North America Rice Market

Taille du marché en milliards USD

TCAC :

%

USD

7.37 Billion

USD

9.52 Billion

2024

2032

USD

7.37 Billion

USD

9.52 Billion

2024

2032

| 2025 –2032 | |

| USD 7.37 Billion | |

| USD 9.52 Billion | |

|

|

|

Marché du riz en Amérique du Nord, par type de produit (riz brun, riz blanc, riz noir et riz rouge), catégorie de riz (riz étuvé, riz au jasmin, riz basmati, riz sauvage et autres), granulométrie (riz à grains courts, riz à grains moyens et riz à grains longs), nature (biologique et conventionnelle), utilisateur final (ménage/détail, industrie de transformation des aliments, industrie de la farine, alimentation animale et autres), canal de distribution (direct et indirect) - Tendances et prévisions de l'industrie jusqu'en 2030.

Analyse et perspectives du marché du riz en Amérique du Nord

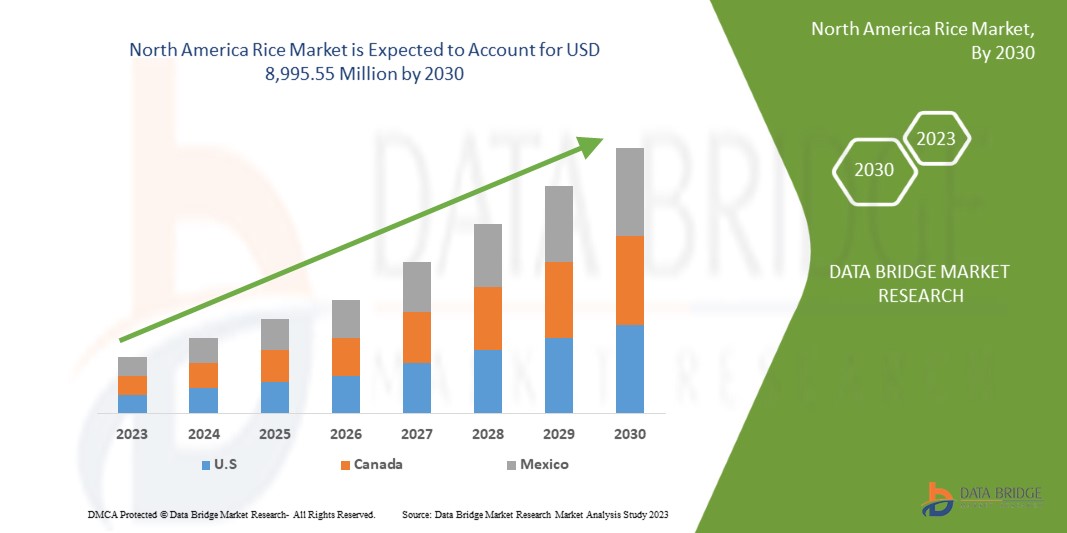

Le marché du riz en Amérique du Nord devrait croître considérablement au cours de la période de prévision de 2023 à 2030. Data Bridge Market Research analyse que le marché croît avec un TCAC de 3,3 % au cours de la période de prévision de 2023 à 2030 et devrait atteindre 8 995,55 millions USD d'ici 2030. L'augmentation de la demande de riz dans diverses applications dans différentes industries devrait stimuler le marché.

La disponibilité d'une gamme plus large de produits stimule l'expansion du marché. En outre, le marché est également influencé par l'évolution croissante des consommateurs vers des habitudes alimentaires plus saines. En plus de ces expansions, la R&D et la modernisation des pratiques de culture du riz sur le marché ont ouvert davantage de possibilités commerciales pour les producteurs de riz.

Le rapport sur le marché du riz en Amérique du Nord fournit des détails sur la part de marché, les nouveaux développements et l'impact des acteurs du marché national et local, analyse les opportunités en termes de poches de revenus émergentes, de changements dans la réglementation du marché, d'approbations de produits, de décisions stratégiques, de lancements de produits, d'expansions géographiques et d'innovations technologiques sur le marché. Pour comprendre l'analyse et le scénario du marché, contactez-nous pour un briefing d'analyste. Notre équipe vous aidera à créer une solution d'impact sur les revenus pour atteindre votre objectif souhaité.

|

Rapport métrique |

Détails |

|

Période de prévision |

2023 à 2030 |

|

Année de base |

2022 |

|

Années historiques |

2021 (personnalisable de 2020 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en millions USD |

|

Segments couverts |

Par type de produit (riz brun, riz blanc, riz noir et riz rouge), catégorie de riz (riz étuvé, riz au jasmin, riz basmati, riz sauvage et autres), granulométrie (riz à grains courts, riz à grains moyens et riz à grains longs), nature (biologique et conventionnel), utilisateur final (ménage/détail, industrie de transformation alimentaire, industrie de la farine, alimentation animale et autres), canal de distribution (direct et indirect)

|

|

Pays couverts |

États-Unis, Canada et Mexique. |

|

Acteurs du marché couverts |

Riceland Foods, St. Maries Wild Rice et Ankeny Lakes Wild Rice Company, Doguet's Rice Milling Company, Supreme Rice, LLC, Koda Farms, Inc., Martin Rice Company, SunWest Foods, Goya Foods, Inc., LT Foods, Robbins Rice Company, Riviana Foods Inc., Kohinoor Foods Ltd., KRBL, PLANETRICE et Willmill Rice Co. LLC, entre autres. |

Définition du marché

Le riz est une céréale qui est l'un des aliments de base les plus consommés au monde. Il appartient à la famille des graminées et est connu sous le nom d'Oryza sativa. Il se distingue par ses petites graines de forme ovale, généralement de couleur blanche, brune ou noire. Dans de nombreuses régions du globe, notamment en Asie, le riz est un aliment de base et une riche source de glucides. Il peut être utilisé comme base pour de nombreux plats et peut être préparé de différentes manières, notamment en le faisant bouillir, en le cuisant à la vapeur ou en le faisant frire. Il existe de nombreux types de riz, chacun ayant un goût, une saveur et une composition nutritionnelle distincts. Le riz blanc, le riz brun, le riz noir et d'autres variétés sont des variétés de riz populaires. De plus, le riz présente de nombreux avantages pour la santé : il conserve la couche de son et contient des éléments bénéfiques comme les flavonoïdes qui aident au traitement des maladies cardiaques, des cancers gastriques et pancréatiques et du diabète de type 2. C'est une céréale dépourvue de gluten qui profite aux personnes sensibles au gluten ou à la maladie cœliaque.

Dynamique du marché du riz en Amérique du Nord

Cette section traite de la compréhension des moteurs, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- CONTINUE LA LIBÉRATION DE NOUVELLES VARIÉTÉS DE RIZ

La recherche agricole peut avoir un impact significatif sur les consommateurs en améliorant la qualité, la sécurité et la disponibilité des aliments. En investissant dans la recherche, les scientifiques et les fabricants peuvent développer de nouvelles variétés de cultures, de nouvelles techniques agricoles et de nouvelles technologies qui peuvent profiter aux consommateurs et aux acteurs du marché de plusieurs manières. La mise sur le marché de nouvelles variétés de riz peut avoir un impact profond sur le marché et l'économie en créant de nouvelles opportunités de marché pour les agriculteurs et les entreprises agroalimentaires, ce qui peut conduire à une augmentation des profits et de la croissance. Les nouvelles variétés de riz sont souvent développées pour avoir une production élevée et résister aux facteurs de stress environnementaux tels que la sécheresse ou les maladies. Cette productivité accrue peut conduire à des rendements plus élevés et à des coûts de production plus faibles, ce qui se traduit par un faible coût pour les consommateurs. De nouvelles variétés de riz peuvent également être développées pour avoir un meilleur goût, une meilleure apparence et un meilleur contenu nutritionnel. Les nouvelles variétés mises sur le marché peuvent être plus désirables pour les consommateurs et augmenter la demande, ce qui conduit à des profits plus élevés pour les agriculteurs et les acteurs du marché.

Par exemple,

- En novembre 2022, des scientifiques de l'USDA en Arkansas ont développé et commercialisé un riz violet, l'USDA Tiara. Le son de la nouvelle variété comprend des antioxydants bénéfiques, ce qui le rend plus coloré et plus sain que le riz blanc. L'un des pigments du riz violet est appelé anthocyanes, des substances chimiques connues pour leurs propriétés anti-inflammatoires et protectrices de la santé des artères.

- En mai 2022, la station expérimentale agricole de l'Arkansas a lancé un nouveau riz aromatique de type jasmin appelé ARoma 22 en réponse à la demande croissante de riz aromatique aux États-Unis. Les tests sensoriels indiquent que l'ARoma 22 présente plus d'arômes et une plus grande uniformité de couleur que son prédécesseur, ainsi que les caractéristiques recherchées par les consommateurs de riz aromatique asiatique importé.

- En février 2022, Horizon Ag a annoncé la sortie d'une nouvelle variété de riz Clearfield à haut rendement créée par la station expérimentale agricole de l'Arkansas pour les producteurs de riz en 2023. La nouvelle variété CLL18 est une variété de riz à grains longs, très performante et tolérante aux herbicides. Cette variété à haut rendement devrait offrir des avantages substantiels à l'industrie du riz, car elle a été spécifiquement conçue pour optimiser le rendement et les performances, et a subi des tests et des évaluations rigoureux.

- En janvier 2022, les sélectionneurs de riz de la station expérimentale agricole de l'Arkansas ont créé deux nouvelles variétés de riz conventionnelles qui surpassent leurs prédécesseurs en termes de potentiel de rendement. La variété à grain moyen, officiellement appelée Taurus, a donné un potentiel de rendement moyen de 232 boisseaux par acre lors des essais de développement de variétés de riz de l'Arkansas de 2021.

Ainsi, la diffusion et le développement continus de variétés de riz représentent un développement significatif dans le domaine de l’agriculture et sont sur le point d’avoir un impact majeur sur la production de riz dans les années à venir, ce qui devrait stimuler la croissance du marché.

Opportunité

COLLABORATION ACTIVE, LANCEMENTS ET EFFORTS PROMOTIONNELS DES PRINCIPAUX ACTEURS DU MARCHÉ

Pour faire face à la demande croissante de riz parmi les consommateurs, les principaux acteurs du marché du riz en Amérique du Nord procèdent à divers développements et décisions stratégiques pour développer leurs activités. Des nouveaux lancements aux investissements en passant par les acquisitions, les principaux acteurs du marché font évoluer leurs pratiques commerciales et élargissent encore davantage leurs portefeuilles de produits.

Par exemple,

- En janvier 2023, selon Adgully, KRBL a annoncé le lancement de sa nouvelle campagne, « Basmati Rice Se No Compromise », en 2023. Avec cette campagne, India Gate agit sans équivoque comme un capitaine de catégorie, encourageant les consommateurs à choisir le basmati emballé plutôt que le basmati khulla (en vrac). Cette campagne aidera les consommateurs à concentrer leur attention sur l'entreprise.

- En juin 2022, Riceland Foods a dévoilé un nouveau partenariat avec Arva Intelligence, la coopérative orientant son action vers la collecte de données agronomiques et économiques liées à la production agricole de ses membres agriculteurs. Pour ses partenaires agriculteurs, Riceland s'engage à générer de la valeur grâce à la durabilité grâce à l'Ingrain Good Sustainability Initiative.

- En avril 2022, selon Business Standard Private Ltd. Pour que les consommateurs puissent préparer de véritables biryanis à la maison avec la plus grande commodité, LT Foods, une entreprise de produits alimentaires de consommation vieille de 70 ans, a lancé le kit Daawat Biryani. Au fil des ans, LT Foods a augmenté et renforcé sa part de marché en Inde, en Amérique du Nord, en Europe et au Moyen-Orient tout en élargissant sa clientèle à plus de 60 pays par tous les canaux. Parallèlement, LT Foods a amélioré sa gamme de produits grâce à l'innovation pour suivre l'évolution et les nouvelles tendances des clients dans le monde entier en se concentrant sur les plateformes de commodité et de santé, conformément à son plan de croissance.

- En mars 2022, LT Foods a annoncé l'acquisition de 51 % de Golden Star Trading Inc. ainsi que de sa marque Golden Star via sa filiale LT Foods America In. Cette acquisition aidera l'entreprise à étendre ses activités commerciales et à gagner une base de consommateurs plus large.

- En octobre 2020, Goya Foods, Inc. a annoncé un projet d'agrandissement d'une valeur de 80 millions de dollars pour son usine de fabrication et de distribution située au Texas. Cette expansion comprendra l'acquisition d'équipements de transformation alimentaire modernes et avancés, qui permettront à l'entreprise de doubler sa capacité de production, répondant ainsi à la demande croissante de ses produits.

Ainsi, de tels développements attireront davantage d’opportunités de croissance pour le marché du riz en Amérique du Nord et attireront de plus en plus de consommateurs vers ce marché.

Contraintes/Défis

CONTRAINTES CLIMATIQUES DANS LA PRODUCTION DE RIZ

Les changements dans les composantes naturelles et humaines des agroécosystèmes ont un impact direct sur les choix agricoles et la sécurité alimentaire. Les variations de température et de précipitations ont un impact direct sur la quantité et la qualité de la production de riz et ont un impact indirect sur la planification des opérations agricoles importantes et sur les effets économiques des ravageurs, des mauvaises herbes et des maladies. Les conditions météorologiques défavorables entravent également la chaîne d'approvisionnement et le transport. Les principaux facteurs climatiques qui peuvent avoir un impact négatif sur la production de riz en Amérique du Nord sont la température et les précipitations.

Le riz est une culture de saison chaude qui nécessite des températures élevées pour sa croissance et son développement. Aux États-Unis, le riz est généralement cultivé dans des régions où les températures moyennes varient entre 21 et 29 °C (70 à 85 °F) pendant la saison de croissance. Si les températures sont trop basses, la croissance de la plante de riz peut être retardée et le rendement peut être réduit. Le changement climatique devrait avoir un impact sur la production de riz dans le monde entier, y compris en Amérique du Nord. La hausse des températures et les changements dans les régimes de précipitations pourraient réduire les rendements et affecter la qualité du riz produit. En outre, les phénomènes météorologiques extrêmes tels que les ouragans, les tornades et les inondations peuvent également endommager les cultures de riz et perturber la production.

Par exemple,

- En septembre 2021, selon Science News, les riziculteurs de la vallée de Sacramento en Californie ont découvert une parcelle de terre poussiéreuse et stérile, dont le sol desséché craquait sous chaque pas. Une sécheresse dévastatrice a touché une grande partie de l'ouest des États-Unis, le sol est exposé et se réchauffe à des températures de 35 degrés Celsius (95 degrés Fahrenheit). Début 2020, la sécheresse a commencé et le temps s'est dégradé de plus en plus.

- En août 2021, selon un article de Scientific American, les températures nocturnes élevées peuvent également avoir un impact sur la production : chaque augmentation de 1 °C des températures nocturnes au-dessus de 35 °C entraîne une baisse de 10 % des rendements de riz. Les inondations et la sécheresse constituent également une menace pour la production, tout comme l'élévation du niveau de la mer qui pourrait submerger les terres cultivées de basse altitude dans l'eau salée, ce qui affecte également la production de riz.

L'utilisation généralisée du riz moderne encourage les agriculteurs à utiliser davantage de machines, en particulier en Amérique du Nord, ce qui entraîne un compactage du sol. L'engorgement permanent et la monoculture du riz ont souvent entraîné des déficits en microéléments, notamment en zinc et en soufre, ainsi que des toxicités, notamment en fer. La carence en zinc est le trouble le plus courant des microéléments chez le riz des zones humides en raison de ces contraintes climatiques pendant la production de riz qui devraient à terme affecter le marché du riz.

Impact post-COVID-19 sur le riz

L'incertitude causée par l'apparition de la pandémie de coronavirus (COVID-19) dans le monde a affecté et modifié la dynamique complète des industries nord-américaines menant à la pandémie et a eu un impact négatif sur la croissance de l'économie nord-américaine. Les effets peuvent être observés sur l'intensité et l'efficacité des efforts de confinement, les changements de comportement (éviter d'acheter et d'investir), les changements dans les habitudes de dépenses, les efforts de confinement sur les perturbations de l'offre, les séquelles du resserrement spectaculaire du marché sont observées, les prix des matières premières volatils et l'augmentation du fardeau de la dette. En raison de (COVID-19), tous les pays ont été confrontés à une crise à plusieurs niveaux comprenant des perturbations économiques nationales, une chute de la demande extérieure, un effondrement des prix et un effondrement de l'offre et de la demande des produits.

Après la pandémie, la demande de riz et de produits à base de riz a augmenté car il n'y aura plus de restrictions de mouvement, donc l'approvisionnement en produits sera facile. En outre, les entreprises ont développé leurs unités de transformation pour fabriquer des produits à base de riz, la demande dans l'industrie de transformation alimentaire, les ménages et l'industrie de la farine a également augmenté, ce qui pourrait propulser la croissance du marché.

De plus, la forte demande de riz stimulera la croissance du marché. En outre, la demande de riz dans les ménages et dans le commerce de détail après la pandémie de COVID-19 a augmenté. De plus, l'intérêt des consommateurs pour le riz pour ses bienfaits pour la santé et le développement de la recherche devraient alimenter la croissance du marché du riz en Amérique du Nord.

Développements récents

- En juin 2022, Riceland Foods a dévoilé un nouveau partenariat avec Arva Intelligence, la coopérative orientant son action vers la collecte de données agronomiques et économiques liées à la production agricole de ses membres agriculteurs. Pour ses partenaires agriculteurs, Riceland s'engage à générer de la valeur grâce à la durabilité grâce à l'Ingrain Good Sustainability Initiative.

- En octobre 2020, Goya Foods, Inc. a annoncé un projet d'agrandissement d'une valeur de 80 millions de dollars pour son usine de fabrication et de distribution située au Texas. Cette expansion comprendra l'acquisition d'équipements de transformation alimentaire modernes et avancés, qui permettront à l'entreprise de doubler sa capacité de production, répondant ainsi à la demande croissante de ses produits.

Portée du marché du riz en Amérique du Nord

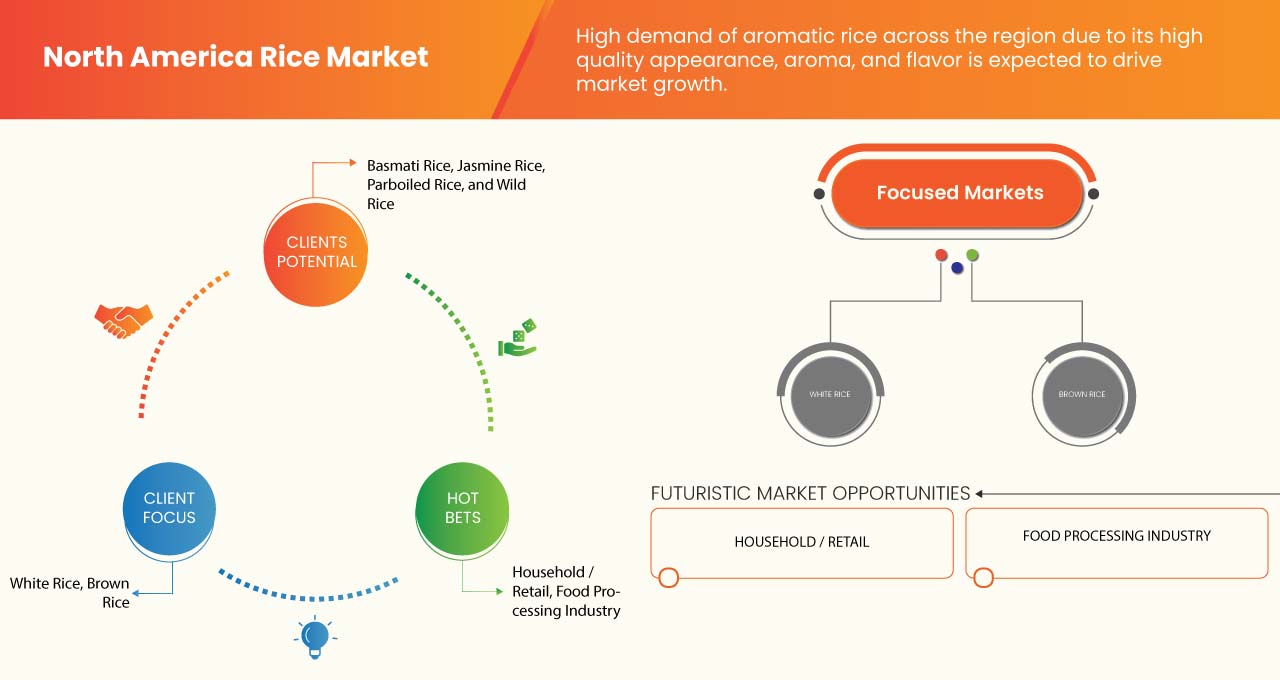

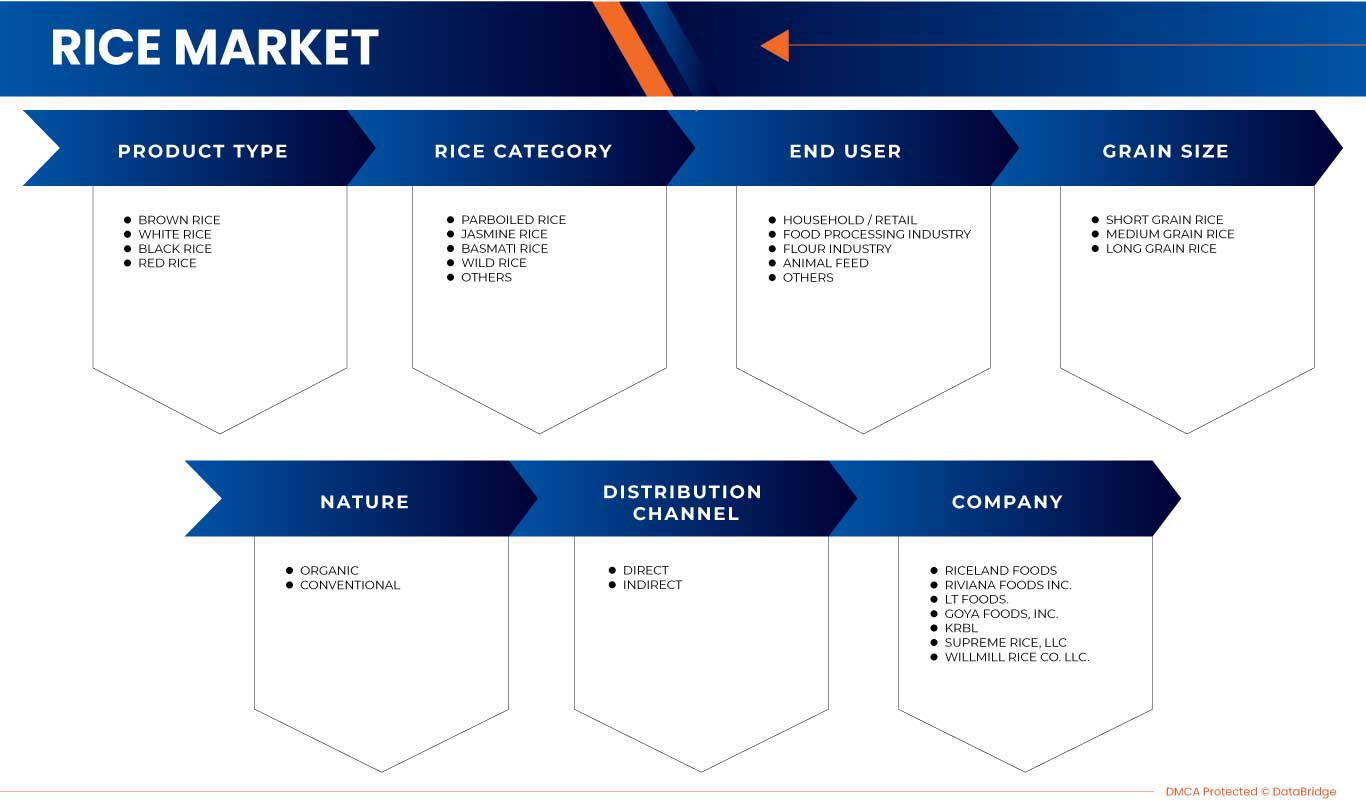

Le marché nord-américain du riz est segmenté en six segments notables en fonction du type de produit, de la catégorie de riz, de la granulométrie, de la nature, de l'utilisateur final et du canal de distribution. La croissance de ces segments vous aidera à analyser les principaux segments de croissance des industries et à fournir aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour prendre des décisions stratégiques afin d'identifier les principales applications du marché.

PAR TYPE DE PRODUIT

- Riz brun

- Riz blanc

- Riz noir

- Riz rouge

Sur la base du type de produit, le marché du riz en Amérique du Nord est segmenté en riz brun, riz blanc, riz noir et riz rouge.

PAR CATÉGORIE DE RIZ

- Riz étuvé

- Riz au jasmin

- Riz Basmati

- Riz sauvage

- Autres

Sur la base de la catégorie de riz, le marché du riz en Amérique du Nord est segmenté en riz étuvé, riz au jasmin, riz basmati, riz sauvage et autres.

PAR GRAIN

- Riz à grains courts

- Riz à grains moyens

- Riz à grains longs

Sur la base de la granulométrie, le marché nord-américain du riz est segmenté en riz à grains courts, riz à grains moyens et riz à grains longs.

PAR NATURE

- Organique

- Conventionnel

Sur la base de la nature, le marché du riz nord-américain est segmenté en biologique et conventionnel.

PAR UTILISATEUR FINAL

- Ménage/Commerce de détail

- Industrie de transformation des aliments

- Industrie de la farine

- Alimentation animale

- Autres

Sur la base de l'utilisateur final, le marché du riz en Amérique du Nord est segmenté en produits ménagers/de détail, industrie de transformation alimentaire, industrie de la farine, aliments pour animaux, etc.

PAR CANAL DE DISTRIBUTION

- Direct

- Indirect

Sur la base du canal de distribution, le marché du riz en Amérique du Nord est segmenté en direct et indirect.

Analyse/perspectives régionales du marché du riz en Amérique du Nord

Le marché du riz en Amérique du Nord est analysé et des informations sur la taille et les tendances du marché sont fournies sur la base des références ci-dessus.

Les pays du marché du riz en Amérique du Nord sont les États-Unis, le Canada et le Mexique.

Les États-Unis dominent le marché du riz en Amérique du Nord avec un TCAC d'environ 3,4 %. Les États-Unis dominent le marché du riz en Amérique du Nord en raison de la forte préférence des consommateurs pour le riz.

La section pays du rapport fournit également des facteurs individuels d'impact sur le marché et des changements dans la réglementation du marché qui ont un impact sur les tendances actuelles et futures du marché. L'analyse des points de données en aval et en amont de la chaîne de valeur, l'analyse des tendances techniques des cinq forces de Porter et les études de cas sont quelques-uns des indicateurs utilisés pour prévoir le scénario de marché pour les différents pays. En outre, la présence et la disponibilité des marques nord-américaines et les défis auxquels elles sont confrontées en raison de la concurrence importante ou rare des marques locales et nationales, l'impact des tarifs nationaux et les routes commerciales sont pris en compte tout en fournissant une analyse prévisionnelle des données nationales.

Analyse du paysage concurrentiel et des parts de marché du riz en Amérique du Nord

Le paysage concurrentiel du marché nord-américain du riz fournit des détails par concurrents. Les détails inclus sont la présentation de l'entreprise, les finances de l'entreprise, les revenus générés, le potentiel du marché, les investissements dans la recherche et le développement, les nouvelles initiatives du marché, les sites et installations de production, les forces et les faiblesses de l'entreprise, le lancement de produits, les pipelines d'essais de produits, les approbations de produits, les brevets, la largeur et l'étendue du produit, la domination des applications, la courbe de survie technologique. Les points de données ci-dessus fournis ne concernent que l'orientation des entreprises par rapport au marché nord-américain du riz.

Certains des principaux acteurs opérant sur le marché du riz en Amérique du Nord sont Riceland Foods., St. Maries Wild Rice & Ankeny Lakes Wild Rice Company, Doguet's Rice Milling Company, Supreme Rice, LLC, Koda Farms, Inc., Martin Rice Company, SunWest Foods., Goya Foods, Inc., LT Foods., Robbins Rice Company, Riviana Foods Inc., Kohinoor Foods Ltd., KRBL, PLANETRICE et Willmill Rice Co. LLC, entre autres.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.