North America Sports Flooring Market

Taille du marché en milliards USD

TCAC :

%

USD

4,869.15 Billion

USD

7,042.96 Billion

2022

2030

USD

4,869.15 Billion

USD

7,042.96 Billion

2022

2030

| 2023 –2030 | |

| USD 4,869.15 Billion | |

| USD 7,042.96 Billion | |

|

|

|

Marché des revêtements de sol sportifs en Amérique du Nord, par type (revêtements de sol en caoutchouc, revêtements de sol en PVC, revêtements de sol en bois, revêtements de sol en gazon artificiel, revêtements de sol en polyuréthane et revêtements de sol en polypropylène), application (intérieure et extérieure), sports (gymnase, basket-ball, badminton, tennis, football, studio de danse et d'aérobic, athlétisme, volley-ball et autres), utilisation finale (commerciale et résidentielle), type de construction (rénovation/entretien et nouvelle construction), canal de vente (vente directe et point de vente de sport) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et taille du marché des revêtements de sol sportifs en Amérique du Nord

Les revêtements de sol sportifs sont des solutions de revêtement de sol spécialisées conçues pour les événements sportifs. Il existe de nombreux types de revêtements de sol sportifs, notamment en caoutchouc, en bois dur et en matériaux synthétiques. Les terrains de basket-ball sont souvent équipés de revêtements de sol sportifs en bois dur, car ils offrent un excellent rebond de balle et une bonne traction aux joueurs et sont souvent fabriqués en érable ou en chêne. Les revêtements de sol sportifs synthétiques en PVC ou en vinyle sont adaptables et peuvent être adaptés à différentes activités sportives. Les revêtements de sol sportifs en caoutchouc sont populaires pour les pistes intérieures, les zones d'haltérophilie et les studios d'aérobic, car ils sont connus pour leurs qualités d'absorption des chocs.

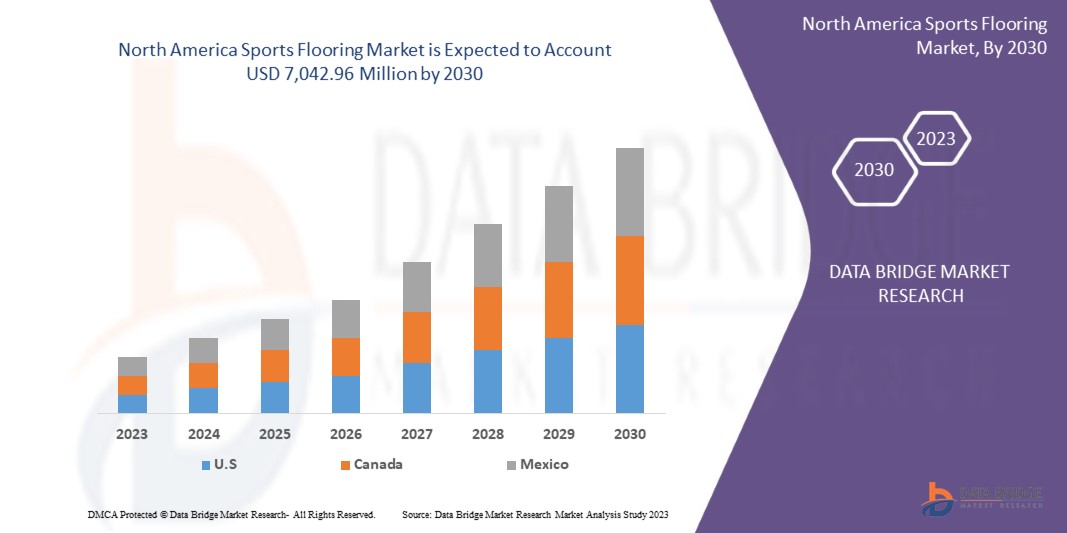

Data Bridge Market Research analyse que le marché devrait atteindre 7 042,96 millions USD d'ici 2030, contre 4 869,15 millions USD en 2022, avec un TCAC de 4,9 % au cours de la période de prévision de 2023 à 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2015 à 2020) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Type (revêtement de sol en caoutchouc, revêtement de sol en PVC, revêtement de sol en bois , revêtement de sol en gazon artificiel, revêtement de sol en polyuréthane et revêtement de sol en polypropylène), application (intérieure et extérieure), sports (gymnase, basket-ball, badminton, tennis, football, studio de danse et d'aérobic, athlétisme, volley-ball et autres), utilisation finale (commerciale et résidentielle), type de construction (rénovation/entretien et nouvelle construction), canal de vente (vente directe et point de vente de sport) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Rephouse Ltd, CONICA AG, Junckers Industrier A/S, FAB FLOORINGS INDIA, FLEXCOURT, Sika AG, Tarkett, Gerflor, Forbo Flooring Systems, Horner Sports Flooring., Asian Flooring India Private Limited, INDIANA SPORTS INFRA, SnapSports, LX Hausys, Abacus Sports, Hamberger Industriewerke GmbH, KTL SPORTS FLOORING et Ecore International, entre autres |

Définition du marché

Les revêtements de sol sportifs sont des solutions de revêtement de sol spécialisées conçues pour les événements sportifs. Ces options de revêtement de sol prennent en compte des éléments tels que l'absorption des chocs, la traction et le rebond de la balle, car elles sont conçues pour offrir sécurité, performance, durabilité et confort aux athlètes. Les installations sportives intérieures telles que les gymnases, les arènes, les salles polyvalentes et les centres de fitness sont souvent équipées de revêtements de sol sportifs.

Dynamique du marché des revêtements de sol sportifs en Amérique du Nord

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

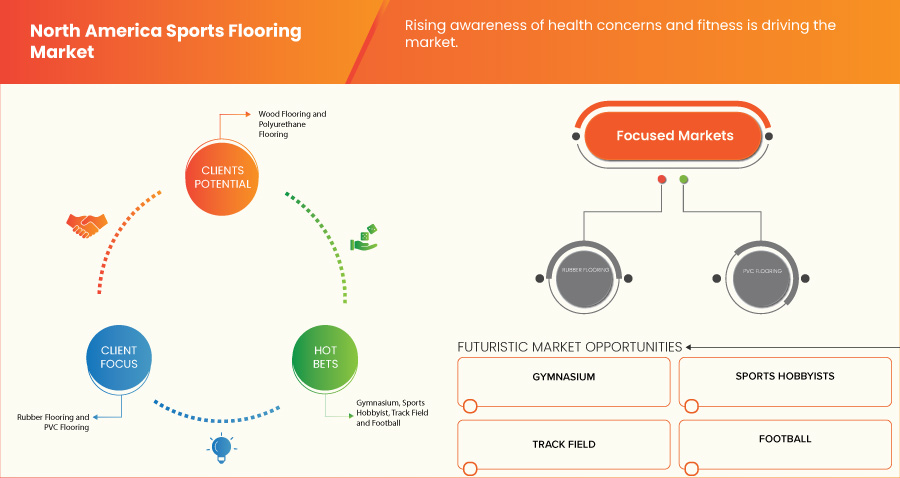

- Sensibilisation croissante aux problèmes de santé et de forme physique

La population dans son ensemble est de plus en plus consciente des problèmes de santé et de forme physique. Les gens recherchent activement des moyens d'améliorer leur bien-être général à mesure qu'ils prennent conscience des effets négatifs d'un mode de vie sédentaire. Les gens accordent la priorité à l'activité physique régulière et adoptent des modes de vie plus sains en raison de cette prise de conscience croissante, ce qui a entraîné un changement significatif dans le comportement des consommateurs. Le développement du marché nord-américain des revêtements de sol sportifs est considérablement alimenté par la sensibilisation croissante des gens aux problèmes de santé et à la forme physique. Il existe un besoin croissant d'options de revêtements de sol sportifs appropriés à mesure que les gens prennent conscience de l'importance d'un mode de vie actif et de la participation à des activités physiques régulières.

La prévalence croissante des maladies chroniques liées à l’inactivité et à une mauvaise condition physique a encore accru l’urgence pour les individus de prendre des mesures proactives pour maintenir leur santé.

- Croissance de la participation des femmes à diverses activités sportives

Le marché nord-américain des revêtements de sol sportifs est en pleine croissance en raison du nombre croissant de femmes participant à différentes activités sportives telles que le badminton et le basket-ball, entre autres. Les femmes sont désormais beaucoup plus engagées et actives dans le sport que jamais auparavant, participant à tout, des sports amateurs aux compétitions bien connues. Cette augmentation de la participation sportive des femmes a créé une demande pour des solutions de revêtements de sol sportifs spécialisées qui répondent à leurs besoins et exigences spécifiques.

La croissance du sport féminin a été favorisée par l'émergence de nouvelles ligues et compétitions, ainsi que par l'attention accrue des médias et les possibilités de parrainage. Les femmes de tous âges sont désormais davantage encouragées à participer à des activités sportives et à accorder une grande priorité à leur forme physique grâce à cette visibilité et à cette reconnaissance accrues.

Les entreprises du secteur des revêtements de sol sportifs ont la possibilité de bénéficier de la popularité croissante des sports féminins en fournissant des produits de revêtement de sol de haute qualité adaptés à leurs besoins particuliers.

- Inquiétude croissante concernant la sécurité et la performance des athlètes

Il est de plus en plus important de fournir aux athlètes un environnement sûr et propice à leurs performances tout en minimisant les risques de blessures. Les athlètes, les entraîneurs et les gestionnaires d’installations sportives recherchent activement des solutions de pointe pour réduire ces risques en raison de la prise de conscience croissante des effets potentiels à long terme des blessures liées au sport sur la santé. Les revêtements de sol sportifs sont essentiels pour offrir une surface encourageante et protectrice aux athlètes, en aidant à dévier les impacts, à offrir une traction et à réduire les risques de trébuchements, de glissades et de chutes.

L'importance de la performance et de la sécurité des athlètes est également reconnue par les organismes directeurs et les organisations en charge des réglementations et des normes sportives, ce qui a conduit à l'inclusion de directives spécifiques pour les revêtements de sol sportifs dans leurs règlements. Cela accroît le besoin de solutions pour des revêtements de sol sportifs conformes.

Opportunités

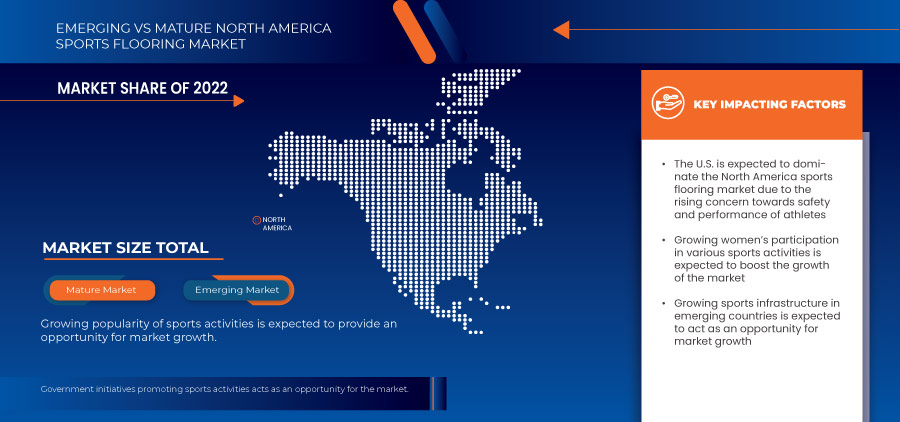

- Développement des infrastructures sportives dans la région

L'une des principales exigences des installations sportives est de disposer de sols sportifs de haute qualité qui offrent performance, sécurité et durabilité. Cela crée un environnement favorable à la croissance du marché des sols sportifs en Amérique du Nord.

De plus, la construction d'installations sportives polyvalentes dans les pays émergents accroît les opportunités de marché. Ces installations accueillent une gamme d'activités sportives et récréatives, telles que le basket-ball, le volley-ball, le tennis et le football en salle. Des systèmes de revêtements de sol sportifs polyvalents pouvant accueillir plusieurs sports deviennent essentiels pour ces sites, ce qui stimule la demande de matériaux de revêtement de sol sportifs adaptables et durables.

La demande croissante d'installations sportives, d'événements régionaux et internationaux, de ligues sportives professionnelles, de sites polyvalents et de promotion de la santé contribue au besoin croissant de solutions de revêtements de sol sportifs de haute qualité. Par conséquent, de nombreuses opportunités de croissance pour le marché des revêtements de sol sportifs en Amérique du Nord dans un avenir proche.

- Le gouvernement prend des initiatives pour promouvoir les activités sportives

Les gouvernements des pays en développement prennent des initiatives et réalisent des investissements pour développer les infrastructures sportives afin de promouvoir le sport et un mode de vie sain. Ces initiatives stimulent la demande de solutions de revêtement de sol sportif, créant ainsi des opportunités pour les acteurs du marché de fournir leurs produits et services.

Lorsque les gouvernements accordent la priorité au développement du sport et y investissent, cela crée un environnement favorable à la croissance des infrastructures sportives, entraînant une demande accrue de solutions de revêtements de sol sportifs.

Ainsi, les subventions et financements publics destinés aux clubs sportifs, aux académies et aux établissements d'enseignement peuvent stimuler le marché des revêtements de sol sportifs. Le soutien financier permet à ces organisations de moderniser leurs installations, notamment en investissant dans des revêtements de sol sportifs de qualité. Les fabricants et les fournisseurs peuvent collaborer avec ces institutions pour fournir des solutions de revêtement de sol sur mesure qui répondent à leurs exigences spécifiques, ce qui accroît les opportunités commerciales.

Contraintes/Défis

- Dépendance à l'égard de la main-d'œuvre qualifiée et disponibilité limitée de la main-d'œuvre

L'installation de revêtements de sol sportifs nécessite des compétences et des connaissances spécialisées. Il est essentiel de faire appel à des professionnels formés qui comprennent les subtilités des techniques d'installation appropriées, la préparation de la surface et l'application de la colle. Cependant, il peut y avoir une pénurie de main-d'œuvre qualifiée avec une expertise dans l'installation de revêtements de sol sportifs, ce qui peut entraver la réalisation rapide et efficace des projets.

La main d'œuvre qualifiée joue un rôle crucial pour garantir que le revêtement de sol est correctement installé, notamment en ce qui concerne le nivellement, le marquage des lignes et les finitions sans joint. La disponibilité limitée de travailleurs qualifiés peut entraîner un compromis dans le contrôle de la qualité, ce qui peut entraîner des installations de mauvaise qualité et l'insatisfaction des clients.

- Coûts d'installation et d'achat élevés

Le coût d'achat et d'installation est un obstacle majeur pour le marché nord-américain des revêtements de sol sportifs. Les entreprises de ce secteur sont confrontées à des obstacles de taille en raison des coûts liés à l'achat et à l'installation de systèmes de revêtements de sol sportifs. Les matériaux et équipements de revêtement de sol sportif de haute qualité peuvent être coûteux au départ, et l'installation par un expert peut également être assez coûteuse.

De plus, les revêtements de sol sportifs sont souvent plus chers que les revêtements de sol conventionnels en raison de leur nature spécialisée, qui doit respecter des normes strictes de sécurité et de performance. Les coûts plus élevés résultent de la nécessité de matériaux, d'ingénierie et de méthodes de fabrication de pointe pour garantir une absorption des chocs, une traction et une durabilité idéales. Par conséquent, les coûts d'installation et d'achat élevés constituent un frein au marché des revêtements de sol sportifs.

Développements récents

- En juillet 2023, Tarkett a lancé PureGrain, une innovation qui devrait complètement changer le paysage des terrains de sport. Ce produit révolutionnaire, fabriqué à partir d'épis de maïs, représente non seulement un grand pas vers un avenir plus vert, mais il offre également d'excellentes performances pour les athlètes de tous niveaux. Ce type de lancement de produit a aidé l'entreprise à élargir son portefeuille de produits et à conquérir une nouvelle base de consommateurs

- En avril 2023, la société a annoncé la sortie de six nouveaux modèles en érable. Ces modèles Taraflex sont incroyablement réalistes et reproduisent nos bandes d'érable Connor tout en simulant le revêtement de sol le plus prestigieux de la NBA. Ce type de lancement de produit aidera l'entreprise à acquérir un avantage concurrentiel sur le marché

- En septembre 2021, le fabricant de matériaux de construction et de décoration intérieure LX Hausys s'est joint à une offre d'acquisition d'une participation dans la société de meubles Hanssem. LX Hausys a annoncé son intention d'investir 300 milliards de wons (259 millions de dollars) dans une société à vocation spécifique créée par IMM Private Equity (PE). Hanssem fabrique des revêtements de sol, des portes et des fenêtres. Avec cette acquisition, LX Hausys devrait renforcer sa présence sur le marché local de la décoration intérieure en utilisant la synergie entre les deux sociétés

- En 2021, l'instance dirigeante internationale du basket-ball, la FIBA, et Junckers Industier A/s ont conclu un accord à long terme en vertu duquel Junckers fournira des parquets en bois dans le monde entier d'ici 2024. Cet accord aide l'entreprise à générer un chiffre d'affaires stable et à gagner une nouvelle base de consommateurs en promouvant son image de marque

Portée du marché des revêtements de sol sportifs en Amérique du Nord

Le marché nord-américain des revêtements de sol sportifs est segmenté en six segments notables en fonction du type, de l'application, des sports, de l'utilisation finale, du type de construction et du canal de vente. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Revêtement de sol en caoutchouc

- Revêtement de sol en PVC

- Parquet en bois

- Revêtement de sol en gazon artificiel

- Revêtement de sol en polyuréthane

- Revêtement de sol en polypropylène

Sur la base du type, le marché est segmenté en revêtements de sol en caoutchouc, revêtements de sol en PVC, revêtements de sol en bois, revêtements de sol en gazon artificiel, revêtements de sol en polyuréthane et revêtements de sol en polypropylène.

Application

- Intérieur

- De plein air

Sur la base de l’application, le marché est segmenté en intérieur et extérieur.

Sportif

- Salle de sport

- Basket-ball

- Badminton

- Tennis

- Football

- Studio de danse et d'aérobic

- Athlétisme

- Volley-ball

- Autres

Sur la base des sports, le marché est segmenté en salle de sport, basket-ball, badminton, tennis, football, studio de danse et d'aérobic, athlétisme, volley-ball et autres.

Utilisation finale

- Commercial

- Résidentiel

En fonction de l’utilisation finale, le marché est segmenté en commercial et résidentiel.

Type de construction

- Rénover/Entretenir

- Nouvelle construction

Sur la base du type de construction, le marché est segmenté en rénovation/entretien et construction neuve.

Canal de vente

- Vente directe

- Magasin de sport

Sur la base du canal de vente, le marché est segmenté en vente directe et en points de vente sportifs.

Analyse/perspectives régionales du marché des revêtements de sol sportifs en Amérique du Nord

Le marché est analysé et des informations sur la taille du marché et les tendances sont fournies par pays, type, application, sports, utilisation finale, type de construction et canal de vente comme référencé ci-dessus.

Les pays du marché des revêtements de sol sportifs en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis devraient dominer le marché nord-américain des revêtements de sol sportifs en raison de la prise de conscience croissante des problèmes de santé et de forme physique. Les préoccupations croissantes concernant la sécurité et les performances des athlètes contribuent également à la croissance du marché.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques régionales et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des revêtements de sol sportifs en Amérique du Nord

Le paysage concurrentiel du marché des revêtements de sol sportifs en Amérique du Nord fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue des produits, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché des revêtements de sol sportifs en Amérique du Nord.

Certains des principaux acteurs opérant sur le marché des revêtements de sol sportifs en Amérique du Nord sont Rephouse Ltd, CONICA AG, Junckers Industrier A/S, FAB FLOORINGS INDIA, FLEXCOURT, Sika AG, Tarkett, Gerflor, Forbo Flooring Systems, Horner Sports Flooring., Asian Flooring India Private Limited, INDIANA SPORTS INFRA, SnapSports, LX Hausys, Abacus Sports, Hamberger Industriewerke GmbH, KTL SPORTS FLOORING et Ecore International, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 PORTER’S FIVE FORCES: NORTH AMERICA SPORTS FLOORING MARKET

4.3 VENDOR SELECTION CRITERIA

4.4 SUPPLY CHAIN ANALYSIS

4.4.1 OVERVIEW

4.4.2 LOGISTICS COST SCENARIO

4.4.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

4.5 CLIMATE CHANGE SCENARIO

4.5.1 ENVIRONMENTAL CONCERNS

4.5.2 INDUSTRY RESPONSE

4.5.3 GOVERNMENT’S ROLE

4.5.4 ANALYST RECOMMENDATION

4.6 RAW MATERIAL COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING POPULARITY OF SPORTS ACTIVITIES

5.1.2 RISING AWARENESS OF HEALTH CONCERNS AND FITNESS

5.1.3 GROWING WOMEN’S PARTICIPATION IN VARIOUS SPORTS ACTIVITIES

5.1.4 RISING CONCERN TOWARDS SAFETY AND PERFORMANCE OF ATHLETES

5.2 RESTRAINTS

5.2.1 HIGH INSTALLATION AND PURCHASE COSTS

5.2.2 VARIETY IN CONSUMER PREFERENCE

5.3 OPPORTUNITIES

5.3.1 GROWING SPORTS INFRASTRUCTURE IN THE REGION

5.3.2 GOVERNMENT INITIATIVES PROMOTING SPORTS ACTIVITIES

5.4 CHALLENGES

5.4.1 DEPENDENCY ON SKILLED LABOR AND LIMITED AVAILABILITY OF WORKFORCE

5.4.2 STRINGENT REGULATIONS REGARDING INSTALLATION

6 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE

6.1 OVERVIEW

6.2 RUBBER FLOORING

6.2.1 RECYCLED RUBBER FLOORING

6.2.2 VULCANIZED RUBBER FLOORING

6.3 PVC FLOORING

6.4 WOOD FLOORING

6.4.1 STANDARD

6.4.2 HIGH-END

6.5 ARTIFICIAL TURF FLOORING

6.6 POLYURETHANE FLOORING

6.7 POLYPROPYLENE FLOORING

7 NORTH AMERICA SPORTS FLOORING MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 INDOOR

7.2.1 RUBBER FLOORING

7.2.2 PVC FLOORING

7.2.3 WOOD FLOORING

7.2.4 POLYURETHANE FLOORING

7.2.5 POLYPROPYLENE FLOORING

7.2.6 ARTIFICIAL TURF FLOORING

7.3 OUTDOOR

7.3.1 ARTIFICIAL TURF FLOORING

7.3.2 PVC FLOORING

7.3.3 POLYURETHANE FLOORING

7.3.4 POLYPROPYLENE FLOORING

7.3.5 RUBBER FLOORING

8 NORTH AMERICA SPORTS FLOORING MARKET, BY SPORTS

8.1 OVERVIEW

8.2 GYM

8.3 BASKETBALL

8.4 BADMINTON

8.5 TENNIS

8.6 FOOTBALL

8.7 DANCE AND AEROBIC STUDIO

8.8 TRACK AND FIELD

8.9 VOLLEYBALL

8.1 OTHERS

9 NORTH AMERICA SPORTS FLOORING MARKET, BY END-USE

9.1 OVERVIEW

9.2 COMMERCIAL

9.3 RESIDENTIAL

10 NORTH AMERICA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE

10.1 OVERVIEW

10.2 RENOVATE/MAINTAINED

10.3 NEW CONSTRUCTION

11 NORTH AMERICA SPORTS FLOORING MARKET, BY SALES CHANNEL

11.1 OVERVIEW

11.2 DIRECT SALES

11.3 SPORTS OUTLET

12 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TARKETT

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 GERFLOR

15.2.1 COMPANY SNAPSHOT

15.2.2 PRODUCT PORTFOLIO

15.2.3 RECENT DEVELOPMENTS

15.3 LX HAUSYS

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENT

15.4 SIKA AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 PRODUCT PORTFOLIO

15.4.4 RECENT DEVELOPMENTS

15.5 HAMBERGER INDUSTRIEWERKE GMBH

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 RECENT DEVELOPMENTS

15.6 ABACUS SPORTS

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 ASIAN FLOORING INDIA PRIVATE LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CONICA AG

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 ECORE INTERNATIONAL

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENTS

15.1 FAB FLOORINGS INDIA

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 FLEXCOURT

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 FORBO GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 HORNER SPORTS FLOORING.

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 INDIANA SPORTS INFRA

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENTS

15.15 JUNCKERS INDUSTRIER A/S

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 KTL SPORTS FLOORING

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 REPHOUSE LTD

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 SNAPSPORTS

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 NORTH AMERICA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 3 NORTH AMERICA RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 4 NORTH AMERICA WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 5 NORTH AMERICA SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 6 NORTH AMERICA INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA SPORTS FLOORING MARKET, BY COUNTRY, 2021-2030 (MILLION SQUARE FEET)

TABLE 14 U.S. SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 15 U.S. SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 16 U.S. RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 17 U.S. WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 18 U.S. SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 19 U.S. INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 20 U.S. OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 21 U.S. SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 22 U.S. SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 23 U.S. SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 24 U.S. SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 25 CANADA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 26 CANADA SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 27 CANADA RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 28 CANADA WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 29 CANADA SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 30 CANADA INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 31 CANADA OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 CANADA SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 33 CANADA SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 34 CANADA SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 35 CANADA SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

TABLE 36 MEXICO SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 37 MEXICO SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (MILLION SQUARE FEET)

TABLE 38 MEXICO RUBBER FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 MEXICO WOOD FLOORING IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 40 MEXICO SPORTS FLOORING MARKET, BY APPLICATION, 2021-2030 (USD MILLION)

TABLE 41 MEXICO INDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 MEXICO OUTDOOR IN SPORTS FLOORING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 MEXICO SPORTS FLOORING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 44 MEXICO SPORTS FLOORING MARKET, BY END-USE, 2021-2030 (USD MILLION)

TABLE 45 MEXICO SPORTS FLOORING MARKET, BY CONSTRUCTION TYPE, 2021-2030 (USD MILLION)

TABLE 46 MEXICO SPORTS FLOORING MARKET, BY SALES CHANNEL, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA SPORTS FLOORING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SPORTS FLOORING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SPORTS FLOORING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SPORTS FLOORING MARKET: REGIONAL VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SPORTS FLOORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SPORTS FLOORING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SPORTS FLOORING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA SPORTS FLOORING MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 10 NORTH AMERICA SPORTS FLOORING MARKET: SEGMENTATION

FIGURE 11 GROWING POPULARITY OF SPORTS ACTIVITIES IS DRIVING THE GROWTH OF THE NORTH AMERICA SPORTS FLOORING MARKET IN THE FORECAST PERIOD FROM 2023 TO 2030

FIGURE 12 RUBBER FLOORING SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SPORTS FLOORING MARKET IN 2023 AND 2030

FIGURE 13 VENDOR SELECTION CRITERIA

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SPORTS FLOORING MARKET

FIGURE 15 NORTH AMERICA SPORTS FLOORING MARKET: BY TYPE, 2022

FIGURE 16 NORTH AMERICA SPORTS FLOORING MARKET: BY APPLICATION, 2022

FIGURE 17 NORTH AMERICA SPORTS FLOORING MARKET: BY SPORTS, 2022

FIGURE 18 NORTH AMERICA SPORTS FLOORING MARKET: BY END-USE, 2022

FIGURE 19 NORTH AMERICA SPORTS FLOORING MARKET: BY CONSTRUCTION TYPE, 2022

FIGURE 20 NORTH AMERICA SPORTS FLOORING MARKET: BY SALES CHANNEL, 2022

FIGURE 21 NORTH AMERICA SPORTS FLOORING MARKET: SNAPSHOT (2022)

FIGURE 22 NORTH AMERICA SPORTS FLOORING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.