North America Sulfuric Acid Market, By Raw Material (Base Metal Smelters, Elemental Sulfur, Pyrite Ore and Others), Form (Concentrated, 66 Degree Baume Sulfuric Acid, Tower/Glover Acid, Chamber/Fertilizer Acid, Battery Acid and Dilute Sulfuric Acid), Manufacturing Process (Contact Process, Lead Chamber Process, Wet Sulfuric Acid Process, Metabisulfite Process and Others), Distribution Channel (Offline and Online), Application (Fertilizers, Chemical Manufacturing, Petroleum Refining, Metal Processing, Automotive, Textile, Drug Manufacturing, Pulp & Paper, Industrial And Others) Industry Trends and Forecast to 2029.

North America Sulfuric Acid Market Analysis and Size

Sulfuric acid is a strong acid with hygroscopic characteristics and oxidizing properties. It is used in the fertilizer, chemical, synthetic textile, and pigment industries. Other applications include manufacturing batteries metal pickling, among other industrial manufacturing processes. In market sulfuric acid is available in different concentration grades such as 98%, 96.5%, 76%, 70% and 38%. A large quantity of sulfuric acid produces potassium sulfates and fertilizers.

Sulfuric acid is a highly corrosive, colorless viscous liquid and one of the most used chemicals in various fertilizer, pulp & paper, mining, and chemical industries. The largest amount of sulfuric acid is used to make phosphoric acid, used, in turn, to make the phosphate fertilizers, calcium dihydrogen phosphate, and ammonium phosphates. It is also used to make ammonium sulfate, an essential fertilizer in sulfur-deficient.

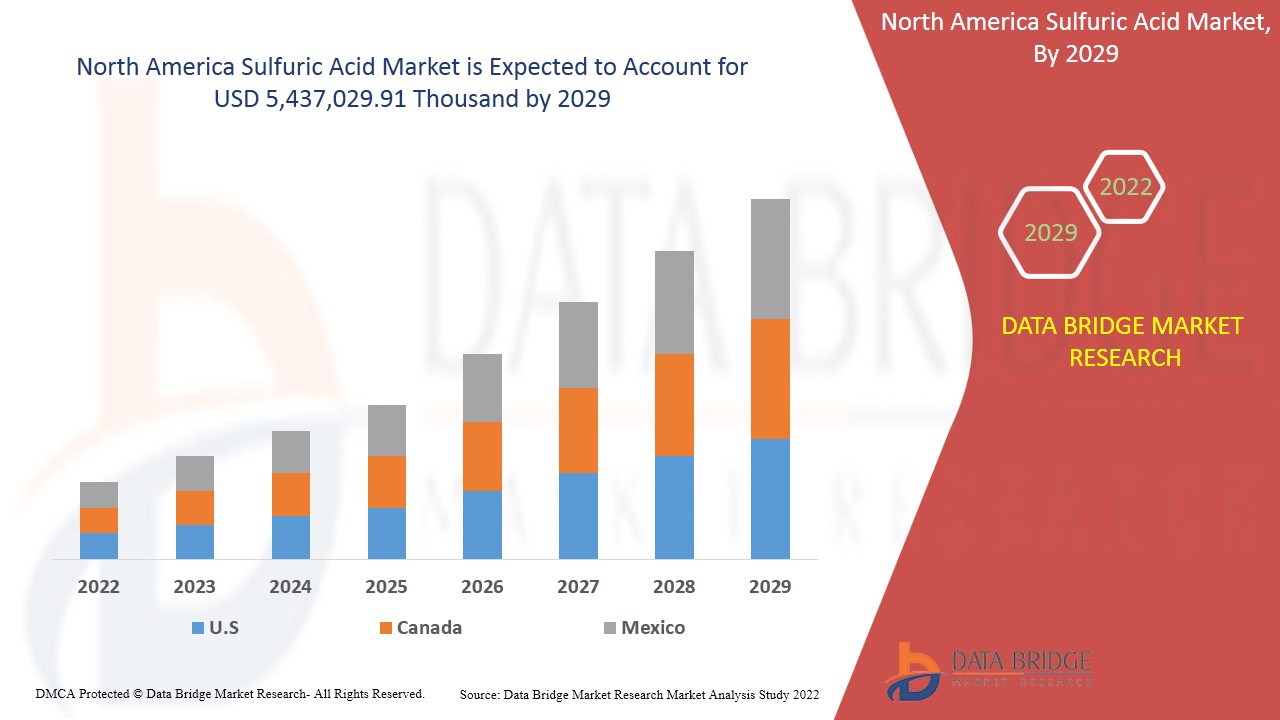

Increasing demand for fertilizers in the agriculture industry and the growing demand for sulfuric acid across various industries are some of the drivers boosting sulfuric acid demand in the market. Data Bridge Market Research analyses that the sulfuric acid market is expected to reach the value of USD 5,437,029.91 thousand by the year 2029, at a CAGR of 3.5% during the forecast period. "Fertilizers" accounts for the most prominent application segment in the respective market owing to rise in the demand for phosphate base fertilizers. The market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and climate chain scenario.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Thousand, Volumes in Thousand Tonne, Pricing in USD |

|

Segments Covered |

Par matière première (fonderies de métaux de base, soufre élémentaire, minerai de pyrite et autres), forme (concentré, acide sulfurique à 66 degrés Baume, acide de tour/Glover, acide de chambre/engrais, acide de batterie et acide sulfurique dilué), procédé de fabrication (procédé de contact, procédé de chambre de plomb, procédé d'acide sulfurique humide, procédé de métabisulfite et autres), canal de distribution (hors ligne et en ligne), application (engrais, fabrication de produits chimiques, raffinage du pétrole, traitement des métaux, automobile, textile, fabrication de médicaments, pâte et papier, industrie et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique en Amérique du Nord |

|

Acteurs du marché couverts |

LANXESS (Cologne, Allemagne), Brenntag GmbH (une filiale de Brenntag SE) (Essen, Allemagne), Adisseo (Antony, France), Veolia (Paris, France), Univar Solutions Inc (Illinois, États-Unis), NORAM Engineering & Construction Ltd. (Vancouver, Canada), Nouryon (Amsterdam, Pays-Bas), International Raw Materials LTD (Pennsylvanie, États-Unis), BASF SE (Ludwigshafen, Allemagne), Aurubis AG (Hambourg, Allemagne), Nyrstar (Budel, Pays-Bas), Merck KGaA (Darmstadt, Allemagne), Shrieve (Texas, États-Unis) |

Définition du marché

L'acide sulfurique est un liquide incolore, inodore et visqueux, soluble dans l'eau à toutes les concentrations. C'est un acide fort obtenu par oxydation de solutions de dioxyde de soufre et utilisé en grande quantité comme réactif industriel et de laboratoire. L'acide sulfurique ou acide sulfurique, également connu sous le nom d'huile de vitriol, est un acide minéral composé de soufre, d'oxygène et d'hydrogène, de formule moléculaire H2SO4 et dont le point de fusion est de 10 °C, le point d'ébullition est de 337 °C. Les États-Unis sont le plus grand consommateur d'engrais en raison de la demande accrue d'engrais à base d'acide sulfurique dans la région.

Cadre réglementaire

- RÈGLEMENTS DU DÉPARTEMENT DES TRANSPORTS DES ÉTATS-UNIS : L'acide sulfurique est classé comme marchandise dangereuse, conformément aux réglementations du DOT des États-Unis, en vertu de 49 CFR 172.101. Numéro d'identification ONU : UN 2796 Nom d'expédition correct : Acide sulfurique contenant au plus 51 % d'acide ou Acide de batterie, liquide Numéro de classe de danger et description : 8 (Corrosif) Groupe d'emballage : PG II Étiquette(s) DOT requise(s) : Classe 8 (Corrosif) Numéro du Guide des mesures d'urgence nord-américaines (2012) : 157

Le COVID-19 a eu un impact minimal sur le marché de l'acide sulfurique

La COVID-19 a eu un impact sur diverses industries manufacturières au cours de l'année 2020-2021, car elle a entraîné la fermeture de lieux de travail, la perturbation des chaînes d'approvisionnement et des restrictions sur les transports. Cependant, le déséquilibre entre l'offre et la demande et son impact sur les prix sont considérés comme à court terme et devraient se rétablir à la fin de cette pandémie. En raison de l'arrêt des opérations de production dans diverses industries à travers le monde, la demande d'acide sulfurique a considérablement diminué. De plus, avec la baisse continue des besoins du raffinage du pétrole automobile et de nombreuses autres industries, les marges des fabricants diminuent, ce qu'ils gagnent grâce à l'approvisionnement en acide sulfurique. Cependant, les gouvernements prennent des mesures pour assouplir les impôts, le déficit budgétaire et d'autres mesures afin de minimiser l'impact. Ces mesures pourraient stabiliser la situation de l'acide sulfurique à l'avenir et aider le marché à croître comme il l'était avant la pandémie.

La dynamique du marché de l'acide sulfurique comprend :

- Demande croissante d'engrais dans l'industrie agricole

L'engrais est un produit chimique ajouté aux cultures pour augmenter la productivité globale. Les agriculteurs l'utilisent pour améliorer la puissance du sol, ce qui contribue à augmenter la production des cultures. Il contient des nutriments essentiels tels que le potassium, l'azote et le phosphore, nécessaires à la croissance des plantes. La demande d'engrais de haute qualité augmente dans l'industrie agricole. Plusieurs engrais sont fabriqués à partir d'acide sulfurique, ce qui contribue à augmenter la production des cultures et la fertilité du sol. L'acide sulfurique peut facilement être mélangé au sol et aux engrais liquides.

- Demande croissante d'acide sulfurique dans un large éventail d'industries

L'acide sulfurique est utilisé dans l'industrie de transformation des métaux, les engrais et l'agriculture, l'automobile, le raffinage du pétrole et du gaz et d'autres. Il est davantage utilisé dans les produits de nettoyage utilisés dans l'industrie de transformation des métaux pour nettoyer la surface des tôles d'acier, appelés décapages, et est utilisé pour éliminer la corrosion des produits en fer. Dans les engrais, l'acide sulfurique permet de fabriquer du superphosphate de chaux et du sulfate d'ammonium. Avec l'augmentation de la demande de cultures vivrières riches en nutriments, le besoin et l'utilisation d'acide sulfurique augmentent dans les engrais

- Croissance significative de l'industrie chimique

Les industries chimiques produisent des produits pétrochimiques, des polymères et des produits chimiques industriels. L'acide sulfurique est un produit chimique de base nécessaire utilisé principalement pour produire de l'acide phosphorique . Il est utilisé pour fabriquer plusieurs produits chimiques très demandés dans l'industrie chimique. La croissance du marché augmente en raison des besoins accrus en acide chlorhydrique, acide nitrique, sels de sulfate, détergents synthétiques, colorants et pigments, explosifs et autres médicaments.

- Utilisation croissante dans la récupération des circuits imprimés usagés

Les déchets générés par les appareils électriques et électroniques constituent une préoccupation majeure dans le monde entier. Avec la diminution du cycle de vie de la plupart des appareils électroniques et l'indisponibilité de technologies de recyclage adaptées, d'énormes déchets électroniques et électriques seront générés dans les années à venir. Différents métaux tels que l'or, le cuivre, le nickel, l'argent, le zinc, le fer et le platine sont récupérés à partir des circuits imprimés usagés. La récupération des circuits imprimés usagés s'effectue à l'aide de procédés tels que la pyrolyse par micro-ondes, la lixiviation acide, l'extraction par solvant et la précipitation oxydative. L'efficacité de la lixiviation du cuivre est d'environ 95 % lorsqu'on utilise un lixiviant composé d'acide sulfurique et de peroxyde d'hydrogène.

- Demande croissante de batteries dans l'industrie automobile

L'utilisation d'acide sulfurique dans les batteries permet aux automobiles de stocker de l'énergie pendant de longues périodes, ce qui permet une durée de vie plus longue des batteries et des véhicules. Par conséquent, la croissance de l'industrie automobile dans le segment des véhicules électriques devrait offrir des opportunités lucratives pour la croissance du marché de l'acide sulfurique en Amérique du Nord.

- Abondance du soufre comme matière première

Lors de la production d'acide sulfurique, divers éléments soufrés subissent plusieurs processus et produisent la forme acide du soufre. La disponibilité du soufre est abondante dans le monde entier, ce qui constitue un avantage pour les fabricants d'acide sulfurique.

Contraintes/défis rencontrés par le marché de l'acide sulfurique

- Risques pour la santé associés à l’acide sulfurique

L'acide sulfurique est un acide diprotique puissant. Il est de nature exothermique et présente des propriétés hygroscopiques. C'est un puissant agent oxydant et réagit avec de nombreux métaux à haute température. Le H2SO4 concentré est également un puissant agent déshydratant. L'ajout d'eau dans l'acide sulfurique concentré est une réaction puissante et peut entraîner des explosions. Ainsi, l'augmentation des risques pour la santé associés à l'utilisation de l'acide sulfurique sur la peau, les yeux et d'autres organes est susceptible d'entraver la demande du marché nord-américain de l'acide sulfurique.

- Difficultés liées au transport et à la manipulation de l'acide sulfurique

L'acide sulfurique a des propriétés déshydratantes car il absorbe l'humidité et l'eau de son environnement. C'est un composé incolore qui est toxique et qui doit être stocké et maintenu à une plage de température spécifique. Il est transportable dans un réservoir ou un conteneur en acier inoxydable avec une concentration minimale d'environ 90 % et des températures ne dépassant pas 35 °C. En outre, les préoccupations concernant le transport et la manipulation de l'acide sulfurique devraient remettre en cause le marché de l'acide sulfurique au cours de la période de prévision 2022-2029.

Ce rapport sur le marché de l'acide sulfurique fournit des détails sur les nouveaux développements récents, les réglementations commerciales, l'analyse des importations et des exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs du marché national et localisé, les opportunités d'analyse en termes de poches de revenus émergentes, les changements dans les réglementations du marché, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance du marché des catégories, les niches d'application et la domination, les approbations de produits, les lancements de produits, les expansions géographiques, les innovations technologiques sur le marché. Pour obtenir plus d'informations sur le marché de l'acide sulfurique, contactez Data Bridge Market Research pour un briefing d'analyste . Notre équipe vous aidera à prendre une décision de marché éclairée pour atteindre la croissance du marché.

Développements récents

- En novembre 2020, Airedale Chemical Company Limited a acquis Alutech, qui propose une gamme de solutions de traitement des métaux, notamment des agents de blanchiment de l'aluminium et des nettoyants de prétraitement. Ce développement aide l'entreprise à augmenter la demande d'acide sulfurique, ce qui a augmenté ses bénéfices.

- En mai 2017, BASF SE a lancé un nouveau catalyseur à base d'acide sulfurique, apprécié en raison de sa forme géométrique unique. Cette mise à jour aide l'entreprise à augmenter sa capacité de production, ce qui génère des revenus à l'avenir.

Portée du marché de l'acide sulfurique en Amérique du Nord

Le marché de l'acide sulfurique est segmenté en fonction de la matière première, de la forme, du processus de fabrication, du canal de distribution et de l'application. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Matière première

- Fonderies de métaux de base

- Soufre élémentaire

- Minerai de pyrite

- Autres

Sur la base des matières premières, le marché de l'acide sulfurique est segmenté en fonderies de métaux de base, soufre élémentaire, minerai de pyrite et autres. Le soufre élémentaire représente le plus grand marché et devrait connaître une forte croissance en raison de la disponibilité abondante de soufre à travers le monde.

Formulaire

- Concentré (98%)

- Acide Tower/Glover (77,67 %)

- Chambre/Acide d'engrais (62,8 %)

- Acide de batterie (33,5 %)

- Acide sulfurique Baume à 66 degrés (93 %)

- Acide sulfurique dilué (10 %)

Sur la base de la forme, le marché de l'acide sulfurique est segmenté en acide concentré (98 %), acide tour/gant (77,67 %), acide chambre/engrais (62,8 %), acide batterie (33,5 %), acide sulfurique à 66 degrés baume (93 %) et acide sulfurique dilué (10 %). L'acide chambre/engrais (62,8 %) représente le plus grand marché et devrait connaître une forte croissance car il est disponible avec une plage d'acidité élevée et abaisse le niveau de pH du sol, ce qui améliore l'absorption des nutriments.

Processus de fabrication

- Processus de contact

- Processus de la Chambre de plomb

- Procédé de traitement à l'acide sulfurique par voie humide

- Procédé de métabisulfite

- Autres

Sur la base du processus de fabrication, le marché de l'acide sulfurique est segmenté en processus de contact, processus de chambre de plomb, processus d'acide sulfurique humide, processus de métabisulfite et autres. Le processus de contact représente le plus grand marché et devrait connaître une forte croissance car il réduit l'émission de gaz nocifs lors de la production d'acide sulfurique.

Canal de distribution

- Hors ligne

- En ligne

Sur la base du canal de distribution, le marché nord-américain de l'acide sulfurique est segmenté en hors ligne et en ligne. Le segment hors ligne représente le plus grand marché et devrait connaître une forte croissance car le transport de la grande quantité vers le pays voisin est facile.

Application

- Engrais

- Fabrication de produits chimiques

- Raffinage du pétrole

- Traitement des métaux

- Automobile

- Textile

- Fabrication de médicaments

- Pâte à papier et papier

- Industriel

- Autres

En fonction de l'application, le marché de l'acide sulfurique est segmenté en engrais, fabrication de produits chimiques, raffinage du pétrole, transformation des métaux, automobile, textile, fabrication de médicaments, pâtes et papiers, industrie et autres. Les engrais devraient dominer le segment des applications à mesure que la demande d'engrais sulfuriques augmente pour les plantations de cultures et la fertilité des sols.

Analyse/perspectives régionales du marché de l'acide sulfurique

Le marché de l’acide sulfurique est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, matière première, forme, processus de fabrication, canal de distribution et application comme référencé ci-dessus.

Les pays couverts dans le rapport sur le marché de l’acide sulfurique sont les États-Unis, le Canada et le Mexique en Amérique du Nord.

Les États-Unis dominent le marché de l'acide sulfurique en raison de la présence d'un grand nombre de fabricants et de la demande croissante de diverses industries telles que la fabrication de produits chimiques et d'engrais, entre autres. Les États-Unis devraient connaître une croissance significative au cours de la période de prévision de 2022 à 2029 en raison de la demande croissante de batteries dans l'industrie automobile de la région.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que l'analyse de la chaîne de valeur en aval et en amont, les tendances techniques et l'analyse des cinq forces du porteur, les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et des routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché de l'acide sulfurique

Le paysage concurrentiel du marché de l'acide sulfurique fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit, la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises liée au marché de l'acide sulfurique.

Certains des principaux acteurs opérant sur le marché de l'acide sulfurique sont LANXESS, Brenntag GmbH (une filiale de Brenntag SE), Adisseo, Veolia, Univar Solutions Inc, NORAM Engineering & Construction Ltd., Nouryon, International Raw Materials LTD, BASF SE, Aurubis AG, Nyrstar, Merck KGaA, Shrieve, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SULFURIC ACID MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 RAW MATERIAL LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 AVERAGE ESTIMATED PRICING ANALYSIS

4.2 PRICE TRENDS BY RAW MATERIALS IN NORTH AMERICA

4.3 PRICE TRENDS BY FORM IN NORTH AMERICA

4.4 PRICE TRENDS BY APPLICATION IN NORTH AMERICA

4.5 REGULATORY OVERVIEW:

4.6 VALUE CHAIN ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASING DEMAND FOR FERTILIZERS IN AGRICULTURAL INDUSTRY

5.1.2 SIGNIFICANT GROWTH IN CHEMICAL INDUSTRY

5.1.3 GROWING DEMAND FOR SULFURIC ACID ACROSS A DIVERSE RANGE OF INDUSTRIES

5.1.4 RISING USE IN RECOVERY OF WASTE PRINTED CIRCUIT BOARDS

5.2 RESTRAINTS

5.2.1 HEALTH HAZARDS ASSOCIATED WITH SULFURIC ACID

5.2.2 STRINGENT GOVERNMENT REGULATIONS ON USAGE OF SULFURIC ACID

5.2.3 VOLATILITY IN RAW MATERIAL PRICES

5.3 OPPORTUNITIES

5.3.1 GROWING DEMAND FOR BATTERIES IN AUTOMOTIVE INDUSTRY

5.3.2 ABUNDANCE OF SULFUR AS A RAW MATERIAL

5.4 CHALLENGES

5.4.1 DECLINE IN SALES RESULTING FROM OVERSUPPLY OF SULFURIC ACID

5.4.2 DIFFICULTIES INVOLVED IN TRANSPORTATION AND HANDLING OF SULFURIC ACID

6 IMPACT OF COVID-19 ON THE NORTH AMERICA SULFURIC ACID MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE NORTH AMERICA SULFURIC ACID MARKET

6.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE NORTH AMERICA SULFURIC ACID MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 IMPACT ON PRICE

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL

7.1 OVERVIEW

7.2 ELEMENTAL SULFUR

7.3 BASE METAL SMELTERS

7.4 PYRITE ORE

7.5 OTHERS

8 NORTH AMERICA SULFURIC ACID MARKET, BY FORM

8.1 OVERVIEW

8.2 CHAMBER/FERTILIZER ACID (62.18%)

8.3 CONCENTRATED (98%)

8.4 TOWER/GLOVER ACID (77.67%)

8.5 BATTERY ACID (33.5%)

8.6 DILUTE SULFURIC ACID (10%)

8.7 66 DEGREE BAUME SULFURIC ACID (93%)

9 NORTH AMERICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS

9.1 OVERVIEW

9.2 CONTACT PROCESS

9.3 LEAD CHAMBER PROCESS

9.4 WET SULFURIC ACID PROCESS

9.5 METABISULFITE PROCESS

9.6 OTHERS

10 NORTH AMERICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 OFFLINE

10.3 ONLINE

11 NORTH AMERICA SULFURIC ACID MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FERTILIZERS

11.2.1 CHAMBER/FERTILIZER ACID (62.18%)

11.2.2 CONCENTRATED (98%)

11.2.3 TOWER/GLOVER ACID (77.67%)

11.2.4 BATTERY ACID (33.5%)

11.2.5 DILUTE SULFURIC ACID (10%)

11.2.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.3 PETROLEUM REFINING

11.3.1 CHAMBER/FERTILIZER ACID (62.18%)

11.3.2 CONCENTRATED (98%)

11.3.3 TOWER/GLOVER ACID (77.67%)

11.3.4 BATTERY ACID (33.5%)

11.3.5 DILUTE SULFURIC ACID (10%)

11.3.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.4 METAL PROCESSING

11.4.1 CHAMBER/FERTILIZER ACID (62.18%)

11.4.2 CONCENTRATED (98%)

11.4.3 TOWER/GLOVER ACID (77.67%)

11.4.4 BATTERY ACID (33.5%)

11.4.5 DILUTE SULFURIC ACID (10%)

11.4.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.5 DRUG MANUFACTURING

11.5.1 CHAMBER/FERTILIZER ACID (62.18%)

11.5.2 CONCENTRATED (98%)

11.5.3 TOWER/GLOVER ACID (77.67%)

11.5.4 BATTERY ACID (33.5%)

11.5.5 DILUTE SULFURIC ACID (10%)

11.5.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6 CHEMICAL MANUFACTURING

11.6.1 BY FORM

11.6.1.1 CHAMBER/FERTILIZER ACID (62.18%)

11.6.1.2 CONCENTRATED (98%)

11.6.1.3 TOWER/GLOVER ACID (77.67%)

11.6.1.4 BATTERY ACID (33.5%)

11.6.1.5 DILUTE SULFURIC ACID (10%)

11.6.1.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.6.2 BY APPLICATION

11.6.2.1 AGRICULTURE CHEMICALS

11.6.2.2 HYDROCHLORIC ACID

11.6.2.3 NITRIC ACID

11.6.2.4 DYES AND PIGMENTS

11.6.2.5 SULFATE SALTS

11.6.2.6 SYNTHETIC DETERGENTS

11.6.2.7 OTHERS

11.7 TEXTILE

11.7.1 CHAMBER/FERTILIZER ACID (62.18%)

11.7.2 CONCENTRATED (98%)

11.7.3 TOWER/GLOVER ACID (77.67%)

11.7.4 BATTERY ACID (33.5%)

11.7.5 DILUTE SULFURIC ACID (10%)

11.7.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.8 INDUSTRIAL

11.8.1 CHAMBER/FERTILIZER ACID (62.18%)

11.8.2 CONCENTRATED (98%)

11.8.3 TOWER/GLOVER ACID (77.67%)

11.8.4 BATTERY ACID (33.5%)

11.8.5 DILUTE SULFURIC ACID (10%)

11.8.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.9 AUTOMOTIVE

11.9.1 CHAMBER/FERTILIZER ACID (62.18%)

11.9.2 CONCENTRATED (98%)

11.9.3 TOWER/GLOVER ACID (77.67%)

11.9.4 BATTERY ACID (33.5%)

11.9.5 DILUTE SULFURIC ACID (10%)

11.9.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.1 PULP & PAPER

11.10.1 CHAMBER/FERTILIZER ACID (62.18%)

11.10.2 CONCENTRATED (98%)

11.10.3 TOWER/GLOVER ACID (77.67%)

11.10.4 BATTERY ACID (33.5%)

11.10.5 DILUTE SULFURIC ACID (10%)

11.10.6 66 DEGREE BAUME SULFURIC ACID (93%)

11.11 OTHERS

11.11.1 CHAMBER/FERTILIZER ACID (62.18%)

11.11.2 CONCENTRATED (98%)

11.11.3 TOWER/GLOVER ACID (77.67%)

11.11.4 BATTERY ACID (33.5%)

11.11.5 DILUTE SULFURIC ACID (10%)

11.11.6 66 DEGREE BAUME SULFURIC ACID (93%)

12 NORTH AMERICA SULFURIC ACID MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SULFURIC ACID MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

13.2 MERGERS & ACQUISITIONS

13.3 EXPANSIONS

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 VEOLIA

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT UPDATES

15.2 AURUBIS AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT UPDATES

15.3 MERCK KGAA

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT UPDATE

15.4 UNIVAR SOLUTIONS INC.

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT UPDATE

15.5 BASF SE

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT UPDATES

15.6 ACIDEKA S.A.

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT UPDATE

15.7 ADISSEO

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT UPDATE

15.8 AGUACHEM LTD

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT UPDATE

15.9 AIREDALE CHEMICAL COMPANY LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT UPDATE

15.1 BOLIDEN GROUP

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT UPDATE

15.11 BRENNTAG GMBH (A SUBSIDARY OF BRENNTAG SE)

15.11.1 COMPANY SNAPSHOT

15.11.2 REVENUE ANALYSIS

15.11.3 PRODUCT PORTFOLIO

15.11.4 RECENT UPDATE

15.12 ETI BAKIR

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT UPDATE

15.13 FERALCO AB

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT UPDATES

15.14 FLUORSID

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT UPDATE

15.15 INTERNATIONAL RAW MATERIALS LTD

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT UPDATE

15.16 LANXESS

15.16.1 COMPANY SNAPSHOT

15.16.2 REVENUE ANALYSIS

15.16.3 PRODUCT PORTFOLIO

15.16.4 RECENT UPDATES

15.17 NORAM ENGINEERS AND CONSTRUCTORS LTD.

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT UPDATES

15.18 NOURYON

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT UPDATES

15.19 NYRSTAR

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT UPDATES

15.2 SHRIEVE

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT UPDATES

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 IMPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 2 EXPORT DATA OF SULFURIC ACID; OLEUM; HS CODE - 2807 (USD THOUSAND)

TABLE 3 EMISSION STANDARDS SULFURIC ACID PLANT (CPCB- INDIA)

TABLE 4 DEMAND FOR FERTILIZER NUTRIENT USE IN THE WORLD, 2016-2022 (THOUSAND TONES)

TABLE 5 NEWLY LAUNCHED AND EXPECTED LAUNCH MODELS OF ELECTRICAL CARS

TABLE 6 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 8 NORTH AMERICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA ELEMENTAL SULFUR IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 10 NORTH AMERICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA BASE METAL SMELTERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 12 NORTH AMERICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA PYRITE ORE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 14 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (THOUSAND TONNE)

TABLE 16 NORTH AMERICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA CHAMBER/FERTILIZER ACID (62.18%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA CONCENTRATED (98%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA TOWER/GLOVER ACID (77.67%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA BATTERY ACID (33.5%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA DILUTE SULFURIC ACID (10%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA 66 DEGREE BAUME SULFURIC ACID (93%) IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA CONTACT PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA LEAD CHAMBER PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA WET SULFURIC ACID PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA METABISULFITE PROCESS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA OFFLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA ONLINE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA FERTILIZERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA METAL PROCESSING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA TEXTILE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA INDUSTRIAL IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA PULP & PAPER IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA SULFURIC ACID MARKET, BY COUNTRY, 2020-2029 (THOUSAND TONNE)

TABLE 56 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 58 NORTH AMERICA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 73 U.S. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 74 U.S. SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 75 U.S. SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 76 U.S. SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 77 U.S. SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 78 U.S. SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 79 U.S. FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 80 U.S. PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 81 U.S. METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 82 U.S. DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 83 U.S. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 84 U.S. CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 85 U.S. TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 86 U.S. INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 87 U.S. AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 88 U.S. PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 89 U.S. OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 90 CANADA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 91 CANADA SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 92 CANADA SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 93 CANADA SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 94 CANADA SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 95 CANADA SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 96 CANADA FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 97 CANADA PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 98 CANADA METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 99 CANADA DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 100 CANADA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 101 CANADA CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 102 CANADA TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 103 CANADA INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 104 CANADA AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 105 CANADA PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 106 CANADA OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 107 MEXICO SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (USD THOUSAND)

TABLE 108 MEXICO SULFURIC ACID MARKET, BY RAW MATERIAL, 2020-2029 (THOUSAND TONNE)

TABLE 109 MEXICO SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 110 MEXICO SULFURIC ACID MARKET, BY MANUFACTURING PROCESS, 2020-2029 (USD THOUSAND)

TABLE 111 MEXICO SULFURIC ACID MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD THOUSAND)

TABLE 112 MEXICO SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 113 MEXICO FERTILIZERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 114 MEXICO PETROLEUM REFINING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 115 MEXICO METAL PROCESSING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 116 MEXICO DRUG MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 117 MEXICO CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 118 MEXICO CHEMICAL MANUFACTURING IN SULFURIC ACID MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 119 MEXICO TEXTILE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 120 MEXICO INDUSTRIAL IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 121 MEXICO AUTOMOTIVE IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 122 MEXICO PULP & PAPER IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

TABLE 123 MEXICO OTHERS IN SULFURIC ACID MARKET, BY FORM, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SULFURIC ACID MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SULFURIC ACID MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SULFURIC ACID MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SULFURIC ACID MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SULFURIC ACID MARKET: RAW MATERIAL LIFE LINE CURVE

FIGURE 7 NORTH AMERICA SULFURIC ACID MARKET: MULTIVARIATE MODELLING

FIGURE 8 NORTH AMERICA SULFURIC ACID MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 NORTH AMERICA SULFURIC ACID MARKET: DBMR MARKET POSITION GRID

FIGURE 10 NORTH AMERICA SULFURIC ACID MARKET: APPLICATION COVERAGE GRID

FIGURE 11 NORTH AMERICA SULFURIC ACID MARKET: CHALLENGE MATRIX

FIGURE 12 NORTH AMERICA SULFURIC ACID MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 NORTH AMERICA SULFURIC ACID MARKET: SEGMENTATION

FIGURE 14 ASIA-PACIFIC IS EXPECTED TO DOMINATE AND IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 15 SIGNIFICANT GROWTH IN THE CHEMICAL INDUSTRY IS EXPECTED TO DRIVE THE NORTH AMERICA SULFURIC ACID MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 16 ELEMENTAL SULFUR SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SULFURIC ACID MARKET IN 2022 & 2029

FIGURE 17 AVERAGE ESTIMATED PRICING ANALYSIS OF SULFURIC ACID

FIGURE 18 PRICE OF 98% SULFURIC ACID

FIGURE 19 VALUE CHAIN ANALYSIS OF NORTH AMERICA SULFURIC ACID MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF NORTH AMERICA SULFURIC ACID MARKET

FIGURE 21 FERTILIZER CONSUMPTION IN VARIOUS COUNTRIES (2019) (KILOGRAMS PER HECTARE OF LAND)

FIGURE 22 NORTH AMERICA SULFURIC ACID MARKET: BY RAW MATERIAL, 2021

FIGURE 23 NORTH AMERICA SULFURIC ACID MARKET: BY FORM, 2021

FIGURE 24 NORTH AMERICA SULFURIC ACID MARKET: BY MANUFACTURING PROCESS, 2021

FIGURE 25 NORTH AMERICA SULFURIC ACID MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 NORTH AMERICA SULFURIC ACID MARKET: BY APPLICATION, 2021

FIGURE 27 NORTH AMERICA SULFURIC ACID MARKET: SNAPSHOT (2021)

FIGURE 28 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2021)

FIGURE 29 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2022 & 2029)

FIGURE 30 NORTH AMERICA SULFURIC ACID MARKET: BY COUNTRY (2021 & 2029)

FIGURE 31 NORTH AMERICA SULFURIC ACID MARKET: BY RAW MATERIAL (2022-2029)

FIGURE 32 NORTH AMERICA SULFURIC ACID MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.