Marché nord-américain de la 5G RF sur fibre optique, par composant (matériel et services), bande de fréquence (bande L, bande S, bande C, bande K, bande X, bande KU et bande KA), gamme de fréquences (moins de 30 GHz, de 30 GHz à 40 GHz, de 40 GHz à 50 GHz, plus de 50 GHz), taille de l'organisation (organisations à petite échelle, organisations à moyenne échelle et organisations à grande échelle), application (cellulaire, satellite de communication, radiodiffusion, sécurité publique, navigation, haut débit et radar). Utilisateur final (télécommunications, gouvernement et armée, mines, tunnels et systèmes souterrains/de métro, civil, aéronefs/UAV, automobile (V2X), commercial, stations terrestres de satellites et autres), - Tendances et prévisions de l'industrie jusqu'en 2029

Analyse et taille du marché de la 5G RF sur fibre optique en Amérique du Nord

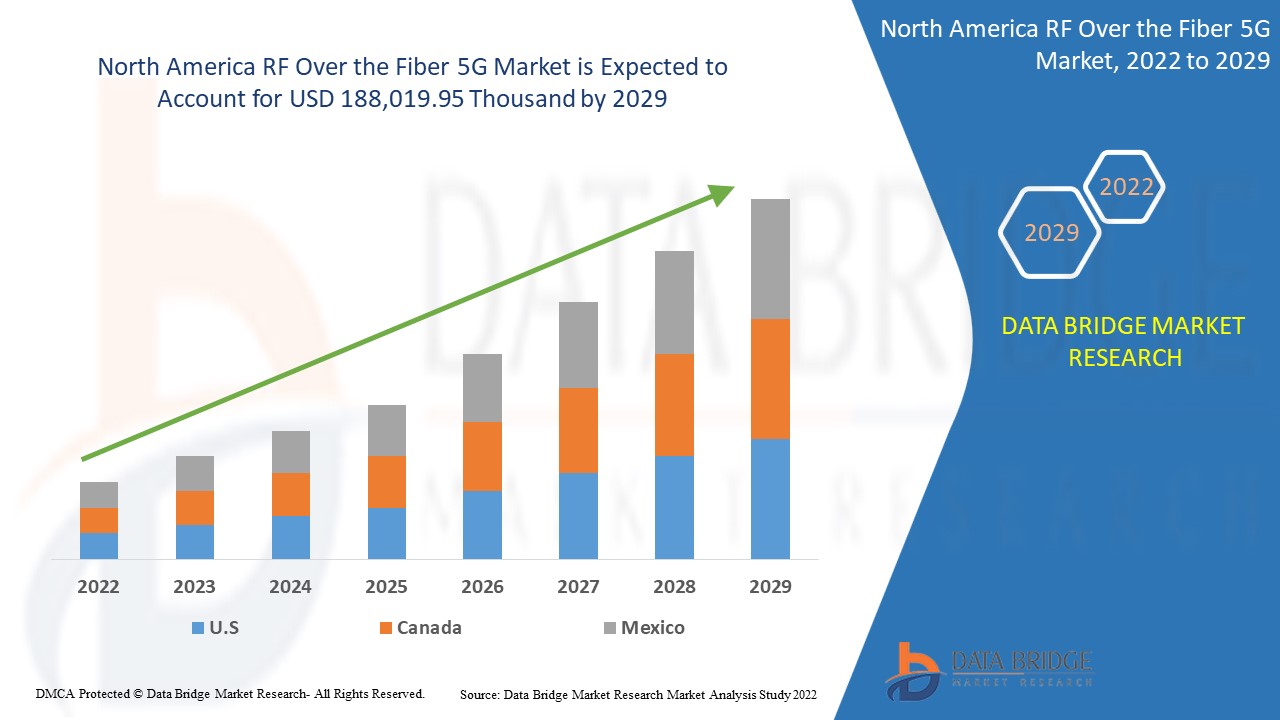

Data Bridge Market Research estime que le marché de la RF sur fibre 5G devrait atteindre la valeur de 188 019,95 milliers de dollars d'ici 2029, à un TCAC de 22,5 % au cours de la période de prévision. Le « matériel » représente le segment d'offre le plus important sur le marché de la RF sur fibre 5G. Le rapport sur le marché de la RF sur fibre 5G couvre également en profondeur l'analyse des prix, l'analyse des brevets et les avancées technologiques.

|

Rapport métrique |

Détails |

|

Période de prévision |

2022 à 2029 |

|

Année de base |

2021 |

|

Années historiques |

2020 (personnalisable de 2019 à 2015) |

|

Unités quantitatives |

Chiffre d'affaires en milliers de dollars américains, volumes en unités, prix en dollars américains |

|

Segments couverts |

Par composant (matériel et services), bande de fréquence (bande L, bande S, bande C, bande K, bande X, bande KU et bande KA), plage de fréquence (moins de 30 GHz, de 30 GHz à 40 GHz, de 40 GHz à 50 GHz, plus de 50 GHz), taille de l'organisation (organisations à petite échelle, organisations à moyenne échelle et organisations à grande échelle), application (cellulaire, satellite de communication, radiodiffusion, sécurité publique, navigation, haut débit et radar). Utilisateur final (télécommunications, gouvernement et armée, mines, tunnels et systèmes souterrains/de métro, civil, aéronefs/UAV, automobile (V2X), commercial, stations terrestres de satellites et autres) |

|

Pays couverts |

États-Unis, Canada et Mexique |

|

Acteurs du marché couverts |

SEIKOH GIKEN Co., Ltd., ETL Systems Ltd, EMCORE Corporation, DEV Systemtechnik GmbH, Narda-MITEQ, Syntonics LLC, Intelibs, Inc., Olabs Technology Company Limited, Octane Wireless, II-VI Incorporated, global Invacom. MicroComp Nordic AB, Broadcom, APIC Corporation, VectraWave, G&H Group, HUBER + SHUNER, RFOptic, Optical Zonu Corp, ViaLite, Global Foxcom, Glenair, entre autres. |

Définition du marché

RF sur fibre (RFoF) fait référence à une technologie dans laquelle un signal de lumière modulée par radiofréquence est transmis via une liaison à fibre optique. Le signal est ensuite transmis via un câble à fibre optique jusqu'à sa destination. La numérisation croissante des entreprises a augmenté la demande de vitesse, ainsi le segment 5G en RF sur fibre augmente. La RF sur fibre est utilisée pour convertir et transmettre des signaux radio via des câbles. Cette technologie a gagné en importance en raison de ses applications variées et de son rapport coût-efficacité. Au début de l'ère de la transmission, on utilisait des câbles en cuivre ou coaxiaux, qui ont été remplacés par des fibres optiques. À ce jour, les solutions RF sur fibre sont utilisées par l'industrie du divertissement et de la navigation. De nombreuses nouvelles applications font leur apparition sur le marché chaque jour, nécessitant des solutions RF sur fibre en raison de leurs propriétés uniques.

Dynamique du marché de la RF sur fibre 5G

Cette section traite de la compréhension des moteurs, des avantages, des opportunités, des contraintes et des défis du marché. Tout cela est discuté en détail ci-dessous :

Conducteurs

- Avènement des solutions de fibre optique à haut débit.

La fibre optique est une technologie moderne utilisée principalement dans le secteur des télécommunications pour transmettre des informations de manière numérique sous forme d'impulsions lumineuses à travers des brins de fibre en verre. La transmission de données à haut débit est possible grâce à l'éclatement ou à la superposition des données sous forme de signaux lumineux, ce qui permet une vitesse de transmission de données élevée sur une longue distance sans atténuation. À mesure que le nombre d'utilisateurs d'Internet augmente, la quantité de bande passante disponible par utilisateur augmente également, ce qui accroît la demande de fibre optique à haut débit sur le marché.

- Pénétration croissante des téléphones mobiles et tablettes GSM

Les téléphones portables numériques sans fil modernes doivent fonctionner comme un véritable centre de communication qui offre toute la gamme de fonctionnalités intelligentes de l'industrie cellulaire. Celles-ci incluent diverses fonctionnalités telles que la navigation Web, la messagerie électronique, le PDA sans fil, la fonction de mémo vocal, la radiomessagerie bidirectionnelle, le répondeur et le système de positionnement global (GPS) dans une seule entité.

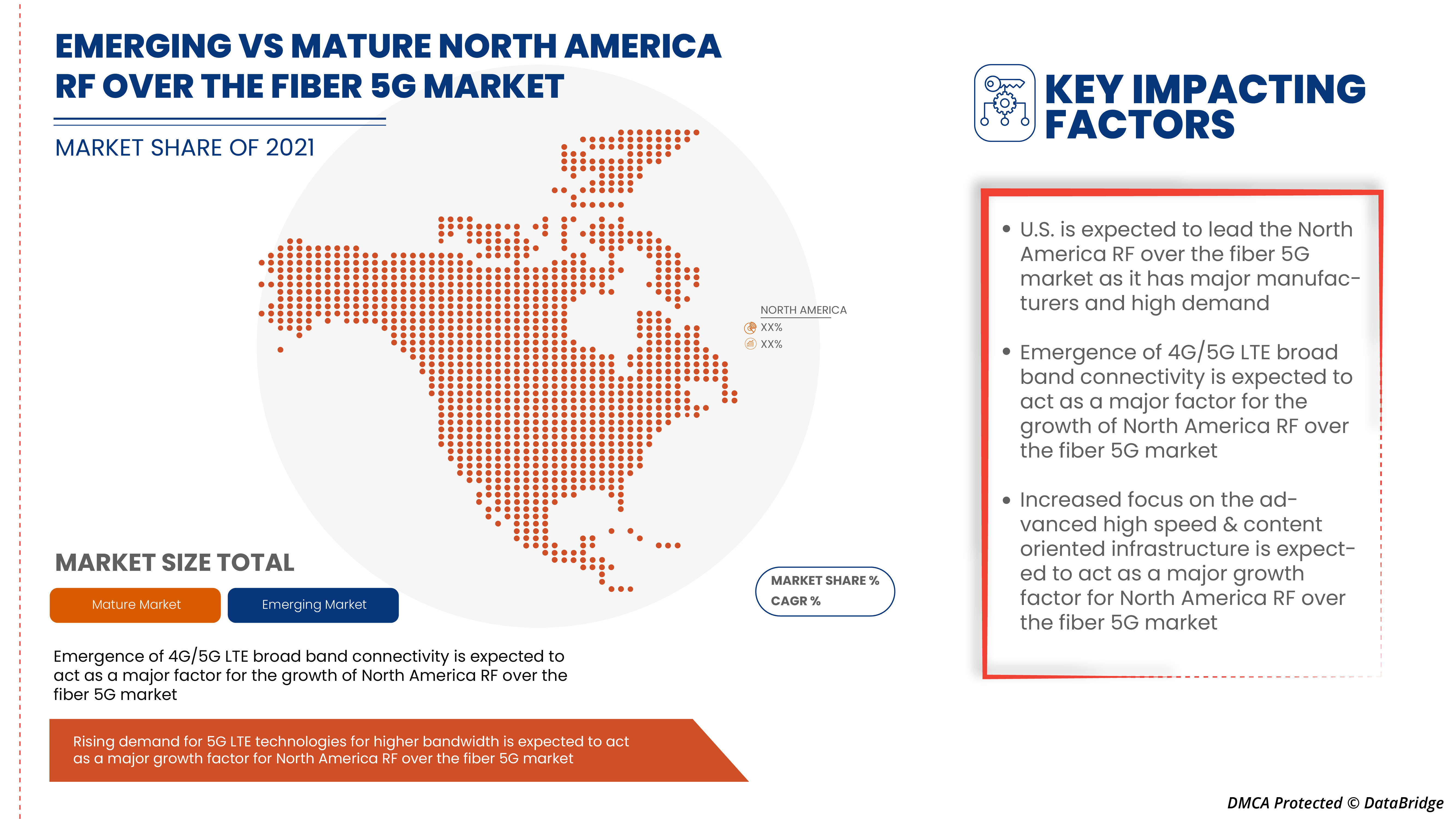

- Émergence de la connectivité haut débit LTE 4G/5G

La 4G/5G est la prochaine génération de technologie cellulaire sans fil. Elle fournira des débits de données élevés allant jusqu'à 3000 Mbps (3 Gbps) dans le monde réel. Les smartphones et autres appareils intelligents bénéficieront énormément de la 5G. L'Internet des objets (IoT) bénéficiera également énormément de la vitesse et de la bande passante fournies par la 5G. De plus, le réseau 5G peut également améliorer les capacités de connectivité et de communication, car la LTE/5G peut offrir des vitesses de communication beaucoup plus élevées à un coût nettement inférieur.

Retenue/Défis

- Limites technologiques des fibres optiques RF

La fibre optique est la méthode de choix pour la transmission fiable de données à large bande passante. La communication par fibre optique repose sur la superposition de données sous forme de signaux lumineux qui peuvent se propager sur un support beaucoup plus rapidement que d'autres modes de transmission de données. Cependant, il existe peu de limitations technologiques qui constituent un obstacle, l'une des limitations les plus importantes de la fibre étant sa fragilité. Les fibres optiques sont généralement constituées de verre, les câbles à fibre optique sont plus fins et plus légers que les câbles métalliques, ce qui rend la fibre plus sujette aux dommages. L'exposition aux produits chimiques ou aux radiations peut endommager un réseau de fibre optique, et ses câbles fragiles peuvent facilement être coupés lors de rénovations de bâtiments et autres.

- Coût d'investissement initial élevé pour les fibres optiques RF

Le réseau RF sur fibre (RFoF) offre plusieurs avantages tels qu'une bande passante élevée, une vitesse élevée et un faible poids, mais tout cela s'accompagne d'un coût d'investissement élevé. Les composants du réseau à fibre optique sont assez chers. C'est pourquoi d'autres câbles traditionnels sont toujours préférés, lorsque le coût est un facteur majeur dans le choix du type de réseau.

Impact post-COVID-19 sur le marché de la 5G RF sur fibre optique

La COVID-19 a eu un impact considérable sur le marché de la RF sur fibre 5G, car presque tous les pays ont opté pour la fermeture de toutes les installations de production, à l'exception de celles qui produisent les biens essentiels. Le gouvernement a pris des mesures strictes telles que l'arrêt de la production et de la vente de biens non essentiels, le blocage du commerce international et bien d'autres pour empêcher la propagation de la COVID-19. Les seules entreprises en activité dans cette situation de pandémie étaient les services essentiels autorisés à ouvrir et à exécuter les processus.

La croissance du marché de la RF sur fibre 5G augmente en raison des politiques gouvernementales visant à stimuler le commerce international après le Covid. De plus, les avantages offerts par la RF sur fibre 5G pour optimiser les coûts et les itinéraires augmentent la demande de RF sur fibre 5G sur le marché. Cependant, des facteurs tels que la congestion associée aux routes commerciales et les restrictions commerciales entre certains pays freinent la croissance du marché. La fermeture des installations de production pendant la situation de pandémie a eu un impact significatif sur le marché.

Les fabricants prennent diverses décisions stratégiques pour rebondir après la COVID-19. Les acteurs mènent de nombreuses activités de recherche et développement pour améliorer la technologie impliquée dans la RF sur fibre 5G. Grâce à cela, les entreprises apporteront au marché des solutions avancées et précises. En outre, les initiatives gouvernementales visant à stimuler le commerce international ont conduit à la croissance du marché.

Développement récent

- En mai 2022, EMCORE Corporation a annoncé avoir finalisé l'acquisition de l'activité spatiale et de navigation de L3Harris. Cette acquisition aidera l'entreprise à élargir son portefeuille de produits de navigation inertielle sur le marché.

- En mars 2022, SEIKOH GIKEN CO., LTD. a annoncé sa participation à la conférence et à l'exposition sur la communication par fibre optique 2022 à San Diego, en Californie. L'entreprise présente différents produits tels que le connecteur duplex LC Intelli-cross, le petit réseau de fibres, l'adaptateur et bien d'autres. La conférence aidera l'entreprise à attirer davantage de clients sur le marché.

Portée du marché de la RF sur fibre 5G

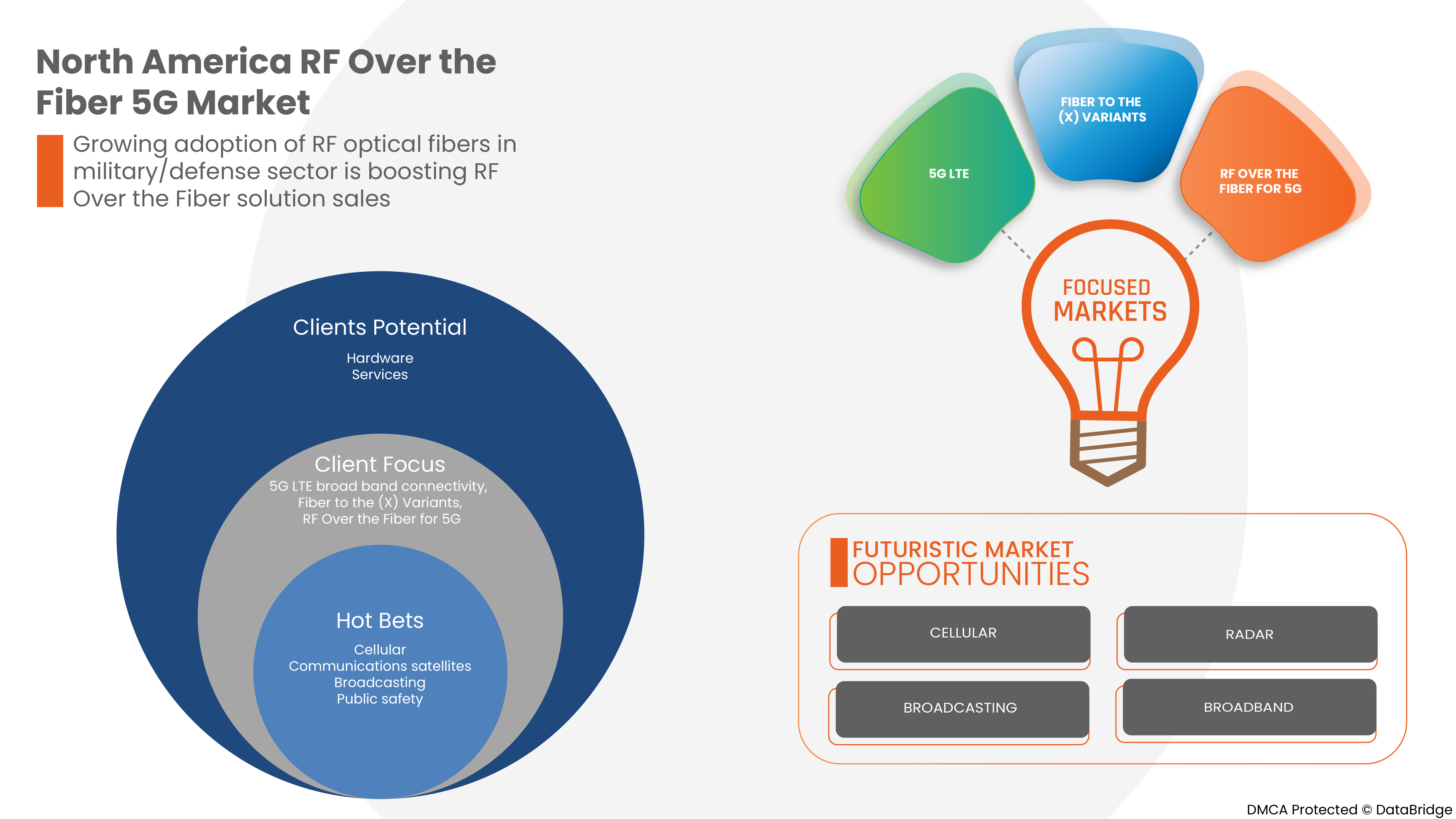

Le marché RF sur fibre 5G est segmenté en fonction du composant, de la bande de fréquence, de la plage de fréquence, de la taille de l'organisation, de l'application et de l'utilisateur final. La croissance parmi ces segments vous aidera à analyser les segments de croissance faibles dans les industries et fournira aux utilisateurs un aperçu précieux du marché et des informations sur le marché pour les aider à prendre des décisions stratégiques pour identifier les principales applications du marché.

Par composant

- Matériel

- Service

Sur la base des modules, le marché RF sur fibre 5G est segmenté en matériel et service

Par bande de fréquence

- Bande L

- Bande S

- Bande Ka

- Bande C

- Bande K

- Bande X

- Bande Ku

Sur la base de la bande de fréquence, le marché RF sur fibre 5G est segmenté en bande L, bande S, bande C, bande K, bande X, bande KU et bande KA.

Par utilisateur final

- Télécommunication,

- Gouvernement et armée,

- Mines, tunnels et systèmes souterrains/métro,

- Civil,

- Avion / Drone ,

- Automobile (V2X),

- Commercial,

- Stations terrestres de satellites

- Autres

Sur la base de l'utilisateur final, le marché RF sur fibre 5G est segmenté en télécommunications ; gouvernement et militaire ; mines, tunnels et systèmes souterrains/de métro ; civil ; aéronefs/UAV ; automobile (V2X) ; commercial ; stations terrestres par satellite et autres.

Par gamme de fréquences

- Moins de 30 GHz

- 30 GHz à 40 GHz

- 40 GHz à 50 GHz

- Plus de 50 GHz

Sur la base de la gamme de fréquences, le marché RF sur fibre 5G est segmenté en moins de 30 GHz, 30 GHz à 40 GHz, 40 GHz à 50 GHz, plus de 50 GHz.

Par taille d'organisation

- Organisations à grande échelle

- Organisations de taille moyenne

- Organisations à petite échelle

Sur la base de la taille de l’organisation, le marché RF sur fibre 5G est segmenté en organisations à petite échelle, organisations à moyenne échelle et organisations à grande échelle.

Par application

- Télécommunications

- Diffuser

- Navigation

- Radar

- Haut débit

Sur la base des applications, le marché RF sur fibre 5G est segmenté en téléphonie cellulaire, satellite de communication, radiodiffusion, sécurité publique, navigation, haut débit et radar.

Analyse/perspectives régionales du marché de la 5G RF sur fibre

Le marché RF sur fibre 5G est analysé et des informations et tendances sur la taille du marché sont fournies par pays, composant, bande de fréquence, plage de fréquence, taille de l'organisation, application et utilisateur final, comme référencé ci-dessus.

Les pays couverts par le rapport sur le marché de la fibre 5G RF sont les États-Unis, le Canada et le Mexique.

L'Amérique du Nord domine le marché de la 5G RF sur fibre. La Chine devrait connaître la croissance la plus rapide sur ce marché. Les développements croissants des infrastructures, du commerce et de l'industrie dans les pays émergents comme l'Afrique du Sud, la Chine et les États-Unis sont à l'origine de la domination du marché.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and RF Over the Fiber 5G Market Share Analysis

The RF over the fiber 5G market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to RF over the fiber 5G market.

Some of the major key players operating in the RF over the fiber 5G market are SEIKOH GIKEN Co., Ltd., ETL Systems Ltd, EMCORE Corporation, DEV Systemtechnik GmbH, Narda-MITEQ, Syntonics LLC, Intelibs, Inc., Olabs Technology Company Limited, Octane Wireless, II-VI Incorporated, and global Invacom. MicroComp Nordic AB, Broadcom, APIC Corporation , VectraWave, G&H Group, HUBER + SHUNER, RFOptic, Optical Zonu Corp, ViaLite, Global Foxcom, Glenair among others.

SKU-

Accédez en ligne au rapport sur le premier cloud mondial de veille économique

- Tableau de bord d'analyse de données interactif

- Tableau de bord d'analyse d'entreprise pour les opportunités à fort potentiel de croissance

- Accès d'analyste de recherche pour la personnalisation et les requêtes

- Analyse de la concurrence avec tableau de bord interactif

- Dernières actualités, mises à jour et analyse des tendances

- Exploitez la puissance de l'analyse comparative pour un suivi complet de la concurrence

Table des matières

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF NORTH AMERICA RF OVER THE FIBER 5G MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 YEARS CONSIDERED FOR THE STUDY

2.3 GEOGRAPHIC SCOPE

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET END-USER COVERAGE GRID

2.9 MULTIVARIATE MODELLING

2.1 COMPONENT CURVE

2.11 CHALLENGE MATRIX

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTERS FIVE FORCES

4.2 PRICE ANALYSIS

4.3 TECHNOLOGICAL TRENDS

4.4 REGULATORY FRAMEWORK

4.4.1 EUROPE

4.4.2 U.S.

4.4.3 INDIA

4.5 VALUE CHAIN ANALYSIS

4.6 CASE STUDIES

4.6.1 CASE STUDY 1- BELOW CASE STUDY WAS CONDUCTED BY VIALIGHT COMMUNICATIONS

4.6.2 CASE STUDY 2- BELOW CASE STUDY WAS CONDUCTED BY RF OPTICS

4.6.3 CASE STUDY 3- BELOW CASE STUDY WAS CONDUCTED BY DEV

4.6.4 CASE STUDY 3- BELOW CASE STUDY WAS CONDUCTED BY RF INDUSTRIES

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ADVENT OF HIGH-SPEED FIBER OPTICAL SOLUTIONS

5.1.2 GROWING PENETRATION OF GSM MOBILE PHONES & TABLETS

5.1.3 EMERGENCE OF 4G/5G LTE BROADBAND CONNECTIVITY

5.1.4 EFFICIENT PERFORMANCE OFFERED BY FIBER OPTIC CABLE

5.2 RESTRAINTS

5.2.1 TECHNOLOGICAL LIMITATIONS OF RF OPTICAL FIBERS

5.2.2 HIGH INITIAL COST OF INVESTMENT FOR RF OPTICAL FIBERS

5.3 OPPORTUNITIES

5.3.1 GROWING ADOPTION OF RF OPTICAL FIBERS IN MILITARY/DEFENSE SECTOR

5.3.2 GROWING NEED FOR FIBER TO THE (X) (FTTX) VARIANTS

5.3.3 INCREASED FOCUS ON THE ADVANCED HIGH-SPEED & CONTENT-ORIENTED INFRASTRUCTURE

5.3.4 IMPORTANCE OF RF OVER FIBER (RFOF) TRANSCEIVER

5.4 CHALLENGES

5.4.1 DIFFICULTY IN IMPLEMENTING THE RF OPTICAL FIBERS ON TRADITIONAL INFRASTRUCTURE

6 NORTH AMERICA RF OVER FIBER 5G MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 TRANSCEIVERS

6.2.1.1 SFF & SFP

6.2.1.2 SFP+ & SFP28

6.2.1.3 QSFP, QSEP+, QSFP14 & QSFP28

6.2.1.4 CFP, CFP2 & CFP4

6.2.1.5 CXP

6.2.1.6 XFP

6.2.2 OPTICAL AMPLIFIERS

6.2.2.1 SEMICONDUCTOR OPTICAL AMPLIFIERS

6.2.2.2 ERBIUM-DOPED FIBER AMPLIFIERS

6.2.2.3 FIBER RAMAN AMPLIFIERS

6.2.3 ANTENNAS

6.2.4 OPTICAL SWITCHES

6.2.4.1 ALL-OPTICAL SWITCH

6.2.4.2 ELECTRO-OPTICAL SWITCH

6.2.5 OPTICAL CABLES

6.2.5.1 SINGLE MODE

6.2.5.2 MULTIMODE

6.2.6 OTHERS

6.3 SERVICE

6.3.1 INSTALLATION SERVICES

6.3.2 REPAIR AND MAINTENANCE

7 NORTH AMERICA RF OVER FIBER 5G MARKET, BY FREQUENCY BAND

7.1 OVERVIEW

7.2 L BAND

7.3 S BAND

7.4 KA BAND

7.5 C BAND

7.6 K BAND

7.7 X BAND

7.8 KU BAND

8 NORTH AMERICA RF OVER FIBER 5G MARKET, BY FREQUENCY RANGE

8.1 OVERVIEW

8.2 LESS THAN 30 GHZ

8.3 30 GHZ TO 40 GHZ

8.4 40 GHZ TO 50 GHZ

8.5 MORE THAN 50 GHZ

9 NORTH AMERICA RF OVER FIBER 5G MARKET, BY ORGANIZATION SIZE

9.1 OVERVIEW

9.2 LARGE SCALE ORGANIZATIONS

9.3 MEDIUM SCALE ORGANIZATIONS

9.4 SMALL SCALE ORGANIZATIONS

10 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 CELLULAR

10.2.1 HARDWARE

10.2.1.1 TRANSCEIVERS

10.2.1.2 OPTICAL AMPLIFIERS

10.2.1.3 ANTENNAS

10.2.1.4 OPTICAL SWITCHES

10.2.1.5 OPTICAL CABLES

10.2.1.6 OTHERS

10.2.2 SERVICE

10.2.2.1 INSTALLATION SERVICES

10.2.2.2 REPAIR AND MAINTENANCE

10.2.3 BY APPLICATION

10.2.3.1 CELLULAR COMMUNICATION

10.2.3.2 DAS SOLUTION

10.2.3.3 FTTX

10.2.3.4 TRAFIC STEERING

10.3 COMMUNICATIONS SATELLITES

10.3.1 HARDWARE

10.3.1.1 TRANSCEIVERS

10.3.1.2 OPTICAL AMPLIFIERS

10.3.1.3 ANTENNAS

10.3.1.4 OPTICAL SWITCHES

10.3.1.5 OPTICAL CABLES

10.3.1.6 OTHERS

10.3.2 SERVICE

10.3.2.1 INSTALLATION SERVICES

10.3.2.2 REPAIR AND MAINTENANCE

10.4 BROADCASTING

10.4.1 HARDWARE

10.4.1.1 TRANSCEIVERS

10.4.1.2 OPTICAL AMPLIFIERS

10.4.1.3 ANTENNAS

10.4.1.4 OPTICAL SWITCHES

10.4.1.5 OPTICAL CABLES

10.4.1.6 OTHERS

10.4.2 SERVICE

10.4.2.1 INSTALLATION SERVICES

10.4.2.2 REPAIR AND MAINTENANCE

10.5 PUBLIC SAFETY

10.5.1 HARDWARE

10.5.1.1 TRANSCEIVERS

10.5.1.2 OPTICAL AMPLIFIERS

10.5.1.3 ANTENNAS

10.5.1.4 OPTICAL SWITCHES

10.5.1.5 OPTICAL CABLES

10.5.1.6 OTHERS

10.5.2 SERVICE

10.5.2.1 INSTALLATION SERVICES

10.5.2.2 REPAIR AND MAINTENANCE

10.6 RADAR

10.6.1 HARDWARE

10.6.1.1 TRANSCEIVERS

10.6.1.2 OPTICAL AMPLIFIERS

10.6.1.3 ANTENNAS

10.6.1.4 OPTICAL SWITCHES

10.6.1.5 OPTICAL CABLES

10.6.1.6 OTHERS

10.6.2 SERVICE

10.6.2.1 INSTALLATION SERVICES

10.6.2.2 REPAIR AND MAINTENANCE

10.7 NAVIGATION

10.7.1 HARDWARE

10.7.1.1 TRANSCEIVERS

10.7.1.2 OPTICAL AMPLIFIERS

10.7.1.3 ANTENNAS

10.7.1.4 OPTICAL SWITCHES

10.7.1.5 OPTICAL CABLES

10.7.1.6 OTHERS

10.7.2 SERVICE

10.7.2.1 INSTALLATION SERVICES

10.7.2.2 REPAIR AND MAINTENANCE

10.8 BROADBAND

10.8.1 HARDWARE

10.8.1.1 TRANSCEIVERS

10.8.1.2 OPTICAL AMPLIFIERS

10.8.1.3 ANTENNAS

10.8.1.4 OPTICAL SWITCHES

10.8.1.5 OPTICAL CABLES

10.8.1.6 OTHERS

10.8.2 SERVICE

10.8.2.1 INSTALLATION SERVICES

10.8.2.2 REPAIR AND MAINTENANCE

11 NORTH AMERICA RF OVER FIBER 5G MARKET, BY END USER

11.1 OVERVIEW

11.2 TELECOMMUNICATION

11.3 GOVERNMENT AND MILITARY

11.4 SATELLITE GROUND STATIONS

11.5 AIRCRAFT /UAV

11.6 MINES, TUNNELS AND UNDERGROUND/SUBWAY SYSTEMS

11.7 AUTOMOTIVE (V2X)

11.8 CIVIL

11.9 COMMERCIAL

11.9.1 FINANCIAL INSTITUTION

11.9.2 SHOPPING-MALLS AND RETAIL

11.9.3 AIRPORTS

11.9.4 CONCERT HALLS AND STADIUM

11.9.5 OTHERS

11.1 OTHERS

12 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY REGION

12.1 NORTH AMERICA

12.1.1 U.S.

12.1.2 CANADA

12.1.3 MEXICO

13 NORTH AMERICA RF OVER FIBER 5G MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: NORTH AMERICA

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 HUBER+SUHNER

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 BROADCOM

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 GLENAIR

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 II-VI INCORPORATED

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 SEIKOH GIKEN CO., LTD.

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 PRODUCT PORTFOLIO

15.5.4 RECENT DEVELOPMENT

15.6 APIC CORPORATION

15.6.1 COMPANY SNAPSHOT

15.6.2 PRODUCT PORTFOLIO

15.6.3 RECENT DEVELOPMENTS

15.7 DEV SYSTEMTECHNIK GMBH

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENT

15.8 ELKAY

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 ETL SYSTEMS LTD

15.9.1 COMPANY SNAPSHOT

15.9.2 PRODUCT PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 EMCORE CORPORATION

15.10.1 COMPANY SNAPSHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENTS

15.11 NORTH AMERICA FOXCOM

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 G&H GROUP

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 NORTH AMERICA INVACOM

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 INTELIBS, INC.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 MICROWAVE PHOTONIC SYSTEMS, INC.

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENT

15.16 MICROCOMP NORDIC AB

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 NARDA-MITEQ

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 OPTICAL ZONU CORP

15.18.1 COMPANY SNAPSHOT

15.18.2 PRODUCT PORTFOLIO

15.18.3 RECENT DEVELOPMENTS

15.19 OCTANE WIRELESS

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENT

15.2 OLABS TECHNOLOGY COMPANY LIMITED

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 RFOPTIC

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 SYNTONICS LLC

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENT

15.23 VECTRAWAVE

15.23.1 COMPANY SNAPSHOT

15.23.2 PRODUCT PORTFOLIO

15.23.3 RECENT DEVELOPMENTS

15.24 VIALITE

15.24.1 COMPANY SNAPSHOT

15.24.2 PRODUCT PORTFOLIO

15.24.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Liste des tableaux

TABLE 1 PRICE RANGE OF COMPONENTS USED IN RF OVER FIBER 5G SYSTEMS

TABLE 2 DIFFERENT RF OVER FIBER (RFOF) TRANSCEIVER KEY CHARACTERISTICS

TABLE 3 NORTH AMERICA RF OVER FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 4 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 5 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 6 NORTH AMERICA TRANSCEIVERS IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 7 NORTH AMERICA OPTICAL AMPLIFIERS IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 8 NORTH AMERICA OPTICAL AMPLIFIERS IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 9 NORTH AMERICA OPTICAL CABLES IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 10 NORTH AMERICA SERVICE IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 NORTH AMERICA SERVICE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 12 NORTH AMERICA RF OVER FIBER 5G MARKET, BY FREQUENCY BAND, 2020-2029 (USD THOUSAND)

TABLE 13 NORTH AMERICA L BAND IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 14 NORTH AMERICA S BAND IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 NORTH AMERICA KA BAND IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 NORTH AMERICA C BAND IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 17 NORTH AMERICA K BAND IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 NORTH AMERICA X BAND IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 19 NORTH AMERICA KU BAND IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 NORTH AMERICA RF OVER FIBER 5G MARKET, BY FREQUENCY RANGE, 2020-2029 (USD THOUSAND)

TABLE 21 NORTH AMERICA LESS THAN 30 GHZ IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 NORTH AMERICA 30 GHZ TO 40 GHZ IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 23 NORTH AMERICA 40 GHZ TO 50 GHZ IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 NORTH AMERICA MORE THAN 50 GHZ IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 25 NORTH AMERICA RF OVER FIBER 5G MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 26 NORTH AMERICA LARGE SCALE ORGANIZATIONS IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 27 NORTH AMERICA MEDIUM SCALE ORGANIZATIONS IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 NORTH AMERICA SMALL SCALE ORGANIZATIONS IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 29 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 30 NORTH AMERICA CELLULAR IN RF OVER FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 31 NORTH AMERICA CELLULAR IN RF OVER FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 32 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 NORTH AMERICA SERVICES IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 34 NORTH AMERICA CELLULAR IN RF OVER FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 35 NORTH AMERICA COMMUNICATIONS SATELLITES IN RF OVER FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 36 NORTH AMERICA COMMUNICATIONS SATELLITES IN RF OVER FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 37 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 38 NORTH AMERICA SERVICES IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 39 NORTH AMERICA BROADCASTING IN RF OVER FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 40 NORTH AMERICA BROADCASTING IN RF OVER FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 41 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 42 NORTH AMERICA SERVICES IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 43 NORTH AMERICA PUBLIC SAFETY IN RF OVER FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 44 NORTH AMERICA PUBLIC SAFETY IN RF OVER FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 45 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 46 NORTH AMERICA SERVICES IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 47 NORTH AMERICA RADAR IN RF OVER FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 48 NORTH AMERICA RADAR IN RF OVER FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 49 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 50 NORTH AMERICA SERVICES IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 51 NORTH AMERICA NAVIGATION IN RF OVER FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 52 NORTH AMERICA NAVIGATION IN RF OVER FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 53 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 54 NORTH AMERICA SERVICES IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 55 NORTH AMERICA BROADBAND IN RF OVER FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 56 NORTH AMERICA BROADBAND IN RF OVER FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 57 NORTH AMERICA HARDWARE IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 58 NORTH AMERICA SERVICES IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 59 NORTH AMERICA RF OVER FIBER 5G MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 60 NORTH AMERICA TELECOMMUNICATION IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 61 NORTH AMERICA GOVERNMENT AND MILITARY IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 62 NORTH AMERICA SATELLITE GROUND STATIONS IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 63 NORTH AMERICA AIRCRAFT /UAV IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 64 NORTH AMERICA MINES, TUNNELS AND UNDERGROUND/SUBWAY SYSTEMS IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 65 NORTH AMERICA AUTOMOTIVE (V2X) IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 66 NORTH AMERICA CIVIL IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 67 NORTH AMERICA COMMERCIAL IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 68 NORTH AMERICA COMMERCIAL IN RF OVER FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 69 NORTH AMERICA OTHERS IN RF OVER FIBER 5G MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 70 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 71 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 72 NORTH AMERICA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 73 NORTH AMERICA TRANSCEIVERS IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 74 NORTH AMERICA OPTICAL AMPLIFIERS IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 75 NORTH AMERICA OPTICAL SWITCH IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 76 NORTH AMERICA OPTICAL CABLES IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 77 NORTH AMERICA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 78 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY FREQUENCY BAND, 2020-2029 (USD THOUSAND)

TABLE 79 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY FREQUENCY RANGE, 2020-2029 (USD THOUSAND)

TABLE 80 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 82 NORTH AMERICA CELLULAR IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 83 NORTH AMERICA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 84 NORTH AMERICA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 85 NORTH AMERICA CELLULAR IN RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 86 NORTH AMERICA COMMUNICATIONS SATELLITES IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 87 NORTH AMERICA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 88 NORTH AMERICA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 89 NORTH AMERICA BROADCASTING IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 91 NORTH AMERICA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 92 NORTH AMERICA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 93 NORTH AMERICA PUBLIC SAFETY IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 94 NORTH AMERICA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 95 NORTH AMERICA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 96 NORTH AMERICA RADAR IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 97 NORTH AMERICA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 98 NORTH AMERICA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 99 NORTH AMERICA NAVIGATION IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 100 NORTH AMERICA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 101 NORTH AMERICA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 102 NORTH AMERICA BROADBAND IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 103 NORTH AMERICA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 104 NORTH AMERICA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 105 NORTH AMERICA RF OVER THE FIBER 5G MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 106 NORTH AMERICA COMMERCIAL IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 107 U.S. RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 108 U.S. HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 109 U.S. TRANSCEIVERS IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 110 U.S. OPTICAL AMPLIFIERS IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 111 U.S. OPTICAL SWITCH IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 112 U.S. OPTICAL CABLES IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 113 U.S. SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 114 U.S. RF OVER THE FIBER 5G MARKET, BY FREQUENCY BAND, 2020-2029 (USD THOUSAND)

TABLE 115 U.S. RF OVER THE FIBER 5G MARKET, BY FREQUENCY RANGE, 2020-2029 (USD THOUSAND)

TABLE 116 U.S. RF OVER THE FIBER 5G MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 117 U.S. RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 118 U.S. CELLULAR IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 119 U.S. HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 120 U.S. SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 121 U.S. CELLULAR IN RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 122 U.S. COMMUNICATIONS SATELLITES IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 123 U.S. HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 124 U.S. SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 125 U.S. BROADCASTING IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 126 U.S. HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 127 U.S. SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 128 U.S. PUBLIC SAFETY IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 129 U.S. HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 130 U.S. SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 131 U.S. RADAR IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 132 U.S. HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 133 U.S. SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 134 U.S. NAVIGATION IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 135 U.S. HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 136 U.S. SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 137 U.S. BROADBAND IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 138 U.S. HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 139 U.S. SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 140 U.S. RF OVER THE FIBER 5G MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 141 U.S. COMMERCIAL IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 142 CANADA RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 143 CANADA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 144 CANADA TRANSCEIVERS IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 145 CANADA OPTICAL AMPLIFIERS IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 146 CANADA OPTICAL SWITCH IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 147 CANADA OPTICAL CABLES IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 148 CANADA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 149 CANADA RF OVER THE FIBER 5G MARKET, BY FREQUENCY BAND, 2020-2029 (USD THOUSAND)

TABLE 150 CANADA RF OVER THE FIBER 5G MARKET, BY FREQUENCY RANGE, 2020-2029 (USD THOUSAND)

TABLE 151 CANADA RF OVER THE FIBER 5G MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 152 CANADA RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 153 CANADA CELLULAR IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 154 CANADA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 155 CANADA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 156 CANADA CELLULAR IN RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 157 CANADA COMMUNICATIONS SATELLITES IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 158 CANADA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 159 CANADA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 160 CANADA BROADCASTING IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 161 CANADA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 162 CANADA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 163 CANADA PUBLIC SAFETY IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 164 CANADA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 165 CANADA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 166 CANADA RADAR IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 167 CANADA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 168 CANADA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 169 CANADA NAVIGATION IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 170 CANADA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 171 CANADA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 172 CANADA BROADBAND IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 173 CANADA HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 174 CANADA SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 175 CANADA RF OVER THE FIBER 5G MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 176 CANADA COMMERCIAL IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 177 MEXICO RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 178 MEXICO HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 179 MEXICO TRANSCEIVERS IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 180 MEXICO OPTICAL AMPLIFIERS IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 181 MEXICO OPTICAL SWITCH IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 182 MEXICO OPTICAL CABLES IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 183 MEXICO SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 184 MEXICO RF OVER THE FIBER 5G MARKET, BY FREQUENCY BAND, 2020-2029 (USD THOUSAND)

TABLE 185 MEXICO RF OVER THE FIBER 5G MARKET, BY FREQUENCY RANGE, 2020-2029 (USD THOUSAND)

TABLE 186 MEXICO RF OVER THE FIBER 5G MARKET, BY ORGANIZATION SIZE, 2020-2029 (USD THOUSAND)

TABLE 187 MEXICO RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 188 MEXICO CELLULAR IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 189 MEXICO HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 190 MEXICO SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 191 MEXICO CELLULAR IN RF OVER THE FIBER 5G MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 192 MEXICO COMMUNICATIONS SATELLITES IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 193 MEXICO HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 194 MEXICO SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 195 MEXICO BROADCASTING IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 196 MEXICO HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 197 MEXICO SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 198 MEXICO PUBLIC SAFETY IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 199 MEXICO HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 200 MEXICO SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 201 MEXICO RADAR IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 202 MEXICO HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 203 MEXICO SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 204 MEXICO NAVIGATION IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 205 MEXICO HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 206 MEXICO SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 207 MEXICO BROADBAND IN RF OVER THE FIBER 5G MARKET, BY COMPONENT, 2020-2029 (USD THOUSAND)

TABLE 208 MEXICO HARDWARE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 209 MEXICO SERVICE IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 210 MEXICO RF OVER THE FIBER 5G MARKET, BY END USER, 2020-2029 (USD THOUSAND)

TABLE 211 MEXICO COMMERCIAL IN RF OVER THE FIBER 5G MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

Liste des figures

FIGURE 1 NORTH AMERICA RF OVER THE FIBER 5G MARKET: SEGMENTATION

FIGURE 2 NORTH AMERICA RF OVER THE FIBER 5G MARKET : DATA TRIANGULATION

FIGURE 3 NORTH AMERICA RF OVER THE FIBER 5G MARKET: DROC ANALYSIS

FIGURE 4 NORTH AMERICA RF OVER THE FIBER 5G MARKET: REGIONAL MARKET ANALYSIS

FIGURE 5 NORTH AMERICA RF OVER THE FIBER 5G MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 NORTH AMERICA RF OVER THE FIBER 5G MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 NORTH AMERICA RF OVER THE FIBER 5G MARKET: DBMR MARKET POSITION GRID

FIGURE 8 NORTH AMERICA RF OVER THE FIBER 5G MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 NORTH AMERICA RF OVER THE FIBER 5G MARKET: MARKET END-USER COVERAGE GRID

FIGURE 10 NORTH AMERICA RF OVER THE FIBER 5G MARKET: SEGMENTATION

FIGURE 11 GROWING PENETRATION OF GSM MOBILE PHONES AND TABLETS IS EXPECTED TO BE KEY DRIVERS FOR NORTH AMERICA RF OVER THE FIBER 5G MARKET IN THE FORECAST PERIOD OF 2021 TO 2029

FIGURE 12 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF NORTH AMERICA RF OVER THE FIBER 5G MARKET IN 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF NORTH AMERICA RF OVER THE FIBER 5G MARKET

FIGURE 14 CORRELATION BETWEEN 5G AND OPTICAL FIBER

FIGURE 15 TOP 10 COUNTRIES WITH SMARTPHONES (IN MILLIONS)

FIGURE 16 TRADITIONAL VS RF OPTIC APPROACH

FIGURE 17 DIFFERENT FIBER TO THE (X) (FTTX) VARIANT NETWORK ARCHITECTURE

FIGURE 18 TOP 10 COUNTRIES WITH THE MOST DATA CENTRES

FIGURE 19 NORTH AMERICA RF OVER FIBER 5G MARKET: BY COMPONENT,2021

FIGURE 20 NORTH AMERICA RF OVER FIBER 5G MARKET: BY FREQUENCY BAND, 2021

FIGURE 21 NORTH AMERICA RF OVER FIBER 5G MARKET: BY FREQUENCY RANGE, 2021

FIGURE 22 NORTH AMERICA RF OVER FIBER 5G MARKET: BY ORGANIZATION SIZE, 2021

FIGURE 23 NORTH AMERICA RF OVER THE FIBER 5G MARKET: BY APPLICATION, 2021

FIGURE 24 NORTH AMERICA RF OVER FIBER 5G MARKET: BY END USER, 2021

FIGURE 25 NORTH AMERICA NORTH AMERICA RF OVER THE FIBER 5G MARKET : SNAPSHOT (2021)

FIGURE 26 NORTH AMERICA NORTH AMERICA RF OVER THE FIBER 5G MARKET : BY COUNTRY (2021)

FIGURE 27 NORTH AMERICA NORTH AMERICA RF OVER THE FIBER 5G MARKET : BY COUNTRY (2022 & 2029)

FIGURE 28 NORTH AMERICA NORTH AMERICA RF OVER THE FIBER 5G MARKET : BY COUNTRY (2021 & 2029)

FIGURE 29 NORTH AMERICA NORTH AMERICA RF OVER THE FIBER 5G MARKET : BY COMPONENT (2022-2029)

FIGURE 30 NORTH AMERICA RF OVER FIBER 5G MARKET: COMPANY SHARE 2021 (%)

Méthodologie de recherche

La collecte de données et l'analyse de l'année de base sont effectuées à l'aide de modules de collecte de données avec des échantillons de grande taille. L'étape consiste à obtenir des informations sur le marché ou des données connexes via diverses sources et stratégies. Elle comprend l'examen et la planification à l'avance de toutes les données acquises dans le passé. Elle englobe également l'examen des incohérences d'informations observées dans différentes sources d'informations. Les données de marché sont analysées et estimées à l'aide de modèles statistiques et cohérents de marché. De plus, l'analyse des parts de marché et l'analyse des tendances clés sont les principaux facteurs de succès du rapport de marché. Pour en savoir plus, veuillez demander un appel d'analyste ou déposer votre demande.

La méthodologie de recherche clé utilisée par l'équipe de recherche DBMR est la triangulation des données qui implique l'exploration de données, l'analyse de l'impact des variables de données sur le marché et la validation primaire (expert du secteur). Les modèles de données incluent la grille de positionnement des fournisseurs, l'analyse de la chronologie du marché, l'aperçu et le guide du marché, la grille de positionnement des entreprises, l'analyse des brevets, l'analyse des prix, l'analyse des parts de marché des entreprises, les normes de mesure, l'analyse globale par rapport à l'analyse régionale et des parts des fournisseurs. Pour en savoir plus sur la méthodologie de recherche, envoyez une demande pour parler à nos experts du secteur.

Personnalisation disponible

Data Bridge Market Research est un leader de la recherche formative avancée. Nous sommes fiers de fournir à nos clients existants et nouveaux des données et des analyses qui correspondent à leurs objectifs. Le rapport peut être personnalisé pour inclure une analyse des tendances des prix des marques cibles, une compréhension du marché pour d'autres pays (demandez la liste des pays), des données sur les résultats des essais cliniques, une revue de la littérature, une analyse du marché des produits remis à neuf et de la base de produits. L'analyse du marché des concurrents cibles peut être analysée à partir d'une analyse basée sur la technologie jusqu'à des stratégies de portefeuille de marché. Nous pouvons ajouter autant de concurrents que vous le souhaitez, dans le format et le style de données que vous recherchez. Notre équipe d'analystes peut également vous fournir des données sous forme de fichiers Excel bruts, de tableaux croisés dynamiques (Fact book) ou peut vous aider à créer des présentations à partir des ensembles de données disponibles dans le rapport.