Marché nord-américain du diagnostic des accidents vasculaires cérébraux, par gravité (modérée, grave, légère), type (tomodensitométrie (CT Scan), angiographie par tomodensitométrie (CTA), imagerie par résonance magnétique (IRM), angiographie par résonance magnétique (ARM), échographie Doppler transcrânienne , test d'impulsion vidéo de la tête (VHIT), autres), application (accident vasculaire cérébral ischémique, accident vasculaire cérébral hémorragique, attaques ischémiques transitoires (TIAS)), utilisateur final (hôpitaux, cliniques, centres de chirurgie ambulatoire, soins à domicile), canal de distribution (appel d'offres direct, distributeurs tiers, autres), stade (préopératoire, périopératoire, postopératoire), pays (États-Unis, Canada, Mexique), tendances et prévisions de l'industrie jusqu'en 2028

Analyse et perspectives du marché : marché nord-américain du diagnostic des accidents vasculaires cérébraux

Analyse et perspectives du marché : marché nord-américain du diagnostic des accidents vasculaires cérébraux

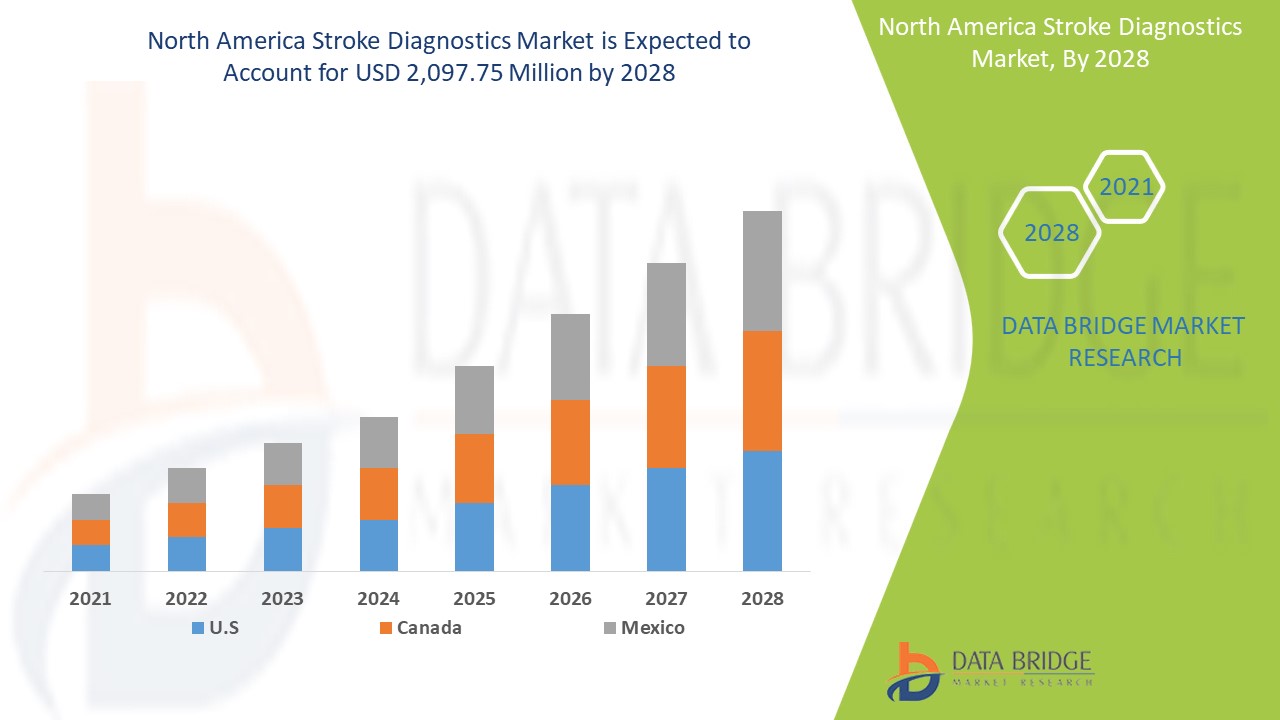

Le marché nord-américain du diagnostic des accidents vasculaires cérébraux devrait connaître une croissance au cours de la période de prévision de 2021 à 2028. Data Bridge Market Research analyse que le marché connaît une croissance de 6,6 % au cours de la période de prévision de 2021 à 2028 et devrait atteindre 2 097,75 millions USD d'ici 2028. La croissance de la R&D dans le secteur de la santé et l'augmentation des dépenses de santé sont les principaux moteurs qui devraient propulser la demande du marché au cours de la période de prévision. En revanche, les rappels de produits freinent le marché.

Un accident vasculaire cérébral survient lorsque l'apport sanguin au cerveau est diminué ou complètement bloqué, ce qui empêche le tissu cérébral de recevoir de l'oxygène et des nutriments. Différents types d'appareils de diagnostic sont utilisés pour détecter un accident vasculaire cérébral et ses premiers symptômes, par exemple la tomodensitométrie (TDM), l'angiographie par tomodensitométrie (CTA), l'imagerie par résonance magnétique (IRM), l'angiographie par résonance magnétique (ARM), l'échographie Doppler transcrânienne et d'autres.

L'incidence croissante des accidents vasculaires cérébraux et des maladies cardiovasculaires et neurologiques a accru la demande de diagnostics d'accidents vasculaires cérébraux dans les pays en développement. En outre, l'augmentation des dépenses de santé stimule la croissance du marché. D'un autre côté, le coût élevé du diagnostic peut freiner la croissance du marché. La présence d'acteurs sur le marché et le lancement de nouveaux produits offrent une opportunité. Cependant, le manque de professionnels qualifiés peut constituer un défi pour le marché.

Le rapport sur le marché du diagnostic des accidents vasculaires cérébraux fournit des détails sur la part de marché, les nouveaux développements, l'impact des acteurs du marché national et local, l'analyse des opportunités en termes de poches de revenus émergentes, les changements dans la réglementation du marché, les approbations de produits , les décisions stratégiques, les lancements de produits, les expansions géographiques et les innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

Portée et taille du marché du diagnostic des accidents vasculaires cérébraux en Amérique du Nord

Portée et taille du marché du diagnostic des accidents vasculaires cérébraux en Amérique du Nord

Le marché nord-américain du diagnostic des accidents vasculaires cérébraux est segmenté en fonction de la gravité, du type, de l'application, de l'utilisateur final, du canal de distribution et du stade. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

- En fonction de la gravité, le marché nord-américain du diagnostic des accidents vasculaires cérébraux est segmenté en modéré, sévère et léger. En 2021, le segment modéré devrait dominer le marché, avec une augmentation des activités de recherche et développement.

- Sur la base du type, le marché nord-américain du diagnostic des accidents vasculaires cérébraux est segmenté en tomodensitométrie (CT Scan), angiographie par tomodensitométrie (CTA), imagerie par résonance magnétique (IRM), angiographie par résonance magnétique (ARM), échographie Doppler transcrânienne, test d'impulsion vidéo de la tête (VHIT), autres. En 2021, le segment de la tomodensitométrie (CT Scan) devrait dominer le marché avec les initiatives gouvernementales croissantes visant à fournir des appareils plus avancés.

- En fonction des applications, le marché nord-américain du diagnostic des accidents vasculaires cérébraux est segmenté en accidents vasculaires cérébraux ischémiques, accidents vasculaires cérébraux hémorragiques et accidents ischémiques transitoires (AIT). En 2021, l'AVC ischémique devrait dominer le marché avec le lancement croissant de produits par les principaux acteurs du marché.

- En fonction des utilisateurs finaux, le marché nord-américain du diagnostic des accidents vasculaires cérébraux est segmenté en hôpitaux, soins à domicile, centres de chirurgie ambulatoire et cliniques. En 2021, le segment hospitalier devrait dominer le marché avec la présence de professionnels et de personnel qualifiés.

- En fonction du canal de distribution, le marché nord-américain du diagnostic des accidents vasculaires cérébraux est segmenté en appels d'offres directs, distributeurs tiers et autres. En 2021, les appels d'offres directs devraient dominer le marché en raison du nombre croissant de patients victimes d'accidents vasculaires cérébraux.

- En fonction du stade de développement, le marché nord-américain du diagnostic des accidents vasculaires cérébraux est segmenté en préopératoire, périopératoire et postopératoire. En 2021, le préopératoire devrait dominer le marché en raison des progrès croissants dans le développement des produits.

Analyse du marché des diagnostics d'AVC au niveau des pays

Le marché du diagnostic des accidents vasculaires cérébraux est analysé et des informations sur la taille du marché sont fournies en fonction de la gravité, du type, de l’application, des utilisateurs finaux, du canal de distribution et du stade.

Les pays couverts par le rapport sur le marché du diagnostic des accidents vasculaires cérébraux en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Le segment du diagnostic des accidents vasculaires cérébraux en Amérique du Nord devrait connaître le taux de croissance le plus élevé au cours de la période de prévision de 2021 à 2028 en raison de l'augmentation des recherches et du développement visant à améliorer la qualité des produits. Les États-Unis devraient être le leader de la croissance du marché nord-américain du diagnostic des accidents vasculaires cérébraux, et le segment des appels d'offres directs devrait dominer en raison de l'incidence croissante de la maladie dans le pays.

La section par pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché national qui ont un impact sur les tendances actuelles et futures du marché. Des points de données tels que les nouvelles ventes, les ventes de remplacement, la démographie des pays, les actes réglementaires et les tarifs d'importation et d'exportation sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des canaux de vente sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

L'augmentation des progrès et de la technologie pour le développement de nouveaux produits stimule la croissance du marché des diagnostics d'AVC

Le marché du diagnostic des accidents vasculaires cérébraux vous fournit également une analyse détaillée du marché de la croissance de chaque pays dans le secteur du diagnostic des accidents vasculaires cérébraux, avec les ventes de médicaments de diagnostic des accidents vasculaires cérébraux, l'impact des progrès de la technologie de diagnostic des accidents vasculaires cérébraux et les changements dans les scénarios réglementaires avec leur soutien au marché du diagnostic des accidents vasculaires cérébraux. Les données sont disponibles pour la période historique de 2011 à 2019.

Analyse du paysage concurrentiel et des parts de marché du diagnostic des accidents vasculaires cérébraux

Le paysage concurrentiel du marché du diagnostic des accidents vasculaires cérébraux fournit des détails par concurrent. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement du produit, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation de l'entreprise vers le marché du diagnostic des accidents vasculaires cérébraux.

Les principales entreprises présentes sur le marché nord-américain du diagnostic des accidents vasculaires cérébraux sont Siemens, Koninklijke Philips NV, Stryker, Hologic, Inc., ESAOTE SPA, Medtron AG, Shenzhen Anke High-Tech CO., Ltd, Aspect Imaging Ltd, Siemens, FONAR Corp, FUJIFILM Holdings Corporation, General Electric Company, ALPINION MEDICAL SYSTEMS Co., Ltd., Ltd, TERASON DIVISION TERATECH CORPORATION, Analogic Corporation, Carestream Health, IMRIS, Deerfield Imaging Inc., Canon Inc., SAMSUNG, SternMed GmbH, entre autres.

De nombreux lancements de produits et accords sont également initiés par des entreprises du monde entier, ce qui accélère également le marché du diagnostic des accidents vasculaires cérébraux.

Par exemple,

- En février 2021, Koninklijke Philips NV a annoncé avoir finalisé avec succès l'acquisition de BioTelemetry, Inc., un fournisseur américain de premier plan de diagnostic et de surveillance cardiaque à distance. Cette acquisition a ajouté de nouveaux produits technologiques de détection portables à sa gamme de produits

- En septembre 2021, SAMSUNG a annoncé avoir finalisé l'acquisition de la société HARMAN. L'acquisition a augmenté le portefeuille de produits et les avancées technologiques de l'entreprise

La collaboration, le lancement de produits, l'expansion commerciale, les récompenses et la reconnaissance, les coentreprises et d'autres stratégies des acteurs du marché améliorent le marché de l'entreprise sur le marché du diagnostic des accidents vasculaires cérébraux, ce qui offre également à l'organisation l'avantage d'améliorer son offre de diagnostic des accidents vasculaires cérébraux.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA STROKE DIAGNOSTICS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES MODEL

5 EPIDEMIOLOGY

6 NORTH AMERICA STROKE DIAGNOSTICS MARKET: REGULATIONS

6.1 REGULATION IN THE U.S.

6.2 REGULATION IN EUROPE

6.3 REGULATION IN CHINA

6.4 REGULATION IN JAPAN

6.5 REGULATION IN SOUTH AFRICA

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 TECHNOLOGICAL ADVANCEMENT

7.1.2 INCREASE IN THE INCIDENCE OF STROKE

7.1.3 INCREASE IN THE GERIATRIC POPULATION

7.1.4 INCREASE IN NUMBER OF PATIENTS WITH HYPERTENSION AND CORONARY HEART DISEASES

7.2 RESTRAINTS

7.2.1 HIGH COST OF DIAGNOSIS

7.2.2 INCREASE IN PRODUCT RECALL

7.3 OPPORTUNITIES

7.3.1 RISE IN HEALTHCARE SPENDING

7.3.2 INCREASE IN DIABETIC POPULATION AND OBESITY

7.3.3 INCREASE IN FDA APPROVAL AND PRODUCT LAUNCH

7.3.4 RISE IN AWARENESS REGARDING HEALTH AND STROKE

7.4 CHALLENGES

7.4.1 UNFAVORABLE REIMBURSEMENT SCENARIO

7.4.2 COMPLICATION RELATED TO DIAGNOSTIC DEVICES

8 IMPACT OF COVID-19 ON NORTH AMERICA STROKE DIAGNOSTICS MARKET

8.1 IMPACT ON PRICE

8.2 IMPACT ON DEMAND

8.3 IMPACT ON SUPPLY CHAIN

8.4 STRATEGIC INITIATIVES

8.5 CONCLUSION

9 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY

9.1 OVERVIEW

9.2 MODERATE

9.3 SEVERE

9.4 MILD

10 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE

10.1 OVERVIEW

10.2 COMPUTED TOMOGRAPHY (CT SCAN)

10.3 COMPUTED TOMOGRAPHY ANGIOGRAPHY (CTA)

10.4 MAGNETIC RESONANCE IMAGING (MRI)

10.5 MAGNETIC RESONANCE ANGIOGRAPHY (MRA)

10.6 TRANSCRANIAL DOPPLER ULTRASOUND

10.7 VIDEO HEAD IMPULSE TEST (VHIT)

10.8 OTHERS

10.8.1 CAROTID ULTRASOUND

10.8.2 CAROTID ANGIOGRAPHY

10.8.3 ELECTROCARDIOGRAPHY (EKG)

10.8.4 ECHOCARDIOGRAPHY

10.8.5 BLOOD TESTS

10.8.6 NUCLEAR NEUROIMAGING

10.8.7 OTHERS

11 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 ISCHEMIC STROKE

11.2.1 THROMBOTIC STROKES

11.2.2 EMBOLIC STROKES

11.3 HEMORRHAGIC STROKE

11.3.1 INTRACEREBRAL HEMORRHAGE

11.3.2 SUBARACHNOID HEMORRHAGE

11.4 TRANSIENT ISCHEMIC ATTACKS (TIAS)

12 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITAL

12.3 CLINICS

12.4 AMBULATORY SURGICAL CENTERS

12.5 HOME HEALTHCARE

12.6 OTHERS

13 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTORS

13.4 OTHERS

14 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE

14.1 OVERVIEW

14.2 PRE OPERATIVE

14.3 PERI OPERATIVE

14.4 POST OPERATIVE

15 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 STROKE DIAGNOSTICS MARKET COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 SWOT ANALYSIS

18 COMPANY PROFILE

18.1 SIEMENS

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 COMPANY SHARE ANALYSIS

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 KONINKLIJKE PHILIPS N.V.

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 COMPANY SHARE ANALYSIS

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 GENERAL ELECTRIC COMPANY

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 COMPANY SHARE ANALYSIS

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 CANON INC

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 COMPANY SHARE ANALYSIS

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 COMPANY SHARE ANALYSIS

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 ALPINION MEDICAL SYSTEMS CO., LTD

18.6.1 COMPANY SNAPSHOT

18.6.2 PRODUCT PORTFOLIO

18.6.3 RECENT DEVELOPMENTS

18.7 ANALOGIC CORPORATION

18.7.1 COMPANY SNAPSHOT

18.7.2 PRODUCT PORTFOLIO

18.7.3 RECENT DEVELOPMENT

18.8 ASPECT IMAGING LTD

18.8.1 COMPANY SNAPSHOT

18.8.2 PRODUCT PORTFOLIO

18.8.3 RECENT DEVELOPMENT

18.9 BPL MEDICAL TECHNOLOGIES

18.9.1 COMPANY SNAPSHOT

18.9.2 PRODUCT PORTFOLIO

18.9.3 RECENT DEVELOPMENT

18.1 CARESTREAM HEALTH

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 PRODUCT PORTFOLIO

18.10.4 RECENT DEVELOPMENTS

18.11 ESAOTE SPA

18.11.1 COMPANY SNAPSHOT

18.11.2 PRODUCT PORTFOLIO

18.11.3 RECENT DEVELOPMENTS

18.12 FONAR CORP

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 PRODUCT PORTFOLIO

18.12.4 RECENT DEVELOPMENT

18.13 FUJIFILM HOLDINGS CORPORATION

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 PRODUCT PORTFOLIO

18.13.4 RECENT DEVELOPMENTS

18.14 HOLOGIC, INC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 PRODUCT PORTFOLIO

18.14.4 RECENT DEVELOPMENTS

18.15 IMRIS, DEERFIELD IMAGING INC.

18.15.1 COMPANY SNAPSHOT

18.15.2 PRODUCT PORTFOLIO

18.15.3 RECENT DEVELOPMENT

18.16 MEDFIELD DIAGNOSTICS AB

18.16.1 COMPANY SNAPSHOT

18.16.2 PRODUCT PORTFOLIO

18.16.3 RECENT DEVELOPMENT

18.17 MEDTRON AG

18.17.1 COMPANY SNAPSHOT

18.17.2 PRODUCT PORTFOLIO

18.17.3 RECENT DEVELOPMENT

18.18 NEUSOFT CORPORATION

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 PRODUCT PORTFOLIO

18.18.4 RECENT DEVELOPMENT

18.19 SAMSUNG

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 PRODUCT PORTFOLIO

18.19.4 RECENT DEVELOPMENTS

18.2 SHENXHEN ANKE HIGH-TECH CO., LTD.

18.20.1 COMPANY SNAPSHOT

18.20.2 PRODUCT PORTFOLIO

18.20.3 RECENT DEVELOPMENT

18.21 SHIMADZU CORPORATION

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 PRODUCT PORTFOLIO

18.21.4 RECENT DEVELOPMENTS

18.22 SIUI

18.22.1 COMPANY SNAPSHOT

18.22.2 PRODUCT PORTFOLIO

18.22.3 RECENT DEVELOPMENTS

18.23 STERNMED GMBH

18.23.1 COMPANY SNAPSHOT

18.23.2 PRODUCT PORTFOLIO

18.23.3 RECENT DEVELOPMENT

18.24 STRYKER

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 PRODUCT PORTFOLIO

18.24.4 RECENT DEVELOPMENTS

18.25 TERASON DIVISION TERATECH CORPORATION

18.25.1 COMPANY SNAPSHOT

18.25.2 PRODUCT PORTFOLIO

18.25.3 RECENT DEVELOPMENT

19 QUESTIONNAIRE

20 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 2 NORTH AMERICA MODERATE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 3 NORTH AMERICA SEVERE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 NORTH AMERICA MILD IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 5 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 6 NORTH AMERICA COMPUTED TOMOGRAPHY (CT SCAN) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 7 NORTH AMERICA COMPUTED TOMOGRAPHY ANGIOGRAPHY (CTA) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 8 NORTH AMERICA MAGNETIC RESONANCE IMAGING (MRI) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 NORTH AMERICA MAGNETIC RESONANCE ANGIOGRAPHY (MRA) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 NORTH AMERICA TRANSCRANIAL DOPPLER ULTRASOUND IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 11 NORTH AMERICA VIDEO HEAD IMPULSE TEST (VHIT) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 13 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 14 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 15 NORTH AMERICA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 NORTH AMERICA ISCHEMIC STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 17 NORTH AMERICA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 18 NORTH AMERICA HEMORRHAGIC STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 19 NORTH AMERICA TRANSIENT ISCHEMIC ATTACKS (TIAS) IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 21 NORTH AMERICA HOSPITAL IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 22 NORTH AMERICA CLINICS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 NORTH AMERICA AMBULATORY SURGICAL CENTERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 NORTH AMERICA HOME HEALTHCARE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 26 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 27 NORTH AMERICA DIRECT TENDER IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 28 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 30 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 31 NORTH AMERICA PRE OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 32 NORTH AMERICA PERI OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 NORTH AMERICA POST OPERATIVE IN STROKE DIAGNOSTICS MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 34 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY COUNTRY, 2019-2028 (USD MILLION)

TABLE 35 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 36 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 37 NORTH AMERICA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 38 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 39 NORTH AMERICA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 40 NORTH AMERICA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 41 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 42 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 43 NORTH AMERICA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 44 U.S. STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 45 U.S. STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 46 U.S. OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 47 U.S. STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 48 U.S. ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 49 U.S. HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 50 U.S. STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 51 U.S. STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 52 U.S. STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 53 CANADA STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 54 CANADA STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 55 CANADA OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 56 CANADA STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 57 CANADA ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 58 CANADA HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 59 CANADA STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 60 CANADA STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 61 CANADA STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

TABLE 62 MEXICO STROKE DIAGNOSTICS MARKET, BY SEVERITY, 2019-2028 (USD MILLION)

TABLE 63 MEXICO STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 64 MEXICO OTHERS IN STROKE DIAGNOSTICS MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 65 MEXICO STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 66 MEXICO ISCHEMIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 67 MEXICO HEMORRHAGIC STROKE IN STROKE DIAGNOSTICS MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 68 MEXICO STROKE DIAGNOSTICS MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 69 MEXICO STROKE DIAGNOSTICS MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 70 MEXICO STROKE DIAGNOSTICS MARKET, BY STAGE, 2019-2028 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA STROKE DIAGNOSTICS MARKET: NORTH AMERICA VS REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA STROKE DIAGNOSTICS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA STROKE DIAGNOSTICS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA STROKE DIAGNOSTICS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA STROKE DIAGNOSTICS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA STROKE DIAGNOSTICS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN DEMAND FOR STROKE DIAGNOSTISIS EXPECTED TO DRIVE THE NORTH AMERICA STROKE DIAGNOSTICS MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 12 MODERATE IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA STROKE DIAGNOSTICS MARKET IN 2021 & 2028

FIGURE 13 NORTH AMERICA IS EXPECTED TO DOMINATE THE NORTH AMERICA STROKE DIAGNOSTICS MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA STROKE DIAGNOSTICS MARKET

FIGURE 15 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, 2020

FIGURE 16 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, 2020-2028 (USD MILLION)

FIGURE 17 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, CAGR (2021-2028)

FIGURE 18 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY, LIFELINE CURVE

FIGURE 19 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, 2020

FIGURE 20 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, 2020-2028 (USD MILLION)

FIGURE 21 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, CAGR (2021-2028)

FIGURE 22 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY TYPE, LIFELINE CURVE

FIGURE 23 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, 2020

FIGURE 24 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, 2020-2028 (USD MILLION)

FIGURE 25 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, CAGR (2021-2028)

FIGURE 26 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 27 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, 2020

FIGURE 28 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, 2020-2028 (USD MILLION)

FIGURE 29 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, CAGR (2021-2028)

FIGURE 30 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY END USER, LIFELINE CURVE

FIGURE 31 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 32 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, 2020-2028 (USD MILLION)

FIGURE 33 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 34 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 35 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, 2020

FIGURE 36 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, 2020-2028 (USD MILLION)

FIGURE 37 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, CAGR (2021-2028)

FIGURE 38 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY STAGE, LIFELINE CURVE

FIGURE 39 NORTH AMERICA STROKE DIAGNOSTICS MARKET: SNAPSHOT (2020)

FIGURE 40 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2020)

FIGURE 41 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2021 & 2028)

FIGURE 42 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY COUNTRY (2020 & 2028)

FIGURE 43 NORTH AMERICA STROKE DIAGNOSTICS MARKET: BY SEVERITY (2021-2028)

FIGURE 44 STROKE DIAGNOSTICS MARKET COMPANY SHARE 2020 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.