

19.13.3 RECENT UPDATE

19.14 LOTUS LEAF COATINGS, INC.

19.14.1 COMPANY SNAPSHOT

19.14.2 PRODUCT PORTFOLIO

19.14.3 RECENT UPDATE

19.15 NANOPHYLL INC.

19.15.1 COMPANY SNAPSHOT

19.15.2 PRODUCT PORTFOLIO

19.15.3 RECENT UPDATE

19.16 NEI CORPORATION

19.16.1 COMPANY SNAPSHOT

19.16.2 PRODUCT PORTFOLIO

19.16.3 RECENT UPDATES

19.17 NEVERWET, LLC.

19.17.1 COMPANY SNAPSHOT

19.17.2 PRODUCT PORTFOLIO

19.17.3 RECENT UPDATE

19.18 PEARL NANO

19.18.1 COMPANY SNAPSHOT

19.18.2 PRODUCT PORTFOLIO

19.18.3 RECENT UPDATE

19.19 SURFACTIS TECHNOLOGIES

19.19.1 COMPANY SNAPSHOT

19.19.2 PRODUCT PORTFOLIO

19.19.3 RECENT UPDATES

19.2 UNITED PROTECTIVE TECHNOLOGIES, LLC.

19.20.1 COMPANY SNAPSHOT

19.20.2 PRODUCT PORTFOLIO

19.20.3 RECENT UPDATE

20 QUESTIONNAIRE

21 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF SUPERHYDROPHOBIC COATINGS "SUPERHYDROPHOBIC COATING"; HS CODE - 340590

TABLE 2 EXPORT DATA OF SUPERHYDROPHOBIC COATINGS "SUPERHYDROPHOBIC COATING"; HS CODE - 340590

TABLE 3 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND )

TABLE 4 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (THOUSAND LITER)

TABLE 5 NORTH AMERICA SILICA NANOPARTICLES IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 6 NORTH AMERICA SILICA NANOPARTICLES IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (THOUSAND LITER)

TABLE 7 NORTH AMERICA MANGANESE POLYSTYRENE OXIDE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 8 NORTH AMERICA MANGANESE OXIDE POLYSTYRENE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (THOUSAND LITER)

TABLE 9 NORTH AMERICA ZINC OXIDE POLYSTYRENE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 10 NORTH AMERICA ZINC OXIDE POLYSTYRENE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (THOUSAND LITER)

TABLE 11 NORTH AMERICA CARBON NANOTUBES IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 12 NORTH AMERICA CARBON NANOTUBES IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (THOUSAND LITER)

TABLE 13 NORTH AMERICA GRAPHENE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 14 NORTH AMERICA GRAPHENE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (THOUSAND LITER)

TABLE 15 NORTH AMERICA PRECIPITATED CALCIUM CARBONATE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 16 NORTH AMERICA PRECIPITATED CALCIUM CARBONATE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (THOUSAND LITER)

TABLE 17 NORTH AMERICA OTHER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 18 NORTH AMERICA OTHER SEGMENTS IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (THOUSAND LITER)

TABLE 19 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY SUBSTRATE TYPE, 2019-2028 (USD THOUSAND )

TABLE 20 NORTH AMERICA METAL IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 21 NORTH AMERICA METAL IN SUPER HYDROPHOBIC COATING MARKET, BY TYPE, 2019-2028 (USD THOUSAND )

TABLE 22 NORTH AMERICA GLASS IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 23 NORTH AMERICA POLYMER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 24 NORTH AMERICA CERAMICS IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 25 NORTH AMERICA CONCRETE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 26 NORTH AMERICA TEXTILES IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 27 NORTH AMERICA OTHER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 28 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND )

TABLE 29 NORTH AMERICA SOL-GEL PROCESS IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 30 NORTH AMERICA CHEMICAL VAPOR DEPOSITION (CVD) IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 31 NORTH AMERICA ELECTROSPINNING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 32 NORTH AMERICA PHASE SEPARATION IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 33 NORTH AMERICA OTHER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 34 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY COATING LAYER, 2019-2028 (USD THOUSAND )

TABLE 35 NORTH AMERICA MULTI-LAYER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 36 NORTH AMERICA SINGLE-LAYER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 37 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY APPLICATION METHOD, 2019-2028 (USD THOUSAND )

TABLE 38 NORTH AMERICA SPRAYING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 39 NORTH AMERICA DIP COATING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 40 NORTH AMERICA ROLL COATING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 41 BRUSHING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 43 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY FUNCTION, 2019-2028 (USD THOUSAND )

TABLE 44 NORTH AMERICA ANTI-CORROSION IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 45 NORTH AMERICA ANTI-WETTING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 46 NORTH AMERICA ANTI-ICING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 47 NORTH AMERICA SELF-CLEANING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 48 NORTH AMERICA OTHER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 49 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY GRADE, 2019-2028 (USD THOUSAND )

TABLE 50 NORTH AMERICA CHEMICAL GRADE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 51 NORTH AMERICA FOOD GRADE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 52 NORTH AMERICA OTHER IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 53 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD THOUSAND )

TABLE 54 NORTH AMERICA OFFLINE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 55 NORTH AMERICA ONLINE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 56 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET, BY END USER, 2019-2028 (USD THOUSAND )

TABLE 57 NORTH AMERICA INDUSTRIAL IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 58 NORTH AMERICA INDUSTRIAL IN SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND )

TABLE 59 NORTH AMERICA AEROSPACE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 60 NORTH AMERICA AEROSPACE IN SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND )

TABLE 61 NORTH AMERICA ELECTRONICS IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 62 NORTH AMERICA ELECTRONICS IN SUPER HYDROPHOBIC COATING MARKET, BY RAWMATERIAL, 2019-2028 (USD THOUSAND )

TABLE 63 NORTH AMERICA METAL MATRIX IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 64 NORTH AMERICA AUTOMOTIVE IN SUPER HYDROPHOBIC COATING MARKET, BY TYPE, 2019-2028 (USD THOUSAND )

TABLE 65 NORTH AMERICA BUILDING& CONSTRUCTION IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 66 NORTH AMERICA A BUILDING& CONSTRUCTION IN SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND )

TABLE 67 NORTH AMERICA HEALTH CARE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 68 NORTH AMERICA HEALTH CARE IN SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND )

TABLE 69 NORTH AMERICA TEXTILE IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 70 NORTH AMERICA TEXTILE IN SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND )

TABLE 71 NORTH AMERICA PACKAGING IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 72 NORTH AMERICA PACKAGING IN SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND )

TABLE 73 NORTH AMERICA OTHERS IN SUPER HYDROPHOBIC COATING MARKET, BY REGION, 2019-2028 (USD THOUSAND)

TABLE 74 NORTH AMERICA OTHERS IN SUPER HYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND )

TABLE 75 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY COUNTRY ,2019-2028 (USD THOUSAND)

TABLE 76 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY COUNTRY,2019-2028 (THOUSAND LITER)

TABLE 77 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 78 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (THOUSAND LITER)

TABLE 79 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY SUBSTRATE TYPE, 2019-2028 (USD THOUSAND)

TABLE 80 NORTH AMERICA METAL IN SUPERHYDROPHOBIC COATING MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 81 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 82 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY COATING LAYER, 2019-2028 (USD THOUSAND)

TABLE 83 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY APPLICATION METHOD, 2019-2028 (USD THOUSAND)

TABLE 84 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY FUNCTION, 2019-2028 (USD THOUSAND)

TABLE 85 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY GRADE, 2019-2028 (USD THOUSAND)

TABLE 86 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 87 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 88 NORTH AMERICA INDUSTRIAL IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 89 NORTH AMERICA AEROSPACE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 90 NORTH AMERICA ELECTRONICS IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 91 NORTH AMERICA AUTOMOTIVE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 92 NORTH AMERICA BUILDING & CONSTRUCTION IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 93 NORTH AMERICA HEALTHCARE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 94 NORTH AMERICA TEXTILES IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 95 NORTH AMERICA PACKAGING IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 96 NORTH AMERICA OTHERS IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 97 U.S. SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 98 U.S. SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (THOUSAND LITER)

TABLE 99 U.S. SUPERHYDROPHOBIC COATING MARKET, BY SUBSTRATE TYPE, 2019-2028 (USD THOUSAND)

TABLE 100 U.S. METAL IN SUPERHYDROPHOBIC COATING MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 101 U.S. SUPERHYDROPHOBIC COATING MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 102 U.S. SUPERHYDROPHOBIC COATING MARKET, BY COATING LAYER, 2019-2028 (USD THOUSAND)

TABLE 103 U.S. SUPERHYDROPHOBIC COATING MARKET, BY APPLICATION METHOD, 2019-2028 (USD THOUSAND)

TABLE 104 U.S. SUPERHYDROPHOBIC COATING MARKET, BY FUNCTION, 2019-2028 (USD THOUSAND)

TABLE 105 U.S. SUPERHYDROPHOBIC COATING MARKET, BY GRADE, 2019-2028 (USD THOUSAND)

TABLE 106 U.S. SUPERHYDROPHOBIC COATING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 107 U.S. SUPERHYDROPHOBIC COATING MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 108 U.S. INDUSTRIAL IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 109 U.S. AEROSPACE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 110 U.S. ELECTRONICS IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 111 U.S. AUTOMOTIVE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 112 U.S. BUILDING & CONSTRUCTION IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 113 U.S. HEALTHCARE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 114 U.S. TEXTILES IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 115 U.S. PACKAGING IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 116 U.S. OTHERS IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 117 CANADA SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 118 CANADA SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (THOUSAND LITER)

TABLE 119 CANADA SUPERHYDROPHOBIC COATING MARKET, BY SUBSTRATE TYPE, 2019-2028 (USD THOUSAND)

TABLE 120 CANADA METAL IN SUPERHYDROPHOBIC COATING MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 121 CANADA SUPERHYDROPHOBIC COATING MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 122 CANADA SUPERHYDROPHOBIC COATING MARKET, BY COATING LAYER, 2019-2028 (USD THOUSAND)

TABLE 123 CANADA SUPERHYDROPHOBIC COATING MARKET, BY APPLICATION METHOD, 2019-2028 (USD THOUSAND)

TABLE 124 CANADA SUPERHYDROPHOBIC COATING MARKET, BY FUNCTION, 2019-2028 (USD THOUSAND)

TABLE 125 CANADA SUPERHYDROPHOBIC COATING MARKET, BY GRADE, 2019-2028 (USD THOUSAND)

TABLE 126 CANADA SUPERHYDROPHOBIC COATING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 127 CANADA SUPERHYDROPHOBIC COATING MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 128 CANADA INDUSTRIAL IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 129 CANADA AEROSPACE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 130 CANADA ELECTRONICS IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 131 CANADA AUTOMOTIVE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 132 CANADA BUILDING & CONSTRUCTION IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 133 CANADA HEALTHCARE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 134 CANADA TEXTILES IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 135 CANADA PACKAGING IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 136 CANADA OTHERS IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 137 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 138 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (THOUSAND LITER)

TABLE 139 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY SUBSTRATE TYPE, 2019-2028 (USD THOUSAND)

TABLE 140 MEXICO METAL IN SUPERHYDROPHOBIC COATING MARKET, BY TYPE, 2019-2028 (USD THOUSAND)

TABLE 141 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY TECHNOLOGY, 2019-2028 (USD THOUSAND)

TABLE 142 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY COATING LAYER, 2019-2028 (USD THOUSAND)

TABLE 143 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY APPLICATION METHOD, 2019-2028 (USD THOUSAND)

TABLE 144 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY FUNCTION, 2019-2028 (USD THOUSAND)

TABLE 145 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY GRADE, 2019-2028 (USD THOUSAND)

TABLE 146 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD THOUSAND)

TABLE 147 MEXICO SUPERHYDROPHOBIC COATING MARKET, BY END-USER, 2019-2028 (USD THOUSAND)

TABLE 148 MEXICO INDUSTRIAL IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 149 MEXICO AEROSPACE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 150 MEXICO ELECTRONICS IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 151 MEXICO AUTOMOTIVE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 152 MEXICO BUILDING & CONSTRUCTION IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 153 MEXICO HEALTHCARE IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 154 MEXICO TEXTILES IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 155 MEXICO PACKAGING IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

TABLE 156 MEXICO OTHERS IN SUPERHYDROPHOBIC COATING MARKET, BY RAW MATERIAL, 2019-2028 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET : SEGMENTATION

FIGURE 2 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET: THE RAW MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET : MARKET END-USER COVERAGE GRID

FIGURE 11 NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET: SEGMENTATION

FIGURE 14 INCREASING DEMAND FOR ELECTRIC VEHICLES IS DRIVING THE NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 SILICA NANOPARTICLES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THENORTH AMERICA SUPERHYDROPHOBIC COATING MARKET IN 2021 & 2028

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA SUPERHYDROPHOBIC COATINGS MARKET

FIGURE 17 ANNUAL U.S ELECTRIC CAR SALES

FIGURE 18 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY RAW MATERIAL, 2020

FIGURE 19 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY SUBSTRATE TYPE, 2020

FIGURE 20 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY TECHNOLOGY, 2020

FIGURE 21 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY COATING LAYER, 2020

FIGURE 22 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY APPLICATION METHOD, 2020

FIGURE 23 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY FUNCTION, 2020

FIGURE 24 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY GRADE, 2020

FIGURE 25 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 26 NORTH AMERICA SUPER HYDROPHOBIC COATING MARKET: BY END USER, 2020

FIGURE 27 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: SNAPSHOT (2020)

FIGURE 28 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: BY COUNTRY (2020)

FIGURE 29 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: BY COUNTRY (2021 & 2028)

FIGURE 30 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: BY COUNTRY (2020 & 2028)

FIGURE 31 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: BY RAW MATERIAL (2021-2028)

FIGURE 32 NORTH AMERICA SUPERHYDROPHOBIC COATING MARKET: COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.