Marché nord-américain des substituts du sucre, par type (sirops à haute teneur en fructose, édulcorants à haute intensité , édulcorants à faible intensité), forme (cristallisé, liquide, poudre), catégorie (naturel, synthétique), application (boissons, produits alimentaires, soins bucco-dentaires, produits pharmaceutiques, autres) – Tendances et prévisions du secteur jusqu'en 2029

Analyse du marché et taille

L'obésité, le diabète et le syndrome métabolique sont devenus des problèmes majeurs de santé publique en raison de leur lien avec un apport calorique déséquilibré. Les substituts du sucre jouent un rôle important dans la réduction des calories dans le cadre d'une alimentation saine et d'un programme d'activité physique pour lutter contre les maladies mentionnées ci-dessus.

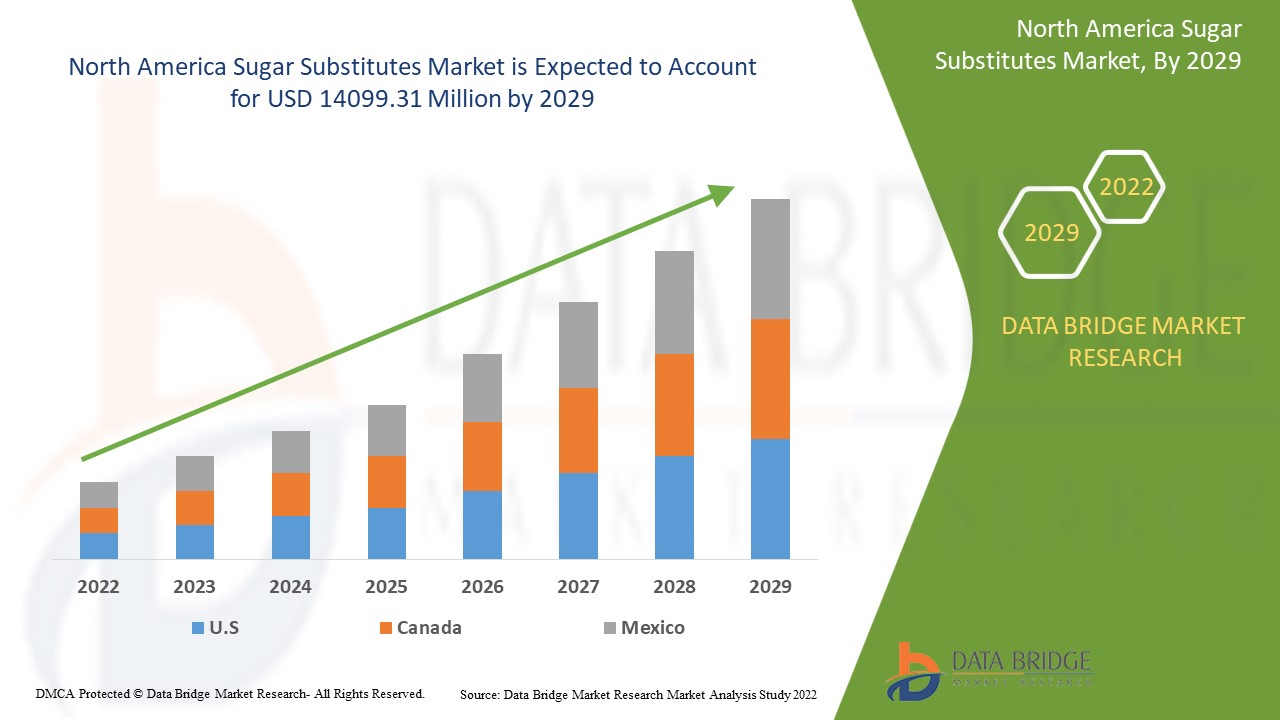

Data Bridge Market Research analyse que le marché des substituts du sucre, qui a connu une croissance d'une valeur de 7 617,42 millions USD en 2021, devrait atteindre la valeur de 14 099,31 millions USD d'ici 2029, à un TCAC de 8,0 % au cours de la période de prévision de 2022 à 2029.

Définition du marché

Un substitut de sucre est un additif alimentaire qui a le goût du sucre, mais qui contient beaucoup moins de calories que les édulcorants à base de sucre, ce qui en fait un édulcorant zéro calorie ou hypocalorique. Ils sont dérivés de substances naturelles ou créés artificiellement à l'aide de produits chimiques et de conservateurs.

Portée du rapport et segmentation du marché

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Type (sirops à haute teneur en fructose, édulcorants à haute intensité, édulcorants à faible intensité), forme (cristallisé, liquide, poudre), catégorie (naturel, synthétique), application (boissons, produits alimentaires, soins bucco-dentaires, produits pharmaceutiques, autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

DuPont (États-Unis), ADM (États-Unis), Tate & Lyle (Royaume-Uni), Ingredion (États-Unis), Cargill Incorporated (États-Unis), Roquette Frères (France), PureCircle Ltd (États-Unis), MacAndrews & Forbes Incorporated (États-Unis), JK Sucralose Inc. (Chine), Ajinomoto Co. Inc. (Japon), JK Sucralose Inc. (Chine), Ajinomoto Co. Inc. (Japon), NutraSweetM Co. (États-Unis), Südzucker AG (Allemagne), Layn Corp. (Chine), Zhucheng Haotian Pharm Co., Ltd. (Chine), HSWT (France) |

|

Opportunités |

|

Dynamique du marché des substituts du sucre

Conducteurs

- Préférence croissante pour le sucre naturel

Les substituts du sucre sont couramment utilisés dans les boissons telles que les sodas , les jus aromatisés et d'autres produits alimentaires. Les substituts du sucre naturels gagnent en popularité aux États-Unis, les consommateurs se tournant vers les aliments et boissons biologiques. Le sucre naturel est un édulcorant hypocalorique extrait de plantes comme la stévia, le fruit des moines et d'autres, dont le pouvoir sucrant est 200 fois supérieur à celui du sucre. Ces avantages, ainsi que leur caractère biologique, ont contribué à la croissance du marché.

Demande croissante dans diverses industries d'utilisateurs finaux

L'utilisation croissante de substituts de sucre dans diverses applications finales, telles que les produits pharmaceutiques, les cosmétiques, l'alimentation humaine, la production d'éthanol, l'alimentation animale, etc., stimule également le marché. Ils peuvent être utilisés comme agent de rétention d'eau dans les sérums de soins personnels et cosmétiques, ainsi que comme complément nutritionnel dans les produits pharmaceutiques comme les sirops et les injections. Une R&D solide, associée à une expertise technique, a propulsé l'entreprise au premier plan, ce qui a entraîné une croissance continue de la demande en sucre cristallisé.

Opportunité

L'innovation technique croissante dans le secteur de la transformation alimentaire et la demande croissante de barres nutritives stimuleront la croissance du marché. Les fabricants de substituts du sucre devraient bénéficier des fluctuations des prix du sucre. Grâce à ces facteurs, le marché se développe parallèlement à l'augmentation du nombre de patients diabétiques et à la prise de conscience des consommateurs en matière de santé.

Restrictions

Cependant, de nombreux scientifiques estiment qu'une consommation excessive de substituts du sucre peut entraîner de graves problèmes de santé tels que le diabète de type II, les maladies cardiaques, l'obésité et, dans certains cas, le cancer. La diminution de la disponibilité des substituts du sucre, combinée au développement des édulcorants artificiels, a fait évoluer les préférences des consommateurs vers ces derniers, limitant ainsi la croissance du marché.

Ce rapport sur le marché des substituts du sucre détaille les évolutions récentes, la réglementation commerciale, l'analyse des importations et exportations, l'analyse de la production, l'optimisation de la chaîne de valeur, la part de marché, l'impact des acteurs nationaux et locaux, l'analyse des opportunités de revenus émergents, l'évolution de la réglementation, l'analyse stratégique de la croissance du marché, la taille du marché, la croissance des catégories de marché, les niches d'application et la domination du marché, les homologations de produits, les lancements de produits, les expansions géographiques et les innovations technologiques. Pour plus d'informations sur le marché des substituts du sucre, contactez Data Bridge Market Research pour obtenir un briefing d'analyste. Notre équipe vous aidera à prendre une décision éclairée et à stimuler votre croissance.

Impact du COVID-19 sur le marché des substituts du sucre

La pandémie de COVID-19 en Amérique du Nord constitue un obstacle majeur à l'économie nord-américaine et a un impact sur la croissance de l'industrie agroalimentaire. Les fabricants de produits alimentaires ont réduit la production de produits alimentaires majeurs. De plus, face à la recherche de solutions pour améliorer leur santé et leur bien-être général, la demande de produits moins sucrés et immunostimulants a rapidement augmenté en raison de la pandémie de COVID-19. La plupart des consommateurs soucieux de leur santé se sont tournés vers des aliments hypocaloriques ou sans sucre. Face à cette prise de conscience croissante de la santé et à la forte demande de solutions à teneur réduite en sucre au sein de la population nord-américaine, les fabricants et les formulateurs de produits ont été contraints d'utiliser des substituts du sucre.

Développement récent

- Tate & Lyle lancera les outils de conception de solutions d'édulcorants VANTAGE en juillet 2020. Il s'agit d'une collection d'outils de conception de solutions d'édulcorants nouveaux et innovants, ainsi que d'un programme éducatif, pour créer des aliments et des boissons à teneur réduite en sucre avec des édulcorants hypocaloriques.

Portée du marché des substituts du sucre en Amérique du Nord

Le marché des substituts du sucre est segmenté selon le type, la forme, la catégorie et l'application. La croissance de ces segments vous aidera à analyser les segments à faible croissance des industries et à fournir aux utilisateurs une vue d'ensemble et des informations précieuses sur le marché, les aidant ainsi à prendre des décisions stratégiques pour identifier les applications clés du marché.

Taper

- Édulcorants à haute intensité

- Édulcorants de faible intensité

- Sirops à haute teneur en fructose

Sur la base du type, le marché est segmenté en édulcorants à haute intensité, édulcorants à faible intensité et sirops à haute teneur en fructose.

Formulaire

- Poudre

- Cristallisé

- Liquide.

Sur la base de la forme, le marché est segmenté en poudre, cristallisé et liquide.

Catégorie

- Naturel

- Synthétique

Sur la base de la catégorie, le marché est segmenté en naturel et synthétique.

Application

- Produits alimentaires

- Soins bucco-dentaires

- Médicaments

- Boissons

Sur la base de l'application, le marché est segmenté en boissons, produits alimentaires, soins bucco-dentaires, produits pharmaceutiques et autres.

Analyse/perspectives régionales du marché des substituts du sucre

Le marché des substituts du sucre est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, forme, catégorie et application, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché des substituts du sucre sont les États-Unis, le Canada et le Mexique.

Sur le marché nord-américain des substituts du sucre, l'Amérique du Nord et l'Europe détiennent la grande majorité des parts de marché grâce à la présence d'acteurs clés, à des investissements importants en R&D, à des méthodes de production technologiquement avancées et à la disponibilité des matières premières dans la région. L'essor des produits pharmaceutiques grâce à l'utilisation de sucre naturel s'est avéré le facteur le plus prometteur pour la croissance du marché.

La section pays du rapport présente également les facteurs d'impact sur les marchés individuels et les évolutions de la réglementation qui influencent les tendances actuelles et futures du marché. Des données telles que l'analyse des chaînes de valeur en aval et en amont, les tendances techniques, l'analyse des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour chaque pays. De plus, la présence et la disponibilité des marques nord-américaines et les difficultés rencontrées face à la concurrence forte ou faible des marques locales et nationales, l'impact des tarifs douaniers nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des substituts du sucre

Le paysage concurrentiel du marché des substituts du sucre fournit des détails par concurrent. Il comprend la présentation de l'entreprise, ses données financières, son chiffre d'affaires, son potentiel de marché, ses investissements en recherche et développement, ses nouvelles initiatives commerciales, sa présence en Amérique du Nord, ses sites et installations de production, ses capacités de production, ses forces et faiblesses, le lancement de nouveaux produits, leur ampleur et leur portée, ainsi que leur dominance dans certaines applications. Les données ci-dessus concernent uniquement les activités des entreprises sur le marché des substituts du sucre.

Certains des principaux acteurs opérant sur le marché des substituts du sucre sont :

- DuPont (États-Unis)

- ADM (États-Unis)

- Tate & Lyle (Royaume-Uni)

- Ingredion (États-Unis)

- Cargill Incorporated (États-Unis)

- Roquette Frères (France)

- PureCircle Ltd (États-Unis)

- MacAndrews & Forbes Incorporated (États-Unis)

- JK Sucralose Inc. (Chine)

- Ajinomoto Co. Inc. (Japon)

- JK Sucralose Inc. (Chine)

- Ajinomoto Co. Inc. (Japon)

- NutraSweetM Co. (États-Unis)

- Südzucker AG (Allemagne)

- Layn Corp. (Chine)

- Zhucheng Haotian Pharm Co., Ltd. (Chine)

- HSWT (France)

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SUGAR SUBSTITUTES MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 PRODUCT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.1.1 GROWING NUMBER OF OBESITY & DIABETIC POPULATION

3.1.2 RISING TREND OF HEALTHY LIFESTYLE AND HEALTHY PRODUCTS

3.1.3 INCREASED USAGE OF SUGAR SUBSTITUTES IN FOOD & BAKERY PRODUCTS

3.1.4 INCREASING DEMAND FOR NATURAL SWEETENERS/PLANT SOURCED SWEETENERS

3.1.5 FLUCTUATING PRICES OF SUGAR AND INCREASED TAXATION ON SUGAR PRODUCTS

3.2 RESTRAINTS

3.2.1 STRINGENT REGULATIONS AND POLICIES FOR SUGAR SUBSTITUTE

3.2.2 SIDE EFFECTS OF THE SUGAR SUBSTITUTE

3.3 OPPORTUNITIES

3.3.1 GROWING CONSUMPRION OF HEALTHY AND NUTRITIONAL DRINKS HAVING SUGAR SUBSTITUTES

3.3.2 INCREASING AWARENESS OF SUGAR SUBSTITUTE IN DEVELOPING NATIONS

3.3.3 STRONG INITIATIVES AND STUDIES FOR THE PRODUCT DEVELOPMENT

3.3.4 NEW SUGAR LABELING RULES

3.4 CHALLENGES

3.4.1 MORE EFFORTS TOWARDS TASTE IMPROVEMENT

3.4.2 VAGUENESS ABOUT SUGAR SUBSTITUTE BENEFITS

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PARENT MARKET ANALYSIS

5.2 EXPECTED GROWTH OF SWEETENERS USAGE FOR NEXT 3 YEARS

6 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE

6.1 OVERVIEW

6.2 HIGH-FRUCTOSE SYRUPS

6.3 HIGH-INTENSITY SWEETENERS

6.3.1 ASPARTAME

6.3.2 CYCLAMATE

6.3.3 ACE-K

6.3.4 SACCHARINE

6.3.5 STEVIA

6.3.6 SUCROLOSE

6.3.7 HONEY

6.3.8 GLYCYRRHIZIN

6.3.9 ALITAME

6.3.10 NEOTAME

6.3.11 OTHERS

6.4 LOW-INTENSITY SWEETENERS

6.4.1 ERYTHRITOL

6.4.2 MALTITOL

6.4.3 SORBITOL

6.4.4 XYLITOL

6.4.5 ISOMALT

6.4.6 HYDROGENATED STARCH HYDROYSATES

6.4.7 MANNITOL

6.4.8 LACITOL

6.4.9 D-TAGATOSE

6.4.10 TREHALOSE

6.4.11 OTHERS

7 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM

7.1 OVERVIEW

7.2 CRYSTALLIZED

7.3 LIQUID

7.4 POWDER

8 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION

8.1 OVERVIEW

8.2 BEVERAGES

8.2.1 CARBONATED SOFT DRINKS

8.2.2 FLAVORED DRINKS

8.2.3 POWDERED BEVERAGES

8.2.3.1 RTD COFFEE

8.2.3.2 RTD TEA

8.2.3.3 SMOOTHIES

8.2.3.4 OTHERS

8.2.4 JUICES

8.2.5 DAIRY ALTERNATIVE DRINKS

8.2.6 FUNCTIONAL DRINKS

8.2.7 OTHERS

8.3 FOOD PRODUCTS

8.3.1 DAIRY PRODUCTS

8.3.1.1 ICE CREAM

8.3.1.2 TOPPINGS

8.3.1.3 YOGURTS

8.3.1.4 PUDDING

8.3.1.5 OTHERS

8.3.2 BAKERY PRODUCTS

8.3.2.1 COOKIES & BISCUITS

8.3.2.2 CAKE & PASTRIES

8.3.2.3 MUFFINS & DONUTS

8.3.2.4 BREADS & ROLLS

8.3.2.5 OTHERS

8.3.3 CONFECTIONERY

8.3.3.1 CHOCOLATE

8.3.3.2 GUMMIES & MARSHMALLOWS

8.3.3.3 HARD CANDIES

8.3.3.4 OTHERS

8.3.4 TABLE-TOP SWEETENER

8.3.5 NUTRITIONAL BARS

8.3.6 BREAKFAST CEREALS

8.3.7 OTHERS

8.4 ORAL CARE

8.4.1.1 TOOTHPASTE

8.4.1.2 ORAL RINSES

8.4.1.3 OTHERS

8.5 PHARMACEUTICALS

8.5.1.1 SYRUPS

8.5.1.2 GRANULATED POWDERS

8.5.1.3 TABLETS

8.5.1.4 OTHERS

8.6 OTHERS

9 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY

9.1 OVERVIEW

9.2 NATURAL

9.3 SYNTHETIC

10 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY GEOGRAPHY

10.1 NORTH AMERICA

10.1.1 U.S.

10.1.2 CANADA

10.1.3 MEXICO

11 NORTH AMERICA SUGAR SUBSTITUTES MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

12 SWOT & DBMR ANALYSIS

12.1 DATA BRIDGE MARKET RESEARCH ANALYSIS

13 COMPANY PROFILES

13.1 ADM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 CARGILL, INCORPORATED.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 INGREDION INCORPORATED

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 TATE & LYLE

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCT PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 AJINOMOTO HEALTH & NUTRITION NORTH AMERICA, INC.

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALSIANO

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BENEO (A SUBSIDIARY OF SÜDZUCKER AG)

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 DUPONT.

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 FOODCHEM INTERNATIONAL CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 HYET SWEET

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 JK SUCRALOSE INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENT

13.12 MAFCO WORLDWIDE LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCT PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 MATSUTANI CHEMICAL INDUSTRY CO., LTD.

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MITSUI SUGAR CO.,LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENT

13.15 NUTRASWEET CO.

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENT

13.16 PURECIRCLE

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENEUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 PYURE BRANDS LLC

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENTS

13.18 ROQUETTE FRÈRES

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 STARTINGLINE S.P.A.

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 ZUCHEM INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 2 NORTH AMERICA HIGH-FRUCTOSE SYRUPS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 5 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 7 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 8 NORTH AMERICA CRYSTALLIZED FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 NORTH AMERICA LIQUID FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 NORTH AMERICA POWDER FORM IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 11 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 12 NORTH AMERICA BEVERAGES APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 13 NORTH AMERICA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 14 NORTH AMERICA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 15 NORTH AMERICA FOOD PRODUCTS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 NORTH AMERICA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 17 NORTH AMERICA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 18 NORTH AMERICA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 19 NORTH AMERICA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 20 NORTH AMERICA ORAL CARE APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 NORTH AMERICA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 22 NORTH AMERICA PHARMACEUTICALS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 NORTH AMERICA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 24 NORTH AMERICA OTHERS APPLICATION IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 26 NORTH AMERICA NATURAL CATGORY IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 27 NORTH AMERICA SYNTHETIC CATEGORY IN SUGAR SUBSTITUTES MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 29 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 30 NORTH AMERICA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 31 NORTH AMERICA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 32 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 33 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 34 NORTH AMERICA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 35 NORTH AMERICA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 36 NORTH AMERICA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 37 NORTH AMERICA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 38 NORTH AMERICA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 39 NORTH AMERICA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 40 NORTH AMERICA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 41 NORTH AMERICA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 42 NORTH AMERICA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 43 U.S. SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 44 U.S. HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 45 U.S. LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 46 U.S. SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 47 U.S. SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 48 U.S. SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 49 U.S. BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 50 U.S. POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 U.S. FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 52 U.S. BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 53 U.S. CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 54 U.S. DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 55 U.S. ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 56 U.S. PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 CANADA SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 58 CANADA HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 59 CANADA LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 60 CANADA SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 61 CANADA SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 62 CANADA SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 63 CANADA BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 64 CANADA POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 65 CANADA FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 66 CANADA BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 67 CANADA CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 68 CANADA DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 69 CANADA ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 70 CANADA PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 71 MEXICO SUGAR SUBSTITUTES MARKET, BY TYPE, 2018-2027 (USD MILLION)

TABLE 72 MEXICO HIGH-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 73 MEXICO LOW-INTENSITY SWEETENERS IN SUGAR SUBSTITUTES MARKET, BY COMPOSITION, 2018-2027 (USD MILLION)

TABLE 74 MEXICO SUGAR SUBSTITUTES MARKET, BY FORM, 2018-2027 (USD MILLION)

TABLE 75 MEXICO SUGAR SUBSTITUTES MARKET, BY CATEGORY, 2018-2027 (USD MILLION)

TABLE 76 MEXICO SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 77 MEXICO BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 78 MEXICO POWDERED BEVERAGES IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 79 MEXICO FOOD PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 80 MEXICO BAKERY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 81 MEXICO CONFECTIONERY IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 82 MEXICO DAIRY PRODUCTS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 83 MEXICO ORAL CARE IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 84 MEXICO PHARMACEUTICALS IN SUGAR SUBSTITUTES MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SUGAR SUBSTITUTES MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SUGAR SUBSTITUTES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SUGAR SUBSTITUTES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SUGAR SUBSTITUTES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SUGAR SUBSTITUTES MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA SUGAR SUBSTITUTES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA SUGAR SUBSTITUTES MARKET

FIGURE 11 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SEGMENTATION

FIGURE 12 GROWING NUMBER OF OBESITY & DIABETIC POPULATION AND RISING TREND OF HEALTHY LIFESTYLE AND HEALTHY PRODUCTS ARE EXPECTED TO DRIVE THE NORTH AMERICA SUGAR SUBSTITUTES MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 13 HIGH-FRUCTOSE SYRUPS IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA SUGAR SUBSTITUTES MARKET IN 2020 & 2027

FIGURE 14 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY TYPE, 2019

FIGURE 15 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY FORM, 2019

FIGURE 16 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY APPLICATION, 2019

FIGURE 17 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY CATEGORY, 2019

FIGURE 18 NORTH AMERICA SUGAR SUBSTITUTES MARKET: SNAPSHOT (2019)

FIGURE 19 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2019)

FIGURE 20 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2020 & 2027)

FIGURE 21 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY COUNTRY (2019 & 2027)

FIGURE 22 NORTH AMERICA SUGAR SUBSTITUTES MARKET: BY TYPE (2020-2027)

FIGURE 23 NORTH AMERICA SUGAR SUBSTITUTES MARKET: COMPANY SHARE 2019 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.