North America Smart Contact Lens Market, By Design (Micro-LED Display Contact Lens, Diagnostic Sensor Integrated Contact Lens, Photodetector Contact Lens, Drug Eluding Contact Lenses, Electrochemical Contact Lens Sensors, Light Diffractive Contact Lenses, Fluorescence-Based Contact Lenses, and Others) Material (Poly (2-Hydroxyethyl Methacrylate) (PHEMA), Polyvinyl Alcohol (PVA), Polyacrylamide (PA), Polyethylene Terephthalate (PET), Polydimethylsiloxane (PDMS), and Others), Application (Monitoring, Therapeutics, and Other Application), Usability (Single Use, Extended Use), Technology (Fluorescence-Based Sensing Technology, Holographic Sensing Technology, Colorimetric Based Sensing Technology, Electrochemical-Based Technologies, and Others), Population Type (Pediatric, Adult, and Geriatric), End User (Eye Hospital, Ophthalmology Clinics, Homecare Settings, and Others), Distribution Channel (Retail Stores, Online Stores, Eye Care Practitioners, and Others) Industry Trends and Forecast to 2030.

North America Smart Contact Lens Market Analysis and Size

The North America smart contact lens market is expected to grow in the forecast period due to the rise in market players and the availability of advanced products. Along with this, manufacturers are engaged in R&D activity to launch novel products in the market. However, the high cost of smart contact lenses may hamper the growth of the North America smart contact lens market in the forecast period.

The rise in FDA approval and the presence of a wide range of products and devices are raising market growth. The rising government investments with the rising awareness among the population are expected to provide lucrative opportunities to market growth. However, the increasing product recall may challenge the market's growth.

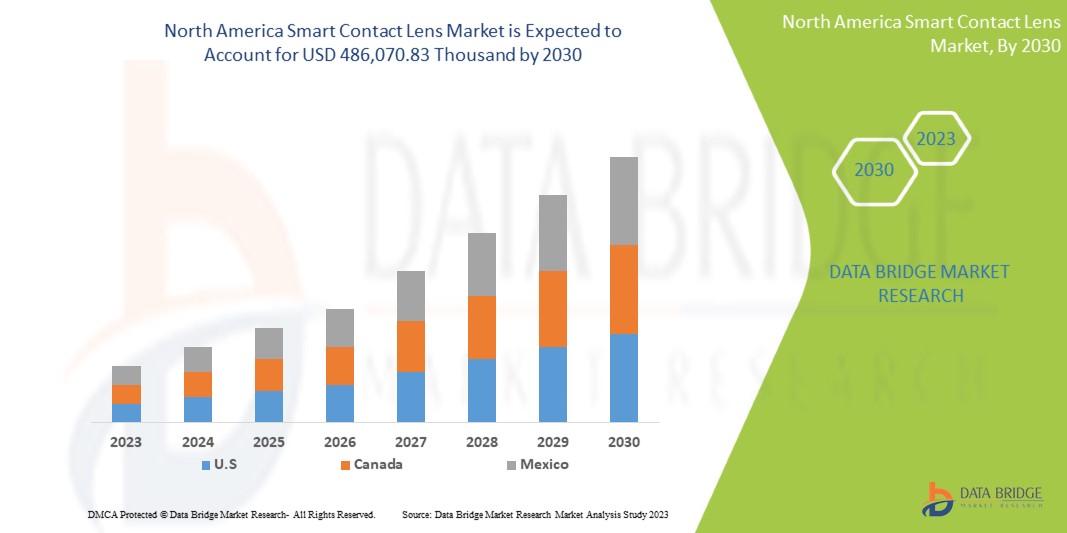

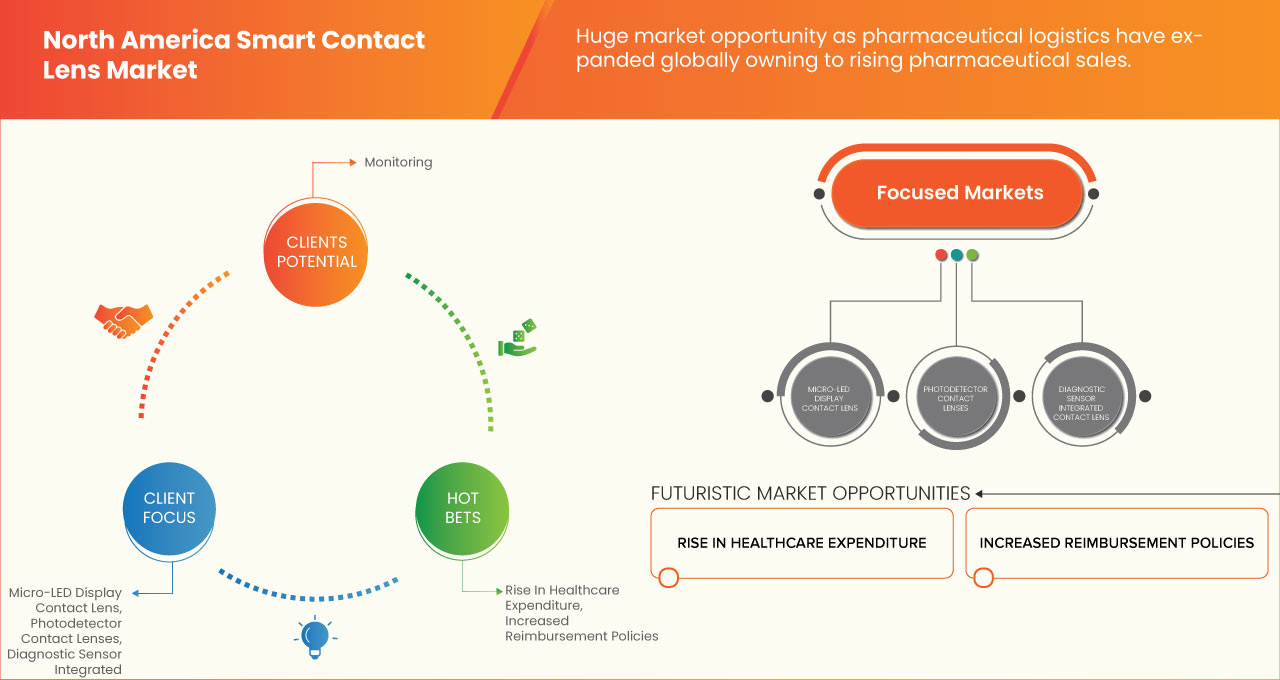

Data Bridge Market Research analyzes that the North America smart contact lens market is expected to reach the value of USD 486,070.83 thousand by 2030, at a CAGR of 13.6%. The micro-LED display contact lenses segment is expected to dominate the North America smart contact lens market with the increasingly advanced technology and rising strategic initiatives by major market players.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable 2015 to 2020) |

|

Quantitative Units |

Revenue in USD Thousand |

|

Segments Covered |

Par conception (lentilles de contact à affichage micro-LED, lentilles de contact à capteur de diagnostic intégré, lentilles de contact à photodétecteur, lentilles de contact à élution de médicament, capteurs de lentilles de contact électrochimiques, lentilles de contact à diffraction de lumière, lentilles de contact à fluorescence et autres), matériau (poly(méthacrylate de 2-hydroxyéthyle) (PHEMA), alcool polyvinylique (PVA), polyacrylamide (PA), polyéthylène téréphtalate (PET), polydiméthylsiloxane (PDMS) et autres), application (surveillance, thérapeutique et autres applications), facilité d'utilisation (usage unique, utilisation prolongée), technologie (technologie de détection à fluorescence, technologie de détection holographique, technologie de détection colorimétrique, technologies électrochimiques et autres), type de population (pédiatrique, adulte et gériatrique), utilisateur final (hôpital ophtalmologique, cliniques d'ophtalmologie, établissements de soins à domicile et autres), canal de distribution (magasins de détail, magasins en ligne, praticiens en soins oculaires et Autres) |

|

Pays couvert |

NOUS |

|

Acteurs du marché couverts |

Innovega INC, InWith Corp, Sensimed AG, RaayonNova LLC, Mediprint, e-Vision Smart Optics, Inc. et SAMSUNG entre autres |

Définition du marché

Une lentille de contact intelligente avec affichage visuel intégré est conçue pour agrandir les images pour les personnes malvoyantes. La lentille brevetée, conçue par une société appelée Mojo Vision, peut projeter le contenu d'un smartphone.

La lentille de contact intelligente est une lentille de contact dure ou souple ordinaire entourée d'un écran à cristaux liquides, d'un minuscule contrôleur ASIC (Application-Specific Integrated Circuit), d'un capteur de lumière, d'un accéléromètre et d'un gyroscope, et d'une batterie lithium-ion solide très fine.

Les lentilles de contact intelligentes sont utilisées pour diverses applications, telles que la myopie, l’hypoxie et d’autres troubles oculaires.

Dynamique du marché des lentilles de contact intelligentes en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

Augmentation de la prévalence des erreurs de réfraction

Les erreurs de réfraction incluent divers types de maladies oculaires, qui provoquent des problèmes de vision qui rendent difficile de voir clairement un objet, et les lentilles de contact intelligentes aident en fournissant des images plus claires. L'utilisation croissante de lentilles intelligentes pour prévenir la dégénérescence maculaire devrait stimuler la croissance du marché des lentilles de contact intelligentes.

Par exemple,

- Selon l'étude de l'Institut national de la santé de 2015, 917 sujets ont participé. La prévalence des erreurs de réfraction non corrigées était de 23,97 % chez les hommes et de 20 % chez les femmes. La prévalence augmentait avec l'âge

- Selon Peter Ivins Eye Care en 2018, les résultats d'un essai clinique de 2 ans montrent que les lentilles MiyoSmart ralentissent la progression de la myopie de 59 % et ralentissent la croissance axiale de l'œil de 60 % en moyenne.

Restrictions

Augmentation des effets secondaires associés aux lentilles de contact

Le port de lentilles de contact est une amélioration considérable par rapport aux lunettes. Les gens voient les objets plus clairement en utilisant des lentilles de contact. Elles s'adaptent facilement à l'œil et permettent aux personnes d'effectuer de nombreuses tâches qui pourraient être inconfortables avec des lunettes, comme voyager et faire de l'exercice, entre autres. Cependant, si les lentilles de contact ne sont pas utilisées correctement, il peut y avoir de nombreux effets secondaires, pouvant même affecter la vision de l'œil à long terme.

Vous trouverez ci-dessous les différents types de risques et d’effets secondaires liés à l’utilisation de lentilles de contact intelligentes :

- Blocage de l'apport d'oxygène aux yeux : les lentilles de contact reposent directement sur l'œil, recouvrent toute la cornée et la quantité d'oxygène qui atteint les yeux diminue. Des passages d'oxygène sont nécessaires pour garder l'œil en bonne santé

- Diminution du réflexe cornéen : les lentilles de contact entraînent une diminution du réflexe cornéen de l'œil. Le réflexe cornéen est un mécanisme de protection de l'œil

- Abrasion cornéenne : les lentilles de contact peuvent rayer la cornée et provoquer une abrasion cornéenne si les lentilles de contact ne sont pas correctement ajustées ou même lorsque les yeux sont trop secs

- Yeux rouges ou conjonctivite : Si les personnes portent des lentilles de contact pendant de longues heures, il y aura un risque élevé de conjonctivite

Il s'agit de divers symptômes associés aux allergies oculaires saisonnières lors du port de lentilles de contact intelligentes. De plus, les personnes souffrent d'allergies provoquant des démangeaisons ou des brûlures aux solutions pour lentilles de contact, ce qui freine la demande pour le marché des lentilles de contact intelligentes

Opportunité

Progrès technologiques dans le domaine des lentilles de contact

De jour en jour, la technologie évolue et développe divers produits pour améliorer le mode de vie des gens, et il en va de même pour les soins oculaires. À mesure que la technologie progresse, différentes marques adoptent des matériaux, des conceptions de lentilles et des horaires de port qui peuvent s'adapter à presque tous les besoins individuels et contribuent également à développer des lentilles de contact de meilleure qualité, ce qui améliore la vie des porteurs. Les utilisateurs bénéficient d'une plus grande flexibilité et d'un plus grand choix en matière de lentilles de contact. Il existe une grande variété de lentilles de contact disponibles sur le marché.

Par exemple,

-

Lentilles de contact à port prolongé

-

Lentilles de contact à port quotidien

-

Lentilles de contact rigides perméables au gaz (RGP)

-

Lentilles de contact souples

Les matériaux des lentilles de contact ont également beaucoup changé au cours des dernières années. Les nouveaux matériaux pour lentilles de contact offrent une meilleure respirabilité de l'oxygène que la dernière génération de lentilles de contact souples. Un hydrogel de silicone est incorporé au polymère, ce qui permet à davantage d'oxygène de passer directement à travers la lentille de contact jusqu'à la cornée. Ces nouveaux matériaux peuvent fournir jusqu'à dix fois plus d'oxygène à la cornée que les lentilles de contact précédentes, offrant ainsi un confort et une portabilité supérieurs.

Les fabricants présents sur le marché développent de nouvelles technologies de lentilles de contact intelligentes avec un petit écran intégré qui offre au porteur des images de réalité augmentée sur un écran placé directement sur les globes oculaires du porteur. De plus, les fabricants ont utilisé une nouvelle technologie unique qui offre régulièrement aux utilisateurs une expérience de confort plus optimale lors de l'utilisation d'appareils numériques. Pour cette raison, les progrès technologiques dans le domaine des lentilles de contact devraient constituer une opportunité pour répondre à la demande croissante du marché nord-américain des lentilles de contact intelligentes.

Défi

Problèmes de sécurité liés à l’utilisation de lentilles de contact

Les lentilles de contact présentent de nombreux avantages, mais aussi de nombreux inconvénients. Le port de lentilles de contact peut entraîner plusieurs problèmes graves, notamment des infections oculaires et des ulcères cornéens. Ces problèmes peuvent se développer très rapidement et être très graves.

Il est important de se sécher les mains avant de toucher les lentilles de contact, car les germes présents sur les mains peuvent être transférés aux lentilles de contact et à l'étui à lentilles. Certains germes peuvent provoquer des infections oculaires.

Par exemple,

- Selon le rapport du CDC de 2017, 99 % des porteurs de lentilles de contact interrogés ont admis avoir au moins une mauvaise habitude d'hygiène des lentilles pouvant entraîner une infection, comme le rinçage des lentilles à l'eau du robinet. Un tiers d'entre eux ont consulté un médecin pour un œil rouge ou douloureux lié à leurs lentilles.

Les lentilles de contact peuvent donner l’illusion de se passer de l’entretien des lunettes. Pourtant, les lentilles de contact nécessitent un entretien important pour conserver leur efficacité et garder les yeux en bonne santé.

Bien que les lentilles de contact soient généralement une forme sûre et efficace de correction de la vue, elles ne sont pas totalement sans risque, surtout si elles ne sont pas entretenues correctement. Les lentilles de contact sont des dispositifs médicaux et le fait de ne pas les porter, de les nettoyer et de les conserver conformément aux instructions peut augmenter le risque d'infections oculaires, telles que la kératite microbienne, ce qui peut remettre en cause la croissance du marché nord-américain des lentilles de contact intelligentes

Développements récents

- En juillet 2022, Raayon Nova/Smart Contact Lens a présenté son prototype d'appareil lors de la conférence AR à l'Université de Columbia. Cela aidera l'entreprise à développer ses activités en Amérique du Nord.

- En avril 2018, une demande de brevet a révélé que Samsung étudiait le développement d'une lentille de contact capable de projeter des images directement dans l'œil de l'utilisateur, de prendre des photos et de se connecter sans fil à un smartphone. Cela a aidé l'entreprise à accroître sa présence en Amérique du Nord.

Portée du marché des lentilles de contact intelligentes en Amérique du Nord

Le marché nord-américain des lentilles de contact intelligentes est divisé en huit segments en fonction de la conception, du matériau, de l'application, de la facilité d'utilisation, de la technologie, de la population, de l'utilisateur final et du canal de distribution. La croissance entre les segments vous aide à analyser les niches de croissance et les stratégies pour aborder le marché et déterminer vos principaux domaines d'application et la différence entre vos marchés cibles.

Par conception

- Lentille de contact à affichage micro-LED

- Capteur de diagnostic avec lentille de contact intégrée

- Lentilles de contact photodétectrices

- Lentilles de contact anti-drogue

- Capteurs de lentilles de contact électrochimiques

- Lentilles de contact diffractives de la lumière

- Lentilles de contact à fluorescence

- Autres

Sur la base de la conception, le marché nord-américain des lentilles de contact intelligentes est segmenté en lentilles de contact à fluorescence, capteurs de lentilles de contact électrochimiques, lentilles de contact à diffraction de lumière, lentilles de contact à affichage micro-LED, lentilles de contact à photodétecteur, lentilles de contact à évasion de médicament, lentilles de contact intégrées à un capteur de diagnostic, et autres.

Par matériau

- Poly(méthacrylate de 2-hydroxyéthyle) (PHEMA)

- Alcool polyvinylique (PVA)

- Polyacrylamide (PA)

- Polyéthylène téréphtalate (PET)

- Polydiméthylsiloxane (PDMS)

- Autre

Sur la base du matériau, le marché nord-américain des lentilles de contact intelligentes est segmenté en poly (méthacrylate de 2-hydroxyéthyle) (PHEMA), alcool polyvinylique (PVA), polyacrylamide (PA), polyéthylène téréphtalate (PET), polydiméthylsiloxane (PDMS) et autres.

Par application

- Surveillance

- Thérapeutique

- Autres applications

Sur la base des applications, le marché nord-américain des lentilles de contact intelligentes est segmenté en surveillance, thérapeutique et autres applications.

Par facilité d'utilisation

- À usage unique

- Utilisation prolongée

Sur la base de la facilité d'utilisation, le marché nord-américain des lentilles de contact intelligentes est segmenté en usage unique et usage prolongé.

Par technologie

- Technologie de détection basée sur la fluorescence

- Technologie de détection holographique

- Technologie de détection basée sur la colorimétrie

- Technologies basées sur l'électrochimie

- Autre

Sur la base de la technologie, le marché nord-américain des lentilles de contact intelligentes est segmenté en technologie de détection basée sur la fluorescence, technologie de détection holographique, technologie de détection basée sur la colorimétrie, technologies électrochimiques et autres.

Par type de population

- Pédiatrique

- Adulte

- Gériatrie

Sur la base du type de population, le marché nord-américain des lentilles de contact intelligentes est segmenté en pédiatrie, adultes et gériatrie.

Par utilisateur final

- Hôpital ophtalmologique

- Cliniques d'ophtalmologie

- Cadre de soins à domicile

- Autre

Sur la base de l'utilisateur final, le marché nord-américain des lentilles de contact intelligentes est segmenté en hôpitaux ophtalmologiques, cliniques d'ophtalmologie, établissements de soins à domicile et autres.

Par canal de distribution

- Magasins de détail

- Boutiques en ligne

- Professionnels de la vue

- Autre

Sur la base du canal de distribution, le marché nord-américain des lentilles de contact intelligentes est segmenté en magasins de détail, magasins en ligne, ophtalmologistes et autres.

Analyse/perspectives régionales du marché des lentilles de contact intelligentes en Amérique du Nord

Le marché nord-américain des lentilles de contact intelligentes est classé en huit segments notables : conception, matériau, application, facilité d'utilisation, technologie, population, utilisateur final et canal de distribution.

Les pays couverts par le marché des lentilles de contact intelligentes en Amérique du Nord sont les États-Unis

Les États-Unis devraient être le leader du marché des lentilles de contact intelligentes en Amérique du Nord, car ils comprennent un grand nombre d'acteurs majeurs du marché et un vaste réseau de fournisseurs et de fabricants.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of phosphorus and its derivatives and the challenges faced due to stringent regulations are considered while providing forecast analysis of the country data.

Competitive Landscape and North America Smart Contact Lens Market Share Analysis

North America smart contact lens market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, business expansion, service facilities, partnership, strategic development, application dominance, and technology lifeline curve. The above data points provided are only related to the company's focus on the North America smart contact lens market.

Some of the key market players in the North America smart contact lens market are Innovega INC, InWith Corp, Sensimed AG, RaayonNova LLC, Mediprint, e-Vision Smart Optics, Inc., and SAMSUNG among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE NORTH AMERICA SMART CONTACT LENS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DESIGN LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 LIST OF TERMINATED/PAUSED PIPELINE PROJECTS

4.4 PATENT ANALYSIS

4.5 PIPELINE ANALYSIS FOR THE NORTH AMERICA SMART CONTACT LENS MARKET

4.6 INDUSTRY INSIGHT

5 NORTH AMERICA SMART CONTACT LENS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASE IN PREVALENCE OF REFRACTIVE ERROR

6.1.2 RISING CASES OF DIABETIC RETINOPATHY

6.1.3 INCREASING R&D ACTIVITIES BY KEY MARKET PLAYERS FOR SMART CONTACT LENS

6.1.4 RISE IN THE PREVALENCE OF EYE DISORDER

6.2 RESTRAINTS

6.2.1 INCREASING SIDE EFFECTS ASSOCIATED WITH CONTACT LENSES

6.2.2 GROWING ACCEPTANCE OF REFRACTIVE SURGERIES

6.3 OPPORTUNITIES

6.3.1 TECHNOLOGICAL ADVANCEMENTS IN CONTACT LENSES

6.3.2 INCREASING PREFERENCE FOR CONTACT LENSES INSTEAD OF EYEGLASSES

6.4 CHALLENGES

6.4.1 SAFETY CONCERNS ASSOCIATED WITH THE USE OF CONTACT LENSES

6.4.2 STRICT REGULATIONS AND STANDARDS FOR APPROVAL OF CONTACT LENSES

7 NORTH AMERICA SMART CONTACT LENS MARKET, BY DESIGN

7.1 OVERVIEW

7.2 MICRO LED DISPLAY CONTACT LENS

7.3 DIAGNOSTIC SENSOR INTEGRATED CONTACT LENS

7.4 PHOTODETECTOR CONTACT LENSES

7.5 DRUG ELUDING CONTACT LENSES

7.6 ELECTROCHEMICAL CONTACT LENS SENSORS

7.7 LIGHT DIFFRACTIVE CONTACT LENSES

7.8 FLUORESCENCE-BASED CONTACT LENSES

7.9 OTHERS

8 NORTH AMERICA SMART CONTACT LENS MARKET, BY MATERIAL

8.1 OVERVIEW

8.2 POLY (2-HYDROXYETHYL METHACRYLATE) (PHEMA)

8.3 POLYVINYL ALCOHOL (PVA)

8.4 POLYACRYLAMIDE (PA)

8.5 POLYETHYLENE TEREPHTHALATE (PET)

8.6 POLYDIMETHYLSILOXANE (PDMS)

8.7 OTHER

9 NORTH AMERICA SMART CONTACT LENS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 MONITORING

9.2.1 EYE PRESSURE MONITORING

9.2.2 GLUCOSE LEVELS MONITORING

9.3 THERAPEUTICS

9.3.1 ALLERGY RELIEF

9.3.2 CORNEAL INJURY

9.3.3 EYE INJURIES

9.3.4 OTHER

9.4 OTHER APPLICATION

9.4.1 FARSIGHTEDNESS

9.4.2 AUGMENTED REALITY (AR/VR)

9.4.3 NIGHT VISION

9.4.4 OTHERS

10 NORTH AMERICA SMART CONTACT LENS MARKET, BY USABILITY

10.1 OVERVIEW

10.2 SINGLE USE

10.3 EXTENDED USE

11 NORTH AMERICA SMART CONTACT LENS MARKET, BY TECHNOLOGY

11.1 OVERVIEW

11.2 FLUORESCENCE-BASED SENSING TECHNOLOGY

11.3 HOLOGRAPHIC SENSING TECHNOLOGY

11.4 COLORIMETRIC BASED SENSING TECHNOLOGY

11.5 ELECTROCHEMICAL-BASED TECHNOLOGIES

11.6 OTHER

12 NORTH AMERICA SMART CONTACT LENS MARKET, BY POPULATION

12.1 OVERVIEW

12.2 GERIATRIC

12.3 ADULT

12.4 PEDIATRIC

13 NORTH AMERICA SMART CONTACT LENS MARKET, BY END USER

13.1 OVERVIEW

13.2 EYE HOSPITAL

13.3 OPHTHALMOLOGY CLINICS

13.4 HOMECARE SETTING

13.5 OTHERS

14 NORTH AMERICA SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 RETAIL STORES

14.2.1 PHARMACIES

14.2.2 INDEPENDENT BRAND SHOWROOMS

14.2.3 OTHERS

14.3 ONLINE STORES

14.3.1 E-COMMERCE WEBSITES

14.3.2 COMPANY-OWNED WEBSITES

14.4 EYE CARE PRACTITIONERS

14.5 OTHERS

15 NORTH AMERICA SMART CONTACT LENS MARKET, BY REGION

15.1 NORTH AMERICA

15.1.1 U.S

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 SENSIMED AG

17.1.1 COMPANY SNAPSHOT

17.1.2 PRODUCT PORTFOLIO

17.1.3 RECENT DEVELOPMENT

17.2 AZALEA VISION

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 RECENT DEVELOPMENTS

17.3 E-VISION SMART OPTICS, INC.

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 RECENT DEVELOPMENT

17.4 GLAKOLENS BIYOMEDIKAL BIYOTEKNOLOJI SAN. VE TIC. A.Ş.

17.4.1 COMPANY SNAPSHOT

17.4.2 PIPELINE PORTFOLIO

17.4.3 RECENT DEVELOPMENTS

17.5 INNOVEGA INC.

17.5.1 COMPANY SNAPSHOT

17.5.2 PIPELINE PORTFOLIO

17.5.3 RECENT DEVELOPMENTS

17.6 INWITH CORP

17.6.1 COMPANY SNAPSHOT

17.6.2 PIPELINE PORTFOLIO

17.6.3 RECENT DEVELOPMENT

17.7 MEDIPRINT

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENTS

17.8 RAAYONNOVA

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 SAMSUNG

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Liste des tableaux

TABLE 1 NORTH AMERICA SMART CONTACT LENS MARKET, PATENT ANALYSIS

TABLE 2 NORTH AMERICA SMART CONTACT LENS MARKET, BY DESIGN, 2021- 2030 (USD THOUSAND)

TABLE 3 NORTH AMERICA MICRO LED DISPLAY CONTACT LENS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 4 NORTH AMERICA DIAGNOSTIC SENSOR INTEGRATED CONTACT LENS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 5 NORTH AMERICA PHOTODETECTOR CONTACT LENSES IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 6 NORTH AMERICA DRUG ELUDING CONTACT LENSES IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 7 NORTH AMERICA ELECTROCHEMICAL CONTACT LENS SENSORS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 8 NORTH AMERICA LIGHT DIFFRACTIVE CONTACT LENSES IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 9 NORTH AMERICA FLUORESCENCE-BASED CONTACT LENSES IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 10 NORTH AMERICA OTHERS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 11 NORTH AMERICA SMART CONTACT LENS MARKET, BY MATERIAL, 2021-2030 (USD THOUSAND)

TABLE 12 NORTH AMERICA POLY (2-HYDROXYETHYL METHACRYLATE) (PHEMA) IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS)

TABLE 13 NORTH AMERICA POLYVINYL ALCOHOL (PVA) IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS)

TABLE 14 NORTH AMERICA POLYACRYLAMIDE (PA) IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS)

TABLE 15 NORTH AMERICA POLYETHYLENE TEREPHTHALATE (PET) IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS)

TABLE 16 NORTH AMERICA POLYDIMETHYLSILOXANE (PDMS) IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS)

TABLE 17 NORTH AMERICA OTHERS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS)

TABLE 18 NORTH AMERICA SMART CONTACT LENS MARKET, BY APPLICATION, 2021-2030 (USD THOUSAND)

TABLE 19 NORTH AMERICA MONITORING IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS)

TABLE 20 NORTH AMERICA MONITORING IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSANDS)

TABLE 21 NORTH AMERICA THERAPEUTICS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS))

TABLE 22 NORTH AMERICA THERAPEUTICS IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSANDS))

TABLE 23 NORTH AMERICA OTHER APPLICATION IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSANDS)

TABLE 24 NORTH AMERICA OTHER APPLICATION IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSANDS))

TABLE 25 NORTH AMERICA SMART CONTACT LENS MARKET, BY USABILITY, 2021- 2030 (USD THOUSAND)

TABLE 26 NORTH AMERICA SINGLE USE IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 27 NORTH AMERICA EXTENDED USE IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 28 NORTH AMERICA SMART CONTACT LENS MARKET, BY TECHNOLOGY, 2021- 2030 (USD THOUSAND)

TABLE 29 NORTH AMERICA FLUORESCENCE-BASED SENSING TECHNOLOGY IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 30 NORTH AMERICA HOLOGRAPHIC SENSING TECHNOLOGY IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 31 NORTH AMERICA COLORIMETRIC BASED SENSING TECHNOLOGY IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 32 NORTH AMERICA ELECTROCHEMICAL-BASED TECHNOLOGIES IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 33 NORTH AMERICA OTHERS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 34 NORTH AMERICA SMART CONTACT LENS MARKET, BY POPULATION TYPE, 2021- 2030 (USD THOUSAND)

TABLE 35 NORTH AMERICA GERIATRIC IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 36 NORTH AMERICA ADULT IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 37 NORTH AMERICA PEDIATRIC IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 38 NORTH AMERICA SMART CONTACT LENS MARKET, BY END USER, 2021-2030 (USD THOUSAND)

TABLE 39 NORTH AMERICA EYE HOSPITAL IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 40 NORTH AMERICA OPHTHALMOLOGY CLINICS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 41 NORTH AMERICA HOME CARE SETTING IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 42 NORTH AMERICA OTHERS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 43 NORTH AMERICA SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021-2030 (USD THOUSAND)

TABLE 44 NORTH AMERICA REATIL STORES IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 45 NORTH AMERICA RETAIL STORES IN SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD THOUSAND)

TABLE 46 NORTH AMERICA ONLINE STORES IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 47 NORTH AMERICA ONLINE STORES IN SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD THOUSAND)

TABLE 48 NORTH AMERICA EYE CARE PRACTITIONERS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 49 NORTH AMERICA OTHERS IN SMART CONTACT LENS MARKET, BY REGION, 2021-2030 (USD THOUSAND)

TABLE 50 NORTH AMERICA PATIENT TEMPERATURE MANAGEMENT MARKET, BY COUNTRY, 2021- 2030 (USD THOUSAND)

TABLE 51 NORTH AMERICA SMART CONTACT LENS MARKET, BY DESIGN, 2021- 2030 (USD THOUSAND)

TABLE 52 NORTH AMERICA SMART CONTACT LENS MARKET, BY MATERIAL, 2021- 2030 (USD THOUSAND)

TABLE 53 NORTH AMERICA SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSAND)

TABLE 54 NORTH AMERICA MONITORING IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSAND)

TABLE 55 NORTH AMERICA THERAPEUTICS IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSAND)

TABLE 56 NORTH AMERICA OTHER APPLICATIONS IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSAND)

TABLE 57 NORTH AMERICA SMART CONTACT LENS MARKET, BY USABILITY, 2021- 2030 (USD THOUSAND)

TABLE 58 NORTH AMERICA SMART CONTACT LENS MARKET, BY TECHNOLOGY, 2021- 2030 (USD THOUSAND)

TABLE 59 NORTH AMERICA SMART CONTACT LENS MARKET, BY POPULATION TYPE, 2021- 2030 (USD THOUSAND)

TABLE 60 NORTH AMERICA SMART CONTACT LENS MARKET, BY END USER, 2021- 2030 (USD THOUSAND)

TABLE 61 NORTH AMERICA SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD THOUSAND)

TABLE 62 NORTH AMERICA RETAIL STORES IN SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD THOUSAND)

TABLE 63 NORTH AMERICA ONLINE STORES IN SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD THOUSAND)

TABLE 64 U.S. SMART CONTACT LENS MARKET, BY DESIGN, 2021- 2030 (USD THOUSAND)

TABLE 65 U.S. SMART CONTACT LENS MARKET, BY MATERIAL, 2021- 2030 (USD THOUSAND)

TABLE 66 U.S. SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSAND)

TABLE 67 U.S. MONITORING IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSAND)

TABLE 68 U.S. THERAPEUTICS IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSAND)

TABLE 69 U.S. OTHER APPLICATIONS IN SMART CONTACT LENS MARKET, BY APPLICATION, 2021- 2030 (USD THOUSAND)

TABLE 70 U.S. SMART CONTACT LENS MARKET, BY USABILITY, 2021- 2030 (USD THOUSAND)

TABLE 71 U.S. SMART CONTACT LENS MARKET, BY TECHNOLOGY, 2021- 2030 (USD THOUSAND)

TABLE 72 U.S. SMART CONTACT LENS MARKET, BY POPULATION TYPE, 2021- 2030 (USD THOUSAND)

TABLE 73 U.S. SMART CONTACT LENS MARKET, BY END USER, 2021- 2030 (USD THOUSAND)

TABLE 74 U.S. SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD THOUSAND)

TABLE 75 U.S. RETAIL STORES IN SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD THOUSAND)

TABLE 76 U.S. ONLINE STORES IN SMART CONTACT LENS MARKET, BY DISTRIBUTION CHANNEL, 2021- 2030 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA SMART CONTACT LENS MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA SMART CONTACT LENS MARKET: DATA TRIANGULATION

FIGURE 3 NORTH AMERICA SMART CONTACT LENS MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA SMART CONTACT LENS MARKET: NORTH AMERICA VS COUNTRY MARKET ANALYSIS

FIGURE 5 NORTH AMERICA SMART CONTACT LENS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA SMART CONTACT LENS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA SMART CONTACT LENS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA SMART CONTACT LENS MARKET: APPLICATION COVERAGE GRID

FIGURE 9 NORTH AMERICA SMART CONTACT LENS MARKET: SEGMENTATION

FIGURE 10 INCREASING R&D ACTIVITES BY KEY MARKET PLAYERS FOR SMART CONTACT LENS IS EXPECTED TO DRIVE THE NORTH AMERICA SMART CONTACT LENS MARKET GROWTH IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 11 MICRO-LED DISPLAY CONTACT LENSES IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE NORTH AMERICA SMART CONTACT LENS MARKET IN 2023 & 2030

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA SMART CONTACT LENS MARKET

FIGURE 13 NUMBER OF MYOPIA CASES

FIGURE 14 NORTH AMERICA SMART CONTACT LENS MARKET: BY DESIGN, 2022

FIGURE 15 NORTH AMERICA SMART CONTACT LENS MARKET: BY DESIGN, 2023-2030 (USD THOUSAND)

FIGURE 16 NORTH AMERICA SMART CONTACT LENS MARKET: BY DESIGN, CAGR (2023-2030)

FIGURE 17 NORTH AMERICA SMART CONTACT LENS MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 18 NORTH AMERICA SMART CONTACT LENS MARKET: BY MATERIAL, 2022

FIGURE 19 NORTH AMERICA SMART CONTACT LENS MARKET: BY MATERIAL, 2023-2030 (USD THOUSAND)

FIGURE 20 NORTH AMERICA SMART CONTACT LENS MARKET: BY MATERIAL, CAGR (2023-2030)

FIGURE 21 NORTH AMERICA SMART CONTACT LENS MARKET: BY MATERIAL, LIFELINE CURVE

FIGURE 22 NORTH AMERICA SMART CONTACT LENS MARKET: BY APPLICATION, 2022

FIGURE 23 NORTH AMERICA SMART CONTACT LENS MARKET: BY APPLICATION, 2023-2030 (USD THOUSAND)

FIGURE 24 NORTH AMERICA SMART CONTACT LENS MARKET: BY APPLICATION, CAGR (2023-2030)

FIGURE 25 NORTH AMERICA SMART CONTACT LENS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 NORTH AMERICA SMART CONTACT LENS MARKET: BY USABILITY, 2022

FIGURE 27 NORTH AMERICA SMART CONTACT LENS MARKET: BY USABILITY, 2023-2030 (USD THOUSAND)

FIGURE 28 NORTH AMERICA SMART CONTACT LENS MARKET: BY USABILITY, CAGR (2023-2030)

FIGURE 29 NORTH AMERICA SMART CONTACT LENS MARKET: BY USABILITY, LIFELINE CURVE

FIGURE 30 NORTH AMERICA SMART CONTACT LENS MARKET: BY TECHNOLOGY, 2022

FIGURE 31 NORTH AMERICA SMART CONTACT LENS MARKET: BY TECHNOLOGY, 2023-2030 (USD THOUSAND)

FIGURE 32 NORTH AMERICA SMART CONTACT LENS MARKET: BY TECHNOLOGY, CAGR (2023-2030)

FIGURE 33 NORTH AMERICA SMART CONTACT LENS MARKET: BY TECHNOLOGY, LIFELINE CURVE

FIGURE 34 NORTH AMERICA SMART CONTACT LENS MARKET: BY POPULATION TYPE, 2022

FIGURE 35 NORTH AMERICA SMART CONTACT LENS MARKET: BY POPULATION TYPE, 2023-2030 (USD THOUSAND)

FIGURE 36 NORTH AMERICA SMART CONTACT LENS MARKET: BY POPULATION TYPE, CAGR (2023-2030)

FIGURE 37 NORTH AMERICA SMART CONTACT LENS MARKET: BY POPULATION TYPE, LIFELINE CURVE

FIGURE 38 NORTH AMERICA SMART CONTACT LENS MARKET: BY END USER, 2022

FIGURE 39 NORTH AMERICA SMART CONTACT LENS MARKET: BY END USER, 2023-2030 (USD THOUSAND)

FIGURE 40 NORTH AMERICA SMART CONTACT LENS MARKET: BY END USER, CAGR (2023-2030)

FIGURE 41 NORTH AMERICA SMART CONTACT LENS MARKET: BY END USER, LIFELINE CURVE

FIGURE 42 NORTH AMERICA SMART CONTACT LENS MARKET: BY DISTRIBUTION CHANNEL, 2022

FIGURE 43 NORTH AMERICA SMART CONTACT LENS MARKET: BY DISTRIBUTION CHANNEL, 2023-2030 (USD THOUSAND)

FIGURE 44 NORTH AMERICA SMART CONTACT LENS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2023-2030)

FIGURE 45 NORTH AMERICA SMART CONTACT LENS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 46 NORTH AMERICA SMART CONTACT LENS: SNAPSHOT (2022)

FIGURE 47 NORTH AMERICA SMART CONTACT LENS: BY COUNTRY (2022)

FIGURE 48 NORTH AMERICA SMART CONTACT LENS: BY COUNTRY (2023 & 2030)

FIGURE 49 NORTH AMERICA SMART CONTACT LENS: BY COUNTRY (2022 & 2030)

FIGURE 50 NORTH AMERICA SMART CONTACT LENS: BY DESIGN (2023 & 2030)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.