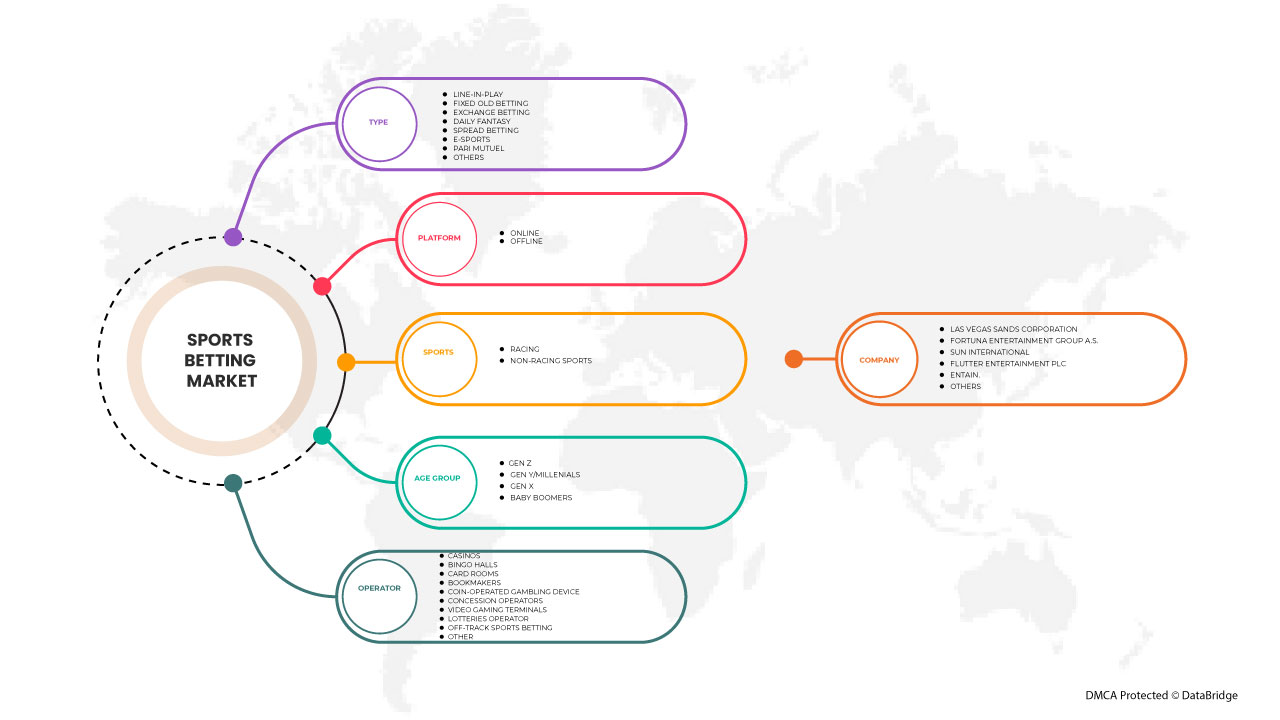

Marché des paris sportifs en Amérique du Nord, par type (Line-In-Play, paris fixes anciens, paris d'échange, Fantasy quotidien, paris à spread, e-sports, pari mutuel), plateforme (en ligne et hors ligne), sports (courses et sports non liés aux courses), opérateur ( casinos , salles de bingo, salles de cartes, bookmakers, appareils de jeu à pièces, opérateurs de concession, terminaux de jeux vidéo, opérateur de loteries, paris sportifs hors piste et autres), groupe d'âge (GEN Z, GEN Y/MILLENIALS, GEN X, Baby Boomers) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché des paris sportifs en Amérique du Nord

Les paris sportifs sont des paris financiers sur le résultat d'un ou de plusieurs matchs, sur l'événement/non-événement d'un événement au sein d'un match, ou sur des sports d'une durée de sept jours ou sur une rivalité d'une saison. Les paris sportifs consistent à parier sur le résultat d'événements sportifs. Les parieurs tentent de prédire le résultat d'un événement afin de gagner leur pari - et potentiellement de réaliser un profit. La NFL, la LNH, la NBA, la MLB et d'autres sports américains emblématiques font tous partie du package des paris sportifs. Mais en plus de cela, ils proposent également une gamme de sports européens et d'autres sports mondiaux, de sorte que les paris sportifs en ligne sont un bon choix si la personne vient d'autres territoires à travers le monde.

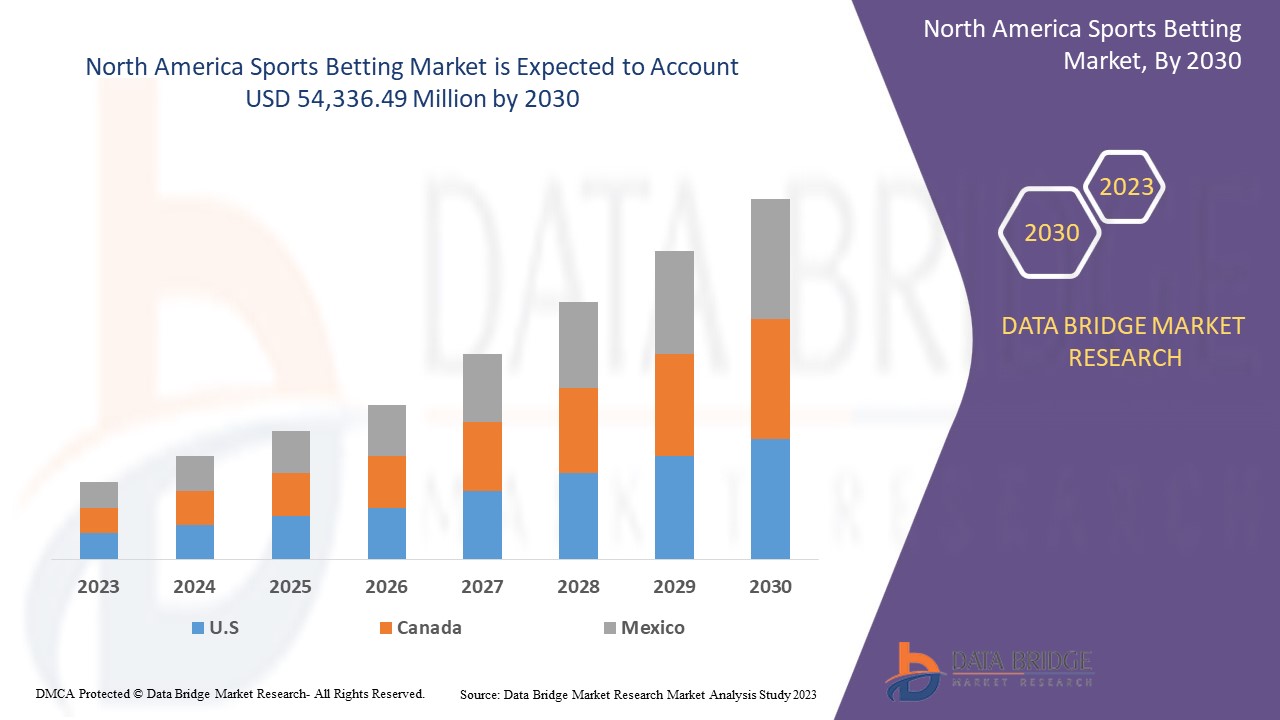

Le marché des paris sportifs en Amérique du Nord devrait connaître une croissance de marché au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 8,9 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 54 336,49 millions USD d'ici 2030.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type (paris en jeu, paris fixes anciens, paris d'échange, fantasy quotidien, paris à spread, sports électroniques, pari mutuel), plateforme (en ligne et hors ligne), sports (courses et sports non liés aux courses), opérateur (casinos, salles de bingo, salles de cartes, bookmakers, appareils de jeu à pièces, exploitants de concessions, terminaux de jeux vidéo, opérateur de loteries, paris sportifs hors piste et autres), groupe d'âge (GÉNÉRATION Z, GÉNÉRATION Y/MILLENIALS, GÉNÉRATION X, baby-boomers). |

|

Pays couverts |

États-Unis, Canada, Mexique |

|

Acteurs du marché couverts |

Français BETSSON AB, FORTUNA ENTERTAINMENT GROUP AS, LAS VEGAS SANDS CORPORATION, bet365., Flutter Entertainment plc, 888 Holdings Plc, Entain, Kindred Group plc, MGM Resorts International, Kindred Group plc, Wynn Resorts Ltd, NOVIBET, Galaxy Entertainment Group Limited, Resorts World à Sentosa Pte. Ltd., Sun International, RTSmunity as, SKY INFOTECH, Peermont North America Proprietary Limited, SJM Holdings Limited, Sportradar AG, FanUp, Inc., Rivalry Ltd., EveryMatrix., Kairos Group, BETAMERICA, Scientific Game, ComeOn Group, entre autres. |

Définition du marché

Les paris sportifs sont des paris financiers sur le résultat d'un ou plusieurs matchs, sur des événements/non-événements d'un événement au sein d'un match, ou sur des paris sur des événements sportifs d'une durée de sept jours ou sur une rivalité d'une saison. Les paris sportifs consistent à miser sur le résultat d'événements sportifs. Les parieurs tentent de prédire le résultat d'un événement pour gagner leur pari - et potentiellement en tirer profit.

La NFL, la NHL, la NBA, la MLB et d'autres sports américains emblématiques font tous partie du package de paris sportifs. Mais en plus de cela, ils proposent également une gamme de sports européens et d'autres mondes, donc les paris sportifs en ligne sont un bon choix si les gens viennent d'autres territoires à travers le monde.

Dynamique du marché des paris sportifs

Conducteurs

-

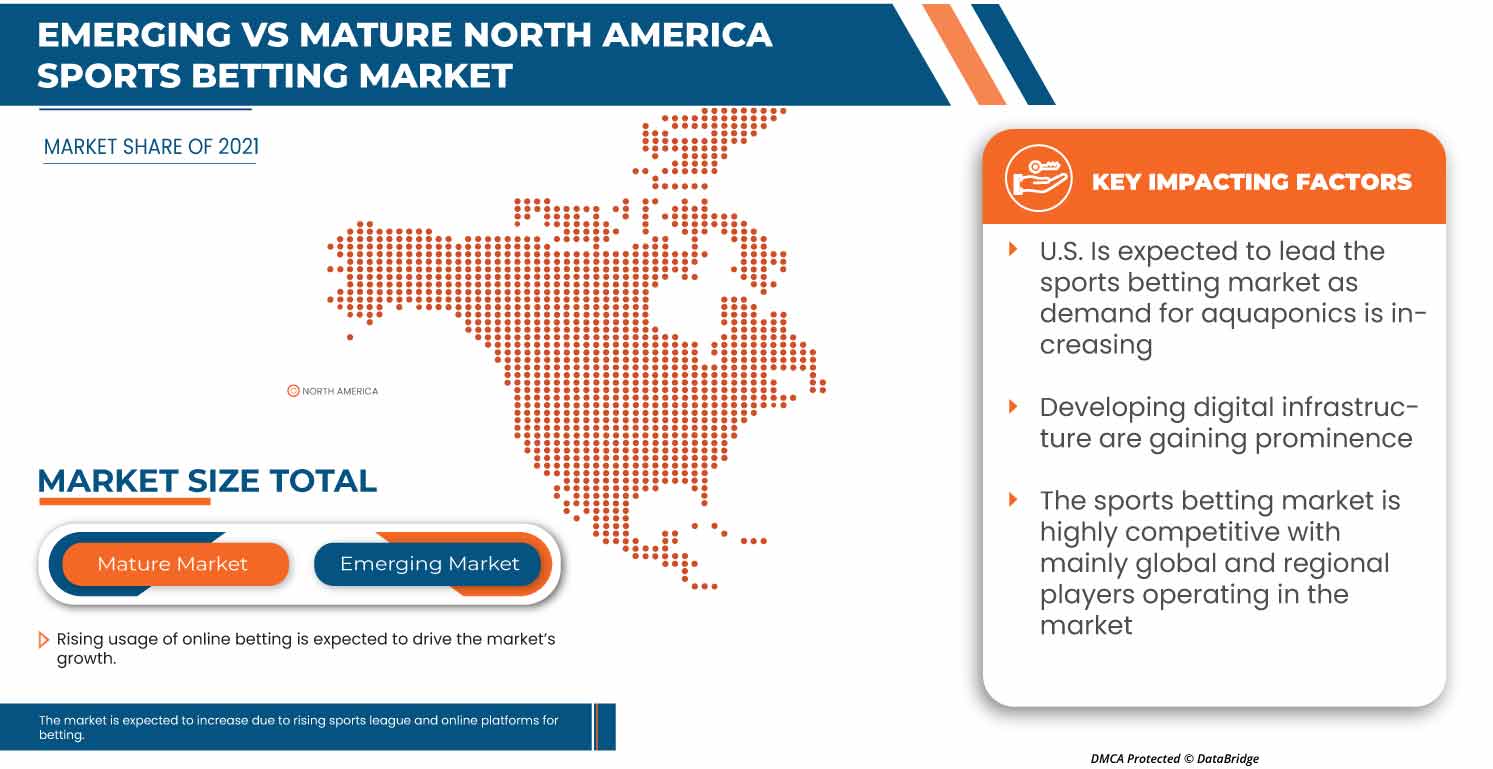

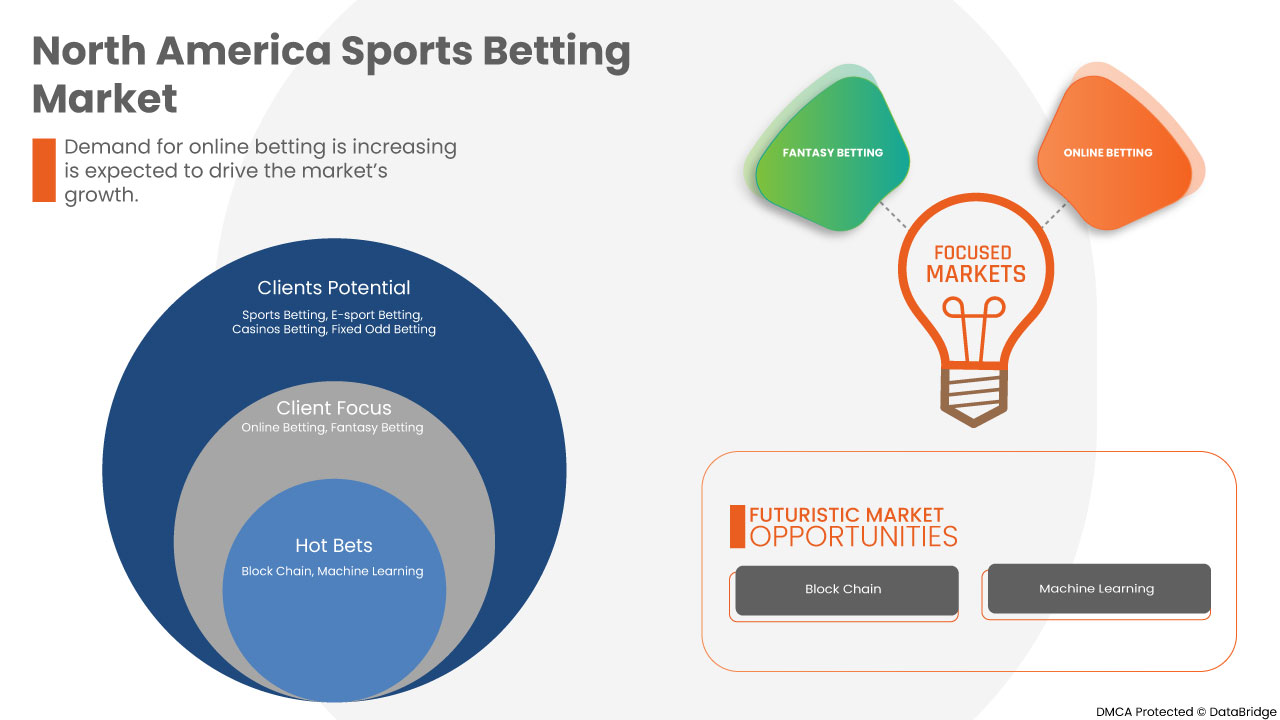

L'utilisation croissante des paris en ligne

Les paris sportifs consistent à prédire les résultats d'un événement sportif et à parier sur le résultat. Les sports les plus populaires pour les paris aux niveaux amateur et professionnel sont le football, le football américain, le basket-ball, le baseball, le hockey, le cyclisme sur piste, les courses automobiles, les arts martiaux mixtes et la boxe. La fréquence des paris sportifs varie selon les cultures. En plus des événements non sportifs comme les compétitions de téléréalité et les élections, les paris sportifs sont légaux dans les compétitions non humaines comme les combats de coqs, les courses de lévriers et les courses de chevaux.

-

L'augmentation de la concurrence dans le e-sport

Chaque année, de plus en plus de personnes jouent aux jeux vidéo et se tournent de plus en plus vers les mondes virtuels. La popularité des jeux d’e-sport rapporte aujourd’hui plus d’argent que les industries de la musique et du cinéma réunies. Pour beaucoup de gens, le jeu n’est plus seulement un passe-temps. Le secteur de l’e-sport est en pleine expansion en raison de la pandémie. Des millions de personnes se sont tournées vers les jeux récréatifs pendant le confinement ; certaines se sont même tournées vers les jeux professionnels. Mais la variété des jeux et des genres disponibles est tout aussi impressionnante que le succès des meilleurs titres d’e-sport.

Opportunité

-

Montée en puissance des plateformes de couverture en direct des sports électroniques

Le secteur de l’e-sport a connu une croissance significative en termes de spectateurs et de revenus. L’augmentation de l’audience a été le facteur clé de la croissance des revenus, et pas seulement parce que ces spectateurs rapportaient de l’argent. Les marques s’engagent dans le marketing de l’e-sport, à la fois directement et indirectement, car elles reconnaissent le potentiel d’atteindre un public important et engagé. L’augmentation des investissements et des revenus de l’e-sport a été alimentée en partie par la pop-culturisation du secteur. L’aspect social du streaming en direct et du gameplay est l’une des principales raisons pour lesquelles l’e-sport a atteint de tels sommets. Les fans peuvent interagir directement avec les joueurs et les équipes via des services de streaming spécifiques aux jeux vidéo comme Twitch et YouTube Gaming, tandis que les réseaux sociaux plus largement utilisés ont favorisé ces relations. Certaines organisations d’e-sport, comme FaZe Clan, se développent agressivement sur des marchés tels que celui des produits dérivés, donnant à leurs marques une plus grande reconnaissance que si elles s’étaient concentrées uniquement sur l’e-sport.

Contraintes/Défis

Dans le monde des paris sportifs, tout le monde est à la recherche d'un avantage. Si la plupart des parieurs chevronnés et avisés savent que l'augmentation d'un capital nécessite une gestion prudente de l'argent, des recherches analytiques approfondies et beaucoup de patience, de nombreux parieurs novices recherchent des gains rapides.

Dans le monde moderne, les paris sportifs sont devenus très répandus. Les paris sportifs sont un type de jeu dans lequel on parie sur le résultat d'un événement sportif. Les paris en ligne sont l'un des nombreux types de paris sportifs disponibles partout. Les élections politiques et les compétitions de téléréalité ne sont que des exemples d'activités non sportives sur lesquelles on peut parier. L'industrie du jeu a changé la façon dont les sports sont regardés et même pratiqués. L'incertitude du résultat est un élément essentiel de l'attrait du sport. Si le résultat est prédéterminé, l'intégrité du sport est perdue, et avec cela, une grande partie de sa signification et de son attrait pour les fans. Le trucage de matchs est donc une menace majeure pour le sport, et l'avènement des jeux de hasard en ligne a augmenté le risque de trucage de matchs à des fins financières. L'ampleur de l'industrie du jeu en Amérique du Nord est attrayante pour le crime organisé, et la gamme des types de paris a augmenté en interne.

Impact post-COVID-19 sur le marché des paris sportifs

La COVID-19 a eu un impact positif sur le marché. L'utilisation des jeux en ligne a augmenté au cours de ces années, comme les paris et les jeux de sports fantastiques, entre autres. Par conséquent, l'utilisation des paris sportifs a considérablement augmenté dans la population mondiale. Par conséquent, la pandémie a eu un effet positif sur ce marché.

Développement récent

- En septembre 2022, Entain Plc a annoncé avoir collaboré avec Bally's Corporation, BetMGM, DraftKings FanDuel et MGM Resorts International pour lancer des principes pour un jeu responsable. Cela contribue à l'image de marque de l'organisation, entre autres, à l'échelle mondiale.

Portée du marché des paris sportifs en Amérique du Nord

Le marché des paris sportifs en Amérique du Nord est segmenté en type, plateforme, opérateur, sports et groupe d'âge. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

Taper

- Ligne en jeu

- Anciens paris fixes

- Paris d'échange

- Fantasy Quotidienne

- Paris sur spread

- Sports électroniques

- Pari Mutuel

- Autres

Sur la base du type, le marché des paris sportifs en Amérique du Nord est segmenté en paris en ligne, paris fixes, paris d'échange, fantasy quotidien, paris à spread, e-sports, pari mutuel, autres.

Plate-forme

- En ligne

- Hors ligne

Sur la base de la plateforme, le marché des paris sportifs en Amérique du Nord est segmenté en en ligne et hors ligne.

Sportif

- Courses

- Sports non liés à la course

Sur la base des sports, le marché des paris sportifs en Amérique du Nord est segmenté en sports de course et sports non liés à la course.

Opérateur

- Qualité alimentaire

- Casinos

- Salles de bingo

- Salles de cartes

- Bookmakers

- Appareil de jeu à pièces

- Opérateurs de concessions

- Terminaux de jeux vidéo

- Opérateur de loteries

- Paris sportifs hors piste

- Autres

Sur la base de l'opérateur, le marché des paris sportifs en Amérique du Nord est segmenté en produits alimentaires, casinos, salles de bingo, salles de cartes, bookmakers, appareils de jeu à pièces, opérateurs de concession, terminaux de jeux vidéo, opérateurs de loteries, paris sportifs hors piste, autres.

Groupe d'âge

- Génération Z

- Génération Y/Millennials

- Génération X

- Les baby-boomers

Sur la base de la tranche d’âge, le marché des paris sportifs en Amérique du Nord est segmenté en génération Z, génération Y, génération X et baby-boomers.

Analyse/perspectives régionales du marché des paris sportifs

Le marché des paris sportifs est analysé et des informations sur la taille et les tendances du marché sont fournies par pays, type, plateforme, sport, opérateur, tranche d'âge comme référencé ci-dessus.

Le marché nord-américain comprend les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché des paris sportifs en termes de part de marché et de chiffre d'affaires et continueront de renforcer leur domination au cours de la période de prévision. Cela est dû à la forte demande de vérification et de validation des dispositifs médicaux dans le pays.

La section pays du rapport fournit également des facteurs d'impact sur les marchés individuels et des changements de réglementation sur le marché qui ont un impact sur les tendances actuelles et futures du marché. Des points de données, tels que les ventes de produits neufs et de remplacement, la démographie des pays, l'épidémiologie des maladies et les tarifs d'importation et d'exportation, sont quelques-uns des principaux indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la forte concurrence des marques locales et nationales, ainsi que l'impact des canaux de vente sont pris en compte lors de l'analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché des paris sportifs

Le paysage concurrentiel du marché des paris sportifs fournit des détails sur les concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, la présence en Amérique du Nord, les sites et installations de production, les capacités de production, les forces et les faiblesses de l'entreprise, le lancement du produit, la largeur et l'étendue du produit et la domination des applications. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises vers le marché des paris sportifs.

Français Certains des principaux acteurs opérant sur le marché des paris sportifs sont BETSSON AB, FORTUNA ENTERTAINMENT GROUP AS, LAS VEGAS SANDS CORPORATION, bet365., Flutter Entertainment plc, 888 Holdings Plc, Entain, Kindred Group plc, MGM Resorts International, Kindred Group plc, Wynn Resorts Ltd, NOVIBET, Galaxy Entertainment Group Limited, Resorts World at Sentosa Pte. Ltd., Sun International, RTSmunity as, SKY INFOTECH, Peermont North America Proprietary Limited, SJM Holdings Limited, Sportradar AG, FanUp, Inc., Rivalry Ltd., EveryMatrix., Kairos Group, BETAMERICA, Scientific Game, ComeOn Group entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA SPORTS BETTING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 MULTIVARIATE MODELING

2.6 TYPE LIFELINE CURVE

2.7 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.8 DBMR MARKET POSITION GRID

2.9 VENDOR SHARE ANALYSIS

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 CONSUMER BEHAVIOUR PATTERN

4.2 PESTEL ANALYSIS

4.2.1 POLITICAL

4.2.1.1 POLITICAL STABILITY OF ORGANIZATIONS:

4.2.1.2 FISCAL POLICY (TAXATION):

4.2.1.3 TRANSPARENCY IN GOVERNMENT STRUCTURE

4.2.2 ECONOMIC

4.2.2.1 INFLATION:

4.2.2.2 ECONOMIC GROWTH RATE

4.2.2.3 EXCHANGE AND INTEREST RATE

4.2.3 SOCIAL

4.2.3.1 DEMOGRAPHICS

4.2.3.2 GENDER

4.2.3.3 CULTURAL AND SOCIETAL NORMS

4.2.4 TECHNOLOGICAL

4.2.4.1 TECHNOLOGICAL INNOVATIONS

4.2.4.2 RESEARCH AND DEVELOPMENT

4.2.5 LEGAL

4.2.5.1 EMPLOYER REGULATIONS

4.2.5.2 LAW GOVERNING INTELLECTUAL PROPERTY

4.2.5.3 CONSUMER PROTECTION LEGISLATION

4.3 PORTER'S FIVE FORCES ANALYSIS FOR NORTH AMERICA SPORTS BETTING MARKET

5 REGULATION COVERAGE

5.1 REGULATIONS IN EUROPE

5.2 REGULATIONS IN NORTH AMERICA

5.3 REGULATIONS IN AUSTRALIA

5.4 REGULATIONS IN AFRICA

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING USAGE OF ONLINE BETTING

6.1.2 INCREASING E-SPORTS COMPETITION

6.1.3 DEVELOPING DIGITAL INFRASTRUCTURE

6.1.4 INCREASE IN THE NUMBER OF SPORTS LEAGUES AND EVENTS

6.2 RESTRAINTS

6.2.1 STRINGENT REGULATORY FRAMEWORK

6.2.2 DECLINE IN OFFLINE BETTING PLATFORMS

6.3 OPPORTUNITIES

6.3.1 RISE IN LIVE ESPORTS COVERAGE PLATFORM

6.3.2 SURGE IN PURCHASING POWER OF MIDDLE-INCOME GROUPS

6.3.3 INCREASING MARKETING & ADVERTISEMENTS

6.4 CHALLENGES

6.4.1 HIGH RISK OF SCAMS AND FRAUDERY

6.4.2 HIGH TAXATION IN SPORTS BETTING

7 NORTH AMERICA SPORTS BETTING MARKET, BY TYPE

7.1 OVERVIEW

7.2 LINE-IN-PLAY

7.3 FIXED ODD BETTING

7.4 E-SPORTS

7.5 EXCHANGE BETTING

7.6 SPREAD BETTING

7.7 DAILY FANTASY

7.8 PARI MUTUEL

7.9 OTHERS

8 NORTH AMERICA SPORTS BETTING MARKET, BY PLATFORM

8.1 OVERVIEW

8.2 ONLINE

8.2.1 BLOCK CHAIN

8.2.2 ARTIFICIAL INTELLIGENCE

8.2.3 VIRTUAL REALITY

8.2.4 MACHINE LEARNING TOOLS

8.2.5 OTHERS

8.3 OFFLINE

9 NORTH AMERICA SPORTS BETTING MARKET, BY SPORTS

9.1 OVERVIEW

9.2 RACING

9.2.1 HORSE

9.2.2 AUTO

9.2.3 DOG

9.2.4 OTHERS

9.3 NON - RACING

9.3.1 FOOTBALL

9.3.2 CRICKET

9.3.3 BASKETBALL

9.3.4 TENNIS

9.3.5 BASEBALL

9.3.6 BOXING

9.3.7 HOCKEY

9.3.8 GOLF

9.3.9 OTHERS

10 NORTH AMERICA SPORTS BETTING MARKET, BY OPERATOR

10.1 OVERVIEW

10.2 CASINOS

10.3 CARD ROOMS

10.4 BINGO HALLS

10.5 BOOK MAKERS

10.6 COIN-OPERATED GAMBLING DEVICE

10.7 CONCESSION OPERATOR

10.8 VIDEO GAMING TERMINALS

10.9 LOTTERIES OPERATOR

10.1 OFF-TRACK SPORTS BETTING

10.11 OTHER

11 NORTH AMERICA SPORTS BETTING MARKET, BY AGE GROUP

11.1 OVERVIEW

11.2 GEN Y/MILLENNIALS

11.3 GEN X

11.4 GEN Z

11.5 BABY BOOMERS

12 NORTH AMERICA SPORTS BETTING MARKET, BY REGION

12.1 NORTH AMERICA

13 NORTH AMERICA SPORTS BETTING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 FORTUNAEN TERTAINMENT GROUP A.S.

15.1.1 COMPANY SNAPSHOT

15.1.2 COMPANY SHARE ANALYSIS

15.1.3 PRODUCT PORTFOLIO

15.1.4 RECENT DEVELOPMENT

15.2 FLUTTER ENTERTAINMENT PLC

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 WYNN RESORTS LTD.

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 COMPANY SHARE ANALYSIS

15.3.5 RECENT DEVELOPMENTS

15.4 ENTAIN

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 BET365.

15.5.1 COMPANY SNAPSHOT

15.5.2 PRODUCT PORTFOLIO

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 RECENT DEVELOPMENT

15.6 888 HOLDINGS PLC

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 BETAMERICA

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 COMEON GROUP

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENTS

15.9 BETSSON AB

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCT PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 EVERYMATRIX.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 FANUP, INC.

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 KAIROS GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 KINDRED GROUP PLC

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUS ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 LAS VEGAS SANDS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 COMPANY SHARE ANALYSIS

15.14.4 PRODUCT PORTFOLIO

15.14.5 RECENT DEVELOPMENTS

15.15 NOVIBET

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 PEERMONT NORTH AMERICA PROPRIETARY LIMITED.

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 RESORTS WORLD SENTOSA

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RTSMUNITY A.S.

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENT

15.19 SCIENTIFIC GAMES

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 SKY INFOTECH

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 SPORTRADAR AG

15.21.1 COMPANY SNAPSHOT

15.21.2 REVENUE ANALYSIS

15.21.3 PRODUCT PORTFOLIO

15.21.4 RECENT DEVELOPMENTS

15.22 SUN INTERNATIONAL

15.22.1 COMPANY SNAPXSHOT

15.22.2 REVENUE ANALYSIS

15.22.3 PRODUCT PORTFOLIO

15.22.4 RECENT DEVELOPMENTS

15.23 TONYBET

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 VARIOUS E-SPORTS TYPES AND THEIR GENRES

TABLE 2 BLOCKCHAIN IN ESPORTS

TABLE 3 TOP 10 BIGGEST SPORTS LEAGUES IN THE WORLD

TABLE 4 LIST OF ESPORTS COVERAGE PLATFORM

TABLE 5 IMPACT OF TAX ON ONLINE BETTING

TABLE 6 NORTH AMERICA SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 7 NORTH AMERICA LINE-IN-PLAY IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 NORTH AMERICA FIXED ODD BETTING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 9 NORTH AMERICA E-SPORTS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 NORTH AMERICA EXCHANGE BETTING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 NORTH AMERICA SPREAD BETTING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 NORTH AMERICA DAILY FANTASY IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 13 NORTH AMERICA PARI MUTUEL IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 NORTH AMERICA OTHERS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 NORTH AMERICA SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 16 NORTH AMERICA ONLINE IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 NORTH AMERICA ONLINE IN SPORTS BETTING MARKET, BY TECHNOLOGY, 2021-2030 (USD MILLION)

TABLE 18 NORTH AMERICA OFFLINE IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 NORTH AMERICA SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 20 NORTH AMERICA RACING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 21 NORTH AMERICA RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 22 NORTH AMERICA NON-RACING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 NORTH AMERICA NON-RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 24 NORTH AMERICA SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 25 NORTH AMERICA CASINOS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 NORTH AMERICA CARD ROOMS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 27 NORTH AMERICA BINGO HALLS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 NORTH AMERICA BOOK MAKERS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 NORTH AMERICA COIN-OPERATED GAMBLING DEVICE IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 NORTH AMERICA CONCESSION OPERATOR IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 NORTH AMERICA VIDEO GAMING TERMINALS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 32 NORTH AMERICA LOTTERIES OPERATOR IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 NORTH AMERICA OFF-TRACK SPORTS BETTING IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 NORTH AMERICA OTHER IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 NORTH AMERICA SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 36 NORTH AMERICA GEN Y/MILLENNIALS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 NORTH AMERICA GEN X IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 NORTH AMERICA GEN Z IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 39 NORTH AMERICA BABY BOOMERS IN SPORTS BETTING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 NORTH AMERICA SPORTS BETTING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 41 NORTH AMERICA SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 42 NORTH AMERICA SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 43 NORTH AMERICA ONLINE IN SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 44 NORTH AMERICA SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 45 NORTH AMERICA RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 46 NORTH AMERICA NON-RACING SPORTS IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 47 NORTH AMERICA SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 48 NORTH AMERICA SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 49 U.S. SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 U.S. SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 51 U.S. ONLINE IN SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 52 U.S. SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 53 U.S. RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 54 U.S. NON-RACING SPORTS IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 55 U.S. SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 56 U.S. SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 57 CANADA SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 CANADA SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 59 CANADA ONLINE IN SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 60 CANADA SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 61 CANADA RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 62 CANADA NON-RACING SPORTS IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 63 CANADA SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 64 CANADA SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

TABLE 65 MEXICO SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 MEXICO SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 67 MEXICO ONLINE IN SPORTS BETTING MARKET, BY PLATFORM, 2021-2030 (USD MILLION)

TABLE 68 MEXICO SPORTS BETTING MARKET, BY SPORTS, 2021-2030 (USD MILLION)

TABLE 69 MEXICO RACING IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 70 MEXICO NON-RACING SPORTS IN SPORTS BETTING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 71 MEXICO SPORTS BETTING MARKET, BY OPERATOR, 2021-2030 (USD MILLION)

TABLE 72 MEXICO SPORTS BETTING MARKET, BY AGE GROUP, 2021-2030 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA SPORTS BETTING MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SPORTS BETTING MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SPORTS BETTING MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SPORTS BETTING MARKET: NORTH AMERICA VS. REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SPORTS BETTING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SPORTS BETTING MARKET: MULTIVARIATE MODELLING

FIGURE 7 NORTH AMERICA SPORTS BETTING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 NORTH AMERICA SPORTS BETTING MARKET: DBMR MARKET POSITION GRID

FIGURE 9 NORTH AMERICA SPORTS BETTING MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA SPORTS BETTING MARKET: SEGMENTATION

FIGURE 11 RISING THE USAGE OF ONLINE BETTING AND INCREASING ESPORTS COMPETITION IS DRIVING THE NORTH AMERICA SPORTS BETTING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 12 LINE-IN-PLAY SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SPORTS BETTING MARKET FROM 2023 TO 2030

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE NORTH AMERICA SPORTS BETTING MARKET

FIGURE 14 NORTH AMERICA DATA FOR ONLINE BETTING USAGE

FIGURE 15 AI IN ESPORTS

FIGURE 16 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE, 2022

FIGURE 17 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE, 2023-2030 (USD MILLION)

FIGURE 18 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE, CAGR (2023-2030)

FIGURE 19 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE, LIFELINE CURVE

FIGURE 20 NORTH AMERICA SPORTS BETTING MARKET: BY PLATFORM, 2022

FIGURE 21 NORTH AMERICA SPORTS BETTING MARKET: BY PLATFORM, 2023-2030 (USD MILLION)

FIGURE 22 NORTH AMERICA SPORTS BETTING MARKET: BY PLATFORM, CAGR (2023-2030)

FIGURE 23 NORTH AMERICA SPORTS BETTING MARKET: BY PLATFORM, LIFELINE CURVE

FIGURE 24 NORTH AMERICA SPORTS BETTING MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 25 NORTH AMERICA SPORTS BETTING MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD MILLION)

FIGURE 26 NORTH AMERICA SPORTS BETTING MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 27 NORTH AMERICA SPORTS BETTING MARKET : BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 28 NORTH AMERICA SPORTS BETTING MARKET: BY OPERATOR, 2022

FIGURE 29 NORTH AMERICA SPORTS BETTING MARKET: BY OPERATOR, 2023-2030 (USD MILLION)

FIGURE 30 NORTH AMERICA SPORTS BETTING MARKET: BY OPERATOR, CAGR (2023-2030)

FIGURE 31 NORTH AMERICA SPORTS BETTING MARKET: BY OPERATOR, LIFELINE CURVE

FIGURE 32 NORTH AMERICA SPORTS BETTING MARKET: BY AGE GROUP, 2022

FIGURE 33 NORTH AMERICA SPORTS BETTING MARKET: BY AGE GROUP, 2023-2030 (USD MILLION)

FIGURE 34 NORTH AMERICA SPORTS BETTING MARKET: BY AGE GROUP, CAGR (2023-2030)

FIGURE 35 NORTH AMERICA SPORTS BETTING MARKET: BY AGE GROUP, LIFELINE CURVE

FIGURE 36 NORTH AMERICA SPORTS BETTING MARKET: SNAPSHOT (2022)

FIGURE 37 NORTH AMERICA SPORTS BETTING MARKET: BY COUNTRY (2022)

FIGURE 38 NORTH AMERICA SPORTS BETTING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 39 NORTH AMERICA SPORTS BETTING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 40 NORTH AMERICA SPORTS BETTING MARKET: BY TYPE (2023 & 2030)

FIGURE 41 NORTH AMERICA SPORTS BETTING MARKET: COMPANY SHARE 2022 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.