North America Sperm Separation Devices Market

Taille du marché en milliards USD

TCAC :

%

USD

226.63 Million

USD

811.22 Million

2021

2029

USD

226.63 Million

USD

811.22 Million

2021

2029

| 2022 –2029 | |

| USD 226.63 Million | |

| USD 811.22 Million | |

|

|

|

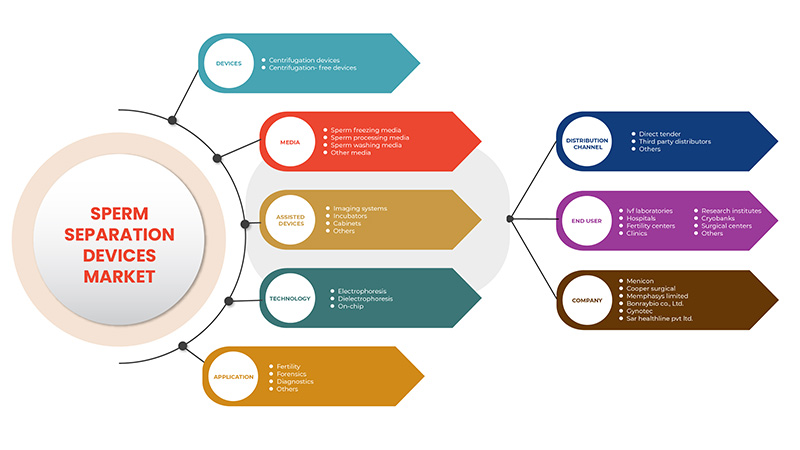

Marché des dispositifs de séparation des spermatozoïdes en Amérique du Nord, par dispositifs (dispositifs de centrifugation et dispositifs sans centrifugation), supports (supports de lavage des spermatozoïdes, supports de traitement des spermatozoïdes, supports de congélation des spermatozoïdes et autres supports), dispositifs assistés (systèmes d'imagerie, incubateurs, armoires et autres), technologie ( électrophorèse , diélectrophorèse et sur puce), application (fertilité, diagnostic, médecine légale et autres), utilisateur final (hôpitaux, cliniques, cryobanques, centres chirurgicaux, instituts de recherche, centres de fertilité, laboratoires de FIV et autres), canal de distribution (appel d'offres direct, distributeurs tiers et autres), tendances et prévisions de l'industrie jusqu'en 2029

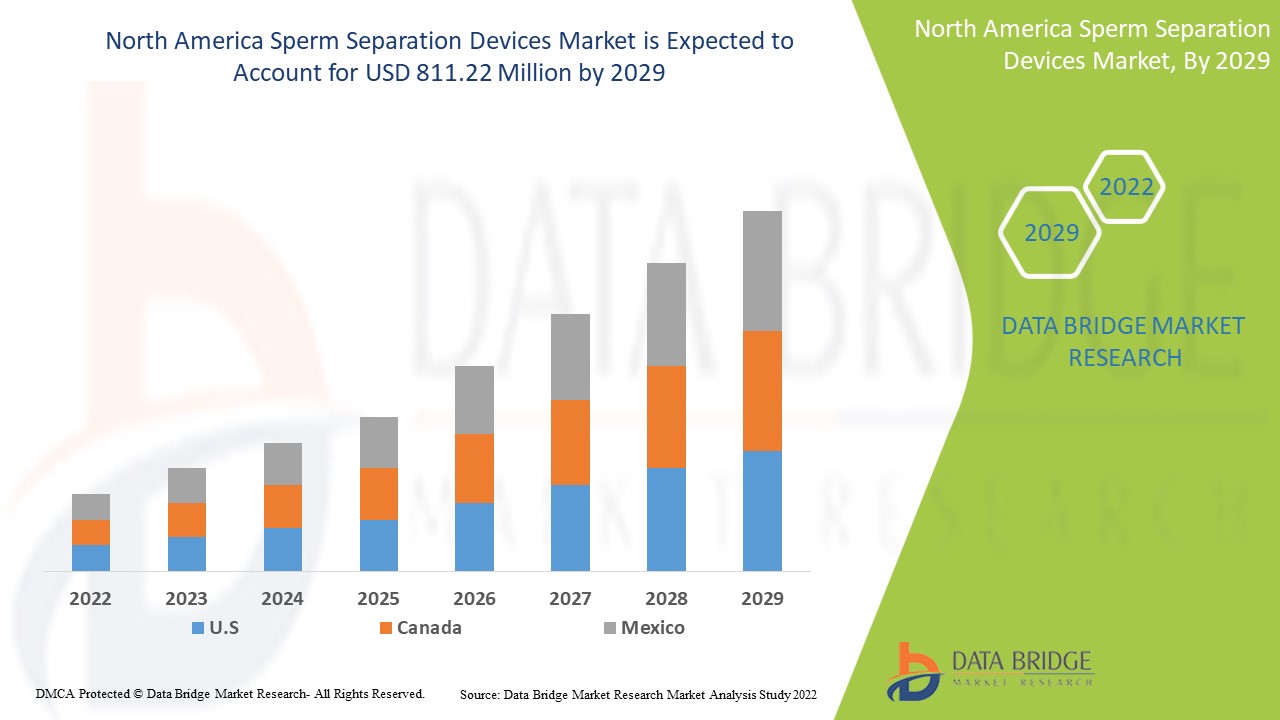

Analyse et perspectives du marché

Le marché des dispositifs de séparation des spermatozoïdes en Amérique du Nord devrait connaître une croissance du marché au cours de la période de prévision de 2022 à 2029. Data Bridge Market Research analyse que le marché croît avec un TCAC de 17,3% au cours de la période de prévision de 2022 à 2029 et devrait atteindre 811,22 millions USD d'ici 2029 contre 226,63 millions USD en 2021. L'augmentation du nombre de personnes masculines souffrant d'infertilité et la forte consommation d'alcool sont les principaux moteurs qui ont propulsé la demande du marché au cours de la période de prévision.

Cependant, les coûts élevés associés au faible taux de réussite du traitement de FIV peuvent entraver la croissance future du marché des dispositifs de séparation des spermatozoïdes. L'adoption d'alliances stratégiques telles que les partenariats et les acquisitions par des acteurs clés du marché constitue une opportunité pour la croissance du marché des dispositifs de séparation des spermatozoïdes.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable pour 2019-2014) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD, volumes en unités, prix en USD |

|

Segments couverts |

Par dispositifs (dispositifs de centrifugation et dispositifs sans centrifugation), supports (supports de lavage du sperme, supports de traitement du sperme, supports de congélation du sperme et autres supports), dispositifs assistés (systèmes d'imagerie, incubateurs, armoires et autres), technologie (électrophorèse, diélectrophorèse et sur puce), application (fertilité, diagnostic, médecine légale et autres), utilisateur final (hôpitaux, cliniques, cryobanques, centres chirurgicaux, instituts de recherche, centres de fertilité, laboratoires de FIV et autres), canal de distribution (appel d'offres direct, distributeurs tiers et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

Bonraybio Co., Ltd., DxNow, Hamilton Thorne, Ltd., Promega Corporation, Nidacon International AB, Memphasys, Menicon Co., Ltd., The Cooper Companies Inc., SAR Healthline Pvt Ltd., entre autres |

Définition du marché :

Les dispositifs de séparation des spermatozoïdes sont utilisés pour diverses méthodes, notamment la centrifugation et la nage en amont. Bien que l'objectif principal de cette technologie soit l'insémination artificielle, le nombre de domaines d'application de cette technologie a augmenté, ainsi que les progrès réalisés dans l'utilisation des dispositifs de séparation des spermatozoïdes.

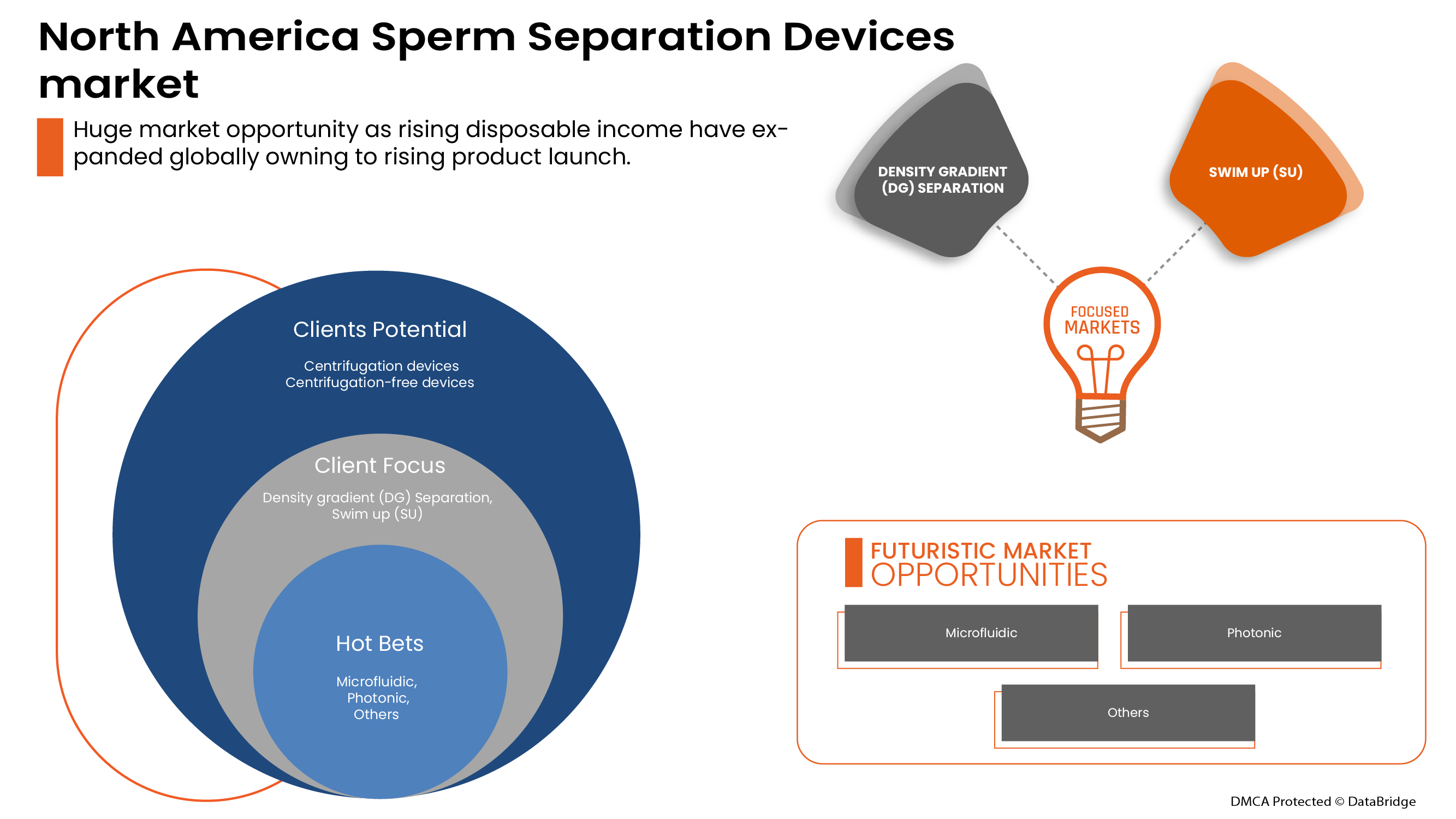

La demande pour le marché des dispositifs de séparation des spermatozoïdes a augmenté dans les pays développés comme dans les pays en développement, et la raison en est l'augmentation des initiatives stratégiques du marché. Le marché des dispositifs de séparation des spermatozoïdes est en croissance en raison de l'introduction de produits innovants, de l'augmentation des produits technologiques et de l'augmentation du revenu disponible. Le marché va croître au cours de la période de prévision en raison de l'exploration des marchés émergents, des initiatives stratégiques des acteurs du marché et de l'augmentation des dépenses de santé.

La technique de tri des spermatozoïdes (la méthode du microtri) est la procédure la plus efficace jamais conçue pour séparer les spermatozoïdes porteurs du chromosome X et ceux porteurs du chromosome Y. Elle tire parti du fait que le grand chromosome X possède beaucoup plus d'ADN que le minuscule chromosome Y. Un échantillon de sperme est d'abord prélevé sur le futur père.

Dynamique du marché des dispositifs de séparation des spermatozoïdes en Amérique du Nord

Conducteurs

- Augmentation de l'incidence de l'infertilité chez les hommes et les femmes

L'infertilité touche des millions de personnes en âge de procréer dans le monde et a un impact sur leurs familles et leurs communautés. Face à ce problème croissant, les patients doivent recourir à divers soins de fertilité pour la prévention, le diagnostic et le traitement de l'infertilité.

- Augmentation des dépenses de santé

Au cours de la dernière décennie, les dépenses de santé ont augmenté de façon spectaculaire pour améliorer les services de santé aux patients. Les États-Unis sont le plus grand marché de soins de santé où les dépenses totales de santé ont augmenté au cours des dernières années. L'objectif fondamental de la croissance des dépenses est de fournir des dispositifs médicaux appropriés, abordables et de haute qualité.

Pour promouvoir une population en meilleure santé et répondre aux urgences sanitaires dans les pays développés comme dans les pays en développement, les organismes gouvernementaux concernés ainsi que les organisations de santé prennent l'initiative d'accélérer les dépenses de santé.

Retenue

-

Réglementation stricte

Les inquiétudes concernant l'efficacité et la sécurité des produits utilisés dans la fécondation in vitro et d'autres techniques ont conduit la plupart des gouvernements à mettre en place des organismes de réglementation et des politiques pour surveiller le développement de nouveaux dispositifs. Les dispositifs de séparation des spermatozoïdes peuvent être utilisés après avoir satisfait à des normes réglementaires strictes, garantissant que les dispositifs sont sûrs, bien étudiés et ne présentent pas d'effets indésirables.

Les directives récentes et les amendements apportent des orientations adéquates aux fabricants. Les réglementations internationales telles que celles de la FDA américaine jouent un rôle majeur dans le lancement de nouveaux dispositifs de séparation du sperme sur le marché. Ainsi, cela peut constituer un frein majeur pour le marché.

Opportunité

-

Une augmentation du nombre d'activités de recherche et développement

Les activités de R&D sont essentielles pour assurer une croissance continue du marché et permettre le lancement de nouveaux appareils et produits efficaces. Elles permettent également aux entreprises d'acquérir et de conserver un avantage concurrentiel sur un marché concurrentiel.

Ces dernières années, l’augmentation du financement et des activités de R&D a accru le lancement et la demande de dispositifs efficaces de séparation des spermatozoïdes qui offrent des options de traitement pour l’infertilité.

Défi

- Complications et effets secondaires associés aux procédures et aux dispositifs

Les traitements de fertilité qui utilisent différents dispositifs sont généralement très sûrs, mais toutes les procédures médicales comportent un certain risque d'effets secondaires potentiels. Les effets secondaires de la FIV peuvent inclure des réactions aux médicaments hormonaux de fertilité pris pendant la préparation au prélèvement d'ovules.

Ces complications et facteurs de risque affectent la perception du patient quant au choix du traitement, ce qui peut remettre en cause la croissance du marché.

Impact post-COVID-19 sur le marché nord-américain des dispositifs de séparation des spermatozoïdes

La COVID-19 a entraîné une augmentation substantielle de la demande de fournitures médicales, tant de la part des professionnels de la santé que du grand public, pour des raisons de précaution. Les fabricants de ces articles ont la possibilité de profiter de la demande accrue de fournitures médicales en garantissant un approvisionnement constant d'équipements de protection individuelle sur le marché. La COVID-19 devrait avoir un impact important sur le marché des dispositifs de séparation du sperme

Portée et taille du marché des dispositifs de séparation des spermatozoïdes en Amérique du Nord

Le marché nord-américain des dispositifs de séparation des spermatozoïdes est segmenté en fonction des dispositifs, des supports, des dispositifs assistés, de la technologie, de l'application, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Appareils

- Dispositifs de centrifugation

- Dispositifs sans centrifugation

Sur la base des appareils, le marché nord-américain des dispositifs de séparation du sperme est segmenté en dispositifs de centrifugation et dispositifs sans centrifugation.

Médias

- Médias

- Milieux de congélation du sperme

- Milieux de traitement du sperme

- Milieux de lavage du sperme

- Autres médias

Sur la base des supports, le marché nord-américain des dispositifs de séparation du sperme est segmenté en supports de congélation du sperme, supports de traitement du sperme, supports de lavage du sperme et autres supports.

Appareils assistés

- Systèmes d'imagerie

- Incubateurs

- Armoires

- Autres

Sur la base des dispositifs assistés, le marché nord-américain des dispositifs de séparation des spermatozoïdes est segmenté en systèmes d'imagerie, incubateurs, armoires et autres.

Technologie

- Électrophorèse

- Diélectrophorèse

- Sur puce

Sur la base de la technologie, le marché nord-américain des dispositifs de séparation du sperme est segmenté en électrophorèse, diélectrophorèse et sur puce.

Application

- Fécondité

- Médecine légale

- Diagnostic

- Autres

Sur la base des applications, le marché nord-américain des dispositifs de séparation des spermatozoïdes est segmenté en fertilité, médecine légale, diagnostic et autres.

Utilisateur final

- Laboratoires de FIV

- Hôpitaux

- Centres de fertilité

- Cliniques

- Instituts de recherche

- Cryobanques

- Centres chirurgicaux

- Autres

Sur la base de l'utilisateur final, le marché nord-américain des dispositifs de séparation des spermatozoïdes est segmenté en laboratoires de FIV, hôpitaux, centres de fertilité, cliniques, instituts de recherche, cryobanques, centres chirurgicaux et autres.

Canal de distribution

- Appel d'offres direct

- Distributeurs tiers

- Autres

On the basis of distribution channel, the North America sperm separation devices market is segmented into direct tender, third party distributors and others.

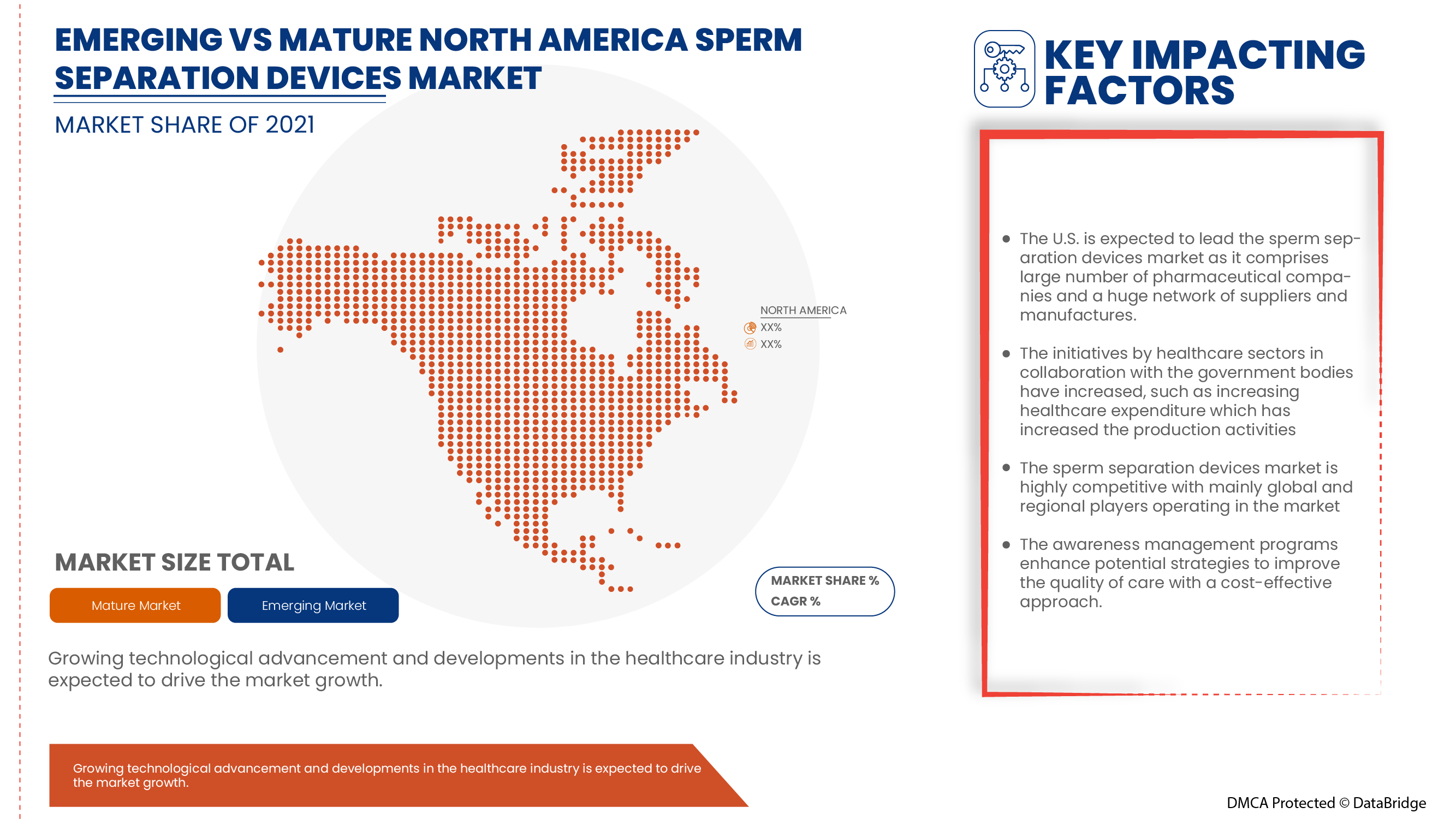

North America Sperm Separation Devices Market Country Level Analysis

The sperm separation devices market is analyzed, and market size information is provided by devices, media, assisted devices, technology, application, end user, and distribution channel.

The countries covered in the North America sperm separation devices market report are U.S., Canada and Mexico.

The U.S. is expected to dominate the North America sperm separation devices market due to the rise in technological advancement.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

The North America sperm separation devices market also provides you with a detailed market analysis of every country's growth in the sperm separation devices industry. Moreover, it provides detailed information regarding sperm separation devices, the impact of regulatory scenarios, and trending parameters regarding the sperm separation devices market. The data is available for the historic period 2012 to 2020

Competitive Landscape and North America Sperm Separation Devices Market Share Analysis

The North America sperm separation devices market competitive landscape provides details by a competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company's focus related to the sperm separation devices market.

Some of the major companies which are dealing in the North America sperm separation devices market are Bonraybio Co., Ltd., DxNow, Hamilton Thorne, Ltd., Promega Corporation, Nidacon International AB, Memphasys, Menicon Co., Ltd., The Cooper Companies Inc., SAR Healthline Pvt Ltd., among others.

Strategic alliances such as mergers, acquisitions, and agreements by the key market players are further expected to accelerate the growth of the North America sperm separation devices market.

For instance,

- In February 2019, Nidacon International AB announced that they had developed a method that could be helpful in solving the problem in the lab, which helped in obtaining a good yield of motile sperm from highly viscous semen samples

Collaboration, product launch, business expansion, award and recognition, joint ventures, and other strategies by the market player are enhancing the company's footprints in the sperm separation devices market which also provides the benefit for the organization's profit growth.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SPERM SEPARATION DEVICES MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 END USER LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PESTEL ANALYSIS

5 INDUSTRIAL INSIGHTS

6 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: REGULATIONS

6.1 REGULATION IN THE U.S.

6.1.1 GUIDELINES FOR MANUFACTURER

6.2 REGULATION IN EUROPE

6.2.1 GUIDELINES FOR MANUFACTURERS

6.3 REGULATION IN CANADA

6.3.1 GUIDELINES FOR MANUFACTURERS

6.4 REGULATION IN SOUTH AFRICA

6.4.1 GUIDELINES FOR MANUFACTURERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASE IN INCIDENCE OF INFERTILITY IN MEN AND WOMEN

7.1.2 RISE IN THE IVF, INTRAUTERINE INSEMINATION (IUI), AND INTRA-CERVICAL INSEMINATION (ICI)

7.1.3 INCREASE IN HEALTHCARE EXPENDITURE

7.1.4 STRATEGIC INITIATIVES TAKEN BY VARIOUS MARKET PLAYERS

7.2 RESTRAINTS

7.2.1 HIGH COST OF SPERM SEPARATION DEVICES

7.2.2 STRICT REGULATORY

7.3 OPPORTUNITIES:

7.3.1 RISE IN NUMBER OF RESEARCH AND DEVELOPMENT ACTIVITIES

7.3.2 INCREASING PUBLIC AWARENESS ABOUT THE FERTILITY

7.4 CHALLENGES

7.4.1 COMPLICATIONS AND SIDE EFFECTS ASSOCIATED WITH PROCEDURES AND DEVICES

7.4.2 SHORTAGE OF SKILLED PERSONNEL

8 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DEVICES

8.1 OVERVIEW

8.2 CENTRIFUGATION-FREE DEVICES

8.2.1 BY TYPE

8.2.1.1 MIGRATION-SEDIMENTATION (MS)

8.2.1.2 MICROFLUIDIC SPERM SORTERS (MFSS)

8.2.2 BY DESIGN TYPE

8.2.2.1 STANDARD

8.2.2.2 OBLIQUE

8.2.2.3 COIL

8.2.3 BY VOLUME

8.2.3.1 LESS THAN 1ML

8.2.3.2 1-3 ML

8.2.3.3 MORE THAN 3 ML

8.2.4 BY TECHNOLOGY

8.2.4.1 MICROFLUIDIC

8.2.4.2 PHOTONIC

8.2.4.3 OTHERS

8.3 CENTRIFUGATION DEVICES

8.3.1 BY TYPE

8.3.1.1 DENSITY GRADIENT (DG) SEPARATION

8.3.1.2 SWIM UP (SU)

8.3.2 BY DESIGN TYPE

8.3.2.1 STANDARD

8.3.2.2 OBLIQUE

8.3.2.3 COIL

8.3.3 BY VOLUME

8.3.3.1 LESS THAN 1ML

8.3.3.2 1-3 ML

8.3.3.3 MORE THAN 3 ML

8.3.4 BY TECHNOLOGY

8.3.4.1 MICROFLUIDIC

8.3.4.2 PHOTONIC

8.3.4.3 OTHERS

9 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY MEDIA

9.1 OVERVIEW

9.2 SPERM FREEZING MEDIA

9.3 SPERM PROCESSING MEDIA

9.4 SPERM WASHING MEDIA

9.5 OTHER MEDIA

10 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES

10.1 OVERVIEW

10.2 IMAGING SYSTEMS

10.3 INCUBATOR

10.4 CABINET

10.5 OTHERS

11 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 ELECTROPHORESIS

11.3 DIELECTROPHORESIS

11.4 ON-CHIP

12 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FERTILITY

12.2.1 IN-VITRO FERTILIZATION

12.2.2 INTRAUTERINE INSEMINATION

12.2.3 INTRA-CERVICAL INSEMINATION

12.3 FORENSICS

12.4 DIAGNOSTICS

12.5 OTHERS

13 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTORS

13.4 OTHERS

14 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY END USER

14.1 OVERVIEW

14.2 IVF LABORATORIES

14.3 HOSPITALS

14.4 FERTILITY CENTERS

14.5 CLINICS

14.6 RESEARCH INSTITUTES

14.7 CRYOBANKS

14.8 SURGICAL CENTERS

14.9 OTHERS

15 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY GEOGRAPHY

15.1 NORTH AMERICA

15.1.1 U.S.

15.1.2 CANADA

15.1.3 MEXICO

16 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

17 COMPANY PROFILE

17.1 THE COOPER COMPANIES INC.

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 BONRAYBIO CO., LTD

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENT

17.3 MENICON CO., LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 MEMPHASYS

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENTS

17.5 SAR HEALTHLINE PVT LTD

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENT

17.6 DXNOW

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 GYNOTEC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 HAMILTON THORNE, LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 KOEK BIOTECHNOLOGY BIOENGINEERING AND MEDICAL SERVICES INDUSTRY & TRADE INC.

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 NIDACON INTERNATIONAL AB

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 PROMEGA CORPORATION

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 SEAFORIA

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENT

17.13 SPERM PROCESSOR PVT LTD.

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (USD MILLION)

TABLE 2 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 4 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 5 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 6 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 7 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 9 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 10 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 11 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 12 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (USD MILLION)

TABLE 13 NORTH AMERICA SPERM FREEZING MEDIA IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 NORTH AMERICA SPERM PROCESSING MEDIA IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 NORTH AMERICA SPERM WASHING MEDIA IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 NORTH AMERICA OTHER MEDIA IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (USD MILLION)

TABLE 18 NORTH AMERICA IMAGING SYSTEMS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 NORTH AMERICA INCUBATOR IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 NORTH AMERICA CABINET IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 NORTH AMERICA OTHERS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 23 NORTH AMERICA ELECTROPHORESIS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 NORTH AMERICA DIELECTROPHORESIS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 NORTH AMERICA ON-CHIP IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 NORTH AMERICA FERTILITY IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 NORTH AMERICA FERTILITY IN SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 29 NORTH AMERICA FORENSICS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 NORTH AMERICA DIAGNOSTICS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 NORTH AMERICA OTHERS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 32 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 33 NORTH AMERICA DIRECT TENDER IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 NORTH AMERICA THIRD PARTY DISTRIBUTORS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 NORTH AMERICA OTHERS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 37 NORTH AMERICA IVF LABORATORIES IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 NORTH AMERICA HOSPITALS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 NORTH AMERICA FERTILITY CENTERS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 NORTH AMERICA CLINICS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 NORTH AMERICA RESEARCH INSTITUTES IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 NORTH AMERICA CRYOBANKS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 43 NORTH AMERICA SURGICAL CENTERS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 NORTH AMERICA OTHERS IN SPERM SEPARATION DEVICES MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 46 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (USD MILLION)

TABLE 47 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (UNITS)

TABLE 48 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (ASP)

TABLE 49 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 51 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 52 NORTH AMERICA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 53 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 54 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 55 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 56 NORTH AMERICA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 57 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (USD MILLION)

TABLE 58 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (UNITS)

TABLE 59 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (ASP)

TABLE 60 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (USD MILLION)

TABLE 61 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (UNITS)

TABLE 62 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (ASP)

TABLE 63 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 64 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 65 NORTH AMERICA FERTILITY IN SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 66 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 67 NORTH AMERICA SPERM SEPARATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 68 U.S. SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (USD MILLION)

TABLE 69 U.S. SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (UNITS)

TABLE 70 U.S. SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (ASP)

TABLE 71 U.S. CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 U.S. CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 73 U.S. CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 74 U.S. CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 75 U.S. CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 76 U.S. CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 77 U.S. CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 78 U.S. CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 U.S. SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (USD MILLION)

TABLE 80 U.S. SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (UNITS)

TABLE 81 U.S. SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (ASP)

TABLE 82 U.S. SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (USD MILLION)

TABLE 83 U.S. SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (UNITS)

TABLE 84 U.S. SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (ASP)

TABLE 85 U.S. SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 86 U.S. SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 U.S. FERTILITY IN SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 U.S. SPERM SEPARATION DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 U.S. SPERM SEPARATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 90 CANADA SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (USD MILLION)

TABLE 91 CANADA SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (UNITS)

TABLE 92 CANADA SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (ASP)

TABLE 93 CANADA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 94 CANADA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 95 CANADA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 96 CANADA CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 97 CANADA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 98 CANADA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 99 CANADA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 100 CANADA CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 101 CANADA SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (USD MILLION)

TABLE 102 CANADA SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (UNITS)

TABLE 103 CANADA SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (ASP)

TABLE 104 CANADA SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (USD MILLION)

TABLE 105 CANADA SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (UNITS)

TABLE 106 CANADA SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (ASP)

TABLE 107 CANADA SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 108 CANADA SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 CANADA FERTILITY IN SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 110 CANADA SPERM SEPARATION DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 111 CANADA SPERM SEPARATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 112 MEXICO SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (USD MILLION)

TABLE 113 MEXICO SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (UNITS)

TABLE 114 MEXICO SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (ASP)

TABLE 115 MEXICO CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 116 MEXICO CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 117 MEXICO CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 118 MEXICO CENTRIFUGATION-FREE DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 119 MEXICO CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 MEXICO CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY DESIGN TYPE, 2020-2029 (USD MILLION)

TABLE 121 MEXICO CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY VOLUME, 2020-2029 (USD MILLION)

TABLE 122 MEXICO CENTRIFUGATION DEVICES IN SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 123 MEXICO SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (USD MILLION)

TABLE 124 MEXICO SPERM SEPARATION DEVICES MARKET, BY MEDIA, 2020-2029 (UNITS)

TABLE 125 MEXICO SPERM SEPARATION DEVICES MARKET, BY DEVICES, 2020-2029 (ASP)

TABLE 126 MEXICO SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (USD MILLION)

TABLE 127 MEXICO SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (UNITS)

TABLE 128 MEXICO SPERM SEPARATION DEVICES MARKET, BY ASSISTED DEVICES, 2020-2029 (ASP)

TABLE 129 MEXICO SPERM SEPARATION DEVICES MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 MEXICO SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 131 MEXICO FERTILITY IN SPERM SEPARATION DEVICES MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 132 MEXICO SPERM SEPARATION DEVICES MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 133 MEXICO SPERM SEPARATION DEVICES MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

Liste des figures

FIGURE 1 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: NORTH AMERICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: SEGMENTATION

FIGURE 11 THE INCREASE IN PREVALENCE OF INFERTILITY IS EXPECTED TO DRIVE THE NORTH AMERICA SPERM SEPARATION DEVICES MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 CENTRIFUGATION DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SPERM SEPARATION DEVICES MARKET IN 2022 & 2029

FIGURE 13 NORTH AMERICA IS ANTICIPATED TO DOMINATE THE NORTH AMERICA SPERM SEPARATION DEVICES MARKET, AND ASIA-PACIFIC IS ESTIMATED TO BE GROWING WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 MARKET OVERVIEW

FIGURE 15 MEDICAL DEVICE SPENDING VS. NATIONAL HEALTH EXPENDITURES, 2016

FIGURE 16 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DEVICES, 2021

FIGURE 17 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DEVICES, 2022-2029 (USD MILLION)

FIGURE 18 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DEVICES, CAGR (2022-2029)

FIGURE 19 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DEVICES, LIFELINE CURVE

FIGURE 20 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY MEDIA, 2021

FIGURE 21 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY MEDIA, 2022-2029 (USD MILLION)

FIGURE 22 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY MEDIA, CAGR (2022-2029)

FIGURE 23 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY MEDIA, LIFELINE CURVE

FIGURE 24 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY ASSISTED DEVICES, 2021

FIGURE 25 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY ASSISTED DEVICES, 2022-2029 (USD MILLION)

FIGURE 26 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY ASSISTED DEVICES, CAGR (2022-2029)

FIGURE 27 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY ASSISTED DEVICES, LIFELINE CURVE

FIGURE 28 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY TECHNOLOGY, 2021

FIGURE 29 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY TECHNOLOGY, 2022-2029 (USD MILLION)

FIGURE 30 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY TECHNOLOGY, CAGR (2022-2029)

FIGURE 31 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 32 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY APPLICATION, 2021

FIGURE 33 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 34 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 35 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 36 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 37 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 38 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 39 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 40 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY END USER, 2021

FIGURE 41 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 42 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY END USER, CAGR (2022-2029)

FIGURE 43 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY END USER, LIFELINE CURVE

FIGURE 44 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: SNAPSHOT (2021)

FIGURE 45 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY COUNTRY (2021)

FIGURE 46 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: BY DEVICES (2022-2029)

FIGURE 49 NORTH AMERICA SPERM SEPARATION DEVICES MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.